State of colorado storage unit insurance

Importance of storage unit insurance in Colorado

If you have a storage unit in Colorado, it is important to consider getting insurance for your belongings. While storage facilities typically have security measures in place, accidents can still happen, such as theft, fire, or damage from natural disasters. Having insurance will provide financial protection in case of any unforeseen events.

Understanding the State of Colorado regulations regarding storage unit insurance

In the state of Colorado, there are no specific laws that require storage unit insurance. However, it is highly recommended to have insurance coverage for your stored items. Storage facilities may have their own requirements regarding insurance, so it’s essential to check the terms and conditions of your storage rental agreement.

When considering storage unit insurance, here are some key points to keep in mind:

1. **Coverage for your belongings**: Insurance for your storage unit will typically cover your belongings in case of damage or loss due to events such as theft, fire, vandalism, or natural disasters. It is important to review the policy to understand the extent of coverage provided.

2. **Liability protection**: Some insurance policies may also provide liability protection in case someone is injured on your storage unit premises. This can be helpful in case of accidents or unforeseen circumstances.

3. **Evaluate the value of your items**: Before getting storage unit insurance, take inventory of the items you plan to store and evaluate their value. This will help you determine the appropriate amount of coverage you need.

4. **Cost of insurance**: The cost of storage unit insurance will vary depending on factors such as the value of your stored items, the location of the storage facility, and the coverage limits. It is recommended to obtain quotes from different insurance providers to compare the costs and coverage options.

5. **Consider existing insurance policies**: Before purchasing storage unit insurance, check with your existing insurance providers (such as homeowners or renters insurance) to see if they offer coverage for stored belongings. It is possible that your current policy may provide some level of coverage for items in storage.

6. **Read the policy carefully**: When selecting a storage unit insurance policy, it is crucial to carefully read and understand the terms and conditions. Pay attention to coverage limits, deductibles, exclusions, and any additional requirements or restrictions.

While storage unit insurance is not mandatory in Colorado, it is a wise investment to protect your valuable belongings. In case of any unexpected events, having insurance coverage can provide peace of mind and financial protection. Make sure to evaluate your options, review the policies, and choose the best coverage for your specific needs.

The Basics of Storage Unit Insurance

What is storage unit insurance and why is it necessary?

Storage unit insurance is a type of insurance that provides coverage for the items you have stored in a storage facility. While the storage facility may have its own insurance policy to cover damages to the building or liability claims, this policy does not typically extend to cover the contents of individual storage units. That’s where storage unit insurance comes in.

Storage unit insurance is necessary because it helps protect your belongings from a variety of risks such as theft, fire, water damage, and natural disasters. Without insurance, you could be left financially responsible for replacing your items if they are lost or damaged. Having insurance for your storage unit gives you peace of mind and financial protection in case the unexpected happens.

Different types of storage unit insurance policies available in Colorado

In Colorado, there are various types of storage unit insurance policies available to suit different needs and budgets. Here are some common options:

1. Tenant Insurance: This type of insurance is specifically designed for tenants renting storage units. It provides coverage for the contents of the storage unit against theft, fire, water damage, and other covered risks.

2. Homeowner’s or Renter’s Insurance: Your existing homeowner’s or renter’s insurance policy may already provide some coverage for items in storage. However, it’s important to review the policy terms to understand the extent of coverage and any limitations.

3. Third-Party Insurance: Some storage facilities may offer the option to purchase insurance through a third-party provider. These policies usually provide comprehensive coverage for your stored items and may offer additional benefits such as liability protection.

4. Specialized Coverage: If you have valuable or high-risk items in storage, such as antiques, artwork, or expensive electronics, you may need specialized coverage. This type of insurance provides higher limits and broader coverage for these specific items.

Comparing the different types of storage unit insurance policies available can help you determine the best option for your needs. Consider factors such as coverage limits, deductibles, exclusions, and the reputation of the insurance provider when making your decision.

Remember, it’s always a good idea to consult with an insurance professional who can guide you through the process and help you select the most suitable storage unit insurance policy for your specific situation.

By being proactive and obtaining the appropriate insurance for your storage unit, you can ensure that your belongings are protected and minimize the financial risks associated with storing your items in a storage facility.

SafeStor: A Reliable Self-Storage Insurance Provider in Colorado

Overview of SafeStor and its services

SafeStor is a reputable insurance provider that specializes in offering storage unit insurance in Colorado. With their extensive experience in the industry, they understand the unique needs and concerns of individuals who rely on storage facilities to safeguard their belongings.

SafeStor offers comprehensive insurance policies specifically designed to protect the contents of your storage unit. Their policies provide coverage against common risks such as theft, fire, water damage, and natural disasters. By partnering with SafeStor, you can have peace of mind knowing that your valued possessions are protected.

Benefits of getting storage unit insurance through SafeStor

When considering storage unit insurance providers, there are several compelling reasons to choose SafeStor:

1. Tailored Coverage: SafeStor understands that every customer’s needs are different. They offer customizable insurance policies that can be tailored to suit your specific requirements and ensure optimal coverage for your stored items.

2. Competitive Rates: SafeStor strives to provide affordable insurance options without compromising on coverage. They offer competitive rates that fit within various budgets, making it accessible for everyone to protect their stored belongings.

3. Easy Claims Process: In the unfortunate event of a loss or damage to your stored items, SafeStor has a streamlined claims process. Their dedicated claims team is readily available to assist and guide you through the necessary steps to file a claim and get the compensation you deserve.

4. Excellent Customer Service: SafeStor prioritizes customer satisfaction and strives to provide exceptional service. Their knowledgeable insurance professionals are readily available to answer any questions you may have and provide expert guidance in selecting the right policy for your needs.

5. Flexibility and Convenience: SafeStor offers flexible insurance options that can be easily managed online. You can conveniently review and update your policy details, make payments, and access important documents through their user-friendly online portal.

Comparing insurance providers is crucial in making an informed decision about your storage unit insurance. When comparing SafeStor with other providers, consider factors such as coverage options, customer reviews, financial stability, and the ease of the claims process.

By choosing SafeStor as your storage unit insurance provider, you can rest assured that your stored belongings are protected by a reliable and reputable company. Whether you need insurance for personal or business storage needs, SafeStor has the right solution to safeguard your valued possessions.

Don’t wait until it’s too late. Contact SafeStor today to get a free quote and start protecting your stored items with reliable storage unit insurance.

Understanding the Coverage

What does storage unit insurance cover in Colorado?

Storage unit insurance in Colorado typically provides coverage for the following:

– Loss or damage to your belongings caused by theft

– Damage from fire, smoke, or explosions

– Water damage from burst pipes, leaking roofs, or natural disasters like floods

– Vandalism or malicious damage

– Damage caused by pests or vermin

– Damage from falling objects or collapse of the storage unit’s structure

It’s important to note that coverage may vary depending on the specific insurance policy you choose. Be sure to review the policy terms and conditions to understand what is covered and any specific exclusions.

Limitations and exclusions to be aware of when selecting a policy

When selecting a storage unit insurance policy in Colorado, it’s essential to be aware of the following limitations and exclusions:

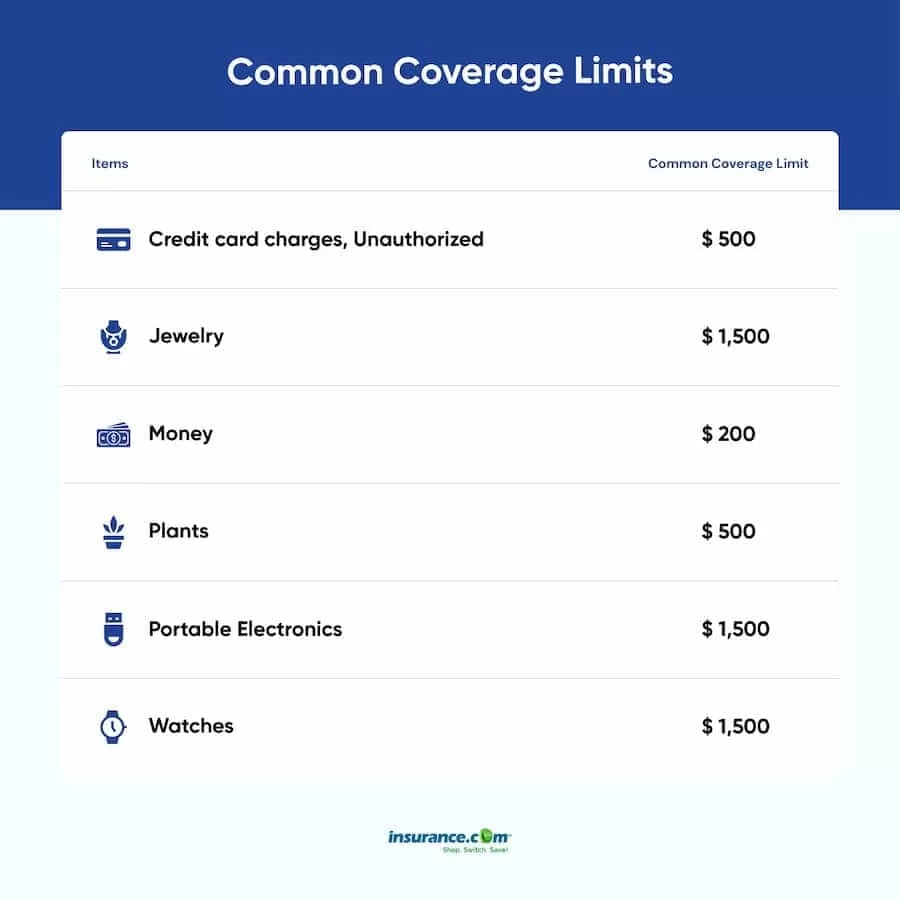

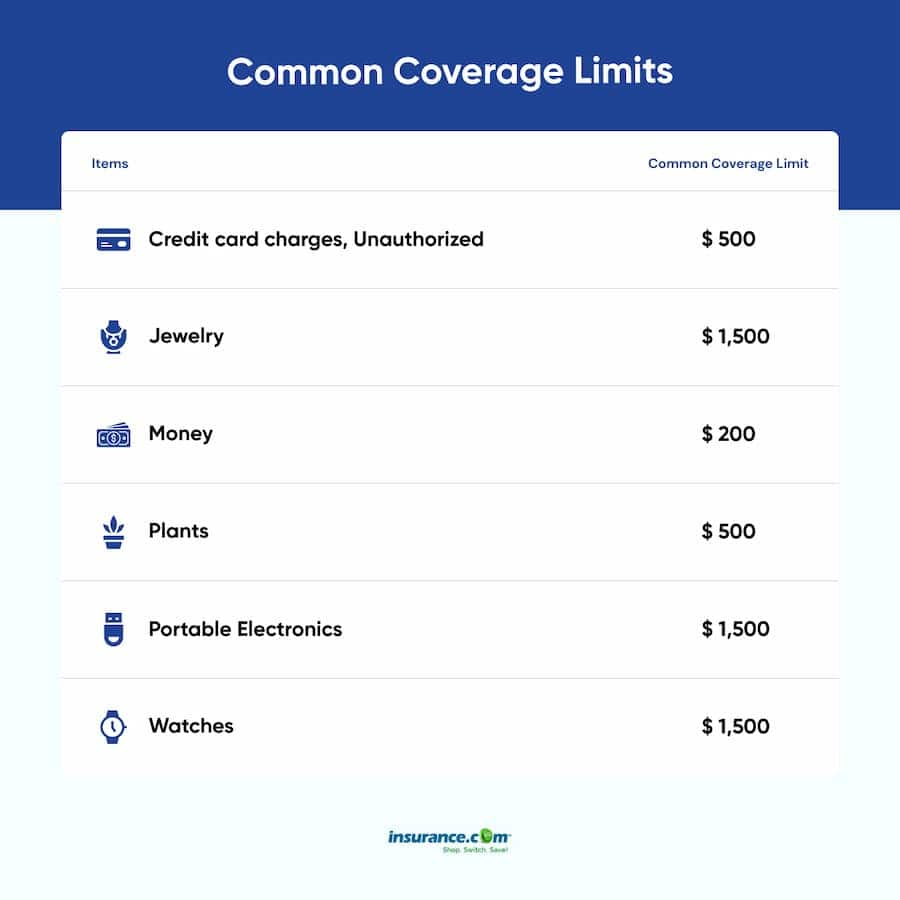

– Valuation: Storage unit insurance policies typically offer coverage based on the value you declare for your stored items. It’s important to accurately assess the value to ensure proper coverage. Some policies may also have limits on the maximum amount of coverage available.

– Deductibles: Like other insurance policies, storage unit insurance may have a deductible that you’ll need to pay before the coverage applies. Consider the deductible amount and how it fits into your budget.

– Exclusions: Insurance policies often have exclusions or specific circumstances under which coverage may not apply. Common exclusions include damage from natural disasters like earthquakes or hurricanes, damage caused by war or terrorism, and intentional acts.

– Negligence: If your negligence leads to the damage or loss of your stored items, the insurance policy may not cover the costs. For example, if you fail to secure your belongings properly, resulting in theft, the insurance may deny the claim.

– Proof of Loss: In the event of a claim, you may be required to provide proof of the damage or loss. This can include documentation such as photos, receipts, or a detailed inventory of the items.

It’s essential to carefully read and understand the terms and conditions of any storage unit insurance policy to ensure it meets your needs and expectations. If you have any questions or concerns, it’s recommended to consult with an insurance professional who can provide guidance and clarification.

Remember, having storage unit insurance in place can provide valuable protection for your belongings and give you peace of mind knowing that you’re financially covered in case of unexpected events.

How Storage Facilities in Colorado Handle Insurance

Requirements imposed by storage facilities for insurance coverage

When renting a storage unit in Colorado, it is common for storage facilities to require tenants to have insurance coverage for their stored belongings. This requirement is in place to protect both the tenant and the facility in case of any damage or loss to the stored items.

Storage facilities may have specific insurance requirements that tenants must meet, such as minimum coverage limits or proof of insurance. They may ask for documentation or a certificate of insurance showing that the tenant has an active insurance policy in place. This is to ensure that the tenant has adequate coverage and to avoid any disputes or liabilities in case of an incident.

Alternatives to self-storage insurance provided by the facility

While storage facilities often offer their own insurance options, tenants have the flexibility to choose alternative insurance options if they prefer. Here are some alternatives to consider:

1. Homeowners or Renters Insurance: Depending on your insurance policy, it may cover your stored belongings in a storage unit. Check with your insurance provider to see if your policy extends coverage to off-premises storage.

2. Umbrella Insurance: If you have an umbrella insurance policy, it may provide additional coverage for your stored belongings in a storage unit. Umbrella insurance typically offers broader coverage than standard homeowners or renters insurance policies.

3. Specialty Storage Insurance: Some insurance companies specialize in offering insurance specifically designed for storage units. These policies often provide comprehensive coverage tailored to the unique risks associated with storing belongings.

It’s important to compare the coverage, costs, and limitations of different insurance options to make an informed decision. Consider factors such as the value of your stored items, the deductibles, the coverage limits, and any additional protections offered by each policy.

Ultimately, the goal of insurance coverage for your storage unit is to safeguard your belongings and provide financial protection in case of unexpected events. By understanding the coverage options available and carefully selecting the right insurance policy, you can have peace of mind knowing that your stored items are protected. To ensure that you comply with any insurance requirements imposed by the storage facility, be sure to have proper documentation and proof of your insurance coverage.

Choosing the Right Storage Unit Insurance Policy

Factors to consider when selecting a storage unit insurance policy

When choosing a storage unit insurance policy, there are several factors you should consider to ensure you select the right coverage for your needs. These include:

1. Coverage Options: Review the coverage options provided by different insurance providers. Ensure that the policy covers the specific risks you are concerned about, such as theft, fire, water damage, and more.

2. Policy Limits: Check the policy limits to ensure they adequately cover the value of your stored belongings. Some policies may have a maximum coverage amount, so make sure it aligns with your requirements.

3. Deductibles: Consider the deductible amount of the insurance policy. This is the amount you will need to pay out of pocket before the insurance coverage kicks in. A higher deductible may result in lower premiums, but make sure it’s affordable for you.

4. Additional Coverage: Some storage unit insurance policies may offer additional coverage options, such as coverage for valuable items or specialty items like artwork or collectibles. If you have specific items of high value, ensure that they are adequately covered.

5. Policy Exclusions: Read the policy exclusions carefully to understand what circumstances or events may not be covered. Common exclusions include natural disasters, intentional acts, or negligence on your part.

6. Cost: Compare the costs of different insurance providers to find a policy that fits within your budget. However, keep in mind that the cheapest option may not always offer the best coverage, so consider the overall value you will receive.

Price comparison and customer reviews of different insurance providers

To help you make an informed decision, it’s essential to compare the prices and read customer reviews of different insurance providers. This will give you insights into the reputation and customer satisfaction levels of each company. Some factors to consider include:

1. Premiums: Compare the premiums offered by different insurance providers for the coverage you need. Request quotes from multiple providers and analyze the cost-effectiveness of each option.

2. Customer Reviews: Look for online customer reviews to get an idea of the level of customer satisfaction with each insurance provider. Pay attention to feedback regarding claims processing, customer service, and overall experience.

3. Financial Stability: Consider the financial stability of the insurance company. You want to choose a provider that is financially secure and will be able to fulfill claims in the event of a loss or damage to your stored items.

4. Reputation: Research the reputation of the insurance providers you are considering. Check if they have any industry awards or accolades, as this can indicate their expertise and reliability.

By considering these factors and doing some research, you can confidently select a storage unit insurance policy that offers the coverage you need at a reasonable price. Remember to review your policy periodically to ensure it still meets your changing needs and adjust the coverage as necessary.

Note: The information provided in this blog is for informational purposes only and does not constitute legal or insurance advice. It is always recommended to consult with an insurance professional to discuss your specific situation and insurance options.

Tips for Making a Claim

Steps to follow when filing a claim for storage unit insurance in Colorado

When you need to file a claim for your storage unit insurance, it’s essential to follow the correct steps to ensure a smooth process. Here are the steps you should take:

1. Notify the Insurance Provider: Contact your insurance provider as soon as possible to report the loss or damage. They will guide you on the next steps and provide you with the necessary claim forms.

2. Document the Loss or Damage: Take photos or videos of the affected items to provide evidence of the loss or damage. This documentation will support your claim and help in the valuation process.

3. Review your Policy: Familiarize yourself with your policy coverage and any applicable exclusions. This will help you understand what is covered and what may not be eligible for reimbursement.

4. Fill out the Claim Form: Complete the claim form provided by your insurance provider accurately and provide all the necessary details. Be thorough and include all relevant information to expedite the claims process.

5. Submit Supporting Documents: Along with the claim form, you may need to provide additional supporting documents, such as receipts, invoices, or appraisals for high-value items. Make sure to gather all necessary documentation to support your claim.

6. Cooperate with the Investigation: If your claim requires further investigation, cooperate fully with the insurance company’s process. Provide any requested information promptly and respond to all inquiries in a timely manner.

7. Follow Up Regularly: Stay in touch with your insurance provider to ensure that your claim is progressing smoothly. Follow up on any outstanding requirements or documentation needed to avoid any delays in the settlement.

Common mistakes to avoid during the claims process

During the claims process, it’s important to avoid common mistakes that could potentially delay or deny your claim. Here are some mistakes to avoid:

1. Failure to Report Promptly: Notify your insurance provider as soon as possible after discovering the loss or damage. Delaying the report could result in a denial of your claim.

2. Insufficient Documentation: Take the time to thoroughly document the loss or damage. Without proper evidence, it may be challenging to support your claim and receive appropriate compensation.

3. Inaccurate Information: Ensure that all the information provided on the claim form is accurate and complete. Any discrepancies or errors could result in delays or complications during the claims process.

4. Lack of Cooperation: Be proactive in providing requested information and cooperating with the insurance company throughout the investigation. Failure to cooperate may result in a denial of your claim.

5. Failure to Review Policy: Familiarize yourself with your insurance policy, including coverage limits, deductibles, and exclusions. Understanding your policy will help you set realistic expectations and avoid any surprises during the claims process.

By following these tips and avoiding common mistakes, you can increase the likelihood of a successful claim settlement for your storage unit insurance. Remember, it’s always recommended to consult with an insurance professional for personalized advice regarding your specific situation.

Frequently Asked Questions

Answers to commonly asked questions regarding storage unit insurance in Colorado

Do I need insurance for my storage unit?

Yes, it is highly recommended to have insurance coverage for your items stored in a storage facility. While the storage facility may have their own insurance, it may not cover the full value of your belongings or specific risks such as theft, fire, or water damage. Having a separate storage unit insurance policy ensures that your items are adequately protected.

What does storage unit insurance cover?

Storage unit insurance typically covers the loss or damage to your belongings stored in a storage facility. The coverage may include risks such as theft, fire, water damage, natural disasters, and more. It is important to review the specific coverage options and policy limits of the insurance policy to ensure it meets your needs.

How much coverage do I need for my storage unit?

The amount of coverage you need for your storage unit will depend on the value of the items you are storing. It is important to assess the total value of your belongings and select a policy that provides adequate coverage. Consider factors such as the replacement cost of your items and any valuable or specialty items that may require additional coverage.

What is a deductible?

A deductible is the amount of money you will need to pay out of pocket before the insurance coverage kicks in. When selecting a storage unit insurance policy, consider the deductible amount and ensure it is affordable for you. A higher deductible may result in lower premiums, but make sure it is a manageable amount for you to pay in the event of a claim.

Can I add additional coverage for valuable items?

Yes, some storage unit insurance policies may offer additional coverage options for valuable items or specialty items such as artwork or collectibles. If you have specific items of high value, consider adding this coverage to ensure they are adequately protected. Review the policy terms and conditions to understand the coverage limits and any requirements for insuring valuable items.

Additional resources for further information

For more information on storage unit insurance and understanding your coverage options, you may find the following resources helpful:

– Alliance Insurance of the Rockies: Contact Alliance Insurance of the Rockies for personalized assistance and guidance in selecting the right storage unit insurance policy for your needs.

– State regulations: Familiarize yourself with the storage unit insurance regulations in Colorado to ensure compliance and understand your rights as a policyholder.

– Insurance industry websites: Visit websites such as the National Association of Insurance Commissioners (NAIC) or the Insurance Information Institute (III) for more general information on storage unit insurance and insurance-related topics.

Remember, it is always recommended to consult with an insurance professional to discuss your specific situation and insurance options. They can provide personalized advice and help you navigate the complexities of storage unit insurance.

About Storage Unit Insurance in Colorado

Recap of the importance of storage unit insurance in Colorado

– It is highly recommended to have insurance coverage for your items stored in a storage facility.

– The storage facility’s insurance may not cover the full value of your belongings or specific risks such as theft, fire, or water damage.

– Having a separate storage unit insurance policy ensures that your items are adequately protected.

What does storage unit insurance cover?

– Storage unit insurance typically covers the loss or damage to your belongings stored in a storage facility.

– The coverage may include risks such as theft, fire, water damage, natural disasters, and more.

– Review the specific coverage options and policy limits to ensure it meets your needs.

How much coverage do I need for my storage unit?

– The amount of coverage you need for your storage unit will depend on the value of the items you are storing.

– Assess the total value of your belongings and select a policy that provides adequate coverage.

– Consider factors such as the replacement cost of your items and any valuable or specialty items that may require additional coverage.

What is a deductible?

– A deductible is the amount of money you will need to pay out of pocket before the insurance coverage kicks in.

– Consider the deductible amount and ensure it is affordable for you.

– A higher deductible may result in lower premiums, but make sure it is a manageable amount for you to pay in the event of a claim.

Can I add additional coverage for valuable items?

– Yes, some storage unit insurance policies may offer additional coverage options for valuable or specialty items.

– If you have specific items of high value, consider adding this coverage to ensure they are adequately protected.

– Review the policy terms and conditions to understand the coverage limits and any requirements for insuring valuable items.

Additional resources for further information

– Contact Alliance Insurance of the Rockies for personalized assistance in selecting the right storage unit insurance policy.

– Familiarize yourself with the storage unit insurance regulations in Colorado to ensure compliance and understand your rights as a policyholder.

– Visit websites such as the National Association of Insurance Commissioners or the Insurance Information Institute for more general information on storage unit insurance and insurance-related topics.

Final thoughts on finding the right coverage for your storage needs

– Storage unit insurance is an important investment to protect your belongings while they are stored in a facility.

– Assess the value of your items and select a policy that provides adequate coverage.

– Consult with an insurance professional to discuss your specific situation and insurance options.

– They can provide personalized advice and help you navigate the complexities of storage unit insurance.

Conclusion

Having insurance for your storage unit in Colorado is highly recommended to ensure the protection of your belongings. The storage facility’s insurance may not cover the full value of your items or specific risks. By obtaining a separate storage unit insurance policy, you can have peace of mind knowing your belongings are adequately covered against theft, fire, water damage, and more. Assess the value of your items and choose a policy with sufficient coverage. Consult with an insurance professional for personalized guidance in selecting the right storage unit insurance policy for your needs.