Overview of Storage Unit Insurance

What is storage unit insurance and why is it important?

Storage unit insurance is a type of insurance coverage specifically designed to protect your belongings while they are stored in a storage unit. It provides financial protection in case of damage or loss due to unpredictable events such as theft, fire, natural disasters, or water damage. Having storage unit insurance is important because it gives you peace of mind knowing that your items are protected, especially when they are not within your immediate control.

The cost of storage unit insurance and its value

The cost of storage unit insurance can vary depending on various factors such as the coverage amount, deductible, and the insurance provider. Typically, the cost is a percentage of the value of the items you are storing. While it may feel like an additional expense, storage unit insurance can provide great value in terms of protecting your belongings.

It’s important to compare different insurance options before making a decision. Some storage rental facilities may offer their own insurance plans, but it’s advisable to explore other options as well, such as independent insurance providers. This allows you to compare coverage options, deductibles, and premiums to find the best policy that suits your needs and budget.

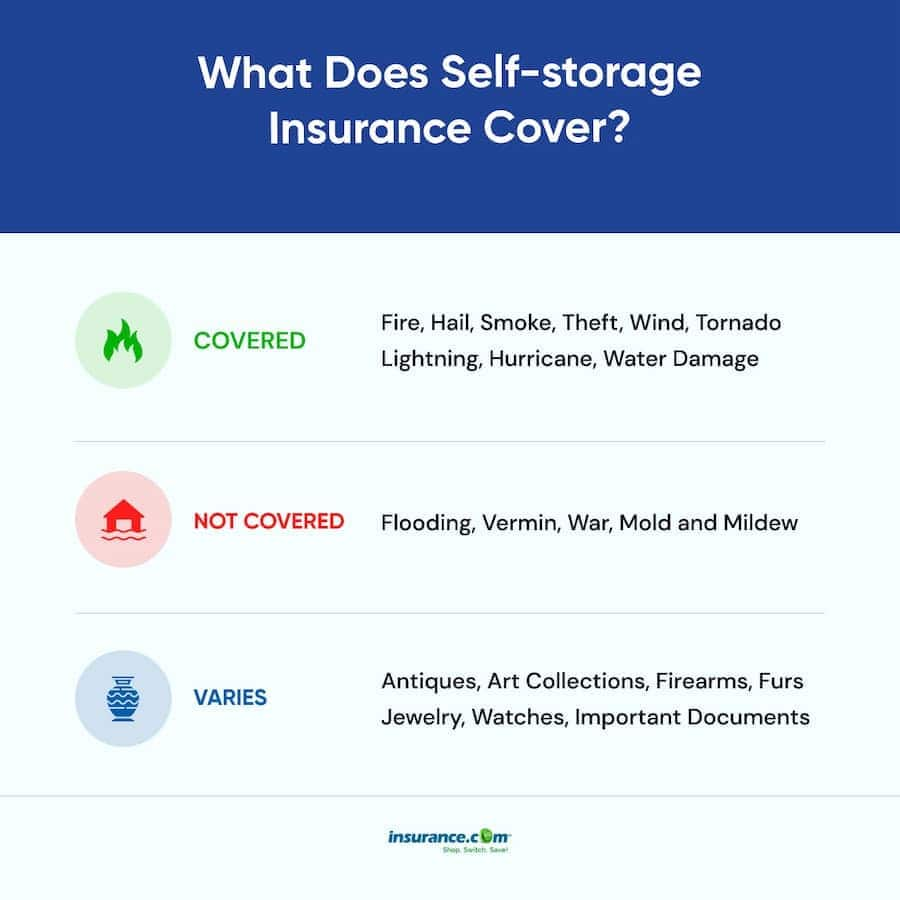

Comparing insurance policies can help you understand what is covered and what is not covered. It’s crucial to carefully read the policy wording and ask questions if anything is unclear. Generally, storage unit insurance covers damage or loss due to theft, fire, vandalism, and certain natural disasters. However, there may be limitations and exclusions, so it’s important to be aware of them. Outside factors like vermin infestations or damage caused by improper packing may not be covered by storage unit insurance.

When comparing storage unit insurance options, you should also consider the level of security provided by the storage facility itself. Some facilities may offer enhanced security measures such as 24/7 video surveillance, gated access, and on-site security personnel. These additional security features can help reduce the risk of theft or vandalism and give you added peace of mind.

Therefore, while most storage companies require insurance for rented storage units, it’s crucial to compare your options before purchasing coverage. Understanding what is covered and not covered by storage unit insurance is essential to make an informed decision. By comparing policies, costs, and considering the additional security measures provided by the storage facility, you can find the best storage unit insurance that suits your needs and offers the necessary protection for your belongings.

Coverage and Protection

Types of risks covered by storage unit insurance

– Fire and smoke damage: Storage unit insurance will typically cover damage caused by fire and smoke, ensuring that your belongings are protected in the event of a fire incident.

– Theft and burglary: If your storage unit is broken into and your belongings are stolen, storage unit insurance can provide coverage for the loss.

– Water damage: Storage unit insurance can also cover water damage caused by leaks, floods, or other unforeseen circumstances. This can be particularly important if your stored items are susceptible to water damage, such as furniture or electronics.

– Natural disasters: Storage unit insurance can provide coverage for damage caused by natural disasters such as hurricanes, tornadoes, earthquakes, and floods. It’s important to check your policy to understand the specific coverage for these types of risks.

What is not typically covered by storage unit insurance

– Mold and mildew: Most storage unit insurance policies do not cover damage caused by mold and mildew. It is important to take precautions to prevent moisture build-up in your storage unit to minimize the risk of mold and mildew damage.

– Vermin infestation: Damage caused by pests and rodents, such as rats or termites, is usually not covered by storage unit insurance. It is essential to ensure that your storage unit is properly sealed and protected against pests to prevent infestations.

– Acts of terrorism: Storage unit insurance typically does not cover damage caused by acts of terrorism. This exclusion is common in many insurance policies across various industries.

– Intentional damage or negligence: If you intentionally cause damage to your stored items or negligently fail to protect them, storage unit insurance may not provide coverage. It is essential to take reasonable care of your belongings to ensure coverage if a claim needs to be filed.

It is crucial to review the terms and conditions of your storage unit insurance policy carefully. This will help you understand the coverage provided and any exclusions that may apply. Additionally, it is advisable to compare different insurance options before purchasing to ensure you find the best coverage at the most competitive rate. Remember, having your own insurance can provide peace of mind and protect your belongings in the event of unexpected damage or loss.

Financial Protection

How storage unit insurance financially protects your possessions

When you rent a storage unit, it’s essential to understand that your belongings are not automatically covered by the storage facility’s insurance. While the facility’s insurance may cover the physical building, it does not typically provide coverage for the contents of individual units. This is where storage unit insurance comes in.

By having a separate insurance policy for your storage unit, you can protect your possessions financially. In the event of unforeseen circumstances like theft, vandalism, fire, water damage, or natural disasters, storage unit insurance can provide coverage for the loss or damage of your stored items. This financial safety net ensures that you are not left with the burden of replacing or repairing your belongings out of your pocket.

The benefits of having a separate insurance policy for storage units

While some may assume that their homeowners or renters insurance will extend coverage to their storage unit, this is not always the case. It’s crucial to have a separate insurance policy specifically designed for storage units for several reasons:

1. Enhanced Coverage: Storage unit insurance offers specific coverage for the risks associated with storing items outside of your home or office. It typically provides coverage for theft, burglary, fire, smoke damage, water damage, and even damage caused by natural disasters like hurricanes or floods. Having this dedicated coverage ensures that your belongings are protected in any unfortunate event.

2. Peace of Mind: As a storage unit renter, you want to have peace of mind knowing that your possessions are financially protected. With a storage unit insurance policy in place, you can rest easy knowing that if something happens to your stored items, you have coverage to help recover their value or replace them.

3. Cost-Effective: Storage unit insurance often comes at a low monthly or annual premium, considering the value it protects. For a relatively small cost, you can secure coverage for thousands of dollars worth of belongings. This makes it a cost-effective way to mitigate the financial risks associated with storing your possessions.

4. Customizable Coverage: Different storage unit insurance policies offer various levels of coverage, giving you the flexibility to choose the policy that best suits your needs. You can customize the coverage limits and options to ensure that it aligns with the value of your stored items and your specific requirements.

5. Independent Claims: Having your own storage unit insurance policy means that any claims you make will not impact your homeowners or renters insurance policy. It keeps your claims separate, preventing any potential increase in premiums or changes to your existing coverage.

Therefore, storage unit insurance is essential to financially protect your belongings stored in a storage unit. It covers risks like theft, burglary, fire, water damage, and natural disasters, which are not typically covered by the storage facility’s insurance. By having a separate insurance policy for your storage unit, you can have peace of mind and safeguard your possessions in case of unexpected damage or loss. When selecting a storage unit insurance policy, be sure to review the coverage, exclusions, and compare different options to find the most suitable coverage at a competitive rate.

In-Transit Coverage

How storage unit insurance covers your items during transit

When it comes to storage unit insurance, it is essential also to consider in-transit coverage. In-transit coverage can be beneficial if you plan to move your belongings from your home to a storage unit or vice versa. This type of coverage extends protection to your items while they are in transit, ensuring their safety during the moving process.

Storage unit insurance policies with in-transit coverage typically provide protection against risks such as theft, damage, or loss during transportation. This means that if your belongings are damaged in a moving truck accident or stolen during transit, your insurance can provide coverage for the loss.

Limitations and exclusions regarding in-transit coverage

While in-transit coverage can offer additional protection for your belongings, it’s important to be aware of the limitations and exclusions that may apply. Some common limitations include:

– Distance restrictions: Some insurance policies may have restrictions on the distance covered during transit. For example, if you are moving your items to a storage unit within a certain radius, they may provide coverage. However, if you are moving them across the country, additional coverage may be required.

– Time restrictions: In-transit coverage may have time limitations, meaning it only applies for a certain period during the moving process. It’s crucial to review your policy to understand when the coverage begins and ends.

– Mode of transportation: Certain insurance policies may specify the mode of transportation covered during transit. For example, coverage may only apply if your belongings are transported in a professional moving truck and may not include coverage if you transport them in your personal vehicle.

– Exclusions: Similar to storage unit insurance, in-transit coverage may also have exclusions. These typically include intentional damage, negligence, acts of terrorism, and damages caused by vermin infestation or mold and mildew.

Remember to carefully review the terms and conditions of your storage unit insurance policy, including any provisions regarding in-transit coverage. This will help you understand the extent of the protection provided and any limitations or exclusions that may apply.

By comparing different insurance options and understanding the specific coverage provided, you can make an informed decision to ensure your belongings are adequately protected during both storage and transit. Having the right insurance coverage can give you peace of mind and safeguard your items against unexpected damage or loss.

Property Insurance for Commercial Self-Storage Facilities

Protection from fires, floods, and damages to the facility

Property insurance for commercial self-storage facilities is crucial for protecting the facility itself from various risks. This type of insurance typically covers damages caused by fires, floods, vandalism, or other unforeseen events that may occur on the property. By having property insurance, storage facility owners can safeguard their investment and ensure that any repairs or replacements needed are covered.

Fires can pose a significant threat to storage facilities, as they can quickly spread and cause extensive damage. Property insurance can provide financial protection to cover the costs of repairing or rebuilding damaged structures, as well as replacing any lost equipment or inventory.

Likewise, flood damage can be devastating to a self-storage facility. Whether it’s caused by severe weather or a plumbing issue, floods can result in significant structural damage and loss of stored belongings. With property insurance, storage facility owners can receive compensation to cover repair costs and reimburse renters for their damaged items.

Additionally, property insurance can also cover damages resulting from vandalism or theft. It’s essential for storage facility owners to have the necessary coverage to protect against these risks and ensure the security of their renters’ belongings.

Coverage for businesses and personal belongings

Property insurance for commercial self-storage facilities not only protects the facility itself but also extends coverage to the stored belongings of businesses and individuals renting units. However, it’s important to note that the coverage provided by the storage facility’s insurance may not be sufficient to fully protect the renters’ items. Therefore, renters are encouraged to obtain their own insurance to ensure adequate coverage.

For commercial renters, property insurance can help protect their inventory, equipment, or other business assets stored in the facility. This coverage can provide peace of mind knowing that their business belongings are protected against unexpected damages or losses.

On the other hand, individuals renting storage units for personal use can also benefit from property insurance. It can cover their valuable belongings, such as furniture, electronics, and sentimental items, in case of theft, fire, or other covered perils. Personal property insurance can help replace or repair damaged items, alleviating the financial burden on the renters.

Therefore, property insurance for commercial self-storage facilities is essential for protecting both the facility and the stored belongings of renters. By having comprehensive coverage, storage facility owners can mitigate risks and ensure the financial security of their business. Renters, whether businesses or individuals, should also consider obtaining their own insurance to guarantee adequate protection for their stored items. It’s crucial to review policies, compare insurance options, and understand the specific coverage provided to make informed decisions and safeguard valuable belongings.

Peace of Mind

How storage unit insurance provides peace of mind

Storage unit insurance offers peace of mind by providing protection against unexpected loss or damage to your items. Knowing that your belongings are covered can alleviate concerns about potential risks such as natural disasters, theft, or vandalism. With the right insurance coverage, you can have peace of mind knowing that your items are safeguarded.

Minimizing the stress and worry of potential risks

One of the main benefits of storage unit insurance is its ability to minimize the stress and worry associated with potential risks. By having insurance in place, you can feel confident that your items are protected, even in rare situations such as a natural disaster or theft. Instead of constantly worrying about the safety of your belongings, you can focus on other important aspects of your life, knowing that you have taken steps to protect your possessions.

In addition to protecting your items from common risks, storage unit insurance can also provide coverage during transit, further minimizing your stress and worry. With in-transit coverage, your belongings are protected during the moving process, ensuring their safety from damage or loss. Knowing that your items are covered throughout the entire moving journey can provide peace of mind and alleviate any concerns about potential accidents or theft.

In-Transit Coverage

How storage unit insurance covers your items during transit

When it comes to storage unit insurance, in-transit coverage is an important factor to consider, especially if you plan to move your belongings from your home to a storage unit or vice versa. In-transit coverage extends protection to your items while they are in transit, ensuring their safety during the moving process.

Storage unit insurance policies with in-transit coverage typically provide protection against risks such as theft, damage, or loss during transportation. This means that if your belongings are damaged in a moving truck accident or stolen during transit, your insurance can provide coverage for the loss.

Limitations and exclusions regarding in-transit coverage

While in-transit coverage can offer additional protection for your belongings, it’s important to be aware of the limitations and exclusions that may apply. Common limitations include distance restrictions, time restrictions, specified modes of transportation, and exclusions for intentional damage, negligence, acts of terrorism, and vermin infestation or mold and mildew.

By thoroughly reviewing the terms and conditions of your storage unit insurance policy, including any provisions regarding in-transit coverage, you can better understand the extent of the protection provided and any limitations or exclusions that may apply. This knowledge will assist you in making an informed decision and ensuring that your belongings are adequately protected during both storage and transit.

Therefore, storage unit insurance not only provides peace of mind but also minimizes the stress and worry associated with potential risks. In-transit coverage further enhances this protection by ensuring the safety of your belongings during the moving process. By comparing different insurance options and thoroughly understanding the coverage provided, you can make an informed decision to safeguard your items against unexpected damage or loss.

Rare Occurrences but Worth the Investment

The rare instances of natural disasters, theft, and vandalism

Storage unit insurance provides essential protection against the rare but possible occurrences of natural disasters, theft, and vandalism. While these events may be infrequent, they can have significant consequences in terms of emotional and financial toll. Natural disasters like fires, floods, and earthquakes can damage or destroy your stored items, leaving you with a devastating loss. Likewise, theft or vandalism can result in the loss of valuable possessions or irreparable damage to sentimental items. Although such occurrences are rare, the investment in storage unit insurance is well worth it for the added security and peace of mind it offers.

Why the cost of storage unit insurance is justified

While the risks of natural disasters, theft, and vandalism are rare, the cost of storage unit insurance is a small price to pay for the protection and security it provides. The financial coverage offered by insurance can help replace lost items or cover the cost of repairs for damaged belongings. By investing in insurance, you are safeguarding your stored items against unexpected events and mitigating the potential financial burden that could result from their loss or damage. The peace of mind that comes with knowing your possessions are protected is invaluable and justifies the cost of storage unit insurance.

As you consider your options for storage unit insurance, it is crucial to thoroughly read and understand the terms of any insurance policy before committing. Familiarize yourself with the coverage provided, including any limitations or exclusions that may apply. For instance, some policies may have distance or time restrictions for in-transit coverage or certain exclusions for intentional damage or vermin infestation.

Therefore, while the risks of natural disasters, theft, and vandalism are rare, the investment in storage unit insurance is justified for the added peace of mind and protection it offers. By comparing different insurance options and thoroughly understanding the coverage provided, you can make an informed decision to safeguard your items against unexpected damage or loss. Remember to read the fine print and ensure that the insurance policy meets your specific needs.

Customized Insurance Policies

Tailoring insurance to cover a diverse range of possibilities

Customized storage unit insurance policies offer the flexibility to tailor coverage to your specific needs, ensuring that your belongings are adequately protected against a wide range of risks. By allowing you to choose the level of coverage and specific protections you require, customized policies offer peace of mind and assurance that your items are safeguarded.

One of the benefits of customized storage unit insurance is the ability to add additional coverage for risks that may not be included in standard policies. For example, if you live in an area prone to earthquakes or floods, you can opt for specific coverage to protect your items against these natural disasters. This customization allows you to have comprehensive coverage that addresses the unique risks you may face.

Additionally, customized policies can provide coverage for specific types of belongings that may need extra protection. For example, if you have valuable artwork or antiques stored in your unit, you can choose to add additional coverage for these high-value items. This ensures that you are adequately compensated in case of loss or damage to these prized possessions.

The flexibility of customized storage unit insurance options

Customized storage unit insurance options offer flexibility in terms of coverage limits and deductibles. This means that you can choose the level of protection that best suits your needs and budget. For example, if you have a higher value of items in your storage unit, you can opt for a higher coverage limit to ensure that you are fully protected.

Moreover, customized policies allow you to adjust coverage based on your changing storage needs. If you acquire new items or remove existing ones from your storage unit, you can easily update your policy accordingly. This flexibility ensures that you always have the right amount of coverage for your belongings.

Comparing different customized insurance options is crucial in finding the best policy for your specific needs. Consider factors such as coverage limits, deductibles, additional protections, and exclusions when evaluating different policies. By thoroughly understanding the terms and conditions of each policy, you can make an informed decision and choose the customized coverage that provides the greatest protection for your stored items.

Therefore, customized storage unit insurance policies offer tailored coverage that can address a diverse range of risks and specific protection needs. By choosing a customized policy, you can have peace of mind knowing that your belongings are adequately protected against unexpected loss or damage. The flexibility of these options allows you to adjust your coverage based on changing needs, ensuring that you are always protected. Compare different policies to find the best coverage for your storage unit and make an informed decision to safeguard your items.

Conclusion

Recap of the advantages of storage unit insurance

Storage unit insurance provides a safety net and peace of mind against unexpected loss or damage to your items. Some key advantages of storage unit insurance are:

– Customization: Customized storage unit insurance policies offer flexibility to tailor coverage to your specific needs. You can choose the level of coverage and specific protections you require, ensuring that your belongings are adequately protected against a wide range of risks.

– Additional Coverage: Customized insurance policies allow you to add extra coverage for risks that may not be included in standard policies. This means that you can address specific risks such as earthquakes or floods if you live in an area prone to these natural disasters.

– Protection for High-Value Items: If you have valuable artwork or antiques stored in your unit, customized policies allow you to add additional coverage for these high-value items to ensure proper compensation in case of loss or damage.

– Flexibility: Customized policies offer flexibility in terms of coverage limits and deductibles. This means you can choose the level of protection that fits your needs and budget. You can also adjust the coverage as your storage needs change, ensuring you always have the right amount of protection.

Making an informed decision about protecting your stored belongings

When it comes to choosing storage unit insurance, it is important to make an informed decision. Here are some key factors to consider:

– Coverage Limits: Compare different policies to determine the coverage limits that adequately protect the value of your stored items.

– Deductibles: Consider the deductibles associated with each policy and choose one that fits your financial situation.

– Additional Protections: Evaluate if the policy offers specific protections for risks that are relevant to your location or the nature of your stored items.

– Exclusions: Carefully read and understand the exclusions of each policy to ensure there are no surprises if you need to make a claim.

By thoroughly understanding the terms and conditions of storage unit insurance policies, you can choose the one that provides the greatest protection for your stored items. Comparing different policies, considering coverage limits, deductibles, additional protections, and exclusions will help you make the right decision.

Remember, insurance for storage units may be a requirement by most storage companies, but it is essential to compare your options before purchasing coverage. Investing in storage unit insurance is a small price to pay for the protection and security it offers, giving you peace of mind knowing that your belongings are safeguarded against unexpected events.

Learn about Michigan renters insurance for storage units.