Does my homeowners insurance cover storage unit state farm

Many people use storage units to safely store their belongings, whether they’re moving, decluttering, or just need extra space. However, it’s important to understand the coverage options available for your items in storage. While most homeowners and renters policies provide coverage for items stored away from your home, they typically don’t cover flood damage. In this article, we’ll explain the insurance options available for your storage unit and how to protect your belongings from potential damages or losses.

Explanation of homeowners insurance coverage for storage units

If you have a homeowners or renters insurance policy, you may already have some coverage for items stored outside of your home. However, it’s important to note that these policies may not cover damage caused by floods, earthquakes, or other natural disasters. To ensure your items are fully protected, you may want to consider purchasing additional insurance for your storage unit.

When selecting a storage unit insurance policy, be sure to consider the value of the items you’re storing, as well as any potential risks or hazards associated with the storage facility. Some policies may have limitations or exclusions for certain types of items, such as jewelry or electronics. It’s also a good idea to take an inventory of the items you’re storing and keep a record of their value, in case you need to file a claim with your insurance provider.

Another important factor to consider is the packing process. Properly packing your items can help protect them from potential damage or loss, as well as make it easier to file an insurance claim if necessary. Labeling boxes and creating a list of items in each box can also help ensure you have enough insurance coverage and make it easier to locate specific items in storage.

Therefore, while most homeowners and renters policies provide some coverage for items stored away from your home, it’s important to understand the limitations and exclusions of these policies. Purchasing additional insurance for your storage unit, properly packing your items, and keeping an inventory and record of their value can help ensure your belongings are fully protected. If you have any questions about insurance coverage for your stored items, be sure to contact your insurance provider.

Personal Property Coverage

Overview of personal property coverage in homeowner’s insurance

When you purchase homeowners insurance, you expect it to cover losses that may occur to your home and personal belongings. Personal property coverage is a part of your homeowners insurance policy that helps you protect your belongings from disasters like theft, fire, hail, and other covered perils.

However, your homeowners insurance policy may not cover all your belongings in case of a loss. Most policies have a limit on coverage for belongings that are not located within the premises of your home. In such cases, you may need additional coverage to fully protect your items stored in a storage unit.

If you are renting a storage unit, it is essential to check what your homeowners insurance policy covers for off-premises personal property. Although State Farm homeowners insurance may cover your belongings kept in storage units, you need to ensure whether you have the off-premises personal property coverage through your policy.

The coverage limit for the personal property kept outside of your home is generally lower than the coverage limit of your belongings that are stored inside your home. Ensure that you have enough coverage to protect your belongings from any potential financial loss in case of a disaster or theft.

Does homeowners insurance cover items in storage units?

Your homeowners insurance policy may cover items kept in a storage unit from certain perils. If your policy includes off-premises personal property coverage, it may cover your stored items from perils like theft, fire, and other damages as stated in your policy. The coverage limit for off-premises personal property coverage is usually ten percent of your policy’s dwelling coverage limit.

Keep in mind that some policies may not cover all types of losses, and high-value items like artwork, jewelry, and collectibles may require additional insurance to be fully protected. You may want to reach out to your insurance agent to determine whether you have the right coverage and limits that meet your specific needs.

High-Value items coverage

If you have high-value items that are stored in your storage unit, your homeowners insurance policy may not provide the full coverage you need. You may need to purchase endorsements, riders, or a separate policy that can cover your high-value items.

Endorsements or riders are add-ons to your existing policy that increase the coverage of specific items. For example, if you have an expensive piece of jewelry that is valued higher than the off-premises personal property coverage limit in your policy, you may need to purchase a rider for that particular item to ensure it is adequately covered.

A separate policy for high-value items may be a better option if you have multiple valuable items in storage. These policies can provide higher coverage limits and may also cover other items that your regular homeowners insurance policy would not.

It is essential to understand the coverage limit and exclusions of your homeowners insurance policy concerning off-premises personal property before storing your items in a storage unit. By doing so, you can ensure your belongings are adequately protected from potential losses.

Additional Coverage for Off-Premises Items

Details about additional coverage for off-premises items in homeowners insurance policies

When it comes to storing your belongings in a storage unit, it is essential to check with your insurance provider about your coverage limit and exclusions for personal property kept off-premises. Depending on your policy, your homeowners insurance may or may not cover the loss of your stored items.

Suppose your State Farm homeowners insurance policy does cover off-premises personal property. In that case, the coverage limit is typically ten percent of your policy’s dwelling coverage limit. This coverage may not be enough in case of damage to high-value items like expensive jewelry, art, or collectible items.

If you have high-value items, you may need additional coverage to provide extra protection for your belongings. Endorsements, riders, or a separate policy are the three types of insurance that may be available to increase coverage limits for high-value items.

Endorsements or riders are add-ons to your existing policy that can increase the coverage of specific items. An example of using a rider would be, if you have a piece of jewelry that is valued higher than the off-premises personal property coverage limit in your policy. You may need to purchase a rider for that item separately to ensure it is adequately covered.

A separate policy for high-value items may be a good option for individuals with multiple valuable items in storage. These policies provide higher coverage limits and offer additional coverage compared to regular homeowners’ insurance policies.

Ensure that you understand the coverage limit of holding items off-premises in your homeowners insurance policy before storing your items in a storage unit. It is always best to check with your insurance agent to ensure that you have the right coverage that meets your specific needs. You don’t want to find out after the fact that your insurance policy will either not cover your loss or provide inadequate coverage.

So, it is essential to review your homeowners insurance policy before you rent a storage unit. If your policy includes off-premises personal property coverage, you may have some protection against potential losses. However, if you have high-value items, you may need to purchase additional coverage to ensure that you are fully covered. By doing so, you can have peace of mind knowing that your belongings are safe and adequately protected from potential losses.

Coverage Limits

Explanation of coverage limits for personal property stored in storage units

When you store your personal belongings in a storage unit, it is essential to understand the coverage limits of your homeowners insurance policy. Personal property coverage in a homeowners insurance policy usually covers losses caused by theft, fire, and other covered perils. However, the coverage limit for off-premises personal property is generally lower than your dwelling coverage limit, usually between 10% to 20% of your personal property limit.

For example, if your policy’s dwelling coverage is $300,000, and your personal property coverage limit is 50% of the dwelling coverage, i.e., $150,000, your off-premises personal property coverage limit would be between $15,000 to $30,000. Thus, if you have stored $50,000 worth of personal property in a storage unit, you may receive only up to $5,000 to $10,000 in coverage if your stored items are stolen or damaged.

It is important to note that the coverage limit only applies to covered perils listed in your policy. Some policies may exclude specific perils, such as floods, earthquakes, and hurricanes. Therefore, it is crucial to read your policy carefully to understand any limitations and exclusions.

Moreover, keep in mind that if the value of your stored personal property exceeds your coverage limit, you may need to purchase additional insurance or endorsements to ensure that your items are fully protected. You may also want to consider purchasing a separate policy for high-value items in storage units.

So, it is critical to understand the coverage limits and exclusions of your homeowners insurance policy before storing your personal belongings in storage units. Knowing the policy’s coverage limits and exclusions will help you make informed decisions about whether you need additional coverage for your stored items. For more information and guidance, it’s beneficial to speak with your insurance agent and explore various insurance options to fully protect your stored belongings.

Exceptions to Coverage

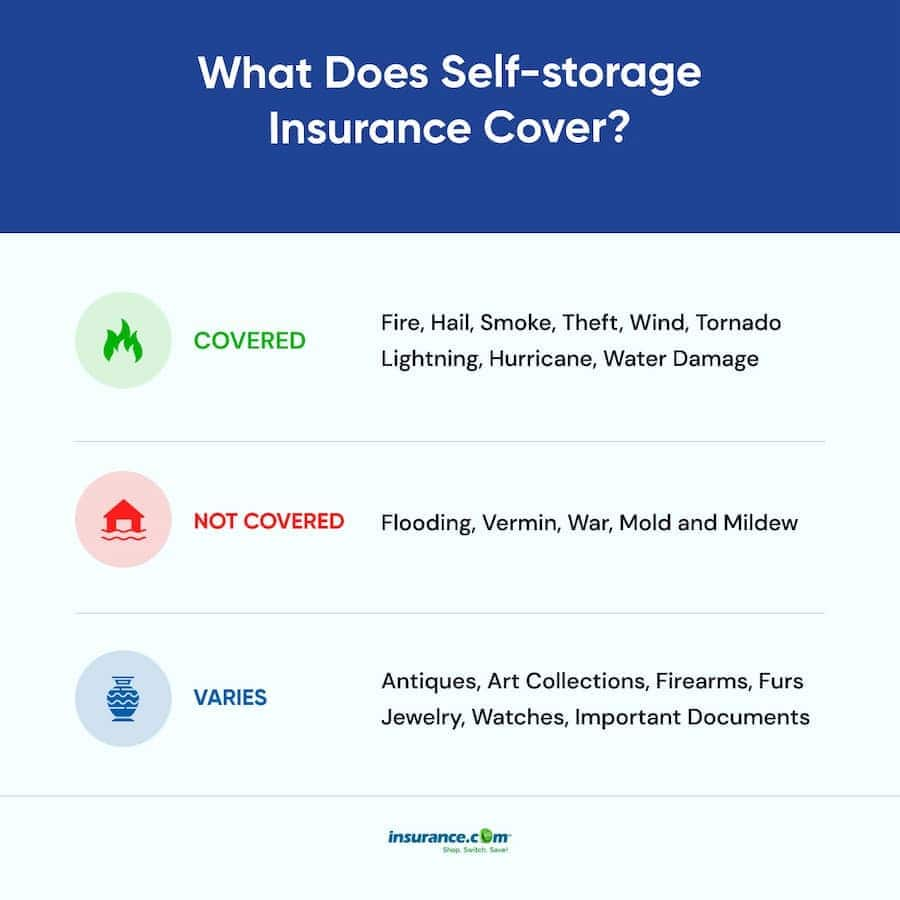

When it comes to storage unit insurance, homeowners insurance policies may not cover all perils and circumstances. While theft, fire, and wind are typically covered by storage unit insurance, other events may be excluded from coverage. If your stored property is damaged due to perils like flooding, mold and mildew, vermin, earthquake, or war, you may not be covered by your homeowners insurance policy.

It is crucial to note that even if your homeowners insurance policy covers your stored property, coverage limits may be lower than you expect. Off-premises personal property coverage limits may be between 10% to 20% of your personal property limit, which may be far lower than the actual value of your stored items. For example, if you have $50,000 worth of items stored in a unit, your off-premises personal property coverage may only cover up to $5,000 to $10,000.

Moreover, it is important to consider the value of high-priced items stored in a storage unit. If your storage unit contains high-value items like art, jewelry, or antiques, the coverage limit of your homeowners insurance may not be sufficient. To ensure such items are fully protected, separate additional coverage or insurance may be required to mitigate financial loss.

Examples of circumstances where homeowners insurance may not cover items stored in storage units

– Flooding: Homeowner’s insurance typically excludes flooding from coverage. Therefore, if your storage unit contains items that are damaged from flooding, you may not be able to claim insurance.

– Mold and mildew: Mold and mildew in storage units can result from changes in temperature, humidity, or poor ventilation. Most homeowner’s policies exclude any damage caused by fungus, rot, and mold.

– Vermin: Storage units can attract pests and rodents, resulting in damage to stored items. While some homeowner’s policies may provide limited coverage for vermin damage, most exclude it.

– Earthquake: Homeowner’s insurance policies typically exclude damage caused by earthquakes unless you obtain separate insurance coverage for earthquakes.

– War: Homeowner’s policies typically exclude damage caused by war or acts of terrorism.

It is crucial to read your homeowner’s insurance policy carefully to understand any limitations and exclusions related to off-premises personal property coverage. Furthermore, experts suggest working with an insurance professional to assess your coverage needs and explore various insurance options to protect your possessions. Properly knowing the exclusions and exceptions to coverage can help make informed decisions regarding storing your personal items in storage units.

State Farm’s Coverage for Detached Structures

Explanation of State Farm’s coverage for detached structures and how storage units may be included

State Farm’s homeowners insurance policy covers detached structures located on your property, separate from your main dwelling, with clear space between them. This coverage includes structures like detached garages, equipment sheds, barns, and guest cottages. The basic policy covers these structures for up to 10% of your main dwelling coverage.

State Farm’s policy also covers personal property for specific perils, including fire, lightning, windstorm, hail, and theft. However, when it comes to storing your personal belongings in storage units, it is important to understand the coverage limits of your policy.

Personal property coverage in the homeowners insurance policy covers losses caused by theft, fire, and other covered perils. However, the coverage limit for off-premises personal property is generally lower than your dwelling coverage limit, usually between 10% to 20% of your personal property limit.

For example, if you have a State Farm homeowners insurance policy with dwelling coverage of $300,000 and a personal property coverage limit of 50% of the dwelling coverage, i.e., $150,000, your off-premises personal property coverage limit would be between $15,000 to $30,000, depending on the policy.

If you have stored your personal property in a storage unit and it is stolen or damaged, you may only receive up to $5,000 to $10,000 in coverage if the value of your stored personal property is $50,000. Coverage limits only apply to covered perils listed in your policy, which may exclude specific perils such as floods, earthquakes, and hurricanes. Therefore, it is essential to read your policy carefully to understand any limitations and exclusions.

If the value of your stored personal property exceeds your coverage limit, it may be necessary to purchase additional insurance or endorsements to ensure full protection. You may also want to consider purchasing a separate policy for high-value items in storage units.

So, understanding the coverage limits and exclusions of your State Farm homeowners insurance policy is crucial before storing your personal belongings in storage units. Knowing the policy’s coverage limits and exclusions will help you make informed decisions about whether you need additional coverage for your stored items. It is advisable to speak with your insurance agent for more information and guidance and to explore various insurance options to fully protect your stored belongings.

Obtaining Additional Insurance

Options for obtaining additional insurance coverage for items stored in storage units

If the coverage limits of your State Farm homeowners insurance policy fall short of protecting the full value of your stored personal property, it may be necessary to obtain additional coverage. There are several options to consider:

-

Storage unit insurance:

Many storage facilities offer insurance coverage for stored items. This type of insurance may provide additional protection for covered perils such as theft, fire, and water damage. However, the coverage limits and exclusions may vary depending on the facility and policy.

-

Self-storage insurance:

You may also purchase a separate self-storage insurance policy to protect your stored belongings. Many insurance providers offer this type of policy with coverage limits tailored to your specific needs. It may also provide coverage for additional perils such as earthquake and flood damage.

-

Endorsements:

Endorsements are add-ons to your existing State Farm homeowners insurance policy that enhance your coverage. For example, you may obtain an endorsement to increase the off-premises personal property coverage limit or to add additional perils such as flood and earthquake damage.

-

Flood insurance:

Homeowners insurance policies typically do not cover flood damage. Therefore, if you are storing items in a storage unit located in a flood-prone area, it is essential to purchase separate flood insurance. The National Flood Insurance Program (NFIP) offers affordable flood insurance policies that cover both residential and commercial properties.

-

Valuable items insurance:

If you are storing high-value items such as jewelry, artwork, or antiques, you may also consider obtaining valuable items insurance. This type of insurance provides additional coverage for items that exceed the standard limits of your homeowners insurance policy.

It is important to carefully review the terms and conditions of any insurance policy or endorsement before purchasing it. Pay attention to the coverage limits, exclusions, deductibles, and premiums to ensure that you are getting the best coverage for your needs and budget.

Remember that insurance is not a substitute for proper packing and protection of your stored belongings. Take the time to pack your items carefully and label them appropriately to minimize the risk of damage or loss. Also, choose a reputable storage facility with proper security measures to protect your stored items from theft or vandalism.

So, obtaining additional insurance coverage for items stored in storage units is a critical step in protecting your valuable belongings. There are several options to consider, including storage unit insurance, self-storage insurance, endorsements, flood insurance, and valuable items insurance. Carefully review the terms and conditions of each option and choose the best coverage for your needs and budget.

Tips for Protecting Your Personal Property

Tips for securing your personal property in storage units to minimize risk of damage or theft

When you’re storing your personal property in storage units, keeping them safe and secure is crucial. Here are some tips to help you protect your personal property in storage units and mitigate the risk of damage or theft.

Choose a Secure Storage Facility

One of the most important things to do is to choose a storage facility that offers excellent security features. Look for security measures such as video surveillance, gated access, and on-site security personnel. The facility should also have proper lighting and be well-maintained to prevent mishaps or accidents.

Pack Your Belongings Carefully

Packing your personal property carefully is vital when storing them in a storage unit. Use high-quality packing materials such as bubble wrap, packing peanuts, and sturdy boxes to protect your belongings from damage. Make sure to label your boxes correctly to find your items easily. Use pallets or shelving to keep your items off the ground and protect them from moisture.

Insurance Coverage

Proper insurance coverage is crucial for protecting your belongings in storage units. Check your homeowners or renters insurance policies to ensure that your property is fully covered in a storage unit. If necessary, purchase additional insurance for valuable or high-priced items.

Document Your Belongings

Before storing your personal property in storage units, take inventory and document everything you’re storing. You can use a photo or video inventory to help verify any damage or loss accurately. Having a list of everything you’re storing can also help ensure you have enough insurance coverage.

Regularly Check on Your Belongings

Make sure to visit your storage unit regularly to check on your belongings. Regularly checking on your items can help you identify any issues such as damage or theft promptly. It also helps to ensure that the items are still in their proper location.

Therefore, storing your personal property in a storage unit can be convenient and useful, but it’s essential to do it properly. Follow these tips to help protect your belongings and prevent damage or theft while in storage. Remember, choosing a secure storage facility, carefully packing your belongings, having proper insurance, documenting your belongings, and regularly checking on your belongings can help keep your stored items safe and secure.

Tips for Protecting Your Personal Property

Tips for Securing Your Personal Property in Storage Units to Minimize Risk of Damage or Theft

When individuals store their belongings in a storage unit, it is essential to keep them safe and secure. Here are tips to help protect personal property in storage units and mitigate the risk of damage or theft.

Choose a Secure Storage Facility

Choosing a storage facility with excellent security features is one of the essential things to do. On-site security personnel, gated access, video surveillance, proper lighting, and a well-maintained facility will prevent mishaps or accidents.

Pack Your Belongings Carefully

It is vital to pack personal property carefully when storing them in a storage unit. Using high-quality packing materials such as sturdy boxes, packing peanuts, and bubble wrap will protect them from damage. Labeling boxes accurately will ensure that items are easily found. Pallets or shelving will keep items off the ground and protect them from moisture.

Insurance Coverage

Proper insurance coverage is crucial for protecting personal property in storage units. Homeowners or renters should check their insurance policies to make sure that their property is fully covered. Purchasing additional insurance for valuable or high-priced items is also necessary.

Document Your Belongings

Before storing personal property in storage units, documenting and taking inventory of everything being stored is essential. Using photo or video inventory can help verify any damage or loss. Having a list of stored belongings will ensure sufficient insurance coverage.

Regularly Check on Your Belongings

Regularly visiting the storage unit to check on belongings is necessary to identify any damage or theft promptly. Checking on items will also ensure that they are still in their proper location.

Conclusion

Reiteration of Coverage Options and Tips for Protection, along with Final Thoughts and Next Steps

Therefore, storing personal property in a storage unit can be convenient and useful, provided that it is done properly. Following tips such as choosing a secure storage facility, carefully packing belongings, having proper insurance coverage, documenting personal property, and regularly checking on items will help keep them safe and secure. Always remember to visit the storage unit frequently and opt for additional insurance if necessary.

You’ll be interested in Insure my storage unit.

1 thought on “Does my homeowners insurance cover storage unit state farm”