Is storage unit insurance mandatory in florida

Overview of storage unit insurance requirements in Florida

In Florida, storage facilities have the right to require their tenants to have insurance coverage for the items they store in their units. This requirement helps protect both the tenant and the storage facility in the event of damage, theft, or other unforeseen circumstances. While it may seem like an additional expense, having insurance coverage for stored belongings is vital to safeguarding your valuable items.

Understanding the importance of insurance coverage for stored belongings

Having insurance coverage for stored belongings is crucial because it provides financial protection in case of any unexpected events. Whether it’s theft, fire, or water damage, having insurance ensures that you will be adequately compensated for the loss or damage to your stored items. Without insurance, you would be solely responsible for the costs of replacing or repairing your belongings.

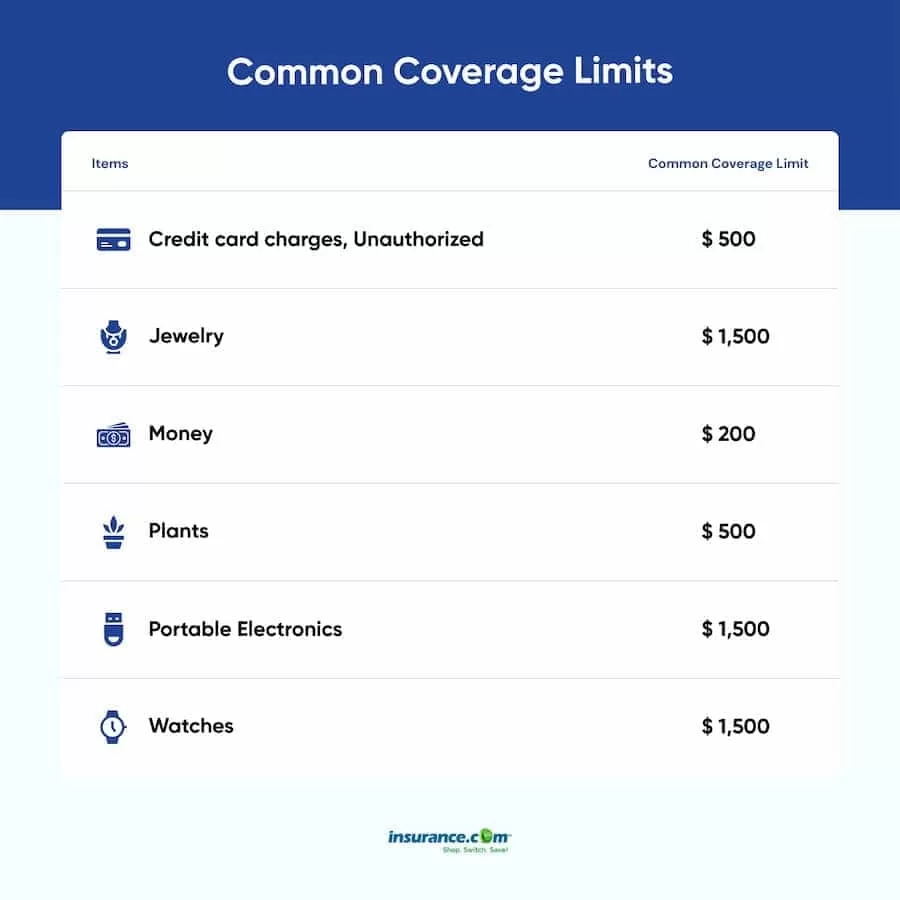

While some storage facilities offer insurance options, it’s essential to understand the coverage provided. Often, the insurance offered by storage facilities has limited coverage and may not fully protect your valuable items. Therefore, it’s recommended that tenants consider supplemental insurance through their homeowners insurance provider or a third-party insurance company.

Comparing homeowners insurance with supplemental insurance for storage units

When it comes to insuring your stored belongings, you have two options: adding additional coverage to your existing homeowners insurance or purchasing supplemental insurance from a third-party provider. Let’s compare the two options:

|

Homeowners Insurance |

Supplemental Insurance |

|---|---|

|

May provide limited coverage for items stored off-premises |

Specifically designed to cover stored belongings |

|

Coverage amount may be a percentage of the initial coverage |

Can provide coverage up to the full value of stored items |

|

May require additional premium or deductible |

May have its own premium and deductible |

|

Managed by the same insurance provider as homeowners policy |

Managed by a separate insurance provider |

It’s important to review your homeowners insurance policy to understand the extent of coverage it provides for stored belongings. If the coverage is limited or insufficient, purchasing supplemental insurance specifically designed for storage units can give you peace of mind knowing that your valuable items are adequately protected.

Conclusion

Therefore, storage facilities in Florida can require tenants to have insurance coverage for their stored belongings. While renters insurance typically includes off-premises coverage, it’s often a good idea to consider supplemental insurance to ensure that your valuable items are adequately protected. By comparing your homeowners insurance with supplemental insurance options, you can find the best coverage for your stored belongings and have the peace of mind knowing that you are financially protected in case of any unforeseen events.

Factors that Determine Insurance Requirement

Different storage facilities and their insurance policies

Each storage facility may have different insurance policies and requirements for their tenants. Some storage companies may offer insurance coverage themselves and include it in the rental agreement. This means that tenants may not be required to provide separate proof of insurance.

On the other hand, some storage facilities may not offer insurance coverage and therefore require tenants to obtain their own renter’s insurance policy. In these cases, tenants will need to provide proof of insurance that covers their items stored in the unit.

Dependence on specific storage facility rules and regulations

Whether or not a storage facility can require insurance may also depend on the rules and regulations set by that particular facility. Some states may have specific laws regarding insurance requirements for storage units, while others may leave it up to the discretion of the facility owner.

In some cases, storage facilities may require insurance to protect themselves from liability in the event of damage or theft of a tenant’s belongings. Requiring insurance can help ensure that tenants have adequate coverage for their stored items and alleviate any potential legal issues for the facility.

It’s important for tenants to familiarize themselves with the specific requirements of the storage facility they are renting from. This includes understanding whether insurance is mandatory and if so, what the minimum coverage requirements are.

Understanding the importance of renter’s insurance for storage units

While renter’s insurance for storage units may not be as common as other types of insurance policies, it is important for tenants to consider the benefits it provides. Here are some reasons why having renter’s insurance is important for storage unit tenants:

– Coverage for damage or theft: Renter’s insurance can provide financial protection in the event that a tenant’s belongings are damaged or stolen while in storage. This can help cover the cost of replacing or repairing the items.

– Liability coverage: Renter’s insurance can also provide liability coverage in case someone is injured while on the storage facility premises. This can help protect tenants from potential legal and financial consequences.

– Additional living expenses: In the event that a tenant’s home becomes uninhabitable due to damage or loss of belongings in storage, renter’s insurance can assist with additional living expenses such as temporary housing.

– Peace of mind: Having renter’s insurance can provide tenants with peace of mind, knowing that their belongings are protected. It can give them a sense of security and alleviate worries about potential financial losses.

Conclusion

In most cases, storage facilities can require tenants to have renter’s insurance coverage for their stored items. The specific insurance requirements may vary depending on the facility and its rules and regulations. It is important for tenants to understand these requirements and obtain the necessary coverage to protect their belongings. Renter’s insurance provides financial and liability protection in case of damage, theft, or injuries on the storage facility premises. It is advisable for tenants to research and compare insurance policies to find the best coverage for their specific needs.

Mandatory Insurance Policies

Storage facilities that require mandatory insurance coverage in Florida

In the state of Florida, many storage facilities have made it mandatory for tenants to have insurance coverage for their stored items. This requirement is in place to protect both the tenants and the facility itself in the event of damages, theft, or accidents on the premises. By having insurance, tenants can ensure that they are financially protected and have peace of mind regarding their stored belongings.

Details of the insurance coverage provided by the facilities

Each storage facility may have different insurance policies and coverage options for their tenants. Some facilities offer insurance coverage themselves and include it in the rental agreement. This means that tenants do not need to provide separate proof of insurance.

On the other hand, some facilities may require tenants to obtain their own renter’s insurance policy. In these cases, tenants are responsible for providing proof of insurance that covers their stored items. The specific coverage requirements may vary depending on the facility, but it is important for tenants to ensure that they have adequate coverage for their belongings.

Renter’s insurance for storage units typically provides coverage for damage or theft of stored items. This can help tenants financially recover in case of unexpected events. It may also provide liability coverage in case someone is injured on the storage facility premises. Additionally, some policies may include coverage for additional living expenses if a tenant’s home becomes uninhabitable due to damage or loss of belongings in storage.

To comply with the mandatory insurance requirement, tenants should familiarize themselves with the specific rules and regulations set by the storage facility they are renting from. This includes understanding the insurance requirements and any minimum coverage amounts.

It is also recommended for tenants to research and compare different insurance policies to find the best coverage for their specific needs. By choosing the right insurance policy, tenants can ensure that their stored items are adequately protected and they are prepared for any unforeseen circumstances.

Therefore, mandatory insurance policies for storage units are becoming more common, including in the state of Florida. Tenants should carefully review the requirements of their storage facility and obtain the necessary coverage to protect their belongings. Renter’s insurance provides financial and liability protection, giving tenants peace of mind and security regarding their stored items. Researching and comparing insurance policies can help tenants find the best coverage option for their specific needs.

Proof of Insurance

Documentation required to prove insurance coverage

When renting a storage unit, tenants may be required to provide proof of insurance that covers their stored items. This documentation is typically necessary to ensure that tenants have adequate coverage in case of damage or theft. The specific documents required may vary depending on the storage facility and its policies.

In some cases, the storage facility itself may offer insurance coverage and include it in the rental agreement. In these instances, tenants may not be required to provide separate proof of insurance. However, if the facility does not offer insurance or if the tenant wishes to obtain additional coverage, they will likely need to provide proof of a separate renter’s insurance policy.

Ensuring compliance with storage facility policies

To ensure compliance with the storage facility’s insurance requirements, tenants should familiarize themselves with the specific rules and regulations set by the facility. Some states may have specific laws regarding insurance requirements for storage units, while others may leave it up to the discretion of the facility owner.

The storage facility may require tenants to have a minimum coverage amount to protect themselves from liability in the event of damage or theft. The exact coverage requirements will vary depending on the facility. Tenants should carefully review their rental agreement and seek clarification from the facility if they have any questions about the insurance policy.

It is important for tenants to obtain the necessary documentation and coverage to comply with the storage facility’s insurance requirements. Failure to provide proof of insurance may result in the inability to rent a storage unit or potential eviction.

By adhering to the storage facility’s insurance policies, tenants can ensure that their stored items are adequately protected and that they are compliant with the terms of their rental agreement.

Overall, while renter’s insurance for storage units may not be as common as other types of insurance policies, it is important for tenants to consider the benefits it provides. Having renter’s insurance can provide financial protection in the event of damage or theft, as well as liability coverage for potential injuries. It can also help with additional living expenses if a tenant’s home becomes uninhabitable. By obtaining the necessary coverage and understanding the specific insurance requirements of the storage facility, tenants can have peace of mind knowing that their belongings are protected.

Alternatives to Storage Facility Insurance

When it comes to insuring your stored belongings in a storage unit, there are a few alternatives to consider. These options can provide additional coverage and peace of mind, ensuring that your items are protected in case of damage or theft.

Options for obtaining insurance coverage for stored belongings

1. Renter’s Insurance: One option is to add additional coverage to your existing renter’s insurance policy. Most renter’s insurance policies include off-premises coverage, which typically includes items stored in a storage unit. However, the coverage may be limited as it is usually a percentage of the initial coverage amount. It’s important to review your policy and consider supplemental coverage if needed.

2. Third-Party Supplemental Insurance: Another option is to explore supplemental insurance coverage through a third-party provider. This type of insurance can offer additional coverage for your stored items beyond what is provided by your renters insurance. These policies can sometimes be customized to meet your specific needs and can provide peace of mind knowing that your possessions are adequately protected.

Comparison of different insurance alternatives in terms of cost and coverage

To help you make an informed decision, here is a comparison of the different insurance alternatives in terms of cost and coverage:

|

Insurance Alternative |

Cost |

Coverage |

|---|---|---|

|

Renter’s Insurance |

Typically included in your renter’s insurance policy |

Usually a percentage of the initial coverage amount |

|

Third-Party Supplemental Insurance |

Additional cost on top of your renter’s insurance premium |

Can provide additional coverage beyond what is offered by renter’s insurance |

It’s important to evaluate the cost and coverage of each option based on your specific needs and the value of your stored belongings. Consider the items you are storing, their worth, and the potential risks involved. This will help you determine the level of coverage you require and the cost you are willing to pay.

Therefore, while storage facility insurance may be required by some storage facilities, there are alternatives available to ensure your stored belongings are adequately covered. Whether it’s adding additional coverage to your renter’s insurance or exploring third-party supplemental insurance, it is crucial to evaluate your options and choose the insurance that best fits your needs. By doing so, you can have peace of mind knowing that your stored items are protected from potential risks.

Renters Insurance

Understanding the need for renters insurance for stored belongings

When renting a storage unit, it is important to consider the need for renters insurance to protect your stored belongings. While homeowners insurance may provide coverage for items stored off-premises, it is essential to review your policy and determine if additional coverage is needed. Renters insurance typically includes off-premises coverage, which generally includes items kept in a storage unit. However, it is important to note that your renters insurance policy may only offer a percentage of the initial coverage amount. In such cases, considering supplemental coverage with your insurance provider or through a third-party may be necessary.

Benefits and drawbacks of renters insurance for storage units

Renters insurance for storage units offers several benefits, but there are certain drawbacks to consider as well.

Benefits:

– Financial protection: Having renters insurance can provide financial protection in the event of damage or theft to your stored belongings.

– Liability coverage: Renters insurance can offer liability coverage for potential injuries that may occur while your belongings are stored in a storage unit.

– Additional living expenses: If your home becomes uninhabitable, renters insurance may help with additional living expenses.

– Compliance with storage facility requirements: Many storage facilities require tenants to provide proof of insurance. Having renters insurance ensures compliance with these requirements.

Drawbacks:

– Coverage limitations: Renters insurance policies may have limitations on coverage amounts, which means you may not be fully reimbursed for loss or damage to your belongings.

– Additional cost: Renters insurance is an additional expense to consider when renting a storage unit.

– Policy restrictions: Some renters insurance policies may have restrictions on certain types of belongings or specific coverage circumstances. Reviewing the policy thoroughly is important to understand what is covered and what is not.

Therefore, renters insurance for storage units can provide valuable protection and peace of mind. It is important to assess your existing homeowners insurance policy and consider if additional coverage is needed. Familiarize yourself with the specific insurance requirements set by the storage facility and ensure you have the necessary documentation and coverage to comply. By doing so, you can have confidence that your stored items are adequately protected and that you are following the terms of your rental agreement.

Self-Storage Rental Insurance

Exploring the option of self-storage rental insurance

When considering renting a storage unit, it’s important to understand the option of self-storage rental insurance. While your homeowners insurance may provide coverage for items stored off-premises, it’s worth reviewing your policy to determine if additional coverage is necessary. Self-storage rental insurance typically includes off-premises coverage, ensuring that your belongings are protected even when they are not on your property. However, it’s important to note that the coverage provided by your self-storage rental insurance policy may only be a percentage of the initial coverage amount. In such cases, it may be beneficial to consider supplemental coverage through your insurance provider or a third-party.

Advantages and disadvantages of self-storage rental insurance

Advantages:

– Financial protection: Self-storage rental insurance offers financial protection in the event of damage or theft to your stored belongings.

– Liability coverage: This type of insurance can also provide liability coverage for injuries that may occur while your belongings are in the storage unit.

– Additional living expenses: If your home becomes uninhabitable, self-storage rental insurance may help with additional living expenses.

– Compliance with storage facility requirements: Many storage facilities require tenants to provide proof of insurance. Having self-storage rental insurance ensures compliance with these requirements.

Disadvantages:

– Coverage limitations: Self-storage rental insurance policies may have limitations on coverage amounts, which means you may not be fully reimbursed for loss or damage to your belongings.

– Additional cost: Self-storage rental insurance is an additional expense to consider when renting a storage unit.

– Policy restrictions: Some self-storage rental insurance policies may have restrictions on certain types of belongings or specific coverage circumstances. It’s crucial to thoroughly review the policy to understand what is covered and what is not.

Therefore, self-storage rental insurance can provide valuable protection and peace of mind when storing your belongings in a storage unit. It’s important to assess your existing homeowners insurance policy to determine if additional coverage is needed. Familiarize yourself with the specific insurance requirements set by the storage facility and ensure you have the necessary documentation and coverage to comply. By doing so, you can have confidence that your stored items are adequately protected, and you are following the terms of your rental agreement.

Exceptions to Insurance Requirements

Storage facilities that do not require insurance in Florida

In the state of Florida, there are some storage facilities that do not require tenants to have insurance coverage for their stored belongings. These facilities may have their own internal insurance policies that cover any damage or loss that may occur. So, if you are renting a storage unit in Florida, it is important to check with the facility to see if insurance is a requirement or if they provide coverage themselves.

Factors influencing exemptions from insurance obligations

There are several factors that may influence whether a storage facility requires tenants to have insurance for their stored items. These factors can vary from one facility to another and may include:

1. Location: Some states or regions may have specific laws or regulations that determine whether insurance coverage is required for storage units. It is important to check the local laws and regulations to understand any obligations regarding insurance for your stored belongings.

2. Facility policies: Each storage facility has its own set of rules and policies, which may include an insurance requirement. Some facilities may choose to make insurance optional for tenants, while others may have a strict requirement in place.

3. Liability concerns: Storage facilities have a responsibility to ensure the safety and security of their premises. Requiring tenants to have insurance coverage helps protect the facility from liability in case of damage or loss to stored items. Facilities may require insurance to mitigate the risk of potential lawsuits or financial burdens.

4. Type of storage: The type of storage unit you choose can also influence whether insurance is required. For example, climate-controlled units or units with added security measures may have different insurance requirements compared to standard units.

5. Value of stored items: The value of the items you plan to store can also impact insurance requirements. If you are storing high-value items, such as expensive furniture or valuable collectibles, the facility may require you to have insurance coverage to protect against potential losses.

6. Lease agreements: The terms of your lease agreement with the storage facility will outline any insurance obligations you may have. It is essential to carefully read and understand the lease agreement to ensure compliance with any insurance requirements.

It is important to note that even if a storage facility does not require insurance, it is still highly recommended to have coverage for your stored belongings. Accidents, natural disasters, and theft can happen anywhere, and having insurance provides an added layer of protection and peace of mind.

Therefore, while many storage facilities do require tenants to have insurance coverage for their stored belongings, there are exceptions where insurance may not be mandatory. It is important to check with your storage facility to understand their insurance requirements and to assess the risks involved in storing your items without insurance. Regardless of whether insurance is required or not, it is always recommended to have coverage to protect your belongings from unforeseen events.

Conclusion

Summary of storage unit insurance requirements in Florida

In the state of Florida, there are storage facilities that do not require tenants to have insurance coverage for their stored belongings. These facilities may have their own internal insurance policies that cover any damage or loss that may occur. However, it is important to check with the facility to see if insurance is a requirement or if they provide coverage themselves.

On the other hand, many storage facilities in Florida do require tenants to have insurance for their stored items. This requirement is often stated in the lease agreement and is meant to protect both the facility and the tenant in case of damage or loss.

Important factors to consider when renting a storage unit

When renting a storage unit, there are several important factors to consider, including:

1. Insurance requirements: Check with the storage facility to understand their insurance requirements. Some facilities may require tenants to have insurance coverage, while others may provide their own coverage.

2. Location: Different states or regions may have specific laws or regulations regarding insurance requirements for storage units. Make sure to check the local laws and regulations to understand your obligations.

3. Facility policies: Each storage facility has its own set of rules and policies, which may include insurance requirements. Make sure to carefully read and understand the lease agreement to ensure compliance.

4. Liability concerns: Requiring tenants to have insurance coverage helps protect the storage facility from liability in case of damage or loss to stored items. Facilities may require insurance to mitigate the risk of potential lawsuits or financial burdens.

5. Type of storage: The type of storage unit you choose may impact insurance requirements. Climate-controlled units or units with added security measures may have different insurance requirements compared to standard units.

6. Value of stored items: The value of the items you plan to store can also influence insurance requirements. Facilities may require insurance coverage for high-value items to protect against potential losses.

It is important to note that even if insurance is not required by the storage facility, it is still highly recommended to have coverage for your stored belongings. Accidents, natural disasters, and theft can happen anywhere, and having insurance provides an added layer of protection and peace of mind.

Regardless of whether insurance is required or not, it is always a wise decision to have coverage to protect your belongings from unforeseen events when renting a storage unit.

Learn more about Insurance for general storage units.