Introduction

Overview of homeowners insurance coverage for belongings in storage units after a fire

Homeowners insurance provides coverage for personal belongings that are stored in a rented storage unit as long as the unit is in the same name as the policyholder. However, there are certain stipulations that apply to this coverage. In this article, we will explore what is covered by homeowners insurance for storage units, the limitations on coverage, and the steps you need to take to ensure adequate protection for your belongings.

What is covered?

When it comes to homeowners insurance coverage for storage units, the policy typically extends to the personal property stored in the unit. This includes items such as furniture, clothing, electronics, and appliances. In the event of a covered loss, such as a fire or theft, the insurance company will reimburse you for the value of the damaged or stolen items, up to the policy limits.

Policy limits

It is important to note that homeowners insurance policies have coverage limits for personal belongings, both within the home and in storage units. These limits vary depending on the insurance company and policy type. It is crucial to review your policy and understand the coverage limits specific to your plan. If the value of your stored items exceeds the policy limits, you may need to purchase additional coverage, known as a rider or floater, to adequately protect your belongings.

Exclusions and limitations

While homeowners insurance provides coverage for items stored in a rented storage unit, there are certain exclusions and limitations to be aware of. Some common exclusions include damage caused by floods, earthquakes, and pests. Additionally, certain high-value items, such as fine jewelry or collectibles, may have limited coverage under the standard homeowners policy. Separate insurance policies, known as endorsements, may be necessary to fully protect these types of valuables.

Steps to protect your belongings

To ensure that your belongings are adequately protected in a storage unit, it is important to take certain steps:

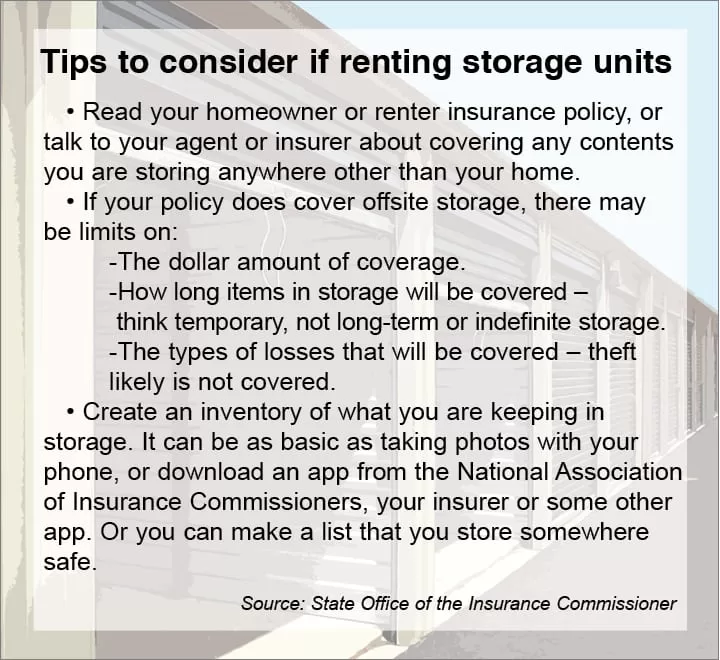

– Review your homeowners insurance policy to understand the coverage limits and exclusions specific to stored items.

– Take an inventory of the items you plan to store, including photographs and receipts. This will help in the event of a claim.

– If the value of your stored items exceeds the policy limits, consider purchasing additional coverage through a rider or floater.

– Take precautions to prevent damage, such as using climate-controlled storage units and proper packing materials.

– Notify your insurance company about the storage unit rental and provide them with the necessary information to update your policy.

Therefore, homeowners insurance generally covers personal belongings stored in rented storage units, with certain stipulations and limitations. It is important to review and understand your policy’s coverage limits, exclusions, and take necessary steps to ensure adequate protection for your stored items.

Understanding Homeowners Insurance Coverage

Explanation of the off-premises personal property coverage in a homeowners policy

Homeowners insurance is designed to protect your property and possessions in case of damage or loss. While the coverage generally extends to your personal belongings within your home, what happens when you need to store some of those items off-premises, such as in a storage unit? Here’s what you need to know about homeowners insurance and coverage for storage units:

Does homeowners insurance cover storage units?

Yes, homeowners insurance typically covers personal property that is stored in a storage unit that you rent. However, there are certain stipulations that apply to this coverage. Here are a few key considerations to keep in mind:

– The storage unit must be in the same name as the policyholder: In order for your homeowners insurance to cover items stored in a storage unit, the unit must be in your name. If the storage unit is under someone else’s name, your policy may not provide coverage.

– Coverage limits apply: Just like with other personal property covered by your homeowners insurance, there are coverage limits for items stored in a storage unit. It’s important to review your policy and understand the limits to ensure that your belongings are adequately covered.

– Types of perils covered: Homeowners insurance typically covers personal property against common perils such as fire, theft, and vandalism. This coverage typically extends to items in storage units as well. However, it’s important to review your policy to understand exactly what perils are covered.

Additional coverage options for storage units

While homeowners insurance may cover personal property stored in a storage unit, there may be limitations and exclusions. If you have valuable items or need additional coverage, there are options available to provide more comprehensive protection. Here are a few additional coverage options to consider:

– Storage unit insurance: Some storage facilities offer insurance options tailored specifically for storage units. These policies can provide additional coverage for your belongings, including protection against perils not covered by your homeowners insurance.

– Scheduled personal property coverage: If you have high-value items, such as jewelry or collectibles, you may want to consider adding scheduled personal property coverage to your homeowners insurance. This coverage allows you to specifically list and insure individual items for their full value.

Review and understand your policy

When it comes to homeowners insurance and coverage for storage units, it’s essential to review and understand your policy. Take the time to read through the terms, conditions, and coverage limits to ensure you have the appropriate protection for your stored belongings. If you have any questions or concerns, reach out to your insurance provider for clarification.

Therefore, homeowners insurance typically covers personal property stored in a storage unit, as long as the unit is in the same name as the policyholder. However, it’s important to be aware of the coverage limits and consider additional coverage options if needed.

Covered Perils

Explanation of the perils typically covered by homeowners insurance for storage units after a fire (fire, lightning, theft, vandalism)

When it comes to homeowners insurance coverage for storage units, there are certain perils that are typically covered. These include:

– Fire: If a fire damages your storage unit and your belongings, homeowners insurance will typically provide coverage for the loss.

– Lightning: If a lightning strike causes damage to your storage unit and your belongings, homeowners insurance should cover the cost of repair or replacement.

– Theft: If your storage unit is broken into and your belongings are stolen, homeowners insurance will usually cover the stolen items up to the policy’s coverage limits.

– Vandalism: If your storage unit is vandalized, causing damage to your belongings, homeowners insurance should provide coverage for the loss.

It’s important to note that the specific coverage may vary depending on your insurance policy, so it’s always recommended to review your policy and discuss any questions or concerns with your insurance provider.

While these perils are typically covered, there are some perils that are usually excluded from coverage. These include:

– Flooding: Damage caused by flooding, including water damage from heavy rains or rising waters, is typically not covered by homeowners insurance for storage units.

– Mold and mildew: Damage caused by mold or mildew growth is generally not covered by homeowners insurance.

– Vermin: Damage caused by pests such as rodents or insects is usually not covered by homeowners insurance.

– Earthquake: Damage caused by earthquakes is often not covered by homeowners insurance for storage units.

– War: Damage caused by acts of war or terrorism is typically not covered by homeowners insurance.

It’s important to be aware of these exclusions and consider additional coverage options if you live in an area prone to these perils. For example, you may want to explore separate insurance policies specifically for flood or earthquake coverage.

Therefore, homeowners insurance typically provides coverage for storage units, including protection against perils such as fire, lightning, theft, and vandalism. However, it’s important to review your policy and understand the coverage limits, as well as any exclusions that may apply. If you have valuable items or need additional coverage, there are options available to provide more comprehensive protection. Always take the time to review and understand your policy to ensure you have the appropriate protection for your stored belongings.

Personal Property Coverage

How belongings in storage units are covered by personal property coverage in homeowners insurance

Homeowners insurance provides coverage for your property and possessions in case of damage or loss. While the coverage generally extends to your personal belongings within your home, it also includes coverage for items stored off-premises, such as in a storage unit. Here’s what you need to know about homeowners insurance and coverage for storage units:

Does homeowners insurance cover storage units?

Yes, homeowners insurance typically covers personal property that is stored in a storage unit that you rent. However, there are certain stipulations that apply to this coverage. Here are a few key considerations to keep in mind:

– The storage unit must be in the same name as the policyholder: To ensure coverage for items stored in a storage unit, the unit must be rented under your name. If the storage unit is under someone else’s name, your policy may not provide coverage.

– Coverage limits apply: Just like with other personal property covered by your homeowners insurance, there are coverage limits for items stored in a storage unit. Review your policy to understand these limits and ensure that your belongings are adequately covered.

– Types of perils covered: Homeowners insurance typically covers personal property against common perils such as fire, theft, and vandalism. This coverage generally extends to items in storage units as well. However, it’s important to review your policy to understand exactly what perils are covered.

Additional coverage options for storage units

While homeowners insurance may cover personal property stored in a storage unit, there may be limitations and exclusions. If you have valuable items or need additional coverage, consider these options:

– Storage unit insurance: Some storage facilities offer insurance options tailored specifically for storage units. These policies can provide additional coverage for your belongings, including protection against perils not covered by your homeowners insurance.

– Scheduled personal property coverage: If you have high-value items, such as jewelry or collectibles, you may want to add scheduled personal property coverage to your homeowners insurance. This allows you to specifically list and insure individual items for their full value.

Review and understand your policy

When it comes to homeowners insurance and coverage for storage units, it’s essential to review and understand your policy. Read through the terms, conditions, and coverage limits to ensure you have the appropriate protection for your stored belongings. If you have any questions or concerns, reach out to your insurance provider for clarification.

To summarize, homeowners insurance typically covers personal property stored in a storage unit, as long as the unit is in the same name as the policyholder. However, it’s important to be aware of the coverage limits and consider additional coverage options if needed.

Supplemental Insurance

Information on supplemental insurance that storage unit owners can sell for renter’s goods

Storage unit owners often offer supplemental insurance to protect the goods stored in their facility. This type of insurance is specifically designed to provide coverage for personal belongings stored in storage units. Here’s what you need to know about supplemental insurance for storage units:

– What is supplemental insurance for storage units?: Supplemental insurance is an additional coverage option that storage unit owners can offer to their customers. It provides protection for the renter’s belongings in case of damage, theft, or loss while stored in the unit. This insurance is meant to complement the renter’s existing coverage, such as homeowners insurance, by providing additional coverage for items in storage.

– Coverage options: Supplemental insurance for storage units often covers a wide range of perils, including fire, water damage, theft, vandalism, and natural disasters. The coverage limits and terms may vary depending on the insurance provider and the specific policy. It’s important to review the policy carefully to understand what is covered and any exclusions that may apply.

– Cost of supplemental insurance: The cost of supplemental insurance for storage units can vary based on several factors, including the value of the stored items and the desired coverage limits. Some storage facilities may offer different coverage tiers with varying prices. It’s recommended to compare quotes from different insurance providers to find the most suitable coverage at a competitive price.

– Benefits of supplemental insurance: Supplemental insurance offers several benefits for both storage unit renters and storage facility owners. For renters, it provides peace of mind knowing that their belongings are protected in case of unexpected events. It can also provide coverage for items that may not be adequately covered by their existing insurance policies. For storage facility owners, offering supplemental insurance can help attract and retain customers by providing added protection and value.

– Considerations when purchasing supplemental insurance: Before purchasing supplemental insurance for your storage unit, it’s important to consider a few key factors. First, assess the value of the items you plan to store and determine if they require additional coverage. Review your existing insurance policies, such as homeowners or renters insurance, to see if they already provide coverage for items in storage. If not, supplemental insurance may be a worthwhile investment. Additionally, carefully review the terms, conditions, and coverage limits of the supplemental insurance policy to ensure it meets your needs.

Therefore, storage unit owners often offer supplemental insurance to provide additional coverage for the renter’s goods stored in their facility. This insurance can protect against a wide range of perils and provide peace of mind for renters. Before purchasing supplemental insurance, it’s important to assess your needs, review existing insurance coverage, and carefully consider the terms and conditions of the policy. Reach out to the storage facility for more information on their supplemental insurance options and to obtain a quote.

Filing a Claim

Steps to take when filing a claim for belongings damaged or lost in a storage unit fire

1. Notify your insurance provider

As soon as you discover that your belongings in the storage unit have been damaged or lost due to a fire, it is important to notify your insurance provider. They will guide you through the claims process and provide you with the necessary forms and documentation requirements.

2. Gather evidence

To support your claim, gather as much evidence as possible. Take photos or videos of the damage or loss, and make a detailed list of the items that have been affected. Providing this evidence will help in assessing the value of your claim.

3. Provide documentation

Your insurance provider will require certain documentation when filing a claim for belongings damaged or lost in a storage unit fire. This may include the storage unit rental agreement, proof of ownership for the items, and any receipts or appraisals that demonstrate their value. Make sure to provide all the necessary documents to expedite the claims process.

4. Cooperate with the investigation

Your insurance provider may conduct an investigation to determine the cause of the fire and assess the validity of your claim. It is important to fully cooperate with their investigation and provide any additional information or evidence they may require.

5. Await claim resolution

After submitting your claim and all the necessary documentation, it is time to await the resolution from your insurance provider. The length of time it takes to process and settle a claim can vary depending on the complexity of the case. Your insurance provider will keep you informed about the progress of your claim.

6. Review the claim settlement

Once your claim has been resolved, review the settlement carefully. Ensure that you agree with the amount offered and that it covers the full value of your damaged or lost belongings. If you have any concerns or disputes, discuss them with your insurance provider to seek a fair resolution.

7. Appeal if necessary

If you are not satisfied with the claim settlement, you have the right to appeal the decision. Provide any additional evidence or information that supports your case and explains why you believe the settlement should be adjusted. Follow the appeal process outlined by your insurance provider.

Therefore, if your belongings in a storage unit are damaged or lost due to a fire, follow these steps to file a claim with your insurance provider. By promptly notifying them, gathering evidence, providing documentation, cooperating with the investigation, and reviewing the claim settlement, you can ensure a smoother claims process and a fair resolution.

Home Insurance Limitations

Discussion on the limitations and exclusions of homeowners insurance coverage for storage units

When it comes to homeowners insurance, it’s important to understand that while your policy may offer coverage for your personal belongings, there are limitations and exclusions when it comes to storing these items in a storage unit. Here are some key points to consider:

1. Coverage Limits

Most homeowners insurance policies provide coverage for personal belongings, including those stored in a storage unit. However, this coverage is usually limited to a certain percentage of your policy’s personal property limit, typically around 10%. This means that if your policy’s personal property limit is $100,000, the coverage for items in storage may be limited to $10,000.

It’s important to review your policy and understand the specific coverage limits for storage unit stored items. If you have valuable items that exceed the coverage limit, you may need to consider additional insurance options.

2. Exclusions

While homeowners insurance generally covers damage or loss due to perils such as fire, theft, and vandalism, there are exclusions that may apply to items stored in a storage unit. Some common exclusions include damage caused by floods, earthquakes, and pests.

It’s crucial to review your policy’s exclusion list to understand what perils are not covered. If necessary, you may need to purchase additional coverage or a separate storage unit insurance policy to protect against these excluded perils.

3. Proof of Ownership

When filing a claim for damaged or lost items in a storage unit, your insurance provider will likely require proof of ownership for the items. This may include receipts, appraisals, or photographs of the items before they were stored. It’s important to keep a record of these documents in a secure location, separate from the items themselves.

4. Claim Process

In the event of damage or loss to your belongings in a storage unit, it’s crucial to promptly notify your insurance provider and initiate the claims process. This involves providing documentation, such as the storage unit rental agreement, proof of ownership, and any evidence of the damage or loss. Cooperating fully with any investigation by the insurance provider is also important to ensure a smooth claims process.

5. Settlement Review

After submitting your claim, your insurance provider will assess the value of the damage or loss and offer a settlement. It’s important to carefully review this settlement to ensure that it covers the full value of your belongings. If you have any concerns or disputes, it’s recommended to discuss them with your insurance provider to seek a fair resolution.

6. Appeal Process

If you are not satisfied with the claim settlement, you have the right to appeal the decision. It’s important to provide any additional evidence or information that supports your case and explains why you believe the settlement should be adjusted. Follow the appeal process outlined by your insurance provider to ensure your concerns are properly addressed.

Therefore, homeowners insurance may provide coverage for items stored in a storage unit, but there are limitations and exclusions that you need to be aware of. Understanding these limitations, gathering the necessary documentation, and following the claims process can help you navigate the insurance process and ensure a fair resolution in the event of damage or loss to your stored belongings.

Alternative Insurance Options

Exploration of other insurance options for storage units after a fire

If you have experienced a fire in your storage unit and your homeowners insurance does not cover the damage or loss, there are other insurance options to consider. Here are a few alternatives to explore:

1. Storage facility insurance

Many storage facilities offer insurance options for their customers. While these policies may not provide the same level of coverage as a homeowners insurance policy, they can still offer some protection for your belongings. It is important to carefully review the terms and conditions of the storage facility insurance to understand what is covered and what is not.

2. Third-party insurance

Some insurance companies specialize in providing coverage specifically for storage units. These third-party insurance providers may offer policies with varying levels of coverage and premiums. It is recommended to compare quotes from different providers and read customer reviews to ensure you are choosing a reputable and reliable insurance company.

3. Additional endorsements or riders

If you are unable to find a separate insurance policy for your storage unit, you may be able to add an endorsement or rider to your existing homeowners insurance policy. This can help extend coverage to your belongings in the storage unit, although it may come with certain limitations or restrictions. It is important to discuss this option with your insurance provider to understand the specifics of the endorsement or rider.

4. Umbrella insurance policy

Another option to consider is an umbrella insurance policy. Umbrella policies provide additional liability coverage that extends beyond the limits of your homeowners insurance policy. While this type of policy may not specifically cover the belongings in your storage unit, it can provide overall financial protection in case of unforeseen events or lawsuits.

5. Review and update your homeowners insurance

If you frequently use storage units or have valuable items stored in them, it may be worthwhile to review and update your homeowners insurance policy to ensure adequate coverage. Speak with your insurance provider to discuss any specific concerns or to inquire about additional coverage options that can better protect your belongings.

Overall, it is important to thoroughly research and explore different insurance options for your storage unit in case of a fire or other damage. Each option may have its own benefits and limitations, so it’s crucial to find the best fit for your needs and budget. Be proactive in assessing your insurance coverage and seek professional advice to make an informed decision.

Conclusion

Summary of homeowners insurance coverage for storage units after a fire and the importance of understanding policy terms and limitations

So, homeowners insurance does cover personal property stored in a rented storage unit, as long as the unit is in the same name as the policyholder. However, there may be certain stipulations and limitations to the coverage. In cases where homeowners insurance does not cover the damage or loss of belongings in a storage unit, there are alternative insurance options to consider.

One alternative is storage facility insurance, which some storage facilities offer to their customers. While these policies may not provide the same level of coverage as homeowners insurance, they can still offer some protection for stored belongings. It is important to carefully review the terms and conditions of the storage facility insurance to understand what is covered and what is not.

Another option is to seek third-party insurance providers that specialize in coverage for storage units. These providers may offer policies with varying levels of coverage and premiums. It is advisable to compare quotes from different providers and read customer reviews to ensure the chosen insurance company is reputable and reliable.

If separate insurance for the storage unit cannot be found, homeowners may consider adding an endorsement or rider to their existing homeowners insurance policy. This can help extend coverage to the belongings in the storage unit, although there may be limitations or restrictions. It is essential to discuss this option with the insurance provider to fully understand the specifics of the endorsement or rider.

Another consideration is an umbrella insurance policy, which provides additional liability coverage beyond the limits of homeowners insurance. While this type of policy may not specifically cover the belongings in the storage unit, it can provide overall financial protection in case of unforeseen events or lawsuits.

Regularly reviewing and updating homeowners insurance policy is crucial, especially for those who frequently use storage units or have valuable items stored in them. This ensures adequate coverage and can help protect belongings. Consulting with the insurance provider can help address specific concerns and explore additional coverage options.

Therefore, it is vital to thoroughly research and explore different insurance options for storage units to be prepared in case of a fire or other damage. Each option may have its own benefits and limitations, so it is essential to find the best fit for individual needs and budget. Being proactive in assessing insurance coverage and seeking professional advice can help make informed decisions.

Explore Does renters insurance cover storage units allstate.