Does renters insurance include coverage at a storage unit

Overview of renters insurance and its coverage

Renters insurance is a type of insurance policy that provides coverage for personal belongings and liability protection for individuals who rent their living space. It offers financial protection in case of damage or loss of personal property due to events like theft, fire, or vandalism. But what about storage units? Does renters insurance cover items stored in storage units? Let’s dive into the details.

Does renters insurance cover storage units?

Yes, renters insurance typically covers storage units. This means that if you have a storage unit where you store your belongings, your renters insurance policy will provide some level of coverage for those items. Whether you have an overcrowded apartment or need to store seasonal items, knowing that your belongings are protected can bring peace of mind.

Coverage limits on storage units

While renters insurance does cover storage units, it’s important to understand that there may be coverage limits in place. These limits determine the maximum amount that the insurance company will reimburse you for in case of a claim. The coverage limit for items in storage units is usually a percentage of the overall personal property coverage limit provided by your renters insurance policy.

For example, if your policy has a personal property coverage limit of $50,000 and the coverage for storage units is set at 10% of that limit, then you would have coverage for up to $5,000 worth of belongings in your storage unit. It’s essential to review your policy carefully to understand the specific coverage limits for your storage unit.

When to purchase additional renters coverage for a storage unit

If the coverage limit provided by your renters insurance policy is not sufficient to cover the value of your belongings in the storage unit, you may consider purchasing additional coverage. This is especially important if you have high-value items or if the total value of your stored belongings exceeds the coverage limit.

Speak to your insurance provider to discuss your options for increasing coverage or adding specific endorsements to your policy. They can guide you through the process and help you determine the best course of action based on your specific needs.

Other storage unit insurance options

Apart from renters insurance, there are other insurance options available specifically designed for storage units. Some storage facilities may offer their insurance policies, which you can purchase to supplement your existing coverage. These policies may provide higher coverage limits or additional protection for specific types of items.

It is recommended to carefully review the terms and conditions of any storage unit insurance policy offered by the storage facility. Make sure to understand the coverage limits, exclusions, and any deductible that may apply. Comparing the cost and coverage of different options can help you make an informed decision.

Final Thoughts: Does renters insurance cover items in storage units?

Therefore, renters insurance generally covers items stored in storage units. However, it’s important to know the coverage limits, consider additional coverage if needed, and explore other insurance options available. Reviewing your policy and discussing your needs with your insurance provider can help ensure that your stored belongings are adequately protected. Remember, having insurance is essential for safeguarding your personal property from unexpected events.

Understanding Renters Insurance

Explanation of what renters insurance covers and its benefits

Renters insurance offers protection for your personal belongings in the event of damage or loss. It is designed specifically for those who rent their living space, whether it’s an apartment, house, or condominium. Understanding the coverage provided by renters insurance is essential, especially when it comes to storage units.

Does Renters Insurance Cover Storage Units?

Yes, renters insurance does cover items stored in a storage unit. Most standard renters insurance policies include personal property coverage, which covers your belongings even when they are stored outside of your primary residence. This means that if your storage unit is damaged by a covered peril, such as fire, theft, or vandalism, your renters insurance will provide financial reimbursement for your lost or damaged items. However, it’s important to note that the coverage for items in a storage unit may be subject to certain limits and exclusions.

Coverage Limits on Storage Units

While renters insurance does cover items in storage units, there may be limitations on the amount of coverage provided. Most policies have a limit on the amount of coverage for personal property stored outside of the primary residence, typically around 10% of the total personal property coverage limit. For example, if your renters insurance policy has a $50,000 limit for personal property, the coverage for items in storage may be capped at $5,000. It’s important to review your policy and understand the specific coverage limits for storage units.

When to Purchase Additional Renters Coverage for a Storage Unit

If the value of the items in your storage unit exceeds the coverage limits of your renters insurance policy, it may be wise to consider purchasing additional coverage. This can be done by increasing the overall coverage limit of your renters insurance policy or by adding a separate storage unit insurance policy. By doing so, you can ensure that all your valuable items are adequately protected in case of damage or loss.

Other Storage Unit Insurance Options

In addition to renters insurance, there are other storage unit insurance options available. Some storage facilities offer their own insurance policies that you can purchase. These policies are designed specifically for the items stored in their facilities and may provide additional coverage beyond what is offered by renters insurance. It’s important to carefully read and understand the terms and conditions of any storage unit insurance policy before making a decision.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Therefore, renters insurance does cover items in storage units, but the coverage may be subject to certain limits and exclusions. It’s important to review your policy and understand the specific coverage provided for items stored outside of your primary residence. If the value of the items in your storage unit exceeds the coverage limits of your renters insurance policy, consider purchasing additional coverage to ensure adequate protection. Explore other storage unit insurance options offered by storage facilities to find the best solution for your needs.

Coverage for Personal Property in Storage Units

Explanation of how renters insurance extends coverage to storage units

Renters insurance provides coverage for personal belongings in the event of damage or loss. This applies not only to items inside your rented living space, but also to items stored in a storage unit. It’s important to understand the coverage provided by your renters insurance policy to ensure that your stored belongings are adequately protected.

Understanding Renters Insurance Coverage for Storage Units

Renters insurance typically includes personal property coverage, which extends to items stored outside of your primary residence. This means that if your storage unit is damaged or affected by a covered peril such as fire, theft, or vandalism, your renters insurance will reimburse you for the financial loss of your belongings. However, it’s important to note that there may be certain limits and exclusions when it comes to coverage for items in storage units.

Limitations on Coverage for Storage Units

While renters insurance does cover items in storage units, there are usually limitations on the amount of coverage provided. Most policies have a cap on the coverage for personal property stored outside of your primary residence, typically around 10% of the total personal property coverage limit. This means that if your renters insurance policy has a $50,000 limit for personal property, the coverage for items in storage may be capped at $5,000. It’s essential to review your policy and understand the specific coverage limits for storage units.

When to Consider Additional Coverage

If the value of the items stored in your storage unit exceeds the coverage limits of your renters insurance policy, it may be wise to consider purchasing additional coverage. This can be done by increasing the overall coverage limit of your renters insurance policy or by obtaining a separate storage unit insurance policy. Doing so will ensure that all your valuable items are adequately protected in case of damage or loss.

Exploring Other Storage Unit Insurance Options

In addition to renters insurance, some storage facilities offer their own insurance policies specifically designed for the items stored in their facilities. These policies may provide additional coverage beyond what is offered by renters insurance. It’s important to carefully read and understand the terms and conditions of any storage unit insurance policy before making a decision.

Final Thoughts: Ensuring Coverage for Items in Storage Units

Overall, renters insurance does cover items in storage units, although coverage may be subject to certain limits and exclusions. Reviewing your policy and understanding the specific coverage provided for items stored outside of your primary residence is crucial. If the value of the items in your storage unit exceeds the coverage limits of your renters insurance policy, consider purchasing additional coverage or exploring other storage unit insurance options offered by storage facilities. This will help ensure that your belongings are adequately protected in case of any unforeseen incidents.

Storage Unit Requirements

Discussion on whether storage facilities require renters insurance

When renting a storage unit, it is important to understand the requirements set by the storage facility. While renters insurance may cover items stored in a storage unit, not all storage facilities require it. Here are a few key points to consider:

1. Facility Policies: Some storage facilities may require renters insurance as part of their rental agreement. This is to protect both the facility and the renter in case of damage or loss to the stored items. It is important to check with the storage facility beforehand to determine if renters insurance is mandatory.

2. Liability: Renters insurance not only provides coverage for your personal belongings but also includes liability protection. This means that if someone is injured while in your storage unit, your renters insurance can help cover medical expenses or legal fees. Even if the storage facility does not require renters insurance, having this additional liability coverage can be beneficial.

3. Peace of Mind: Even if renters insurance is not required by the storage facility, it is still a good idea to consider purchasing a policy. Storage units can be susceptible to various risks such as fire, theft, or water damage. Having renters insurance can provide peace of mind knowing that your items are protected.

4. Comparing Options: If the storage facility does not require renters insurance, you still have the choice to purchase a policy on your own. It is recommended to compare the coverage and costs of different insurance providers to find the best option for your needs. Online platforms like Lemonade offer renters insurance policies specifically designed for those who need coverage for their storage units.

5. Storage Facility Insurance: Some storage facilities offer their own insurance policies that you can purchase. These policies may provide additional coverage or have different terms compared to traditional renters insurance. It is important to carefully review the details of the storage facility’s insurance policy to understand what is covered and any limitations that may apply.

Therefore, while renters insurance may cover items stored in a storage unit, it is not always required by the storage facility. However, having renters insurance provides an added layer of protection for your belongings and can offer liability coverage. If the storage facility does not require renters insurance, it is still a good idea to consider purchasing a policy for peace of mind. Comparing different insurance options, including those offered by storage facilities, will help you find the best coverage for your storage unit needs.

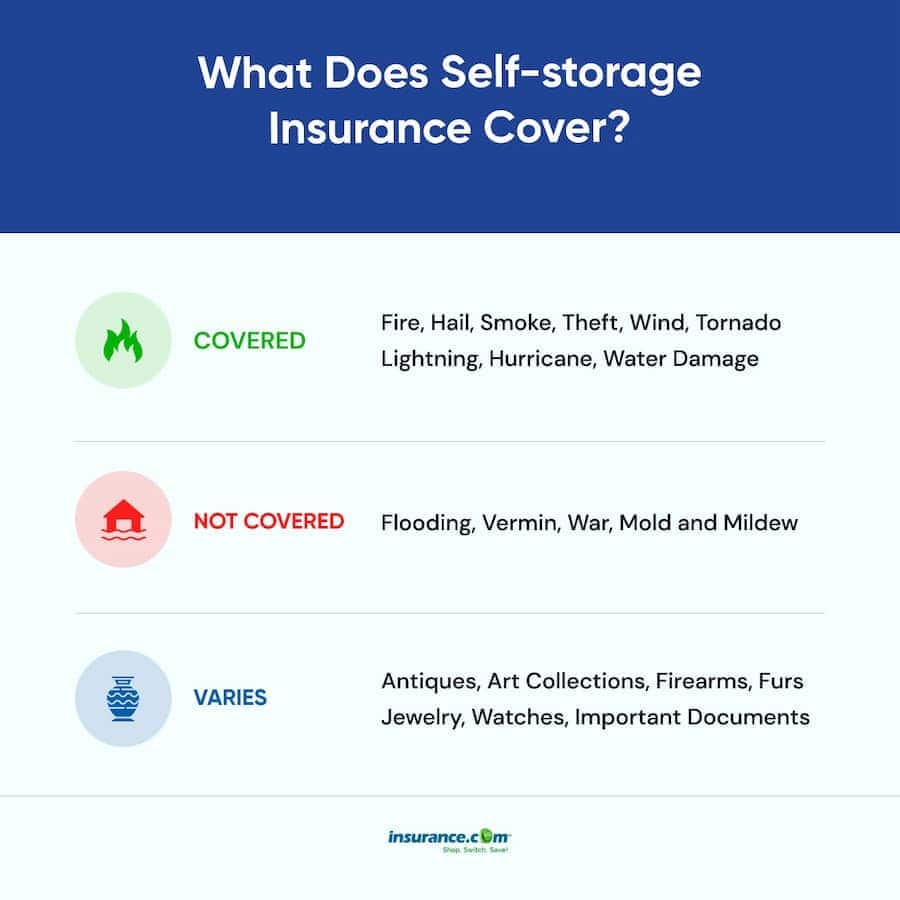

Self-Storage Coverage

Explanation of how storage facilities may offer self-storage coverage through licensed insurance companies

When it comes to storing your belongings in a storage unit, it’s important to understand the coverage options available to you. While renters insurance may cover items stored in a storage unit, not all storage facilities require it. However, some storage facilities offer self-storage coverage through licensed insurance companies. Here’s what you need to know:

1. Additional Coverage: Storage facilities that offer self-storage coverage provide an additional layer of protection for your belongings. This coverage is typically provided through licensed insurance companies that specialize in self-storage insurance. It is important to carefully review the terms and conditions of this coverage to understand what is covered and any limitations that may apply.

2. Storage Facility Requirements: While not all storage facilities require renters insurance, they may require you to have self-storage coverage through their chosen insurance provider. This requirement is in place to ensure that your belongings are adequately protected while in storage. It’s important to check with the storage facility to determine if self-storage coverage is mandatory.

3. Comparing Coverage: If the storage facility offers self-storage coverage, it’s also a good idea to compare the coverage and costs with other insurance providers. This will help you determine if the facility’s coverage is the best option for your needs. Keep in mind that self-storage coverage may have different terms and limitations compared to traditional renters insurance.

4. Understanding the Policy: When opting for self-storage coverage through a storage facility, it’s crucial to carefully review the details of the policy. This includes understanding what is covered, the coverage limits, and any deductibles that may apply. It’s also important to inquire about the claims process and how to file a claim in the event of damage or loss.

5. Additional Considerations: While self-storage coverage offered by a storage facility can provide peace of mind, it may not include liability protection. Renters insurance, on the other hand, typically includes liability coverage, which can be beneficial if someone is injured in your storage unit. If liability coverage is important to you, purchasing a separate renters insurance policy may be necessary.

So, while not all storage facilities require renters insurance, some facilities offer self-storage coverage through licensed insurance companies. This coverage provides an additional layer of protection for your belongings while in storage. It’s important to compare the coverage and costs of different options to determine the best choice for your needs. Carefully reviewing the details of the policy is crucial to ensure you understand what is covered and any limitations that may apply. Additionally, consider whether liability protection is important and if it is included in the self-storage coverage offered by the storage facility.

Limitations and Conditions

Discussion on the limitations and conditions of coverage for personal property in storage units

When it comes to renters insurance coverage for items stored in a storage unit, there are a few limitations and conditions to keep in mind. Here are some important factors to consider:

1. **Coverage Limits:** Renters insurance typically comes with coverage limits for personal property. This means that there is a maximum amount of money that the insurance company will reimburse you for in case of damage or loss. It is important to review your policy to understand these coverage limits and ensure that they are sufficient for the value of the items you have stored in the unit.

2. **Deductibles:** Renters insurance policies often come with deductibles, which is the amount of money you need to pay out of pocket before your insurance coverage kicks in. Make sure you understand the deductible amount specified in your policy and factor it into your financial planning.

3. **Valuables and Specialty Items:** Some renters insurance policies may have specific limitations or exclusions when it comes to valuable or specialty items stored in a storage unit. These could include items such as jewelry, artwork, or collectibles. It is important to carefully read your policy or speak with an insurance representative to understand if any additional coverage or special riders are needed for these items.

4. **Proof of Ownership and Value:** In the event of a claim, your insurance company may require proof of ownership and value for the items stored in your storage unit. This could include receipts, photos, or appraisals. It is recommended to keep records of your stored items to facilitate the claims process if needed.

5. **Maintenance and Security:** Insurance coverage for storage units may also be subject to the maintenance and security conditions set by the storage facility. This could include requirements such as regular inspections, adequate locks, or security systems. Failure to meet these conditions could result in the denial of a claim.

6. **Updates and Reevaluation:** As with any insurance policy, it is important to regularly review and update your renters insurance coverage. This includes reevaluating the value of your stored items, updating your policy with any new acquisitions, and ensuring that your coverage limits are still adequate.

It is crucial to be aware of these limitations and conditions to ensure that you have the proper coverage for your items stored in a storage unit. Taking the time to understand your policy and any additional requirements set by the storage facility will help provide you with the peace of mind that your belongings are adequately protected. Remember to review your policy regularly and make any necessary updates to ensure that your coverage aligns with your storage unit needs.

Determining Coverage Limits

Explanation on how renters insurance policies typically cover personal property in storage units up to 10% of the policy’s limit

When it comes to renters insurance coverage for items stored in a storage unit, it’s important to understand how the coverage limits are determined. Generally, renters insurance policies provide coverage for personal property up to a certain limit. This limit is typically based on the overall coverage limit of the policy, which is determined by factors such as the value of your possessions and the level of coverage you choose.

For personal property stored in a storage unit, renters insurance policies typically offer coverage up to 10% of the policy’s overall limit. For example, if your renters insurance policy has a coverage limit of $50,000, you would have up to $5,000 of coverage for items stored in a storage unit.

It’s essential to review your policy and understand the coverage limits for personal property in storage units. If the value of the items in your storage unit exceeds the coverage limit, you may want to consider purchasing additional coverage to ensure they are adequately protected.

In addition to the coverage limits, it’s important to consider the deductible amount specified in your policy. The deductible is the amount of money you need to pay out of pocket before your insurance coverage kicks in. Make sure to factor in the deductible when evaluating the insurance coverage for your stored items.

While renters insurance typically covers personal property in storage units, there may be limitations or exclusions for certain valuable or specialty items. Items such as jewelry, artwork, or collectibles may require additional coverage or special riders. It’s crucial to carefully read your policy or consult with an insurance representative to determine if any additional coverage is needed for these items.

When making a claim for items stored in a storage unit, your insurance company may require proof of ownership and value. This can include receipts, photos, or appraisals of the items. It’s a good practice to keep records of your stored items to facilitate the claims process if needed.

Additionally, the coverage for storage units may be subject to maintenance and security conditions set by the storage facility. This could involve requirements such as regular inspections, adequate locks, or security systems. Failing to comply with these conditions may result in the denial of a claim. Make sure to familiarize yourself with the terms and requirements set by the storage facility to ensure your coverage remains valid.

To ensure that your coverage aligns with your storage unit needs, it’s crucial to regularly review and update your renters insurance policy. This includes reevaluating the value of your stored items, updating your policy with any new acquisitions, and ensuring that your coverage limits are still adequate.

Therefore, renters insurance typically covers personal property in storage units, but there are limitations and conditions to be aware of. Understanding the coverage limits, deductibles, and any additional requirements for valuable or specialty items will help ensure that your belongings are adequately protected. Regularly reviewing and updating your policy will help ensure that your coverage remains aligned with your storage unit needs.

Additional Considerations

Factors to consider when choosing renters insurance for storage unit coverage

When it comes to choosing renters insurance for coverage of items stored in a storage unit, there are a few additional factors to consider. These considerations can help ensure that you are selecting the right policy to protect your belongings. Here are some things to keep in mind:

1. **Insurance Provider:** The first step is to choose a reputable insurance provider. Look for a company with a good track record and positive customer reviews. It’s important to have confidence in your insurance provider’s ability to handle claims and provide excellent customer service.

2. **Additional coverage:** While renters insurance generally covers personal property in storage units, it’s a good idea to check if your policy offers any additional coverage options specifically for storage units. Some insurance providers may offer endorsements or riders that provide extra protection for items kept in storage.

3. **Cost of coverage:** Consider the cost of coverage in relation to the value of the items you have stored. Review the coverage limits and deductibles of different policies to ensure you are getting the best value for your money. It may also be worth comparing quotes from different insurance providers to find the most affordable option.

4. **Review policy details:** Carefully review the details of any renters insurance policy you are considering. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations that may apply. Make sure the policy meets your specific needs and provides adequate protection for the items you have stored.

5. **Availability of claims process:** Understand the claims process of the insurance provider you choose. Find out how to file a claim and what documentation may be required. Consider the reputation of the insurance company when it comes to handling claims and how quickly they process and resolve them.

6. **Customer support:** Look for an insurance provider that offers excellent customer support. Check if they have a dedicated claims hotline or online portal for easy access to information and assistance. Having good customer support can make a big difference if you ever need to file a claim or have questions about your policy.

7. **Other storage unit insurance options:** In addition to renters insurance, there may be other insurance options specifically designed for items in storage units. It’s worth exploring these alternatives to see if they provide better coverage or lower costs. Examples include storage unit insurance offered by storage facilities or specialized insurance providers.

By considering these factors, you can make an informed decision when choosing renters insurance for coverage of items stored in a storage unit. Take the time to compare policies, understand the details, and select the policy that best meets your needs. This way, you can have peace of mind knowing that your belongings are well-protected, even when they are not in your apartment.

Summary of the coverage provided by renters insurance for personal property in storage units

Renters insurance typically covers personal property stored in a storage unit, providing financial protection in case of damage or loss. However, there are a few key points to keep in mind regarding coverage limits and additional considerations:

1. **Coverage limits:** The standard renters insurance policy has coverage limits for personal property, which may also apply to items stored in a storage unit. It’s important to review your policy and ensure that the coverage limit is sufficient to protect your belongings. If you have more expensive items, you may need to purchase additional coverage to adequately protect them.

2. **Additional coverage:** While renters insurance generally covers personal property in storage units, it’s wise to check if your policy offers any additional coverage options specifically for storage units. Some insurance providers offer endorsements or riders that provide extra protection for items stored in storage facilities.

3. **Choosing the right insurance provider:** Selecting a reputable insurance provider is crucial. Look for a company with a good track record and positive customer reviews. You want to have confidence in your insurance provider’s ability to handle claims and provide excellent customer service.

4. **Cost of coverage:** Consider the cost of coverage in relation to the value of the items you have stored. Compare the coverage limits and deductibles of different policies to find the best value for your money. Request quotes from different insurance providers to ensure you’re getting the most affordable option.

5. **Review policy details:** Thoroughly review the details of any renters insurance policy you’re considering. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations that may apply. It’s crucial to ensure that the policy meets your specific needs and provides adequate protection for the items you have stored.

6. **Understanding the claims process:** Familiarize yourself with the claims process of the insurance provider you choose. Know how to file a claim and what documentation may be required. Consider the reputation of the insurance company when it comes to handling claims and how quickly they process and resolve them.

7. **Customer support:** Look for an insurance provider that offers excellent customer support. Check if they have a dedicated claims hotline or online portal for easy access to information and assistance. Good customer support can make a significant difference if you ever need to file a claim or have questions about your policy.

8. **Exploring other insurance options:** Besides renters insurance, there may be other insurance options specifically designed for items in storage units. It’s worthwhile to explore these alternatives to see if they offer better coverage or lower costs. For example, storage facilities or specialized insurance providers may offer storage unit insurance.

By considering these factors, you can make an informed decision when selecting renters insurance for coverage of items stored in a storage unit. Take the time to compare policies, understand the details, and choose the policy that best suits your needs. This way, you can have peace of mind knowing that your belongings are well-protected, even when they are not in your apartment.

Discover Does state farm home insurance cover storage units.

1 thought on “Does renters insurance include coverage at a storage unit”