Does renters insurance cover a storage unit

When it comes to storing personal property in a storage unit, it is important to understand whether renters insurance covers it or not. While renters insurance may cover belongings stored in a storage unit, it is subject to a sub-limit. This blog post will provide an overview of renters insurance and storage unit coverage, as well as some frequently asked questions about self-storage insurance.

Overview of renters insurance and storage unit coverage

Renters insurance generally covers personal property against perils such as fire, theft, vandalism, and certain types of water damage. However, coverage for personal property in a storage unit is subject to a sub-limit that depends on the location of the storage unit. If you have a renters policy for your rental home or apartment, the coverage may extend to items in storage but with limitations.

The sub-limit is the maximum amount that the insurance company will pay for any damages or loss of personal property stored in a storage unit. It is important to check the coverage limit of your policy before storing any high-value items in a storage unit.

Coverage limits for storage units

Items stored in a self-storage unit are covered by renters insurance, but the coverage limits may vary based on the location of the storage unit. In some cases, the storage company may offer insurance for the items stored in the unit, but it is important to review the contract to determine the extent of coverage provided.

Frequently asked questions about self-storage insurance

If the contents of a storage unit are damaged and the owner does not have insurance, unfortunately, their belongings will not be covered. However, in some cases, the storage company’s insurance may offer partial coverage for the lost or damaged items.

Self-storage insurance can be purchased from several insurance providers, but it is essential to understand the policy’s distinctions and limits. It is important to select an insurance policy that meets the specific needs of the items stored in the unit, including their value and risk of damage or theft.

Therefore, renters insurance may cover personal property stored in a storage unit, but the coverage is subject to a sub-limit. It is important to review the policy coverage limits and consider purchasing additional insurance coverage if storing high-value items in a storage unit.

Conclusion

Therefore, storing personal property in a storage unit can be a good option for temporary or long-term storage. Renters insurance generally covers personal property stored in a storage unit, but the coverage may be subject to sub-limits and coverage limits based on the location of the storage unit. It is important to review the policy coverage limits and consider purchasing additional insurance coverage to ensure the protection of high-value items.

How Renters Insurance Works

Explanation of what renters insurance covers and its limitations

Renters insurance is a type of insurance designed to provide coverage for renters. It covers personal liability and personal property in case of damage or loss. The coverage typically applies to rented homes or apartments. However, it also extends to personal property stored in a self-storage unit.

If you’re renting an apartment or home, renters insurance can help you protect your possessions. It offers coverage in case of theft, fire, water damage, and other perils. The policy typically covers the cost of repairs or replacement of damaged items. However, when it comes to storing your personal property in a self-storage unit, there are some limitations to keep in mind.

While renters insurance covers your personal property stored in a self-storage unit, it is subject to a sub-limit. This sub-limit is the maximum amount your insurance provider will pay for the items in your storage unit. The sub-limit varies depending on the state you live in.

For instance, if your policy has a coverage limit of $50,000, your storage unit sub-limit may only be $5,000. That means your insurance provider will only pay up to $5,000 for the items you have in storage. Keep in mind; this sub-limit reduces the overall coverage amount stipulated in your renters policy.

Another thing to keep in mind is that renters insurance does not cover specific items such as jewelry, antiques, and art. There’s often a cap on the amount you can claim for expensive items, and it typically ranges between $1,500 and $2,000. If you have valuable possessions, such as jewelry or antiques, you may need to consider purchasing additional insurance to cover the full value of these items.

So, renters insurance is an essential coverage for renters to protect their personal property. It covers your possessions against several perils, including fire, theft, water damage, and more. However, it’s essential to note the limitations of renters insurance when it comes to self-storage units. The coverage applies to your stored items, but it is subject to a sub-limit, which is often lower than the overall coverage in your renters policy. As such, you may need to purchase additional insurance for valuable possessions that exceed the policy’s sub-limit.

Personal Property Coverage

Detailed explanation of personal property coverage and how it applies to storage units

Renters insurance is an important coverage for renters as it provides protection for personal property and personal liability. It covers damage or loss caused by perils such as fire, theft, water damage, and other specific issues. However, personal property coverage for renters insurance applied in storage units comes with certain limitations that you should know.

Firstly, while renters insurance covers personal property stored in a self-storage unit, it is subject to a sub-limit. This means that the coverage limit for your stored belongings is a part of your policy’s overall coverage amount but has a lesser value. The sub-limit depends on where you reside and can vary between states.

For example, if your renters insurance policy has a coverage limit of $50,000, you may have a storage unit sub-limit of only $5,000. That means if you have $10,000 worth of items in your storage unit that were damaged due to a peril that the policy covers, your insurance provider will only pay up to $5,000. The sub-limit is set to ensure your coverage amount isn’t entirely depleted by one loss event, leaving you without coverage for other issues that may arise.

Secondly, some items aren’t covered by renters insurance, such as jewelry, antiques, and art. There’s often a limit on the amount you can claim for expensive articles, ranging between $1,500 and $2,000. So if your jewelry is worth $3,000 and is stolen from your self-storage unit, your rental insurance policy will reimburse you a maximum of $2,000 for the valuable item.

Another crucial thing to consider is that the renters’ insurance policy’s sub-limit for the storage unit applies only to temporary storage. For long-term storage, you may have to purchase separate insurance that covers your stored items’ perils.

Finally, while renters insurance covers your belongings stored in self-storage units from the same perils as would apply to your possessions in your rented home or apartment, it is not a blanket policy. Always read the fine print or ask your insurer to clarify anything that may seem confusing.

Therefore, renters insurance is an essential coverage option for renters that provides protection for both personal property and personal liability. It covers damage or loss caused by specific perils, including those that apply to personal property stored in self-storage units. However, there are some limitations to keep in mind when it comes to coverage limits and specific article coverage. Make sure to read your policy’s fine print and understand the terms and limitations before settling for a policy.

Covered Perils

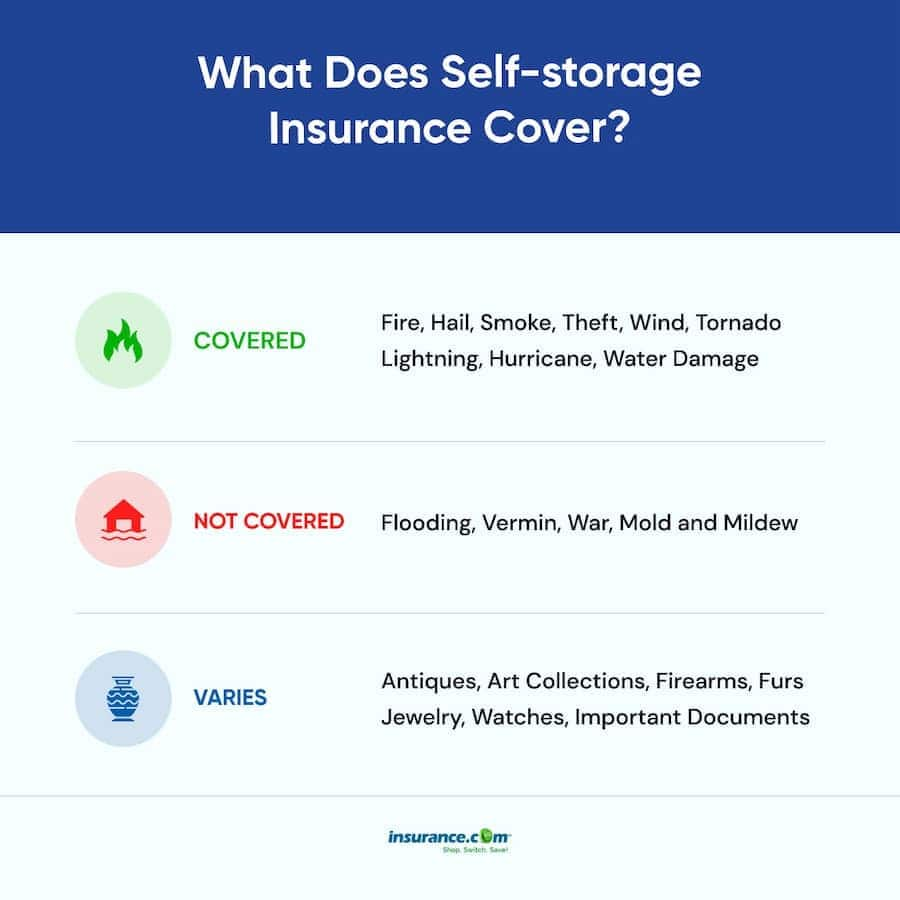

Discussion of the types of damage covered by renters insurance in a storage unit

Renters insurance provides coverage for personal property stored in a self-storage unit. The coverage applies to several perils, including fire, theft, vandalism, and water damage from burst pipes. It’s important to note that the coverage for stored goods is subject to a sub-limit within your renters policy, which is often lower than the overall coverage limit.

One of the most common perils that renters insurance covers is fire damage. If a fire breaks out in your storage unit and your possessions are damaged or destroyed, your renters insurance policy will pay for the repairs or replacement costs up to the specified limit. Theft is another peril that renters insurance covers. If someone breaks into your storage unit and steals your possessions, your policy will reimburse you for the stolen items, up to your renters insurance limits.

Vandalism is another peril renters insurance covers. If someone damages your property intentionally, such as by painting graffiti on your furniture, your insurance policy will pay for the repair or replacement costs. Water damage is also covered, but only if it arises from a burst pipe within the storage facility. If your stored items are damaged by flooding, rain, or snow, your renters insurance policy will not cover the costs of replacement.

In addition to these perils, renters insurance also covers damage caused by other natural disasters, such as lightning, wind, and hail. If your storage unit is destroyed by a covered peril, your insurance policy will pay for the repairs or replacement costs up to your specified limit.

However, it’s important to keep in mind that renters insurance does not cover every type of damage. For example, if your possessions are damaged by pests such as rodents, or insects, your insurance policy will not cover the costs of repair or replacement. Similarly, if your property is damaged due to your own neglect or failure to take preventive measures against damage from occurring, such as not securing fragile items properly, your policy may not cover the costs.

Therefore, renters insurance provides coverage for personal property stored in a self-storage unit. The coverage applies to several perils, including fire, theft, vandalism, and water damage from burst pipes. However, it’s important to note that coverage for stored goods is subject to a sub-limit within your renters policy. While renters insurance covers many perils, it’s essential to understand the policy’s limitations to ensure you have the right coverage for your needs.

Coverage Limits

Information on how coverage limits can affect your policy’s coverage of a storage unit

Renters insurance covers personal property stored in a self-storage unit up to a certain limit, usually up to 10% of the total personal property coverage amount. However, the coverage for stored goods is subject to a sub-limit within the renters policy, usually lower than the overall coverage limit. This means that if you have valuable belongings stored in a storage unit, you may need to consider purchasing additional storage unit insurance to fill in any coverage gaps.

When deciding whether to purchase additional storage coverage, it’s essential to consider how much coverage you need. If your off-premises protection is limited to 10% of your total personal property amount, or an even lower dollar amount, you should weigh how much storage insurance you need to fill in your coverage gap. For instance, if your personal property limit for off-residence contents is $5,000, and you have $15,000 worth of personal belongings stored in the unit, you should purchase $10,000 worth of coverage.

It’s also important to consider what perils are covered by your insurance policy. Some policies limit off-residence coverage to theft only, meaning that if your storage unit burns down, floods, or is impacted by any cause other than theft, you will be left without coverage. Therefore, it’s crucial to know precisely what perils your policy covers and whether any additional storage insurance is needed to ensure complete coverage for your stored items.

Furthermore, some storage facilities may require added insurance for your items’ protection. It’s necessary to understand the facility’s insurance requirements before renting a storage unit and ensure that you have adequate coverage for your stored belongings.

Therefore, while renters insurance provides coverage for stored personal property, it’s important to understand the limitations of the policy. Coverage for stored goods is subject to a sub-limit within the renters policy, and specific perils may not be covered, such as pest damage. To ensure complete coverage, additional storage unit insurance may be worthwhile, particularly for valuable stored items. Before renting a storage unit, it’s necessary to understand the insurance requirements of the facility and consider whether additional coverage is needed to protect your belongings fully.

Additional Coverages

Explanation of supplementary coverages that renters insurance may provide for storage units

Renters insurance covers personal property stored in self-storage units but with certain limitations. However, some renters insurance policies provide additional coverage for stored goods. These additional coverages may include:

1. Off-premises coverage: This coverage extends beyond your home or apartment to protect your belongings wherever they are. In other words, your renters insurance policy will cover your property if it’s damaged or stolen while it’s in storage.

2. Replacement cost coverage: This coverage ensures that you will be reimbursed for the cost of replacing your damaged or stolen property with new items, regardless of their original value.

3. Temporary living expenses: If your home or apartment becomes uninhabitable due to a covered peril, your renters insurance policy will pay for your temporary living expenses. This coverage may also apply if your storage unit is damaged, and you need to find temporary storage for your belongings.

4. Identity theft protection: Some renters insurance policies offer identity theft protection, which can help you recover from the financial aftermath of identity theft.

5. Liability coverage: If someone is injured on your storage unit’s premises, your renters insurance policy may provide liability coverage for any resulting lawsuits or medical bills.

It’s essential to understand what additional coverages your renters insurance policy provides. Adding certain coverages may increase your insurance premium, but it can also provide greater protection for your stored goods. Ensure you read through your policy thoroughly to understand it better and determine what additional coverages are worth the extra cost.

Therefore, renters insurance policies provide coverage for personal property stored in self-storage units, but with limitations. However, knowing what additional coverages are available can provide greater peace of mind for your stored belongings. Ensure you understand your policy’s terms, conditions, and coverages before renting a storage unit. If you’re unsure, reach out to your insurance agent to discuss your options and determine what coverage best fits your needs.

Policy Exclusions

Common exclusions found in renters insurance policies and how they apply to storage units

While renters insurance policies provide coverage for personal property stored in self-storage units, there are exclusions to this coverage. It’s crucial to understand what these exclusions are to ensure you have adequate protection for your belongings. Here are some common exclusions found in renters insurance policies and how they apply to storage units:

1. Negligence: If your personal property is damaged due to your own negligence, your renters insurance policy may not cover the cost of repairs or replacement. For example, if you fail to properly secure your storage unit and your property is stolen, your insurance company may deny your claim.

2. Earthquakes and floods: Most renters insurance policies exclude coverage for damages caused by earthquakes and floods. If your storage unit is damaged due to one of these natural disasters, your policy will not cover it.

3. High-value items: Renters insurance policies typically have sub-limits for high-value items, such as jewelry or fine art. If you have valuable items in your storage unit, ensure they are properly insured by adding a floater to your policy or purchasing separate insurance.

4. Illegal activities: If your personal property is stored in a storage unit where illegal activities are taking place, your renters insurance policy will not cover any damages or thefts that occur.

5. Intentional damage: If you intentionally damage your own property, your renters insurance policy will not cover the cost of repairs or replacement.

It’s essential to understand these common exclusions to ensure that your policy provides adequate coverage for your stored belongings. If you have high-value items or live in an area prone to earthquakes or floods, consider purchasing additional insurance or adding a floater to your policy to ensure your belongings are protected.

Therefore, while renters insurance policies provide coverage for personal property stored in self-storage units, it’s essential to understand the limitations and exclusions of your policy. Understanding additional coverages and exclusions can provide greater peace of mind and ensure that your stored belongings are adequately protected. Ensure you read your policy carefully and reach out to your insurance agent to discuss your options and determine what coverage best fits your needs.

Filing a Claim

Process for filing a claim for damage to personal property stored in a storage unit

Renters insurance is a valuable coverage that protects your personal property in the event of theft, damage or loss. If you have renters insurance and you store your belongings in a self-storage unit, you may be wondering what the process is for filing a claim for any damages to your stored property.

The first step in filing a claim for damage to personal property stored in a storage unit is to contact your insurer. Your insurer will ask you to provide them with information about the damage that has occurred. This may include the date and time of the incident, as well as any other relevant details such as police reports, receipts or photos of the damage. Once your insurer has gathered all of the necessary information, they will provide you with a claim number and a claims adjuster.

The claims adjuster will contact you to schedule a time to inspect the damage to your stored property. During this inspection, the adjuster will assess the extent of the damage and determine if it is covered under your renters insurance policy. Once the adjuster has completed the inspection, they will provide you with a written estimate of the damages.

With the estimate and all other relevant information in hand, your insurer will work with you to settle the claim. Depending on the nature of the damage and your policy, your insurer may pay you the actual cash value of your damaged property or the cost to replace it with new items of similar or like kind and quality. If your policy has a deductible, you will need to pay this amount before your insurer pays out any settlement.

It is important to note that filing a claim for damage to personal property stored in a storage unit may affect your insurance premium. Depending on the details of your policy and the extent of the damage, your insurer may increase your premium at the time of renewal. However, it is always recommended to file a claim to receive the appropriate coverage for your damages as per your policy.

Therefore, renters insurance provides an added layer of protection for your personal property, including items stored in self-storage units. When filing a claim for damages to your stored property, it is crucial to provide your insurer with all the necessary information, work with the adjuster, and review the written estimate before accepting any settlement. Being informed about the process and your policy’s coverages can help you understand your options and make the best decision for your situation.

Conclusion

Summary of key points and importance of understanding renters insurance coverage for storage units.

Therefore, renters insurance is a critical coverage that protects your personal property, including items stored in self-storage units. It is essential to understand what your policy covers and what it does not to ensure that you have sufficient coverage for your stored items. If your renters insurance does not provide adequate coverage for your stored property, it may be worth considering purchasing additional storage unit insurance.

When it comes to filing a claim for damage to personal property stored in a storage unit, it is crucial to provide your insurer with all the necessary information. Contacting your insurer and working with a claims adjuster are critical steps in the process. It is important to review the written estimate before accepting any settlement to ensure that you are receiving the appropriate coverage for your damages as per your policy.

One important thing to remember is that filing a claim for damage to personal property stored in a storage unit may affect your insurance premium. Your insurer may increase your premium at the time of renewal, depending on the details of your policy and the extent of the damage. However, it is always recommended to file a claim in case of damage to your stored items.

To summarize, don’t forget to consider the following when it comes to understanding renters insurance coverage for your stored possessions:

– Understand what perils are covered by your storage unit insurance policy.

– Check your policy details to see what items are not covered by storage insurance.

– Consider adding an additional endorsement to your renters’ policy for particularly valuable items.

– Contact your insurer to file a claim for any damage to your stored property.

– Work with an adjuster to assess the extent of the damage and decide if it is covered under your renters insurance policy.

– Review the written estimate before accepting any settlement to ensure that you receive the appropriate coverage for your damages.

– Be aware that filing a claim for damage to personal property stored in a storage unit may affect your insurance premium.

– Evaluate the need to purchase additional storage unit insurance if your renters insurance does not provide sufficient coverage for your stored items.

By being informed about these key points, you can make the best decisions for your situation and ensure that your stored property is protected. Take the time to review your renters insurance policy and seek additional coverage if needed to ensure that your stored items are adequately protected.

Discover Storage unit insurance companies.