Farmers insurance storage unit insurance

Overview of Farmers Insurance and the Importance of Storage Unit Insurance

Farmers Insurance is a well-known and reputable provider of homeowners insurance. Many homeowners and renters rely on Farmers Insurance to protect their belongings in case of unforeseen events such as theft, fire, or natural disasters. However, when it comes to using your homeowners insurance for a self-storage unit, it is important to understand that this may not be the best idea.

The Illusion of Convenience

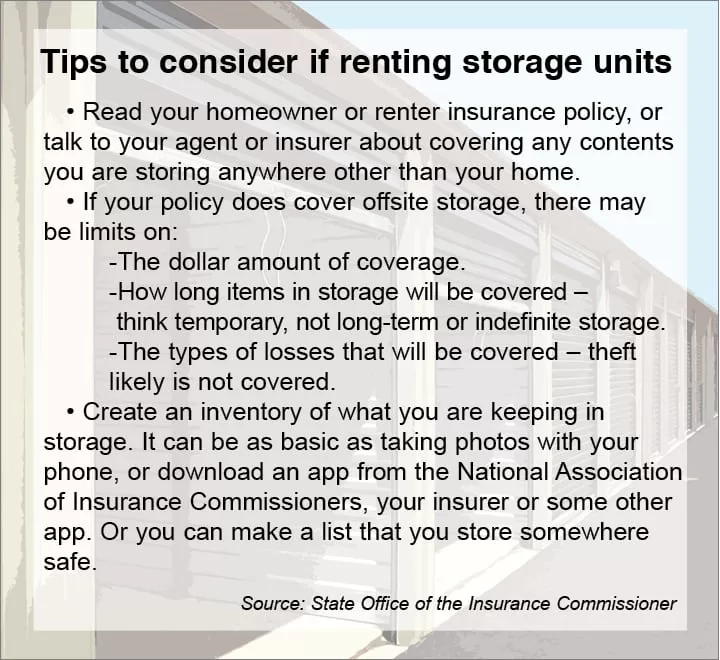

One of the main reasons why homeowners insurance may seem like a convenient option for self-storage users is that many self-storage facilities require their customers to have insurance for the full replacement cost of the contents of their storage unit. These facilities often ask to see a copy of your homeowners or renters policy before proceeding with renting a unit. While this may seem like a simple and easy solution, it is important to consider the limitations and disadvantages of relying on your homeowners insurance for self-storage coverage.

Limitations of Homeowners Insurance for Self-Storage

Using your homeowners insurance for a self-storage unit comes with several limitations and drawbacks, including:

1. Limited coverage: Homeowners insurance typically provides limited coverage for belongings stored off-premises, such as in a self-storage unit. The coverage may only be a fraction of what your policy offers for belongings kept within your home.

2. Deductibles and depreciation: Most homeowners insurance policies have deductibles, which means you would need to pay a certain amount out of pocket before your insurance coverage kicks in. Additionally, homeowners insurance may only provide coverage for the depreciated value of your belongings, rather than their full replacement cost.

3. Policy exclusions: It is important to carefully review your homeowners insurance policy to determine if it covers belongings stored in a self-storage unit. Some policies may have specific exclusions for items stored off-premises or may have limitations on the types of items covered.

4. Risk of premium increases: Making a claim for items stored in a self-storage unit could potentially result in an increase in your homeowners insurance premiums. This could make it more expensive to maintain coverage for your home and belongings in the long run.

Benefits of Storage Unit Insurance

While using your homeowners insurance for a self-storage unit may seem like a convenient option, it is important to consider alternatives such as storage unit insurance. Storage unit insurance is specifically designed to provide coverage for belongings stored in self-storage units, offering benefits such as:

1. Comprehensive coverage: Storage unit insurance typically provides comprehensive coverage for a wide range of risks, including theft, fire, water damage, and natural disasters. This ensures that your belongings are protected against various potential hazards.

2. Flexible coverage options: Storage unit insurance allows you to choose the coverage that suits your specific needs. You can select coverage limits based on the value of your stored belongings, ensuring that you have adequate protection.

3. No impact on homeowners insurance: Opting for storage unit insurance means that any claims made for items stored in your self-storage unit will not affect your homeowners insurance policy. This allows you to maintain separate coverage for your home and belongings without the risk of premium increases.

4. Peace of mind: By having storage unit insurance, you can have peace of mind knowing that your stored belongings are protected. This can give you the confidence to store valuable or treasured items securely without worrying about potential losses.

Therefore, while using your homeowners insurance for a self-storage unit may initially seem like a convenient option, it is important to consider the potential limitations and drawbacks. Exploring alternatives such as storage unit insurance can provide more comprehensive coverage and peace of mind, ensuring that your stored belongings are adequately protected.

Understanding the Risks of Storage Units

Exploring the potential risks and pitfalls of storing belongings in a storage unit

Storage units can be a convenient solution for individuals who need extra space or are in transition. However, it’s important to understand the risks and pitfalls associated with using a storage unit to store valuable possessions. Here are some key points to consider:

1. Limited Insurance Coverage

Using your homeowners insurance for a storage unit may seem like a convenient option, but it often comes with limitations. Most homeowners insurance policies provide limited coverage for items stored outside the home, including storage units. This means that if your belongings are damaged or stolen while in storage, you may not receive full compensation for their value.

2. Exclusions and Deductibles

Even if your homeowners insurance does cover items in storage, there are often exclusions and deductibles that can reduce the amount of compensation you receive. Certain types of belongings, such as expensive jewelry or collectibles, may not be fully covered by your policy. Additionally, any claims made for items in storage may also affect your policy’s deductible, making it more expensive to file future claims for your home.

3. Inadequate Security Measures

While many storage facilities have security measures in place, such as surveillance cameras and gated access, they are not foolproof. Break-ins and thefts can still occur, leaving your stored items vulnerable. Relying solely on your homeowners insurance may not provide sufficient protection in the event of such incidents.

4. Limited Control over Conditions

Storage units can be subject to temperature fluctuations, humidity, and other environmental factors that can damage your belongings. Without proper climate control, items such as electronics, artwork, and documents may be at risk of deterioration. Homeowners insurance may not fully compensate for these damages, leaving you with significant financial loss.

5. Coverage Gaps during Transit or Relocation

If you are using a storage unit during a move or relocation, there may be gaps in coverage during the transportation of your belongings. Homeowners insurance typically covers items while they are in your home or in storage, but may not provide coverage during transit. This means your items may be at risk during the moving process, and relying solely on your homeowners insurance may not be sufficient.

Exploring Alternatives

Given the limitations and risks associated with using homeowners insurance for storage units, it’s important to explore alternative options. Some self-storage facilities offer their own insurance policies specifically tailored for stored belongings. These policies may provide more comprehensive coverage and peace of mind.

Another option is to consider separate storage insurance policies offered by insurance companies. These policies are specifically designed to cover items stored in self-storage units, providing better protection and coverage for your valued possessions.

Therefore, while it may seem convenient to rely on your homeowners insurance for a storage unit, it often comes with limitations and may not provide sufficient coverage. Understanding the risks and exploring alternative options can help ensure the safety and protection of your stored belongings.

Farmers Insurance Storage Unit Coverage

Comprehensive explanation of Farmers insurance coverage for storage units

Farmers Insurance offers coverage options specifically designed for storage units, providing comprehensive protection for your belongings. Here’s a breakdown of their coverage and the key benefits they offer:

1. Increased Coverage Limits

Unlike homeowners insurance policies, Farmers Insurance offers higher coverage limits for items stored in self-storage units. This means that you can receive full compensation for the value of your belongings in case of damage or theft.

2. Expanded Coverage Options

Farmers Insurance provides coverage for a wide range of items, including electronics, collectibles, furniture, and more. This ensures that your valuables are protected, regardless of their type or value.

3. Enhanced Security Measures

Farmers Insurance understands the importance of security when it comes to storage units. They offer coverage for losses due to theft, burglary, and vandalism, giving you peace of mind knowing that your stored items are protected.

4. Climate Control and Environmental Damage Coverage

Unlike many standard homeowners insurance policies, Farmers Insurance covers damages caused by environmental factors such as temperature fluctuations, humidity, and mold. This ensures that your belongings remain safe and protected against potential damage.

5. Coverage for Transit and Relocation

If you are using a storage unit during a move or relocation, Farmers Insurance provides coverage for your belongings during transit. This means that your items are protected from any accidents or damages that may occur during the moving process.

Exploring the Benefits of Farmers Insurance

By choosing Farmers Insurance for your storage unit coverage, you can enjoy several benefits:

– Higher coverage limits give you peace of mind knowing that your items are fully protected.

– Expanded coverage options ensure that all types of belongings are covered, regardless of their value.

– Enhanced security measures provide protection against theft, burglary, and vandalism.

– Coverage for environmental damage safeguards your belongings from temperature fluctuations, humidity, and other factors.

– Coverage during transit and relocation ensures that your items are protected throughout the moving process.

Conclusion

When it comes to protecting your stored belongings, relying solely on your homeowners insurance may not provide sufficient coverage. Farmers Insurance offers specialized coverage options for storage units, providing enhanced protection and peace of mind. By understanding the limitations of using homeowners insurance and exploring alternatives, such as Farmers Insurance, you can ensure that your valuable possessions are adequately protected.

Benefits of Farmers Insurance Storage Unit Coverage

Highlighting the advantages and benefits of choosing Farmers as your storage unit insurance provider

With the risks and limitations of using homeowners insurance for a self-storage unit in mind, it is essential to consider alternative options when it comes to protecting your stored belongings. Farmers Insurance offers specialized coverage specifically designed for self-storage units, providing you with additional benefits and peace of mind. Here are some advantages of choosing Farmers Insurance for your storage unit coverage:

1. Comprehensive Coverage: Farmers Insurance storage unit coverage offers broader protection compared to relying solely on homeowners insurance. This means that your stored belongings are more likely to be fully covered in the event of damage, theft, or other covered perils.

2. Higher Coverage Limits: Unlike typical homeowners insurance policies, Farmers Insurance storage unit coverage often provides higher coverage limits specifically for items stored in self-storage units. This means that you can have greater financial protection for your valuable possessions.

3. Additional Coverage Options: Farmers Insurance offers additional coverage options, such as coverage for business property stored in a self-storage unit. This is especially beneficial for small business owners or entrepreneurs who utilize storage units for their business needs.

4. Flexibility with Deductibles: Farmers Insurance provides flexibility when it comes to selecting deductibles for your storage unit coverage. You can choose a deductible amount that suits your budget and risk tolerance, ensuring that you have control over your insurance costs.

5. Enhanced Security Measures: Farmers Insurance understands the importance of security when it comes to protecting your stored belongings. They offer coverage for losses due to theft along with enhanced security measures, such as monitored alarm systems, to minimize the risk of theft or unauthorized access.

6. Simplified Claims Process: In the unfortunate event of a covered loss or damage to your stored belongings, Farmers Insurance offers a simplified claims process. Their responsive and efficient claims team is dedicated to resolving your claims quickly and ensuring a smooth experience for policyholders.

7. Tailored Coverage for Different Needs: Farmers Insurance recognizes that different individuals have unique storage needs. They provide customizable coverage options, allowing you to tailor your insurance policy to meet your specific requirements. Whether you need coverage for personal items, business inventory, or a combination of both, Farmers Insurance has you covered.

It is important to consult with a Farmers Insurance agent to understand the specific coverage options available in your area and determine the best policy for your storage unit needs. By choosing Farmers Insurance for your storage unit coverage, you can enjoy the benefits of comprehensive protection and peace of mind knowing that your stored belongings are well-insured.

**Contacting a Farmers Agent for a Quote**

Information on how to get a free quote for Farmers insurance storage unit coverage

When it comes to protecting your stored belongings in a self-storage unit, it is crucial to choose the right insurance coverage. Farmers Insurance offers specialized coverage designed specifically for self-storage units, providing you with added benefits and peace of mind. If you are interested in getting a quote for Farmers insurance storage unit coverage, here is some information on how to contact a Farmers agent.

1. Research and Locate a Farmers Agent: Start by researching local Farmers agents in your area. You can visit the Farmers Insurance website or use online directories to find agents near you. Look for agents who specialize in property or storage unit insurance to ensure they have the expertise needed to provide you with the right coverage.

2. Request a Quote: Once you have identified a Farmers agent, reach out to them to request a quote for storage unit coverage. You can contact them through their website, call their office, or even visit them in person. Be prepared to provide details about the storage unit location, the value of the belongings you plan to store, and any specific coverage requirements you may have.

3. Consultation and Customization: During the quote process, the Farmers agent will guide you through the available coverage options and help you tailor your insurance policy to meet your specific needs. They will explain the different coverage limits, deductibles, and additional options that you can choose from, ensuring that you have a policy that aligns with your requirements.

4. Review the Quote: Once the Farmers agent has provided you with a quote, take the time to review it carefully. Make sure you understand the coverage details, including any limitations or exclusions that may apply. Feel free to ask the agent any questions you may have to ensure that you are fully informed before making a decision.

5. Evaluate and Compare: It is always a good idea to evaluate the quote you receive from Farmers Insurance and compare it with other insurance options available to you. Consider factors such as coverage limits, deductibles, premium costs, and the reputation of the insurance provider. This will help you make an informed decision and choose the best insurance policy for your storage unit needs.

6. Make Your Decision: Once you have reviewed and compared the quotes, it’s time to make your decision. If you find that Farmers insurance storage unit coverage aligns with your needs and offers the benefits you are looking for, you can proceed with purchasing the policy. Contact the Farmers agent to finalize the insurance agreement and ensure that your stored belongings are adequately protected.

Remember, contacting a Farmers agent for a quote is the first step towards securing the right insurance coverage for your self-storage unit. They will provide you with personalized guidance and help you explore the different options available. By taking the time to research, request a quote, and evaluate your options, you can have peace of mind knowing that your stored belongings are well-insured.

Comparing Farmers Insurance to Other Options

A comparison between Farmers insurance and other storage unit insurance providers

When it comes to insuring your self-storage unit, there are various options available to you. It is important to understand the differences between them and choose the one that best suits your needs. Here is a comparison between Farmers Insurance and other storage unit insurance providers:

1. Comprehensive Coverage:

– Farmers Insurance offers comprehensive coverage for your stored belongings, providing protection against damage, theft, and other covered perils.

– Other insurance providers may also offer comprehensive coverage, depending on the policy you choose.

2. Higher Coverage Limits:

– Farmers Insurance storage unit coverage often provides higher coverage limits specifically for items stored in self-storage units. This means you have greater financial protection for your valuable possessions.

– Other insurance providers may also offer higher coverage limits, so it is important to compare the options available to you.

3. Additional Coverage Options:

– Farmers Insurance offers additional coverage options, such as coverage for business property stored in a self-storage unit. This is beneficial for small business owners or entrepreneurs.

– Other insurance providers may also offer additional coverage options, so it is worth exploring what they have to offer.

4. Flexibility with Deductibles:

– Farmers Insurance provides flexibility when it comes to selecting deductibles for your storage unit coverage. This allows you to choose a deductible amount that suits your budget and risk tolerance.

– Other insurance providers may also offer flexibility with deductibles, so compare the options available to find the best fit for you.

5. Enhanced Security Measures:

– Farmers Insurance understands the importance of security and offers coverage for losses due to theft along with enhanced security measures, such as monitored alarm systems.

– Other insurance providers may also offer security measures, so consider what additional security features they provide.

6. Claims Process:

– Farmers Insurance offers a simplified claims process, ensuring a smooth experience for policyholders in the event of a covered loss or damage.

– Other insurance providers may also have efficient claims processes, so it is important to research and compare their claims handling abilities.

7. Tailored Coverage:

– Farmers Insurance recognizes that different individuals have unique storage needs and provides customizable coverage options.

– Other insurance providers may also offer tailored coverage options, so assess their offerings to find the most suitable policy for your specific requirements.

While Farmers Insurance offers a range of benefits and advantages for storage unit coverage, it is essential to research and compare other insurance providers to ensure you make the best choice. Consult with insurance agents, read customer reviews, and consider your individual needs and budget before making a decision. Remember, the goal is to protect your stored belongings and have peace of mind knowing they are well-insured.

Frequently Asked Questions about Storage Unit Insurance

Providing answers to common questions about storage unit insurance

1. What is storage unit insurance?

Storage unit insurance is a type of insurance coverage specifically designed for protecting the contents of a self-storage unit. It provides financial protection in case of damage, theft, or other covered events that may occur to the belongings stored in the unit.

2. Why do I need storage unit insurance?

While some self-storage facilities may offer limited coverage, it is often insufficient to fully protect your valuables. Storage unit insurance provides additional coverage tailored to the specific needs of storing personal or business belongings, giving you peace of mind knowing that your items are adequately insured.

3. Is storage unit insurance mandatory?

While storage unit insurance is not always mandatory, many self-storage facilities require customers to have insurance as a condition of renting a unit. This requirement is to ensure that customers have proper coverage in case of any loss or damage to their belongings.

4. Can I use my homeowners or renters insurance for my storage unit?

Although some homeowners or renters insurance policies may provide limited coverage for items stored in a self-storage unit, relying solely on this coverage can be risky. Homeowners insurance may have limitations on coverage limits, exclusions, or higher deductibles when it comes to items stored in a storage unit. It is important to review your policy carefully and consider obtaining specialized storage unit insurance for adequate protection.

5. What does storage unit insurance typically cover?

Storage unit insurance typically covers a wide range of perils, including theft, fire, water damage, vandalism, and natural disasters. The coverage may also extend to items damaged during transportation to and from the storage facility. It is important to review the specific policy details to understand what events are covered and any exclusions or limitations that may apply.

6. How much does storage unit insurance cost?

The cost of storage unit insurance can vary depending on factors such as the value of the stored items, the coverage limits chosen, and the location of the storage facility. It is recommended to contact insurance providers to get quotes and compare coverage options to find the best policy for your needs and budget.

7. Can I cancel storage unit insurance at any time?

Yes, you can typically cancel storage unit insurance at any time. However, it is important to review the terms and conditions of your policy regarding cancellation and any applicable fees. If you decide to cancel, make sure you have an alternative insurance solution in place to protect your stored belongings.

8. How do I make a claim with storage unit insurance?

In case of a covered loss or damage, you can usually file a claim with your storage unit insurance provider by contacting their claims department or using their online claims platform. It is important to document the damage or loss, gather any necessary supporting documentation, and provide all relevant information to ensure a smooth claims process.

9. Can I increase my coverage limits over time?

Yes, many storage unit insurance policies allow you to increase your coverage limits as your storage needs change. It is recommended to periodically review your coverage and adjust it accordingly to ensure your belongings are adequately protected.

10. What should I consider when choosing storage unit insurance?

When choosing storage unit insurance, consider factors such as the coverage limits, exclusions, deductibles, additional coverage options, claims process, and the reputation of the insurance provider. It is important to compare different options and choose a policy that best suits your individual needs and provides the desired level of coverage and protection for your stored belongings.

Remember, having adequate insurance for your storage unit is crucial to safeguard your valuable possessions and provide peace of mind. It is recommended to consult with insurance professionals, read customer reviews, and thoroughly understand the terms and conditions of the policy before making a decision.

Understanding the Limitations and Exclusions

Explaining the limitations and exclusions of Farmers insurance storage unit coverage

When considering insurance for your self-storage unit, it is important to understand the limitations and exclusions that may apply. While Farmers Insurance offers comprehensive coverage with several benefits, there are certain situations and risks that may not be covered. Here are some important limitations and exclusions to be aware of:

1. Natural Disasters: Farmers Insurance does not cover damage caused by flooding, earthquakes, or other natural disasters. This means that if your stored belongings are damaged due to these events, you may not be able to make a claim.

2. Vermin, Mold, and Mildew: Damage caused by vermin, mold, and mildew is not typically covered by Farmers Insurance. If your stored items are affected by these issues, you may not receive compensation for the damage.

3. Poor Maintenance at the Self-Storage Facility: Farmers Insurance may not cover damage caused by poor maintenance at the self-storage facility. This includes issues such as roof leaks, faulty security systems, or inadequate pest control. It is important to choose a reputable facility that maintains proper upkeep to reduce the risk of damage.

4. Limit on Off-Premises Coverage: While Farmers Insurance provides coverage for personal belongings stored in self-storage units, there is often a limit. This limit is typically around 10% of the overall coverage amount specified in your homeowner’s policy. If you have valuable items stored in the unit, this limit may not be sufficient to fully cover their value.

It is crucial to carefully review your insurance policy and understand the limitations and exclusions that apply. If you have specific concerns or valuable items that require additional coverage, it may be necessary to explore alternative insurance options or consider purchasing additional coverage from Farmers Insurance.

Comparing Farmers Insurance to Other Options

A comparison between Farmers insurance and other storage unit insurance providers

When it comes to insuring your self-storage unit, there are various options available to you. It is important to understand the differences between them and choose the one that best suits your needs. Here is a comparison between Farmers Insurance and other storage unit insurance providers:

1. Comprehensive Coverage:

– Farmers Insurance offers comprehensive coverage for your stored belongings, providing protection against damage, theft, and other covered perils.

– Other insurance providers may also offer comprehensive coverage, depending on the policy you choose.

2. Higher Coverage Limits:

– Farmers Insurance storage unit coverage often provides higher coverage limits specifically for items stored in self-storage units. This means you have greater financial protection for your valuable possessions.

– Other insurance providers may also offer higher coverage limits, so it is important to compare the options available to you.

3. Additional Coverage Options:

– Farmers Insurance offers additional coverage options, such as coverage for business property stored in a self-storage unit. This is beneficial for small business owners or entrepreneurs.

– Other insurance providers may also offer additional coverage options, so it is worth exploring what they have to offer.

4. Flexibility with Deductibles:

– Farmers Insurance provides flexibility when it comes to selecting deductibles for your storage unit coverage. This allows you to choose a deductible amount that suits your budget and risk tolerance.

– Other insurance providers may also offer flexibility with deductibles, so compare the options available to find the best fit for you.

5. Enhanced Security Measures:

– Farmers Insurance understands the importance of security and offers coverage for losses due to theft along with enhanced security measures, such as monitored alarm systems.

– Other insurance providers may also offer security measures, so consider what additional security features they provide.

6. Claims Process:

– Farmers Insurance offers a simplified claims process, ensuring a smooth experience for policyholders in the event of a covered loss or damage.

– Other insurance providers may also have efficient claims processes, so it is important to research and compare their claims handling abilities.

7. Tailored Coverage:

– Farmers Insurance recognizes that different individuals have unique storage needs and provides customizable coverage options.

– Other insurance providers may also offer tailored coverage options, so assess their offerings to find the most suitable policy for your specific requirements.

While Farmers Insurance offers a range of benefits and advantages for storage unit coverage, it is essential to research and compare other insurance providers to ensure you make the best choice. Consult with insurance agents, read customer reviews, and consider your individual needs and budget before making a decision. Remember, the goal is to protect your stored belongings and have peace of mind knowing they are well-insured.

Conclusion

Summarizing the key points and emphasizing the importance of securing proper insurance for storage units

So, using your homeowners insurance for a self-storage unit may not be the best idea due to various limitations and exclusions. Farmers Insurance, one of the insurance providers that offer coverage for self-storage units, has its own set of restrictions that may leave you unprotected in certain situations. It is important to understand these limitations and consider alternative insurance options that can provide comprehensive coverage for your stored belongings.

Comparing Farmers Insurance to other storage unit insurance providers, it is clear that there are various factors to consider when choosing the right insurance policy. While Farmers Insurance offers comprehensive coverage, higher coverage limits for self-storage units, and additional coverage options, other providers may also offer similar benefits. It is crucial to research and compare the options available to ensure you select the best policy for your specific needs.

When it comes to securing proper insurance for your self-storage unit, it is important to remember the following:

– Understand the limitations and exclusions of your insurance policy to determine if it adequately covers your stored belongings.

– Take into account specific risks such as natural disasters, vermin and mold damage, and poor maintenance at the self-storage facility.

– Review the coverage limits and ensure they are sufficient to cover the full value of your belongings.

– Consider additional coverage options that may be available, such as coverage for business property stored in a self-storage unit.

– Evaluate the flexibility of deductibles and the security measures provided by the insurance provider.

– Research and compare claims handling processes to ensure a smooth experience in the event of a covered loss or damage.

– Look for insurance providers that offer tailored coverage options to meet your specific storage needs.

Securing proper insurance for your self-storage unit is essential to protect your belongings and provide peace of mind. While homeowners insurance may seem convenient, it is important to consider the limitations and exclusions that may leave you financially unprotected. By exploring alternative insurance options and comparing the benefits and advantages offered by different providers, you can make an informed decision and ensure your stored belongings are well-insured.

Check out Does renters insurance cover storage unit with geico.

2 thoughts on “Farmers insurance storage unit insurance”