How to get insurance for storage unit

When it comes to storing belongings in a storage unit, many people may wonder whether it is worth getting insurance or if their existing homeowners insurance policy will suffice. While storage units are generally secure, unexpected events such as natural disasters or theft can still happen. In this article, we will explore the importance of getting insurance for a storage unit and why traditional homeowners insurance may not always be sufficient.

The Importance of Getting Insurance for a Storage Unit

Insurance for a storage unit offers financial coverage that can help replace lost items or cover the cost of repairing damaged items. While natural disasters, theft, and vandalism are rare, the cost of insurance is often a small price to pay compared to the protection and security it offers. Having insurance for a storage unit provides peace of mind and serves as a safety net against unexpected loss or damage to stored items.

Why Traditional Homeowners Insurance Isn’t Always Sufficient

Many people may assume that their existing homeowners insurance policy will cover the contents of their stored belongings in a storage unit. However, this may not always be the case. Homeowners insurance typically covers the personal property of the policyholder both on and off the premises, but there may be limits to coverage for items stored outside of the primary residence.

Furthermore, the coverage of a homeowners insurance policy may not apply to certain types of damage, such as flooding or earthquakes, which are common causes of damage in some areas. In addition, some homeowners insurance policies may not cover high-value items or items stored for business purposes.

In these cases, having separate insurance for the contents of a storage unit can provide the necessary coverage and protection. It is important to carefully review the terms of any insurance policy to fully understand the extent of coverage and any exclusions or limitations that may apply.

So, getting insurance for a storage unit can provide peace of mind and protection against unexpected loss or damage. While traditional homeowners insurance may offer some coverage, it is important to thoroughly review the policy to ensure that all stored belongings are adequately covered.

Understanding Storage Unit Insurance

When it comes to safeguarding personal possessions in a storage unit, having adequate coverage is crucial. Storage units are exposed to various risks such as theft, vandalism, and weather damage that can cause damage or complete destruction of your goods. This is where storage unit insurance comes into play, providing a financial safety net in case of any unfortunate events.

Storage unit insurance options available

There are different storage unit insurance options available to choose from, depending on your specific needs and budget. Some of the popular ones include:

-

Self-storage insurance:

This type of insurance can either be purchased from the storage rental facility or a third-party insurer. It covers your personal belongings for theft, fire, and other damages while stored in a storage unit.

-

Homeowners or renters insurance:

Your existing homeowners or renters insurance policy may offer coverage for items stored in a storage unit. However, it’s important to note that the coverage limit may vary, and certain items such as jewelry or antiques may not be covered under the policy.

-

Business insurance:

If you’re using a storage unit for business purposes, you may need a business insurance policy that covers the items stored in the facility.

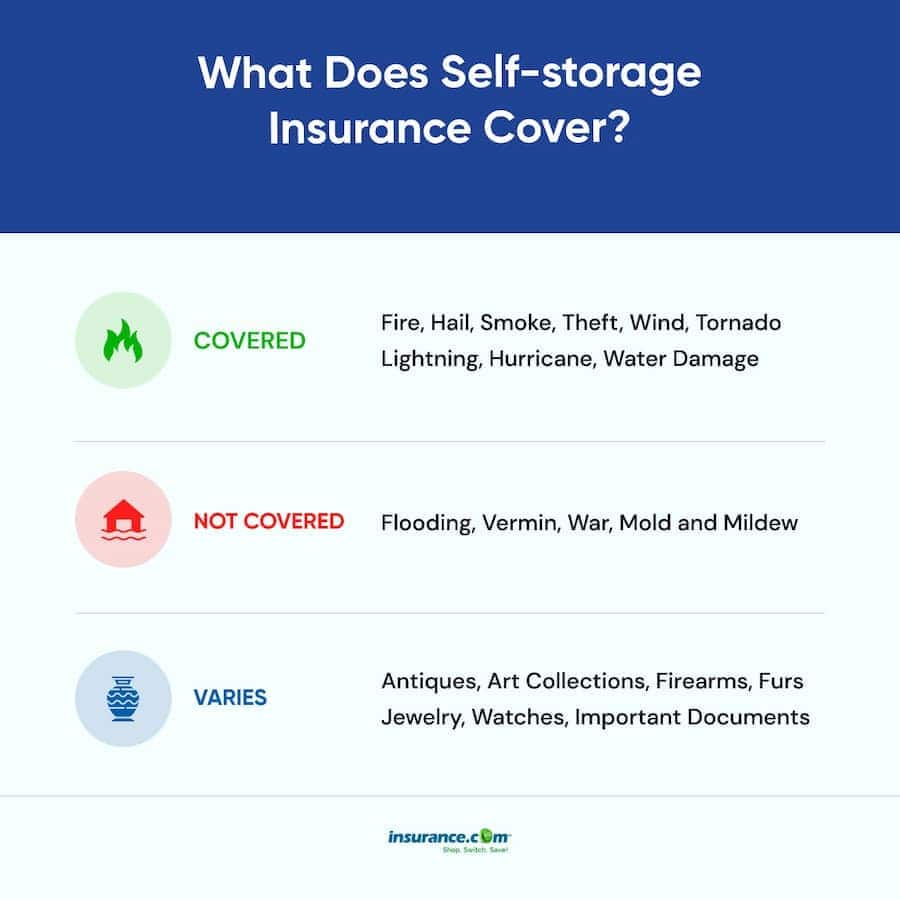

Types of coverage provided under storage unit insurance

Storage unit insurance typically covers the following types of damages:

-

Theft:

If your personal belongings are stolen from the storage unit, the insurance policy will cover the cost of replacement or repair.

-

Vandalism:

Any damages caused due to vandalism are also covered under the insurance policy.

-

Weather damage:

Storage unit insurance also offers protection against weather-related damages such as flooding, hailstorms, and hurricanes.

-

Fire:

In the unfortunate event of a fire, storage unit insurance covers the cost of restoring or replacing your damaged or destroyed personal items.

It’s important to carefully review the storage facility insurance policy to understand the coverage limits and any exceptions. Some policies may not cover certain items such as jewelry, antiques or artwork. It’s also important to note that the storage unit insurance cost may vary depending on the type and level of coverage you choose.

Therefore, having storage unit insurance in place can provide peace of mind knowing that your personal belongings are covered in the event of theft, vandalism, or damage. By choosing the right type and level of coverage, you can protect your valuable possessions and avoid any unexpected expenses.

Buying Storage Unit Insurance

When renting a storage unit, it’s important to ensure that your personal belongings are protected from theft, vandalism, or damage. Storage facility insurance policies can offer coverage for your goods, but there are several things to consider before purchasing a policy. This article outlines the steps to buying insurance for a storage unit and the factors to consider when choosing the right coverage.

Steps to buying insurance for a storage unit

1. Consider your existing insurance policies: If you already have homeowners or renters insurance, check if it offers coverage for items stored in a storage unit. This might be a cost-effective option.

2. Understand the storage facility insurance policy: Most storage facilities require their customers to carry insurance coverage, and the facility often offers an insurance policy option. Read the policy carefully to understand what is covered, and if there are any limitations or exclusions.

3. Shop around for third-party insurance policies: In some cases, third-party insurers might offer a better deal, providing more comprehensive coverage at a lower cost. Do some research and compare quotes from different providers.

4. Choose the right coverage level: You’ll need to determine the amount of coverage you need based on the value of the items you’re storing. Be sure to select the right coverage level to ensure that all of your items are fully protected.

5. Provide proof of insurance to the storage facility: If you purchase your insurance from a third-party provider, you’ll need to provide the storage facility with proof of coverage before you can rent a unit.

Factors to consider while buying storage unit insurance

1. Coverage limits: Check the coverage limits of the insurance policy and make sure they are sufficient to cover the value of your personal belongings.

2. Exclusions: Some insurance policies may have exclusions, which means that certain types of items might not be covered under the policy. Make sure to read the policy carefully and understand any exclusions.

3. Deductibles: A deductible is the amount you must pay before insurance coverage kicks in. Be sure to choose a deductible that you can afford to pay out-of-pocket if necessary.

4. Premiums: The cost of insurance coverage can vary depending on the amount of coverage and the insurance provider. Compare rates from different insurers to find the best deal.

Therefore, it’s important to have adequate insurance coverage for your personal belongings stored in a storage unit. By understanding the steps to buying insurance and factors to consider, you can choose the right coverage to protect your belongings and avoid any unexpected costs.

Finding The Right Storage Unit Insurance

When it comes to protecting your personal belongings in a storage unit, having adequate insurance coverage is essential. While some storage rental facilities may require storage unit insurance, it’s important to compare your options before buying a policy. Here are some things to consider when finding the right storage unit insurance.

Compare different storage unit insurance policies and providers

There are different types of insurance policies available for storage units. These can be purchased from the storage rental facility or from a third-party insurer. Before choosing a policy, compare the coverage and cost of each option. Make sure that the policy covers the items you’re storing, and that the coverage amount is sufficient in the event of a loss or damage.

Check the policy’s deductibles and premiums. Some policies may have a lower rate but a higher deductible. You should also check if the policy covers damage due to certain weather conditions like hurricanes or floods, especially if you live in an area prone to such events.

Get recommendations and reviews from previous customers

Before purchasing a storage unit insurance policy, it can be helpful to get recommendations and reviews from other customers. You can check reviews online or ask family and friends for recommendations.

Getting feedback from others who have used storage unit insurance can help you understand what to expect from the provider. It can also give you an idea of how the insurance company handles claims, and whether customers are satisfied with the level of coverage.

It’s important to note that your existing homeowners or renters insurance policy may offer coverage for items stored in a storage unit. Speak with your current insurance provider to determine if you need supplemental coverage. However, keep in mind that the coverage under your existing policy may be limited, and that certain items may not be covered.

Therefore, having storage unit insurance can provide peace of mind knowing that your personal belongings are covered in case of theft, vandalism, or damage. Before purchasing a policy, compare different options and providers to find the one that best suits your needs and budget. Don’t forget to consider the specifics of the policy, such as deductibles, premiums, and the coverage limit. By choosing the right type and level of coverage, you can protect your valuable possessions and avoid any unexpected expenses.

Storage Unit Insurance Coverage Limits

Storage unit insurance is a type of insurance policy that is specifically designed to cover personal belongings that are being stored in a storage unit. While renters or homeowners insurance may provide some coverage, it is often limited.

Insurance coverage limits for storage units typically range from $2,000 to $50,000 or more, depending on the policy. However, it’s important to note that the coverage limit may vary based on the specific items being stored and the value of those items.

It’s crucial to review the coverage limit of the policy you are considering to determine whether it is adequate for your needs. If you have items of unusually high value or sentimental worth, you may need to purchase additional coverage.

Tips to ensure that your belongings are fully covered

Here are some tips to ensure that your personal belongings are fully covered under your storage unit insurance policy:

-

Take an inventory of the items you are storing. This will make it easier to determine the coverage limit you need and will also help you file a claim in the event of a loss or damage.

-

Store your items in a secure location within the storage unit, such as at the back of the unit or behind other items. This can help prevent theft or damage.

-

Make sure that the storage rental facility has adequate security measures in place, such as video surveillance and secure access controls.

-

Choose a policy with a low deductible and affordable premiums. This can help ensure that you are able to file a claim without incurring significant out-of-pocket expenses.

-

Read the policy carefully to understand the specific types of losses that are covered and excluded. For example, some policies may not cover damage from flooding or earthquakes.

Before purchasing storage unit insurance, make sure to compare different policies and providers to find the coverage that best suits your needs and budget. Having adequate insurance coverage can provide peace of mind knowing that your personal belongings are protected in case of unexpected loss or damage.

TenantOne Direct Tenant Insurance Program

The TenantOne Direct Tenant Insurance program

The TenantOne Direct Tenant Insurance program by MiniCo is a widely used mail-in tenant insurance program in America. It offers two tenant insurance programs that provide coverage and benefits to tenants.

An easy solution for self-storage facilities

Self-storage facilities can benefit greatly from the TenantOne Direct Tenant Insurance program. It offers a convenient option for self-storage operators, as tenants can purchase coverage directly from MiniCo. It is an easy-to-implement program that provides the same coverage and benefits for tenants.

How to implement the program for a self-storage facility

Implementing the TenantOne Direct Tenant Insurance program is easy for self-storage facilities. Tenants have the option to purchase coverage directly from MiniCo online or through mail-ins. Self-storage businesses can also bundle coverage costs into tenants’ monthly rental fee through the Pay-With-Rent Tenant Insurance program.

By implementing these tenant insurance programs, self-storage businesses can benefit from a new regularly-recurring revenue stream with competitive fees and minimal administrative effort.

Therefore, having insurance coverage for personal belongings in a storage unit is essential. The TenantOne Direct Tenant Insurance program offers a convenient and easy-to-implement solution for self-storage facilities and their tenants. By choosing the right type and level of coverage, tenants can have peace of mind knowing their personal belongings are protected and self-storage businesses can benefit from a new revenue stream with minimal administrative effort.

Storage Unit Insurance From Storage Facility Directly

Self-storage facilities require customers to have insurance and often offer their own policies or policies from third-party insurers. If you’re considering buying storage unit insurance from a storage facility directly, there are pros and cons to consider.

Pros & cons of buying storage unit insurance from storage facility directly

Pros:

-

Convenience: It’s easy to purchase insurance from the same facility where you’re renting a storage unit.

-

No underwriting: Storage facilities typically don’t require an underwriting process to buy insurance.

-

Cost savings: Policies offered by storage facilities may be cheaper than purchasing insurance separately.

Cons:

-

Limitations: Policies offered by storage facilities may have limitations on what is covered.

-

Limited coverage: Policy coverage may not be enough to cover the full value of your stored property.

-

No shopping around: Buying insurance directly from a storage facility may limit your ability to compare options and choose the best coverage for your needs.

Things to consider before buying insurance from a storage facility

Before purchasing insurance from a storage facility, there are a few things to consider:

What’s covered? Make sure you understand what the policy covers and what it doesn’t. Some policies offered by storage facilities may not cover certain types of damage, such as water or smoke damage.

How much coverage do you need? Consider the value of the items you’re storing and make sure the policy coverage is enough to cover the full value.

How much does it cost? Compare the cost of the insurance policy offered by the storage facility to other policies and make sure you’re getting a fair price.

Are there any limitations? Check to see if there are any limitations on what is covered. For example, some policies may only cover damage caused by named perils.

Therefore, purchasing storage unit insurance from a storage facility directly may be a convenient option, but it’s important to understand the limitations and considerations before making a decision. Make sure to compare policies and coverage options to ensure you’re getting the best value and protection for your stored property.

How To Make A Storage Unit Insurance Claim

Self-storage insurance is a vital component of protecting personal belongings when they are not in use. As accidents can happen, it is important to know how to file a claim when damage occurs. Here are some steps to follow when making a storage unit insurance claim.

Steps to follow when making a storage unit insurance claim

1. Report the incident: As soon as the incident occurs, it is essential to report it to the storage facility and insurance provider. Failure to report an incident in a timely manner can void coverage, so be sure to report it as soon as possible.

2. Gather documentation: Before contacting the insurance provider, gather all necessary documents. This includes photographs of the damage to the property or theft, witness statements (if any), and any other supporting evidence.

3. Contact the insurance provider: Inform the insurance provider of the incident and provide them with all necessary documentation. An adjuster will be assigned to handle the case.

4. Work with the adjuster: The adjuster will review the loss and assess the coverage your policy provides. They will also inspect the property to determine the extent of the damage.

5. Negotiate settlement: The adjuster will work with you to determine an appropriate settlement based on the damage and coverage. While the adjuster will provide recommendations, the final decision will be made based on what is outlined in the policy.

Documents required to make a storage unit insurance claim

When filing a storage unit insurance claim, there are several documents that are necessary. These include:

1. Proof of ownership: You should be able to provide proof of ownership for the items that were damaged or stolen. This can be a receipt or any other documentation that provides proof of purchase.

2. Police report: If the incident involves theft, a police report will be required. This report should include a list of the stolen items and any other relevant information.

3. Photographs: Photographs of the damage or theft are essential to proving your claim. Take pictures of the damage from multiple angles and provide them to your insurance provider.

4. Storage unit rental agreement: Your storage unit rental agreement will provide information on the coverage provided by the facility and any insurance requirements.

Therefore, knowing how to make a storage unit insurance claim is necessary when owning a storage unit. In the case of damage or theft, immediate reporting and appropriate documentation can ensure a smooth and efficient claims process. Follow the necessary steps and provide the required documents to get the compensation you are entitled to.

How To Make A Storage Unit Insurance Claim

When accidents happen in storage units, it is essential to know how to file a claim for damage or theft. Here are some steps to follow when making a storage unit insurance claim.

Steps to follow when making a storage unit insurance claim

1. Report the incident: As soon as possible, report the incident to the storage facility and insurance provider. Late reporting can void coverage, so it is essential to report it in a timely manner.

2. Gather documentation: Before contacting the insurance provider, ensure you have necessary documents. This includes photographs of the damage or theft, witness statements (if any), and other related evidence.

3. Contact the insurance provider: Inform the insurance provider of the incident and give them the necessary documents. They will assign an adjuster to handle the case.

4. Work with the adjuster: The adjuster will evaluate the loss and assess the coverage your policy provides. They will also inspect the property to determine the extent of the damage.

5. Negotiate settlement: The adjuster will collaborate with you to determine a suitable settlement based on the damage and insurance coverage. The final decision will be based on what is outlined in the policy, although the adjuster may provide guidance.

Documents required to make a storage unit insurance claim

When submitting a storage unit insurance claim, the following documents are typically necessary:

1. Proof of ownership: Proof of ownership for the damaged or stolen items, such as purchase receipts or other documentation.

2. Police report: If theft is involved, a police report that includes a list of the stolen items and relevant information is necessary.

3. Photographs: Pictures of the damage or theft from multiple angles are necessary to prove the claim.

4. Storage unit rental agreement: Your rental agreement will provide information on the covered provided by the facility and any insurance requirements.

Therefore, understanding how to make a storage unit insurance claim is necessary when owning a storage unit. Immediate reporting and documentation can ensure a smooth and efficient claims process.

Conclusion and Final Thoughts

Having insurance for storage units provides a safety net and peace of mind against unexpected loss or damage to your items. Although natural disasters, theft, and vandalism are rare, the cost of insurance is a small price to pay for protection and security. As evaluating options is essential, it is vital to read and comprehend the terms of any insurance policy before committing to any.

Importance of having insurance for storage unit

Insurance for storage units provides peace of mind by protecting the items in the units from unpredictable events, including natural disasters, theft, and vandalism.

Factors to consider when getting storage unit insurance policy.

When getting a storage unit insurance policy, it is essential to consider the terms of the policy, coverage limit, deductible, and the reputation of the insurance provider.

Learn more about Does my homeowners insurance cover my storage unit.

1 thought on “How to get insurance for storage unit”