Importance of Storage Unit Insurance

Why is storage unit insurance necessary?

Storage unit insurance is necessary for several reasons:

1. **Protection of stored belongings**: Self-storage facilities and mobile storage container leasing companies do not automatically insure your stored property. By purchasing storage unit insurance, you ensure that your belongings are protected in case of theft, damage, or other unforeseen incidents.

2. **Comprehensive coverage**: Storage unit insurance provides comprehensive coverage for the items stored in your unit. This coverage extends to items such as furniture, appliances, electronics, clothing, and other personal belongings. Having this protection in place gives you peace of mind knowing that your valuable possessions are covered.

3. **Protection during transit**: Storage unit insurance also offers protection during transit. This means that if you are moving your belongings to or from the storage unit, they will be covered in case of any accidents or damage that may occur during transport.

4. **Low deductibles for claims**: One of the benefits of having storage unit insurance is that it typically comes with low deductibles for claims. This means that if you need to file a claim, you will not have to pay a significant amount out of pocket before receiving compensation for your losses.

5. **Prevents risk of cancellation**: Another important reason to have storage unit insurance is that it prevents the risk of cancellation to your homeowner’s policy should a claim occur. Some homeowner’s insurance policies may cancel your coverage if you file a claim for items stored outside of your home. By having separate storage unit insurance, you can ensure that your homeowner’s policy remains intact.

Understanding the risks of not having storage unit insurance

Choosing not to have storage unit insurance can leave you financially vulnerable. Here are some risks associated with not having this coverage:

1. **Loss of value**: Without storage unit insurance, you risk losing the value of your stored belongings in case of theft, fire, water damage, or other unforeseen events. This can be a significant financial loss, especially if your stored items include valuable or sentimental items.

2. **Out-of-pocket expenses**: If your stored belongings are damaged or stolen and you do not have insurance, you will be responsible for the costs of replacing or repairing them out of pocket. These expenses can add up quickly and may put a strain on your budget.

3. **Cancellation of homeowner’s policy**: If you file a claim for items stored outside of your home on your homeowner’s insurance policy, there is a risk that your coverage may be canceled. This can leave you without any insurance coverage for your home as well.

4. **Lack of peace of mind**: Not having storage unit insurance can create unnecessary worry and stress. Knowing that your belongings are protected in case of unforeseen events can give you peace of mind and allow you to focus on other important matters.

Therefore, storage unit insurance is necessary to protect your stored belongings, provide comprehensive coverage, and prevent financial risks. By understanding the importance of this coverage and the risks associated with not having it, you can make an informed decision to ensure the safety of your stored items.

Coverage Options for Storage Unit Insurance

Exploring different types of storage unit insurance coverage

When it comes to protecting your belongings in a storage unit, there are different coverage options available. Here are some common types of storage unit insurance coverage:

1. Storage Protectors Contents Insurance Program: This program provides economical coverages specifically designed for stored belongings. It offers an additional layer of protection against potential losses due to unforeseen incidents. By purchasing this coverage, you can alleviate concerns about burglaries, damages, or losses that may occur.

2. Homeowner’s Insurance: While homeowner’s insurance can provide coverage for personal belongings, it’s important to speak with your insurance brokerage to clarify their policies and deductibles. In some cases, homeowner’s insurance may not provide adequate coverage for items stored in a storage unit.

3. Specialized Rental Storage Insurance: Companies like Discount Storage Insurance offer specialized rental storage insurance policies. These policies can be customized to fit your specific needs and budget. They cover theft, damage, or loss of the contents in storage units and mobile storage containers.

Choosing the right coverage for your storage needs

When selecting a coverage option for your storage unit, it’s essential to consider your specific needs. Here are some factors to consider when choosing the right coverage:

1. Value of stored belongings: Determine the value of your belongings stored in the unit. This will help you determine the coverage limits you require.

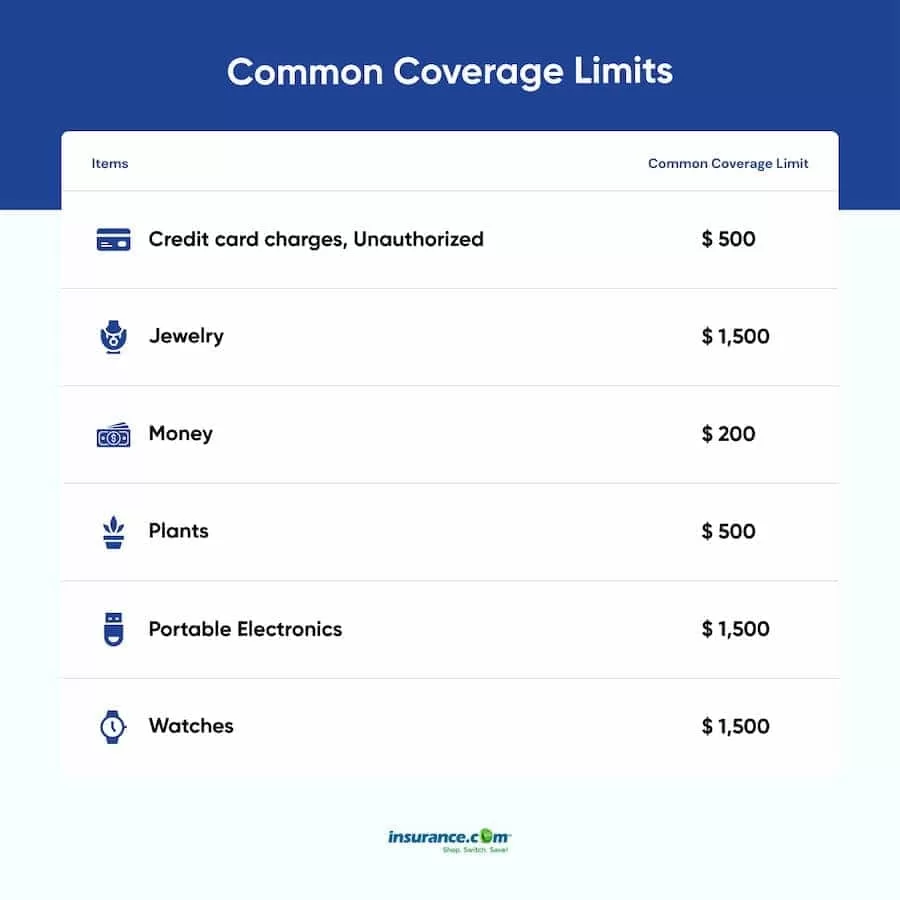

2. Type of belongings: Consider the type of items you have stored. Some items may require additional coverage, such as valuable artwork, jewelry, or antique furniture.

3. Deductibles and premiums: Compare the deductibles and premiums offered by different insurance providers. Look for a balance between affordable premiums and reasonable deductibles.

4. Policy terms and conditions: Read the policy terms and conditions carefully. Understand what is covered and what is not covered under the policy.

5. Additional coverage: If you need additional coverage beyond the standard policy, ask the insurance provider if they offer riders or endorsements that can provide extra protection.

|

Types of Coverage |

Storage Protectors Contents Insurance Program |

Specialized Rental Storage Insurance |

|---|---|---|

|

Coverage for theft |

Yes |

Yes |

|

Coverage for damage |

Yes |

Yes |

|

Coverage for loss |

Yes |

Yes |

|

Customizable coverage |

No |

Yes |

|

Additional coverage options |

No |

Yes |

So, it is advisable to consider getting storage unit insurance to protect your belongings. While homeowner’s insurance may provide some coverage, it’s essential to confirm the extent of coverage and any limitations. Specialized rental storage insurance programs offer customizable policies and additional coverage options to ensure the protection of your stored belongings.

MiniCo: Direct Coverage Provider

Purchasing coverage directly from MiniCo

When it comes to protecting your storage unit and its contents, MiniCo offers direct coverage options tailored specifically for self-storage tenants. By purchasing coverage directly from MiniCo, you can ensure that your belongings are adequately protected against theft, damage, or loss.

Benefits and features of MiniCo’s storage unit insurance

MiniCo’s storage unit insurance program provides a range of benefits and features designed to meet the unique needs of self-storage tenants. Here are some of the key advantages of choosing MiniCo for your storage unit insurance:

1. Convenient application process: MiniCo’s TenantOne Direct Tenant Insurance program simplifies the insurance application process. The self-storage facility provides tenants with the insurance application during the leasing process, and once the tenant submits the application, MiniCo takes care of the rest.

2. Comprehensive coverage: MiniCo’s insurance program offers comprehensive coverage for theft, damage, and loss of stored belongings. This ensures that you are protected against a wide range of risks and incidents.

3. Competitive fees: MiniCo’s Pay-With-Rent Tenant Insurance allows tenants to bundle the insurance costs into their monthly rental fee. This provides a convenient and cost-effective way to obtain the necessary coverage.

4. Minimal administrative effort: By partnering with MiniCo, self-storage businesses can easily incorporate tenant insurance into their operations. MiniCo handles the administrative tasks, allowing businesses to focus on their core operations.

5. Customizable coverage: MiniCo’s specialized rental storage insurance program offers the flexibility to customize your coverage based on your specific needs. This means that you can tailor the policy to adequately protect valuable or unique items stored in your unit.

6. Additional coverage options: In addition to standard coverage, MiniCo also offers additional coverage options. These riders or endorsements provide extra protection for items that may require additional coverage beyond the standard policy.

7. Peace of mind: With MiniCo’s storage unit insurance, you can have peace of mind knowing that your belongings are protected. Whether it’s protecting valuable items or mitigating the financial impact of unexpected incidents, MiniCo’s coverage options offer reliable protection.

Therefore, MiniCo’s direct coverage options for storage unit insurance provide convenient and comprehensive protection for self-storage tenants. By choosing MiniCo, you can benefit from a simplified application process, customizable coverage options, and peace of mind knowing that your belongings are adequately protected. Don’t leave the safety of your stored belongings to chance – consider MiniCo for your storage unit insurance needs.

Simply Fill Out Online Form

The convenience of exploring storage unit insurance options online

Finding the right coverage for your storage needs has never been easier. With online form options, you can explore different rental storage insurance options and choose the coverage that fits your requirements. Whether you need self storage insurance or mobile storage insurance, the online form allows you to customize your coverage and complete the process from the comfort of your own home.

Step-by-step guide to filling out the online form

1. Visit the website: Start by visiting the website of the storage unit insurance provider. Look for the online form or application section.

2. Fill out your information: The online form will require you to provide your personal information, including your name, contact details, and storage unit information. Make sure to provide accurate and up-to-date information.

3. Select your coverage: Once you have entered your information, you will be prompted to select the coverage options that best suit your needs. This may include options for theft, damage, and loss coverage. Consider the value of your stored belongings and any additional coverage you may require.

4. Review and confirm: After selecting your coverage options, take the time to review your choices. Make sure all the information is correct and that you have chosen the coverage that meets your needs.

5. Complete the checkout process: Once you are satisfied with your coverage choices, proceed to the checkout process. This may include entering payment information or setting up automatic payments. Follow the prompts to complete the checkout process.

6. Receive your insurance certificate: After completing the checkout process, you will receive an insurance certificate. This certificate serves as proof of your coverage and should be kept in a safe place.

By providing an efficient and user-friendly online form, the storage unit insurance provider makes it easy for you to explore different coverage options and complete your purchase. With the convenience of online technology, you can complete the entire process from start to finish without leaving your home.

Benefits of Having Storage Unit Insurance

Having insurance coverage for your storage unit provides several benefits that can give you peace of mind and protect your belongings. Here are some of the benefits of having storage unit insurance:

1. Comprehensive coverage for items stored in a unit: Storage unit insurance provides coverage for various types of losses, including theft, damage, and loss. This comprehensive coverage ensures that your belongings are protected in case of unforeseen incidents.

2. Protection during transit: If you are moving your belongings to a storage unit, some insurance policies provide coverage during transit. This protects your belongings from damage or loss during the moving process.

3. Low deductibles for claims: Storage unit insurance policies often have low deductibles, making it more affordable to file a claim in the event of a loss. This means that you won’t have to pay a large amount out of pocket before receiving coverage for your damaged or stolen items.

4. Prevents risk of cancellation to your homeowner’s policy: If you were to make a claim on your homeowner’s insurance for items stored in a storage unit, it could potentially lead to a cancellation of your policy. Having separate storage unit insurance ensures that your homeowner’s policy remains intact in case of a claim.

By having storage unit insurance, you can protect your belongings and have peace of mind knowing that you are covered for potential losses. With the benefits of comprehensive coverage, protection during transit, low deductibles, and the avoidance of cancellation risks, it is a wise investment for anyone using a storage unit.

Self Storage Facilities and Insurance

Understanding that self storage facilities do not insure your goods

When it comes to storing your belongings at a self storage facility, it’s important to understand that the facility itself does not automatically provide insurance for your stored goods. This means that if any of your items are damaged, stolen, or lost while in storage, the facility is not responsible for compensating you for the loss.

Taking responsibility for protecting your stored goods

To ensure that your belongings are protected, it is essential to take responsibility and consider getting storage contents insurance. This type of insurance provides an additional layer of protection for your stored belongings and can alleviate concerns regarding potential losses associated with unanticipated incidents. It covers various types of losses, including theft, damage, and loss, providing you with comprehensive coverage for your items.

Benefits of Having Storage Unit Insurance

Having storage unit insurance offers several benefits that can give you peace of mind and protect your belongings. Here are some of the key benefits:

1. Comprehensive coverage: Storage unit insurance provides coverage for various types of losses, including theft, damage, and loss. This ensures that your belongings are protected in case of unforeseen incidents, giving you peace of mind.

2. Protection during transit: If you are moving your belongings to a storage unit, some insurance policies provide coverage during transit. This means that your items are protected from damage or loss during the moving process, ensuring they arrive at the storage unit safely.

3. Low deductibles for claims: Storage unit insurance policies often have low deductibles, making it more affordable to file a claim in the event of a loss. This means you won’t have to pay a large amount out of pocket before receiving coverage for your damaged or stolen items.

4. Avoidance of cancellation risks: Making a claim on your homeowner’s insurance for items stored in a storage unit could potentially lead to a cancellation of your policy. Having separate storage unit insurance ensures that your homeowner’s policy remains intact in case of a claim, protecting your overall coverage.

By investing in storage unit insurance, you can have peace of mind knowing that your belongings are protected against potential losses. Whether it’s coverage for theft, damage, or loss, the comprehensive protection, coverage during transit, and low deductibles offered by storage unit insurance make it a wise investment for anyone using a storage unit.

To get storage unit insurance, simply fill out an online form provided by the insurance provider. This convenient option allows you to explore different coverage options, provide your information, select the coverage that suits your needs, review and confirm your choices, complete the checkout process, and receive your insurance certificate – all from the comfort of your own home.

SnapNsure: Affordable Insurance Company

Introduction to SnapNsure as an affordable storage unit insurance provider

SnapNsure is an insurance company that specializes in providing affordable insurance coverage for storage units. With their extensive coverage options and competitive rates, they are a top choice for individuals looking to protect their belongings in storage. SnapNsure is underwritten by an A-rated insurance company, ensuring that their customers receive reliable and trustworthy coverage.

Benefits and features of SnapNsure’s coverage options

SnapNsure offers a range of benefits and features that make their coverage options stand out. Here are some of the highlights:

– **Better coverage with savings of 50% or more**: SnapNsure provides coverage for items that mobile storage companies often exclude. With their comprehensive coverage options, customers can enjoy peace of mind knowing that their belongings are protected.

– **Easy switch of policy**: Switching to SnapNsure is a hassle-free process. They will handle the cancellation of an existing policy at no extra cost, making it convenient for customers to transition to their coverage.

– **Add-on coverages for as little as $1/month**: SnapNsure allows customers to add additional coverages to their policy for as little as $1 per month. This flexibility ensures that customers can customize their coverage to meet their specific needs.

– **Coverage for items stored in transit**: For individuals who are moving their belongings to a storage unit, SnapNsure offers coverage during transit. This protects customers from loss or damage that may occur during the moving process.

– **Low deductibles for claims**: SnapNsure policies have low deductibles, making it more affordable for customers to file a claim in the event of a loss. This means that customers won’t have to pay a large amount out of pocket before receiving coverage for their damaged or stolen items.

– **Prevents risk of cancellation to homeowner’s policy**: Making a claim on a homeowner’s insurance for items stored in a storage unit can potentially lead to policy cancellation. By having separate storage unit insurance with SnapNsure, customers can protect their homeowner’s policy and avoid any cancellation risks.

SnapNsure’s user-friendly online form allows customers to easily explore different coverage options and complete their purchase from the comfort of their own home. With their affordable rates and comprehensive coverage, SnapNsure is the ideal choice for individuals looking for storage unit insurance.

Therefore, SnapNsure is an affordable insurance company that offers comprehensive coverage options for storage units. With their competitive rates, easy switch of policy, add-on coverages, coverage during transit, low deductibles, and protection of homeowner’s policies, customers can enjoy the benefits of having reliable insurance coverage for their storage units.

Insurance Coverage through Homeowners Policy

Overview of off-premises personal property coverage in homeowners policies

Homeowners insurance policies typically include coverage for personal property not only within the home but also for belongings that are stored elsewhere, such as storage units. This coverage is known as off-premises personal property coverage, and it is designed to protect your belongings even when they are not within the confines of your home. However, it is important to carefully review your policy to understand the extent of this coverage and any limitations or exclusions that may apply.

How it typically provides insurance coverage for belongings in storage units

When it comes to insurance coverage for belongings in storage units, homeowners policies generally provide coverage for theft, damage, or loss of personal property stored off-site. This coverage is based on the personal property coverage limit specified in your policy. It is important to note that coverage for belongings in storage units is typically subject to the same deductible as your other personal property coverage.

It’s important to understand the limits of your homeowners policy’s coverage for storage units. Some policies may limit coverage for certain types of property, such as jewelry, art, or collectibles, and may require additional riders or endorsements to provide full coverage. Additionally, certain events or perils may not be covered, such as flood damage or loss due to improper packing or storage.

It is recommended to speak with your homeowner’s insurance brokerage to clarify their policies and deductibles for storage unit coverage. They can guide you on the specific details of your policy and help you assess whether additional coverage or a separate storage unit insurance policy is necessary to adequately protect your belongings.

While homeowners insurance can provide some coverage for belongings in storage units, it may not offer the same level of comprehensive protection as a specialized storage unit insurance policy. This is where companies like SnapNsure come in, offering affordable and customizable coverage options specifically tailored to the unique needs of storing belongings in storage units.

Expert Storage Insurance for Personal, Students, or Business

The benefits of choosing expert storage insurance providers

When it comes to protecting your belongings in a storage unit, it is important to choose an expert storage insurance provider like SnapNsure. Here are some key benefits of opting for expert storage insurance:

– **Specialized coverage**: Expert storage insurance providers understand the unique risks associated with storing belongings in a storage unit. They offer specialized coverage options that cater to the needs of individuals, students, and businesses. This ensures that your belongings are adequately protected against theft, damage, or loss.

– **Peace of mind**: With expert storage insurance, you can have peace of mind knowing that your valuable items are covered in case of an unforeseen event. Whether it’s a natural disaster, a break-in, or damage during transit, expert storage insurance provides financial protection and eliminates worries about potential losses.

– **Faster claims process**: Expert storage insurance providers have streamlined claims processes in place to ensure that you receive prompt reimbursement in case of a covered incident. This eliminates the hassle and delays often associated with filing and processing insurance claims.

– **Knowledgeable customer support**: Expert storage insurance providers have knowledgeable and experienced customer support teams that can help answer any questions or concerns you may have about your policy. They can guide you through the coverage options, explain terms and conditions, and assist you with any claim-related issues.

Immediate certificate issuance and potential cost savings

One of the advantages of choosing expert storage insurance providers like SnapNsure is the immediate certificate issuance. Once you purchase a policy, you will receive a certificate of insurance promptly via email. This certificate serves as proof of coverage and can be presented to the storage facility or mobile storage container leasing company.

In addition to immediate certificate issuance, expert storage insurance providers also offer potential cost savings. Their coverage options are designed to be affordable, allowing you to protect your belongings without breaking the bank. With SnapNsure, customers can enjoy savings of 50% or more compared to other insurance providers.

By opting for expert storage insurance, you can have peace of mind, quick claims processing, access to knowledgeable customer support, and potential cost savings. It is the smart choice for individuals, students, and businesses looking to protect their belongings in a storage unit.

Remember, self-storage facilities and mobile storage container leasing companies do not automatically insure your stored property. By purchasing expert storage insurance, you can add an additional layer of protection and eliminate worries about potential losses. So, don’t wait, choose expert storage insurance providers like SnapNsure and ensure the safety of your belongings in storage.

Comparing different storage unit insurance providers and coverage options

1. Storage Protectors Contents Insurance Program

– Offers economical coverages for stored belongings

– Alleviates concerns regarding potential losses

– Eliminates the need to add extra coverage to homeowner’s policy

2. Discount Storage Insurance

– Specialized rental storage insurance

– Protects against burglary, damage, or loss

– Provides customizable policies to fit needs and budgets

3. SnapNsure

– Expert storage insurance provider

– Specialized coverage for personal, students, or businesses

– Peace of mind with financial protection against unforeseen events

– Faster claims process and knowledgeable customer support

– Immediate certificate issuance and potential cost savings

Key considerations for selecting the best storage unit insurance

1. Coverage options

– Look for a provider that offers specialized coverage for storage units

– Consider your specific needs and budget when selecting coverage options

2. Claims process

– Research the claims process of different insurance providers

– Opt for a provider with a streamlined process for prompt reimbursement

3. Customer support

– Choose an insurance provider with knowledgeable and experienced customer support teams

– They should be able to answer any questions or concerns you have about your policy

4. Immediate certificate issuance

– Select an insurance provider that offers immediate certificate issuance

– This is important for presenting proof of coverage to the storage facility or leasing company

5. Cost savings

– Compare the cost of insurance policies from different providers

– Look for potential cost savings without compromising on coverage

Conclusion

When it comes to protecting your belongings in a storage unit, it is crucial to choose an expert storage insurance provider. Options like the Storage Protectors Contents Insurance Program, Discount Storage Insurance, and SnapNsure offer specialized coverage, peace of mind, faster claims processing, knowledgeable customer support, and potential cost savings. Consider key factors like coverage options, claims process, customer support, immediate certificate issuance, and cost savings when selecting the best storage unit insurance for your needs. Don’t forget that self-storage facilities and mobile storage container leasing companies do not automatically insure your stored property, so purchasing storage unit insurance is essential for an additional layer of protection. Choose wisely and ensure the safety of your belongings in storage.

Discover Metlife renters insurance coverage storage unit facility.