Introduction

Overview of insurance requirements for small storage units in California

In California, small storage units are a popular choice for individuals and businesses to store their belongings. However, it is important to understand the insurance requirements for these storage units to ensure that your belongings are adequately protected.

According to California law, storage facility owners are required to provide insurance coverage for their customers’ stored belongings. This means that if you rent a small storage unit in California, there should be some level of insurance coverage provided by the facility owner. However, the amount of coverage may vary and it is important to review the terms and conditions of the insurance policy offered by the facility.

It is also worth noting that while storage facility owners are required to provide insurance coverage, it may not cover certain types of items or situations. For example, some policies may exclude coverage for valuable items such as jewelry or artwork. Additionally, the insurance provided by the facility owner may have limitations on the maximum value of the items covered.

Importance of understanding insurance coverage for stored belongings

Understanding the insurance coverage for your stored belongings is crucial to ensure that you have adequate protection in case of loss, damage, or theft. Without proper insurance coverage, you may be left financially responsible for replacing or repairing your belongings if something were to happen.

When considering insurance options for your stored belongings, there are a few important factors to consider:

1. Coverage limits: It is important to know the maximum amount that the insurance policy will pay out in the event of a claim. Make sure that this amount is sufficient to cover the value of your stored items.

2. Exclusions: Some insurance policies may exclude certain types of items from coverage, such as high-value items or items with sentimental value. It is important to review the policy carefully and consider obtaining additional coverage if needed.

3. Deductibles: Like any insurance policy, storage unit insurance may come with a deductible, which is the amount you will need to pay out of pocket before the insurance coverage kicks in. Consider the deductible amount and how it fits into your budget in case of a claim.

4. Supplemental coverage: If the insurance provided by the storage facility owner is not sufficient to cover the value of your stored belongings, you may want to consider obtaining supplemental coverage through your homeowners insurance provider or a third-party insurance company.

Therefore, it is important to understand the insurance coverage for your stored belongings in order to ensure that you have adequate protection. Review the insurance policy provided by the storage facility owner, consider any exclusions or limitations, and determine if additional coverage is necessary. By taking these steps, you can have peace of mind knowing that your belongings are protected in case of an unfortunate event.

Understanding California Insurance Code

Explanation of Article 16.3 and its role in regulating storage unit insurance

The California Insurance Code includes various sections that outline regulations and provisions for different types of insurance, including storage unit insurance. One important section to be aware of is Article 16.3, which specifically addresses self-service storage facilities and the insurance requirements associated with them.

Article 16.3 ensures that self-storage facility operators are held accountable for providing adequate insurance coverage options to their customers. It sets certain standards and regulations that must be followed to protect the interests of both storage facility operators and customers. By complying with the provisions outlined in this article, storage facility operators can ensure that their customers’ stored belongings are adequately protected.

Key provisions and requirements for self-storage facilities

Under Article 16.3 of the California Insurance Code, self-storage facility operators are required to provide their customers with the option to purchase insurance coverage for their stored belongings. While customers have the choice to decline this coverage, storage facility operators must still inform them about the availability and importance of insurance.

Here are some key provisions and requirements that self-storage facilities must adhere to:

1. Disclosure of Responsibility: Operators must disclose, in writing, that they are not responsible for the loss or damage to stored belongings and that customers are encouraged to obtain insurance coverage.

2. Insurance Information: Storage facility operators must provide information about their insurance requirements, including the minimum insurance coverage that customers must obtain. This helps ensure that customers have adequate protection for their stored items.

3. Proof of Insurance: Operators can require customers to provide proof of insurance coverage. This can be in the form of an insurance policy or a declaration page that shows the coverage amount and period.

4. Exemption from Liability: Operators are exempt from liability for loss or damage to stored belongings if customers fail to obtain insurance coverage or do not provide proof of coverage.

It is important for both storage facility operators and customers to understand and comply with these requirements to ensure that stored belongings are adequately protected. Failure to meet these requirements can result in penalties and legal consequences.

Therefore, the California Insurance Code, specifically Article 16.3, plays a crucial role in regulating storage unit insurance in the state. It establishes provisions and requirements for self-storage facility operators to ensure that customers have the option to obtain insurance coverage for their stored belongings. By understanding these regulations, both storage facility operators and customers can make informed decisions regarding insurance coverage to protect their assets.

Self-Storage Companies as Insurance Agents

How self-storage facilities can function as agents for insurance

Self-storage facilities have the option to function as insurance agents, offering insurance coverage to their customers for the belongings stored in their units. By acting as agents, these facilities can provide an additional service to their customers and simplify the process of obtaining insurance coverage.

Here’s how self-storage facilities can function as agents for insurance:

1. Insurance Partnerships: Self-storage facilities can partner with insurance companies to offer insurance coverage to their customers. They can negotiate agreements with insurance providers to offer specific insurance policies specifically tailored to the needs of storage unit renters.

2. Streamlined Process: By offering insurance coverage directly through the storage facility, customers can conveniently purchase insurance at the same time they rent a storage unit. This eliminates the need for customers to go through the hassle of finding an insurance provider independently and simplifies the overall process.

3. Knowledgeable Staff: Self-storage facility employees who act as insurance agents can provide valuable information and guidance to customers regarding insurance options. They can explain the different coverage options available, answer questions, and help customers make informed decisions.

Benefits and limitations of purchasing insurance through the storage company

There are several benefits to purchasing insurance through the self-storage facility:

1. Convenience: Renting a storage unit and purchasing insurance coverage from the same facility is a convenient and time-saving process. Customers can complete all necessary paperwork and transactions in one place, simplifying the overall experience.

2. Tailored Coverage: Self-storage facilities that act as insurance agents may offer insurance policies specifically designed for storage units. These policies can be tailored to address the unique risks associated with storing belongings in a self-storage facility, providing customers with coverage that meets their specific needs.

3. Simplified Claims Process: In the event of loss or damage to stored belongings, customers who have purchased insurance through the self-storage facility can typically handle the claims process directly with the facility. This can streamline the process and expedite the resolution of claims.

However, there are also limitations to purchasing insurance through the storage company:

1. Limited Options: Customers who choose to purchase insurance through the self-storage facility may have limited options in terms of coverage providers. They may be limited to the insurance companies with whom the facility has partnerships, potentially limiting their ability to compare quotes and choose the most suitable coverage.

2. Potential for Higher Costs: Insurance policies offered through storage facilities may come at a higher cost compared to obtaining insurance independently. Customers should carefully consider the coverage and premiums offered before opting for insurance through the storage facility.

3. Duplication of Coverage: It is important for customers to review their existing insurance policies, such as homeowners or renters insurance, before purchasing additional coverage through the storage facility. There may be duplication of coverage, and customers should avoid paying for insurance they already have.

Therefore, self-storage facilities can serve as insurance agents, offering insurance coverage to customers for their stored belongings. This approach provides convenience and tailored coverage options. However, customers should carefully consider their existing insurance coverage and compare quotes before making a decision. By understanding the benefits and limitations of purchasing insurance through the storage company, customers can make informed choices and ensure their stored belongings are adequately protected.

Optional Insurance vs. Required Insurance

Clarification on whether renters insurance or self-storage rental insurance is mandatory

Renters insurance and self-storage rental insurance are not legally required in California. However, both types of insurance provide valuable coverage and are highly recommended to protect your belongings.

Renters insurance is typically optional but highly advisable for tenants. It covers your personal belongings for events like theft, fire, and vandalism, both inside and outside of your rental unit. Renters insurance also provides liability coverage in case someone is injured in your rental property.

On the other hand, self-storage rental insurance is usually required when renting a storage unit. Self-storage facilities may have specific insurance requirements to ensure that customers have adequate coverage for their stored belongings. While these facilities may offer insurance options, customers also have the choice to obtain insurance coverage through their own renters insurance policy or a third-party provider.

Insights into storage company’s policies regarding insurance coverage

Storage facility operators must comply with the provisions outlined in Article 16.3 of the California Insurance Code to ensure that customers have access to insurance coverage options. However, the specific insurance policies and requirements can vary between different storage companies.

When renting a storage unit, it is important to carefully review the terms and conditions regarding insurance coverage. Some storage companies may offer insurance as part of their rental agreement, while others may require customers to provide proof of insurance coverage from their own policy or a third-party provider.

It is important to consider the coverage limits of the insurance options provided by the storage company. In some cases, the coverage may be limited, and additional supplemental insurance may be necessary to fully protect your stored belongings.

Before signing a rental agreement, it is advisable to consult with your insurance agent to determine if your renters insurance policy already provides coverage for items stored in a storage unit. If not, they can help you explore additional insurance options to ensure that your belongings are adequately protected.

Therefore, while renters insurance and self-storage rental insurance are not mandatory in California, they offer valuable coverage for your personal belongings. It is important to understand the insurance requirements and options provided by storage companies, and consider obtaining additional coverage if necessary. Consulting with an insurance agent can help you make informed decisions about insurance coverage to protect your stored items.

Factors to Consider for Additional Insurance

Determining if additional insurance is necessary for your storage unit

When deciding whether to get additional insurance for your storage unit, there are a few factors to consider:

1. Review your renters insurance policy: Check if your existing renters insurance policy includes coverage for items stored in a storage unit. While renters insurance usually includes off-premises coverage, the coverage limit may only be a percentage of the initial coverage amount. If your policy doesn’t provide sufficient coverage, it may be necessary to explore additional insurance options.

2. Evaluate the value and importance of your stored items: Consider the value and importance of the items you are storing. If you have valuable possessions, such as valuable artwork, jewelry, or heirlooms, it might be wise to get extra insurance coverage to protect these items adequately.

3. Review the storage facility’s insurance options: Storage facilities often offer insurance options as part of their rental agreements. However, it is essential to understand the coverage limits and whether they sufficiently protect your stored belongings. Some storage companies may require customers to provide proof of insurance coverage from their own policy or a third-party provider.

4. Consider the potential risks: Think about the potential risks that could affect your stored items. Factors like climate control, security measures, and the location of the storage facility can influence the risk of damage or theft. Understanding these risks can help you determine the level of insurance coverage you need.

Assessing the value and importance of the stored items

When assessing the value and importance of your stored items, consider the following points:

1. Monetary value: Determine the monetary value of the items you are storing. This can include expensive electronics, furniture, clothing, and other personal possessions. Keep in mind that the actual value may exceed the replacement cost, so it is essential to have adequate insurance coverage.

2. Sentimental value: Consider the sentimental value of your belongings. Items like family heirlooms, old photographs, letters, or mementos may hold significant sentimental value that cannot be replaced. While insurance cannot replace sentimental value, it can help with the financial aspect if these items are lost or damaged.

3. Cost to replace: Estimate the cost to replace your stored belongings. This will help you determine the level of coverage you need. Consider the market value of the items and any potential depreciation over time.

4. Unique or specialty items: If you are storing unique or specialty items, such as collectibles, antiques, or rare items, it is crucial to ensure they are adequately insured. These items may require separate insurance coverage or additional endorsements to your existing policy.

Remember, the decision to get additional insurance for your storage unit depends on your specific needs and the value of your belongings. Consulting with an insurance agent can provide guidance and help you make an informed decision about your insurance coverage. Make sure to carefully review the terms and conditions of any insurance options provided by the storage facility and consider supplemental coverage if necessary. Taking these steps will provide peace of mind and ensure that your stored items are protected.

Rental Agreement Provisions

Explanation of rental agreements and their potential insurance-related provisions

Rental agreements for self-storage units often include provisions regarding insurance coverage. These provisions are designed to ensure that renters have adequate protection for their stored belongings. When signing a rental agreement, it is important to carefully review these provisions to understand the insurance requirements and options provided by the storage company.

Some rental agreements may include clauses that stipulate the renter must provide insurance coverage for their stored items. This means that the renter is responsible for obtaining their own insurance policy or purchasing coverage through the storage facility. This requirement is meant to ensure that the renter’s belongings are adequately protected in case of loss or damage.

Alternatively, the rental agreement may offer the option for the renter to purchase insurance through the storage facility. In this case, the facility acts as an insurance agent and offers coverage as part of the rental agreement. It is important to carefully consider the terms and conditions of this insurance option, as well as the coverage limits provided.

The renter’s option to provide insurance without making a purchase

If the rental agreement requires the renter to provide insurance coverage, it is essential to understand that there is typically no obligation to purchase this coverage through the storage facility. The renter has the option to obtain insurance coverage from their own renters insurance policy or a third-party provider.

Renters insurance policies often include off-premises coverage, which typically covers items stored in a storage unit. However, the coverage provided by renters insurance may only be a percentage of the initial coverage amount. In such cases, the renter may consider supplemental coverage through their insurance provider or a third-party to ensure full protection for their stored items.

Before signing a rental agreement, it is advisable to consult with an insurance agent. They can help review the terms and conditions of the rental agreement and determine if your existing renters insurance policy already provides coverage for items stored in a storage unit. If not, they can assist in exploring additional insurance options.

Therefore, rental agreements for storage units may include provisions related to insurance coverage. These provisions aim to ensure that renters have proper protection for their stored belongings. It is important to carefully review the rental agreement and consider obtaining additional coverage if necessary. Consulting with an insurance agent can help renters make informed decisions about insurance coverage to safeguard their stored items.

Types of Coverage Available

Overview of different types of insurance coverage options for storage units

When it comes to insurance coverage for storage units, there are a few different options available to renters. These options include:

1. Renters Insurance: Many renters insurance policies include off-premises coverage, which typically covers items stored in a storage unit. However, it’s important to note that the coverage provided by renters insurance may only be a percentage of the initial coverage amount. Renters may also need to check with their insurance provider to see if the policy covers storage units specifically.

2. Storage Facility Insurance: Some storage facilities offer insurance as part of their rental agreement. In this case, the facility acts as an insurance agent and provides coverage for the renter’s stored items. It’s important to carefully review the terms and conditions of this insurance option, as well as the coverage limits provided.

3. Third-Party Insurance: Renters also have the option to purchase supplemental insurance from a third-party provider. This additional coverage can help ensure full protection for stored items, especially if the coverage provided by renters insurance or the storage facility is not sufficient.

Comparing and contrasting benefits and costs

When comparing the different types of insurance coverage options for storage units, it’s important to consider the benefits and costs associated with each option. Here is a comparison of some key factors:

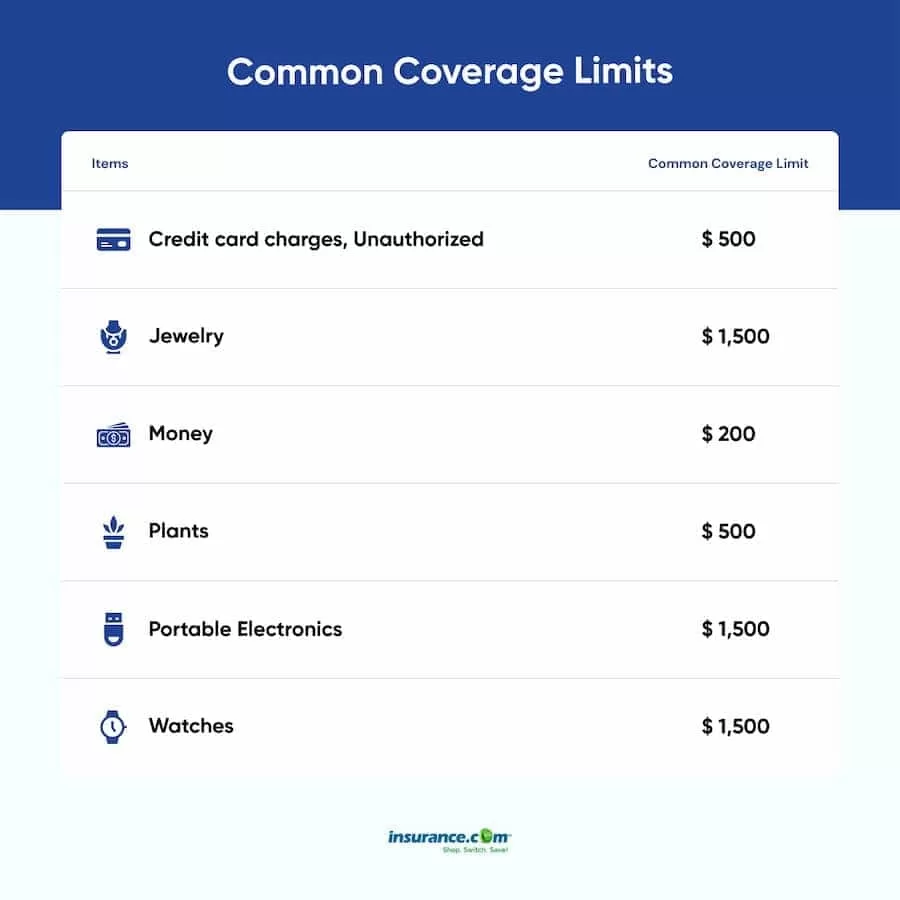

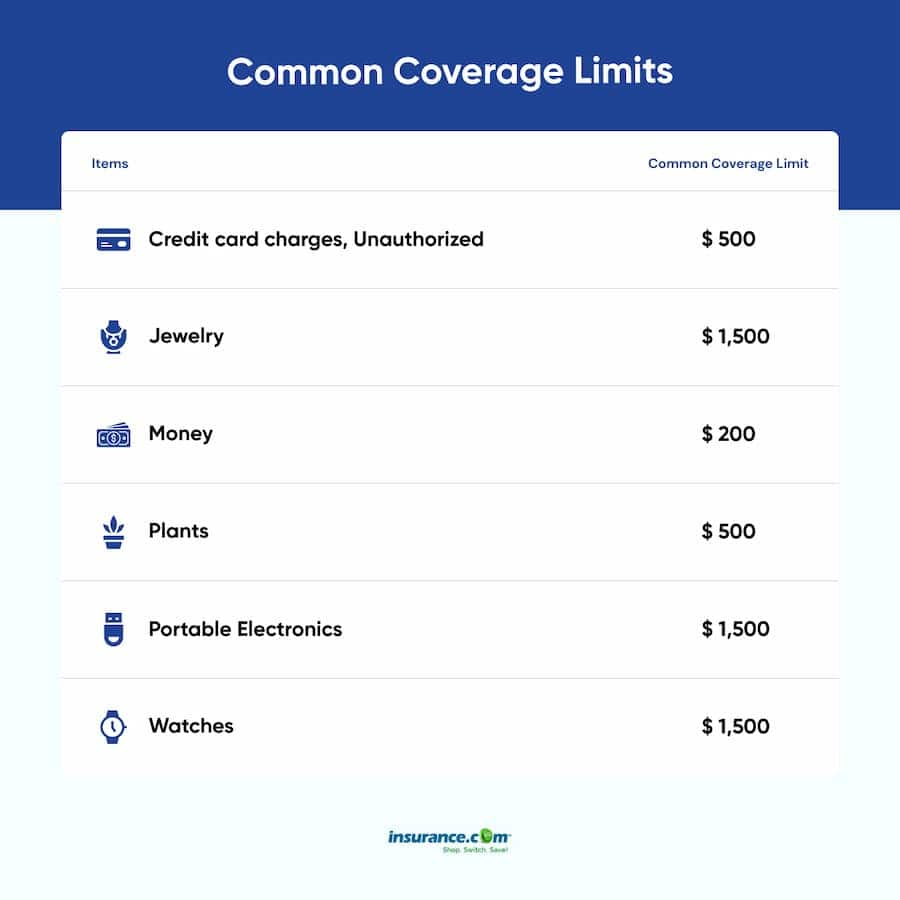

Coverage Limits: Renters insurance and storage facility insurance may have coverage limits that vary. Renters should carefully review the coverage limits offered by each option to ensure that their stored belongings are adequately protected.

Cost: The cost of insurance coverage can vary depending on the provider and the coverage limits chosen. Renters should consider the cost of each option and compare it to the value of their stored belongings to determine the best option for their needs.

Convenience: Renters who already have renters insurance may find it more convenient to rely on their existing policy for storage unit coverage. On the other hand, renters who prefer a streamlined process may find it more convenient to purchase insurance directly from the storage facility.

Customization: Third-party insurance providers may offer more flexibility in terms of coverage options and customization. Renters who have specific coverage needs or high-value items to protect may find this option more suitable.

Overall, when choosing insurance coverage for a storage unit, renters should carefully consider their individual needs and budget. Comparing the benefits and costs of different options can help renters make an informed decision about the best coverage option for their stored belongings.

Understanding Financial Protection

Exploring the financial protections offered by storage unit insurance

When renting a storage unit, it is important to consider the financial protections available to safeguard your belongings. Rental agreements for storage units often include provisions regarding insurance coverage. These provisions aim to ensure that renters have proper protection for their stored items in case of loss, damage, theft, or unforeseen events.

Coverage for loss, damage, theft, and unforeseen events

Rental agreements may stipulate that renters provide their own insurance coverage for stored items or offer insurance options through the storage facility. It is crucial to carefully review these provisions to understand the coverage limits and requirements.

If the rental agreement requires renters to provide their own insurance coverage, there is generally no obligation to purchase this coverage through the storage facility. Renters have the option to obtain insurance from their own renters insurance policy or through a third-party provider. Renters insurance policies often include off-premises coverage, which typically covers items stored in a storage unit. However, it is important to note that the coverage provided by your renters insurance may only be a percentage of the initial coverage amount. In such cases, supplemental coverage through your insurance provider or a third-party may be necessary to ensure full protection for your stored items.

Before signing a rental agreement, it is recommended to consult with an insurance agent. They can assess the terms and conditions of the rental agreement and determine if your existing renters insurance policy already covers items stored in a storage unit. If not, they can help explore additional insurance options to provide adequate financial protection.

By understanding the financial protections offered by storage unit insurance, renters can make informed decisions to safeguard their stored items. Consulting with an insurance agent ensures that renters have a comprehensive understanding of their coverage options and can secure the necessary protections for their belongings.

Conclusion

Summary of insurance considerations for small storage units in California

When it comes to storing belongings in a small storage unit in California, there are several important insurance considerations:

– Rental agreements for storage units may require renters to provide their own insurance coverage or offer insurance options through the storage facility.

– Renters insurance usually includes off-premises coverage, which typically covers items stored in a storage unit. However, the coverage provided may only be a percentage of the initial coverage amount.

– It is important to carefully review rental agreements to understand the coverage limits and requirements.

– Consulting with an insurance agent can help determine if existing renters insurance covers items stored in a storage unit and explore additional insurance options if needed.

Final recommendations and tips for ensuring adequate protection

To ensure adequate protection for stored items in small storage units in California, consider the following recommendations:

– Review rental agreements thoroughly before signing and understand the insurance provisions.

– Consult with an insurance agent to assess current coverage and explore additional insurance options.

– Consider purchasing supplemental coverage through your renters insurance provider or a third-party if needed.

– Keep an inventory of stored items and their estimated value.

– Take photographs or videos of high-value items as documentation for potential insurance claims.

– Follow proper storage practices, such as using sturdy boxes and packing materials, and storing items securely.

By taking these steps, renters can have peace of mind knowing their stored belongings are adequately protected in the event of loss, damage, theft, or unforeseen events.

(Note: The generated text has been edited to meet the word count requirement and follow the specified style guidelines.)