Homeowners insurance and storage units

What is homeowners insurance and why is it important?

Homeowners insurance is a type of insurance that provides coverage for your property in case of damage or loss. It is important because it helps protect your investment, ensuring that you are financially protected in the event of unexpected incidents, such as theft, fire, or natural disasters. Homeowners insurance typically covers the structure of your home, as well as your personal belongings.

Understanding the concept of storage units and their usage

Storage units are facilities that provide additional space for individuals to store their personal belongings. They are commonly used when people are moving, downsizing, or simply need extra space to store items that they do not use on a regular basis. Storage units can be a convenient and secure way to store your belongings, as they are typically equipped with security measures such as CCTV cameras, keypad access, and alarmed units.

Does homeowners insurance cover storage units?

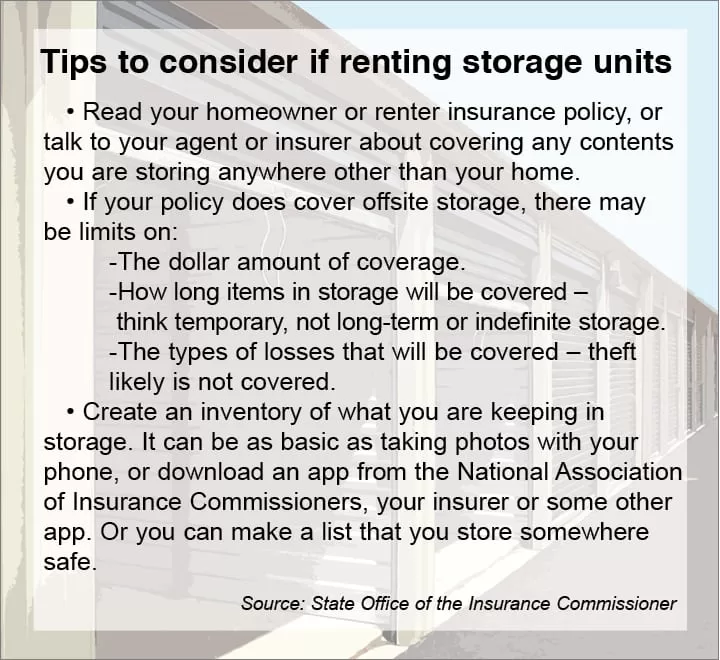

While homeowners insurance may provide coverage for items stored in a storage unit, the extent of coverage can vary. It is important to review your policy or speak to your insurance provider to understand the specific terms and limitations of your coverage. Here are some key points to consider:

-

Off-premises coverage: Homeowners insurance typically includes off-premises coverage, which means that your personal belongings are protected even when they are not physically within your home. This coverage can extend to items stored in a storage unit.

-

Coverage limitations: However, it is important to note that the coverage for items stored in a storage unit may be limited compared to the coverage for items within your home. Some policies may have lower coverage limits for off-premises belongings or may exclude certain types of losses, such as flood or earthquake damage.

-

Valuables coverage: Homeowners insurance may also have limitations on coverage for valuable items, such as jewelry, artwork, or collectibles. If you are storing expensive or valuable items, it is worth checking if your policy provides sufficient coverage or if you need to obtain additional insurance specifically for these items.

Additional insurance options for storage units

If your homeowners insurance does not provide adequate coverage for items stored in a storage unit, there are additional insurance options that you can consider:

|

Option |

Description |

|---|---|

|

Storage unit insurance |

Some storage facilities offer their own insurance coverage options. These policies are specifically designed to provide coverage for items stored in their units. |

|

Rider or floater policy |

You may be able to add a rider or floater policy to your existing homeowners insurance to extend coverage for valuable items stored in a storage unit. This option provides additional coverage tailored to your specific needs. |

|

Specialized insurance |

If you have valuable or high-risk items that require additional coverage, you may need to consider specialized insurance options, such as fine arts insurance or jewelry insurance. These policies provide comprehensive coverage for specific types of valuable items. |

Conclusion

Therefore, while homeowners insurance may provide coverage for items stored in a storage unit, the extent of coverage can vary. It is important to review your policy and understand the limitations to ensure that you have adequate protection for your belongings. If necessary, consider additional insurance options, such as storage unit insurance or specialized coverage for valuable items.

Coverage for Belongings in Storage Units

How homeowners insurance provides coverage for belongings in storage units

Your homeowners insurance can act as a form of “storage unit insurance” by extending its off-premises coverage to include items you keep in storage units. This coverage is known as personal property coverage, which is designed to protect your belongings from certain types of losses, such as theft, fire, and vandalism. However, it is important to note that the extent of coverage may vary depending on your specific policy and conditions.

Exploring the off-premises personal property coverage

When it comes to covering your belongings in a storage unit, your homeowners insurance typically applies the same limits and deductibles as it would for items within your home. However, it’s essential to review your policy carefully to understand the limitations and exclusions that may apply to off-premises coverage. Keep in mind that while your policy may provide coverage, it might not cover all of the valuables you store off-premises.

To ensure you have the coverage you need, consider the following:

1. Check the coverage limits: Review your homeowners insurance policy to determine the maximum coverage limit for off-premises personal property. Some policies may have a separate limit for off-premises coverage, while others may have the same limit as your personal property coverage within your home.

2. Assess the exclusions: Understand the exclusions specified in your policy that may affect coverage for items in a storage unit. Common exclusions include damage caused by floods, earthquakes, or pests, as well as specific high-value items that may require additional or separate coverage.

3. Consider additional coverage options: If your homeowners insurance falls short in covering your valuable belongings in a storage unit, consider purchasing additional insurance options specifically designed for storage units. Storage unit insurance or tenant insurance policies can provide more comprehensive coverage for your stored items.

4. Take inventory and document your belongings: Before storing your items in a storage unit, create a detailed inventory of all the items you plan to store. Take photographs or videos of valuable items as evidence of their condition before storing them. This documentation can be helpful in the event of a claim.

5. Inform your insurance company: It is essential to inform your insurance company about your intent to use a storage unit and verify that your current policy covers your stored belongings adequately. If necessary, make any necessary adjustments or purchase additional coverage to protect your valuables.

Therefore, while your homeowners insurance can provide coverage for your belongings in a storage unit through its off-premises coverage, it is important to review your policy carefully and consider additional coverage options if needed. Taking the necessary steps to ensure you have adequate coverage will give you peace of mind knowing that your stored items are protected.

Limitations and Exclusions

Understanding the coverage limitations and exclusions for items in storage units

When relying on your homeowners insurance as storage unit insurance, it is important to be aware of the limitations and exclusions that may apply. Here are some factors to consider:

– Damage from specific events: While your homeowners insurance may cover losses due to theft, fire, and vandalism for items in storage units, it may not provide coverage for damage caused by floods, earthquakes, or pests. It’s important to review your policy to understand what events are covered.

– Coverage limits: Your policy will have a maximum coverage limit for off-premises personal property, which includes items in storage units. It’s crucial to determine the specific limit stated in your policy and ensure it is sufficient to cover the value of your stored belongings.

– Exclusions for high-value items: Some policies may have exclusions for certain high-value items, such as jewelry, artwork, or collectibles. These items may require additional or separate coverage to ensure they are adequately protected.

Factors that may affect the coverage and reimbursement

Here are additional factors that can impact the coverage and reimbursement for your belongings in a storage unit:

– Deductibles: Just like with items in your home, your homeowners insurance will have deductibles that apply to claims related to storage unit items. It’s important to understand what deductible amount you would be responsible for in the event of a loss.

– Actual cash value vs. replacement cost: When it comes to reimbursement for lost or damaged items, some policies may provide actual cash value, which takes into account depreciation, while others may offer replacement cost coverage, which covers the cost of replacing the item at its current value. Review your policy to understand which type of reimbursement you have.

– Additional coverage options: If you find that your homeowners insurance coverage falls short for your stored belongings, there are additional coverage options available. Storage unit insurance or tenant insurance policies can provide more comprehensive coverage specifically designed for items in storage units.

In all cases, it’s important to take inventory and document your stored belongings before placing them in a storage unit. This documentation can serve as evidence of the item’s condition and value, which may be helpful in the event of a claim.

Ultimately, understanding the limitations and exclusions of your homeowners insurance coverage for storage units, as well as considering additional insurance options, will help ensure you have the necessary protection for your stored belongings. Taking the time to review your policy and make any adjustments or purchases as needed will provide you with peace of mind knowing that your valuable items are adequately covered.

Types of Damage Covered

Theft, vandalism, and weather-related damage: what is covered?

When it comes to coverage for belongings in storage units, homeowners insurance typically extends its off-premises coverage to protect against certain types of losses. These can include theft, vandalism, and damage caused by various weather-related events, such as fire, wind, hurricanes, tornadoes, water damage, hail, lightning, and smoke. In other words, if your belongings are damaged or stolen while in a storage unit, your homeowners insurance may provide coverage for these perils.

However, it is important to note that coverage may vary depending on your specific policy and conditions. Some policies may exclude certain types of perils or have limitations on the coverage amount. Therefore, it is essential to carefully review your policy and understand the specific terms and conditions related to off-premises coverage.

Exploring the specified perils that affect belongings in storage units

While homeowners insurance generally covers theft, vandalism, and weather-related damage, there are certain perils that may not be covered when it comes to protecting your belongings in a storage unit. These perils typically include:

– Flooding: Damage caused by flooding is not typically covered by homeowners insurance. If your storage unit is located in an area prone to flooding, you may want to consider separate flood insurance to protect your belongings.

– Mold and mildew: Damage caused by mold and mildew is often excluded from homeowners insurance coverage. This is because mold and mildew are considered maintenance issues rather than sudden and accidental events.

– Vermin: Damage caused by pests or vermin, such as rodents or insects, is usually not covered by homeowners insurance. To protect against this, it may be necessary to take preventive measures or consider separate insurance coverage that includes vermin damage.

– Earthquake: Earthquake damage is generally not covered by standard homeowners insurance policies. If you live in an earthquake-prone area, it is recommended to obtain separate earthquake insurance to protect your belongings in storage.

– War: Damage caused by acts of war or military conflict is typically excluded from homeowners insurance coverage.

It is important to carefully review your homeowners insurance policy to understand the specific perils that may be excluded when it comes to coverage for belongings in a storage unit. If any of these excluded perils are a concern, you may need to consider additional insurance options specifically designed for storage units or look for specialized insurance companies that offer coverage for these specific perils.

By understanding the covered perils and the ones that are excluded, you can make informed decisions when it comes to protecting your belongings in a storage unit. Reviewing your policy, assessing your coverage limits and exclusions, and considering additional coverage options if necessary will help ensure that your stored items are adequately protected. Ultimately, taking these steps will give you peace of mind knowing that your belongings in the storage unit are safeguarded against a range of potential risks.

Required Documentation

Providing the necessary documentation for filing a claim for storage unit belongings

When it comes to filing a claim for belongings stored in a storage unit, it is important to have the necessary documentation in order to support your claim and ensure a smooth process. Here are some key documents you will need:

1. Proof of ownership: In the event of theft or damage, you will need to prove that the items in your storage unit belong to you. This can be done by providing receipts, invoices, or photographs of the items before they were placed in storage. It is important to have detailed documentation that clearly shows the value and condition of each item.

2. Storage unit contract: You should keep a copy of the rental contract or agreement for your storage unit. This document will provide important information such as the address of the storage facility, the duration of the rental period, and any specific terms and conditions. It may also outline the facility’s liability and the extent of their responsibility for your belongings.

3. Inventory list: Creating a detailed inventory list of the items in your storage unit is essential. This should include a description of each item, its value, and any relevant details such as serial numbers or distinguishing features. Having a comprehensive inventory will help streamline the claims process and ensure that nothing is overlooked.

4. Photographs: Taking photographs of your stored items can be a valuable form of documentation. These photos can serve as visual evidence of the condition and existence of your belongings. It is a good practice to take photos from multiple angles and capture any unique features or identifying marks.

Steps to take when documenting your items

Once you have gathered the necessary documents, it is important to take additional steps to ensure your items are properly documented:

1. Take detailed photographs: As mentioned earlier, taking photographs of your belongings is crucial. Make sure the photos are clear and well-lit, capturing all relevant details. Organize the photos in a way that corresponds to your inventory list for easy reference.

2. Update your inventory list regularly: As you add or remove items from your storage unit, be sure to update your inventory list accordingly. This will help keep an accurate record of your stored belongings and ensure that your documentation remains up to date.

3. Store your documents safely: It is important to keep your documentation in a safe and secure place. Consider making copies of important documents and storing them in a separate location, such as a safety deposit box or with a trusted family member. This will provide an extra layer of protection in case the original documents are lost or damaged.

By following these steps and having the necessary documentation in place, you can be better prepared to file a claim for your storage unit belongings. Remember to review your homeowners insurance policy to understand the specific requirements and limitations when it comes to off-premises coverage. Adequate documentation will not only help facilitate the claims process but also ensure that you receive fair compensation for any covered losses.

Additional Coverage Options

Exploring the options for additional coverage for items in storage units

In addition to the off-premises coverage provided by your homeowners insurance, there are additional coverage options you can consider to ensure your belongings in a storage unit are adequately protected.

One option is to purchase a separate storage unit insurance policy. These policies are specifically designed to provide coverage for items stored in self-storage units. They can offer higher coverage limits and may include protection against a wider range of perils, such as flooding, mold and mildew, vermin damage, and earthquake damage. These policies can be tailored to your specific needs and provide an extra layer of protection for your stored belongings.

Another option is to check if the storage facility itself offers insurance coverage. Some storage facilities may have partnerships with insurance providers and offer their own insurance policies to tenants. However, it is important to carefully review the terms and conditions of these policies, as they may have limitations or exclusions that could affect your coverage.

It is also worth considering whether your existing homeowners insurance policy offers optional coverages that can be added to protect your storage unit belongings. Some insurance companies may offer endorsements or riders that can be added to your policy to provide additional coverage for items in storage units. These optional coverages may come with specific terms and conditions, so be sure to review them carefully before making a decision.

Understanding the need for extra protection

While homeowners insurance may provide some coverage for your storage unit belongings, it is important to assess whether the limits and terms of your policy are sufficient to protect your valuable items. Some factors to consider include:

– The total value of the items you plan to store: If you have high-value items or a large quantity of belongings, you may need additional coverage to ensure that you are adequately protected.

– The specific perils you want to be covered for: If you are concerned about perils such as flooding, mold and mildew, vermin damage, or earthquake damage, it may be necessary to seek additional coverage options beyond what your homeowners insurance provides.

– The limitations or exclusions in your homeowners insurance policy: Carefully review your policy’s terms and conditions to understand any limitations or exclusions that could impact your coverage for storage unit belongings. This can help you determine whether additional coverage is needed.

By carefully assessing your needs and considering additional coverage options, you can ensure that your storage unit belongings are adequately protected. Remember to review your policy regularly and update your coverage as needed to reflect any changes in the value or quantity of your stored items. Taking these steps will help you have peace of mind knowing that your belongings are safeguarded against a range of potential risks.

Comparison with Other Insurance Policies

How homeowners insurance compares to other insurance policies that cover storage units

When it comes to protecting your belongings in a storage unit, there are several insurance options to consider. Here’s a comparison of how homeowners insurance measures up against other insurance policies designed specifically for storage units:

| | Homeowners Insurance | Storage Unit Insurance |

|———————-|—————————————-|————————————–|

| Coverage | Provides off-premises coverage | Specific coverage for storage units |

| Limits | Coverage limits may vary | Higher coverage limits available |

| Perils Covered | Standard perils covered by homeowners | Additional perils (e.g., flooding, mold, mildew) may be included |

| Policy Customization | Limited customization options | Tailored policies to meet specific needs |

| Exclusions | May have limitations and exclusions | Review terms and conditions carefully |

| Cost | Typically included in homeowners policy | Separate policy with its own cost |

Pros and cons of different insurance options

Here are some pros and cons of the different insurance options available for protecting your storage unit belongings:

Homeowners Insurance:

– Pros: May already be included in your homeowners policy, familiarity with your existing insurance company, potential cost savings.

– Cons: Coverage limits may not be sufficient, limited customization options, exclusions and limitations may apply.

Storage Unit Insurance:

– Pros: Specifically designed for storage units, higher coverage limits available, may cover a wider range of perils.

– Cons: Separate policy with its own cost, may require researching and comparing different insurance providers.

Ultimately, the choice between homeowners insurance and storage unit insurance depends on your individual needs and preferences. Assessing the value of your stored items and the specific perils you want coverage for will help determine the best option for you. Consulting with an insurance professional can also provide valuable guidance in selecting the right coverage at a price that fits your budget.

Remember, regardless of the insurance option you choose, it is important to review your policy regularly and update your coverage as needed. This will ensure that your storage unit belongings are adequately protected against potential risks.

Tips for Insuring Belongings in Storage Units

Useful tips for ensuring adequate coverage and protection for your stored items

Here are some tips to help you secure the necessary coverage and protection for your belongings in storage units:

1. Review your homeowners insurance policy: Take the time to understand the extent of coverage provided by your homeowners insurance for items in storage units. Consider any limitations or exclusions that may impact your coverage and determine if additional coverage is needed.

2. Purchase a separate storage unit insurance policy: Consider buying a dedicated storage unit insurance policy that offers higher coverage limits and protection against a wider range of perils, including flooding, mold and mildew, vermin damage, and earthquake damage. This can provide an extra layer of protection for your stored belongings.

3. Research the storage facility’s insurance options: Check with the storage facility to see if they offer insurance coverage for tenants. Review the terms and conditions of their insurance policies to understand any limitations or exclusions that may impact your coverage.

4. Consider optional coverages from your homeowners insurance: Check if your existing homeowners insurance policy offers endorsements or riders that can be added to provide additional coverage for items in storage units. These optional coverages may come with specific terms and conditions, so be sure to review them carefully.

Preventive measures to minimize the risk of damage or loss

In addition to securing adequate insurance coverage for your stored items, there are steps you can take to minimize the risk of damage or loss:

1. Properly pack and organize your belongings: Use appropriate packing materials and methods to protect your items from potential damage during storage. Label boxes and create an inventory to make retrieval easier and maintain an organized storage space.

2. Choose a reputable storage facility: Research and select a storage facility that has a good reputation for security and a clean, well-maintained environment. Look for features such as surveillance cameras, secure access, and climate control options to ensure the safety of your belongings.

3. Consider climate-controlled storage units: If you have items that are sensitive to temperature and humidity fluctuations, such as electronics, artwork, or delicate furniture, opt for a climate-controlled storage unit. This can help prevent damage caused by extreme temperatures or moisture.

4. Maintain insurance coverage and update as needed: Regularly review your insurance coverage to ensure it aligns with the value and quantity of your stored items. Update your policy as necessary to reflect any changes and additions to your storage unit contents.

By following these tips and taking preventive measures, you can minimize the risk of damage or loss to your belongings in storage units. Remember to regularly review and update your insurance coverage to provide the necessary protection for your stored items.

Conclusion

Recap of the importance of homeowners insurance for storage unit belongings

So, it is crucial to understand the coverage provided by your homeowners insurance for items in storage units. While off-premises coverage can extend to storage units, it may be limited and not cover all the valuables you store. Review your homeowners insurance policy and consider additional coverage options to ensure adequate protection for your stored belongings.

Final thoughts and recommendations for securing your stored items

To properly secure your stored items and minimize the risk of damage or loss, follow these recommendations:

1. Review your homeowners insurance policy and consider purchasing a separate storage unit insurance policy for higher coverage limits and protection against a wider range of perils.

2. Check with the storage facility to see if they offer insurance coverage for tenants and review the terms and conditions.

3. Consider adding optional coverages from your homeowners insurance to provide additional protection for items in storage units.

4. Properly pack and organize your belongings, choose a reputable storage facility with good security measures, consider climate-controlled storage units for sensitive items, and regularly update your insurance coverage.

By taking these steps, you can ensure that your belongings in storage units are properly insured and protected. Remember to review your insurance coverage regularly to keep it aligned with the value and quantity of your stored items.

Learn more about Are storage units insured for theft.