Does renter’s insurance cover storage units

When it comes to storing your personal belongings, whether in a storage unit or even in your apartment, it’s important to have insurance coverage for added protection. One common question that arises is whether renters insurance covers storage units. In this blog post, we will explore this topic and provide you with the necessary information to make an informed decision about your insurance needs.

Overview of renter’s insurance coverage

Renters insurance is designed to protect your personal property in case of damage or loss. It typically includes coverage for perils such as fire, theft, vandalism, and certain natural disasters. However, it’s important to note that the coverage provided by renters insurance extends beyond just the items inside your apartment.

Importance of understanding coverage for storage units

Many renters find themselves in a situation where they need to store their belongings in a storage unit. Whether it’s due to a move, downsizing, or simply needing extra space, having insurance coverage for these items is crucial. Understanding the coverage limits and any additional coverage needed is essential to ensure that your belongings are fully protected.

Does renters insurance cover storage units?

Yes, renters insurance typically covers storage units. Most renters insurance policies have what is called off-premises coverage, which means that your personal belongings are covered even when stored outside of your apartment. This includes storage units, whether it’s a short-term rental or a long-term solution.

Coverage limits on storage units

While renters insurance does cover storage units, it’s important to be aware of the coverage limits. Each insurance policy has its own set of limits, which determine the maximum amount of coverage you have for your personal property. These limits may vary for items stored in a storage unit compared to those kept in your apartment. It’s important to review your policy and understand these limits to ensure that your valuable belongings are adequately protected.

When to purchase additional renters coverage for a storage unit

Depending on the value of the items you plan to store in a storage unit, you may need to consider purchasing additional renters coverage. This is especially true if you have high-value items such as jewelry, electronics, or collectibles. These items may exceed the coverage limits provided by your standard renters insurance policy. In such cases, an endorsement or floater policy can be purchased to provide additional coverage specifically for these valuable items.

Other storage unit insurance options

In addition to renters insurance, storage facilities may offer insurance options specifically tailored for their units. These options may provide additional coverage or fill gaps in your existing renters insurance policy. It’s important to compare the coverage and cost of these options with your current policy to determine the best solution for your needs.

Final thoughts: Does renters insurance cover items in storage units?

Therefore, renters insurance generally covers items stored in storage units. However, it’s important to review your policy and understand the coverage limits to ensure that your belongings are adequately protected. If you have high-value items, you may need to purchase additional coverage. Additionally, exploring other insurance options provided by storage facilities can give you added peace of mind. Remember, insurance is there to protect you in case of unexpected events, so taking the time to understand your coverage is always a smart decision.

What is Renter’s Insurance?

Definition and explanation of renter’s insurance

Renter’s insurance is a type of insurance policy that provides financial protection to individuals who are renting their residence. It is designed to cover the personal property of the policyholder in case of damage, theft, or loss. Renter’s insurance also typically includes liability coverage, which can protect the policyholder in case of lawsuits or claims filed against them for injuries or damages that occur within their rented property.

Coverage details and benefits

Renter’s insurance typically covers personal belongings such as furniture, electronics, clothing, and appliances. It can also provide coverage for additional living expenses if the rented property becomes uninhabitable due to covered events. This means that if your apartment catches fire and you are temporarily displaced, your renter’s insurance policy may cover the cost of a hotel or alternative accommodation.

It is important to note that renter’s insurance does not cover the structure of the rented property, as this is the responsibility of the landlord. However, it can provide coverage for improvements made to the unit by the tenant. Renter’s insurance also includes liability coverage, which can protect the policyholder if they are found liable for injuries or damages to others on the rented property.

Renter’s insurance can provide peace of mind and financial protection for renters. It is affordable and offers a wide range of benefits. In addition to covering personal property and liability, some policies may also include coverage for jewelry, collectibles, and other high-value items. It is important to carefully review the terms and conditions of a renter’s insurance policy to ensure that it meets your specific needs and provides adequate coverage.

Does Renter’s Insurance Cover Storage Units?

Renter’s insurance typically covers personal property even when stored outside of your apartment, including in a storage unit. This means that if your belongings are damaged or stolen while in a storage unit, your renter’s insurance policy may provide coverage. However, there are some limitations to consider.

Coverage limits on storage units

The coverage for items stored in a storage unit is subject to the same limits and deductibles as the rest of your renter’s insurance policy. This means that if your policy has a limit of $20,000 for personal property coverage, that limit would apply to items stored in a storage unit as well. It is important to review your policy and understand what your specific coverage limits are.

When to purchase additional renters coverage for a storage unit

If you have valuable items that exceed the coverage limits of your renter’s insurance policy, it may be beneficial to purchase additional coverage specifically for the storage unit. This can help ensure that your high-value items are adequately protected. Some insurance companies offer add-on coverage options for storage units, allowing you to increase the coverage limits for stored items.

Other storage unit insurance options

In addition to renter’s insurance, there are other insurance options specifically designed for storage units. These policies are offered by storage facility operators and typically provide coverage for both the unit itself and the belongings stored inside. However, it is important to carefully review the terms and conditions of these policies to understand what is covered and any limitations or exclusions that may apply.

Final Thoughts

Renter’s insurance generally covers storage units, but it is important to review the terms and conditions of your policy to understand the specific limits and coverage provided. If you have valuable items that exceed the coverage limits, consider purchasing additional coverage or exploring other storage unit insurance options. Remember to carefully document your belongings and keep records of any valuable items to facilitate the claims process in case of loss or damage.

Does Renter’s Insurance Cover Storage Units?

Explanation of coverage for personal property in storage units

Renter’s insurance typically provides coverage for personal property even when it is stored outside of your apartment, including in a storage unit. This means that if your belongings are damaged or stolen while in a storage unit, your renter’s insurance policy may offer protection. However, it is important to understand the limitations and coverage limits that may apply.

Automatic coverage provided by standard policies

The coverage for items stored in a storage unit is subject to the same limits and deductibles as the rest of your renter’s insurance policy. For example, if your policy has a limit of $20,000 for personal property coverage, that limit would also apply to items stored in a storage unit. It is crucial to review your policy and familiarize yourself with the specific coverage limits.

However, if you have valuable items that exceed the coverage limits of your renter’s insurance policy, it may be wise to consider purchasing additional coverage specifically for the storage unit. Some insurance companies offer add-on coverage options for storage units, allowing you to increase the coverage limits for stored items. This can provide extra protection for your high-value possessions.

It is also worth noting that besides renter’s insurance, there are other insurance options available specifically designed for storage units. These policies are typically offered by storage facility operators and cover both the unit itself and the belongings stored inside. However, it is essential to carefully review the terms and conditions of these policies to understand what is covered and any limitations or exclusions that may apply.

Therefore, renter’s insurance generally covers storage units, but it is crucial to review your policy to understand the specific limits and coverage provided. If you have valuable items that exceed the coverage limits, consider purchasing additional coverage or exploring other storage unit insurance options. Additionally, it is essential to document your belongings and keep records of any valuable items to facilitate the claims process in case of loss or damage.

Limits and Exclusions

Details about coverage limits for personal property in storage units

When it comes to renter’s insurance coverage for items stored in a storage unit, it’s important to understand the coverage limits that apply. The coverage for stored items is typically subject to the same limits as the rest of your renter’s insurance policy. For example, if your policy has a limit of $20,000 for personal property coverage, that limit would apply to items stored in a storage unit as well. It’s crucial to review your policy and ensure that your specific coverage limits are sufficient for your stored items.

Exclusions and limitations to be aware of

While renter’s insurance does provide coverage for items stored in a storage unit, there are some exclusions and limitations to be aware of. Certain types of damage may not be covered, such as damage caused by flooding or earthquakes. Additionally, some insurance policies may have limitations on specific types of belongings, such as jewelry or collectibles. It’s important to carefully review your policy to understand any exclusions or limitations that may apply to your stored items.

It’s also worth noting that renter’s insurance typically does not cover the actual structure of the storage unit itself. This is typically the responsibility of the storage facility owner or operator. If there is damage to the unit itself, such as a roof leak or structural issue, it would be important to reach out to the storage facility for assistance.

Therefore, while renter’s insurance generally covers items stored in a storage unit, it’s important to review your policy and understand the specific coverage limits and any exclusions or limitations that may apply. If you have valuable items that exceed the coverage limits, it may be beneficial to consider purchasing additional coverage or exploring other storage unit insurance options. By carefully documenting your belongings and keeping records of any valuable items, you can facilitate the claims process in the event of loss or damage.

Theft and Vandalism Coverage

Understanding coverage for theft and vandalism in storage units

When it comes to protecting your personal belongings stored in a storage unit, renters insurance generally provides coverage for theft and vandalism. This means that if your stored items are stolen or damaged due to vandalism, your insurance policy can help reimburse you for the financial loss.

It’s important to note that the coverage for theft and vandalism in storage units is typically subject to the same limits and exclusions as the rest of your renters insurance policy. Review your policy to ensure that you have adequate coverage for these risks.

Extent of coverage and claims process

In the unfortunate event that your stored items are stolen or vandalized, it’s crucial to understand the extent of your coverage and the claims process. Here are some key points to keep in mind:

– Coverage limits: Your renters insurance policy will have specific limits on the amount of reimbursement you can receive for stolen or vandalized items. Make sure to review these limits and assess if they are sufficient for your stored belongings.

– Deductible: Like any insurance claim, you will need to pay a deductible before your insurance kicks in. Remember to factor in the deductible amount when calculating the potential reimbursement.

– Claims process: To file a claim for theft or vandalism, you will need to provide proof of the incident, such as a police report or any documentation of the damages. It’s essential to document your stored items before any incidents occur, as it can help support your claim.

– Evaluation and reimbursement: Once you file a claim, an insurance adjuster will evaluate the damages and determine the reimbursement amount based on your policy limits. It’s important to cooperate with the adjuster and provide any requested information promptly.

Overall, while renters insurance generally covers theft and vandalism in storage units, it’s crucial to review your policy and understand the specific coverage limits and claims process. If you have valuable items that exceed the coverage limits, consider purchasing additional coverage or exploring other storage unit insurance options.

By being proactive in documenting your belongings and understanding your insurance policy, you can have peace of mind knowing that your stored items are protected. Remember to regularly review and update your policy as needed, and consult with your insurance provider if you have any questions or concerns.

Weather-Related Damage Coverage

Explanation of coverage for weather-related damage to stored property

When it comes to weather-related damage to items stored in a storage unit, renters insurance can provide coverage, depending on the specific policy. Renters insurance typically covers damage caused by weather events such as storms, hurricanes, and strong winds. However, it’s important to review your policy to understand the specific coverage provided for weather-related damage to stored property.

Types of weather events covered and claims process

Renters insurance may cover a range of weather events that can cause damage to stored property. Some common types of weather events that are typically covered include:

– Storms and strong winds

– Hail and ice storms

– Hurricanes and tornadoes

If your stored items are damaged by any of these weather events, you should file a claim with your renters insurance company as soon as possible. The claims process typically involves providing documentation of the damage, such as photographs or receipts, as well as a detailed description of the items affected.

It’s important to note that renters insurance may have certain limitations or exclusions when it comes to weather-related damage. For example, flooding caused by heavy rainfall or a natural disaster like a hurricane may not be covered under a standard renters insurance policy. In these cases, you may need additional coverage, such as flood insurance, to protect your stored items.

In the event of weather-related damage to your stored property, it’s important to act quickly and follow the proper claims process outlined by your renters insurance provider. By promptly documenting the damage and providing the necessary information, you can help ensure a smooth claims process and increase the likelihood of receiving compensation for your losses.

Remember, it’s always a good idea to review your renters insurance policy to understand the specific coverage provided for weather-related damage to stored property. If you have any concerns or questions, reach out to your insurance provider and they will be able to provide you with the necessary information and guidance.

Therefore, renters insurance can provide coverage for items stored in a storage unit, including weather-related damage. However, it’s important to review your policy, understand the coverage limits, exclusions, and limitations that may apply. If you have valuable items that exceed the coverage limits, consider purchasing additional coverage or exploring other storage unit insurance options. By being proactive and informed, you can protect your stored belongings and have peace of mind.

Sub-Limits and Location Dependence

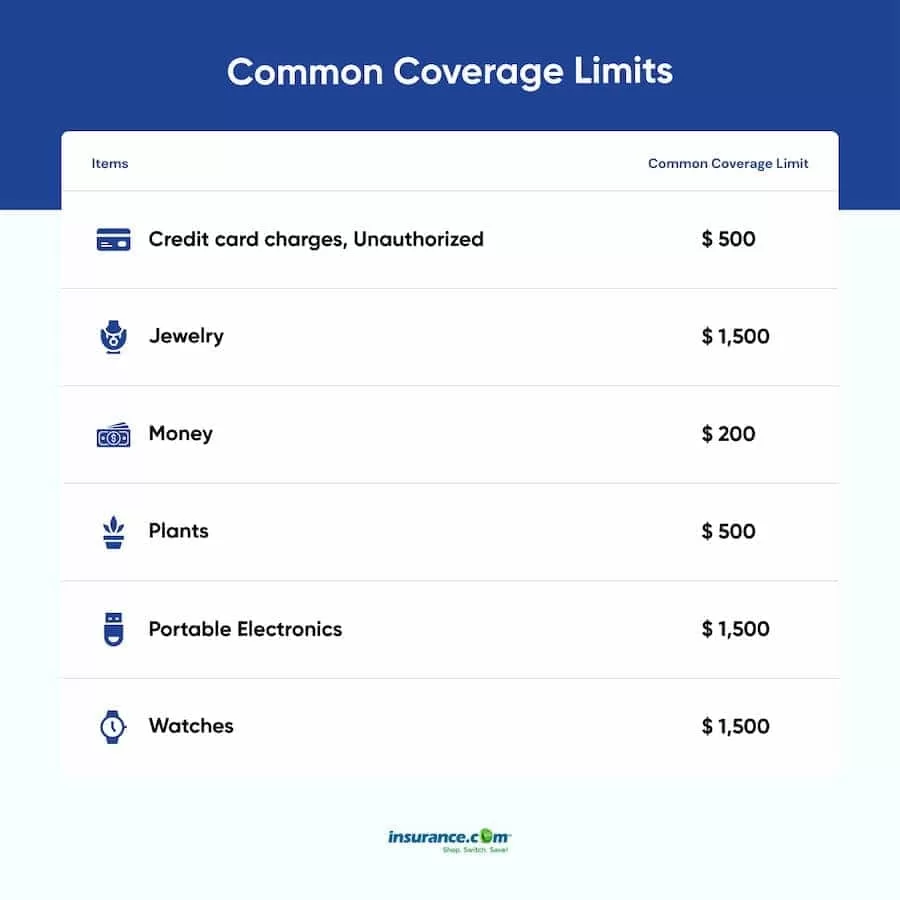

Information about sub-limits for storage unit coverage

When it comes to coverage for items stored in a storage unit, renters insurance policies may have sub-limits in place. Sub-limits refer to the maximum amount of coverage available for specific categories of items, such as jewelry, electronics, or collectibles. These sub-limits can vary from policy to policy and may affect the amount of reimbursement you receive in the event of a claim.

For example, your renters insurance policy may have a sub-limit of $1,000 for jewelry coverage. If you have valuable jewelry stored in a storage unit and it gets damaged or stolen, you may only be reimbursed up to $1,000, even if the total value of the jewelry exceeds that amount.

It’s important to review your renters insurance policy carefully and be aware of any sub-limits that may apply to your coverage. If you have valuable items that exceed the sub-limits, it may be necessary to purchase additional coverage to ensure adequate protection for those items.

How coverage amounts vary depending on location

The coverage amounts provided by renters insurance policies can also vary depending on the location of your storage unit. Some policies may have different coverage limits for items stored in a storage unit within your primary residence compared to a storage unit located off-premises.

For example, your policy may provide $20,000 of coverage for personal property within your primary residence, but only $5,000 of coverage for items stored in a storage unit located off-premises. This difference in coverage amounts is important to consider when evaluating the adequacy of your renters insurance policy for protecting items stored in a storage unit.

It’s important to note that these coverage amounts and variations may differ from one insurance provider to another. It’s recommended to carefully review your policy and consult with your insurance provider to fully understand the coverage amounts and limitations that apply to your specific situation.

Therefore, while renters insurance can provide coverage for items stored in a storage unit, there are certain limitations and variations to be aware of. Sub-limits can restrict the amount of reimbursement you receive for specific categories of items, and coverage amounts may vary depending on the location of your storage unit. It’s important to review your policy, consider the value of your stored items, and assess whether additional coverage is needed to adequately protect your belongings. By having a clear understanding of your renters insurance policy and any additional coverage options, you can ensure the protection of your items in storage units.

Tips for Ensuring Adequate Coverage

Considerations for selecting appropriate coverage for stored property

When it comes to protecting your stored belongings, there are a few tips to keep in mind to ensure you have adequate coverage:

1. Review your renters insurance policy: Take the time to thoroughly read and understand your renters insurance policy. Pay close attention to the coverage limits, exclusions, and limitations that may apply to stored property.

2. Assess the value of your stored items: Take an inventory of the items you have stored in your unit and determine their value. This will help you determine if the coverage provided by your renters insurance policy is sufficient or if you need additional coverage.

3. Consider purchasing additional coverage: If the value of your stored items exceeds the coverage limits of your renters insurance policy, it’s a good idea to purchase additional coverage. This could be an endorsement or a separate policy specifically designed for storage unit insurance.

4. Explore other storage unit insurance options: In addition to renters insurance, there are other insurance options available specifically for storage units. These options may provide more comprehensive coverage or specialized protection for certain types of items, such as valuable artwork or collectibles.

Factors to keep in mind when choosing a policy

When selecting an insurance policy for your stored items, here are a few factors to consider:

1. Coverage limits: Make sure the policy you choose provides adequate coverage for the total value of your stored belongings. Consider any limitations or exclusions that may apply to specific items.

2. Deductible: Understand the deductible amount and how it will affect your ability to file a claim. A higher deductible may result in lower premiums but could mean higher out-of-pocket expenses in the event of a claim.

3. Additional endorsements: Find out if the policy offers any additional endorsements or coverages that may be beneficial to you. These could include coverage for floods, earthquakes, or other natural disasters that may not be included in a standard policy.

4. Reputation and customer service: Research the insurance company and read reviews to ensure they have a good reputation for handling claims and providing excellent customer service.

By taking these tips into consideration, you can make an informed decision when selecting a policy for your stored property. Remember to regularly review and update your coverage as needed to ensure you are adequately protected.

Therefore, renters insurance can provide coverage for items stored in a storage unit, including weather-related damage. However, it’s crucial to review your policy, understand the coverage limits, exclusions, and limitations that may apply. If needed, consider purchasing additional coverage or exploring other storage unit insurance options. By being proactive and informed, you can protect your stored belongings and have peace of mind.

Conclusion

Summary of renter’s insurance coverage for storage units

To summarize, renters insurance typically covers items stored in a storage unit. However, there are limitations to this coverage, and it’s important to review your policy to understand the specific coverage limits, exclusions, and limitations that may apply. Generally, renters insurance will provide coverage for damage caused by events such as fire, theft, and certain types of damage. Homeowners insurance also offers coverage for storage units.

Final thoughts and recommendations

When it comes to protecting your stored belongings, it’s crucial to be proactive and informed. Here are a few recommendations to ensure you have adequate coverage:

1. Review your renters insurance policy and understand the coverage limits and exclusions that may apply.

2. Assess the value of your stored items and determine if your current coverage is sufficient. Purchase additional coverage if needed.

3. Consider exploring other storage unit insurance options, such as specialized policies or endorsements that provide more comprehensive protection.

4. Take into account factors like coverage limits, deductibles, additional endorsements, and the reputation of the insurance company when choosing a policy.

By following these tips and regularly reviewing and updating your coverage, you can have peace of mind knowing that your stored belongings are adequately protected.

Remember, renters insurance can be a valuable asset when it comes to protecting your personal property, even when it is stored outside of your apartment. Take the time to understand your policy, assess your coverage needs, and consider additional options if necessary. With the right insurance in place, you can have confidence that your stored items are protected against unforeseen events.

Find out more about Homeowners insurance and storage units.