Introduction

Overview of State Farm renters insurance

State Farm is a well-known insurance company that offers a variety of insurance policies, including renters insurance. Renters insurance is an important coverage to consider for anyone who is renting a home or an apartment. It provides protection for personal belongings, liability coverage, and additional living expenses in case of a covered loss or damage. State Farm renters insurance policies are designed to help protect policyholders from unexpected events and ensure that they have the financial means to recover from a loss or damage.

Importance of coverage for items in storage units

Many individuals use storage units to store their belongings, whether they are moving, downsizing, or simply need extra space for their possessions. However, it’s important to consider the insurance coverage for items in storage units, as they may not be covered under your homeowners or renters insurance policy. Storage units are often considered separate properties and may require additional coverage.

Typically, homeowners or renters insurance policies provide coverage for personal belongings both on and off-premises. However, the coverage limits for belongings outside the home are usually lower than the coverage limits for items on-premises. While these policies may cover items in storage units, it’s essential to check the specific terms and conditions of your policy to understand the coverage limits and any exclusions that may apply.

Does homeowners insurance cover items in storage units?

Yes, homeowners insurance cover items in storage units under the off-premises personal property coverage section of your policy. However, it’s important to note that the coverage limits for items in storage units may be lower than the coverage limits for items in your home. The policy will typically specify the percentage of your dwelling coverage that is allocated for personal property coverage. While the coverage limits may vary, it is typically around 50-70% of the dwelling coverage amount.

It’s important to understand that homeowners insurance policies do have certain exclusions and limitations. Some policies may exclude coverage for certain types of items, such as collectibles, jewelry, or artwork, or may have specific exclusions for damage caused by certain perils, such as floods or earthquakes. It’s essential to review your policy and speak with your insurance provider to fully understand the terms and conditions of your coverage.

If you are storing valuable items in a storage unit, it may be beneficial to consider additional coverage options. Some insurers offer specific insurance policies for storage units or riders that can be added to your homeowners or renters insurance policy to provide additional protection. These policies or riders may offer higher coverage limits or include coverage for specific perils that may not be covered under your standard policy.

Therefore, homeowners insurance can cover items in storage units under the off-premises personal property coverage section. However, it’s important to review your policy and understand the coverage limits and exclusions that may apply. If you have valuable items or specific coverage needs, it may be beneficial to consider additional insurance options or discuss with your insurance provider to ensure that you have adequate protection for your belongings.

Understanding Renters Insurance Coverage

Explanation of what renters insurance covers

Renters insurance is designed to protect tenants from financial loss caused by unexpected events. It provides coverage for a variety of situations, including damage to personal belongings, liability for accidents that occur within the rental property, and additional living expenses if the rental becomes uninhabitable due to a covered event.

Details on off-premises personal property coverage

One important aspect of renters insurance coverage is the off-premises personal property coverage. This coverage ensures that your belongings are protected even when they are not physically inside your rental unit. This means that if you have items stored in a storage unit, they may still be covered under your renters insurance policy.

It’s worth noting that the coverage limits for belongings stored outside the rental unit are typically lower than the coverage limits for items kept inside the unit. This is because the risk of damage or theft is often higher for items that are not secured within the rental property.

When it comes to storing belongings, it’s essential to review your renters insurance policy to understand the coverage limits and any exclusions that may apply. Some policies may only cover certain perils, such as fire or theft, so it’s important to know what risks are covered and what risks may not be covered.

Therefore, renters insurance can provide coverage for items stored in a storage unit, but it’s important to review the policy carefully to understand the limits and exclusions that may apply. If you have valuable or high-risk items, you may also want to consider additional coverage options to ensure that you have adequate protection in place.

Remember to reach out to a licensed insurance expert to discuss your specific needs and find the right renters insurance policy for you.

Coverage Limits for Storage Units

Information on coverage limits for items in storage units

When it comes to storing your belongings in a storage unit, it’s important to understand the coverage limits provided by your renters insurance policy. While renters insurance can provide coverage for items stored in storage units, the limits for this coverage are typically lower than those for items kept within your rental unit.

The coverage limits for items in storage units are often lower because these items are deemed to be at a higher risk of damage or theft compared to items within your rental property. Insurance companies take into account the increased vulnerability of items in storage, as they are stored off-premises and may not benefit from the same security measures as your rental unit.

Factors that may affect coverage limits

The specific coverage limits for items in storage units can vary depending on factors such as:

1. Policy type: Different renters insurance policies may have different coverage limits for off-premises personal property, including items stored in storage units. It’s important to review your policy documents to understand the specific limits applicable to your coverage.

2. Coverage options: Some insurance companies offer additional coverage options, such as floater policies or endorsements, which can provide higher coverage limits for specific types of high-value items stored in storage units. These options may require an additional premium, but they can offer peace of mind if you have valuable items that need extra protection.

3. Deductibles: Your renters insurance policy will typically have a deductible, which is the amount you are responsible for paying out of pocket before your coverage kicks in. Be sure to review your policy and understand how the deductible may apply to items stored in storage units.

4. Appraisal and documentation: To ensure adequate coverage for high-value items in storage units, it’s a good idea to have appraisals and documentation of their value. This can help expedite the claims process and provide evidence of ownership and value if you need to file a claim for damage or theft.

5. Specific exclusions: While renters insurance generally provides coverage for a wide range of perils, certain exclusions or limitations may apply to items in storage units. For example, damage caused by flooding or earthquakes may not be covered under a standard policy, so it’s important to know any exclusions that may affect your coverage.

Remember, each renters insurance policy is different, so it’s essential to read your policy documents thoroughly and consult with a licensed insurance expert to understand the specific coverage limits and options available to you. By doing so, you can ensure that your belongings stored in storage units are adequately protected against unexpected events.

State Farm Renters Insurance Policies

Types of renters insurance policies offered by State Farm

State Farm offers renters insurance policies that provide coverage for a variety of situations. They understand the importance of protecting tenants from financial loss caused by unexpected events. Here are some common types of renters insurance policies offered by State Farm:

1. Standard Renters Insurance: This policy provides coverage for damage to personal belongings, liability for accidents that occur within the rental property, and additional living expenses if the rental unit becomes uninhabitable due to a covered event.

2. Replacement Cost Renters Insurance: This policy goes a step further and provides coverage for the actual cost of replacing damaged or stolen items, without accounting for depreciation.

3. Tenant Discrimination Coverage: This optional add-on provides coverage for legal expenses and damages related to allegations of discrimination against tenants.

4. Home Sharing Coverage: For those who rent out a portion of their home through platforms like Airbnb, this policy offers coverage for both liability and property damage.

Details on coverage options for storage units

State Farm understands that tenants may have belongings stored in a storage unit outside their rental property. Therefore, they offer coverage options for items stored in storage units under their renters insurance policies. Here are some details to consider:

1. Off-Premises Personal Property Coverage: This coverage ensures that your belongings are protected even when they are not physically inside your rental unit. This means that if you have items stored in a storage unit, they may still be covered under your renters insurance policy.

2. Coverage Limits: It’s important to review your policy to understand the coverage limits for belongings stored outside the rental unit. Generally, the coverage limits for items in storage units are lower compared to those for items kept inside the rental property. This is because the risk of damage or theft is often higher for items outside the property.

3. Exclusions: Like any insurance policy, there may be certain exclusions in coverage. It’s crucial to understand what risks are covered and what risks may not be covered. Some policies may only cover specific perils, such as fire or theft. Make sure you review the policy carefully to know the extent of coverage for items in storage units.

If you have valuable or high-risk items stored in a storage unit, you may want to consider additional coverage options offered by State Farm to ensure that you have adequate protection in place. Remember, it’s always a good idea to consult a licensed insurance expert who can guide you through the details of your specific needs and help you find the right renters insurance policy for you.

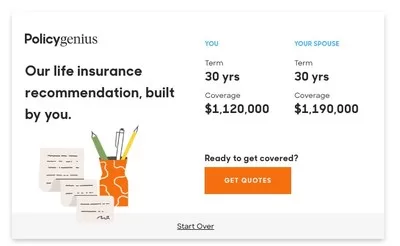

Getting a Quote for Renters Insurance

Guidelines for obtaining a renters insurance quote from State Farm

When it comes to renters insurance, it’s important to get a quote that accurately reflects your needs and the value of your belongings. Here are some guidelines for obtaining a renters insurance quote from State Farm:

1. Provide accurate information: To get an accurate quote, you’ll need to provide accurate information about your rental property, such as the address, type of property, and any additional features or amenities.

2. Determine coverage needs: Before getting a quote, it’s important to assess your coverage needs. Consider the value of your personal belongings, any valuable items you may own, and whether you need additional coverage options like replacement cost coverage or tenant discrimination coverage.

3. Evaluate deductible options: A deductible is the amount you will have to pay out of pocket before your insurance coverage kicks in. State Farm offers different deductible options, so it’s important to consider how much you can comfortably afford to pay in the event of a claim.

4. Review coverage limits: Make sure to review the coverage limits that come with the renters insurance policy. This includes both the coverage limit for your personal belongings inside your rental unit as well as any coverage limits for items stored in storage units.

Tips for accurately assessing the value of stored items

When assessing the value of items stored in a storage unit, it’s important to be thorough and accurate. Here are some tips to help you assess the value of your stored items:

1. Take inventory: Create a detailed inventory of all the items you have in storage. Include descriptions, purchase dates, and the estimated value of each item.

2. Consider replacement cost: Keep in mind the cost to replace each item if it were to be damaged or stolen. This will give you a better idea of the value of your stored belongings.

3. Document valuable items: If you have any valuable items, such as jewelry or electronics, make sure to document them separately. Take pictures, keep receipts, and consider getting appraisals for high-value items.

4. Keep records organized: Organize all your records, including the inventory list, receipts, and any appraisals or valuation documents. This will make it easier to provide documentation to your insurance company in the event of a claim.

By following these guidelines and tips, you can ensure that you have the right renters insurance coverage and accurately assess the value of your stored items. Remember, it’s always a good idea to consult with a licensed insurance expert who can provide personalized advice based on your specific needs.

Exceptions and Exclusions

Common exceptions and exclusions in renters insurance policies

When it comes to renters insurance policies, there are certain exceptions and exclusions that you should be aware of. These are circumstances or items that may not be covered under your policy. Here are some common exceptions and exclusions that you may find in renters insurance policies:

1. Natural disasters: While renters insurance generally covers damage caused by perils like fire, theft, and vandalism, it often excludes coverage for natural disasters such as earthquakes, floods, and hurricanes. If you live in an area prone to these types of events, it’s important to consider additional coverage options.

2. Intentional acts: Renters insurance typically does not cover damage caused by intentional acts. If you intentionally cause damage to your rental property or someone else’s property, it may not be covered by your policy.

3. Pet-related damage: Many renters insurance policies exclude coverage for damage caused by pets. If your pet damages your belongings or causes damage to the rental property, you may not have coverage.

4. Business-related items: Renters insurance usually does not cover business-related items. If you have a home office or run a business from your rental property, you may need to consider separate business insurance to protect your equipment and inventory.

5. High-value items: While renters insurance provides coverage for your personal belongings, there may be limits on coverage for high-value items such as jewelry, artwork, and collectibles. If you have valuable items, you may need to purchase additional coverage or a separate policy to adequately protect them.

Clarification on coverage limitations for certain types of items

It’s important to understand that renters insurance policies have coverage limitations for certain types of items. While your policy may provide coverage for personal belongings inside your rental property, the coverage limits may be different for items stored in a storage unit. Here are some clarifications on coverage limitations:

1. Lower coverage limits: Typically, the coverage limits for items stored in a storage unit are lower compared to items kept inside your rental property. This is because the risk of damage or theft is often higher for items outside the property.

2. Specific perils coverage: Some policies may only cover specific perils, such as fire or theft, for items in storage units. Make sure to review your policy and understand what risks are covered and what risks may not be covered for items in storage.

3. Additional coverage options: If you have valuable or high-risk items stored in a storage unit, it may be worth considering additional coverage options offered by your renters insurance provider. This can help ensure that you have adequate protection in place for those specific items.

Therefore, renters insurance may provide coverage for items stored in a storage unit, but it’s important to review your policy and understand the coverage limitations and any exceptions or exclusions. If you have valuable items or unique circumstances, it’s always a good idea to consult a licensed insurance expert who can help you find the right renters insurance policy and additional coverage options to meet your specific needs.

Making a Claim for Storage Unit Items

Steps to take when filing a claim for stolen or damaged property in a storage unit

If you need to make a claim for stolen or damaged property in your storage unit, there are a few steps you should follow:

1. Notify the storage facility: As soon as you discover the theft or damage, notify the storage facility management. They may have specific procedures in place for reporting and documenting incidents.

2. File a police report: If your items were stolen, it’s important to file a police report. This will help establish a record of the incident and may be required by your insurance company for the claim.

3. Review your insurance policy: Take the time to review your renters insurance policy to understand the coverage limits and requirements for making a claim. This will help ensure that you have all the necessary information when filing the claim.

4. Document the damage or theft: Take photos or videos of the damaged items or the empty storage unit to provide visual evidence of the incident. This will be helpful when filing the claim and assessing the value of the loss.

5. Gather supporting documents: Collect any receipts, appraisals, or other documentation that proves the value of the stolen or damaged items. This will help support your claim and ensure that you receive proper compensation.

6. Contact your insurance company: Reach out to your insurance company to start the claims process. They will guide you through the necessary steps and provide you with the appropriate forms to complete.

7. Provide all required information: When filing the claim, make sure to provide all the necessary information requested by your insurance company. This may include a detailed description of the stolen or damaged items, their value, and any supporting documentation.

Requirements for documenting the value of items

When making a claim for stolen or damaged property in a storage unit, it’s important to provide accurate documentation of the value of the items. Here are some requirements for documenting the value:

1. Receipts: Keep copies of receipts for any valuable items stored in the unit. These receipts will serve as proof of ownership and value.

2. Appraisals: If you have valuable items that do not have receipts, consider getting them professionally appraised. The appraisal will provide an official estimate of the item’s value.

3. Photos: Take clear photos of your items before storing them in the unit. These photos can be used as evidence of the item’s condition and value.

4. Inventory list: Create an inventory list of the items stored in the unit, including descriptions, quantities, and values. This list can help streamline the claims process and ensure accurate compensation.

By following these steps and providing proper documentation, you can increase the chances of a successful claim for stolen or damaged property in your storage unit. Remember to consult with your insurance company and provide all the required information to support your claim.

Exceptions and Exclusions

Common exceptions and exclusions in renters insurance policies

When it comes to renters insurance policies, there are certain exceptions and exclusions that you should be aware of. These are circumstances or items that may not be covered under your policy. Here are some common exceptions and exclusions that you may find in renters insurance policies:

– Natural disasters: While renters insurance generally covers damage caused by perils like fire, theft, and vandalism, it often excludes coverage for natural disasters such as earthquakes, floods, and hurricanes. If you live in an area prone to these types of events, it’s important to consider additional coverage options.

– Intentional acts: Renters insurance typically does not cover damage caused by intentional acts. If you intentionally cause damage to your rental property or someone else’s property, it may not be covered by your policy.

– Pet-related damage: Many renters insurance policies exclude coverage for damage caused by pets. If your pet damages your belongings or causes damage to the rental property, you may not have coverage.

– Business-related items: Renters insurance usually does not cover business-related items. If you have a home office or run a business from your rental property, you may need to consider separate business insurance to protect your equipment and inventory.

– High-value items: While renters insurance provides coverage for your personal belongings, there may be limits on coverage for high-value items such as jewelry, artwork, and collectibles. If you have valuable items, you may need to purchase additional coverage or a separate policy to adequately protect them.

Clarification on coverage limitations for certain types of items

It’s important to understand that renters insurance policies have coverage limitations for certain types of items. While your policy may provide coverage for personal belongings inside your rental property, the coverage limits may be different for items stored in a storage unit. Here are some clarifications on coverage limitations:

– Lower coverage limits: Typically, the coverage limits for items stored in a storage unit are lower compared to items kept inside your rental property. This is because the risk of damage or theft is often higher for items outside the property.

– Specific perils coverage: Some policies may only cover specific perils, such as fire or theft, for items in storage units. Make sure to review your policy and understand what risks are covered and what risks may not be covered for items in storage.

– Additional coverage options: If you have valuable or high-risk items stored in a storage unit, it may be worth considering additional coverage options offered by your renters insurance provider. This can help ensure that you have adequate protection in place for those specific items.

Additional Coverage Options

Information on additional coverage options for high-value or unique items

If you have valuable or unique items that are not adequately covered by your renters insurance policy, there are additional coverage options available to provide extra protection. These options may include:

– Endorsements: An endorsement is a policy amendment that expands the coverage provided by your renters insurance policy. For example, you can add an endorsement to increase coverage limits for high-value items or to cover specific risks that are not included in your standard policy.

– Floaters: A floater is a separate policy that provides specialized coverage for a specific item, such as an engagement ring or a piece of artwork. Floaters generally provide broader coverage and higher limits than what is typically included in a standard renters insurance policy.

Benefits of adding endorsements or floaters to renters insurance policies

There are several benefits of adding endorsements or floaters to your renters insurance policy:

– Increased coverage: By adding an endorsement or a floater, you can increase the coverage limits for your high-value or unique items. This can give you peace of mind knowing that these items are adequately protected.

– Customized coverage: Endorsements and floaters allow you to customize your coverage based on your specific needs. You can choose the coverage limits, deductibles, and types of perils covered to ensure that you have the right level of protection for your valuable items.

– Enhanced protection: Endorsements and floaters often provide broader coverage than what is included in a standard renters insurance policy. This means that you may be covered for risks that are typically excluded, such as accidental damage or mysterious disappearance.

Therefore, while renters insurance may provide coverage for items stored in a storage unit, it’s important to review your policy and understand the coverage limitations and any exceptions or exclusions. If you have valuable items or unique circumstances, it’s always a good idea to consult a licensed insurance expert who can help you find the right renters insurance policy and additional coverage options to meet your specific needs.

Exceptions and Exclusions

Common exceptions and exclusions in renters insurance policies

– Natural disasters: Renters insurance often excludes coverage for natural disasters such as earthquakes, floods, and hurricanes. Additional coverage options may be necessary for those living in high-risk areas.

– Intentional acts: Renters insurance typically does not cover damage caused by intentional acts.

– Pet-related damage: Many renters insurance policies exclude coverage for damage caused by pets.

– Business-related items: Renters insurance usually does not cover business-related items.

– High-value items: Renters insurance may have limits on coverage for high-value items such as jewelry and artwork.

Clarification on coverage limitations for certain types of items

– Lower coverage limits: Coverage limits for items stored in a storage unit are often lower than for items kept inside the rental property due to increased risk of damage or theft.

– Specific perils coverage: Some policies may only cover specific perils, such as fire or theft, for items in storage units.

– Additional coverage options: Renters insurance providers may offer additional coverage options for valuable or high-risk items stored in a storage unit.

Additional Coverage Options

Information on additional coverage options for high-value or unique items

– Endorsements: Policy amendments that expand coverage, such as increasing coverage limits for high-value items or covering specific risks not included in the standard policy.

– Floaters: Separate policies that provide specialized coverage for specific items, offering broader coverage and higher limits than standard renters insurance policies.

Benefits of adding endorsements or floaters to renters insurance policies

– Increased coverage: Endorsements or floaters allow for increased coverage limits for high-value or unique items.

– Customized coverage: Endorsements and floaters allow for customization of coverage based on individual needs.

– Enhanced protection: Endorsements and floaters often provide broader coverage, including risks that are typically excluded.

Conclusion

So, renters insurance may cover items stored in a storage unit but with limitations. It’s important to review your policy and understand the coverage limits, exceptions, and exclusions. Consult with a licensed insurance expert to ensure you have the right renters insurance policy and additional coverage options to adequately protect your belongings in storage.

You’ll be interested in Renters insurance for storage units progressive.