Introduction

When you store your personal belongings in a storage unit, it’s important to protect them. While most homeowners, renters, and condo policies cover theft, vandalism, and weather-related damages to your belongings while you’re moving, they don’t necessarily cover them while in a storage unit. This is where storage unit insurance comes in. In this blog post, we’ll provide an overview of Progressive storage unit insurance and discuss the importance of having this type of coverage.

Overview of Progressive Storage Unit Insurance

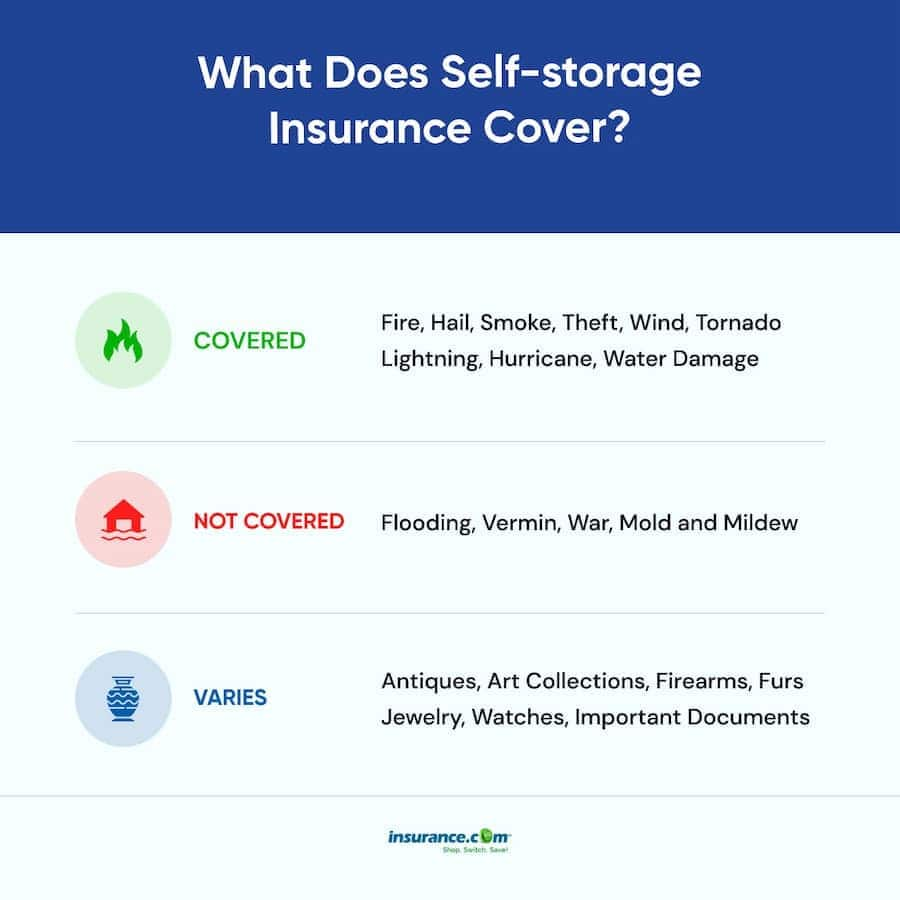

Progressive storage unit insurance is designed to protect your belongings while they’re being stored in a storage unit. This type of insurance typically covers theft, vandalism, fire, smoke, windstorm, and water damage. Additionally, Progressive offers coverage for earthquake, flood, vermin, and mildew, depending on your policy.

One of the benefits of Progressive storage unit insurance is that it includes full replacement value protection. This means that if your item is damaged, destroyed, or lost, Progressive will repair or replace it at the current market value. Full replacement protection is the default insurance coverage at Progressive and costs approximately 1% of your belongings’ estimated total value.

It’s important to note that while Progressive storage unit insurance covers a wide range of perils, there are some exclusions. For example, the policy may not cover damage caused by war, terrorist attacks, or nuclear hazards. Additionally, certain high-value items may need to be insured separately.

The Importance of Storage Unit Insurance

Many people mistakenly assume that their belongings are covered by their homeowner’s or renter’s insurance policy while in a storage unit. However, this is often not the case. Most policies have limitations on coverage for items that are not located on the insured property.

If your belongings are damaged or stolen from a storage unit, the costs of replacing them can add up quickly. Storage unit insurance provides an additional layer of protection and peace of mind.

Another reason to consider storage unit insurance is that storage facilities often require it. In fact, many facilities won’t let you rent a unit without proof of insurance. If they do, they may offer their own insurance policy, but these policies may not provide the same level of coverage as an independent policy.

Therefore, if you’re storing your belongings in a storage unit, it’s important to have the proper insurance coverage. Progressive storage unit insurance provides comprehensive coverage at an affordable price. Be sure to check with your storage facility to determine their insurance requirements and consider purchasing a policy to protect your belongings.

Coverage Options

Types of coverage offered by Progressive storage unit insurance

When it comes to moving, individuals have several options for insurance coverage to protect their belongings. Homeowners, renters, and condo policies generally cover theft, vandalism, and weather-related damage to your belongings while you’re moving. However, full replacement value protection is an additional option that provides a higher level of coverage. If your item is damaged, destroyed, or lost with full replacement value protection, your moving company is required to repair or replace it at its current market value.

Full replacement protection is the default insurance coverage at all moving companies and generally costs about 1% of your belongings’ estimated total value. For instance, if a dining room chair has a full replacement value of $50, you are eligible to receive $12 from the required liability protection. Separate liability insurance can cover the remaining $38.

Another coverage option when it comes to storage units is purchasing Progressive storage unit insurance. With Progressive storage unit insurance, your belongings are protected wherever they are stored. This insurance coverage offers several types of protection, including:

– Personal property coverage: Personal property coverage provides protection for your belongings against theft, fire, and other common causes of loss that can occur in storage units.

– Business property coverage: Business property coverage offers protection for the contents of your business office, including furniture, fixtures, and electronics, while in storage units.

– Vehicle coverage: Vehicle coverage offers protection for your vehicles like cars, motorcycles, and boats, that are stored in storage units.

Limitations of coverage

It’s important to note that there are some limitations to insurance coverage options. For example, most policies have specific limits on high-value items such as jewelry, collectibles, and artwork. Therefore, it’s vital to ensure that you’re aware of your coverage limits when choosing an insurance policy. It’s also important to note that your policy may not cover damages caused by natural disasters, such as earthquakes or floods, which may require the purchase of additional insurance.

Therefore, whether you’re moving or storing items, having adequate insurance coverage is essential to protect your belongings. Progressive storage unit insurance offers several coverage options to ensure that your stored items are protected against theft, fire, and other causes of loss. However, as with any insurance policy, it’s crucial to review the coverage limits and understand the limitations to ensure you choose the right policy for your needs.

Theft Protection

Theft protection coverage details

When moving or storing your belongings, being cautious about theft is necessary. Theft protection coverage is one of the most important aspects of any insurance policy that covers moving or storage. It’s essential to make sure that your policy covers theft, as it can protect you from incurring financial losses in case of an unforeseen event.

Most insurance policies cover theft but may have certain limitations. Progressive storage unit insurance offers protection against theft as part of its personal property coverage, business property coverage, and vehicle coverage options. Personal property coverage provides protection for your belongings against theft, fire, and other common causes of loss that can occur in storage units. Business property coverage offers protection for the contents of your business office while in storage units. Vehicle coverage offers protection for your vehicles, like cars, motorcycles, and boats, that are stored in storage units.

What is covered in case of theft

In case of theft, depending on your policy’s limits, you can receive compensation for the stolen items. Homeowners, renters, and condo policies may provide coverage for the theft of your belongings while you’re moving, but it’s important to read your policy’s fine print for specific limits and exclusions.

With Progressive storage unit insurance, you can start with a limit of $1,000 and can go up to $100,000, depending on your coverage needs. Policyholders can choose to protect their belongings at full replacement value or lesser coverage limits.

But, it’s important to note that coverage for high-value items like jewelry, collectibles, and artwork may have specific limits. Therefore, it’s essential to ensure that you’re aware of your coverage limits when choosing an insurance policy.

Therefore, theft protection is a crucial aspect of any insurance policy. Progressive storage unit insurance offers personal property coverage, business property coverage, and vehicle coverage that provides protection against theft. However, it’s always essential to read the fine print and understand your policy’s limits and exclusions to ensure that you have adequate protection for your belongings.

Vandalism Protection

When it comes to protecting your belongings during a move or while they are in storage, it’s essential to have adequate insurance coverage. In addition to coverage for theft, weather-related damage, and other causes of loss, vandalism protection is another important aspect to consider.

Vandalism protection coverage details

Vandalism protection is an insurance coverage option that protects your belongings against damages caused by intentional harm, such as graffiti, broken windows, or other forms of destruction. This coverage is typically included in most insurance policies for homeowners, renters, and condo owners.

When it comes to storage unit insurance, vandalism protection is also an essential aspect to consider. Many storage unit insurance policies, including Progressive storage unit insurance, offer vandalism protection as part of their coverage options.

What is covered in case of vandalism

Vandalism protection typically covers damages caused by intentional harm to your belongings, including graffiti, broken windows, smashed furniture, or other forms of destruction. In the case of Progressive storage unit insurance, vandalism protection covers damage caused by vandals to your stored belongings.

It’s important to note that not all types of damages caused by intentional harm may be covered under vandalism protection. For instance, if you left valuable items in plain sight and they were stolen, insurance may not cover the theft. Therefore, it’s crucial to review your policy’s coverage limits and exclusions to ensure that you understand what is covered.

Therefore, having adequate vandalism protection for your belongings during a move or while in storage is an essential aspect of insurance coverage. Whether you have a homeowners, renters, or condo policy or purchase additional storage unit insurance, it’s essential to review policy options to ensure that your belongings are protected against intentional harm.

Weather-Related Damage Protection

When it comes to insurance coverage for your belongings, weather-related damage protection is another essential aspect to consider. This coverage protects your items from damages caused by extreme weather events such as flooding, hurricanes, or tornadoes.

Weather-related damage protection coverage details

Most insurance policies for homeowners, renters, and condo owners include coverage for weather-related damages. The coverage limits may vary depending on the policy and insurer. For instance, if your personal property coverage limit is $100,000, your policy may include a separate coverage limit for weather-related damages such as $10,000 or 10% of your total coverage whichever is greater.

Storage unit insurance policies also typically include weather-related damage protection. For instance, Progressive storage unit insurance covers damages caused by natural disasters, including flooding, fires, and lightning strikes.

It’s important to review your policy’s coverage options carefully to understand the coverage limits and exclusions. Some policies may exclude certain types of weather-related damages, such as damages caused by earthquakes or landslides, or place limits on the coverage amount.

What is covered in case of weather-related damages

Weather-related damage protection typically covers damages caused by natural disasters such as flooding, hurricanes, or tornadoes. In the case of storage unit insurance, the coverage may also include damages caused by fires, lightning strikes, or other extreme weather events.

It’s important to note that not all weather-related damages may be covered under your policy. For instance, if you leave your belongings in an area that is prone to flooding, and it floods, your insurance may not cover the damages. Therefore, it’s crucial to take preventive measures to protect your belongings and review your policy’s coverage limits and exclusions.

Therefore, weather-related damage protection is an essential aspect of insurance coverage for your belongings during a move or while in storage. Whether you have a homeowners, renters, or condo policy or purchase additional storage unit insurance, it’s important to review policy options carefully to ensure that your belongings are protected against extreme weather events.

Travel Coverage

Traveling can be an exciting adventure, but it’s also important to have adequate insurance coverage to protect yourself and your belongings. Travel insurance can provide coverage for a variety of risks, from trip cancellations to medical emergencies. One essential aspect of travel coverage to consider is coverage for personal items while traveling.

Coverage for personal items while traveling

Coverage for personal items while traveling typically includes protection for lost, stolen, or damaged luggage and personal belongings. This coverage can help you recover the cost of lost or damaged items, including clothing, electronics, and other personal items.

Travel insurance policies typically include coverage for personal items while traveling, but the specific coverage amounts and limits may vary. It’s essential to review your policy’s coverage limits and exclusions to ensure that your belongings are adequately protected.

Limitations and exclusions of coverage

It’s important to note that coverage for personal items while traveling may have limitations and exclusions. For instance, most policies do not cover theft or damage to personal items left unattended in a public place. Additionally, coverage for high-value items, such as jewelry, may be subject to lower coverage limits.

Other exclusions may include damage caused by wear and tear or losses resulting from intentional acts. It’s crucial to review your policy’s exclusions to understand what types of losses are covered and what types of losses are excluded.

Therefore, travel coverage is an essential aspect of protecting yourself and your belongings while on the go. Coverage for personal items while traveling can provide peace of mind and financial protection in the case of unforeseen events. When purchasing travel insurance, it’s crucial to review your policy’s coverage options, limits, and exclusions to ensure that you have adequate protection for your needs.

Storage Unit Coverage

Storage units are a convenient solution for individuals who do not have enough space at home. However, it’s important to note that personal belongings stored in a storage facility may still be at risk of theft, vandalism, or damage due to weather-related incidents. That’s why having adequate insurance coverage for personal items stored in a storage facility is crucial.

Coverage for personal items stored in a storage facility

Renters insurance may cover personal property located in a storage facility against theft, vandalism, and weather-related damage up to the policy’s limits. This coverage can help you recover the cost of lost or damaged items, including furniture, clothing, electronics, and other personal items.

It’s important to note that different insurance companies may offer different coverage options and limits. Therefore, it’s essential to review your insurance policy’s coverage options and limits concerning personal items stored in a storage facility.

Limitations and exclusions of coverage

Just like any other insurance coverage, coverage for personal items stored in a storage facility may have limitations and exclusions. For instance, most policies do not cover damage caused by natural disasters such as floods or earthquakes. Additionally, coverage for high-value items, such as jewelry, may be subject to lower coverage limits.

Other exclusions may include damage caused by pests or rodents or losses resulting from intentional acts. It’s crucial to read and understand your policy’s exclusions to determine which types of losses are covered and which types of losses are excluded.

Therefore, having coverage for personal items stored in a storage facility is essential to protect yourself financially from unforeseeable events. Before choosing an insurance policy, it’s important to review the coverage options, limits, and exclusions thoroughly. Understanding your policy’s coverage will help you determine if it’s adequate for your needs and gives you peace of mind knowing your personal items are covered.

Claims Process

How to file a claim with Progressive storage unit insurance

Filing a claim with Progressive storage unit insurance is a straightforward process. If you’ve experienced loss or damage to your stored belongings, the first step is to notify Progressive as soon as possible. You can file a claim by phone, online, or through the Progressive mobile app.

When filing a claim, be prepared to provide information about the loss or damage, including the date and time of occurrence and a description of the items affected. It’s also helpful to have any supporting documentation, such as photos or receipts, to provide proof of ownership and value.

What to expect during the claims process

After filing your claim, Progressive will assign an adjuster to investigate the loss or damage. The adjuster will contact you to schedule an inspection of the stored items and assess the extent of the damage.

Once the investigation is complete, Progressive will provide a claims payout based on the terms outlined in your policy. It’s important to review your policy’s coverage limits and exclusions to ensure that you understand the anticipated payout.

If you have any questions or concerns about the claims process or your payout, Progressive’s claims team is available to provide support and answer any questions you may have.

Therefore, filing a claim with Progressive storage unit insurance is a straightforward process. By following the steps outlined above and providing accurate information and documentation, you can help ensure a smooth and timely resolution to your claim. Remember to review your policy’s coverage options and limits regularly to ensure that you have adequate protection for your stored belongings.

Conclusion

In short, Progressive storage unit insurance is a valuable coverage option for anyone who stores belongings in a storage rental unit. The policy offers protection against theft, vandalism, and weather-related damage, providing peace of mind for policyholders.

While the coverage has its benefits, it’s important to note that there are also some drawbacks to consider, such as coverage limitations and exclusions. Policyholders should carefully review their policy’s terms and conditions to ensure that they understand the coverage options and exclusions.

When choosing coverage for stored belongings, it’s also important to consider your individual needs. Factors such as the value of your belongings and the location of your storage unit can impact the coverage options and premiums.

Benefits and drawbacks of Progressive storage unit insurance

Benefits:

– Protection against theft, vandalism, and weather-related damage

– Fast and straightforward claims process

– Flexible coverage options to fit individual needs

– Affordable premium rates

Drawbacks:

– Coverage limitations and exclusions

– Policy may not cover items stored in certain types of storage units

– Additional coverage may be necessary for high-value items

Tips for choosing the right coverage for your needs

– Review your storage unit rental agreement to ensure that you understand the insurance requirements and limitations

– Assess the value and type of items you are storing to determine the appropriate coverage amount

– Compare coverage options and premiums from multiple providers to find the best policy for your needs and budget

– Consider additional coverage options, such as liability protection or flood insurance, if necessary.

By following these tips, you can make an informed decision about your storage unit insurance coverage and help ensure that your belongings are adequately protected. Remember, it’s important to review and update your policy regularly to account for changes in your storage needs or belongings.