Introduction

It’s common to use storage units when moving or downsizing, but have you ever stopped to consider if your belongings are covered by insurance while in storage? The answer to this question varies depending on your insurance carrier, but there are options available to you. In this blog post, we’ll explore the importance of having storage unit insurance and provide an overview of Liberty Mutual’s program.

Importance of having storage unit insurance

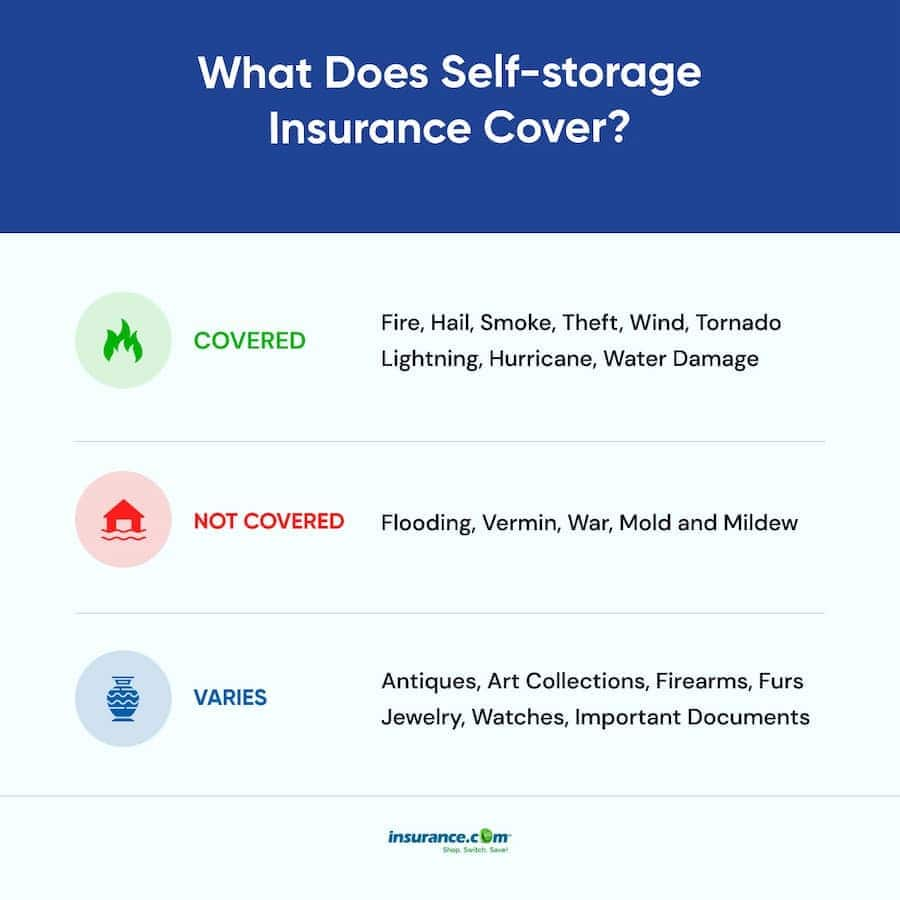

Your homeowners or renters insurance may provide some coverage for items in storage, but it’s not guaranteed. In some cases, you may need to purchase additional coverage specifically for storage units. This is because storage units can be a target for theft or damage from natural disasters like floods or fires. Without insurance, you may be left with significant financial losses if something were to happen to your belongings.

Having storage unit insurance gives you peace of mind knowing that your items are protected. It can also provide coverage for items that may not be covered under your standard homeowners or renters policy. For example, if you have expensive jewelry or art, you may need additional coverage beyond what your standard policy provides.

Overview of Liberty Mutual’s storage unit insurance program

Liberty Mutual offers a storage unit insurance program that provides coverage for up to 100% of your personal property. This coverage is available for items stored in a formal storage unit and can include items like furniture, clothing, and electronics.

In addition to coverage for theft and damage, Liberty Mutual’s storage unit insurance also includes protection against losses caused by natural disasters like floods, earthquakes, and hurricanes. This coverage is important because many standard homeowners or renters policies may not provide coverage for these types of events.

Another benefit of Liberty Mutual’s program is that it is customizable to your specific needs. You can choose the coverage amount that best suits your belongings and budget. Additionally, the program offers flexible payment options, so you can pay monthly or annually.

Therefore, having insurance for items in storage is important for protecting your belongings and minimizing financial losses. Liberty Mutual’s storage unit insurance program provides comprehensive coverage, including protection against theft and damage and losses caused by natural disasters. The program is customizable and offers flexible payment options, making it a convenient option for those in need of storage unit insurance.

Coverage

When moving to a new home, ensuring your personal property is covered should be a priority. One way to do this is by putting your belongings in a formal storage unit. Liberty Mutual offers 100% coverage for personal property stored in a formal storage unit. However, it is crucial to ensure all your property is covered after moving.

Types of coverage included in Liberty Mutual’s storage unit insurance policy

Liberty Mutual’s insurance policy for formal storage units provides various coverage types that protect your property from damages that may occur during the move.

One of the essential coverage provided by Liberty Mutual is protection against inappropriate sales and disposal of your property by a storage unit operator. In case your belongings are sold or disposed of improperly or illegally, Liberty Mutual will offer coverage for it.

Property damage is another significant concern during the move. However, Liberty Mutual’s storage unit insurance policy also includes protection against damages caused by different perils such as fire, lightning, vandalism, and theft.

Protection against inappropriate sales and disposal, property damage, and theft

Liberty Mutual’s storage unit insurance policy can provide coverage for theft of your property. Whether it is a break-in or theft by an employee of the storage unit, your loss will be compensated.

Apart from that, Liberty Mutual’s insurance policy also offers coverage for the misplacement of your property. It means that you will be compensated if the storage unit owner misplaces your items.

It is crucial to remember that your home insurance might not provide full coverage for your property stored in a storage unit. Therefore, it is recommended to ensure that you get an adequate insurance policy to protect your personal property.

Therefore, Moving is a daunting task that requires proper planning and ensuring all your belongings are secure during the move. Liberty Mutual offers a comprehensive insurance policy that protects your property from different perils during the move. It is crucial to ensure that you get adequate coverage for your personal property, especially when opting for a formal storage unit.

Personal Property Coverage

When moving to a new home, it is crucial to ensure that your belongings are covered during the move. One way to do this is by opting for a formal storage unit. Many insurance carriers offer coverage for personal property stored in storage units. Liberty Mutual, for instance, provides 100% coverage for property stored in a formal storage unit. However, it is essential to understand the details of this coverage to make an informed decision.

Details on Liberty Mutual’s personal property coverage for formal storage units

Liberty Mutual’s insurance policy for formal storage units provides various types of coverage to protect your property from damages that may occur during a move. The policy covers damages caused by different perils such as fire, lightning, vandalism, and theft.

One of the significant concerns during a move is the inappropriate sale or disposal of personal property by storage unit operators. Liberty Mutual’s policy includes protection against such actions, and you will be compensated for any losses as a result.

In addition, Liberty Mutual’s insurance policy offers coverage for the misplacement of your items. If the storage unit owner misplaces your belongings, you will be compensated for your loss.

Percentage of coverage offered and requirements for qualifying

Liberty Mutual offers 100% coverage for personal property stored in a formal storage unit. However, there are requirements that must be met to qualify for this coverage.

To qualify for 100% coverage, you must store your belongings in a formal storage unit. This requirement means that you cannot store your property in a friend’s or family member’s garage or shed and retain the 100% coverage.

It is crucial to remember that your home insurance policy may not cover all your property stored in a storage unit. Therefore, it is recommended to ensure that you have adequate insurance coverage to protect your personal property.

Therefore, Liberty Mutual’s personal property coverage for formal storage units offers protection against different perils that may damage your belongings during a move. The policy also includes protection against inappropriate sales and disposal of your property and the misplacement of your items. To qualify for 100% coverage offered, you must meet specific requirements, including using a formal storage unit. Therefore, it is essential to understand the details of the coverage to ensure your property is adequately protected during a move.

Extended Coverage

When it comes to securing personal property, it’s essential to consider coverage for items that are frequently used outside of the home. Liberty Mutual’s personal property insurance policy includes coverage for personal items that may be used outside of the home, such as electronics, furniture, and clothing. This coverage pays the actual cash value of covered personal property that needs replacement due to a covered loss.

Explanation of extended coverage for personal items used outside of the home

Liberty Mutual’s extended coverage protects your personal property regardless of where it’s located. It includes coverage for the loss of items such as laptops, tablets, and other electronic devices. In case of damage or theft, this policy will pay for the necessary repairs or replacements. Additionally, this coverage includes protection for items that are commonly used outside of the home, such as sports equipment.

Common items covered, including equipment and inventory

Liberty Mutual’s personal property insurance covers a wide range of commonly used items, including furniture, clothing, and electronics. Customers can also add coverage for business inventory and equipment, such as tools and machinery. This coverage pays the actual cash value of covered personal property that needs to be replaced due to a covered loss.

In case of water backup and overflow, this coverage also includes damage caused by these perils. Moreover, it covers any necessary increase in living expenses incurred by you and your household so that you can maintain your normal standard of living.

It’s important to note that stated policy limits apply, and this coverage may not be available in all states. This coverage is also subject to a deductible that may vary by state. Ensure that you select adequate coverage to protect your personal property, depending on your needs.

Therefore, extended coverage is crucial to protect personal property, especially when frequently used outside of the home. Liberty Mutual’s personal property insurance policy includes coverage for commonly used items and equipment, providing peace of mind in case of loss or damage. By selecting adequate coverage, homeowners can ensure their personal property is protected in case of loss or damage.

Packing List

When planning a move, creating a packing list is a crucial step in the process. A packing list helps to keep track of all personal items and avoids the possibility of items getting lost or misplaced during the move. In this blog, we will discuss some tips on creating a comprehensive packing list.

Tips on creating a packing list for personal property stored in a unit

Firstly, it’s essential to categorize items by room. This helps to ensure that no item gets left behind, and it’s also easier to unpack once at the new place. It’s also helpful to number the boxes and create a corresponding list of items in each box. Clearly labeling each box with contents and room will come in handy during unpacking.

Another helpful tip is to pare down personal belongings. Create a separate list of items that are no longer needed or are unwanted but still in good condition. These items can be sold, donated, or given away before the move to declutter and reduce the number of items that need to be packed.

Benefits of having a comprehensive list

A comprehensive packing list has several benefits. Firstly, it helps to ensure that no item is left behind. Furthermore, it assists in identifying any items that may be missing during the unpacking process. A detailed list can also help during the unpacking process by making it easier to locate specific items.

A packing list is also helpful when selecting a moving company or renting a moving truck. Accurate estimation of necessary materials such as boxes, tape, and other supplies is crucial for a successful move. A packing list helps to calculate the exact amount of each item required and saves time and money.

Therefore, creating a packing list is a necessary step in the moving process. It can save time, money, and prevent any items from being left behind. When creating a packing list, it’s vital to categorize belongings by room, number boxes, and clearly label the contents. A comprehensive packing list is also useful during the unpacking process and during the selection of a moving company or truck rental.

Insurance Rates

When it comes to getting personal property insurance, rates vary by state and coverage option. It’s important to compare the rates and coverage options available to get the best deal possible.

Details on varying rates by state and coverage options

The rates for personal property coverage vary by state due to different regulations and risks. Some states have higher risks for natural disasters, like hurricanes, earthquakes, or wildfires. Therefore, the rates for personal property insurance in those states tend to be higher. In addition, coverage options also affect the rates. Some policies may have a low premium, but they may have limited coverage for certain items. Therefore, it’s essential to review the policy details to ensure that the necessary coverage is included.

When it comes to Liberty Mutual’s personal property insurance, the rates and coverage options vary based on the location and policy. Customers can get a free online quote to see the rates and compare the coverage options. It’s also essential to speak with a Liberty Mutual representative to have a more detailed and accurate quote based on the specific needs.

Comparison to other insurance options

When looking for personal property insurance, it’s essential to compare the rates and coverage options available from different insurance companies. Some companies may have lower rates, but they may not have adequate coverage or may not have the same level of customer service. Therefore, it’s critical to research and compare to find the best coverage and price.

Compared to other insurance companies, Liberty Mutual’s personal property insurance offers competitive rates and coverage options. Customers can customize their policies based on their needs, and Liberty Mutual also offers discounts for bundling policies or being a responsible homeowner. Additionally, Liberty Mutual has a solid reputation for providing excellent customer service and handling claims efficiently.

Therefore, securing personal property insurance is crucial, and rates and coverage options should be carefully reviewed and compared. Liberty Mutual’s personal property insurance offers comprehensive coverage options and competitive rates, making it a solid choice for homeowners. However, customers should review the policy details and speak with a representative to ensure they are getting the necessary coverage at an affordable price.

Renters Insurance Policy

Overview of Liberty Mutual’s renters insurance policy

Liberty Mutual offers renters insurance policies with comprehensive coverage options that can protect belongings from theft, damage by fire, severe storms, and vandalism. The policy can also help pay for damages caused by some weather-related incidents.

The rates and coverage options vary by state, depending on different regulations and risks. Liberty Mutual’s policy details can be customized based on the specific needs of the customer, and the company offers various discounts for bundling policies and having responsible homeownership.

Liberty Mutual’s renters insurance policy also offers liability coverage to protect individuals from potential lawsuits due to injuries that occur within their rental units. This policy can help cover the costs of medical bills or damages resulting from accidents that are the renter’s fault.

Benefits of low monthly premiums

Liberty Mutual’s renters insurance policies start at as low as $5/month, making it affordable for renters on a budget. Even with the low monthly premiums, renters can still receive comprehensive coverage options comparable to other insurance companies. Liberty Mutual also offers discounts for those with a good rental history, and for those who bundle their policies.

In addition to the affordable rates, Liberty Mutual’s renters insurance policies also come with exceptional customer service. The company has a reputation for processing claims quickly and efficiently, and their representatives are available to answer questions or provide assistance.

So, Liberty Mutual’s renters insurance policies offer comprehensive coverage options that can protect belongings from various damages. The policies also come with low monthly premiums and various discounts, making it affordable for renters on a budget. Along with the competitive rates, Liberty Mutual also offers excellent customer service to ensure customer satisfaction. Renters should review the policy details and speak with a representative to ensure they are getting the necessary coverage at an affordable price.

Expert Reviews

Expert review of Liberty Mutual’s coverage and customer satisfaction

Expert reviews are an important factor when it comes to choosing an insurance company. Experts can weigh all the factors, such as coverage, customer satisfaction rates, and cost, to give an overall rating. According to the MarketWatch Guides team, Liberty Mutual received a 9.1 out of 10.0 rating based on their insurance reviews reputation, costs, coverage, and availability. Liberty Mutual has also received high ratings from other experts, such as JD Power and Consumer Reports.

Liberty Mutual offers coverage options that include auto, home, renters, condo, and life insurance. They also offer several policies that can be customized to meet the specific coverage needs of individual policyholders. In addition, customers can select from different coverage levels, deductibles, and discounts to tailor their policies to their individual situations.

Liberty Mutual’s customer satisfaction rates are high, as well. The company has received high ratings from customer satisfaction surveys conducted by J.D. Power, Consumer Reports, and other organizations. This indicates that policyholders are satisfied with the level of customer service they receive, as well as the ease of filing claims and interacting with the company.

Overall ratings and recommendations

Overall, Liberty Mutual is considered a solid choice for property and casualty insurance in the U.S. It rates highly in coverage options, customer satisfaction, and claims handling. However, customers should be aware of the potential variation in rates and coverage options based on their location and policy specifics. Therefore, it’s essential to review the policy details and speak with a Liberty Mutual representative to ensure they are getting the necessary coverage at an affordable price.

Based on expert reviews and customer feedback, Liberty Mutual is a reputable and reliable insurance company that offers competitive rates and comprehensive coverage options. It’s an excellent choice for homeowners who want to secure their property and personal belongings.

Get A Quote

Information on how to get a quote for Liberty Mutual’s storage unit insurance

If you’re considering Liberty Mutual for your insurance needs, it’s essential to gather all the information you need to make an informed decision. Liberty Mutual offers a variety of insurance options, including coverage for formal storage units.

To get a quote for storage unit insurance from Liberty Mutual, you can begin by visiting their website. From there, navigate to the appropriate section for storage unit coverage and enter the necessary information. You’ll need to provide details about the type of storage unit you have, the location, and the value of the stored items.

Once you have provided all the required information and submitted it through the website, Liberty Mutual will contact you with a quote that outlines the cost and coverage options available. It’s essential to review the quote carefully, as the coverage and cost can vary based on your specific situation.

Steps for purchasing a policy

If you decide to move forward with Liberty Mutual and purchase a policy, the process is relatively straightforward. Begin by reviewing the quote and speaking with a Liberty Mutual representative to clarify any questions or concerns you may have.

Once you’ve reviewed the quote, you can sign up for a policy either online or over the phone. Liberty Mutual will need your personal information and the details of the storage unit, as well as any additional coverage options you may want to add.

Once you’ve signed up for a policy, you’ll be covered for the agreed-upon period, and you’ll be able to access the benefits of the policy if you need them. It’s essential to keep in mind that you’ll need to pay your premiums regularly to maintain coverage.

Therefore, Liberty Mutual is an excellent choice if you’re looking for insurance coverage for a storage unit. With a high level of customer satisfaction and comprehensive coverage options, Liberty Mutual can provide peace of mind and protection for your belongings. By following the steps outlined above, you can get a quote and sign up for a policy that meets your specific needs.

Discover Lemonade storage unit insurance.