Introduction to Storage Unit Insurance in Vermont

Overview of storage unit insurance

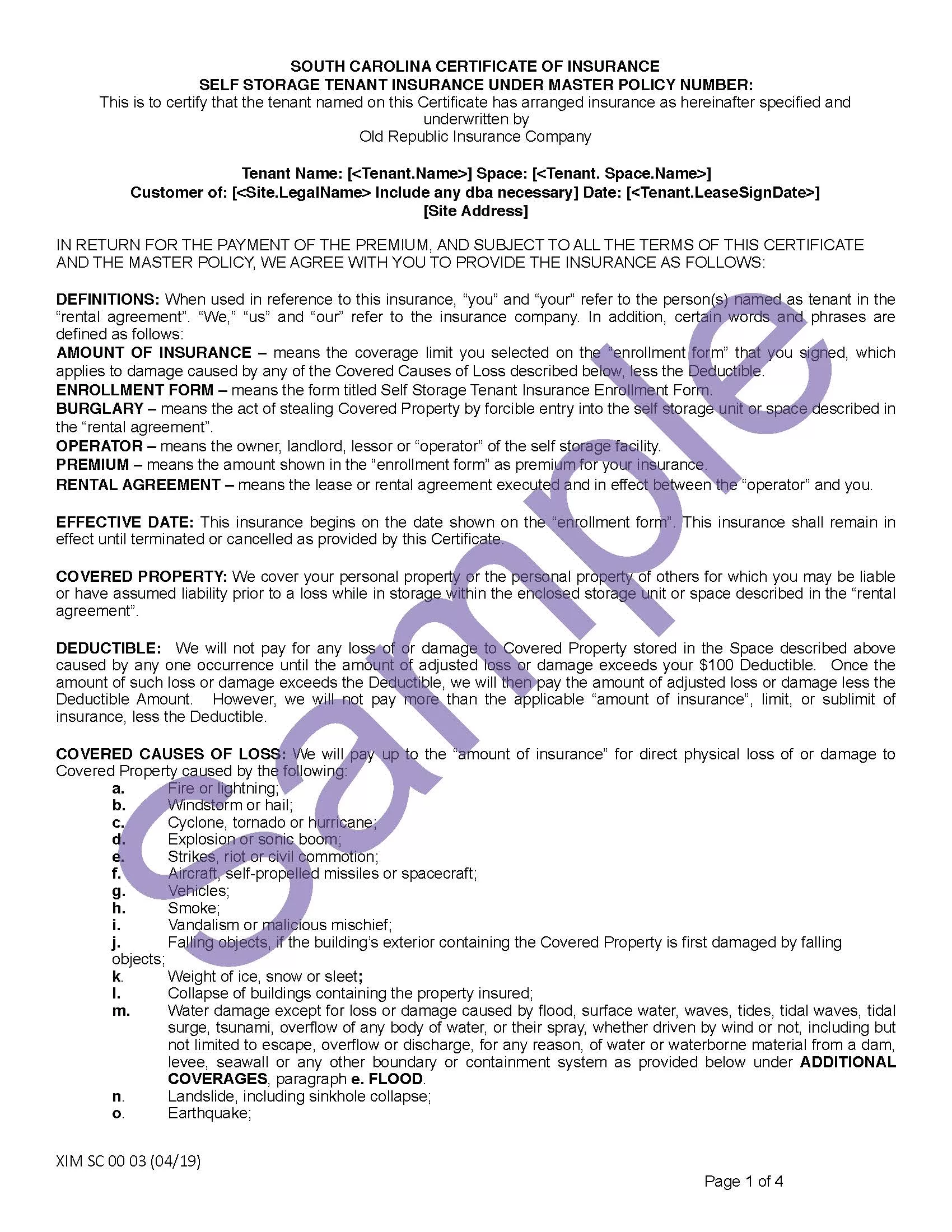

Storage unit insurance is a specialized insurance policy that provides coverage for belongings stored in storage spaces. This type of insurance is important for individuals who use storage units to keep their valuable items safe and protected. It is essential to work with an insurance agent who understands the intricacies of storage unit insurance to ensure that you have adequate coverage for your stored belongings.

Importance of having insurance for your stored belongings

Having insurance for your stored belongings is crucial for several reasons:

1. Protection against theft or damage: Storage unit insurance provides coverage in case your stored belongings are stolen or damaged due to factors such as fire, water damage, or vandalism. This coverage helps you recover the value of your items and provides peace of mind knowing that you are financially protected.

2. Liability coverage: Storage unit insurance may also include liability coverage. This type of coverage protects you in case someone gets injured while on your storage unit premises, preventing you from being held personally responsible for any resulting medical expenses or legal fees.

3. Additional coverage options: Depending on your specific needs, storage unit insurance policies can offer additional coverage options such as climate control protection, which ensures that your items are safe from extreme temperature fluctuations, or flood protection, which covers damage caused by flooding.

4. Cost-effectiveness: While storage unit insurance may seem like an additional expense, it is actually a cost-effective solution. If your belongings are stolen or damaged, the financial burden of replacing them could be much higher than the cost of insurance premiums.

How Can Vermont Residents Get Storage Unit Insurance?

Working with an insurance agent who specializes in storage unit insurance is the best way for Vermont residents to obtain the coverage they need. Paige & Campbell Insurance has a team of experienced agents who have worked with many residents to insure their stored belongings. By leveraging their expertise and knowledge of storage unit insurance policies, they can help you find a policy that suits your specific needs and provides robust coverage for your stored items.

With the assistance of Paige & Campbell Insurance, you can have confidence that your belongings are well protected even when they are not at your residence. Their agents will guide you through the process of selecting the right coverage options, ensuring that you understand the terms and conditions of your policy.

Whether you are storing furniture, electronics, or family heirlooms, having storage unit insurance in place is a smart decision. It offers protection and peace of mind, knowing that your valuable possessions are safeguarded against unforeseen circumstances.

Contact Paige & Campbell Insurance today to get a free quote and secure the necessary coverage for your stored belongings in Vermont.

Understanding Vermont’s Regulation on Self-Storage Insurance

VT Ins. Regulation I-2019-02

The state of Vermont has implemented regulations regarding self-storage insurance to ensure the protection of tenants’ belongings. These regulations, known as VT Ins. Regulation I-2019-02, mandate that insurance is mandatory for all tenants at all self-storage facilities in Vermont.

Definition of a self-storage insurance producer

According to the regulations, a self-storage insurance producer is an individual or entity that offers or sells insurance coverage to tenants of self-storage facilities. This can include the facility owner or operator, an insurance agent, or a third-party insurance provider.

Licensing requirements for self-storage insurance producers

To become a licensed self-storage insurance producer in Vermont, individuals or entities must meet certain requirements set forth by the state. These requirements include:

– Completion of a pre-licensing education course: Prospective self-storage insurance producers must complete a state-approved pre-licensing course that provides them with the necessary knowledge and understanding of self-storage insurance policies.

– Passing the licensing exam: After completing the pre-licensing course, individuals or entities must pass the licensing exam to demonstrate their comprehension of the material.

– Obtaining the appropriate license: Once the licensing exam is passed, self-storage insurance producers must apply for and obtain the appropriate license from the Vermont Department of Financial Regulation.

It is important for individuals or entities selling self-storage insurance in Vermont to adhere to these licensing requirements to ensure compliance with state regulations.

In light of these regulations, tenants have the option of selecting their own private insurance or purchasing a policy from a trusted insurance provider like Safestor Tenant Insurance. If tenants choose to purchase insurance through Safestor, monthly premiums will be applied to their rent payments.

Residents of Vermont should work with insurance agents who are knowledgeable about self-storage insurance policies when selecting coverage. These agents can provide guidance and assistance in navigating the requirements and finding the right insurance policy to protect their belongings while in storage.

By understanding Vermont’s regulations on self-storage insurance and working with knowledgeable insurance agents, tenants can ensure that their belongings are adequately protected during their time in storage.

**Coverage Options and Premiums**

Different coverage options available

When it comes to self-storage insurance in Vermont, tenants have the option to select their own private insurance or purchase a policy from a trusted insurance provider like Safestor Tenant Insurance. These options provide coverage for the loss or damage of personal belongings stored in self-storage facilities.

Private insurance allows tenants to choose their coverage provider and policy terms based on their individual needs. This option can provide flexibility and customization in selecting the level of coverage desired.

On the other hand, purchasing insurance from a trusted insurance provider like Safestor offers a convenient and comprehensive solution. These policies are specifically designed for self-storage tenants and can provide coverage for a wide range of risks, including fire, flood, theft, and damages.

Monthly premiums based on coverage amount

The cost of self-storage insurance premiums in Vermont is typically based on the coverage amount selected by the tenant. Higher coverage limits will result in higher monthly premiums, while lower coverage limits will lead to lower premiums.

It is important for tenants to carefully consider their storage needs and the value of their stored belongings when selecting a coverage amount. Assessing the potential risks and the replacement value of their items can help tenants determine the appropriate coverage amount and ensure they are adequately protected.

Working with knowledgeable insurance agents can help tenants understand the different coverage options available and choose the most suitable policy for their needs. Insurance agents can provide guidance and assistance in navigating the coverage options and finding the right insurance policy that fits their budget and provides sufficient protection.

By understanding the coverage options available and the factors that influence monthly premiums, tenants can make informed decisions and secure the necessary insurance coverage to protect their belongings during their time in storage.

**So**

Understanding Vermont’s regulations on self-storage insurance is crucial for both tenants and insurance providers in the state. By complying with the licensing requirements and working with knowledgeable insurance agents, tenants can ensure that their belongings are adequately protected while in storage.

Different coverage options are available, allowing tenants to choose between private insurance and policies from trusted insurance providers like Safestor Tenant Insurance. Monthly premiums are based on the coverage amount selected, giving tenants the flexibility to choose the level of protection that suits their needs and budget.

By assessing their storage needs and working with insurance professionals, tenants can make informed decisions and secure the necessary coverage to safeguard their belongings during their time in self-storage facilities.

Safestor Insurance: A Reliable Provider in Vermont

Overview of Safestor Insurance

Safestor Insurance is a trusted insurance provider in Vermont that offers coverage for tenants of self-storage facilities. They understand the unique needs of self-storage insurance and provide policies that meet the requirements set forth by the state. With Safestor Insurance, tenants can have peace of mind knowing that their belongings are adequately protected while in storage.

Coverage offered by Safestor Insurance

Safestor Insurance offers comprehensive coverage for a wide range of risks that tenants may face while their belongings are in storage. Their policies typically include protection against theft, fire, water damage, and natural disasters. In addition, they may also offer coverage for damage caused by pests, mold, or other unforeseen circumstances.

Benefits of choosing Safestor Insurance

Choosing Safestor Insurance for self-storage coverage in Vermont comes with several benefits:

– Peace of mind: With Safestor Insurance, tenants can have peace of mind knowing that their belongings are protected against a variety of risks. This can alleviate concerns and allow tenants to focus on other aspects of their move or storage experience.

– Convenient payment: Monthly premiums for Safestor Insurance are applied to the rent payment, simplifying the billing process for tenants. This eliminates the need for separate insurance payments and ensures that coverage remains active as long as the tenant is renting the storage unit.

– Trustworthy provider: Safestor Insurance is a reliable and reputable provider in the industry. They have a track record of providing quality coverage and excellent customer service. Tenants can trust that their insurance needs will be met with Safestor Insurance.

Therefore, Safestor Insurance is a reliable provider of self-storage insurance in Vermont. They offer comprehensive coverage that meets the requirements set forth by the state. Choosing Safestor Insurance provides tenants with peace of mind, convenient payment options, and the assurance of a trustworthy provider. When selecting self-storage insurance in Vermont, tenants should consider the benefits of choosing Safestor Insurance to ensure the protection of their belongings.

Limitations of Homeowners Insurance for Storage Units

When it comes to protecting personal belongings in storage units, many people assume that their homeowners insurance will provide adequate coverage. However, there are limitations to homeowners insurance that may leave items in storage units unprotected. It is important for tenants to understand these limitations and consider alternative options, such as specialized self-storage insurance like Safestor Insurance.

Limited coverage for personal items in storage units

One of the main limitations of homeowners insurance when it comes to storage units is the limited coverage it provides for personal items stored outside of the insured property. Homeowners insurance typically has a coverage limit for off-premises personal property, which may not be sufficient to cover the full value of belongings stored in a separate location. Additionally, certain high-value items or specialty items may not be covered at all by homeowners insurance.

Worldwide personal property coverage limitations

Another limitation of homeowners insurance for storage units is the worldwide personal property coverage limitations. While homeowners insurance may provide coverage for personal belongings worldwide, there are often restrictions and exclusions for items stored in storage units. These limitations may include coverage only within a certain distance from the insured property or specific exclusions for storage units.

In contrast, specialized self-storage insurance like Safestor Insurance provides comprehensive coverage specifically designed for the unique risks associated with storing belongings in a self-storage facility. Safestor Insurance offers coverage for a wide range of risks, including theft, fire, water damage, and natural disasters. They may also offer coverage for damage caused by pests, mold, or other unforeseen circumstances.

Choosing specialized self-storage insurance like Safestor Insurance can provide tenants with peace of mind and the assurance that their belongings are adequately protected. Safestor Insurance offers convenient payment options, with monthly premiums applied to the rent payment, eliminating the need for separate insurance payments. Additionally, Safestor Insurance is a reliable and reputable provider with a track record of providing quality coverage and excellent customer service.

Therefore, while homeowners insurance may provide some coverage for items in storage units, there are limitations that may leave belongings unprotected. It is important for tenants to consider specialized self-storage insurance options, such as Safestor Insurance, to ensure comprehensive coverage and peace of mind.

Property Insurance vs. Self-Storage Insurance in Jeffersonville, Vermont

Distinguishing between property insurance and self-storage insurance

When choosing insurance coverage for your storage facility in Jeffersonville, Vermont, it’s essential to understand the differences between property insurance and self-storage insurance.

Property Insurance:

– Property insurance is designed to protect the physical structure of your storage facility, as well as your business and personal property within it. It typically covers risks such as fire, flood, and damage caused by natural disasters like hurricanes and earthquakes.

– Property insurance is suitable for owners of commercial self-storage facilities who want to safeguard their property, equipment, and assets from potential damages.

Self-Storage Insurance:

– Self-storage insurance, on the other hand, is specifically tailored to protect the belongings of individual tenants stored in self-storage units. It covers risks such as theft, fire, water damage, and damage caused by pests, mold, or other unforeseen circumstances.

– Self-storage insurance is necessary because property insurance usually does not provide coverage for the belongings of individual tenants. Therefore, tenants should secure their own self-storage insurance to ensure their belongings are adequately protected.

Why self-storage insurance is necessary for businesses

For businesses renting out self-storage units in Jeffersonville, Vermont, it is essential to require tenants to have their own self-storage insurance. Here’s why self-storage insurance is necessary for businesses:

1. Liability Protection: Self-storage insurance provides liability protection to the business owner in case of damage or loss to a tenant’s stored belongings. Without self-storage insurance, businesses could be held financially responsible for such incidents.

2. Tenant Satisfaction: Requiring tenants to have self-storage insurance demonstrates the business’s commitment to ensuring the safety and security of their belongings. It helps build trust and satisfaction among tenants, leading to positive reviews and referrals.

3. Risk Transfer: By requiring tenants to have self-storage insurance, businesses transfer the responsibility of covering the cost of damaged or lost belongings to the insurance provider. This helps protect the business’s finances and avoids potential disputes with tenants regarding liability.

4. Compliance with Regulations: Many jurisdictions, including Vermont, may require self-storage facilities to have tenants with self-storage insurance. By enforcing this requirement, businesses can ensure compliance with local regulations and avoid penalties or legal complications.

5. Peace of Mind: Having self-storage insurance gives both the business owner and the tenant peace of mind, knowing that their respective interests are protected in case of unforeseen events that may cause damage or loss to stored belongings.

Therefore, property insurance and self-storage insurance serve different purposes in protecting storage facilities. While property insurance covers the physical structure and business assets, self-storage insurance is necessary to safeguard the belongings of individual tenants. For businesses in Jeffersonville, Vermont, requiring tenants to have self-storage insurance is crucial for liability protection, tenant satisfaction, risk transfer, compliance with regulations, and peace of mind.

Additional Coverage Options and Costs

Policies that offer higher coverage limits

In addition to basic property insurance and self-storage insurance, there are additional coverage options available for storage facility owners in Jeffersonville, Vermont. These options allow for higher coverage limits and may provide additional protection for your business and tenants’ belongings. Some of these options include:

– Business interruption insurance: This coverage helps reimburse you for lost income and extra expenses if your storage facility becomes temporarily unusable due to a covered event, such as a fire or natural disaster.

– Cyber liability insurance: In today’s digital age, protecting your business from cyber threats is crucial. Cyber liability insurance helps cover the costs associated with data breaches, cyberattacks, and legal actions resulting from these incidents.

– Equipment breakdown insurance: If you rely on specialized equipment to operate your storage facility, equipment breakdown insurance can provide coverage for the repair or replacement of these items in the event of a breakdown or mechanical failure.

– Employment practices liability insurance: This coverage protects your business against claims of wrongful termination, discrimination, harassment, or other employment-related issues brought by employees or former employees.

Costs associated with higher coverage options

The cost of additional coverage options will vary depending on factors such as the size of your storage facility, the value of the items stored, and the specific risks associated with your location. It is important to consult with an insurance agent to assess your needs and determine the appropriate coverage limits for your business.

While these additional coverage options may increase your insurance premiums, they provide added peace of mind and financial protection in case of unexpected events or situations. It is crucial to carefully evaluate the costs and benefits of these options to ensure you are adequately protected without overpaying for coverage you may not need.

Always compare different insurance providers and policies to find the best fit for your storage facility. Consider factors such as coverage limits, deductibles, exclusions, and customer reviews or ratings. Working with an experienced insurance agent who understands the unique needs of storage facility owners can also help you make informed decisions about the coverage options and costs associated with them.

Therefore, storage facility owners in Jeffersonville, Vermont have various insurance options available to protect their business and tenants’ belongings. Additional coverage options such as business interruption insurance, cyber liability insurance, equipment breakdown insurance, and employment practices liability insurance can provide higher coverage limits and added protection. The costs associated with these options will vary based on factors specific to your storage facility. It is essential to carefully assess your needs and consult with an insurance agent to determine the appropriate coverage limits and compare different providers to find the best fit for your business.

Case Study: Coverage and Cost Analysis for Storage Units

Examining a case study with different coverage options

To illustrate the importance of insurance coverage for storage units, let’s consider a case study in Jeffersonville, Vermont. We will compare the coverage options available and analyze the associated costs.

In this case study, we will focus on two insurance options: property insurance and self-storage insurance.

Comparing costs and coverage for a storage unit

Property Insurance:

– Coverage: Property insurance provides protection for the physical structure of the storage facility and the business and personal property within it. This includes coverage for risks such as fire, flood, and damage caused by natural disasters like hurricanes and earthquakes.

– Cost: The cost of property insurance for a storage facility in Jeffersonville, Vermont, can vary depending on factors such as the size of the facility, location, and value of the property and assets being insured.

Self-Storage Insurance:

– Coverage: Self-storage insurance is specifically designed to protect the belongings of individual tenants stored in self-storage units. It covers risks such as theft, fire, water damage, and damage caused by pests, mold, or other unforeseen circumstances.

– Cost: The cost of self-storage insurance for individual tenants can vary depending on factors such as the value of their belongings and the coverage limits they choose.

Comparing the costs of property insurance and self-storage insurance, property insurance typically has higher premiums due to its broader coverage for the entire facility. On the other hand, self-storage insurance premiums are usually lower since they only cover the individual tenant’s belongings.

When analyzing the coverage options for a storage unit in Jeffersonville, it is important to consider the specific needs of the facility and its tenants. Property insurance is necessary to protect the facility and its assets from physical damage, while self-storage insurance is essential for tenants to safeguard their own belongings.

Therefore, insurance coverage for storage units in Jeffersonville, Vermont should include property insurance to protect the facility and self-storage insurance to protect the tenants’ belongings. By comparing the costs and coverage of these options, storage facility owners can make informed decisions to ensure adequate protection for their business and the belongings of their tenants.

Conclusion and Frequently Asked Questions

Key takeaways from the article

– When it comes to insurance coverage for storage units in Jeffersonville, Vermont, both property insurance and self-storage insurance are important.

– Property insurance covers the physical structure of the storage facility and the business and personal property within it, while self-storage insurance specifically protects the belongings of individual tenants stored in self-storage units.

– The cost of property insurance is typically higher due to its broader coverage, while self-storage insurance premiums are usually lower since they only cover the individual tenant’s belongings.

– Storage facility owners should consider both property insurance and self-storage insurance to ensure adequate protection for their business and the belongings of their tenants.

Answers to commonly asked questions about storage unit insurance in Vermont

Q: What is the difference between property insurance and self-storage insurance?

A: Property insurance covers the physical structure of the storage facility and the property within it, while self-storage insurance specifically protects the belongings of individual tenants stored in self-storage units.

Q: How much does property insurance cost for a storage facility in Jeffersonville, Vermont?

A: The cost of property insurance can vary depending on factors such as the size of the facility, location, and value of the property and assets being insured.

Q: How much does self-storage insurance cost for individual tenants?

A: The cost of self-storage insurance for individual tenants can vary depending on factors such as the value of their belongings and the coverage limits they choose.

Q: Do storage facility owners need both property insurance and self-storage insurance?

A: Yes, it is recommended for storage facility owners to have both property insurance to protect the facility and self-storage insurance to protect the belongings of their tenants.

Q: What risks are covered by self-storage insurance?

A: Self-storage insurance typically covers risks such as theft, fire, water damage, and damage caused by pests, mold, or other unforeseen circumstances.

Q: Does self-storage insurance cover damage during transit to or from the facility?

A: Yes, self-storage insurance can provide coverage for damage to belongings during transit to or from the storage facility.

Q: Can tenants choose their own coverage limits with self-storage insurance?

A: Yes, tenants can typically choose their own coverage limits with self-storage insurance based on the value of their belongings.

Q: How can storage facility owners ensure adequate protection for their business and tenants?

A: By comparing the costs and coverage of property insurance and self-storage insurance, storage facility owners can make informed decisions to ensure adequate protection for their business and the belongings of their tenants.

Overall, insurance coverage for storage units in Jeffersonville, Vermont should include both property insurance and self-storage insurance to provide comprehensive protection for the facility and its tenants. Proper insurance coverage can help safeguard against potential risks and provide peace of mind for storage facility owners and tenants alike.

Explore Storage unit insurance cheap.