Introduction

Overview of storage unit insurance in California

Storage unit insurance in California is an essential aspect of protecting belongings stored in self-storage facilities. Whether you are a self-storage operator or a tenant, ensuring adequate insurance coverage is crucial to safeguard against potential risks and damages.

In California, there are various insurance options available to both self-storage operators and tenants. Two notable options are the Tenant Insurance program offered by MiniCo and the Storage Insurance program provided by SnapNsure. These programs provide coverage for the contents stored in self-storage units, giving peace of mind to both operators and tenants.

The importance of insurance for protecting belongings in storage units

Insurance coverage for belongings stored in self-storage units is highly recommended due to the potential risks and uncertainties involved. Here are a few key reasons why insurance is crucial for protecting stored belongings:

1. Loss and damage: Storage units can be susceptible to various risks, including fire, water damage, theft, and natural disasters. Having insurance coverage helps to mitigate the financial loss that may arise from these events, ensuring that tenants can recover the value of their belongings.

2. Liability: As a self-storage operator, it is important to protect yourself from potential liability claims. If a tenant’s belongings are damaged or stolen while in your facility, having insurance coverage can prevent legal and financial implications by providing compensation to the affected tenant.

3. Peace of mind: Renting a storage unit is often done to store valuable or sentimental items. Having insurance coverage provides peace of mind for both operators and tenants, knowing that their possessions are protected in the event of unexpected incidents.

Comparing MiniCo and SnapNsure Tenant Insurance programs:

To further understand the options available for storage unit insurance, let’s compare the features of the Tenant Insurance programs offered by MiniCo and SnapNsure:

| Features | MiniCo Tenant Insurance | SnapNsure Storage Insurance |

|—————-|——————————|———————————-|

| Coverage Options | Full replacement cost coverage for stored items | Full replacement cost coverage for stored items |

| Convenience | Insurance costs can be bundled into tenants’ monthly rental fees | Standalone insurance policy |

| Affordability | Competitive fees with minimal administrative effort | Starting at $7.99 per month |

| Additional Benefits | Same coverage and benefits for tenants | “REAL” Insurance Policy for Mobile Storage |

Therefore, storage unit insurance plays a vital role in protecting the belongings stored in self-storage facilities. Both MiniCo and SnapNsure offer convenient insurance options for self-storage operators and tenants, ensuring peace of mind and financial security in the event of unforeseen circumstances. It is advised to carefully consider the coverage options, costs, and additional benefits offered by these programs to choose the most suitable insurance solution for your storage needs.

Understanding Storage Unit Insurance

Key terms and concepts related to storage unit insurance

When renting a storage unit, it’s important to understand the concept of insurance coverage to protect your belongings. Here are a few key terms you need to know:

Tenant Insurance:

This refers to the insurance coverage that tenants can obtain to protect their stored items in a storage unit. It provides financial compensation in case of damage, theft, or loss.

Self-Storage Operator:

This refers to the business or organization that owns and operates the storage facility. They may offer tenant insurance programs as an additional service to their customers.

Pay-With-Rent Tenant Insurance:

This is a type of tenant insurance offered by some self-storage operators. It allows tenants to bundle the insurance cost into their monthly rental fee, providing convenience and peace of mind.

Types of coverage provided by storage unit insurance policies

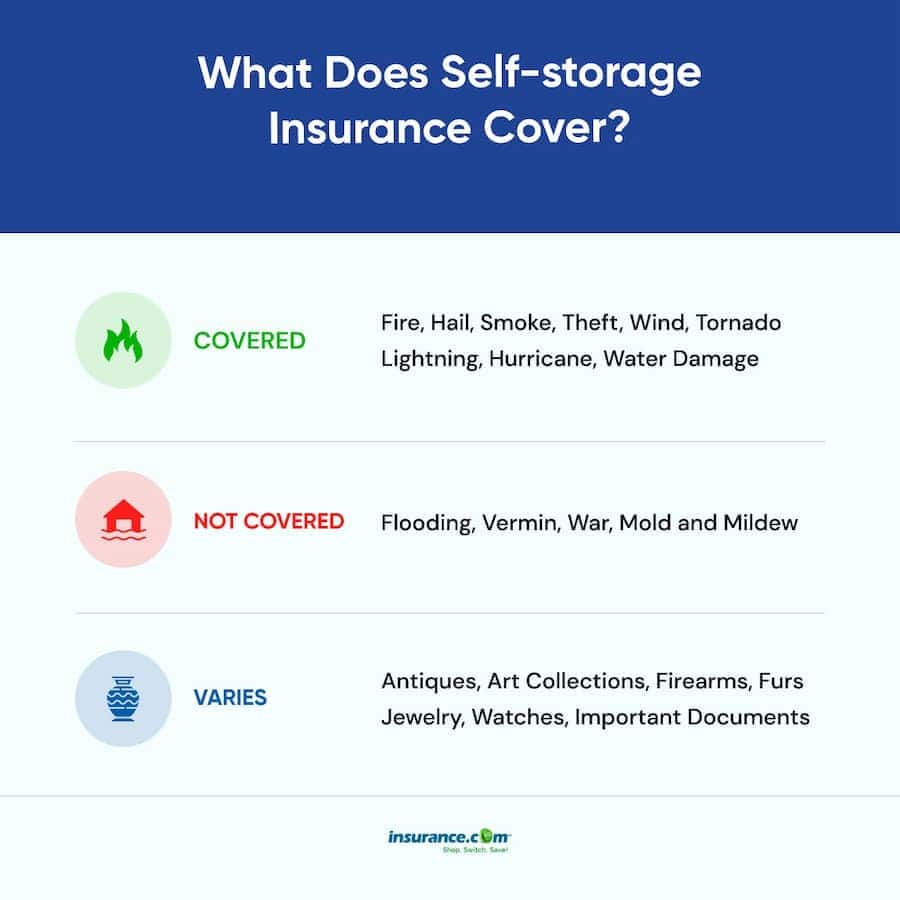

Storage unit insurance policies typically offer coverage for various types of risks and incidents. Here are some common types of coverage you can expect:

Property Damage:

This coverage protects your belongings in case of damage caused by fire, water damage, natural disasters, vandalism, or accidents. It provides financial compensation to replace or repair the damaged items.

Theft:

If your stored items are stolen, this coverage provides reimbursement for the value of the stolen items. It can help alleviate the financial burden and provide peace of mind in case of theft.

Liability:

Some storage unit insurance policies also offer liability coverage. This protects you if someone gets injured while on the storage facility premises. It can cover medical expenses, legal fees, and other related costs.

Additional Coverage:

Depending on the insurance policy, you may have the option to add additional coverage for specific items such as valuable artwork, antiques, or electronics. This allows you to customize your insurance policy to suit your specific needs.

It’s important to carefully review the terms, coverage limits, and exclusions of your storage unit insurance policy. Be aware of any deductibles, limitations, or conditions that may apply. By understanding the key concepts and types of coverage provided, you can make an informed decision to protect your stored belongings.

Factors Influencing Insurance Quotes

When obtaining insurance quotes for your storage unit, there are several factors that insurance companies consider. Understanding these factors can help you get a better idea of what to expect when it comes to insurance rates. Here are some key factors that influence insurance quotes:

Factors that insurance companies consider when providing quotes

– Value of stored items: The total value of your stored items will greatly impact your insurance rates. Insurance companies need to assess the level of risk involved based on the potential value of the items being insured.

– Type of coverage: The type and extent of coverage you choose will also affect your insurance quotes. Basic coverage for property damage and theft will typically have lower premiums compared to policies with additional coverage options.

– Deductible amount: The deductible is the amount you are responsible for paying out of pocket before insurance coverage kicks in. Higher deductibles generally result in lower insurance premiums, while lower deductibles increase the cost of insurance.

– Insurance history: Insurance companies often consider your insurance history when providing quotes. If you have a history of making claims or have been uninsured in the past, it may impact the rates you are offered.

– Security measures: The security measures in place at the storage facility can also impact insurance rates. Facilities with advanced security systems, such as video surveillance, gated access, and alarm systems, may be considered lower risk and result in lower insurance premiums.

How the location of the storage unit affects insurance rates

The location of the storage unit can also influence insurance rates. Here’s why:

– Crime rates: Insurance companies consider the crime rates in the area where the storage facility is located. Higher crime rates may lead to increased risk of theft or vandalism, resulting in higher insurance rates.

– Weather risks: Certain locations are more prone to natural disasters such as hurricanes, floods, or wildfires. Storage units in areas with higher risks of natural disasters may have higher insurance rates due to the increased likelihood of property damage.

– Legal requirements: Insurance rates can also be influenced by legal requirements in different jurisdictions. Some areas may have specific regulations or minimum coverage requirements that affect insurance rates.

– Availability of insurance providers: Insurance rates can vary depending on the availability of insurance providers in a specific location. Areas with a limited number of insurance companies offering coverage for storage units may have higher rates.

It’s important to keep these factors in mind when obtaining insurance quotes for your storage unit. By understanding the factors that influence insurance rates, you can make informed decisions about coverage options and ensure that your stored belongings are adequately protected.

Comparing Storage Insurance Providers

Top storage unit insurance providers in California

When it comes to storage unit insurance, there are several providers to choose from in California. Here are some of the top options:

MiniCo Tenant Insurance:

With nearly 50 years of experience in the self-storage industry, MiniCo is a trusted provider for storage unit insurance. They offer convenient options for both self-storage operators and tenants. MiniCo’s Pay-With-Rent Tenant Insurance allows businesses to bundle coverage costs into tenants’ monthly rental fee, providing an additional revenue stream. They offer competitive fees and minimal administrative effort for the operators. Their coverage includes protection against damage, theft, and loss.

SnapNsure Self-Storage Insurance:

SnapNsure is another well-known insurance provider for storage units in California. They offer a “REAL” insurance policy, not just a protection plan. With SnapNsure, tenants can insure their stored items for as little as $7.99 per month. They provide coverage for property damage, theft, and liability. With SnapNsure, tenants can get a free quote and easily manage their insurance policy online.

Features and benefits of each provider

MiniCo Tenant Insurance:

– Convenient option for self-storage operators to offer tenant insurance programs

– Bundle coverage costs into tenants’ monthly rental fee, providing an additional revenue stream

– Competitive fees and minimal administrative effort for operators

– Coverage includes protection against damage, theft, and loss

– Nearly 50 years of experience in the self-storage industry

SnapNsure Self-Storage Insurance:

– Offers a “REAL” insurance policy, not just a protection plan

– Affordable coverage starting at $7.99 per month

– Coverage for property damage, theft, and liability

– Easy online management of insurance policy

– Free quotes available

When comparing these two storage unit insurance providers, there are a few key factors to consider. MiniCo Tenant Insurance offers the convenience of bundling coverage costs into tenants’ monthly rental fee, providing an additional revenue stream for self-storage operators. On the other hand, SnapNsure Self-Storage Insurance offers affordable coverage starting at $7.99 per month and easy online management of the insurance policy. Both providers offer comprehensive coverage for property damage, theft, and liability.

Ultimately, the choice between MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance will depend on the specific needs and preferences of the self-storage operator and tenant. It’s important to carefully review the features, benefits, and cost of each provider to make an informed decision. By selecting the right storage unit insurance provider, businesses and tenants can have peace of mind knowing their belongings are protected.

Getting a Storage Insurance Quote

Step-by-step guide on how to get a storage insurance quote in California

If you’re considering getting storage insurance in California, here’s a step-by-step guide on how to get a quote:

1. Research Storage Insurance Providers: Start by researching storage insurance providers in California. Look for reputable companies that offer comprehensive coverage and competitive rates. Consider factors such as customer reviews, company stability, and the types of coverage they offer.

2. Visit Provider Websites: Once you have a list of potential providers, visit their websites to gather more information. Look for a “Get a Quote” or “Request a Quote” button or link on their website. Clicking on this will usually take you to a form where you can enter your details.

3. Fill Out the Quote Form: Complete the quote form by providing relevant information. This may include details such as your name, contact information, storage unit location, and the value of the items you want to insure. Be as accurate and detailed as possible to obtain an accurate quote.

4. Submit the Form: Once you have filled out the form, check for any errors or missing information, and then submit it. Some providers may give you an instant quote on their website, while others may contact you with a quote via email or phone.

5. Review the Quote: Once you receive the quote, take the time to review the coverage, limits, and premiums offered. Compare multiple quotes from different providers to ensure you’re getting the best value for your money.

Information required to obtain an accurate quote

To obtain an accurate storage insurance quote in California, you’ll typically need to provide the following information:

1. Storage Unit Location: The address of the storage facility where your items will be stored. This helps the insurance provider determine the risk associated with the location.

2. Value of Stored Items: The estimated value of the items you want to insure. This helps determine the coverage amount you’ll need and the associated premiums.

3. Type of Coverage: Specify the type of coverage you’re looking for, such as property damage, theft, or liability coverage. Different providers may offer different types of coverage, so be clear about your requirements.

4. Personal Information: Your name, contact information, and any specific details required by the provider, such as your storage unit number or lease agreement.

By providing accurate and detailed information, you’ll be able to obtain an accurate storage insurance quote that meets your needs and budget.

Remember, it’s essential to review the coverage, terms, and conditions carefully before making a decision. Taking the time to compare quotes and understand the policy details will help you make an informed decision and ensure your stored belongings are adequately protected.

Coverage Options and Limitations

Types of coverage available for storage unit insurance:

When it comes to storage unit insurance, both MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance offer comprehensive coverage options. Here are the types of coverage available with each provider:

MiniCo Tenant Insurance:

– Protection against damage, theft, and loss

– Coverage for fire, smoke, burglary, lightning, windstorm, hail, water damage, earthquake, building collapse, explosion, vandalism, and riot

– Coverage for vehicles stored in a unit

– Replacement cost coverage

– Rodent/vermin damage coverage

SnapNsure Self-Storage Insurance:

– Coverage for property damage, theft, and liability

Coverage limitations and exclusions to be aware of:

While both MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance provide comprehensive coverage, it’s important to be aware of the limitations and exclusions that may apply. Here are some factors to consider:

MiniCo Tenant Insurance:

– Some exclusions may apply for certain types of damage or loss

– Coverage may have limits or restrictions on certain items

– It’s important to review the policy and understand the specific coverage details

SnapNsure Self-Storage Insurance:

– It’s important to review the policy and understand the specific coverage details

It’s always recommended to carefully read and understand the terms and conditions of any insurance policy to ensure it meets your specific needs. If you have any questions or concerns, it’s best to reach out to the insurance provider directly for clarification.

By understanding the coverage options and limitations of both MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance, you can make an informed decision about which provider is the best fit for your storage unit insurance needs. Both providers offer comprehensive coverage, but it’s important to consider factors such as convenience, pricing, and ease of management when making your decision.

Tips for Lowering Storage Insurance Costs

Strategies for reducing insurance premiums

Here are some strategies you can implement to help lower your storage insurance costs:

– Evaluate your coverage needs: Take a close look at what items you have stored in your unit and determine if you need full coverage for everything. If there are items of lesser value that you can self-insure or remove from your policy, it may help reduce your premium.

– Improve security measures: Investing in security measures such as video surveillance, alarm systems, and secure locks can deter theft and reduce risks, which may result in lower insurance premiums.

– Opt for a higher deductible: Choosing a higher deductible can lower your insurance premium. Just make sure you can afford to pay the higher deductible in the event of a claim.

– Maintain a good claims history: Insurance companies often offer discounts to customers with a good claims history. By avoiding frequent claims and taking good care of your stored items, you can demonstrate your responsible behavior and potentially qualify for lower premiums.

Common discounts and savings opportunities to consider

Both MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance may offer various discounts and savings opportunities to help you save on your storage insurance costs. Here are some common discounts to consider:

– Multi-unit discount: If you rent multiple storage units from the same provider, you may be eligible for a discount on your insurance premiums. This can be an advantage for those with multiple units or for business owners with multiple locations.

– Long-term customer discount: Some insurance providers reward loyalty. If you have been a customer for a long time, you may be eligible for a discount on your insurance premiums.

– Bundling discount: If you already have an existing insurance policy with the same provider, such as renter’s or homeowner’s insurance, you may be eligible for a discount on your storage insurance by bundling your policies together.

– Advance payment discount: Some insurance providers offer discounts for customers who pay their premiums in advance for an extended period. If you can afford to pay for the entire year upfront, you may be able to save on your storage insurance costs.

Remember to always reach out to the insurance providers directly to inquire about any available discounts or savings opportunities. By implementing cost-saving strategies and taking advantage of discounts, you can lower your storage insurance costs while still maintaining the necessary coverage to protect your belongings.

Making a Claim

When it comes to making a claim for storage unit insurance, both MiniCo Tenant Insurance and SnapNsure Self-Storage Insurance have straightforward processes in place. Here are the steps to take when filing a storage insurance claim:

Steps to take when filing a storage insurance claim:

1. Contact your insurance provider: As soon as you discover the damage, theft, or loss, it’s important to contact your insurance provider. They will guide you through the claims process and provide you with the necessary documentation and forms.

2. Document the damage or loss: Take photos or videos of the damaged or stolen items to provide evidence for your claim. Make sure to document the extent of the damage and any visible signs of theft.

3. File a police report (if applicable): If the damage or loss is due to theft or vandalism, it’s essential to file a police report. This report will serve as additional evidence for your claim.

4. Complete the claim form: Fill out the claim form provided by your insurance provider. Provide all the necessary information, including your contact details, storage unit information, and a detailed description of the damage or loss.

5. Submit supporting documentation: Include any supporting documentation that strengthens your claim, such as receipts, invoices, or appraisals for valuable items. This will help the insurance provider assess the value of your claim accurately.

Important information to document and include in the claim:

– Date and time of the incident

– Description of the items involved, including their value and any identifying marks

– Supporting documents, such as receipts, appraisals, or photos of the items

– Contact information of any witnesses or individuals involved in the incident

– Police report number (if applicable)

By following these steps and providing all the necessary information, you can ensure a smooth and efficient claims process.

It’s important to note that each insurance provider may have their specific requirements and documentation needed for a claim. Therefore, it’s crucial to carefully review the instructions provided by your insurance provider and reach out to them directly if you have any questions or need further assistance.

Therefore, making a claim for storage unit insurance involves contacting your insurance provider, documenting the damage or loss, filing a police report if necessary, completing the claim form, and submitting supporting documentation. By understanding the claims process and providing the required information, you can increase the likelihood of a successful claim.

Making a Claim

Steps to take when filing a storage insurance claim:

– Contact your insurance provider: As soon as you discover the damage, theft, or loss, it’s important to contact your insurance provider. They will guide you through the claims process and provide you with the necessary documentation and forms.

– Document the damage or loss: Take photos or videos of the damaged or stolen items to provide evidence for your claim. Make sure to document the extent of the damage and any visible signs of theft.

– File a police report (if applicable): If the damage or loss is due to theft or vandalism, it’s essential to file a police report. This report will serve as additional evidence for your claim.

– Complete the claim form: Fill out the claim form provided by your insurance provider. Provide all the necessary information, including your contact details, storage unit information, and a detailed description of the damage or loss.

– Submit supporting documentation: Include any supporting documentation that strengthens your claim, such as receipts, invoices, or appraisals for valuable items. This will help the insurance provider assess the value of your claim accurately.

Important information to document and include in the claim:

– Date and time of the incident

– Description of the items involved, including their value and any identifying marks

– Supporting documents, such as receipts, appraisals, or photos of the items

– Contact information of any witnesses or individuals involved in the incident

– Police report number (if applicable)

By following these steps and providing all the necessary information, you can ensure a smooth and efficient claims process.

It’s important to note that each insurance provider may have their specific requirements and documentation needed for a claim. Therefore, it’s crucial to carefully review the instructions provided by your insurance provider and reach out to them directly if you have any questions or need further assistance.

Therefore, making a claim for storage unit insurance involves contacting your insurance provider, documenting the damage or loss, filing a police report if necessary, completing the claim form, and submitting supporting documentation. By understanding the claims process and providing the required information, you can increase the likelihood of a successful claim.

Read more about Insurance for storage unit in texas.