Progressive renters insurance and storage unit

Renters insurance is a type of insurance coverage that provides protection for individuals who are renting a property. It is designed to cover personal belongings and provide liability coverage in case of accidents or damages that may occur within the rented premises. Progressive is one of the leading providers of renters insurance, offering a comprehensive range of coverage options to meet the needs of renters. This article provides an overview of Progressive renters insurance and highlights the importance of having renters insurance to protect personal belongings.

Overview of Progressive renters insurance

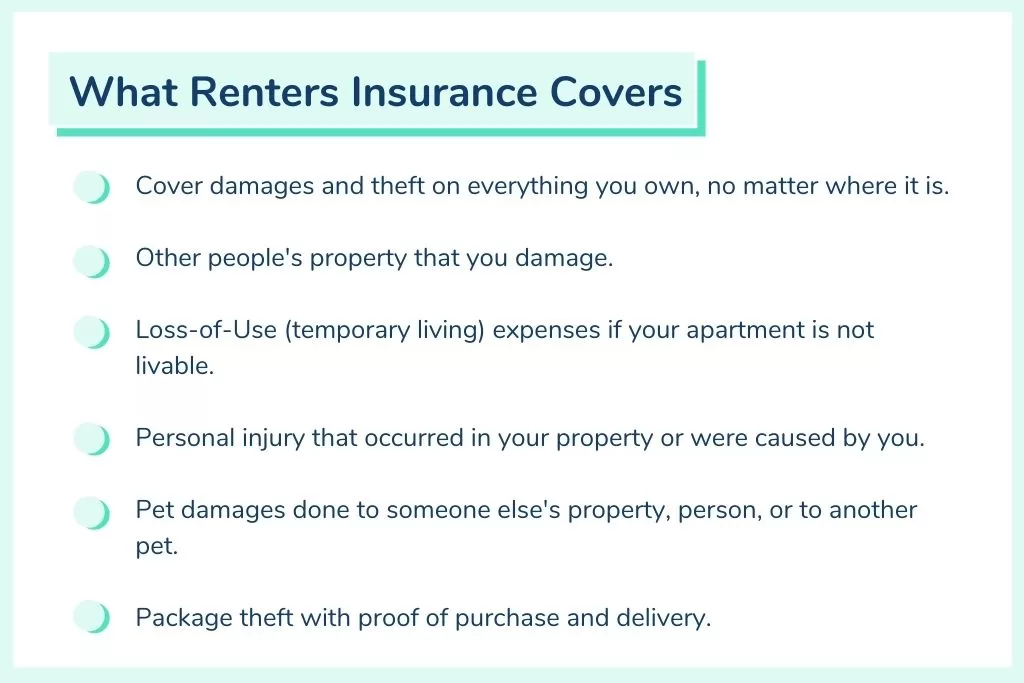

– Progressive offers renters insurance policies that provide coverage for personal belongings, loss of use, and liability.

– Personal belongings coverage includes protection against theft, vandalism, fire, and other covered perils. It helps replace or repair personal items that are damaged or stolen.

– Loss of use coverage provides compensation for additional living expenses if you are temporarily displaced from your rental property due to a covered loss. This coverage can help with the cost of hotel stays, meals, and other necessary expenses.

– Liability coverage protects renters in case they are held responsible for causing bodily injury or property damage to someone else. It can help cover legal expenses and medical bills incurred by the injured party.

– Progressive also offers optional coverages such as personal injury, which provides protection against libel, slander, or invasion of privacy claims, and medical payments, which can help cover medical expenses for individuals injured on the rental property.

Importance of renters insurance for personal belongings

– Renters insurance is important for protecting personal belongings because the landlord’s insurance typically only covers the building structure and not the tenant’s personal property.

– Having renters insurance can provide peace of mind knowing that personal belongings are protected against unexpected events such as fire, theft, or water damage.

– Renters insurance also offers additional benefits such as coverage for belongings damaged or stolen while outside of the home, coverage for damage caused by pets, and coverage for electronic devices and expensive items.

– It is important for renters to carefully assess the value of their personal belongings and choose appropriate coverage limits to ensure adequate protection.

– Renters insurance is typically affordable, with premiums that vary depending on factors such as the location, size of the rental property, and the desired coverage limits.

Therefore, Progressive renters insurance offers comprehensive coverage options to protect personal belongings and provide liability coverage for renters. Having renters insurance is essential for safeguarding personal property and providing financial protection in case of accidents or damage within the rented premises. Renters should carefully consider their coverage needs and choose appropriate limits to ensure they have adequate protection for their personal belongings.

Progressive Renters Insurance Coverage

Coverage options provided by Progressive renters insurance

Renters insurance is designed to protect tenants from financial loss due to theft, damage, or liability issues that can occur while renting a property. Progressive offers comprehensive coverage options that cater to the specific needs of renters. These options include:

– Personal property coverage: Progressive renters insurance provides coverage for personal belongings such as furniture, clothing, appliances, and electronics. This coverage helps tenants replace or repair their belongings in case of damage or loss due to covered incidents like fire, theft, or vandalism.

– Liability coverage: In addition to property coverage, Progressive renters insurance also offers liability coverage. This protects tenants in case they are held responsible for injuries or property damage to others. For example, if a visitor slips and falls in your rented apartment and sues you for medical expenses, liability coverage can help cover the legal fees and compensation costs.

– Additional living expenses coverage: If your rented property becomes uninhabitable due to a covered incident, Progressive renters insurance can help cover the cost of temporary accommodation, such as hotel stays, meals, and other necessary expenses until your home is repaired.

– Medical payments coverage: This coverage option provides reimbursement for medical expenses if someone is injured on your rented property, regardless of who is at fault. It can help cover costs such as hospital visits, x-rays, and prescription medications.

– Water backup coverage: Progressive renters insurance also offers coverage for water backup or sump pump overflow. This can help cover the cost of damages caused by water backup, such as flooded basements and damaged personal items.

– Identity theft coverage: Progressive offers optional coverage for identity theft, which can provide assistance in the event of identity theft, including reimbursement for certain expenses associated with restoring your identity.

Personal property coverage and policy limits

Progressive renters insurance provides coverage for personal property up to policy limits. These limits can be chosen by the renter based on their individual needs. It is important to accurately assess the value of your personal belongings to ensure you have adequate coverage.

The policy limits set the maximum amount of money that Progressive will reimburse if your personal belongings are damaged or stolen. For example, if your policy has a $20,000 limit for personal property coverage and a fire destroys $25,000 worth of items, Progressive will only reimburse you up to the $20,000 limit.

It is recommended to take inventory of your personal belongings and keep a record of their approximate value. This can help you determine the necessary policy limit to ensure your belongings are adequately protected. If you have valuable items such as jewelry, artwork, or collectibles, consider adding additional coverage or purchasing separate riders to protect these items.

Therefore, Progressive renters insurance offers a range of coverage options to protect tenants from financial loss and liability issues. It is important for renters to carefully evaluate their coverage needs and select the appropriate policy limits to ensure they are adequately protected.

Discounts on Progressive Renters Insurance

Different discounts offered by Progressive for renters insurance

Progressive offers various discounts on their renters insurance policies to help tenants save money while still getting the coverage they need. These discounts include:

– Multi-policy discount: If you have another insurance policy with Progressive, such as auto insurance, you may be eligible for a discount on your renters insurance. Bundling multiple policies with Progressive can help you save on both premiums.

– Safety feature discount: Progressive rewards renters who take steps to protect their rented property. If you have safety features installed in your home, such as smoke detectors, fire extinguishers, or a security system, you may qualify for a discount.

– Claims-free discount: If you have a history of being a responsible tenant and have not filed any claims with Progressive in the past, you may be eligible for a claims-free discount. This discount can help lower your premiums as a reward for maintaining a good claims record.

– Pay-in-full discount: Progressive offers discounts to renters who choose to pay their premiums in full upfront. This can help save money on the overall cost of your renters insurance policy.

– Loyalty discount: If you have been insured with Progressive for a certain period of time, you may qualify for a loyalty discount. This discount is a way for Progressive to reward long-term customers for their continued business.

How to qualify for discounts

To qualify for discounts on Progressive renters insurance, there are a few steps you may need to take:

1. Speak with a Progressive insurance agent: Reach out to a Progressive representative to discuss your insurance needs and inquire about available discounts. They can guide you through the process of finding the most suitable policy and ensure you are taking advantage of any applicable discounts.

2. Provide necessary information: To determine eligibility for discounts, Progressive may ask for specific information about your rented property, such as its location, size, and safety features. They may also require details about your claims history and existing insurance policies.

3. Bundle policies: If you have multiple insurance policies, consider bundling them with Progressive to maximize your savings. Not only can bundling lead to discounts on your renters insurance, but it can also save you money on other policies.

4. Install safety features: Take steps to improve the security and safety of your rented property, such as installing smoke detectors, burglar alarms, or deadbolt locks. These safety features may make you eligible for a discount.

5. Maintain a good claims record: Avoid making unnecessary claims and strive to maintain a claims-free record. By doing so, you may qualify for a claims-free discount that can lower your premiums.

By taking advantage of the discounts offered by Progressive, renters can save money on their insurance premiums while still having the peace of mind that comes with comprehensive coverage. To ensure you receive all available discounts, it is essential to communicate with a Progressive representative, provide accurate information, and meet any eligibility requirements.

Renters Insurance and Storage Units

Understanding how renters insurance covers personal property in storage units

Renters insurance provides coverage not only for personal belongings in your rented home but also for items stored in a storage unit. It’s important to understand how renters insurance works when it comes to protecting your belongings in storage.

When you rent a storage unit, your renters insurance policy typically extends coverage to the items stored in that unit. However, there may be certain limitations and exclusions, so it’s crucial to review your policy and understand the specific details of your coverage.

Coverage for theft, vandalism, and weather-related damage while in storage

Renters insurance typically covers theft, vandalism, and weather-related damage, and this coverage generally extends to your belongings in a storage unit. Here’s how renters insurance can help protect your stored items:

– Theft: If your items are stolen from your storage unit, renters insurance can provide reimbursement for the value of the stolen items, up to your policy limits. It’s important to note that there may be certain requirements, such as providing evidence of forced entry, to file a successful claim for theft.

– Vandalism: If your storage unit is vandalized and your belongings are damaged as a result, renters insurance can help cover the cost of repairing or replacing the damaged items. Again, there may be requirements to provide evidence of the vandalism to file a claim.

– Weather-related damage: Storage units are susceptible to weather conditions such as floods or extreme temperatures. If your belongings are damaged due to these weather-related events, renters insurance can provide coverage for the repairs or replacement of the damaged items.

It’s important to review your renters insurance policy and understand any specific limitations or exclusions related to storing items in a storage unit. Some policies may have certain restrictions on the types of items covered or the total value of coverage provided for stored belongings.

Additionally, it’s advisable to take inventory of the items you have stored in the unit and keep a record of their approximate value. This can be helpful when determining the appropriate policy limits for your stored belongings.

Therefore, renters insurance can provide coverage for your personal belongings stored in a storage unit, including protection against theft, vandalism, and weather-related damage. However, it’s crucial to review and understand the specific details and limitations of your policy to ensure you have adequate coverage for your stored items.

Progressive Renters Insurance for College Students

Tailored coverage options for college students living in rental properties

Protection for personal belongings and liability

Progressive offers renters insurance specifically designed for college students living in rental properties. This type of coverage provides protection for personal belongings and liability, ensuring that students have financial safeguards in place while they focus on their studies.

With Progressive renters insurance, college students can enjoy tailored coverage options that meet their specific needs. Whether they are living in a dormitory or off-campus housing, Progressive offers policies that can be customized to cover their personal belongings and protect them against unexpected events.

Coverage for personal belongings includes protection against theft, fire, water damage, and other covered perils. Students can rest easy knowing that their laptops, textbooks, clothing, and other valuable items are covered in the event of a covered loss.

Additionally, Progressive renters insurance provides liability protection, which can be particularly important for college students. Liability coverage helps protect students financially if they are found responsible for causing damage to someone else’s property or if someone is injured while visiting their rental property.

When it comes to itcoverage limits, Progressive gives college students the flexibility to choose the appropriate amount of coverage for their belongings. Students can select the level of protection that suits their needs and budget. It’s important for students to take an inventory of their personal belongings and assess their value to ensure they have adequate coverage in place.

Comparing Progressive renters insurance to other options available to college students, Progressive stands out for its comprehensive coverage, competitive pricing, and user-friendly online tools. With Progressive, students can conveniently manage their policies, file claims, and access their policy documents online.

In addition to providing renters insurance for college students, Progressive also offers discounts and savings opportunities that can help students save money on their premiums. For example, students who have auto insurance with Progressive can bundle their policies and enjoy discounted rates.

Therefore, Progressive renters insurance is an excellent option for college students living in rental properties. With tailored coverage options for personal belongings and liability, Progressive ensures that students have the financial protection they need while they focus on their studies. Students can easily customize their policies, choose their coverage limits, and take advantage of discounts to save money on their premiums.-

Travel coverage with Progressive Renters Insurance

Coverage for damaged or stolen personal property while travelling

When it comes to protecting your personal belongings, renters insurance can provide coverage even when you’re away from home. Progressive Renters Insurance offers travel coverage that helps safeguard your possessions in case of damage or theft while you’re traveling.

Whether you’re going on a weekend getaway or an extended vacation, Progressive Renters Insurance extends its coverage to your personal property while you’re away from home. This means that if your belongings are damaged or stolen during your travels, you may be eligible for reimbursement for the value of the lost items, up to the policy limits.

Just like with coverage for personal property in storage units, there may be certain limitations and exclusions to consider. It’s important to review your policy and understand the specific details of your coverage to ensure you have the appropriate protection for your belongings while traveling.

Policy limits and deductible considerations

When it comes to travel coverage, it’s essential to understand the policy limits and deductible of your renters insurance. Policy limits refer to the maximum amount the insurance company will pay for a covered loss. This means that if you have high-value items, such as expensive jewelry or electronics, you may need to consider additional coverage or increase your policy limits to adequately protect them.

In addition to policy limits, deductibles are an important factor to consider. A deductible is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and experience a covered loss of $1,000, you would need to pay the $500 deductible before your insurance would reimburse you for the remaining $500.

When selecting a renters insurance policy, it’s important to consider both the policy limits and deductibles to ensure you have the right coverage for your needs and budget. Lower deductibles may result in higher premiums, while higher deductibles could lead to lower premiums but a higher upfront cost in the event of a claim.

As with any insurance policy, it’s crucial to review your renters insurance policy and understand the specific details, limitations, and exclusions related to travel coverage. This will ensure that you have adequate coverage for your personal belongings while traveling and can have peace of mind knowing that you’re protected in case of unexpected events.

Therefore, Progressive Renters Insurance offers travel coverage that extends to your personal property while you’re away from home. This coverage can provide reimbursement for damaged or stolen belongings during your travels, up to the policy limits. However, it’s important to review and understand your policy’s policy limits and deductibles to ensure you have the appropriate coverage for your needs.

Parking and Progressive Renters Insurance

Coverage for personal property in vehicles parked in rented spaces

Progressive Renters Insurance not only provides coverage for personal belongings inside the rented property but also extends its protection to your personal property in vehicles parked in rented spaces. This means that if your belongings are damaged or stolen from your vehicle while it’s parked in a rented space, you may be eligible for reimbursement for the value of the lost items, up to the policy limits.

Protection against theft or damage

Just like with coverage for personal property while traveling, there are certain limitations and exclusions to consider when it comes to coverage for personal property in parked vehicles. It’s important to review your policy and understand the specific details of your coverage to ensure you have the appropriate protection for your belongings.

In addition to protecting your personal property in rented spaces, Progressive Renters Insurance also provides coverage against theft or damage to your vehicle itself. This means that if your vehicle is stolen or damaged while parked in a rented space, you may be eligible for reimbursement for the cost of repairs or even the value of the vehicle if it’s deemed a total loss, up to the policy limits.

When it comes to parking and renters insurance, it’s crucial to understand the policy limits and deductible of your coverage. Policy limits refer to the maximum amount the insurance company will pay for a covered loss, while deductibles are the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

Considerations:

– If you have high-value items stored in your vehicle, such as expensive equipment or electronics, you may need to consider additional coverage or increase your policy limits to adequately protect them.

– As with any insurance policy, deductibles are an important factor to consider. Lower deductibles may result in higher premiums, while higher deductibles could lead to lower premiums but a higher upfront cost in the event of a claim.

It’s crucial to review your renters insurance policy and understand the specific details, limitations, and exclusions related to coverage for personal property in parked vehicles. This will ensure that you have adequate coverage for your belongings and vehicle, giving you peace of mind knowing that you’re protected in case of unexpected events.

So, Progressive Renters Insurance offers coverage for personal property in vehicles parked in rented spaces. This coverage can provide reimbursement for damaged or stolen belongings, as well as protection against theft or damage to your vehicle itself. Reviewing and understanding your policy’s policy limits and deductibles is essential to ensure you have the appropriate coverage for your needs and budget.

Homeowners, Renters, and Condo Policies

Coverage for theft, vandalism, and weather-related damage while moving

When it comes to moving, having the right insurance coverage can provide peace of mind and financial protection. Homeowners, renters, and condo policies typically offer coverage for theft, vandalism, and weather-related damage during the process of moving. This means that your personal belongings can be protected while they are in transit or temporarily stored in a new location.

If your items are stolen or damaged due to theft or vandalism during the moving process, your insurance policy may provide coverage for the cost of replacing or repairing the affected items. Similarly, if your belongings are damaged by weather-related events such as rain, wind, or hail while they are being transported or stored, your insurance policy may cover the necessary repairs or replacements.

It’s important to note that coverage for moving-related incidents may have certain limitations and exclusions. For example, coverage may only apply if the items are being moved within a certain distance or if the storage facility meets specific security requirements. It’s crucial to review your policy and understand the specific details of your coverage to ensure you have the appropriate protection during the moving process.

Insurance options during the transition

During the transition period when you are moving from one location to another, it’s important to consider your insurance options to ensure that your belongings are adequately protected. Here are a few insurance options to consider:

1. **Renters insurance**: If you are currently renting a property and plan to continue renting at your new location, it’s essential to have renters insurance in place. Renters insurance provides coverage for your personal belongings, liability protection, and additional living expenses in the event that you are unable to stay in your rental unit due to a covered loss.

2. **Homeowners insurance**: If you are transitioning from renting to owning a home, it’s important to secure homeowners insurance for your new property. Homeowners insurance offers coverage for your dwelling, other structures on your property, personal belongings, liability protection, and additional living expenses. It’s crucial to have homeowners insurance in place before you move into your new home to ensure that you are protected from potential risks.

3. **Condo insurance**: If you are moving into a condominium, condo insurance is necessary to protect your personal belongings, liability, and any improvements or upgrades you have made to the unit. Condo insurance typically covers the interior of the unit, while the condo association’s insurance policy typically covers the exterior structure and common areas.

Before making any insurance decisions, it’s important to compare different policies and coverage options. Consider factors such as policy limits, deductibles, premium costs, and any additional endorsements or riders that may be available. Consulting with an insurance agent can help you understand your options and choose the coverage that best suits your needs.

Therefore, having the right insurance coverage during the moving process is crucial to protect your personal belongings from theft, vandalism, and weather-related damage. Homeowners insurance, renters insurance, and condo insurance policies generally provide coverage for these risks. It’s essential to review your insurance policy and consider your options to ensure that you have the appropriate coverage during the transition period.

Conclusion

Benefits of Progressive renters insurance for storage unit coverage

Renters insurance plays a significant role in protecting personal belongings during the moving process. Progressive renters insurance offers coverage for theft, vandalism, and weather-related damage while your belongings are being moved or temporarily stored in a new location. This coverage provides peace of mind and financial protection, ensuring that you are covered in case of any unfortunate incidents.

Progressive renters insurance also offers additional benefits for storage unit coverage. If you need to store your belongings in a storage facility during the transition period, Progressive renters insurance can provide coverage for any theft or damage that may occur. This additional coverage ensures that your belongings are protected, regardless of their location.

Summary of coverage options and discounts

When choosing an insurance policy for the moving process, it’s important to consider your specific needs and coverage options. Here is a summary of the coverage options and discounts offered by Progressive renters insurance:

1. Personal property coverage: Progressive renters insurance provides coverage for your personal belongings, including furniture, electronics, clothing, and more. This coverage ensures that your belongings are protected from theft, vandalism, and weather-related damage while in transit or in storage.

2. Liability protection: Progressive renters insurance also offers liability protection in case someone is injured in your rental unit or if you accidentally damage someone else’s property. This coverage can help pay for medical expenses and legal fees if you are found responsible for the damages.

3. Additional living expenses: If your rental unit becomes uninhabitable due to a covered loss, Progressive renters insurance can provide coverage for additional living expenses. This coverage can help pay for temporary accommodations, meals, and other necessary expenses while your rental unit is being repaired.

4. Discounts: Progressive renters insurance offers various discounts that can help lower your premium costs. These discounts include multi-policy discounts, safety device discounts, and claims-free discounts. Taking advantage of these discounts can help you save money on your insurance premiums.

Therefore, having the right insurance coverage during the moving process is crucial to protect your personal belongings from theft, vandalism, and weather-related damage. Progressive renters insurance offers comprehensive coverage options for these risks, including coverage for storage units. By choosing Progressive renters insurance, you can have peace of mind knowing that your belongings are adequately protected during the transition period. Remember to review your policy and consider your specific needs to ensure that you have the appropriate coverage in place.

Read more about Storage units first month free no insurance.