Introduction

Overview of storage unit insurance and its importance in Public Storage facilities

Storage unit insurance is crucial to protect your personal belongings while they are stored in a rental storage unit. Public Storage facilities often require renters to have insurance coverage for their stored items. This requirement is in place to ensure that in the event of theft, damage, or natural disasters, the renters are adequately compensated for their losses.

Why you need insurance for your stored belongings

Having insurance for your stored belongings is essential for several reasons:

1. Protection against theft and damage: Storage units can be susceptible to theft and damage from various causes, such as break-ins, fire, water leaks, or climate-related issues. Insurance coverage ensures that you are financially protected in case of such incidents.

2. Coverage for unexpected events: Natural disasters like floods, hurricanes, or earthquakes can happen unexpectedly, causing severe damage to your stored items. Insurance coverage can help you recover the value of your belongings and ease the financial burden.

3. Peace of mind: Knowing that your stored items are insured provides peace of mind. It allows you to focus on other important matters without constantly worrying about the safety of your belongings.

4. Replacement cost coverage: With the right insurance policy, you can receive compensation for the full replacement value of your items, rather than just their depreciated value. This can be especially important for valuable or sentimental items that may be difficult to replace.

5. Additional liability protection: Some storage unit insurance policies also provide liability coverage. This means you are protected in case someone is injured while on the storage facility’s premises.

Types of storage unit insurance policies

There are mainly two types of storage unit insurance policies:

1. Self-storage facility insurance: Many storage facilities offer their own insurance coverage options. These policies are often convenient to purchase and may provide adequate coverage for your belongings. However, it is important to carefully review the terms, conditions, and coverage limits before choosing this option.

2. Personal property insurance: Alternatively, you can opt for personal property insurance through your existing homeowners or renters insurance policy. This typically offers extended coverage for stored items, though it may have certain limitations or additional costs.

Key considerations when choosing storage unit insurance

When selecting storage unit insurance, consider the following factors:

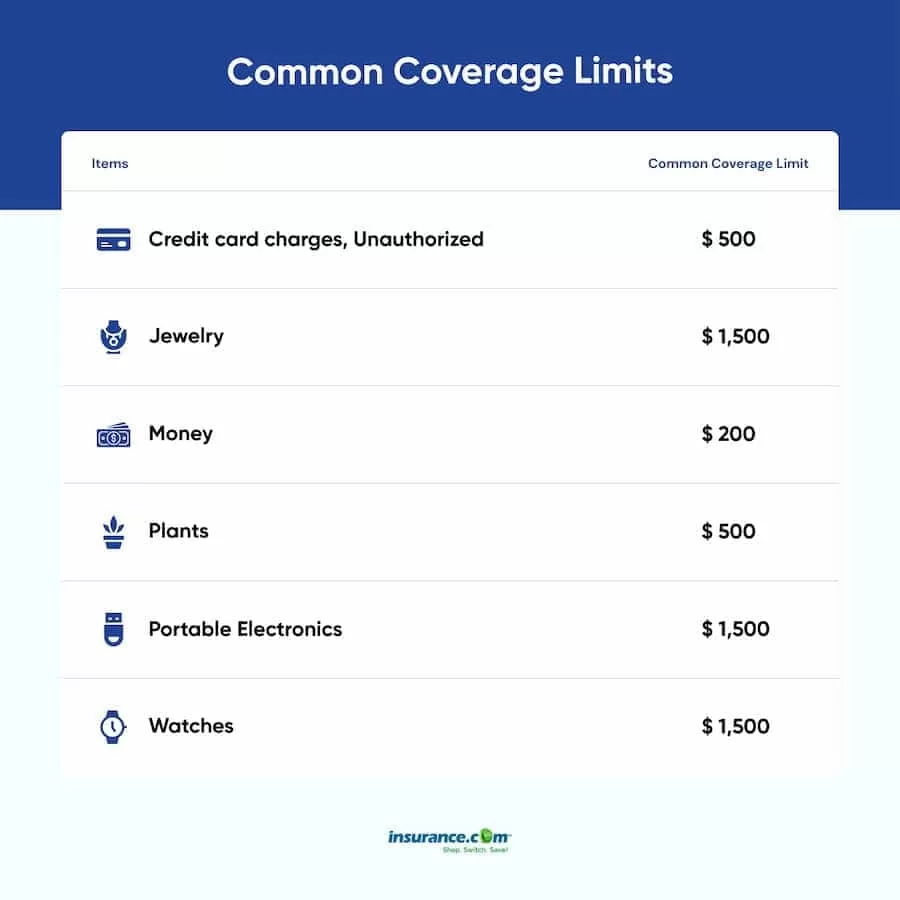

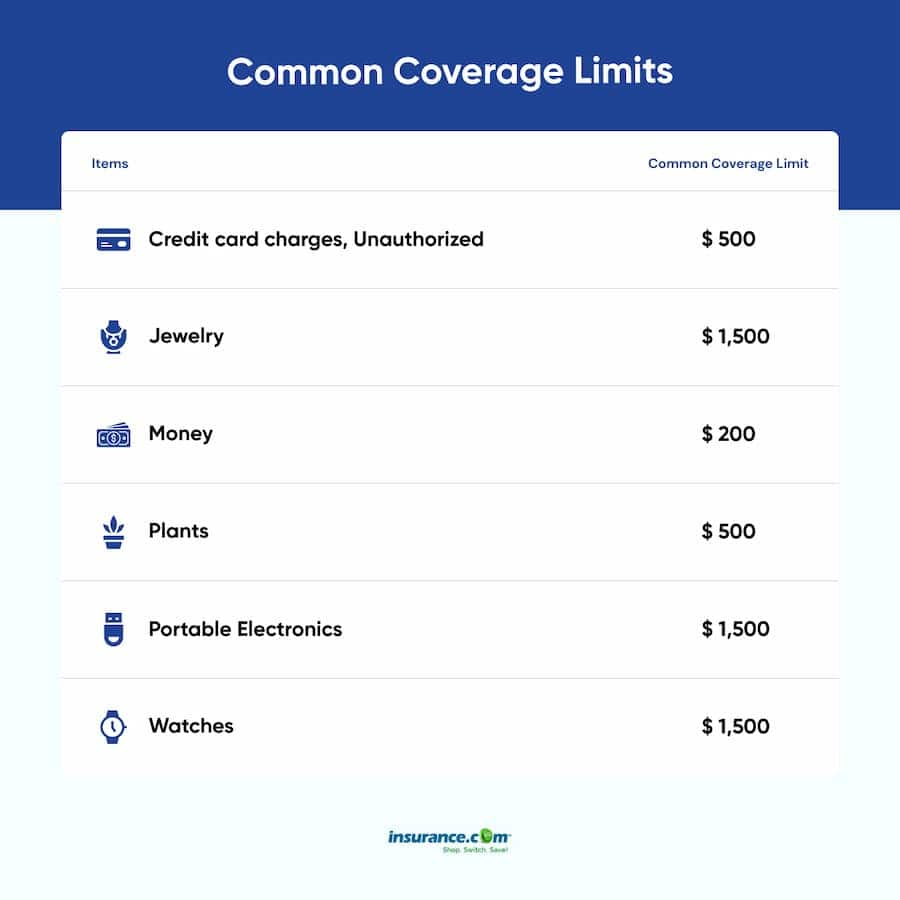

1. Coverage limits: Make sure the insurance policy covers the full value of your stored items. Some policies have lower coverage limits for certain categories of belongings, so it’s important to understand these limits and ensure they meet your needs.

2. Deductibles: Understand the deductible amount you would be responsible for in case of a claim. A lower deductible may mean higher premiums, so weigh the cost-benefit based on the value of your stored items.

3. Exclusions: Review the insurance policy for any exclusions or limitations on coverage. Certain high-value items or specific events may not be covered, so be aware of these restrictions.

4. Premiums: Compare premiums from different insurance providers to ensure you are getting the best value for your coverage. Consider any discounts or promotional offers available.

5. Documentation: Keep an inventory of your stored items and their value, including photographs or receipts. This will be helpful in the event of a claim.

Therefore, having insurance coverage for your stored belongings in a storage unit is essential to protect against theft, damage, and unexpected events. Whether you opt for the insurance offered by the facility or through your existing policy, ensure you understand the coverage, exclusions, and limits to make an informed decision that adequately safeguards your valued possessions. Remember to consult with your insurance agent or the storage facility to determine the best insurance options for your specific needs.

Understanding the insurance requirements set by Public Storage

Public Storage is a popular storage unit company that operates throughout the United States. If you are considering renting a storage unit from Public Storage, it is important to understand their insurance requirements. Here are some key points to know:

– **Insurance requirements**: Public Storage sometimes requires tenants to have insurance coverage for their stored belongings. However, it is important to note that this requirement may not be applicable in all locations. The specific insurance requirements may vary depending on the state and facility.

– **Coverage limits**: If you already have homeowners insurance or renters insurance, it is possible that your policy may provide coverage for your stored belongings. However, it is important to check with your insurance agent to confirm the coverage limits. Many homeowners insurance policies have lower coverage limits for stored belongings compared to those in your primary residence.

– **Additional coverage**: If your existing homeowners or renters insurance policy does not provide sufficient coverage for your stored belongings, you may need to consider additional insurance options. Public Storage may offer insurance plans that can be purchased directly through their company. These plans are designed to provide coverage specifically for items stored in their facilities.

Options for meeting the insurance requirements

If you are required to have insurance coverage for your storage unit at Public Storage, you have a few options to consider:

1. **Use existing homeowners or renters insurance**: Check with your insurance agent to see if your current policy covers stored belongings and if it meets the coverage requirements set by Public Storage. If so, you may be able to simply provide proof of insurance to meet the requirements.

2. **Purchase insurance directly from Public Storage**: Public Storage may offer insurance plans that can be purchased directly from them. These plans are tailored to meet the specific coverage needs of items stored in their facilities. The cost and coverage options may vary, so it is important to explore this option and understand the terms and conditions of the insurance offered.

3. **Explore third-party insurance providers**: If you prefer to have insurance coverage from a different provider, you can also consider third-party insurance options. Some insurance companies specialize in providing coverage for stored belongings, offering customizable plans for storage unit renters.

Therefore, if you are planning to rent a storage unit from Public Storage, it is important to familiarize yourself with their insurance requirements. Whether you use your existing homeowners or renters insurance, purchase insurance through Public Storage, or explore third-party options, having insurance coverage for your stored belongings provides peace of mind and protection in case of unforeseen events.

Coverage Offered by Public Storage

Exploring the insurance coverage offered by Public Storage

When renting a storage unit from Public Storage, it is important to understand the insurance coverage options available to protect your stored belongings. Public Storage offers insurance plans that are specifically designed to cover items stored in their facilities. Here are some details to consider:

– **Coverage against common perils**: Public Storage’s insurance plans typically provide coverage against common perils such as theft, vandalism, and weather damage. This means that if any of these events were to occur and cause damage to your stored belongings, you may be eligible for compensation.

– **Policy terms and conditions**: It is essential to carefully review the terms and conditions of Public Storage’s insurance coverage. This will give you a clear understanding of the coverage limits, deductible amounts, and any exclusions or limitations that may apply. Knowing the details of your insurance policy will help you make informed decisions and ensure that you have the necessary coverage.

– **Limits and deductibles**: Public Storage’s insurance plans may have coverage limits and deductibles that you need to consider. The coverage limit is the maximum amount the insurance company will pay out in the event of a claim. The deductible is the initial amount you are responsible for paying before the insurance company covers the remaining costs. By evaluating these factors, you can determine the level of coverage that best suits your needs.

Details of the coverage against common perils such as theft, vandalism, and weather damage

When it comes to protecting your stored belongings, Public Storage’s insurance plans typically offer coverage against common perils. Here are some specific details regarding the coverage:

– **Theft**: If your stored belongings are stolen, Public Storage’s insurance plans may provide compensation for the value of the stolen items. However, it is important to note that there may be certain conditions and requirements you need to fulfill to file a theft claim. These details are outlined in the insurance policy, so make sure to review them carefully.

– **Vandalism**: In the unfortunate event of vandalism to your stored belongings, Public Storage’s insurance plans may cover the damage caused. The coverage should include repairs or replacement of the damaged items, up to the coverage limit specified in the policy. Again, it is crucial to understand the policy’s terms and conditions for filing vandalism claims.

– **Weather damage**: Public Storage’s insurance plans typically include coverage for weather-related damage, such as damage caused by storms, floods, or other natural disasters. This can provide financial protection in case your stored belongings are affected by these events. However, be aware that there may be specific exclusions or limitations related to weather damage coverage, so it is important to review the policy details thoroughly.

Before finalizing your rental agreement with Public Storage, it is recommended to discuss the insurance coverage options with a representative from the company. They can provide you with detailed information about the specific coverage available and answer any questions you may have. Remember, having adequate insurance coverage for your stored belongings can provide peace of mind and protection in case of unexpected events.

Self-Storage Tenant Insurance Program

Overview of the Self-Storage Tenant Insurance Program offered by Public Storage

Public Storage offers a Self-Storage Tenant Insurance Program that provides insurance coverage specifically for items stored in their facilities. This program is designed to provide protection and peace of mind to tenants who rent storage units from Public Storage.

Key points to know about this insurance program include:

– **Coverage options**: The Self-Storage Tenant Insurance Program offers various coverage options to suit the needs of different tenants. These options may include protection against perils such as fire, theft, and water damage. It is important to familiarize yourself with the specific coverage options and choose the one that best meets your needs.

– **Beneficiary protection**: In case of loss or damage to your stored belongings, the Self-Storage Tenant Insurance Program allows you to select a beneficiary who would receive the insurance payout. This ensures that your loved ones or designated individuals would be financially compensated in the event of a covered incident.

– **Cost and payment**: The cost of the Self-Storage Tenant Insurance Program can vary depending on factors such as the value and type of items being stored. The premium for this insurance can be included in your monthly storage rental fee, making it convenient and easy to manage.

Benefits and advantages of opting for this insurance program

Choosing the Self-Storage Tenant Insurance Program offered by Public Storage can provide several benefits and advantages, including:

– **Comprehensive coverage**: This insurance program offers coverage specifically tailored for items stored in Public Storage facilities. It provides protection against various risks and perils that could result in loss or damage to your belongings. Having this coverage ensures that you are financially protected in case of unforeseen events.

– **Convenience and simplicity**: Opting for the Self-Storage Tenant Insurance Program eliminates the need to search for external insurance providers or modify your existing homeowners or renters insurance policies. The insurance application process is typically straightforward, and the premium can be conveniently paid along with your monthly storage rental fee.

– **Peace of mind**: Knowing that your stored belongings are protected by insurance can give you peace of mind. It allows you to focus on other aspects of your life, knowing that in the event of a covered incident, you have financial protection in place.

It is important to note that the Self-Storage Tenant Insurance Program offered by Public Storage is optional. However, considering the potential risks and the value of your stored belongings, it is advisable to carefully evaluate this insurance program and determine if it is the right choice for you.

Therefore, Public Storage offers a Self-Storage Tenant Insurance Program that provides coverage specifically for items stored in their facilities. This insurance program offers various coverage options, convenient payment methods, and peace of mind to tenants. When renting a storage unit from Public Storage, it is important to consider the insurance requirements and evaluate the benefits of opting for their Self-Storage Tenant Insurance Program. Contact Public Storage or speak with their representatives to get more information on the insurance options available and make an informed decision.

Comparison with Other Insurance Options

Comparing Public Storage insurance with other insurance providers

When considering insurance options for your stored belongings, it is essential to compare Public Storage’s Self-Storage Tenant Insurance Program with other insurance providers. Understanding the features, coverage, and pricing differences can help you make an informed decision.

Features, coverage, and pricing differences

Here are some key points to consider when comparing Public Storage insurance with other insurance options:

– **Coverage specific to storage units**: Public Storage’s insurance program is designed specifically for items stored in their facilities. This specialized coverage ensures that your belongings are protected against risks commonly associated with storage units, such as fire, theft, and water damage. In contrast, other insurance providers may offer more general coverage that may not be tailored to the unique risks of storage units.

– **Convenience and simplicity**: Public Storage’s Self-Storage Tenant Insurance Program offers a seamless and convenient insurance application process that can be easily included in your monthly storage rental fee. This integration simplifies the management of your insurance and eliminates the need to search for external insurance providers. Other insurance companies may require separate applications and payments, adding complexity and potential hassle to the process.

– **Price and value**: The cost of insurance coverage can vary among providers. Public Storage’s insurance program offers competitive pricing, taking into account factors such as the value and type of items being stored. It’s important to compare the pricing and coverage limits of various insurance providers to ensure you are getting the best value for your money.

– **Flexible coverage options**: Public Storage’s insurance program offers various coverage options to suit the needs of different tenants. You can select the level of protection that aligns with the value and importance of your stored belongings. Depending on the insurance provider, you may have different coverage options available, so it’s crucial to compare and choose the one that best meets your individual needs.

Therefore, when comparing Public Storage’s Self-Storage Tenant Insurance Program with other insurance providers, it is important to consider the coverage specific to storage units, the convenience and simplicity of the insurance application and payment process, the price and value of the coverage, and the flexibility of coverage options. By understanding these differences, you can make an informed decision that best protects your stored belongings. It’s recommended to consult with insurance agents from different providers, compare their offerings, and choose the insurance option that provides the most suitable coverage and peace of mind for you.

Additional Coverage Options

Exploring additional coverage options for storage unit insurance

When it comes to protecting your belongings stored in a self-storage unit, you may want to consider additional coverage options to ensure comprehensive protection. While the Self-Storage Tenant Insurance Program offered by Public Storage provides a solid level of coverage, there may be certain items or risks that require specialized coverage.

Specialized coverage for valuable items or specific risks

If you have valuable items, such as jewelry, artwork, or collectibles, you may want to explore additional coverage options to adequately protect these items. Standard storage unit insurance policies may have coverage limits for high-value items, so specialized coverage can provide the extra protection and peace of mind you need.

Additionally, if your stored belongings are at risk of specific perils that may not be covered by a standard insurance policy, it is worth considering specialized coverage. For example, if you live in an area prone to natural disasters such as flooding or earthquakes, you may want to obtain coverage that specifically includes these risks.

To explore additional coverage options for your storage unit insurance, it is recommended to consult with your insurance agent or contact Public Storage directly. They can provide guidance on the available options and help you determine the best course of action based on your individual needs and circumstances.

Therefore, while the Self-Storage Tenant Insurance Program offered by Public Storage provides coverage for items stored in their facilities, additional coverage options may be necessary for specific items or risks. By exploring specialized coverage and discussing your needs with your insurance agent, you can ensure that your stored belongings are adequately protected. Remember to carefully review the terms and conditions of any additional coverage options to fully understand the extent of the coverage provided. By taking the necessary steps to obtain the right insurance coverage, you can have peace of mind knowing that your belongings are protected while in storage.

Rental Agreement Insurance Requirements

Understanding the insurance requirements stated in the rental agreement

When renting a storage unit, it is important to understand the insurance requirements outlined in the rental agreement. Different storage unit companies may have varying insurance requirements for their tenants. Here is a comparison of insurance requirements by some popular storage unit companies:

|

Storage Unit Company |

Insurance Required |

|---|---|

|

CubeSmart |

Yes |

|

iStorage |

Yes |

|

Life Storage |

Yes |

|

Simply Self Storage |

Yes |

|

Extra Space Storage |

Yes |

|

Public Storage |

Sometimes |

|

U-Haul Self Storage |

Yes |

It is important to note that the information provided is based on data as of 12/27/22, and availability and requirements may vary by location.

How to fulfill the insurance requirements to comply with the agreement

To comply with the rental agreement’s insurance requirements, you typically need storage unit insurance, also known as tenant insurance. This insurance protects your belongings stored in the unit, similar to how homeowners insurance protects your home and belongings. However, it is essential to check with your insurance agent to confirm if your homeowners insurance policy covers storage units. It is also important to be aware that homeowners insurance may have lower coverage limits for stored belongings.

If your homeowners insurance policy does not cover storage units or does not provide sufficient coverage, you can consider obtaining renters insurance. Renters insurance, also referred to as tenant insurance, is specifically designed to protect renters and their belongings. It provides coverage for belongings inside the rented premises, including storage units.

When considering additional coverage options for your storage unit insurance, there are a few things to keep in mind. Firstly, if you have valuable items such as jewelry, artwork, or collectibles, you may want to explore specialized coverage options to adequately protect them. Standard storage unit insurance policies may have coverage limits for high-value items, so specialized coverage can provide extra protection.

Additionally, if your stored belongings are at risk of specific perils that may not be covered by a standard insurance policy, it is worth considering specialized coverage. For example, if you live in an area prone to natural disasters such as flooding or earthquakes, obtaining coverage that specifically includes these risks can provide added peace of mind.

To explore additional coverage options for your storage unit insurance, it is recommended to consult with your insurance agent or contact the storage unit company directly. They can provide guidance on the available options and help determine the best course of action based on your individual needs and circumstances.

Therefore, understanding and fulfilling the insurance requirements stated in the rental agreement is crucial when renting a storage unit. While some storage unit companies may require insurance, it is important to ensure that your coverage adequately protects your stored belongings. By exploring additional coverage options and discussing your needs with your insurance agent, you can have peace of mind knowing that your belongings are protected while in storage.

Factors to Consider when Choosing Insurance

Important factors to consider when selecting storage unit insurance

When choosing insurance for your storage unit, it’s essential to consider several factors to ensure you get the coverage that meets your needs. Here are some important factors to keep in mind:

Cost, coverage limits, deductibles, and customer reviews

1. **Cost**: Compare the premiums of different insurance policies to find one that fits within your budget. However, it’s important to remember that while cost is important, it shouldn’t be the sole determining factor. Consider the value of your stored belongings and the level of coverage you require.

2. **Coverage limits**: Check the coverage limits of the insurance policy to ensure they are sufficient for your stored items. Standard storage unit insurance policies may have limits on certain types of items, such as high-value jewelry or collectibles. If you have valuable items, consider additional coverage to adequately protect them.

3. **Deductibles**: Understand the deductible amount you would be responsible for paying in the event of a claim. A higher deductible may result in lower premiums, but it could also mean more out-of-pocket expenses in case of a loss.

4. **Customer reviews**: Research the reputation of the insurance provider to ensure their claims process is smooth and reliable. Read customer reviews and consider the experiences of others who have made claims in the past. This will give you an idea of how responsive and efficient the insurance company is in handling claims.

5. **Policy terms and conditions**: Carefully review the terms and conditions of the insurance policy before making a decision. Understand the scope of coverage, any exclusions, and the process for filing a claim. It’s important to have a clear understanding of what is covered and under what circumstances.

By considering these factors and doing thorough research, you can select an insurance policy that provides the right level of coverage for your stored belongings. Remember to consult with your insurance agent or contact the insurance provider directly to address any specific concerns or questions you may have.

Choosing the right insurance for your storage unit is crucial to protecting your belongings in case of unexpected events. Take the time to compare options, understand the policy terms, and ensure that you have adequate coverage for your stored items.

Conclusion

Summary of the key points discussed in the blog post

In this blog post, we discussed the importance of having insurance coverage for your storage unit. We learned that homeowners insurance policies often cover storage units, but it is important to check with your insurance agent to confirm. We also discovered that renters insurance, also known as tenant insurance, provides coverage for both your personal belongings in a storage unit and the place you rent to live.

We then explored the factors to consider when choosing storage unit insurance. These factors include cost, coverage limits, deductibles, customer reviews, and policy terms and conditions. It is crucial to compare premiums, ensure sufficient coverage limits for your stored items, understand the deductible amount, research the reputation of the insurance provider, and review the policy terms and conditions.

Final thoughts on the importance of storage unit insurance and the available options

Having insurance coverage for your storage unit is vital for protecting your belongings from unexpected events such as theft, damage, or natural disasters. By carefully considering the factors mentioned above, you can select an insurance policy that provides the right level of coverage for your stored belongings.

Remember to consult with your insurance agent or contact the insurance provider directly to address any specific concerns or questions you may have. They can guide you in understanding the available options and help you choose the best insurance coverage for your storage unit.

Therefore, taking the time to research and choose the right insurance for your storage unit is a wise investment. It provides peace of mind knowing that your valuable items are protected and that you are prepared for any unforeseen circumstances.

Learn about Usaa can i get renters insurance for storage units.