Introduction

Overview of the importance of insurance for a storage unit and its benefits

When renting a storage unit, it is important to understand the potential risks that your personal possessions may face. Just like your home or office, storage units are exposed to various threats such as theft, vandalism, and weather-related damages. Without insurance coverage, you may have to bear the financial burden of replacing or repairing your belongings if something goes wrong.

Explaining the different options available for obtaining insurance coverage

When it comes to insuring your storage unit, there are a few different options available. Here are three common choices:

1. Storage Facility Insurance:

– Many storage companies offer insurance coverage as part of their rental agreement. This option may seem convenient, as you can simply add the insurance fee to your monthly rental payment. However, it is essential to carefully review the terms and coverage limits of this insurance before making a decision. Additionally, make sure to confirm whether the facility’s insurance provides adequate protection for the value of your belongings.

2. Homeowner’s or Renter’s Insurance:

– Another option is to check if your homeowner’s or renter’s insurance policy covers your stored belongings. Some policies may include off-premises coverage, which means your possessions would still be protected even when they are not within your home. However, be sure to review the policy details and consult with your insurance provider to ensure that your storage unit is covered.

3. Standalone Storage Unit Insurance:

– If your existing insurance policies do not provide sufficient coverage, or if you prefer a separate insurance policy for your storage unit, standalone storage unit insurance is available. This type of insurance is specifically designed to protect your stored belongings and typically offers flexible coverage options. You can choose the coverage amount that suits your needs and ensure that your possessions are adequately protected.

When comparing your insurance options, consider the following factors:

– Coverage limits: Ensure that the insurance policy covers the total value of your stored items.

– Deductibles: Understand the deductible amount you would be responsible for in the event of a claim.

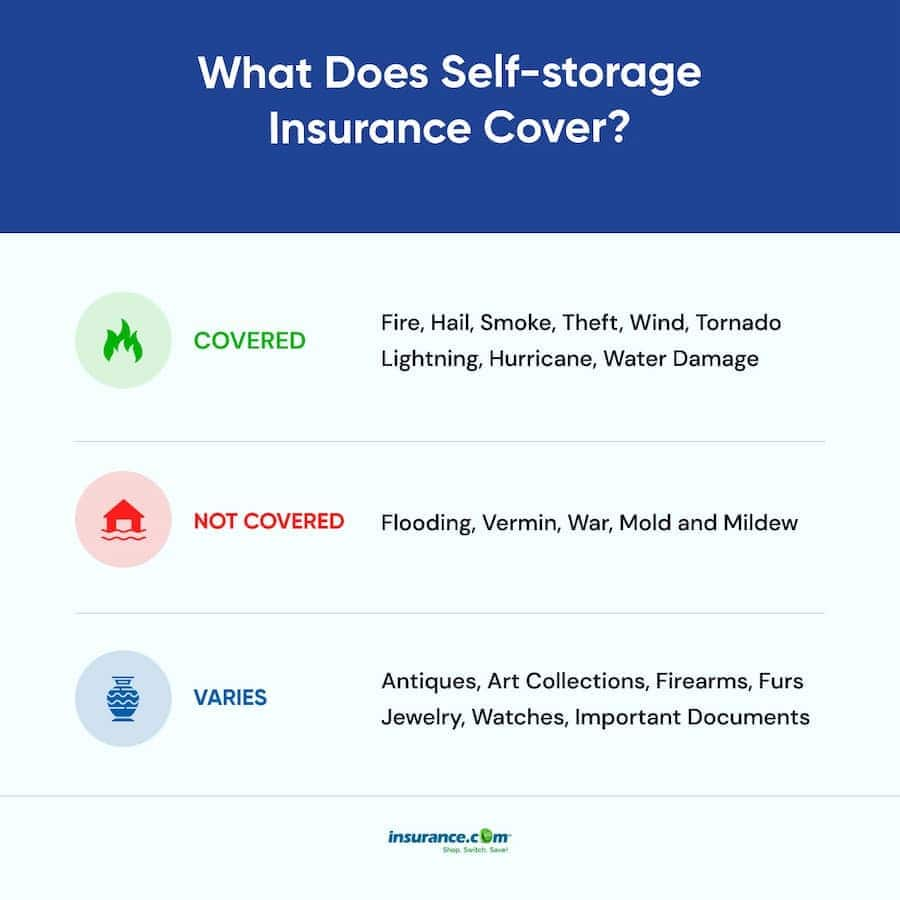

– Perils covered: Review the policy to see which risks and damages are covered, such as theft, fire, water damage, or natural disasters.

– Cost: Compare the premiums and fees associated with each insurance option to determine the most cost-effective choice.

By taking the time to explore your insurance options and compare coverage, you can make an informed decision that provides peace of mind and protects your stored possessions. Remember, having storage unit insurance in place is a smart and responsible choice to safeguard your belongings from unforeseen circumstances.

Insurance Coverage Provided by Homeowners Policy

Explaining how insurance coverage for belongings in a storage unit is typically provided by the off-premises personal property coverage in a homeowners policy

When it comes to protecting your belongings stored in a storage unit, your homeowners insurance policy can offer some coverage. Most homeowners policies include off-premises personal property coverage, which means that your belongings are protected even when they are not in your home. This coverage extends to items kept in a storage unit, but there are a few things you need to keep in mind.

Typically, the coverage provided by your homeowners policy for items in a storage unit is subject to a coverage cap. This means that there is a maximum amount of coverage that the policy will provide for these off-premises belongings. For example, if your homeowners insurance policy has a personal property coverage limit of $50,000, the coverage for items in a storage unit may be capped at 10% of that amount, which is $5,000.

Discussing the limitations and exclusions of this coverage

While the off-premises personal property coverage provided by a homeowners policy can offer some protection for your belongings in a storage unit, it’s important to understand the limitations and exclusions of this coverage.

One limitation is the coverage cap mentioned earlier. If the value of your stored belongings exceeds the coverage limit, you may not have adequate insurance in place to fully protect them. It’s important to take inventory of your items and assess their value to determine if you need additional coverage.

Additionally, the coverage provided by a homeowners policy may not extend to certain types of damage or losses. For example, damage caused by vermin or fungus may not be covered under your policy. Water damage, such as flooding, may also be excluded. These limitations can leave your stored belongings vulnerable to certain risks.

Stand-alone storage unit insurance

In some cases, separate storage unit insurance policies can provide extended coverage not found in a homeowners policy. Stand-alone storage unit insurance policies, such as those offered by Orange Door Storage Insurance, can offer additional protection for your belongings in a storage unit.

For example, Orange Door Storage Insurance policies cover damage from vermin and fungus up to $250. They also provide coverage for water damage, including flooding. These additional coverages can give you peace of mind knowing that your stored belongings are protected from a wider range of risks.

When considering stand-alone storage unit insurance, it’s important to compare the coverage and cost with your existing homeowners policy. Evaluate the value of your stored belongings and determine if the coverage provided by your homeowners policy is sufficient. If not, a stand-alone storage unit insurance policy can help fill any gaps in coverage and provide the added protection you need.

Therefore, while homeowners insurance policies can offer coverage for belongings stored in a storage unit, it is important to understand the limitations and exclusions of this coverage. Taking inventory of your belongings and assessing their value can help determine if additional coverage is needed. Stand-alone storage unit insurance can provide extended coverage not found in a homeowners policy, offering added protection for your stored belongings.

Insurance Options Offered by Storage Facility

Understanding how insurance can be purchased for personal property in a storage facility from the storage company itself

Some storage facilities offer insurance options to renters when they sign up for a storage unit. This insurance is typically provided by the storage company itself and may be referred to as renters insurance or self-storage rental insurance. Here’s what you need to know about these insurance options:

– Renters insurance or self-storage rental insurance is designed specifically for storage units and provides coverage for your personal belongings stored within the unit.

– When purchasing insurance from the storage facility, it’s important to understand the requirements and terms of the policy. This includes the coverage limits, deductible, and any exclusions or limitations that may apply.

– The cost of insurance from the storage facility is usually added to your monthly rental fee, making the process convenient and easy. However, it’s important to compare the cost and coverage of this insurance with other options to ensure you’re getting the best value for your money.

– Some storage facility insurance policies may have limitations on the types of items that can be covered. For example, high-value items such as jewelry or artwork may require additional coverage or a separate policy.

Explaining the requirements and terms of renters insurance or self-storage rental insurance policies

When considering insurance options offered by a storage facility, it’s important to understand the requirements and terms of the policy. Here are some key points to consider:

– The coverage limit of the insurance policy is the maximum amount that the insurance company will pay in the event of a loss. It’s important to assess the value of your stored belongings and choose a policy with a coverage limit that is sufficient to replace them if necessary.

– The deductible is the amount that you will need to pay out of pocket before the insurance coverage kicks in. A higher deductible may result in lower monthly premiums, but it also means you will have to pay more in the event of a claim.

– The policy may have exclusions or limitations on certain types of damage or losses. It’s important to read the policy carefully and understand what is covered and what is not. Common exclusions may include damage caused by natural disasters, pests, or negligence on the part of the renter.

– Some insurance policies may offer additional coverage options, such as liability insurance. This can protect you financially if someone is injured while on the storage facility premises.

Comparing your insurance options is crucial to ensure you have the right coverage for your stored belongings. Whether you choose to purchase insurance through your homeowners policy, a stand-alone storage unit insurance policy, or the insurance offered by the storage facility, it’s important to understand the coverage, cost, and terms of the policy. By comparing your options, you can make an informed decision and have peace of mind knowing that your belongings are protected.

Independent Insurance Companies

Highlighting the option of purchasing insurance for a storage unit through independent insurance companies

Another option for obtaining insurance coverage for your storage unit is to purchase a policy through an independent insurance company. These companies specialize in providing insurance specifically for self-storage units and offer a range of coverage options to suit your needs.

Discussing the advantages and limitations of this approach

There are several advantages to purchasing storage unit insurance through an independent insurance company:

1. **Customizable Coverage**: Independent insurance companies often offer more flexibility in choosing coverage options compared to homeowners insurance. You can typically tailor the policy to fit your specific needs, ensuring that all your valuable items are adequately protected.

2. **Higher Coverage Limits**: While homeowners insurance policies may have a coverage cap for off-premises belongings, independent storage unit insurance policies may offer higher coverage limits. This can be particularly beneficial if you have valuable items stored in your unit.

3. **Specialized Coverage**: Independent insurance companies that specialize in storage unit insurance understand the unique risks associated with storing belongings outside of your home. They may provide coverage for specific hazards that may not be covered under a homeowners policy, such as theft or damage from fire or extreme weather conditions.

Despite these advantages, it’s important to recognize the limitations of purchasing insurance through an independent insurance company:

1. **Additional Cost**: Independent insurance policies for storage units may come with an additional cost compared to the coverage provided by a homeowners policy. It’s crucial to compare the cost of standalone insurance with the coverage provided by your existing homeowners policy to determine the most cost-effective option.

2. **Policy Exclusions**: Like any insurance policy, storage unit insurance policies may have certain exclusions and limitations. It’s essential to carefully review the policy terms and conditions to ensure that your specific needs and concerns are adequately covered.

Therefore, independent insurance companies offer an alternative option for obtaining insurance coverage for your storage unit. Although they provide customizable coverage and higher coverage limits compared to homeowners insurance, it’s important to consider the additional cost and policy exclusions. Assessing your storage unit needs, reviewing the coverage provided by your homeowners policy, and comparing it with standalone insurance options can help you make an informed decision to safeguard your stored belongings.

Safestor

Specialized Self-Storage Insurance

Exploring Safestor, one of the largest companies specializing in self-storage insurance

Safestor is a well-known company that specializes in providing insurance coverage for self-storage units. With their expertise in this area, they offer a range of insurance options tailored specifically for storing personal belongings outside of your home.

Discussing how Safestor works through self-storage facilities and the benefits it offers

When you rent a storage unit from a participating self-storage facility, you have the option to purchase insurance coverage through Safestor. This coverage is specifically designed to protect your stored possessions from risks such as theft, vandalism, fire, and extreme weather conditions.

One of the main benefits of choosing Safestor is the ease and convenience of purchasing insurance directly through the self-storage facility. You don’t need to look for an independent insurance company or go through the hassle of comparing different options. Safestor offers a streamlined process that allows you to add insurance coverage to your storage unit rental agreement.

By purchasing insurance through Safestor, you can enjoy several advantages:

– **Comprehensive Coverage**: Safestor offers comprehensive coverage for a variety of risks that your belongings may face in a storage unit. This can give you peace of mind knowing that your possessions are financially protected.

– **Affordable Premiums**: Safestor aims to provide competitive pricing for their insurance coverage. This means you can obtain the necessary protection for your stored items without breaking the bank.

– **Flexible Coverage Options**: Safestor understands that every individual’s storage needs are different. They offer flexible coverage options that can be customized to suit your specific requirements. Whether you have high-value items or unique storage conditions, Safestor can provide the coverage you need.

– **Easy Claims Process**: In the unfortunate event that you need to make a claim, Safestor has a straightforward claims process. They aim to make the claims experience as smooth and efficient as possible, ensuring that you receive the compensation you deserve.

However, it is important to note that Safestor’s insurance coverage may have certain limitations and exclusions. It is crucial to carefully review the policy terms and conditions to ensure that your specific needs are adequately covered.

Therefore, Safestor offers specialized insurance coverage for storage units, providing convenient and comprehensive protection for your stored belongings. By choosing Safestor, you can benefit from their expertise in the self-storage insurance industry, affordable premiums, and flexible coverage options. It’s always important to review the policy details and compare with other insurance options to ensure you make an informed decision and protect your stored possessions effectively.

MiniCo

Another Leading Self-Storage Insurance Provider

Introducing MiniCo, another prominent company specializing in self-storage insurance

If you are looking for insurance coverage for your storage unit, MiniCo is another reliable option to consider. This company specializes in providing insurance specifically for self-storage units and offers a range of coverage options to suit your needs.

Highlighting its services and advantages for individuals seeking storage unit insurance

There are several services and advantages offered by MiniCo for individuals seeking storage unit insurance:

1. **Comprehensive Coverage**: MiniCo provides comprehensive insurance coverage for your stored belongings. Their policies typically cover a wide range of perils, including theft, fire, water damage, and vandalism.

2. **Flexible Coverage Options**: MiniCo understands that each individual’s storage needs are unique. They offer flexible coverage options that allow you to customize your policy based on the value and type of items you are storing.

3. **Affordable Premiums**: MiniCo strives to provide affordable premiums for their insurance policies. They understand that insurance costs can add up, and they aim to offer competitive pricing while still maintaining high-quality coverage.

4. **Easy Claims Process**: In the unfortunate event that you need to file a claim, MiniCo prides itself on having a straightforward and efficient claims process. They aim to make the claims experience as smooth as possible so that you can quickly recover from any losses or damages.

Comparing MiniCo with other independent insurance companies, such as Orange Door Storage Insurance, can help you determine which provider offers the best coverage and advantages for your specific storage needs. It’s crucial to assess the costs, coverage limits, and policy terms and conditions before making a final decision.

Remember that insurance coverage for storage units is crucial to protect your valuable belongings. Whether you choose to purchase insurance through an independent insurance company like MiniCo or explore other options, comparing your choices will help ensure you have the right coverage in place.

Therefore, MiniCo is a leading company specializing in self-storage insurance. They offer comprehensive coverage, flexible options, affordable premiums, and an easy claims process. When considering storage unit insurance, it’s essential to carefully research and compare different providers to find the best fit for your specific needs. By taking the time to explore your options, you can have peace of mind knowing that your stored belongings are adequately protected.

Yardi Snapnsure

Real Insurance Policy for Mobile Storage

Introducing Yardi Snapnsure as the only company offering a Real Insurance Policy for Mobile Storage, not just a Protection Plan

Highlighting the unique benefits and features of Yardi Snapnsure

Yardi Snapnsure is a leading provider of insurance coverage for mobile storage units. Unlike other companies that only offer protection plans, Yardi Snapnsure provides a real insurance policy to safeguard your stored belongings. This sets them apart from the competition and ensures that you have comprehensive coverage for your mobile storage unit.

Here are some of the unique benefits and features offered by Yardi Snapnsure:

1. **Comprehensive Coverage**: Yardi Snapnsure’s insurance policies offer extensive coverage for a wide range of perils that your stored belongings may face. From theft and fire to water damage and vandalism, they have you covered. With Yardi Snapnsure, you can rest assured knowing that your belongings are fully protected.

2. **Cost Savings**: Yardi Snapnsure understands the importance of affordability. They provide coverage at a competitive premium, allowing you to save up to 50% or more compared to other insurance providers. With Yardi Snapnsure, you can enjoy better coverage while also saving money.

3. **Easy Policy Switch**: Switching to Yardi Snapnsure is effortless. They handle the cancellation of your existing policy at no extra cost, making the transition seamless. You can easily switch to Yardi Snapnsure and enjoy the benefits of their comprehensive insurance coverage.

4. **Licensed and A-rated**: Yardi Snapnsure is backed by an A-rated insurance company and is licensed throughout the continental US. This ensures that you are working with a reputable and reliable insurance provider. You can have peace of mind knowing that your insurance policy is underwritten by a trusted company.

By choosing Yardi Snapnsure, you can have the confidence that your belongings are adequately protected in your mobile storage unit. Their real insurance policy offers better coverage than just a protection plan, giving you the peace of mind you deserve.

Comparing Yardi Snapnsure with other insurance providers, such as MiniCo, can help you make an informed decision based on your specific storage needs. Factors to consider when assessing your options include coverage limits, policy terms and conditions, and pricing.

Remember that insurance coverage is crucial for your stored belongings. Whether you choose Yardi Snapnsure or explore other options, it’s important to carefully evaluate your choices. With Yardi Snapnsure’s comprehensive coverage, cost savings, easy policy switch, and reputable licensing, you can trust that your stored belongings are in good hands.

Therefore, Yardi Snapnsure stands out as the only company offering a real insurance policy for mobile storage, providing better coverage than just a protection plan. Their comprehensive coverage, cost savings, easy policy switch, and reputable licensing make them a top choice for insuring your stored belongings. When considering insurance for your mobile storage unit, research and compare different providers to find the best fit for your specific needs. With Yardi Snapnsure, you can have peace of mind knowing that your valued possessions are protected.

Factors to Consider When Choosing Storage Unit Insurance

Important factors to consider while selecting insurance for a storage unit, such as coverage limits, deductibles, and exclusions

When choosing insurance for your storage unit, there are several factors you should consider to ensure you have the right coverage in place. These factors include:

1. **Coverage Limits**: It’s essential to understand the coverage limits of the insurance policy. Make sure the policy provides adequate coverage for the total value of your stored belongings. If the coverage limit is too low, you may not be fully compensated for any losses or damages.

2. **Deductibles**: Check the deductible amount associated with the insurance policy. A deductible is the amount you need to pay out of pocket before the insurance coverage kicks in. Determine if the deductible is affordable for you and if it aligns with the value of your stored items.

3. **Exclusions**: Review the policy exclusions carefully. Exclusions are situations or types of damage that the insurance policy does not cover. Common exclusions may include damage caused by flooding, pests, or natural disasters. Make sure you are aware of any exclusions that may impact your coverage.

4. **Claims Process**: Consider the ease and efficiency of the claims process. Find out how quickly the insurance company handles claims and the documentation required. A straightforward and efficient claims process can help minimize stress during a difficult situation.

Providing tips and guidelines for making the right choice

To make the right choice when selecting storage unit insurance, consider the following tips and guidelines:

1. **Shop Around**: Take the time to compare different insurance providers, such as MiniCo and Orange Door Storage Insurance, to find the best coverage options and prices. Request quotes and compare the policy terms and conditions to make an informed decision.

2. **Read Reviews**: Read reviews and testimonials from other customers to get an idea of the level of service and satisfaction provided by the insurance company. Look for companies with positive reviews and a strong reputation in the industry.

3. **Seek Recommendations**: Ask for recommendations from friends, family, or storage facility managers who have experience with storage unit insurance. They may be able to provide insights and recommendations based on their own experiences.

4. **Consider Additional Coverage**: Depending on the value and type of items you are storing, you may want to consider additional coverage options such as specialty insurance for high-value items or climate-controlled units. Assess your specific needs and determine if additional coverage is necessary.

By carefully considering these factors and following the tips and guidelines, you can make an informed decision when choosing insurance for your storage unit. Remember to review the policy details, compare different providers, and ensure the coverage aligns with your specific storage needs.

Conclusion

Choosing storage unit insurance requires careful consideration of various factors including coverage limits, deductibles, exclusions, and claims processes. By comparing different providers and policies, as well as considering recommendations and additional coverage options, you can make an informed decision that ensures your stored belongings are adequately protected. Take the time to research and evaluate your options to find the best insurance coverage for your storage unit.

Conclusion

Summarizing the various options available for obtaining insurance for a storage unit

When selecting insurance for a storage unit, it’s crucial to consider factors such as coverage limits, deductibles, exclusions, and claims processes. By evaluating these factors and following certain guidelines, renters can make an informed decision to ensure their belongings are adequately protected.

First, it’s important to understand the coverage limits of the insurance policy. Renters should ensure that the policy provides sufficient coverage for the total value of their stored items. Inadequate coverage may result in not being fully compensated for any losses or damages.

Next, renters should check the deductible amount associated with the insurance policy. They need to determine if the deductible is affordable and aligns with the value of their stored items.

Additionally, it’s crucial to review the policy exclusions. Common exclusions may include damage caused by flooding, pests, or natural disasters. Being aware of any exclusions that may impact coverage is essential.

Furthermore, the ease and efficiency of the claims process should be considered. Renters should inquire about how quickly the insurance company handles claims and the documentation required. A straightforward claims process can reduce stress during a difficult situation.

Reemphasizing the importance of protecting personal possessions and suggesting the best-suited insurance options

To make the best choice when selecting storage unit insurance, renters should shop around and compare different providers. Requesting quotes and examining policy terms and conditions can help make an informed decision.

Reading reviews and testimonials from other customers can provide insight into the level of service and satisfaction offered by insurance companies. Opting for providers with positive reviews and a strong reputation is recommended.

Seeking recommendations from friends, family, or storage facility managers who have experience with storage unit insurance can also be beneficial. They may be able to provide valuable insights and recommendations.

Depending on the value and type of items being stored, renters may want to consider additional coverage options such as specialty insurance for high-value items or climate-controlled units. Assessing specific needs and determining if additional coverage is necessary is essential.

Therefore, when choosing insurance for a storage unit, renters should carefully consider factors such as coverage limits, deductibles, exclusions, and claims processes. By comparing different providers and policies, as well as considering recommendations and additional coverage options, renters can make an informed decision that ensures the adequate protection of their stored belongings. Taking the time to research and evaluate options is key to finding the best insurance coverage for a storage unit.

Learn about Will storage unit insurance cover mice damage.