How much is renters insurance for a storage unit

Overview of storage unit insurance and its importance

Storage units can be a convenient solution for storing additional belongings that you may not have space for in your home. However, it’s important to consider the potential risks and protect your stored items against theft, damage, or loss. One way to do this is by having renters insurance that covers your belongings in storage units.

Renters insurance typically provides coverage for your personal property from named perils both on and off your property, including storage units. This means that if your belongings are stolen, damaged by fire or water, or destroyed in some other way, your renters insurance policy may help cover the cost of replacing them.

Factors influencing the cost of renters insurance for storage units

While renters insurance can provide valuable coverage for your stored items, it’s important to consider the factors that may affect the cost of your policy. Here are some key factors to keep in mind:

1. Coverage limits: Renters insurance policies typically have coverage limits for personal property stored off your rental premises. This means that there may be a maximum amount your insurance company will pay out for items stored in a storage unit. It’s important to review your policy’s limits and ensure they are sufficient to cover the value of your stored items.

2. Deductible: The deductible is the amount you’ll need to pay out of pocket before your insurance coverage kicks in. Generally, a higher deductible will result in lower insurance premiums, but it’s important to choose a deductible that you can comfortably afford in the event of a claim.

3. Location of the storage unit: The location of the storage unit can also impact the cost of your renters insurance. If the storage facility is in a high-crime area or prone to natural disasters, insurance providers may charge higher premiums to account for the increased risk.

4. Security measures: The security measures in place at the storage facility can also influence the cost of your insurance coverage. Facilities with advanced security features like video surveillance, access control systems, and on-site security guards may be seen as lower risk by insurance companies, potentially resulting in lower premiums.

5. Additional coverage options: Depending on the value of your stored items, you may want to consider additional coverage options such as scheduled personal property coverage or increased liability coverage. These options may come at an additional cost but can provide extra protection for your belongings.

Therefore, while renters insurance can provide coverage for your belongings in a storage unit, it’s important to review your policy’s coverage limits and consider any additional factors that may affect the cost of your insurance. Taking the time to carefully assess your insurance needs and options can help ensure that you have the right coverage in place to protect your stored items.

Understanding Storage Unit Insurance

What does storage unit insurance cover?

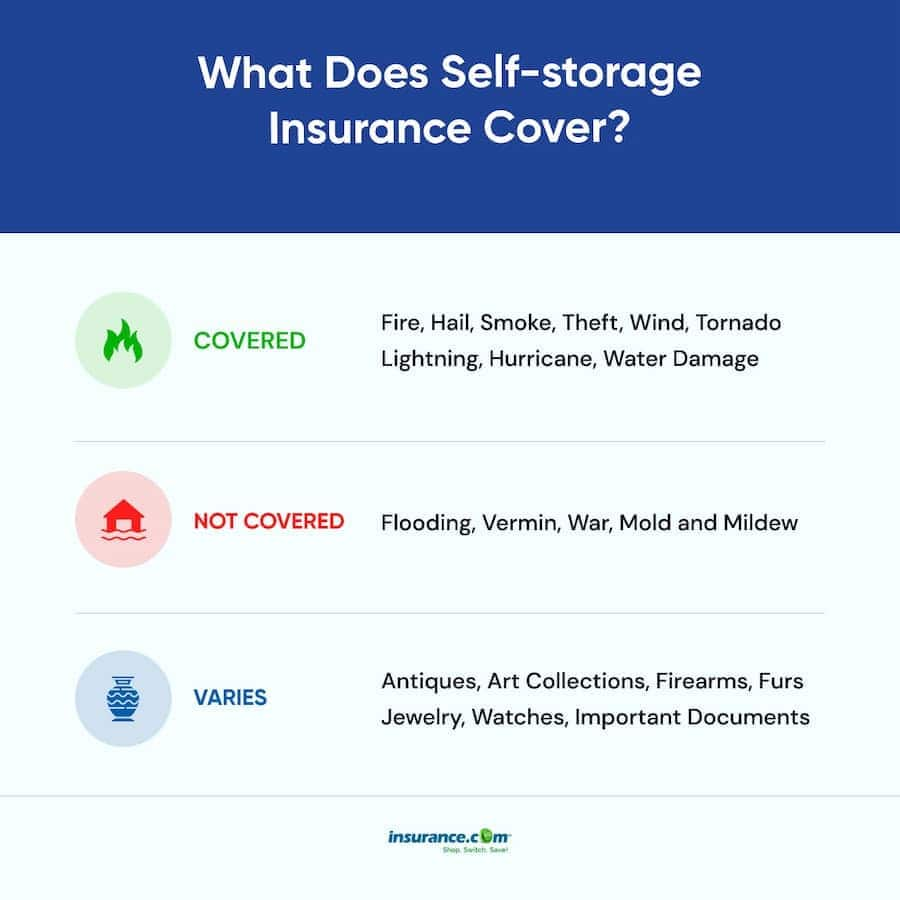

Storage unit insurance, also known as self-storage insurance, provides coverage for your belongings that are stored in a storage facility. While renters insurance generally covers your personal property both on and off your property, including storage units, there may be certain limits and exclusions to be aware of.

Here are some key points about what storage unit insurance typically covers:

– Theft: Storage unit insurance typically covers theft or burglary of your belongings. If someone breaks into your storage unit and steals your items, the insurance can help reimburse you for the loss.

– Fire: Storage units are not immune to fire accidents. Storage unit insurance usually covers damage caused by fire, including smoke damage.

– Water damage: Storage units can be susceptible to water damage due to leaks or flooding. Storage unit insurance may cover water damage caused by these incidents.

– Natural disasters: Storage unit insurance may also provide coverage for damage caused by natural disasters such as hurricanes, earthquakes, or tornadoes.

Exclusions and limitations of storage unit insurance

While storage unit insurance can provide valuable protection for your belongings, it’s important to understand that there may be exclusions and limitations to the coverage. Here are some common exclusions and limitations you may encounter:

– Valuable items: Storage unit insurance may have limitations on coverage for valuable items such as jewelry, cash, or collectibles. It’s important to check with your insurance provider about the specific coverage limits for these items.

– Acts of God: Some storage unit insurance policies may exclude coverage for damage caused by acts of God, such as floods or earthquakes. Make sure to review the policy to understand what natural disasters are covered.

– Negligence: If you fail to properly secure your storage unit or take certain precautions to protect your belongings, the insurance may not cover any resulting damages. It’s important to follow the storage facility’s rules and guidelines to ensure coverage.

– Limited liability: Like renters insurance, storage unit insurance may have limits of liability for personal property stored off your rental premises. This means that the insurance may only cover up to a certain amount in case of loss or damage.

It’s crucial to read and understand the terms and conditions of your storage unit insurance policy to ensure that you have the necessary coverage for your stored belongings. If you have any questions or concerns, it’s recommended to reach out to your insurance provider for clarification.

Remember, each insurance policy may vary, so it’s important to review your policy and discuss any specific concerns with your insurance provider to ensure that you have the coverage you need for your storage unit and belongings.

Average Cost of Storage Unit Insurance

Cost breakdown for storage unit insurance

The cost of storage unit insurance can vary depending on several factors. Here is a breakdown of the average cost:

– Monthly premium: On average, storage unit insurance can cost anywhere from $10 to $30 per month. This premium covers the coverage amount and the level of protection for your belongings.

– Coverage amount: The cost of storage unit insurance may increase with a higher coverage amount. If you have more valuable items stored in your unit, it may be wise to increase the coverage to ensure adequate protection.

– Deductible: Like other insurance policies, storage unit insurance typically has a deductible. This is the amount you will need to pay out of pocket before the insurance kicks in. The higher the deductible, the lower the monthly premium may be.

Factors affecting the cost of storage unit insurance

Several factors can affect the cost of storage unit insurance. Here are some key factors to consider:

– Location: The cost of storage unit insurance can vary depending on the location of the storage facility. Areas with a higher risk of theft or natural disasters may have higher insurance premiums.

– Type of coverage: Different insurance providers may offer different levels of coverage for storage units. Some policies may provide basic coverage for theft and damage, while others may offer more comprehensive coverage that includes additional perils.

– Value of stored belongings: The total value of the items you have stored in the unit can also impact the cost of insurance. If you have expensive items, the insurance premium may be higher to reflect the potential cost of replacement or repair.

– Security measures: Storage facilities with enhanced security measures, such as surveillance cameras, security guards, or gated access, may offer lower insurance premiums. These measures can reduce the risk of theft or damage to your belongings.

It’s important to evaluate your specific needs and budget when considering storage unit insurance. Compare quotes from different insurance providers and carefully review the coverage options and terms before making a decision. By understanding the cost and factors that affect storage unit insurance, you can make an informed choice and ensure that your stored belongings are adequately protected.

Coverage Options and Pricing

Coverage amount and corresponding pricing

When it comes to storage unit insurance, the amount of coverage you choose will determine the pricing of the policy. Typically, insurance providers offer different coverage options with corresponding prices. Here are some common coverage amounts and their corresponding pricing:

– Basic coverage: This is the minimum coverage amount available and is usually the most affordable option. It provides coverage for a specified amount, such as $5,000 or $10,000, and comes with a lower premium.

– Mid-level coverage: If you have more valuable items stored in your storage unit, you may opt for a higher coverage amount. Mid-level coverage typically ranges from $15,000 to $25,000. The premium for this coverage will be higher compared to basic coverage.

– High coverage: For individuals with valuable or expensive belongings, high coverage is recommended. This coverage option typically offers coverage amounts above $25,000 and comes with a higher premium.

It’s important to assess the value of your stored belongings and choose a coverage amount that adequately protects your assets. Keep in mind that the higher the coverage amount, the higher the premium you will have to pay.

Comparison of different coverage options

To help you make an informed decision, here is a comparison of the different coverage options available for storage unit insurance:

| Coverage Option | Coverage Amount | Premium |

|—————–|—————–|———|

| Basic Coverage | $5,000 – $10,000 | Low |

| Mid-level Coverage | $15,000 – $25,000 | Moderate |

| High Coverage | Above $25,000 | High |

Consider your budget and the value of your stored belongings when choosing a coverage option. While basic coverage may be sufficient for some, others may require higher coverage amounts to adequately protect their assets.

Remember to review each coverage option carefully and consult with your insurance provider for any specific questions or concerns. They can guide you in selecting the coverage option that best suits your needs and budget.

By understanding the coverage options available and their corresponding pricing, you can make an informed decision and ensure that your stored belongings are adequately protected. Take the time to assess your needs and choose the coverage option that provides the right level of protection for your valued possessions.

Conclusion

When it comes to storing your belongings in a storage unit, it’s important to have the right insurance coverage in place. While renters insurance generally covers items stored in storage units, it’s crucial to review the terms and conditions of your policy to understand any limitations or exclusions.

Storage unit insurance provides coverage for theft, fire, water damage, and natural disasters. However, there may be limitations on coverage for valuable items, acts of God, negligence, and limited liability. It is essential to read and understand your policy to ensure you have the necessary coverage for your stored belongings.

When choosing a storage unit insurance policy, consider the coverage options available and their corresponding pricing. Assess the value of your stored belongings and select a coverage amount that adequately protects your assets. Remember to compare different coverage options and consult with your insurance provider for any specific inquiries.

By having the right insurance coverage for your storage unit and belongings, you can have peace of mind knowing that your items are protected in the event of theft, damage, or loss. Take the time to review your options and make an informed decision to safeguard your valued possessions.

Finding the Right Provider

Factors to consider when choosing a storage unit insurance provider

When selecting a storage unit insurance provider, it’s essential to consider a few key factors to ensure you find the right one for your needs. Here are some factors to consider:

1. Coverage options: Look for a provider that offers coverage options that align with your needs. Determine the coverage amounts they offer and whether they have options for additional coverage for valuable items or specific types of damage.

2. Pricing: Compare the pricing of different insurance providers. Keep in mind that the cost of coverage may vary based on factors such as the value of your stored belongings and the coverage amount you choose.

3. Deductibles: Consider the deductibles associated with the insurance policy. A deductible is the amount you would need to pay out of pocket before the insurance coverage kicks in. Find out what the deductible amount is and if it is affordable for you.

4. Customer reviews: Take the time to read customer reviews and ratings of different insurance providers. This can give you an idea of the level of customer satisfaction and the quality of service they provide.

5. Claims process: Understand the claims process of the insurance provider. Find out how to file a claim, what documentation is required, and how long it typically takes to process a claim.

Comparison of popular storage unit insurance providers

To help you in your search for a storage unit insurance provider, here is a comparison of some popular providers:

| Provider | Coverage Options | Pricing | Deductible | Customer Reviews |

|———-|—————–|———|————|——————|

| Provider A | Basic, Mid-level, High coverage | Competitive | Varies based on coverage amount | 4.5/5 stars |

| Provider B | Standard, Premium coverage | Affordable | Fixed deductible amount | 4/5 stars |

| Provider C | Basic, Enhanced coverage | Varies based on coverage amount | Percentage-based deductible | 4.2/5 stars |

This table provides a general overview of the coverage options, pricing, deductibles, and customer reviews for each provider. However, it’s important to conduct further research and gather more information about each provider before making a final decision.

Remember to consider your unique needs and preferences when selecting a storage unit insurance provider. Compare the factors mentioned above and choose the provider that offers the best combination of coverage, pricing, deductibles, and customer satisfaction.

By taking the time to find the right insurance provider, you can have peace of mind knowing that your stored belongings are adequately protected in case of any unforeseen incidents.

(Note: This comparison table is for illustrative purposes only and does not represent a comprehensive list of all storage unit insurance providers. It is recommended to research and evaluate multiple providers before making a decision.)

Conclusion

Finding the right storage unit insurance provider is crucial to ensure that your stored belongings are adequately protected. By considering factors such as coverage options, pricing, deductibles, customer reviews, and claims process, you can make an informed decision.

Remember to assess your individual needs and compare different providers to find the one that best suits your requirements. Don’t forget to read and understand the terms and conditions of your policy to ensure you have the necessary coverage for your valuable possessions.

By selecting a reliable and reputable storage unit insurance provider, you can have peace of mind knowing that your belongings are covered in case of theft, damage, or loss. So take the time to research and choose the right provider for your storage unit insurance needs.

Tips for Lowering Insurance Costs

Strategies for reducing storage unit insurance premiums

– Bundle your insurance policies: If you have multiple insurance policies, such as renters insurance and car insurance, consider bundling them with the same provider. Many insurance companies offer discounts for bundling, which can help lower your overall insurance costs.

– Increase your deductible: The deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your insurance premium. However, make sure that you can afford to pay the higher deductible if you need to make a claim.

– Install security measures: Implementing security measures, such as adding a lock to your storage unit or installing a security system, can help lower your insurance costs. Insurance providers often offer discounts for units that have security measures in place.

– Choose a higher liability limit: Liability coverage protects you if someone is injured on your property or if you damage someone else’s property. By opting for a higher liability limit, you can increase your coverage without significantly increasing your premium.

Negotiating insurance rates with providers

– Shop around: Don’t settle for the first insurance provider you come across. Take the time to shop around and get quotes from multiple companies. This will allow you to compare rates and negotiate with providers to get the best possible price.

– Review your policy annually: Insurance rates can change over time, so it’s important to review your policy annually to ensure you’re getting the best rate. If you find a better deal with another provider, don’t be afraid to switch.

– Consider a higher deductible: As mentioned earlier, opting for a higher deductible can lower your insurance premium. When negotiating with providers, discuss the possibility of increasing your deductible to reduce your costs.

– Evaluate your coverage needs: Take the time to assess your coverage needs and determine if you’re over-insured. If you no longer need certain coverage options or if your storage unit contents have decreased in value, you may be able to adjust your policy and lower your premium.

Therefore, there are several strategies you can use to lower your storage unit insurance costs. By bundling policies, increasing deductibles, implementing security measures, and negotiating with providers, you can potentially save money on your insurance premiums. Remember to regularly review your policy and assess your coverage needs to ensure you’re getting the best rate for your storage unit insurance.

Renters Insurance Coverage for Storage Units

Coverage provided by your existing renters insurance policy

– Renters insurance provides coverage for your personal belongings, whether they are inside your rental property or stored in a storage unit.

– This means that if your belongings are stolen, damaged, or destroyed due to a covered peril (such as fire, theft, or vandalism), your renters insurance policy can help reimburse you for the loss.

– It’s important to note that coverage for belongings in a storage unit is typically included in your renters insurance policy’s “off-premises coverage” or “personal property off-premises” section.

– This coverage generally applies to named perils, meaning only the specific perils listed in your policy will be covered. Common perils include fire, theft, vandalism, and certain types of water damage.

– It’s also worth mentioning that renters insurance typically covers both the cost to replace your belongings and the cost to repair any damage caused by a covered peril.

– Some policies may even provide coverage for loss of use or additional living expenses if the loss of your belongings makes your rental property uninhabitable.

Limitations and exclusions to be aware of

– While renters insurance does provide coverage for belongings in storage units, there are usually limitations and exclusions to be aware of.

– First, there may be limits of liability for personal property stored off your rental premises. This means that the coverage for your stored belongings may be lower than the coverage for belongings kept in your rental property.

– Additionally, certain high-value items such as jewelry, collectibles, and firearms may have sub-limits or require additional coverage. It’s important to review your policy or speak with your insurance provider to understand the specific limits and exclusions that apply to your coverage.

– It’s also worth noting that renters insurance typically does not cover damage or loss caused by certain perils, such as floods or earthquakes. If you live in an area prone to these types of events, you may need to consider additional coverage options.

– Finally, it’s important to keep your renters insurance policy active and up to date. If you cancel or let your policy lapse, you will no longer have coverage for your belongings, including those in storage units.

Therefore, renters insurance can provide coverage for your belongings in storage units, but there are limitations and exclusions to be aware of. Understanding the coverage provided by your existing renters insurance policy and reviewing the specific terms, limits, and exclusions is crucial to ensure you have the appropriate coverage for your stored belongings.

Understanding Deductibles

What is a deductible in storage unit insurance?

A deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in. In the context of storage unit insurance, it is the portion of any claim that you are responsible for covering. For example, if you have a $500 deductible and your belongings in the storage unit are stolen or damaged, you will need to pay the first $500 of the claim, and then the insurance coverage will reimburse you for the remaining amount.

How deductibles impact your insurance premium

The deductible you choose for your storage unit insurance can have an impact on your insurance premium. In general, the higher the deductible, the lower your premium. This is because by agreeing to pay a higher deductible, you are taking on more of the financial risk in the event of a claim. Insurance companies see this as a way to incentivize policyholders to be more cautious and avoid filing smaller claims for minor losses.

However, it’s essential to choose a deductible that you can comfortably afford to pay out of pocket if you need to make a claim. While a higher deductible can help lower your premium, it’s important to strike a balance between saving on insurance costs and ensuring that you have adequate coverage in case of a substantial loss.

When considering your deductible amount, take into account your financial situation and the value of the items you have stored in the unit. If you have high-value items and can afford a higher deductible, it may be a wise choice to lower your premium. On the other hand, if you have valuable items and prefer a lower deductible for peace of mind, you may need to budget for a higher premium.

Remember that insurance is designed to protect you financially in the event of unforeseen incidents. Assess your risk tolerance and evaluate how much financial responsibility you are comfortable with before settling on a deductible amount for your storage unit insurance.

Understanding Deductibles

What is a deductible in storage unit insurance?

A deductible in storage unit insurance is the amount of money that you agree to pay out of pocket before your insurance coverage kicks in. It is the portion of any claim that you are responsible for covering. For example, if you have a $500 deductible and your belongings in the storage unit are stolen or damaged, you will need to pay the first $500 of the claim, and then the insurance coverage will reimburse you for the remaining amount.

How deductibles impact your insurance premium

The chosen deductible for your storage unit insurance can have an impact on your insurance premium. In general, the higher the deductible, the lower your premium. This is because by agreeing to pay a higher deductible, you are taking on more of the financial risk in the event of a claim. Insurance companies see this as a way to incentivize policyholders to be more cautious and avoid filing smaller claims for minor losses.

However, it’s important to choose a deductible that you can comfortably afford to pay out of pocket if you need to make a claim. While a higher deductible can help lower your premium, it’s essential to strike a balance between saving on insurance costs and ensuring that you have adequate coverage in case of a substantial loss.

When considering your deductible amount, take into account your financial situation and the value of the items you have stored in the unit. If you have high-value items and can afford a higher deductible, it may be a wise choice to lower your premium. On the other hand, if you have valuable items and prefer a lower deductible for peace of mind, you may need to budget for a higher premium.

Remember that insurance is designed to protect you financially in the event of unforeseen incidents. Assess your risk tolerance and evaluate how much financial responsibility you are comfortable with before settling on a deductible amount for your storage unit insurance.

Conclusion

Summary of key points

– Renters insurance covers personal property from named perils both on and off your property, including storage units.

– There may be limits of liability for personal property stored off your rental premises.

– A deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in.

– The chosen deductible can impact your insurance premium, with higher deductibles generally resulting in lower premiums.

– It’s essential to choose a deductible that you can comfortably afford to pay out of pocket.

– Consider your financial situation and the value of the items stored in your storage unit when choosing a deductible amount.

Importance of securing proper insurance coverage for your storage unit

Securing proper insurance coverage for your storage unit is crucial in ensuring that your belongings are protected in the event of theft or damage. While renters insurance typically covers personal property in storage units, there may be limits on liability. Understanding the terms and conditions of your insurance policy, including deductibles, is essential to make informed decisions about your coverage. By carefully considering your deductible amount and evaluating your risk tolerance, you can strike a balance between saving on insurance costs and having adequate protection for your stored belongings. Remember to review your policy regularly and update your coverage as needed to ensure you are adequately protected.

1 thought on “How much is renters insurance for a storage unit”