Introduction to Renters Insurance in Storage Units

Does Renters Insurance Cover Storage Units?

Yes, renters insurance typically covers storage units. This means that your personal property stored outside of your apartment is still protected. If your belongings in a storage unit are damaged by a covered peril, such as fire, theft, or water damage, your renters insurance policy can provide financial reimbursement.

Coverage Limits on Storage Units

While renters insurance does cover items in storage units, it’s important to be aware of any coverage limits that may apply. Each renters insurance policy has a specific coverage limit for personal property, which is the maximum amount the insurance company will pay for a covered claim.

For example, if your renters insurance policy has a $50,000 coverage limit for personal property and your belongings in the storage unit are worth $60,000, you would only be reimbursed up to the coverage limit of $50,000. It’s important to review your policy carefully and consider purchasing additional coverage if needed.

When to Purchase Additional Renters Coverage for a Storage Unit

If the value of your belongings stored in a storage unit exceeds the coverage limit of your renters insurance policy, it may be wise to purchase additional coverage. Speak with your insurance provider to discuss your options and determine the best course of action.

Other Storage Unit Insurance Options

In addition to renters insurance, there are other insurance options specifically designed for storage units. Some storage facilities may offer their own insurance coverage, which you can purchase at an additional cost. It’s important to carefully review the terms and conditions of this coverage to ensure it meets your needs.

Alternatively, you can also consider a separate self-storage insurance policy. These policies are specifically tailored to cover items stored in a storage unit and provide additional protection beyond what may be offered by your renters insurance.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Renters insurance does typically cover items stored in a storage unit, but it’s important to review your policy and consider any coverage limits that may apply. If the value of your belongings exceeds the coverage limit, additional insurance options may be necessary. Make sure to speak with your insurance provider to determine the best coverage for your storage unit needs.

Understanding Renters Insurance Coverage for Storage Units

Overview of Renters Insurance Coverage

When you have renters insurance, your personal property is typically covered even when it is stored outside of your apartment. This means that if you have belongings in a storage unit, your renters insurance policy will provide some level of coverage for those items. Renters insurance offers personal property coverage, which reimburses you for financial loss if your belongings are damaged by a covered peril such as theft, fire, or water damage.

Specific Coverage for Personal Property in Storage Units

If you have belongings in a storage unit, it is important to understand the coverage limits and any additional coverage options that may be available to you.

– Coverage limits on storage units: Renters insurance policies usually have a certain limit for coverage on items stored in a storage unit. This limit is typically a percentage of the total personal property coverage limit stated in your policy. For example, if your policy has a personal property coverage limit of $50,000 and the coverage on storage units is set at 10%, then your storage unit coverage would be limited to $5,000.

– When to purchase additional renters coverage for a storage unit: If the value of the items you have in storage exceeds the coverage limit provided by your renters insurance policy, you may want to consider purchasing additional coverage specifically for your storage unit. This can be done by increasing the coverage limit for storage units or by adding a separate storage unit insurance policy.

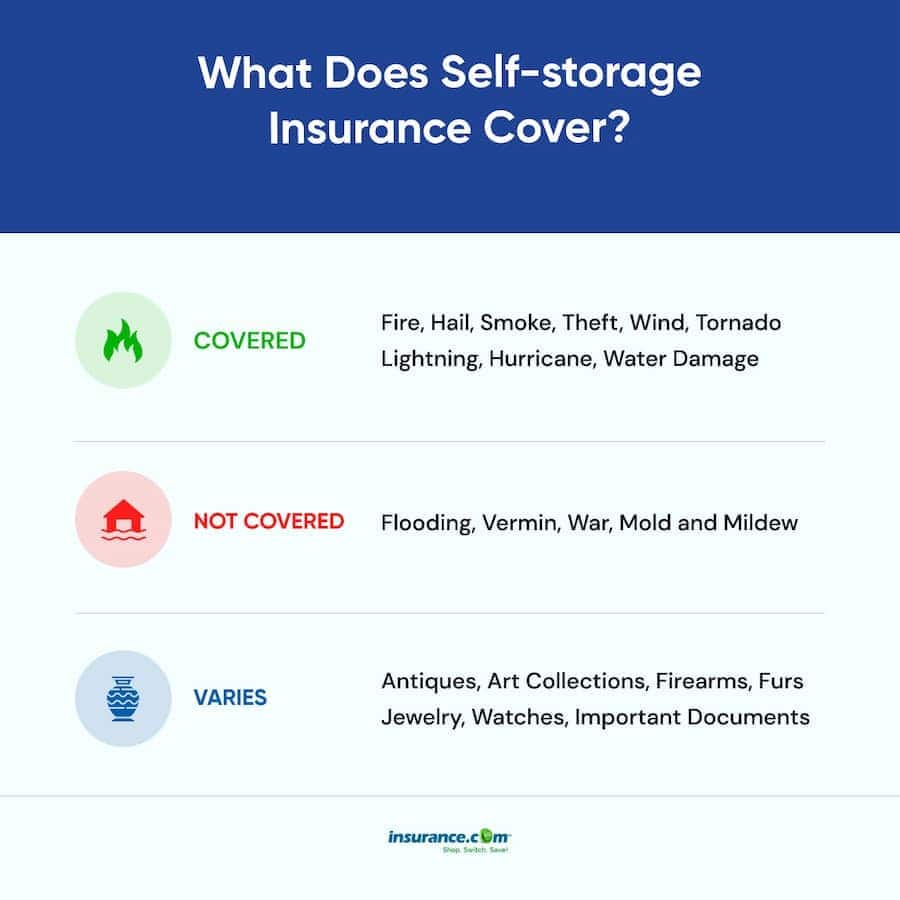

– Other storage unit insurance options: In addition to renters insurance, there are other insurance options specifically designed for storage units. These include self-storage insurance, which is offered by many storage facilities, and standalone storage unit insurance policies. These types of insurance policies may provide more comprehensive coverage for your items in storage, including protection against additional perils such as vermin damage or natural disasters.

Therefore, renters insurance does cover items in storage units to a certain extent. However, it is important to review your policy to understand the coverage limits and consider purchasing additional coverage if needed. Additionally, exploring other insurance options specifically for storage units may provide more comprehensive protection for your belongings.

Limits and Sub-Limits on Renters Insurance Coverage for Storage Units

Determining Sub-Limits for Personal Property in Storage Units

When it comes to renters insurance coverage for items in storage units, there are specific limits and sub-limits that policyholders should be aware of. These limits determine the maximum amount of coverage provided for personal property stored outside of your apartment.

Renters insurance policies typically set a sub-limit on storage unit coverage, which is a percentage of the total personal property coverage limit stated in your policy. For example, if your policy has a personal property coverage limit of $50,000 and the sub-limit for storage units is set at 10%, then your storage unit coverage would be limited to $5,000.

It is important to review your renters insurance policy to understand the specific sub-limit for storage units and ensure that it aligns with the value of the items you have stored. If the value of your stored belongings exceeds the sub-limit, you may want to consider purchasing additional coverage to adequately protect your property.

Factors Affecting Coverage Limits

The coverage limits on storage units may vary depending on several factors:

1. Policy Type: Different renters insurance policies may have different sub-limits for storage unit coverage. Higher-end policies may offer higher sub-limits or no sub-limits at all, providing more comprehensive coverage for items in storage.

2. Storage Facility Requirements: Some storage facilities may have their own insurance requirements for tenants. This means that even if your renters insurance policy provides coverage for storage units, the storage facility may require you to have additional insurance coverage to rent a unit.

3. Value of Stored Items: The total value of the items you have in storage will affect the adequacy of your coverage limits. If the value of your stored belongings is significantly higher than the sub-limit provided by your renters insurance policy, it may be wise to consider purchasing extra coverage.

4. Location: The location of the storage unit can also impact coverage limits. Storage units located in areas prone to natural disasters or high crime rates may have lower coverage limits due to the increased risk of damage or theft.

Understanding these factors and reviewing your policy will help you determine if the coverage provided by your renters insurance policy is sufficient for your storage unit needs. If your belongings exceed the coverage limits or you require more comprehensive protection, there are additional storage unit insurance options available.

It is always advisable to consult with your insurance provider to clarify the specific coverage limits and explore any additional insurance options to ensure your items in storage have adequate protection. By understanding the coverage limits and considering additional coverage if needed, you can have peace of mind knowing that your stored belongings are financially protected.

Exclusions and Limitations of Renters Insurance for Storage Units

Excluded Events and Damages

While renters insurance does provide coverage for items in storage units, it’s important to be aware of certain exclusions and limitations that may apply. Here are some common events and damages that may not be covered by your renters insurance policy:

– Natural disasters: Renters insurance typically covers damages caused by fire, theft, and water damage, but it may not provide coverage for damages caused by natural disasters such as earthquakes, floods, or hurricanes. If you live in an area prone to these types of events, you may need to consider additional insurance coverage specifically for your storage unit.

– Negligence: If the damage to your items stored in a storage unit is deemed to be a result of your own negligence, such as failure to properly pack or secure your belongings, your renters insurance may not cover the loss. It’s important to take proper precautions when storing your items to minimize the risk of damage.

– Unauthorized access: If someone gains unauthorized access to your storage unit and steals or damages your belongings, your renters insurance may not cover the loss. Some insurance policies require evidence of forced entry or signs of break-in to provide coverage for theft.

– Wear and tear: Renters insurance typically covers damages caused by sudden and accidental events, but it may not cover damages that occur gradually over time due to wear and tear. For example, if your furniture in storage gets damaged due to age or constant exposure to humidity, it may not be covered by your policy.

Special Considerations for Certain Items

Certain items may have special considerations when it comes to coverage under your renters insurance policy:

– High-value items: If you have valuable items such as jewelry, antiques, or electronic equipment in your storage unit, they may have coverage limitations under your renters insurance policy. It’s important to review your policy and consider purchasing additional coverage specifically for these high-value items.

– Business property: If you are storing items related to a business or profession in your storage unit, they may not be covered by your renters insurance policy. Business property may require a separate insurance policy to ensure adequate coverage.

– Motor vehicles: Most renters insurance policies do not cover motor vehicles stored in storage units. If you have a car, motorcycle, or other motor vehicle in storage, you may need to explore other insurance options specifically designed for vehicle storage.

Therefore, while renters insurance does provide some coverage for items in storage units, it’s important to review your policy and understand the exclusions and limitations that may apply. Consider purchasing additional coverage if needed, especially for high-value items or specialized items such as business property or motor vehicles. Exploring other insurance options specifically designed for storage units can also provide more comprehensive protection for your belongings.

Choosing the Right Renters Insurance for Your Storage Unit

When it comes to protecting your belongings in a storage unit, it’s important to choose the right renters insurance policy. Here are some factors to consider:

Evaluating Policy Limits and Deductibles

Before purchasing renters insurance for your storage unit, take a close look at the policy limits and deductibles. Here’s what to keep in mind:

– Coverage limits: Make sure the policy provides enough coverage for all the items you have in storage. Consider the total value of your belongings and choose a policy that offers adequate coverage to replace them in case of damage or loss.

– Deductibles: Take note of the deductibles specified in the policy. This is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. Consider your financial situation and choose a deductible that you can comfortably afford.

Considering Additional Coverage Options

While renters insurance provides some coverage for items in storage units, there may be additional coverage options you can consider to enhance protection. Here are a few options to explore:

– Expanded personal property coverage: If you have high-value items or collections of significant worth in your storage unit, you may want to consider purchasing additional coverage specifically for these items. This will ensure that they are adequately protected in case of damage or theft.

– Specialized coverage for business property: If you’re storing items related to a business or profession, your renters insurance policy may not provide coverage. In this case, consider purchasing a separate insurance policy that is specifically designed to protect business property.

– Vehicle storage insurance: Renters insurance typically does not cover motor vehicles stored in storage units. If you have a car, motorcycle, or any other motor vehicle in storage, explore insurance options that are specifically designed to cover vehicles stored in storage units.

Choosing the right renters insurance and considering additional coverage options will provide you with peace of mind knowing that your belongings are protected. Be sure to review your policy, evaluate the coverage limits and deductibles, and consider any additional coverage needed for valuable items, business property, or motor vehicles. By taking these steps, you can ensure that your items in storage are well-covered and protected from any potential risks or damages.

Filing a Claim for Damaged or Stolen Property in a Storage Unit

Documenting and Assessing Damages

When filing a claim for damaged or stolen property in a storage unit, it’s crucial to properly document and assess the damages. Here are some steps to follow:

1. Take inventory: Before storing your belongings in a storage unit, create a detailed inventory list of all the items. Include descriptions, serial numbers (if applicable), and photographs. This will serve as important documentation when filing a claim.

2. Regular inspections: Make it a habit to periodically inspect your storage unit to check for any damages or signs of theft. If you notice any issues, document them immediately with photographs and written descriptions.

3. Report damages promptly: If you discover any damages or theft, report it to the storage facility management and your renters insurance company as soon as possible. Provide them with the necessary documentation, such as the inventory list and evidence of the damages or theft.

4. Assess the value of the damages: Work with your insurance company to assess the value of the damaged or stolen items. They may send an adjuster to evaluate the extent of the damages and calculate the amount you are eligible to claim.

Procedures for Filing a Claim

When filing a claim for damaged or stolen property in a storage unit, follow these procedures:

1. Contact your renters insurance company: Notify your insurance company about the incident and provide them with all the necessary information, including the date and time of the incident, a detailed description of the damages or theft, and any supporting documentation.

2. Complete the claim form: Your insurance company will provide you with a claim form to fill out. Ensure that you provide accurate and detailed information about the items that were damaged or stolen, including their value and any relevant receipts or proof of ownership.

3. Provide supporting documentation: Attach any supporting documentation, such as photographs, inventory lists, police reports (if applicable), and any other evidence of the damages or theft.

4. Cooperate with the claims process: Throughout the claims process, be responsive and cooperative with your insurance company’s requests for additional information or documentation. They may need to investigate the claim further or request additional evidence.

5. Review the settlement: Once your claim is processed, the insurance company will provide you with a settlement offer. Review it carefully to ensure it covers your losses adequately. If you have any concerns or questions, don’t hesitate to reach out to your insurance company for clarification or to negotiate the settlement.

Remember to always keep copies of all the documentation related to your claim, including correspondence with the insurance company and storage facility management. This will help you in case of any disputes or further inquiries.

Therefore, filing a claim for damaged or stolen property in a storage unit requires proper documentation and adherence to the procedures set by your renters insurance company. By following the steps outlined above, you can increase the chances of a smooth and successful claims process.

Tips for Protecting Your Belongings in a Storage Unit

Proper Organization and Packaging

Properly organizing and packaging your belongings in a storage unit can help protect them from damage. Here are some tips to consider:

– Use sturdy boxes: Pack your items in sturdy, durable boxes that are designed for storage. Avoid using old or damaged boxes that may not provide adequate protection.

– Label boxes: Clearly label each box with its contents to make it easier to find specific items later. This will also help you stay organized and prevent unnecessary digging and rearranging.

– Use protective materials: Wrap fragile items in bubble wrap or packing paper to prevent them from getting damaged during transport or while in storage. Use furniture covers or blankets to protect larger items from scratches or dust.

– Stack items properly: Stack boxes in a stable manner, placing heavier items at the bottom and lighter ones on top. This will help prevent boxes from collapsing or crushing fragile items.

Security Measures and Precautions

Taking security measures and precautions can help prevent theft and unauthorized access to your storage unit. Here are some steps to consider:

– Choose a reputable storage facility: Research storage facilities and choose one with good security measures in place, such as surveillance cameras, gated entry, and on-site security personnel. This can deter theft and increase the safety of your belongings.

– Use a sturdy lock: Invest in a high-quality, tamper-proof lock for your storage unit. Avoid using cheap or easily breakable locks that can be easily compromised.

– Limit access: Only grant access to your storage unit to trusted individuals. Avoid sharing your access code or key with others who do not need it.

– Insure your belongings: While renters insurance may provide some coverage for items in a storage unit, it’s a good idea to consider additional storage unit insurance. This can provide extra protection and peace of mind in case of damage, theft, or other unforeseen events.

– Keep an inventory: Maintain an updated inventory of your stored items. This can help you keep track of your belongings and provide valuable documentation in case of a claim.

By following these tips for proper organization and packaging, as well as implementing security measures and precautions, you can help protect your belongings in a storage unit. Remember to review and update your insurance coverage as needed to ensure adequate protection.

Renters Insurance vs. Storage Unit Insurance: Understanding the Differences

Coverage and Limitations of Renters Insurance

Renters insurance provides coverage for your personal property, both inside your apartment and when stored outside, such as in a storage unit. Here are some key points to understand about renters insurance coverage for storage units:

– Renters insurance typically offers personal property coverage that reimburses you for financial loss if your belongings are damaged or stolen.

– The coverage limits on storage units are usually the same as the coverage limits for personal property inside your apartment.

– It’s important to review your renters insurance policy to understand the specific coverage, deductibles, and exclusions related to storage units.

Pros and Cons of Storage Unit Insurance

Storage unit insurance, on the other hand, is a separate insurance policy specifically designed to cover the contents of your storage unit. Here are some pros and cons to consider:

Pros of Storage Unit Insurance:

– Tailored coverage: Storage unit insurance is specifically designed to cover the items stored in your unit, offering more comprehensive coverage than renters insurance.

– Higher coverage limits: Storage unit insurance policies often provide higher coverage limits compared to renters insurance.

– Additional types of loss: Storage unit insurance may cover additional types of loss, such as natural disasters or water damage.

Cons of Storage Unit Insurance:

– Additional cost: Adding a storage unit insurance policy on top of your renters insurance may come with an additional cost.

– Limited coverage options: Storage unit insurance policies may have limitations and exclusions, so it’s important to carefully review the policy to understand what is covered.

So, renters insurance does cover storage units, but it’s important to understand the coverage limits and limitations. Storage unit insurance offers more tailored coverage but may come with additional costs. Consider your specific needs and the value of your stored belongings to decide which insurance option is right for you.

Filing a Claim for Damaged or Stolen Property in a Storage Unit

Documenting and Assessing Damages

When filing a claim for damaged or stolen property in a storage unit, it’s crucial to properly document and assess the damages. Here are some steps to follow:

1. Take inventory: Before storing your belongings in a storage unit, create a detailed inventory list of all the items. Include descriptions, serial numbers (if applicable), and photographs. This will serve as important documentation when filing a claim.

2. Regular inspections: Make it a habit to periodically inspect your storage unit to check for any damages or signs of theft. If you notice any issues, document them immediately with photographs and written descriptions.

3. Report damages promptly: If you discover any damages or theft, report it to the storage facility management and your renters insurance company as soon as possible. Provide them with the necessary documentation, such as the inventory list and evidence of the damages or theft.

4. Assess the value of the damages: Work with your insurance company to assess the value of the damaged or stolen items. They may send an adjuster to evaluate the extent of the damages and calculate the amount you are eligible to claim.

Procedures for Filing a Claim

When filing a claim for damaged or stolen property in a storage unit, follow these procedures:

1. Contact your renters insurance company: Notify your insurance company about the incident and provide them with all the necessary information, including the date and time of the incident, a detailed description of the damages or theft, and any supporting documentation.

2. Complete the claim form: Your insurance company will provide you with a claim form to fill out. Ensure that you provide accurate and detailed information about the items that were damaged or stolen, including their value and any relevant receipts or proof of ownership.

3. Provide supporting documentation: Attach any supporting documentation, such as photographs, inventory lists, police reports (if applicable), and any other evidence of the damages or theft.

4. Cooperate with the claims process: Throughout the claims process, be responsive and cooperative with your insurance company’s requests for additional information or documentation. They may need to investigate the claim further or request additional evidence.

5. Review the settlement: Once your claim is processed, the insurance company will provide you with a settlement offer. Review it carefully to ensure it covers your losses adequately. If you have any concerns or questions, don’t hesitate to reach out to your insurance company for clarification or to negotiate the settlement.

Remember to always keep copies of all the documentation related to your claim, including correspondence with the insurance company and storage facility management. This will help you in case of any disputes or further inquiries. By following these procedures and documenting the damages properly, you can increase the chances of a smooth and successful claims process.

Conclusion: The Importance of Renters Insurance for Storage Units

Protect Your Belongings and Finances

Renters insurance is a valuable investment for anyone with items stored in a storage unit. It offers financial protection against unexpected events like theft, damage, or natural disasters. Whether you have valuable possessions or sentimental items in storage, renters insurance can help you recover financially in case of a loss.

Understanding Coverage Limits and Limitations

While renters insurance does cover items in storage units, it’s important to understand the coverage limits and limitations of your policy. Review your policy carefully to determine if you need additional coverage for certain high-value items or if there are any exclusions that may impact your coverage.

Weighing the Options: Renters Insurance vs. Storage Unit Insurance

Consider your specific needs and the value of your stored belongings when deciding between renters insurance and storage unit insurance. Renters insurance offers coverage for personal property both inside your apartment and when stored outside, providing a convenient and cost-effective solution. On the other hand, storage unit insurance offers more tailored coverage for the contents of your storage unit but may come with additional costs. Evaluate the pros and cons of each option to make an informed decision.

Proper Documentation for Claims

When filing a claim for damaged or stolen property in a storage unit, thorough documentation is crucial. Take inventory of your belongings, including detailed descriptions, serial numbers, and photographs. Regularly inspect your storage unit, report any damages or theft immediately, and provide all necessary documentation to your insurance company. By following proper procedures and providing accurate information, you can increase the chances of a successful claims process.

Cooperation and Communication

Throughout the claims process, it is important to cooperate and communicate effectively with your renters insurance company. Promptly report the incident, complete the claim form accurately, and provide all supporting documentation required. Review the settlement offer carefully to ensure it adequately covers your losses and address any concerns or questions with your insurance company.

So, renters insurance offers coverage for items stored in storage units, providing valuable protection for your belongings and financial peace of mind. Understand the coverage limits and limitations of your policy, consider the options available, and document any damages or theft properly when filing a claim. With the right insurance coverage and proper procedures, you can confidently store your belongings knowing you are protected.

Learn more about Is it standard to get rental insurance for storage unit.