Introduction

When it comes to renting a property, it is important to have renters insurance that covers personal property located in a storage facility against theft, vandalism, and weather-related damage, up to policy limits. This type of coverage can provide peace of mind and financial protection for renters who may not be able to afford to replace their valuable possessions if stolen or damaged.

It is important to note that the information provided here is general and meant to help customers understand different aspects of insurance. The information is not an insurance policy, nor does it modify any provisions, limitations or exclusions in any specific insurance policy. The actual insurance policy or policies involved in a claim will determine whether an accident or other loss is covered.

Overview of Progressive renters insurance coverage

Progressive offers renters insurance that can protect personal property stored in a storage facility against theft, vandalism, and certain types of weather-related damage, such as hail and wind. The coverage limit for personal property depends on the policyholder’s chosen coverage amount.

In addition to providing coverage for personal property, Progressive’s renters insurance also includes liability coverage, which can help policyholders pay for damages if they unintentionally cause harm to someone else’s property or person, such as in the event of a kitchen fire or a guest slipping and falling.

Policyholders can also choose to add optional coverages to their renters insurance policy, such as water backup coverage, which can help pay for damage caused by a water backup, and identity theft coverage, which can help policyholders recover from identity theft.

It is important for renters to understand the terms and conditions of their renters insurance policy, as well as any optional coverages they may choose to add. It is also important to speak with an insurance representative to fully understand the coverages and other features of a specific renters insurance policy.

Comparison of renters insurance coverage from different insurers

Renters insurance coverage and features can vary by insurer and state. It is important for renters to compare policies and coverage options when choosing a renters insurance policy. Here is a comparison of renters insurance coverage from three different insurers:

| Coverage | Insurer A | Insurer B | Insurer C |

|——————-|—————|—————|————–|

| Personal property | Up to $50,000 | Up to $25,000 | Up to $100,000 |

| Liability | $100,000 | $300,000 | $25,000 |

| Water backup | Optional add-on| Included | Included |

| Identity theft | Optional add-on| Optional add-on| Included |

It is important for renters to prioritize their coverage needs and budget when choosing a renters insurance policy. Renters should consider the coverage and features of each policy, as well as any optional add-ons available. It is also important to compare rates from different insurers to find the best renters insurance policy for their specific needs.

What is Renters Insurance?

Explanation of renters insurance and what it covers

Renters insurance is a type of insurance policy that is designed to provide financial protection for individuals who are renting a home or apartment. The primary purpose of renters insurance is to cover personal property and liability protection in the event of damage, theft, or other losses that may occur.

When it comes to personal property, renters insurance may cover items such as furniture, electronics, clothing, and appliances. This coverage extends beyond just your home or apartment, as it may also apply to personal property located in a storage facility. Specifically, renters insurance may cover personal property located in a storage facility against theft, vandalism, and weather-related damage up to your policy’s limits.

In addition to personal property coverage, renters insurance also provides liability protection. This means if you accidentally cause damage to someone else’s property or someone is injured while on your rented property, renters insurance can help pay for damages and legal fees.

It is important to note that the scope and limits of renters insurance vary between insurers and by state, so it is important to read the applicable policy and/or speak to an insurance representative to fully understand the coverages and other features of a specific policy.

When shopping for renters insurance, it is important to compare several quotes from different insurers to find the policy that best fits your needs. Some policies may have lower premiums but may not offer as much coverage, so it is essential to review the details before making a purchase.

Overall, renters insurance is an essential type of coverage for individuals who are renting a home or apartment. It provides valuable protection for personal property and liability, giving you peace of mind and financial protection in the event of unexpected accidents or losses.

Personal Property Coverage

Details on what personal property is covered by renters insurance

Renters insurance is an important consideration for anyone who is renting a home or apartment, as it provides essential protection for personal property and liability. When it comes to personal property coverage, renters insurance may cover items such as furniture, electronics, clothing, and appliances. In addition, some policies may also cover personal property located in a storage facility against theft, vandalism, and weather-related damage up to your policy’s limits.

It is important to note that the details of what is covered by renters insurance can vary between insurers and by state, so it is essential to read the applicable policy and/or speak to an insurance representative to fully understand the coverage details.

Renters insurance can help protect personal property in a variety of situations. For example, if a fire breaks out in your rental home and damages your personal property, renters insurance can help cover the cost of repairs or replacement. Similarly, if a thief breaks into your home and steals your personal belongings, renters insurance can provide compensation for the stolen items.

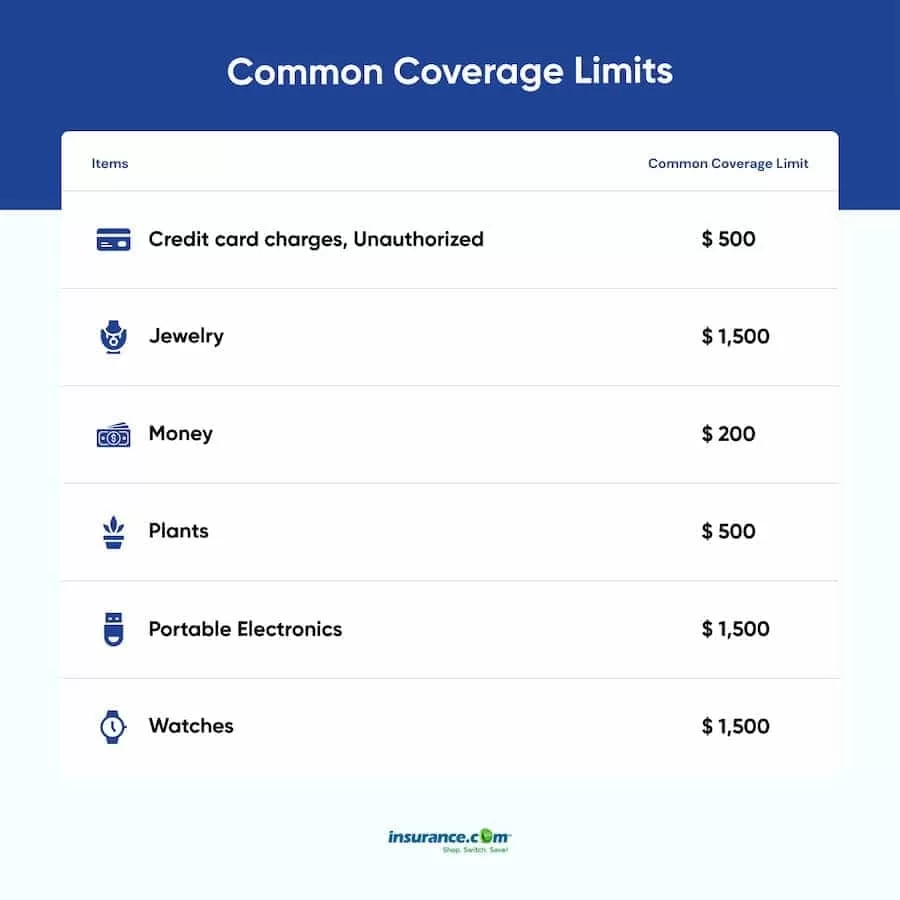

It is essential to remember that renters insurance typically comes with limits, which means that there may be a cap on the amount of coverage provided for certain items or categories of items. For example, there may be a limit on the amount of coverage provided for electronics or jewelry. It is important to review the details of your policy carefully to ensure that you have adequate protection for your personal property.

In addition to personal property coverage, renters insurance also provides liability protection. This means that if you accidentally cause damage to someone else’s property or someone is injured while on your rented property, renters insurance can help pay for damages and legal fees.

Overall, renters insurance provides valuable protection for personal property and liability, giving you peace of mind and financial protection in the event of unexpected accidents or losses. It is essential to shop around for renters insurance policies and compare quotes from different insurers to find the policy that best fits your needs and budget. By taking the time to understand the details of your renters insurance policy, you can ensure that you have the necessary protection to safeguard your personal property and liability.

Storage Unit Coverage

Does Progressive renters insurance cover storage units?

Renters insurance is crucial for individuals who live in rented homes or apartments as it provides financial protection for personal property and liability. Most renters insurance policies may extend coverage to personal property located in a storage facility against theft, vandalism, and weather-related damage up to policy limits.

Progressive renters insurance, like other insurance companies, provides coverage for personal property located in storage facilities. However, it is important to note that the scope and limits of coverage may vary between insurers and by state. It is essential to read the applicable policy and/or speak to an insurance representative to fully understand the coverages and other features of a specific policy.

When shopping for renters insurance coverage for a storage facility, it is essential to consider the value of the items being stored and select a policy with sufficient limits to cover their replacement or repair costs.

Before purchasing renters insurance to cover items stored in a storage facility, it is essential to review the terms of the storage contract. Some storage facilities may require proof of insurance, and it is important to ensure that the policy purchased meets the storage facility’s insurance requirements.

Overall, renters insurance provides valuable protection for personal property stored in a storage facility against theft, vandalism or weather-related damage. Always compare quotes and review policy details to get the best coverage options that meet individual needs.

Theft Coverage in Storage Units

Does renters insurance cover theft in storage units?

When renting a storage unit, it’s important to consider the potential risks involved. Theft is a significant concern for individuals who store their personal property in a storage facility. Fortunately, renters insurance may provide coverage for personal property located in a storage facility against theft, up to the policy limits.

It’s crucial to note that the scope and limits of coverage for theft in storage units may vary between insurers and by state. Before purchasing renters insurance, individuals must compare quotes and review policy details to ensure that they receive adequate coverage.

When selecting renters insurance coverage for a storage unit, it’s crucial to consider the value of the items being stored. Individuals must select a policy with sufficient limits to cover their replacement or repair costs in case of theft.

In addition, individuals must review the storage contract’s terms before purchasing renters insurance. Some storage facilities may require proof of insurance, and it is crucial to ensure that the policy purchased meets the storage facility’s insurance requirements.

It’s important to note that renters insurance does not cover intentional acts of theft by the policyholder or anyone in collusion with the policyholder. Additionally, renters insurance policies may have specific conditions that must be met to file a theft claim in storage units, such as using a quality padlock or notifying the storage facility of the theft immediately.

Overall, renters insurance provides valuable protection against theft in storage units, up to the policy limits. However, it’s essential to compare quotes and review policy details to ensure that the coverage meets individual needs and requirements.

Vandalism Coverage in Storage Units

Does renters insurance cover vandalism in storage units?

For renters who store personal items in a storage unit, vandalism can be a significant concern. Vandalism refers to intentional damage, destruction, or defacement of a person’s property by another party. Fortunately, renters insurance typically provides coverage against vandalism in storage units.

Renters insurance policies generally cover personal property located in a storage facility against theft, vandalism, and weather-related damage up to policy limits. However, it is essential to understand the limitations and exclusions of the policy in question. For instance, some policies may not cover certain types of vandalism, such as graffiti or malicious acts of destruction.

When shopping for renters insurance, it is crucial to compare quotes and review policy details to obtain sufficient coverage options that meet individual needs. It is also important to ensure that the policy meets the storage facility’s insurance requirements.

It is wise for renters to take certain preventative measures to minimize the likelihood of vandalism. For example, storing items at the back of the unit, securing items with locks or chains, and installing security cameras or alarms can deter vandals.

In the unfortunate event that vandalism occurs, renters should document the damage thoroughly, including taking photographs and recording any witness statements. They should also report the incident to the police and the storage facility as soon as possible. Renters insurance claims typically require documentation of the incident, so it is essential to keep all relevant records safe and accessible.

Therefore, renters insurance does cover vandalism in storage units. However, individual policies may vary in the scope and limits of coverage. Renters should review policy details and storage facility insurance requirements when shopping for coverage options and take preventative measures to reduce the risk of vandalism. In the event of vandalism, renters should follow appropriate steps to document the incident and file a claim with their insurance provider.

Weather-Related Damage Coverage in Storage Units

Does renters insurance cover weather-related damage in storage units?

Renters insurance policies typically provide coverage for personal property stored in a storage unit against weather-related damage. This coverage may include damage caused by floods, hurricanes, tornadoes, hail, or other natural disasters. However, it is crucial to review the policy language and exclusions to ensure that the policy covers the specific types of weather-related damage that may be of concern.

Some renters insurance policies may have specified limits on the amount of coverage available for weather-related damage, while others may require additional coverage to be purchased. It is critical to review the policy and ensure that the policy limit is sufficient to cover the value of the stored items.

In addition to reviewing the renters insurance policy, it is important to check the storage facility’s insurance policy and requirements. Some storage facilities may require renters to carry a minimum level of insurance coverage to protect against weather-related damage.

To minimize the risk of weather-related damage, renters should take precautions such as storing items in waterproof containers or wrapping them in plastic to provide additional protection. Some storage facilities may also offer climate-controlled units that provide added protection against temperature and humidity fluctuations.

In the event of weather-related damage, renters should report the incident to their insurance provider promptly. They should also document the damage thoroughly, including taking photographs and making a list of all damaged items. Renters may also need to provide proof of the weather event that caused the damage, such as a news report or documentation from the storage facility.

So, renters insurance policies typically provide coverage for weather-related damage to personal property stored in a storage unit. Renters should review policy language and exclusions to ensure that the policy covers the specific types of weather-related damage that may be of concern. They should also take precautions to minimize the risk of damage and document thoroughly in the event of a claim.

Policy Limits and Deductibles for Storage Units

How policy limits and deductibles apply to renters insurance for storage units

When purchasing renters insurance for storage units, it is crucial to understand the policy limits and deductibles. Policy limits refer to the most an insurance company will pay out for a claim, while deductibles are a specified amount that the policyholder must pay out of pocket before coverage kicks in.

Renters insurance policies generally cover personal property located in a storage facility against theft, vandalism, and weather-related damage up to policy limits. However, the policy limits can vary depending on the insurance provider and the policy’s specific terms and conditions.

It is essential to compare quotes and review policy details to obtain sufficient coverage options that meet individual needs. It is also important to ensure that the policy meets the storage facility’s insurance requirements, often stated in a rental agreement.

In addition to policy limits, renters insurance policies typically require a deductible. The deductible is a predetermined amount that the policyholder must pay out of pocket before the insurance company provides coverage. For instance, if a policyholder has a $500 deductible and incurs a $1,000 loss, the insurance company will pay out $500, and the policyholder must pay the remaining $500.

The deductible amount is an important consideration when shopping for renters insurance. Lower deductibles typically mean higher premiums, while higher deductibles can result in lower premiums but require more out-of-pocket costs for each claim.

So, when purchasing renters insurance for storage units, knowing the policy limits and deductibles is crucial. Renters should review policy details, compare quotes, and ensure the policy meets the storage facilities’ insurance requirements. Lower deductibles result in higher premiums, while higher deductibles mean lower premiums but require more out-of-pocket costs.

Conclusion

Summary of renters insurance coverage for storage units

So, most standard homeowners, renters, and condo insurance policies provide coverage for personal property located in a storage facility against theft, vandalism, and weather-related damage, but not usually for mold and mildew. Policy limits and deductibles are important considerations when purchasing renters insurance for storage units. Policy limits refer to the maximum amount an insurance company will pay out for a claim, while deductibles are the amount a policyholder must pay out of pocket before coverage kicks in.

When shopping for renters insurance, it is essential to review policy details and compare quotes to obtain sufficient coverage options that meet individual needs. It is also important to ensure that the policy meets the storage facility’s insurance requirements, as stated in a rental agreement.

Renters insurance policies typically require a deductible, which can impact premiums and out-of-pocket costs for each claim. Lower deductibles result in higher premiums, while higher deductibles mean lower premiums but require more out-of-pocket costs.

It is essential to research insurance providers and understand their policies’ terms and conditions before signing up for renters insurance for storage units. Certain states may not allow moving companies to sell insurance to their customers, so it is essential to ask for documentation of this policy from the movers. In case of any damage, destruction, or loss of personal property, full replacement value protection requires the moving company to repair or replace it at the current market value, so it is crucial to have proper liability insurance coverage.

Overall, it is important to protect personal property in storage units with renters insurance coverage and to be aware of policy limits and deductibles when selecting a policy.

Explore Self storage unit insurance.