Introduction

What is Lemonade Insurance?

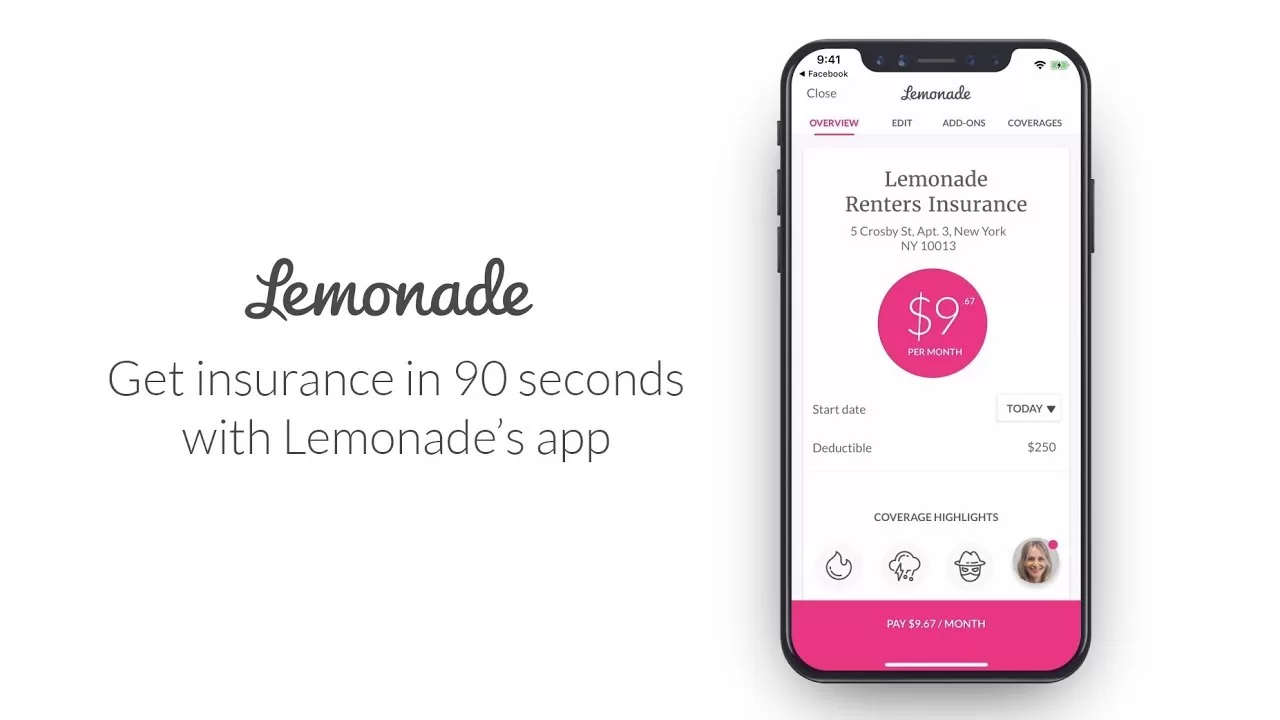

Lemonade Insurance is a modern insurance company that offers renters and homeowners insurance. They provide coverage for your personal belongings, liability protection, and additional living expenses in case of certain covered perils. What sets Lemonade apart is their use of technology-driven processes and their commitment to social impact.

With their AI-powered platform, Lemonade has simplified the insurance process, making it faster, more transparent, and user-friendly. They also operate on a flat fee structure, so you can rest assured that they have no hidden fees or commissions.

Why is Renters Insurance Important?

Renters insurance is essential for anyone who is renting a property. While your landlord may have insurance that covers the building, that insurance doesn’t extend to your personal belongings. Renters insurance protects your belongings from theft, fire, water damage, and other covered perils. It also provides liability coverage in case someone is injured on your property and covers additional living expenses if you are temporarily unable to live in your rented apartment or house.

Some key reasons why renters insurance is important:

1. Protects Your Personal Belongings: Renters insurance provides coverage for your personal belongings, such as furniture, electronics, and clothing, in case of damage or loss due to covered perils.

2. Liability Protection: If someone gets injured in your rented property, renters insurance can help cover their medical bills and legal expenses if they decide to sue you.

3. Additional Living Expenses: If your rented property becomes uninhabitable due to a covered peril, renters insurance can cover your temporary living expenses, such as hotel bills or rent for a temporary home.

4. Affordable Coverage: Renters insurance is generally affordable, with monthly premiums that fit most budgets. It offers financial protection for a relatively small cost.

5. Peace of Mind: Having renters insurance gives you peace of mind knowing that your personal belongings are protected and that you have coverage in case of unexpected events.

Comparison Table: Renters Insurance vs. Homeowners Insurance

Here’s a quick comparison between renters insurance and homeowners insurance:

| Renters Insurance | Homeowners Insurance |

|——————|———————|

| Covers personal belongings | Covers personal belongings and the structure of the home |

| Does not cover the physical structure of the property | Covers repairs and replacement for the structure of the home |

| Provides liability coverage for the tenant | Provides liability coverage for the homeowner |

| Usually cheaper than homeowners insurance | Usually more expensive than renters insurance |

| Required by some landlords | Generally required by mortgage lenders |

Therefore, Lemonade Insurance offers renters and homeowners insurance with a focus on technology and simplicity. Renters insurance is important for protecting your personal belongings and providing liability coverage while homeowners insurance provides coverage for the structure of your home. It’s essential to understand your insurance needs and choose the right policy to ensure you have the proper coverage in place.

Does Renters Insurance Cover Storage Units?

Understanding the Coverage Limits for Storage Units

When it comes to renters insurance, coverage for items stored in a storage unit can vary depending on your policy and the specifics of the storage facility. While renters insurance typically provides coverage for personal property, it’s important to understand the limits of that coverage for items stored outside your rental unit.

Renters insurance policies generally include coverage for personal property both inside and outside your rental unit, which means that items in a storage unit may be covered to some extent. However, it’s important to note that the coverage for items in storage units is often limited and may vary depending on your policy and where you live.

The coverage provided by renters insurance for items in storage units typically includes protection against perils such as theft, fire, vandalism, and water damage. However, it’s important to review your policy to understand the specific coverage and any exclusions that may apply. Some policies may have sub-limits or specific exclusions for certain types of items, such as jewelry, collectibles, or high-value electronics.

Sub-Limits for Personal Property in Storage Facilities

In addition to the overall coverage limits of your renters insurance policy, it’s important to be aware of any sub-limits that may apply specifically to items stored in a storage facility. Sub-limits are lower coverage limits that may be in place for certain categories of items, such as electronics, jewelry, or art. These sub-limits can impact the amount of coverage available for your stored belongings.

To determine the coverage limits for items stored in a storage unit, it’s important to review your renters insurance policy and speak with your insurance provider. They can provide you with specific information about how much coverage is available for items in a storage unit and any additional steps you may need to take to ensure full protection.

It’s also worth noting that some storage facilities may require tenants to have their own renters insurance policy, specifically for their stored belongings. This is to ensure that all items stored in the facility are adequately protected.

So, renters insurance typically provides some coverage for items stored in a storage unit, but it’s important to review your policy and understand the specific coverage and sub-limits that may apply. If you have valuable items or are concerned about the protection of your stored belongings, it may be worth considering additional insurance options specifically designed for self-storage units.

Lemonade Insurance and Self-Storage Facilities

Lemonade’s Approach to Protecting Personal Property in Storage Units

Lemonade renters insurance offers coverage for personal property stored in a self-storage facility. This means that if you have belongings in a storage unit, Lemonade can provide some protection for them. Whether it’s an ancient road bike, a set of home gym equipment, or a decommissioned fish tank, your stored items will have some coverage under your active Lemonade renters or homeowners insurance policy.

However, it’s important to note that the coverage amounts can vary depending on your state. Lemonade’s renters insurance policies generally include coverage for personal property both inside and outside your rental unit, including items in a storage unit. But the specific coverage limits and terms may differ.

Coverage Amounts for Personal Property in Self-Storage Facilities

The coverage provided by Lemonade renters insurance for items in storage units typically includes protection against perils such as theft, fire, vandalism, and water damage. However, it’s crucial to review your policy to understand the specific coverage and any exclusions that may apply.

In addition to the overall coverage limits of your renters insurance policy, there may be sub-limits for items stored in a storage facility. Sub-limits are lower coverage limits that may apply to certain categories of items, such as electronics, jewelry, or high-value art. These sub-limits can impact the amount of coverage available for your stored belongings.

To determine the exact coverage limits for items in your storage unit, it’s essential to review your Lemonade renters insurance policy and consult with your insurance provider. They can give you specific information about the coverage amounts for items in a storage unit and any additional steps you may need to take to ensure full protection.

It’s worth noting that some storage facilities may require tenants to have their own renters insurance policy specifically for their stored belongings. This requirement ensures that all items stored in the facility are adequately protected.

Therefore, Lemonade renters insurance does cover personal property in storage units. However, the coverage amounts and terms may vary depending on your state and policy. To ensure that your stored belongings are adequately protected, review your policy and consider additional insurance options specifically designed for self-storage units if necessary.

Exceptions to Coverage

Items Not Covered by Renters Insurance in Storage Units

While renters insurance may provide coverage for items stored in a storage unit, there are some exceptions to this coverage. It’s important to be aware of these exceptions to ensure you have the right insurance coverage for your stored belongings.

One exception to coverage is when your items are moved due to repairs, renovations, or rebuilding of your home. If you need to temporarily store your belongings in a storage unit during these situations, your renters insurance may not cover them. It’s important to check with your insurance provider to understand if there are any specific limitations or exclusions regarding this situation.

Another exception to coverage is if your rental, condo, or house is not covered by Lemonade. Before your belongings in a storage unit are covered, Lemonade would need to first cover your rental property. It’s important to have the necessary insurance coverage for your home before expecting coverage for items in a storage unit.

Understanding Exclusions and Limitations

Renters insurance policies may have certain exclusions and limitations when it comes to coverage for items stored in a storage unit. It’s important to understand these exclusions and limitations to ensure you have the right insurance coverage for your stored belongings.

Some policies may have sub-limits for certain categories of items, such as jewelry, collectibles, or high-value electronics. These sub-limits may impact the amount of coverage available for your stored belongings. It’s important to review your renters insurance policy to understand any sub-limits that may apply and if additional insurance coverage is needed for specific items.

Additionally, it’s worth noting that some storage facilities may require tenants to have their own renters insurance policy specifically for their stored belongings. This is to ensure that all items stored in the facility are adequately protected. It’s important to communicate with the storage facility to understand their insurance requirements and ensure you have the necessary coverage in place.

Therefore, renters insurance may provide some coverage for items stored in a storage unit, but it’s important to review your policy and understand any exceptions, exclusions, or limitations that may apply. It’s also important to consider additional insurance options specifically designed for self-storage units if you have valuable items or are concerned about the protection of your stored belongings.

How to Ensure Coverage for Storage Units

Reviewing Your Renters Insurance Policy

When it comes to storing your belongings in a storage unit, it’s important to review your renters insurance policy to understand the coverage provided. Here are some key points to consider:

– Check if your renters insurance policy includes coverage for items stored in a storage unit. Some policies may automatically provide coverage, while others may require additional endorsements or riders.

– Understand any exceptions, exclusions, or limitations that may apply. These could include restrictions on certain categories of items or specific situations, such as when your items are moved due to repairs or renovations.

– If your rental property is not covered by your renters insurance policy, you may need to explore other coverage options. Contact your insurance provider to ensure that your rental property is covered before expecting coverage for items in a storage unit.

Adding Additional Coverage for Storage Units

If you have valuable items or are concerned about the protection of your stored belongings, it’s worth considering additional insurance options specifically designed for storage units. Here are a few steps you can take to ensure adequate coverage:

– Check with the storage unit provider to see if they offer any insurance options. They may have policies specifically tailored for their facility, which could provide additional coverage for your stored items.

– Evaluate the value of your stored belongings and determine if they exceed the coverage limits of your renters insurance policy. If necessary, consider purchasing additional coverage or increasing the limits of your existing policy to fully protect your valuable items.

– Take inventory of your stored belongings and keep records of their value. This can help streamline the claims process in case of loss or damage. Consider taking photos or videos of your items and keeping receipts or appraisals as evidence of their value.

Remember, while renters insurance may offer some coverage for items stored in a storage unit, it’s important to review your policy and understand any exceptions, exclusions, or limitations that may apply. If needed, explore additional insurance options to ensure that your stored belongings are adequately protected.

Tips for Protecting Personal Property in Storage Units

Choosing a Secure Storage Facility

When it comes to storing your personal belongings in a storage unit, it’s important to choose a facility that offers a high level of security. Here are some tips to help you select a secure storage facility:

– Research the facility: Before renting a storage unit, do some research on the facility. Look for reviews and ratings to get an idea of its reputation and how well it is maintained.

– Check the security measures: Ask the facility about their security measures. Look for features such as surveillance cameras, gated access, and individual unit alarms. These security measures can help deter theft and provide added protection for your belongings.

– Inquire about insurance requirements: Some storage facilities may require tenants to have their own renters insurance policy specifically for their stored belongings. Make sure to inquire about any insurance requirements and ensure that you have the necessary coverage in place.

Properly Packing and Storing Items

Once you’ve chosen a secure storage facility, it’s important to properly pack and store your items to minimize the risk of damage or loss. Here are some tips for packing and storing your belongings in a storage unit:

– Use sturdy boxes and packing materials: Invest in high-quality boxes and packing materials to properly protect your items. Fragile items should be wrapped in bubble wrap or packing paper, and delicate items should be individually wrapped.

– Label boxes: Clearly label each box with its contents to make it easier to find specific items when you need them. This will also help prevent unnecessary handling and potentially damaging items in the process.

– Organize your unit: Maximize the space in your storage unit by organizing your belongings. Place frequently needed items near the front and stack boxes carefully to prevent them from toppling over.

– Consider climate control: If you have sensitive items such as electronics, artwork, or antiques, consider renting a climate-controlled storage unit. This can help protect your belongings from extreme temperatures, humidity, and moisture.

By following these tips, you can help protect your personal property while it is stored in a storage unit. Remember to review your renters insurance policy and understand any limitations or exclusions that may apply. Additionally, consider exploring additional insurance options specifically designed for self-storage units to ensure the protection of your stored belongings.

What to Do in Case of Loss or Damage

Reporting and Documenting Loss or Damage

In the unfortunate event that you experience loss or damage to your belongings while they are stored in a storage unit, it is important to take the following steps:

1. Report the incident: Notify the storage facility as soon as possible about the loss or damage. Provide them with detailed information about the incident and the items that have been affected.

2. Document the damage: Take photographs or videos of the damaged items as proof of the condition they were in before the incident. This documentation can be crucial when filing a claim with your renters insurance or the storage facility’s insurance, if applicable.

3. Gather evidence: Collect any additional evidence that can support your claim, such as receipts, appraisals, or any other documents that show the value or ownership of the damaged items.

4. Contact your renters insurance provider: If your renters insurance policy covers stored belongings, contact your insurance provider to report the loss or damage. Provide them with all the necessary documentation and information about the incident.

Filing a Claim with Lemonade Insurance

If you have a Lemonade Renters insurance policy and need to file a claim for loss or damage of your stored belongings, you can do so through the Lemonade mobile app or website. Here are the steps to file a claim:

1. Log in to your Lemonade account: Access your Lemonade account using the mobile app or website.

2. Start a new claim: Look for the option to start a new claim and provide the required information about the incident and the items that have been affected.

3. Upload supporting documents: Submit the photographs, videos, receipts, and any other evidence that supports your claim.

4. Review and submit the claim: Carefully review all the information you have provided, make any necessary corrections, and then submit the claim.

Once you have filed the claim, Lemonade will review the information and documentation provided. They may request additional information or conduct an investigation, if needed, to assess the validity of the claim. If your claim is approved, Lemonade will compensate you according to the terms and limits of your renters insurance policy.

Remember, it is important to review your renters insurance policy and understand the coverage and limitations when it comes to stored belongings. Consider discussing your specific needs with your insurance provider to ensure you have adequate coverage for your stored belongings.

Alternatives to Renters Insurance for Storage Units

Considering Specialty Storage Insurance

While renters insurance may offer some coverage for items stored in a storage unit, it’s important to note that the protection may be limited. If you have valuable or high-risk items in your storage unit, you may want to consider specialty storage insurance. This type of insurance is specifically designed to provide comprehensive coverage for items stored in self-storage units. Here are some key points to consider:

– Enhanced coverage: Specialty storage insurance typically offers higher coverage limits than renters insurance for items stored in a storage unit. This can provide greater peace of mind knowing that your valuable belongings are adequately protected.

– Additional perils: Unlike renters insurance, which may have specific exclusions for certain types of perils, specialty storage insurance often covers a wider range of risks. This may include coverage for damage caused by floods, earthquakes, and other natural disasters.

– Individual valuation: Specialty storage insurance may also offer the option to individually value your stored items. This means you can have specific items appraised and insured for their full value, providing extra protection for valuable possessions.

– Flexible terms: Storage insurance policies can typically be tailored to your specific needs. This includes selecting the desired coverage amount, deductible, and duration of coverage. This flexibility allows you to customize your insurance policy to best suit your storage needs.

Exploring Additional Coverage Options

In addition to specialty storage insurance, there are other options to consider for added protection:

– Homeowners Insurance: If you already have homeowners insurance, it may offer coverage for items stored in a storage unit. However, it’s important to review your policy and check for any limitations or exclusions that may apply.

– Umbrella Policy: An umbrella insurance policy provides additional liability coverage beyond the limits of your renters insurance. While it may not directly cover your stored belongings, it can offer financial protection in the event of a lawsuit related to your storage unit.

– Storage Facility Insurance: Some storage facilities offer insurance coverage options for their tenants. These policies are specifically designed for storage units and may offer comprehensive coverage at a competitive rate. However, it’s important to carefully review the terms and conditions of the storage facility insurance to ensure it meets your needs.

As always, it’s recommended to review your insurance coverage options with a licensed insurance agent or broker. They can help assess your specific needs and provide guidance on the best insurance solution for your stored belongings.

Therefore, while renters insurance may provide some coverage for items stored in a storage unit, it’s important to carefully evaluate your insurance options to ensure you have adequate protection. Specialty storage insurance, homeowners insurance, umbrella policies, and storage facility insurance are all alternatives to consider. By understanding your options and selecting the right coverage, you can have peace of mind knowing that your stored belongings are well protected.

Conclusion

The Importance of Properly Insuring Personal Property in Storage Units

It is important to carefully consider your insurance options when it comes to storing personal property in storage units. While renters insurance may provide some coverage, it may be limited and may not adequately protect valuable or high-risk items. Speciality storage insurance is specifically designed to provide comprehensive coverage for items stored in storage units, offering higher coverage limits, additional perils coverage, and the option to individually value stored items. Exploring additional coverage options such as homeowners insurance, umbrella policies, and storage facility insurance can also provide added protection.

Making Informed Decisions about Renters Insurance Coverage

When obtaining renters insurance, it is crucial to understand the terms, conditions, exclusions, and limitations of the policy. Renters insurance not only covers personal belongings inside your home but can also provide coverage for items stolen while on-the-go or stored in storage units. It is recommended to discuss your specific circumstances with licensed insurance agents or brokers who can help assess your needs and guide you in selecting the best insurance solution. By properly insuring your personal property, including items stored in storage units, you can have peace of mind knowing that your belongings are well protected.

Therefore, proper insurance coverage is essential for protecting personal property stored in storage units. While renters insurance may offer some coverage, it may be beneficial to consider specialty storage insurance or explore additional coverage options such as homeowners insurance, umbrella policies, or storage facility insurance. Taking the time to understand your options and select the right coverage will ensure that your stored belongings are adequately protected.

Here’s an interesting read on Jetty insurance storage unit.

1 thought on “Lemonade insurance cover storage unit”