Storage unit insurance coverage

Overview of storage unit insurance coverage and why it’s important

Storage unit insurance is a type of insurance intended to cover the loss, damage, or theft of items stored in a storage unit. Storage unit insurance provides peace of mind in case the unexpected happens to personal possessions while they’re in storage, such as those due to natural disasters like floods, fires, hurricanes, tornadoes, and earthquakes, theft, vandalism, or other covered incidents. It’s important to have storage unit insurance coverage because most standard homeowner’s or renter’s insurance policies do not cover items stored off-premises.

While natural disasters, theft, and vandalism are uncommon, the cost of storage unit insurance is often a small price to pay for the protection and security it offers. In the event that an unforeseen disaster happens, such as a fire or natural disaster, storage unit insurance coverage can help offset the costs of replacing or repairing damaged items. Without insurance, the costs of replacing items lost or damaged can add up quickly and become a substantial financial burden.

Factors to consider when selecting storage unit insurance coverage

Not all storage unit insurance is created equal, so it is essential to understand the terms and limits of the coverage you’re purchasing. Before selecting storage unit insurance coverage, consider these essential factors:

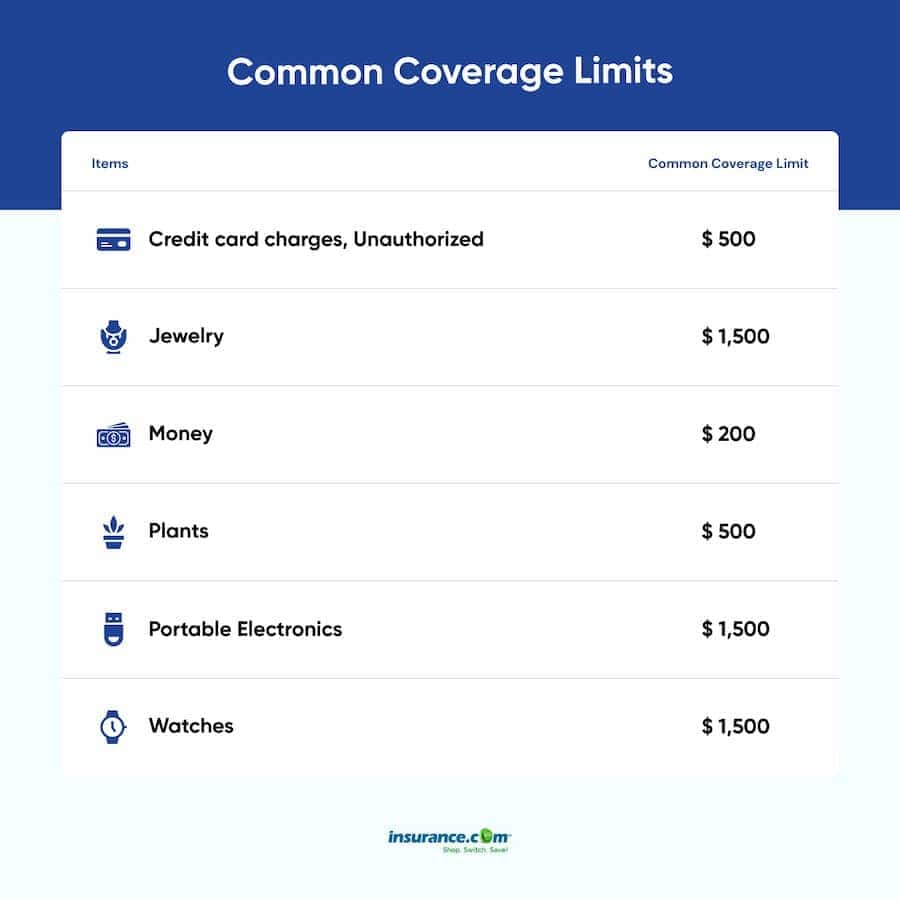

– Coverage Limits: One of the most important elements of a storage unit insurance policy is the coverage limit. The coverage limit is the maximum amount an insurer will pay for a covered loss. It’s essential to understand what is covered and how to file a claim in the event of a loss.

– The Cost of Coverage: The cost of your storage unit insurance coverage will depend on factors such as coverage limits, location, type of storage unit, and the items being stored. Before selecting a policy, compare costs and coverage limits among different insurance providers to find the policy that meets your needs and budget.

– Exclusions and Deductibles: It’s essential to understand the policy’s exclusions. Know what types of incidents are not covered and what deductibles you will be responsible for in the event of a covered loss. It is also important to review any fine print in the policy to avoid unpleasant surprises later on.

– Insurer Reputation: Consider the reputation of the insurer you choose. Research information such as financial stability, customer satisfaction ratings, and any history of complaints or legal issues.

Therefore, storage unit insurance coverage provides peace of mind when storing personal possessions off-site. Before selecting a policy, carefully consider the factors outlined above, and read the policy thoroughly to ensure you are getting the right coverage for your needs.

Understanding Off-Premises Coverage

What is off-premises coverage and why is it important?

Off-premises coverage refers to the insurance coverage for items that are not located in your primary dwelling, such as belongings stored in a storage unit. This coverage is important for individuals who need to store their possessions in a storage unit, as their homeowners or renters insurance may not provide adequate coverage for these off-premises items.

In some cases, homeowners or renters insurance may only cover a limited amount of off-premises items, such as up to 10% of the dwelling coverage amount. This means that if the total value of items in a storage unit exceeds this amount, the individual would not be fully covered in the event of damage or loss.

Comparison of off-premises coverage across different insurance plans

It is important to review your insurance policies to understand the level of off-premises coverage provided. Here is a comparison of off-premises coverage across different insurance plans:

– Homeowners insurance: Typically provides a limit on off-premises coverage, such as 10% of the dwelling coverage amount.

– Renters insurance: Similar to homeowners insurance, may offer limited off-premises coverage.

– Business insurance: May offer coverage for business-related items stored off-premises but may not cover personal items.

– Stand-alone storage unit insurance: A separate policy that can provide extended coverage not found in homeowners or renters insurance policies. For example, Orange Door Storage Insurance policies cover damage from vermin and fungus up to $250, as well as water damage such as flooding.

It is important to take inventory of your belongings and determine if you have enough coverage in place for off-premises items. If your current insurance policies do not provide adequate coverage, it may be worth considering a stand-alone storage unit insurance policy.

Benefits of Commercial Property Coverage

Commercial property coverage is an insurance plan that offers protection for your commercial self-storage facility against fire, floods, and damage to your business and personal property. Having this type of insurance can provide peace of mind to storage facility owners by mitigating the risks of potential losses, while protecting customers who rent storage space. Here are some benefits of opting for commercial property coverage for your storage unit business.

Advantages of opting for commercial property coverage for storage units

– Comprehensive protection: This type of coverage can protect your property, equipment, and other assets from natural disasters such as hurricanes and earthquakes. It also covers physical damage to your facility caused by other events like theft, vandalism, or fire.

– Increased credibility: Having commercial property coverage can increase your credibility in the eyes of potential customers. This suggests that you take the protection of their stored goods seriously and helps win trust among service-users.

– Potential for increased revenue: If you decide to charge for insurance along with rent, it can provide an additional source of revenue for your business.

Furthermore, commercial property coverage can also include business interruption insurance, which provides the financial cushion required to stay afloat in the event of an unexpected closure due to damage or disruption to your business. It can also assist in covering the cost of expenses that arise due to restoring your facility to full operation.

Comparison of cost savings and coverage options across different providers

When choosing commercial property coverage for your storage facility, it is important to compare cost savings and coverage options across different providers. Here are some factors to consider when comparing commercial property insurance policies for storage facilities:

– Price: The cost of commercial property coverage for storage facilities can vary significantly across different providers. It is important to consider the cost-effectiveness of premiums and deductibles and compare pricing between providers.

– Coverage: Look for a policy that covers a wide range of risks relevant to storage facilities, such as natural disasters, theft, or damage to property or goods.

– Additional inclusions/ exclusions: It is important to be aware of any additional coverage inclusions or exclusions that a policy may provide or lack, such as coverage for fire, flood, windstorm, hailstorm, or earthquake.

– Customer service: Consider the responsiveness and quality of customer service provided by different insurers. You may face unexpected questions and want insurance representatives who are prompt and efficient in handling potential issues.

Therefore, it is essential to understand the value of commercial property coverage for storage facilities. It provides a range of benefits, including comprehensive protection, increased credibility, and the potential for increased revenue. Additionally, it is important to compare insurance policies to ensure that you are getting the best coverage for your storage business at the most affordable price. By doing this exercise, you can have peace of mind, knowing that you have taken the necessary steps to manage the risk factors that are commonly associated with owning and running a storage facility.

Coverage Limits for Personal Property

When it comes to storing personal property in a storage unit, it is important to understand the limits of coverage provided by your insurance policies. Homeowners and renters insurance policies may offer coverage for off-premises belongings, including items stored in a storage unit. However, there are often coverage caps that may limit the amount of coverage provided.

For example, a homeowners insurance policy may provide coverage for up to 10% of the dwelling coverage amount for off-premises items. If the total value of the items stored in a storage unit exceeds this amount, the individual may not be fully covered in the event of damage or loss.

Renters insurance policies may also offer coverage for off-premises items, including those stored in a storage unit. However, the coverage amount may also be limited, typically up to 10% of the policy limits.

It is important to review your insurance policies to understand the level of coverage provided for off-premises items, including those stored in a storage unit. In some cases, it may be necessary to purchase additional coverage, such as stand-alone storage unit insurance, to ensure your belongings are fully protected.

Details and limitations of coverage for personal property stored in storage units

The amount of coverage provided for personal property stored in a storage unit may vary depending on the insurance policy. Homeowners and renters insurance policies may provide coverage for off-premises belongings, but there are often limitations to this coverage. Some common limitations include:

– Coverage caps: The amount of coverage provided may be capped at a certain percentage of the dwelling or policy limits.

– Exclusions: Certain types of property may be excluded from coverage, such as jewelry or artwork.

– Perils covered: Only specific perils may be covered, such as fire or theft.

It is important to review your insurance policy to understand the details and limitations of coverage for personal property stored in a storage unit. If you have concerns about the adequacy of your coverage, consider speaking with your insurance agent to review your options. You may also consider purchasing stand-alone storage unit insurance to provide additional protection.

Comparison of coverage limits across different storage companies

Not all storage companies offer the same level of coverage for personal property stored in their units. Some storage companies may offer insurance coverage as part of their rental agreement, while others may require customers to purchase a separate insurance policy.

When comparing coverage limits across different storage companies, it is important to consider:

– The amount of coverage provided: Some storage companies may offer higher coverage limits than others.

– Perils covered: Some storage companies may exclude certain perils from coverage, such as natural disasters or water damage.

– Exclusions: Certain types of property may be excluded from coverage, such as high-value items or vehicles.

Ultimately, it is important to carefully review the insurance terms and conditions of any storage company you are considering to ensure your personal property is adequately protected.

Perils Covered by Storage Unit Insurance

Storage unit insurance is designed to protect personal belongings stored in a storage unit from a variety of risks. The coverage typically includes protection against fire, theft, vandalism, and weather-related damage such as wind, lightning, and falling objects. However, it is important to note that the specific perils covered can vary based on the insurance policy.

When considering purchasing a storage unit insurance policy, it is important to review the terms and conditions carefully to understand what perils are covered. Some policies may exclude certain perils, such as natural disasters or water damage, while others may offer more comprehensive coverage. It is also important to review any deductibles or limits on coverage to ensure your personal property is adequately protected in the event of a loss.

List of perils covered by storage unit insurance including fire, theft, vandalism, and weather-related damage

– Fire

– Smoke damage

– Lightning

– Wind

– Hail

– Falling objects

– Theft

– Vandalism

– Water damage from burst pipes or sprinkler systems

– Damage from pests or vermin

It is important to note that while many storage unit insurance policies offer coverage for these perils, there may be limits on the coverage amounts or deductibles that apply. Be sure to review the terms of your policy carefully and speak with your insurance agent if you have any questions or concerns.

Comparison of coverage options across different insurance providers

When comparing storage unit insurance policies across different insurance providers, it is important to consider the specific perils covered, as well as any exclusions or limitations on coverage. Additionally, you may want to review the deductibles and coverage limits to ensure you are getting the best value for your money.

Some factors to consider when comparing coverage options across different insurers include:

– Availability of coverage for natural disasters or weather-related damage

– Coverage for high-value items such as jewelry or artwork

– Any exclusions or limitations on coverage

– Deductible amounts and coverage limits

– Customer reviews and ratings for the insurance provider

By doing your research and comparing coverage options from multiple providers, you can find a storage unit insurance policy that provides the right level of protection for your personal belongings. Be sure to review the terms and conditions carefully, and speak with your insurance agent if you have any questions or concerns.

Does Renters Insurance Cover Storage Units?

When it comes to personal property, renters insurance can provide coverage for items stored in a storage unit. Homeowners and renters insurance policies may offer coverage for off-premises belongings, but there are often coverage caps that limit the amount of coverage provided. Generally, renters insurance will cover any personal property stored in a storage unit up to 10% of the total personal property limit with some exclusions.

Insights into whether renters insurance covers personal property stored in storage units

While renters insurance policies may offer coverage for personal property stored in a storage unit, it is important to consider the details and limitations of coverage. For example, coverage limits may be capped at a certain percentage of the policy limits, and certain types of property may be excluded from coverage. In some cases, it may be necessary to purchase additional coverage, such as stand-alone storage unit insurance, to ensure adequate protection for personal property stored in a storage unit.

Comparison of coverage limits and exclusions across different insurance providers

When comparing coverage limits and exclusions across different insurance providers for personal property stored in a storage unit, it is crucial to review the insurance terms and conditions of each provider. Some storage companies may offer higher coverage limits than others, while some may exclude certain perils from coverage or exclude certain types of property. Ultimately, renters and homeowners are responsible for making sure their personal property stored in a storage unit is adequately protected. If concerns arise, it is suggested to speak with the insurance agent to review options or to consider purchasing stand-alone storage unit insurance for additional protection.

So, renters insurance is helpful when it comes to providing coverage for personal property stored in a storage unit. However, individuals should be aware of the coverage limits and exclusions in their policy to ensure proper protection. Comparing insurance providers for coverage for stored personal property allows individuals to make a well-informed decision on what is best for coverage of their stored possessions.

Yardi: A Guide to Storage Unit Insurance Coverage

Details of coverage for items in storage under Yardi insurance policies

Yardi offers GoodShield Protection Plan, providing tenants with reliable protection for their stored belongings. The GoodShield Protection Plan includes policy and claims management customer service to policyholders, allowing staff the ability to focus on other tasks. GoodShield offers the ease of online enrollment built right into the Yardi platform leasing workflow, with pre-approval for protection to make signing up fast and easy.

Tenants are conveniently billed for GoodShield with their monthly storage unit rent. And program charges and tracking are built right into the Yardi property management platform, with automated reporting, so staff does not have to worry about charge reconciliation. However, certain restrictions and limitations apply to coverage terms, depending on the insurance company provider and plan selected.

Comparison of coverage limits, exclusions, and additional benefits

When comparing coverage limits, exclusions, and additional benefits across different insurance providers for personal property stored in a storage unit, it is crucial to review the fine print of each policy. Insurance providers may differ in the coverage limits they offer, with some providers offering higher limits compared to others. It is also important to consider the specific terms and conditions of the coverage, as some providers may exclude certain perils from coverage or exclude specific types of property.

For tenants who need additional protection, purchasing a stand-alone insurance policy may be an option to ensure adequate coverage for personal items stored in a storage unit. It is also recommended to speak with an insurance agent to review options, depending on the circumstances and the tenant’s individual needs.

Therefore, tenants have options to consider when it comes to coverage for personal property stored in a storage unit. While renters insurance policies may offer coverage up to a certain limit, it is important to be aware of the exclusions and restrictions in the policy. Comparing insurance providers for coverage of stored personal property allows individuals to make a well-informed decision on what is best for the protection of their stored possessions. Using an insurance provider like Yardi that offers the GoodShield Protection Plan allows for online enrollment and pre-approval for storage coverage, making the process more convenient and straightforward for tenants.

Determining Coverage Limits for Storage Unit Insurance

When it comes to storing personal property in a storage unit, it is vital to ensure that the items are appropriately insured in case of damage or loss. Storage unit insurance can provide coverage for personal property stored in a storage unit, but determining the appropriate coverage limit can be complex.

Factors to consider when determining the coverage limit for storage unit insurance

Several factors need to be considered when determining the appropriate coverage limit for storage unit insurance. These factors include:

– The total value of personal property stored in the storage unit

– The likelihood of damage or loss

– Whether high-value items are stored in the storage unit

– The types of perils covered by the policy

– Any exclusions or limitations in the policy

It is essential to ensure that the coverage limit adequately reflects the total value of personal property stored in the storage unit. Under-insuring personal property can lead to inadequate coverage in the case of loss or damage. Moreover, if high-value items are stored in the storage unit, it is crucial to ensure that they are covered under the policy.

Comparison of factors across different insurance providers

When comparing coverage limits and exclusions across different insurance providers for storage unit insurance, it is vital to review the terms and conditions carefully. Some insurance providers may offer higher coverage limits than others or exclude certain perils or types of property. Reviewing different insurance policies’ details can help individuals make an informed decision on the appropriate coverage limit for their storage unit insurance.

Therefore, determining the appropriate coverage limit for storage unit insurance requires a careful consideration of several factors, including the total value of personal property, the likelihood of loss or damage, the presence of high-value items, and the types of perils covered by the policy. Comparing different insurance providers’ terms and conditions can provide insights into the appropriate coverage limit for storage unit insurance.

Determining Coverage Limits for Storage Unit Insurance

When storing personal property in a storage unit, it is crucial to ensure that the items are appropriately insured in case of damage or loss. However, determining the appropriate coverage limit for storage unit insurance can be complex. Several factors need to be considered when determining the appropriate coverage limit for storage unit insurance. Factors include the total value of personal property stored in the storage unit, the likelihood of damage or loss, whether high-value items are stored in the storage unit, the types of perils covered by the policy, and any exclusions or limitations in the policy.

Under-insuring personal property can lead to inadequate coverage in case of loss or damage. Therefore, it is essential to ensure the coverage limit adequately reflects the total value of personal property stored in the storage unit. If high-value items are stored in the storage unit, it is crucial to ensure that they are covered under the policy.

Comparing coverage limits and exclusions across different insurance providers for storage unit insurance can provide insights into the appropriate coverage limit for the individual’s needs.

Summary of key takeaways regarding storage unit insurance coverage

– Adequate insurance coverage is essential when storing personal property in a storage unit.

– Factors to consider when determining the appropriate coverage limit include the total value of personal property, the likelihood of loss or damage, the presence of high-value items, the types of perils covered by the policy, and any exclusions or limitations in the policy.

– Under-insuring personal property can lead to inadequate coverage in case of loss or damage.

Recommendations for selecting the right coverage for your needs.

When selecting storage unit insurance coverage, individuals should review the policy’s terms and conditions carefully. It is crucial to ensure that the coverage limit adequately reflects the total value of personal property stored in the storage unit. Additionally, individuals should consider whether high-value items are stored in the storage unit and whether they are covered under the policy. Comparing different insurance providers’ terms and conditions can provide insights into the appropriate coverage limit for storage unit insurance.

Conclusion

Therefore, properly insuring personal property stored in a storage unit is essential to protect against loss or damage. It is crucial to determine the appropriate coverage limit for storage unit insurance by considering the total value of personal property stored, the likelihood of loss or damage, and the presence of high-value items. By carefully reviewing different insurance providers’ terms and conditions, individuals can select the right coverage for their needs.

Discover State farm storage unit insurance.

1 thought on “Storage unit insurance coverage”