Introduction

Overview of renter’s insurance and its coverage

Renter’s insurance is a type of insurance policy that provides coverage for the personal property of individuals who are renting a property. This coverage typically includes protection against perils like theft, fire, and water damage. It is designed to financially protect renters and provide assistance in the event of a covered loss or damage.

One important aspect of renter’s insurance is that it extends coverage to personal property even when it is stored outside of the rented apartment. This means that if you have a storage unit where you store some of your belongings, your renter’s insurance policy may cover them in case of damage or loss.

Importance of understanding coverage for storage units

When it comes to storing your belongings in a storage unit, it is crucial to understand the coverage provided by your renter’s insurance policy. While most policies offer coverage for items stored off-premises, there may be limits and restrictions that you need to be aware of.

By reviewing your policy, you can determine the coverage limits for your storage unit. This will help you understand the amount of financial protection available for your belongings in case of a covered event. It is also essential to know what perils are covered, as not all types of damage may fall under the policy’s coverage.

Does Renters Insurance Cover Storage Units?

Yes, renters insurance typically covers storage units. A standard renter’s insurance policy usually includes off-premises coverage for personal property. This means that your belongings in a storage unit will be protected under your policy if they are damaged or destroyed by covered perils.

It is important to note that the coverage provided for items in storage units may be subject to specific limits and conditions. The maximum coverage amount may vary depending on your policy, so it is essential to review your policy and consult with your insurance provider to understand the exact coverage and any limitations.

Coverage Limits on Storage Units

While renters insurance does cover storage units, there may be limits on the coverage amount. It is crucial to be aware of these limits to ensure that you have adequate coverage for your stored items. Some common factors that may affect the coverage limits on storage units include:

1. Percentage of coverage: Renters insurance typically provides a percentage of the overall coverage limit for off-premises items. For example, if your policy has a coverage limit of $50,000 for personal property and a 10% off-premises coverage limit, you would have up to $5,000 in coverage for items stored in a storage unit.

2. Valuation of stored items: The coverage limit may also depend on the valuation of the items stored in the unit. Items of higher value may have lower coverage limits or may require additional coverage.

3. Deductibles: Like any insurance policy, renters insurance often includes a deductible. This is the amount you will need to pay out of pocket before the insurance coverage kicks in. Make sure you understand the deductible amount and factor it into your considerations when selecting insurance coverage for your storage unit.

4. Additional coverage options: If the coverage limit provided by your renters insurance policy is not sufficient for the value of the items you have stored, you may have the option to purchase additional coverage specifically for your storage unit. This could be in the form of a separate insurance policy or an endorsement to your existing renter’s insurance policy.

When to Purchase Additional Renters Coverage for a Storage Unit

If the coverage limit provided by your renters insurance policy is not enough to adequately protect the value of the items stored in your storage unit, you should consider purchasing additional coverage. This is particularly important if you have high-value items or if the coverage limit provided is significantly lower than the value of your stored belongings.

Before deciding to purchase additional coverage, it is essential to review your renter’s insurance policy and consult with your insurance provider. They can provide guidance on the available options for increasing coverage and help you assess your specific needs and risks.

Other Storage Unit Insurance Options

In addition to renters insurance, there are other insurance options available specifically for storage units. These options may provide more comprehensive coverage or higher coverage limits for the items stored. Some alternatives to consider include:

1. Storage unit insurance: Many storage facilities offer insurance options specifically tailored for their units. These policies may have higher coverage limits and provide protection against a broader range of perils.

2. Standalone insurance policies: Some insurance providers offer standalone insurance policies designed specifically for storage units. These policies can provide comprehensive coverage for your stored items and may have additional features or benefits.

When considering these alternative insurance options, it is essential to review the coverage details, limits, and exclusions. Compare them with your existing renters insurance policy to determine which option best suits your needs and provides adequate protection for your stored belongings.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Therefore, renters insurance typically covers items stored in storage units. However, it is essential to review your policy and understand the limits and conditions of this coverage. If the coverage limit provided by your renter’s insurance policy is not sufficient, consider purchasing additional coverage specifically for your storage unit. Alternatively, you can explore other insurance options offered by storage facilities or standalone policies. By having the right insurance coverage in place, you can protect your belongings in storage and gain peace of mind.

Understanding Renter’s Insurance Coverage

Explaining the coverage provided by renter’s insurance

Renter’s insurance is designed to provide financial protection for individuals who are renting a property, such as an apartment or house. It covers their personal belongings and provides liability coverage in case of accidents or damages. One common question that arises is whether renter’s insurance also covers items stored in a storage unit.

Details of personal property coverage

Renter’s insurance generally includes personal property coverage, which reimburses the policyholder for financial loss if their belongings are damaged or destroyed. This coverage applies not only to items kept within the rented property but also extends to items stored outside, such as in a storage unit. In the event of a covered peril, such as fire, theft, or water damage, the insurance can help replace or repair the damaged items.

It’s important to note that renter’s insurance covers the policyholder’s personal property, which typically includes furniture, electronics, clothing, and other belongings. However, there may be certain exclusions or limitations based on the specific policy, so it’s essential to review the terms and conditions of the policy to fully understand what is covered.

Limits and sub-limits for storage units

While renter’s insurance covers items in storage units, there may be certain limits or sub-limits imposed by the insurance provider. These limits determine the maximum amount of coverage available for stored items. For example, if your renter’s insurance policy has a limit of $50,000 for personal property coverage, this limit would apply to both items within your rented property and items stored in a storage unit.

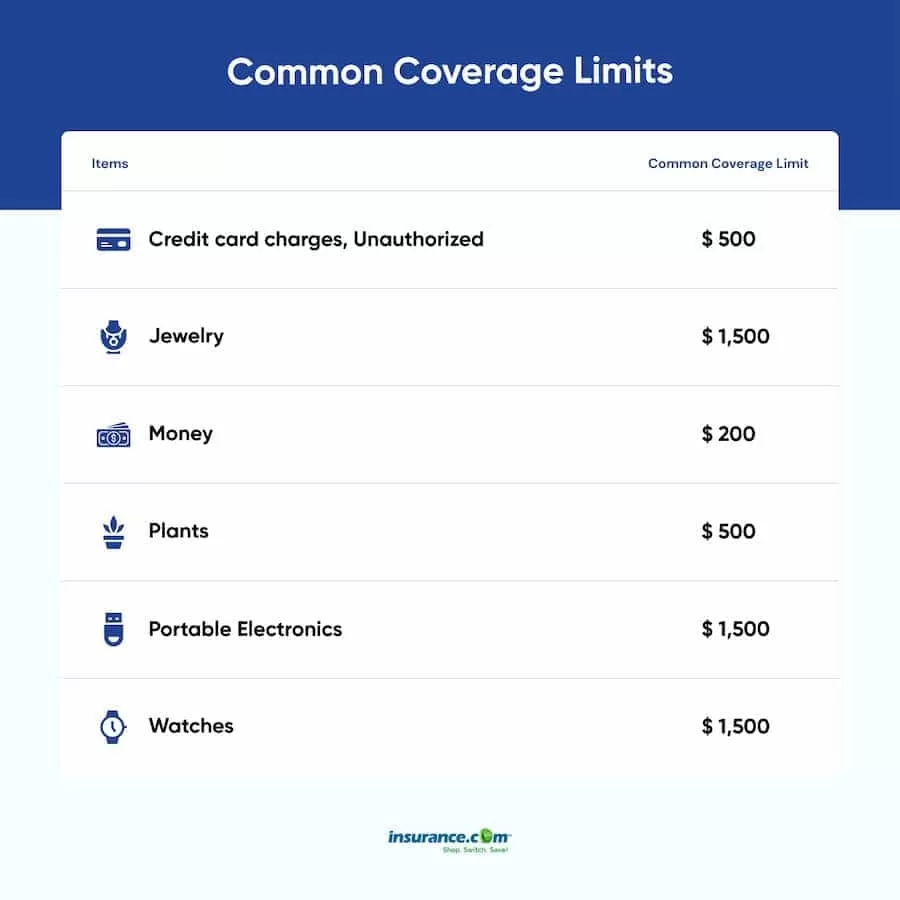

However, within this overall limit, there may be sub-limits for specific categories of items. For instance, the policy may limit coverage for jewelry, collectibles, or artwork to a lower amount. It’s important to be aware of these sub-limits and consider whether additional coverage is necessary for high-value items.

If you are planning to store valuable or expensive items in a storage unit, it’s a good idea to have a conversation with your insurance provider. They can guide you in understanding the coverage limits and help you determine if additional coverage is needed.

In some cases, it may be necessary to purchase additional riders or endorsements to the renter’s insurance policy to increase the coverage for items in a storage unit. These additional coverages can provide more comprehensive protection for valuable or high-value items and may be worth considering if you have such belongings in storage.

Other Storage Unit Insurance Options

Apart from renter’s insurance, there are other insurance options specifically designed for storage units. Some storage facilities offer their own insurance policies that you can purchase. These policies may have different coverage limits and terms compared to a standard renter’s insurance policy. It’s important to carefully compare the coverage and cost of these options before making a decision.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Therefore, renter’s insurance generally covers items stored in a storage unit as part of its personal property coverage. However, there may be limits or sub-limits on the coverage, especially for high-value items. It’s crucial to review your policy and consider additional coverage options if necessary to protect your belongings adequately. Consulting with your insurance provider can help you better understand the specifics of your coverage and determine the best course of action.

Renters Insurance and Storage Units

Confirmation that renters insurance covers storage units

Renters insurance provides coverage for personal belongings even when they are stored outside of your apartment. This includes items stored in a storage unit. The policy typically offers personal property coverage that reimburses you in case of financial loss due to damage or destruction of your belongings.

Explanation of how renters insurance extends to personal property stored outside the apartment

Renter’s insurance not only covers personal property within the rented property but also extends to items stored outside, such as in a storage unit. This means that if your belongings are damaged or destroyed due to a covered peril, such as fire, theft, or water damage, your insurance can help you replace or repair those items.

Coverage for theft, vandalism, and weather-related damage

Renters insurance provides coverage for various perils, including theft, vandalism, and certain weather-related damage. This coverage applies to your belongings whether they are in your apartment or in a storage unit. If your items are stolen or vandalized, or if they are damaged by a covered weather event, such as a storm or flood, your renters insurance can help compensate you for your financial loss.

It’s important to note that while renters insurance covers storage units, there may be limits or sub-limits on the coverage. This means that the amount of coverage available for stored items may be subject to certain restrictions. These limits determine the maximum amount that your insurance will pay out for a claim. Additionally, there may be specific categories of items, such as jewelry or collectibles, that have lower coverage limits.

If you have high-value items or valuable belongings that you plan to store in a storage unit, it’s advisable to review your renters insurance policy and consider purchasing additional coverage if necessary. This can help ensure that your valuable items are adequately protected.

Alternatively, some storage facilities offer their own insurance policies that you can purchase. These policies may have different coverage limits and terms compared to a standard renters insurance policy. It’s important to carefully compare the coverage and cost of these options before making a decision.

Therefore, renters insurance generally covers items stored in a storage unit as part of its personal property coverage. However, it’s important to review your specific policy to understand any limits or sub-limits on coverage. If you have high-value items, considering additional coverage options or having a conversation with your insurance provider can help you make an informed decision to adequately protect your belongings.

Coverage Limits for Storage Units

Renters insurance provides coverage for personal property stored in storage units, but there are certain limits to the coverage. Understanding these limits is essential to ensure that your belongings are adequately protected.

Explanation of coverage limits for personal property in storage units

When it comes to renters insurance, the coverage for personal property stored in a storage unit is typically calculated as a percentage of the total policy limits for personal property. This means that the coverage limit for items in storage will depend on the overall coverage limit chosen for your policy.

For example, if you have a renters insurance policy with a total personal property coverage limit of $50,000 and your storage unit coverage is set at 10%, you would have coverage up to $5,000 for the items stored in the storage unit.

Clarification of the 10% rule and its applicability to the chosen limit

The 10% rule is a common guideline used by insurance providers to determine the coverage for personal property stored in a storage unit. However, it’s important to note that this percentage can vary depending on your insurance policy and provider.

It’s crucial to review your policy and understand the specifics of the coverage to determine the exact percentage that applies to your storage unit. This will help you determine the coverage limit accurately and ensure that your belongings are adequately protected.

Exclusions and exceptions to the coverage

While renters insurance generally covers personal property stored in a storage unit, it’s essential to be aware of any exclusions or exceptions that may apply. Some insurance policies may have limitations on specific categories of items, such as high-value jewelry, collectibles, or artwork.

These items may have sub-limits that are lower than the overall coverage limit, which means that you may need additional coverage or endorsements to adequately protect them. It’s crucial to carefully review your policy and consider additional coverage options if necessary.

Therefore,

Renters insurance does provide coverage for items stored in a storage unit as part of the personal property coverage. However, it’s important to be aware of the coverage limits and any exclusions or exceptions that may apply. Reviewing your policy, considering higher coverage limits, and exploring additional insurance options can help ensure that your belongings are adequately protected. Consulting with your insurance provider can provide valuable guidance in understanding the specific terms and conditions of your policy and determining the best course of action to protect your items in storage.

Benefits of Insuring Storage Units

If you are renting a storage unit to store your personal belongings, it is important to consider including storage unit coverage in your renter’s insurance policy. Doing so can provide several advantages and benefits, ensuring that your stored items are adequately protected.

Advantages of including storage unit coverage in renter’s insurance

Including coverage for your storage unit in your renter’s insurance policy can offer the following advantages:

Protection against unexpected events and emergencies

By adding storage unit coverage to your renter’s insurance policy, you can rest assured knowing that your personal belongings are protected in the event of unexpected events or emergencies such as theft, fire, or water damage. This coverage can provide financial compensation for any damages or losses, allowing you to replace or repair your belongings.

Peace of mind for renters with valuable stored items

If you have valuable items stored in your storage unit, adding coverage to your renter’s insurance policy can provide peace of mind. Valuable items such as jewelry, electronics, or collectibles can be expensive to replace. With storage unit coverage, you can have confidence that your valuable items are protected, giving you peace of mind knowing that you won’t suffer a significant financial loss if something were to happen to them.

While renter’s insurance does provide coverage for items stored in a storage unit as part of the personal property coverage, it’s important to be aware of the coverage limits and any exclusions or exceptions that may apply. Reviewing your policy, considering higher coverage limits, and exploring additional insurance options can help ensure that your belongings are adequately protected. Consulting with your insurance provider can provide valuable guidance in understanding the specific terms and conditions of your policy and determining the best course of action to protect your items in storage.

Factors to Consider

Factors to consider when selecting renters insurance with storage unit coverage

When choosing renters insurance that includes coverage for storage units, there are several factors that you should take into consideration. These factors will help ensure that you have the appropriate coverage for your needs and provide peace of mind when storing your belongings.

Policy terms, deductibles, and premiums

One of the first factors to consider is the terms of the policy, including the deductible and premiums. The deductible is the amount you are responsible for paying out of pocket before the insurance coverage kicks in. It is important to choose a deductible that you can comfortably afford in the event of a loss. Additionally, you should compare the premiums across different insurance providers to find the best value for your money.

Evaluating the need for additional coverage

While renters insurance typically covers personal property stored in a storage unit, it is important to evaluate whether you may need additional coverage. Consider the value of the items you plan to store and whether they exceed the coverage limits provided by your policy. If you have high-value items such as jewelry, collectibles, or artwork, you may want to consider adding endorsements or obtaining separate insurance policies specifically for these items.

It is also important to assess the level of risk associated with storing your belongings in a storage unit. Factors such as the location of the storage facility, security measures in place, and climate control options should be considered when determining the need for additional coverage.

Coverage Comparison Table

To help with your decision-making process, here is a comparison table that outlines the coverage for personal property in storage units across different insurance providers:

| Insurance Provider | Coverage Limit for Storage Units | Exclusions/Exceptions |

|——————–|———————————-|———————-|

| Provider A | Up to 10% of total policy limit | High-value items |

| Provider B | Up to 15% of total policy limit | Certain categories |

| Provider C | Up to 5% of total policy limit | None |

Please note that this table is for illustrative purposes only, and the specific coverage limits and exclusions may vary depending on the policy and insurance provider. It is important to thoroughly review the terms and conditions of your policy to understand the coverage and any limitations that may apply.

Therefore, when selecting renters insurance with coverage for storage units, it is crucial to consider the policy terms, deductibles, and premiums. Evaluating the need for additional coverage, such as endorsements or separate insurance policies for high-value items, is also important. Additionally, comparing coverage limits and exclusions across different insurance providers can help ensure that your belongings are adequately protected. By thoroughly reviewing your policy and considering these factors, you can make an informed decision and have the peace of mind knowing that your items in storage are well-covered.

Things Not Typically Covered

Highlighting items that are typically not covered under renter’s insurance for storage units

While renters insurance generally covers personal property stored in a storage unit, there are certain items that are typically not covered. It’s important to be aware of these exclusions when considering your insurance needs for your storage unit. Here are some examples of items that are typically not covered:

Examples include motor vehicles, recreational vehicles, and high-value collectibles

– Motor vehicles: Renters insurance usually does not cover damage or theft of motor vehicles, such as cars, motorcycles, or boats. If you plan to store a vehicle in a storage unit, you may need to consider separate auto insurance coverage.

– Recreational vehicles: Similarly, recreational vehicles like RVs, campers, and trailers are typically not covered under renters insurance for storage units. If you have these types of vehicles, it’s important to explore options for separate coverage specific to recreational vehicles.

– High-value collectibles: While renters insurance covers personal property, there may be limitations on coverage for high-value collectibles like artwork, antiques, or rare items. These items may require additional endorsements or separate policies to ensure adequate coverage.

It’s important to thoroughly review the terms and conditions of your renters insurance policy to understand what is covered and what is not. If you have items that are not typically covered, it’s advisable to explore alternative insurance options to protect those specific belongings.

Therefore, renters insurance generally provides coverage for personal property stored in a storage unit. However, there may be exceptions and limitations to consider. It’s important to carefully evaluate your insurance needs, review policy terms and coverage limits, and consider additional coverage options if necessary. By taking these factors into account, you can ensure that your stored belongings are adequately protected.

Tips for Maximizing Coverage

Practical tips for maximizing coverage for personal property in storage units

Here are some practical tips to help you maximize the coverage for your personal property in storage units:

1. Choose higher personal property coverage limits: As mentioned earlier, one way to increase the coverage limit for items in a storage unit is to choose higher personal property coverage limits. This will ensure that you have sufficient coverage for your belongings, even if they exceed the standard coverage limits.

2. Evaluate the need for additional endorsements or separate insurance policies: If you have high-value items such as jewelry, collectibles, or artwork, consider adding endorsements or obtaining separate insurance policies specifically for these items. This will provide additional protection and ensure that these valuable belongings are adequately covered.

3. Opt for a storage facility with robust security measures: When selecting a storage facility, opt for one that has robust security measures in place. Look for facilities with features such as surveillance cameras, gated access, and alarm systems. Choosing a facility with enhanced security can help mitigate the risk of theft or damage to your stored belongings.

4. Consider climate-controlled storage units: If you are storing items that are sensitive to temperature and humidity changes, such as electronics, antiques, or delicate fabrics, consider renting a climate-controlled storage unit. These units maintain a consistent temperature and humidity level, which can help protect your belongings from damage caused by extreme environmental conditions.

Documenting belongings, maintaining an inventory, and providing proof of ownership

To ensure smooth claims processing and maximize coverage for your stored belongings, follow these steps:

1. Document your belongings: Before storing your items, take inventory and document them. This can be done by taking photographs or videos of each item, noting any identifying marks or serial numbers, and keeping receipts or appraisals for high-value items.

2. Maintain an inventory: Keep a detailed inventory of all the items you have stored in the unit, including descriptions, values, and purchase dates. Update this inventory regularly to reflect any changes or additions to your stored belongings.

3. Keep copies of important documents: Make copies of your insurance policy, the storage unit lease agreement, and any other relevant documents. Store these copies in a safe place outside of the storage unit, such as a secure digital storage platform or a physical lockbox.

4. Provide proof of ownership: In the event of a claim, you may be required to provide proof of ownership for the damaged or stolen items. Having documentation such as receipts, appraisals, or photographs can help substantiate your claim and ensure a smooth claims process.

Communication with the insurance provider for updates and modifications

It is important to maintain open communication with your insurance provider regarding any updates or modifications to your storage unit or stored belongings. Here are some key points to consider:

1. Inform your insurance provider about changes in storage units: If you decide to switch storage units or move your belongings to a different facility, inform your insurance provider. They may need to update your policy to ensure that you have continued coverage for your stored items.

2. Update your inventory and coverage limits: Regularly review your inventory and coverage limits to ensure they accurately reflect the value of your stored belongings. If you acquire new high-value items or dispose of any items in storage, notify your insurance provider to update your coverage.

3. Review policy terms and conditions: Periodically review the terms and conditions of your renters insurance policy, especially those related to coverage for stored items. This will help you stay informed about any changes or limitations that may impact your coverage.

By following these tips and maintaining open communication with your insurance provider, you can maximize the coverage for your personal property in storage units and ensure that your belongings are adequately protected. Remember to regularly review and update your policy to adapt to any changes in your storage needs or belongings.

Conclusion

Recap of the benefits and coverage details of renter’s insurance for storage units

Therefore, renters insurance does cover items in storage units, providing coverage for personal property even when stored outside of your apartment. The typical renters insurance policy offers personal property coverage that reimburses you for financial loss if your property is damaged by a covered peril. This includes damage sustained by belongings stored in a storage unit.

Here is a recap of the key coverage details for renters insurance in storage units:

– Renters insurance covers belongings that sustain damage from covered perils while kept in a storage unit.

– Liability costs may also be covered if a visitor to the renter’s home is injured on the property or if the renter or a family member causes damage to someone else’s property and is sued as a result.

Encouraging renters to consider the importance of having appropriate coverage

It is important for renters to understand the importance of having appropriate coverage for their personal property in storage units. While renters insurance does provide coverage, it is essential to evaluate the need for additional endorsements or separate insurance policies for high-value items such as jewelry, collectibles, or artwork.

Additionally, renters should consider opting for storage facilities with robust security measures and climate-controlled units for sensitive items. Documenting belongings, maintaining an inventory, and providing proof of ownership are also crucial steps to maximize coverage and ensure a smooth claims process.

Regular communication with the insurance provider is essential to update coverage limits, inform about changes in storage units, and review policy terms and conditions. By following these tips and maintaining open communication, renters can maximize the coverage for their personal property in storage units and ensure their belongings are adequately protected.

Therefore, renters insurance offers valuable coverage for items stored in storage units. Renters should carefully review their policy and consider additional coverage options to ensure they have appropriate protection for their belongings. With the right coverage in place, renters can have peace of mind knowing that their personal property is safeguarded against potential risks.

Find out more about Great amerian insurance claim storage unit.