Insurance coverage storage units

Overview of the importance of storage unit insurance

Storage unit insurance is a type of insurance coverage that financially protects your personal possessions stored in a storage unit. It is designed to provide a safety net in case of incidents like theft, vandalism, and weather-related damage. Just like your home or office, storage units are exposed to risks that could potentially damage or destroy your belongings. Therefore, having insurance in place is crucial to ensure that you are protected financially.

Benefits of having insurance coverage for personal belongings in a storage unit

There are several benefits to having insurance coverage for your personal belongings in a storage unit:

1. Financial protection: Storage unit insurance provides financial protection against potential losses. In the event of theft, vandalism, or damage caused by weather conditions, such as fires or floods, insurance coverage can help you recover the value of your lost or damaged items.

2. Peace of mind: Knowing that your belongings are protected can give you peace of mind. Storage units are not immune to theft or accidents, so having insurance can provide reassurance that you will be able to replace or repair your items if something unexpected happens.

3. Supplemental coverage: While some homeowners or renters insurance policies may cover belongings in storage units, it is important to check with your current insurance provider to determine the extent of coverage. In many cases, additional or supplemental coverage specifically for storage units may be necessary to ensure comprehensive protection.

4. Coverage for various incidents: Storage unit insurance typically covers a range of incidents, including theft, vandalism, fire, smoke damage, water damage, and natural disasters. It is essential to review the terms and conditions of the insurance policy to understand what is covered and any exclusions or limitations.

5. Flexibility: Storage unit insurance can be tailored to your specific needs. You can choose the coverage amount that suits the value of your belongings and select additional options, such as coverage for high-value items or specific types of damage. This flexibility allows you to customize your insurance policy according to your individual requirements.

6. Cost-effective: Storage unit insurance is generally affordable and offers a cost-effective way to protect your valuable possessions. The premiums for storage unit insurance are often based on the declared value of your items and the level of coverage you choose.

7. Legal requirements: Some storage facilities may require tenants to have insurance coverage for their personal belongings. It is important to check the lease agreement or speak with the facility management to understand any insurance requirements or recommendations.

Therefore, storage unit insurance is a valuable investment that provides financial protection and peace of mind for your personal belongings stored in a storage unit. With the potential risks and incidents that could occur, having insurance coverage ensures that you are prepared and financially safeguarded against any unforeseen events. Speak with your current insurance provider to determine the coverage options available and consider the benefits of supplemental storage unit insurance for comprehensive protection.

Types of Coverage for Storage Units

Explanation of different types of insurance coverage available for storage units

When it comes to protecting your belongings stored in a storage unit, there are a few different types of insurance coverage to consider. It’s important to understand these options to ensure you choose the right coverage for your specific needs. Here are the main types of insurance coverage available for storage units:

1. Storage Facility Insurance: Some storage rental facilities automatically offer insurance coverage as part of the rental agreement. This type of coverage typically protects the storage facility itself, including the building and property, against damage caused by events like fire, theft, or vandalism. However, this coverage may not extend to your personal belongings stored in the unit.

2. Third-Party Insurance: If the storage facility’s insurance does not cover your personal belongings, you can purchase third-party insurance. This type of coverage is specifically designed to protect your items stored in the storage unit from various perils such as fire, theft, water damage, and more. Third-party insurance gives you peace of mind knowing that your belongings are financially protected in case of unexpected incidents.

3. Renters/Homeowners Insurance: In some cases, your existing renters or homeowners insurance policy may provide coverage for your stored belongings. However, it’s important to check with your insurance provider to confirm if this coverage applies and if any limitations or restrictions exist. Keep in mind that not all insurance policies automatically cover items stored in a storage unit, so you may need to add additional coverage or a separate policy to protect your belongings.

Comparison between self-storage insurance and renters/homeowners insurance

When considering insurance coverage for your storage unit, you may wonder whether it’s better to go with self-storage insurance or rely on your renters or homeowners insurance policy. Here is a comparison between the two options:

Self-Storage Insurance:

– Purpose-built coverage specifically designed for storage units

– Typically offers higher coverage limits for stored belongings

– May be more flexible in terms of coverage options and deductible amounts

– Can be purchased directly from the storage rental facility or from third-party insurance providers

– May require proof of insurance coverage when renting a storage unit

Renters/Homeowners Insurance:

– Existing policy may provide coverage for stored belongings

– Convenient if you already have a renters or homeowners insurance policy

– Coverage limits for stored belongings may be lower compared to self-storage insurance

– May have limitations or exclusions for specific types of items or perils

– May require additional endorsements or add-ons to cover stored belongings

It is important to carefully evaluate the coverage options, limits, and requirements of both self-storage insurance and renters or homeowners insurance before making a decision. Consider factors such as the value of your stored belongings, the specific perils covered, and the cost of premiums and deductibles. Consulting with your insurance provider can help you understand your coverage options and make an informed choice to protect your stored belongings.

Factors to Consider When Choosing Storage Unit Insurance

Key factors to consider when selecting insurance coverage for storage units

When choosing insurance coverage for your storage unit, there are several important factors to take into consideration. These factors can help you make an informed decision and ensure that your belongings are adequately protected. Here are some key factors to consider:

1. Coverage Limits: It’s important to determine the amount of coverage you need for your stored belongings. Consider the total value of the items you have in storage and choose a policy that offers sufficient coverage to replace those items in case of damage or loss.

2. Perils Covered: Different insurance policies may have varying coverage for specific perils such as fire, theft, water damage, and natural disasters. Assess the risks associated with your storage unit location and choose a policy that provides coverage for the perils most relevant to your situation.

3. Deductibles: Consider the deductible amount associated with the insurance policy. A lower deductible may mean higher premiums, while a higher deductible may result in lower premiums but require you to pay more out of pocket in case of a claim.

4. Policy Exclusions: Review the policy exclusions carefully to understand what is not covered by the insurance policy. Some common exclusions include damage caused by pests, mold, or acts of war. Make sure to choose a policy that aligns with your specific needs and offers coverage for the items you want to protect.

Important features to look for in a storage unit insurance policy

In addition to the key factors mentioned above, there are some important features to consider when evaluating storage unit insurance policies. These features can help ensure that you have comprehensive coverage and peace of mind:

1. Replacement Cost Coverage: Look for a policy that offers replacement cost coverage rather than actual cash value coverage. Replacement cost coverage will reimburse you for the full cost of replacing your items, while actual cash value coverage takes into account depreciation and may provide a lower payout.

2. Additional Coverage Options: Some insurance policies may offer additional coverage options, such as coverage for valuable items or coverage for items in transit. Consider these additional options if they align with your storage needs.

3. Ease of Claims Process: Look for a policy that provides an easy and straightforward claims process. Check customer reviews or ask for recommendations to ensure that the insurance provider has a good track record when it comes to handling claims efficiently and effectively.

4. Cost and Affordability: While cost should not be the sole determining factor, it is important to consider the affordability of the insurance policy. Obtain quotes from multiple insurance providers and compare the premiums, deductibles, and coverage limits to find the most suitable option for your budget.

By carefully considering these factors and features, you can choose the right insurance coverage for your storage unit and ensure that your belongings are protected against unexpected events. Remember to review and update your insurance coverage periodically as your storage needs change.

Understanding Coverage Limits and Deductibles

Explanation of coverage limits and deductibles in storage unit insurance

When it comes to storage unit insurance, it’s important to understand the concept of coverage limits and deductibles. These factors play a significant role in determining the extent of financial protection provided by your insurance policy.

Coverage Limits:

In the context of storage unit insurance, coverage limits refer to the maximum amount of money that will be paid out by the insurance company in the event of a covered loss. This limit is typically stated in the insurance policy and can vary depending on the type of coverage you have. It’s crucial to evaluate whether the coverage limit offered by your storage unit insurance policy is sufficient to adequately protect the value of your stored belongings.

Deductibles:

A deductible is the amount of money that you, as the policyholder, are responsible for paying before the insurance company will cover the remaining costs of a covered loss. For example, if your storage unit insurance policy has a $500 deductible and you file a claim for $2,000 worth of damage, you would need to pay the first $500 out of pocket, and the insurance company would cover the remaining $1,500.

Typically, storage unit insurance policies offer various deductible options, allowing you to choose a higher or lower deductible based on your preferences and budget. It’s essential to carefully evaluate the deductible amounts and consider factors like your financial situation and the value of your stored belongings when selecting a deductible for your insurance policy.

How coverage limits and deductibles affect your insurance policy

Coverage limits and deductibles are important considerations in your storage unit insurance policy as they directly impact how much protection you will have and the cost of your insurance premiums.

Coverage limits determine the maximum amount of money you can claim for a loss. If your coverage limit is too low, you may not be fully reimbursed for the value of your damaged or stolen items. On the other hand, if your coverage limit is too high, you may be paying for more coverage than necessary, resulting in higher premiums. It is essential to carefully assess the value of your stored belongings and select a coverage limit that adequately protects your assets while keeping your insurance costs reasonable.

Deductibles, on the other hand, affect your out-of-pocket expenses when filing a claim. Higher deductibles generally result in lower insurance premiums, as you are taking on more financial responsibility in the event of a loss. On the flip side, lower deductibles mean higher premiums, but you will have a smaller out-of-pocket expense if you need to file a claim. Assess your budget and determine the amount you are comfortable paying in the event of a loss to choose a deductible that aligns with your financial situation.

Understanding coverage limits and deductibles in storage unit insurance is crucial to ensure you have the right level of protection and understand the financial implications of filing a claim. Discussing these factors with your insurance provider can help you make an informed decision and select a policy that suits your needs.

Common Perils Covered by Storage Unit Insurance

Detailed description of perils typically covered by storage unit insurance

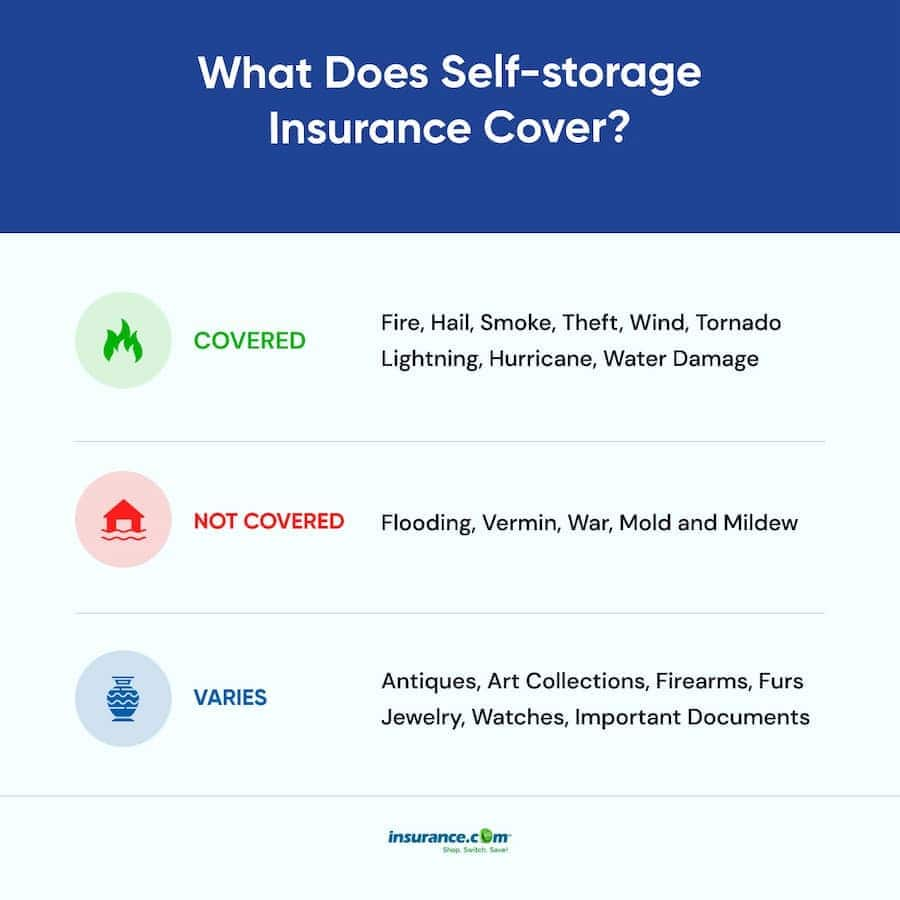

Storage unit insurance provides coverage for various perils that can damage or destroy your possessions stored in a storage facility. These perils are typically outlined in the insurance policy and can include:

1. Theft: Storage unit insurance protects your belongings in the event of theft. If someone breaks into your storage unit and steals your possessions, the insurance company will cover the cost of the stolen items up to the coverage limit.

2. Vandalism: If your storage unit is vandalized, resulting in damage to your belongings, storage unit insurance will provide coverage. This can include acts of vandalism such as graffiti, intentional destruction of property, or other malicious acts.

3. Weather damage: Storage unit insurance also covers damage caused by weather-related perils such as storms, hurricanes, or floods. If your belongings are damaged due to water intrusion, wind, or other weather events, the insurance policy will provide financial protection.

4. Fire: Accidental fires can occur in storage rental facilities, posing a significant risk to your stored belongings. Storage unit insurance can help cover the cost of damage caused by fire, ensuring you receive compensation for your losses.

5. Rodent or pest damage: Storage units are susceptible to infestations by rodents or pests, which can cause damage to your belongings. With storage unit insurance, you can be reimbursed for the cost of repairing or replacing items damaged by these pests.

6. Mold or mildew: Moisture can build up in storage units, leading to the growth of mold and mildew. Storage unit insurance can provide coverage for damage caused by mold or mildew, ensuring your belongings are protected.

Examples of covered events such as theft, vandalism, and weather damage

To give you a better understanding of the types of events covered by storage unit insurance, here are a few examples:

1. Theft example: If someone breaks into your storage unit and steals valuable items such as electronics, jewelry, or furniture, storage unit insurance will reimburse you for the value of the stolen items up to the coverage limit.

2. Vandalism example: If your storage unit is vandalized and your belongings are damaged, storage unit insurance will cover the cost of repairing or replacing the damaged items. This can include instances where graffiti is sprayed on your furniture or intentional destruction of property.

3. Weather damage example: If a severe storm causes water to leak into your storage unit and damages your belongings, storage unit insurance will provide coverage for the cost of repairing or replacing the damaged items.

It’s important to review your storage unit insurance policy to understand the specific perils covered and any exclusions that may apply. This will help you determine the level of protection provided by your insurance policy and whether additional coverage is necessary to fully safeguard your stored belongings.

Exclusions and Limitations in Storage Unit Insurance

Examples of exclusions and limitations in storage unit insurance policies

Storage unit insurance policies typically come with certain exclusions and limitations that you need to be aware of. These exclusions specify the situations and items that are not covered by your insurance policy, while limitations outline the maximum amounts that can be reimbursed for certain types of losses. It is important to review these exclusions and limitations to ensure you have a clear understanding of what is and isn’t covered by your insurance policy.

Some common examples of exclusions in storage unit insurance policies include:

– Damage caused by flooding or earthquakes: Most insurance policies do not cover damage resulting from natural disasters such as floods or earthquakes. If you live in an area prone to these types of events, you may need to explore additional insurance options.

– Damage caused by pests or vermin: Insurance policies often exclude coverage for damage caused by pests or vermin such as rodents or insects. If you are storing valuables that are susceptible to this type of damage, you may need to take preventative measures or consider alternative storage options.

– Items of high value or specialty items: Some insurance policies may have limitations on the coverage provided for high-value items or specialty items such as jewelry, collectibles, or artwork. If you have valuable items stored in your unit, you may need to consider additional insurance coverage specifically tailored to these items.

Understanding what is not covered by your insurance policy

It is important to read and understand the fine print of your storage unit insurance policy to determine the specific exclusions and limitations that apply. By doing so, you can avoid any surprises or gaps in coverage when you need to file a claim.

In addition to the common exclusions mentioned above, it is essential to be aware of any specific exclusions or limitations that may be applicable to your policy. These can vary depending on the insurance provider and the terms of your policy. Some examples of commonly found exclusions and limitations include:

– Self-storage locations with inadequate security measures: Some insurance policies may exclude coverage for storage units that do not meet certain security requirements. If your storage facility does not have proper security measures in place, such as surveillance cameras or secure access controls, it may invalidate your coverage.

– Illegal or prohibited items: Insurance policies typically do not provide coverage for items that are illegal or prohibited. This can include items such as firearms, explosives, or contraband. It is important to familiarize yourself with the list of prohibited items provided by your storage facility and ensure that you do not store any of these items in your unit.

– Normal wear and tear: Insurance policies generally do not cover damage that occurs due to normal wear and tear or gradual deterioration over time. It is important to properly package and store your items to minimize the risk of damage from regular use or aging.

By understanding these exclusions and limitations, you can make informed decisions about your storage unit insurance and take necessary precautions to protect your belongings. If you have any questions or concerns about the exclusions and limitations in your policy, it is recommended to speak with your insurance provider for clarification.

Cost of Storage Unit Insurance

Factors that affect the cost of storage unit insurance

The cost of storage unit insurance can vary depending on several factors. Some of the key factors that can affect the cost of your insurance coverage include:

1. The coverage amount: The more coverage you need, the higher the cost of your insurance policy. Insurance providers typically offer different coverage options, ranging from basic coverage for a lower premium to comprehensive coverage for a higher premium.

2. Location: The location of your storage unit can also impact the cost of insurance. If you are located in an area with a high risk of theft or natural disasters, you may be charged a higher premium to offset the increased risk.

3. Security measures: Storage facilities with enhanced security measures, such as surveillance cameras, gated access, and alarms, may result in lower insurance premiums. These measures reduce the risk of theft or vandalism, making the storage unit a safer option for insurers.

4. Type of belongings: The type and value of the items you are storing can also affect the cost of storage unit insurance. If you have high-value items or specialty items, such as jewelry or artwork, you may require additional coverage, which can increase the overall cost of your policy.

5. Deductible amount: The deductible is the amount you are responsible for paying out of pocket before the insurance coverage kicks in. A higher deductible can lead to lower insurance premiums, but it also means you will have to bear a higher cost in the event of a claim.

Examples of average premiums for different coverage amounts

The cost of storage unit insurance can vary significantly based on the factors mentioned above. However, here are some examples of average premiums for different coverage amounts:

– Basic coverage: For a coverage amount of around $5,000, the average annual premium could range from $100 to $200, depending on your location and other factors.

– Medium coverage: If you need coverage for belongings worth around $10,000, the average annual premium could range from $200 to $400.

– Comprehensive coverage: For a coverage amount of $20,000 or more, the average annual premium could range from $400 to $800 or higher.

It’s important to note that these figures are just examples, and actual premiums may vary based on individual circumstances. To get an accurate estimate of the cost of storage unit insurance, it’s recommended to contact insurance providers for quotes based on your specific needs.

Therefore, the cost of storage unit insurance can depend on various factors such as coverage amount, location, security measures, type of belongings, and deductible amount. It’s advisable to compare quotes from different insurance providers to find the best coverage at a competitive price.

How to File a Claim for Storage Unit Insurance

Step-by-step guide on how to file a claim for storage unit insurance

Filing a claim for storage unit insurance can be a straightforward process if you follow these steps:

1. Notify your insurance provider: As soon as you discover the damage or loss to your stored items, contact your insurance provider to report the incident. They will guide you through the claims process and provide you with the necessary forms and information.

2. Document the damage or loss: Take photos or videos of the damaged or lost items to provide visual evidence of the condition before and after the incident. This documentation will strengthen your claim and help with the valuation of your belongings.

3. Obtain supporting documentation: Gather any supporting documents related to the stored items, such as receipts, appraisals, or any other proof of their value. This information will be useful when assessing the reimbursement amount.

4. File a police report: If the damage or loss is a result of theft or vandalism, it is crucial to file a police report. This report will serve as additional evidence to support your claim.

5. Complete the claim form: Fill out the claim form provided by your insurance provider accurately and thoroughly. Make sure to include all necessary information and supporting documents.

6. Submit the claim: Once you have completed the claim form and gathered all the required documentation, submit them to your insurance provider. Be sure to keep copies of all documents for your records.

7. Cooperate with the investigation: Your insurance provider may conduct an investigation to validate your claim. Cooperate fully and provide any additional information or documentation as requested.

8. Review the settlement offer: Once the investigation is complete, your insurance provider will send you a settlement offer. Review the offer carefully and ensure that it covers the full extent of your loss or damage.

9. Accept or negotiate the settlement: If you are satisfied with the settlement offer, you can accept it and proceed with the reimbursement process. If you believe the offer is insufficient, you can negotiate with your insurance provider to reach a fair resolution.

Important information to gather before filing a claim

Before filing a claim for storage unit insurance, it is essential to gather the following information:

– Insurance policy details: Have your insurance policy number, coverage details, and contact information for your insurance provider readily available.

– Inventory list: Create an inventory list of the items stored in your unit, including their estimated value. This list will help facilitate the claims process and ensure accurate reimbursement.

– Proof of ownership: Gather any documentation that proves your ownership of the stored items, such as receipts, purchase contracts, or warranties.

– Incident details: Document the date, time, and cause of the damage or loss. Include any additional relevant information, such as eyewitness accounts or security camera footage.

– Contact information: Obtain the contact information of any witnesses or individuals involved in the incident, if applicable.

By having this information organized and readily available, you can streamline the claims process and ensure a smooth resolution with your insurance provider. Keep in mind that each insurance provider may have specific requirements or additional documentation needed for the claims process, so it is advisable to consult with them directly for further guidance.

Remember, storage unit insurance is designed to protect your belongings in case of unexpected events. By understanding the claims process and having the necessary information at hand, you can make the most of your insurance coverage when the need arises.

Conclusion

Summary of the importance of storage unit insurance

Having insurance coverage for your storage unit is crucial to protect your belongings from potential risks such as theft, arson, and accidental fires. Storage rental facilities may require insurance coverage, and it is important to confirm what is covered by your current home or renters insurance policy. Supplemental coverage may be necessary to ensure adequate protection for your stored items.

Recommendations for finding the right insurance coverage for your storage unit

When considering storage unit insurance options, it is essential to compare different choices before making a decision. Here are some recommendations for finding the right insurance coverage:

1. Speak with your insurance provider: Contact your current home or renters insurance company to inquire about their coverage for storage units and determine if supplemental insurance is needed.

2. Research storage unit insurance providers: Look for reputable insurance providers that specialize in storage unit coverage. Consider factors such as coverage limits, deductibles, and customer reviews.

3. Compare policies: Request quotes from multiple insurance providers and compare the coverage, premiums, and deductibles offered. Be sure to review the terms and conditions of each policy to understand the extent of coverage provided.

4. Consider additional coverage options: Some insurance providers offer additional coverage for specific items, such as valuable jewelry or artwork. If you have high-value items stored in your unit, consider purchasing additional coverage to ensure adequate protection.

5. Understand policy exclusions: Familiarize yourself with any exclusions or limitations in the insurance policy. Certain items or scenarios may not be covered, so it is important to be aware of any restrictions.

6. Review customer service and claims process: Research the reputation of the insurance provider in terms of customer service and the efficiency of their claims process. Read reviews or ask for recommendations from friends or family who have experience with storage unit insurance claims.

7. Maintain an inventory: Keep an updated inventory of the items stored in your unit, including their estimated value. This will help facilitate the claims process in case of damage or loss.

8. File claims promptly: If an incident occurs, notify your insurance provider and file a claim as soon as possible. Provide all the necessary documentation, such as photos, supporting documents, and a police report if applicable.

By following these recommendations, you can find the right insurance coverage for your storage unit that offers adequate protection and peace of mind. Remember to regularly review your policy to ensure it aligns with your needs and update it when necessary.

Discover Storag unit insurance.

1 thought on “Insurance coverage storage units”