Does homeowner insurance cover storage unit

When it comes to protecting your personal property, homeowners insurance is a great resource. It not only provides coverage for your belongings while they are in your house, but it can also extend that coverage to items stored in a storage unit. However, it’s important to understand that the coverage provided by homeowners insurance for a storage unit may be limited. Before signing a rental contract for a storage unit, it is crucial to ensure that you have the necessary coverage to protect your belongings.

Different types of coverage under homeowners insurance

Before discussing coverage for storage units, it is essential to understand the various types of coverage included in homeowners insurance:

1. Dwelling Coverage: This covers damages or losses to the structure of your house itself.

2. Personal Property Coverage: This covers your belongings, such as furniture, appliances, and clothing.

3. Liability Coverage: This protects you in case someone is injured on your property and sues you.

4. Additional Living Expenses: This coverage helps with temporary living costs if your house becomes uninhabitable due to a covered loss.

What is a storage unit and its purpose?

A storage unit is a rented space designed to store personal belongings. These units come in various sizes and are usually located within a storage facility. People use storage units for a variety of reasons, such as moving, downsizing, or decluttering their homes. These units provide a secure space to store items that may not fit in their current living space.

Now, let’s dive into whether homeowners insurance covers storage units and how the coverage may vary.

Does homeowners insurance cover storage units?

Coverage for Personal Property in Storage Units

Definition of personal property coverage under homeowners insurance

Under homeowners insurance, personal property coverage refers to the protection provided for your belongings in case of theft, damage, or loss. This coverage is not limited to your house alone but also extends to off-premises locations, such as storage units. It is important to review the details of your specific homeowners insurance policy to understand the extent of coverage provided for items in storage.

Inclusion of storage units in the coverage

While homeowners insurance does offer coverage for personal property in storage units, it is essential to note that the coverage may be limited and may not encompass all the valuables stored off-premises. To ensure you have adequate coverage, consider these factors:

1. Review your policy: Read your homeowners insurance policy carefully to understand the extent of coverage provided for items stored in a storage unit. Some policies might have specific limits or exclude certain items from coverage.

2. Valuation of belongings: Before renting a storage unit, assess the value of the items you plan to store. If these items exceed the coverage limits of your homeowners insurance, you might need to purchase additional insurance specifically designed for storage unit contents.

3. Additional storage insurance: If your homeowners insurance falls short in providing sufficient coverage, consider purchasing a separate storage insurance policy. These policies are specifically designed to cover items stored in storage units and may offer broader protection than your homeowners insurance.

4. Communication with your insurance provider: Discuss your storage unit plans with your insurance provider. They can provide guidance on your coverage options, help you understand policy limitations, and suggest additional insurance if needed.

5. Security measures: Storage facilities with enhanced security features might offer better protection for your belongings. Some insurance policies might have specific requirements related to the security measures in place at the storage facility, so it’s important to factor this into your decision-making process.

So, homeowners insurance does offer coverage for personal property in storage units, but the extent of coverage may vary. To ensure your belongings are adequately protected, review your policy, assess the value of your items, consider additional storage insurance, communicate with your insurance provider, and select a secure storage facility.

Limitations and Exclusions

Understanding the limitations of coverage for items in storage units

While homeowners insurance can provide coverage for personal property in storage units, it is important to be aware of the limitations that may exist. Here are some key points to consider:

1. Coverage limits: Your homeowners insurance policy may impose limits on how much it will pay for items stored off-premises. It is crucial to review your policy to understand these limits and determine if they adequately cover the value of the items you plan to store.

2. Deductibles: Your homeowners insurance policy may have a deductible that you need to pay out of pocket before coverage kicks in. Make sure to factor in this cost when assessing your coverage for storage unit items.

3. Type of loss covered: While homeowners insurance generally covers theft, damage, or loss of personal property, it is important to understand the specifics of what is covered. Some policies may exclude certain types of damage, such as water damage or damage caused by pests. Review the terms and conditions of your policy to understand what perils are covered and any exclusions that may apply.

4. Valuable items: If you plan to store high-value items, such as jewelry or artwork, your homeowners insurance may have specific limitations on coverage for these items. You may need to purchase additional coverage or consider a separate policy that provides more comprehensive coverage for valuable items.

Exclusion of certain perils like mold and mildew damage

It is important to note that homeowners insurance may exclude coverage for certain perils, such as mold and mildew damage. These types of damages can be common in storage units, especially if they are not climate-controlled. Mold and mildew can cause significant damage to your belongings and may not be covered under your homeowners insurance policy. Be sure to review the terms and conditions of your policy to understand what perils are excluded and consider additional insurance coverage if necessary.

Therefore:

While homeowners insurance can provide coverage for personal property stored in storage units, it is essential to review your policy and understand the limitations and exclusions that may apply. Consider the value of your stored items, potential deductibles, coverage limits, and any exclusions for specific perils. If your homeowners insurance falls short in providing sufficient coverage, explore additional insurance options that are specifically designed for storage unit contents. By being proactive and understanding your coverage, you can ensure the safe storage of your belongings.

Off-Premises Personal Property Coverage

Explanation of off-premises personal property coverage

When it comes to homeowners insurance, off-premises coverage refers to the protection provided for your belongings that are located outside of your house. This coverage is designed to safeguard your personal property in case of theft, damage, or loss. Off-premises coverage extends to various off-site locations, including storage units.

How it applies to belongings stored in a storage unit

So, how does off-premises personal property coverage apply to belongings stored in a storage unit? Well, it’s important to understand that while homeowners insurance typically offers coverage for items in storage units, the extent of that coverage may be limited. This means that not all of the valuables you store off-premises may be covered.

To ensure you have the necessary coverage, there are a few factors you should consider. First, review your homeowners insurance policy to understand the specific details of your coverage for items stored in a storage unit. Some policies may have limitations or exclusions, such as specific limits on the value of covered items or certain types of belongings that are not eligible for coverage.

Next, evaluate the value of the items you plan to store in the storage unit. If the value exceeds the coverage limits of your homeowners insurance, you may need to purchase additional insurance specifically designed to cover the contents of a storage unit.

In some cases, it may be beneficial to consider purchasing a separate storage insurance policy. These policies are specifically tailored to provide broader protection for items stored in storage units, often offering more comprehensive coverage than homeowners insurance alone.

Additionally, it’s important to communicate with your insurance provider about your storage unit plans. They can provide guidance on your coverage options, help you understand any limitations or exclusions in your policy, and suggest additional insurance if necessary.

Lastly, consider the security measures in place at the storage facility you are considering. Some insurance policies may have specific requirements related to the security of the storage facility, so it’s essential to select a facility that offers enhanced security features.

Therefore, while homeowners insurance does offer coverage for personal property stored in storage units, it’s crucial to review your policy, assess the value of your belongings, consider additional storage insurance if needed, communicate with your insurance provider, and choose a secure storage facility. By taking these steps, you can ensure that your belongings are adequately protected while in a storage unit.

Factors Affecting Coverage

Determining factors that affect coverage for items in storage units

When it comes to coverage for items stored in a storage unit, several factors can impact the extent of protection provided by your homeowners insurance. It’s important to consider these factors to ensure that your belongings are adequately covered. Some of the key determining factors include:

1. **Policy provisions**: Take the time to thoroughly review your homeowners insurance policy to understand the specific provisions related to off-premises coverage. Look for any limitations or exclusions that may apply to items stored in a storage unit. Remember that not all policies are the same, so it’s essential to understand the details of your coverage.

2. **Coverage limits**: Check the coverage limits stated in your policy for personal property stored off-premises. Some insurance policies may have specific limits on the value of covered items. If your storage unit contains high-value items that exceed these limits, you may need to consider additional insurance options.

3. **Type of belongings**: Certain types of belongings may not be eligible for coverage under your homeowners insurance policy. For example, valuable collections, fine art, or antiques may require separate insurance coverage. Consult your insurance provider to determine if any of your belongings fall into this category and if additional coverage is necessary.

4. **Premium costs**: The cost of your homeowners insurance premium may also be affected by the decision to cover items in a storage unit. Some insurance companies may charge an additional premium for this coverage, so be sure to inquire about any potential cost increases.

Premium costs and coverage limits

When it comes to the cost of premiums and coverage limits for items stored in a storage unit, it’s important to understand that these can vary depending on several factors. Here are a few considerations to keep in mind:

1. **Value of belongings**: The value of the items you plan to store in the storage unit will impact the cost of premiums and the coverage limits. Higher-value items may require additional coverage, which can result in higher premiums.

2. **Location of the storage unit**: Insurance companies may take into account the location of the storage unit when calculating premiums. Storage units in areas with higher crime rates or greater risks may lead to higher premiums.

3. **Security precautions**: The security measures in place at the storage facility can also affect the cost of premiums and coverage limits. Facilities with enhanced security features, such as surveillance cameras, access control systems, or on-site security personnel, may be viewed more favorably by insurance companies.

4. **Deductibles**: Review the deductibles stated in your policy. The deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Assess whether the deductible is reasonable for your budget and worth the coverage provided for items stored in a storage unit.

Remember to consult with your insurance provider to understand the specific premium costs and coverage limits for storing your belongings in a storage unit. They can provide personalized guidance based on your policy and help you determine the best options to ensure adequate coverage.

By considering these factors and discussing them with your insurance provider, you can make informed decisions about your coverage options for items stored in a storage unit. It’s essential to have the appropriate protection in place to safeguard your belongings and have peace of mind during the storage process.

Theft, Vandalism, and Weather-Related Damage

Coverage for theft, vandalism, and weather-related damage in storage units

When it comes to storage unit insurance, you can generally expect coverage for damage caused by theft, vandalism, and a range of weather-related events. This includes protection against theft of your belongings, as well as damage caused by fire, wind, hurricanes, tornadoes, water damage, hail, lightning, and smoke.

However, it’s important to note that not all events are covered. Damage related to flooding, mold and mildew, vermin infestation, earthquakes, and war typically fall outside the scope of storage unit insurance coverage. These perils are often considered as separate insurance options or excluded entirely from standard storage unit insurance policies.

Claims process and reimbursement

In the unfortunate event that you need to make a claim for damage or loss of your stored items, the process will generally involve notifying your insurance provider, providing evidence of the damage or loss, and submitting a claim. The specific details of the claims process may vary depending on your insurance policy, so it’s important to review your policy carefully and consult with your insurance provider for guidance.

Reimbursement for your claim can vary as well. Some insurance policies offer actual cash value reimbursement, which takes into account the depreciated value of your belongings at the time of the loss or damage. Other policies may provide replacement cost reimbursement, which covers the full cost of replacing your items with new ones of similar value.

It’s important to keep thorough records of your stored items, including photographs, receipts, and any other documentation that can help establish their value. This documentation can be crucial when filing a claim and can help ensure that you receive appropriate reimbursement for your losses.

Therefore, storage unit insurance generally covers theft, vandalism, and a range of weather-related damage. However, it’s important to understand the limitations and exclusions of your policy, particularly regarding events such as flooding, mold, vermin infestation, earthquakes, and war. By reviewing your homeowners insurance policy, considering additional storage insurance if needed, communicating with your insurance provider, and selecting a secure storage facility, you can ensure that your belongings are adequately protected while in a storage unit.

Additional Coverage Options

Optional coverage for valuable items stored in storage units

While homeowners insurance may provide some coverage for items stored in a storage unit, it’s important to consider additional coverage options for valuable items. Some insurance policies offer optional coverage specifically designed for items of high value, such as jewelry, artwork, or collectibles. This coverage can provide higher coverage limits and may include protection against a broader range of perils.

Keep in mind that optional coverage for valuable items stored in storage units may come with additional premiums or deductibles. It’s important to assess the value of your stored items and determine if the optional coverage is necessary and cost-effective for your needs.

Consideration of riders or endorsements for comprehensive coverage

Another option to consider is adding a rider or endorsement to your homeowners insurance policy to provide comprehensive coverage for items stored in a storage unit. This can provide a higher level of protection and expand the coverage beyond what is typically included in a standard policy.

Riders or endorsements can be customized to fit your specific needs and may cover perils such as flooding, mold and mildew, vermin infestation, earthquakes, and war. It’s important to review the terms and conditions of these additional coverages to ensure they meet your storage unit insurance requirements.

It’s recommended to consult with your insurance provider to understand the options available to you and select the coverage that best suits your needs. They can provide guidance on the types of additional coverage available and help you determine if it is necessary based on the value and type of items you plan to store.

By considering optional coverage for valuable items and exploring additional riders or endorsements for comprehensive coverage, you can enhance the protection for your belongings stored in a storage unit.

Remember to review your policy, communicate with your insurance provider, and select a secure storage facility to ensure the safety of your stored items.

Please note that this information is a general overview and may not cover all scenarios. It’s important to review your specific homeowners insurance policy and consult with your insurance provider for personalized advice and coverage details.

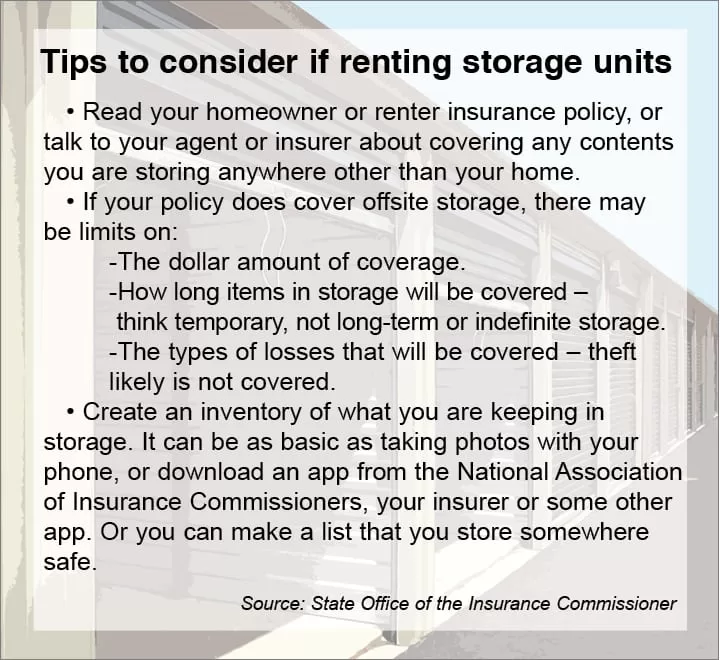

Tips for Protecting Belongings in Storage Units

Preventive measures to safeguard personal property in storage units

It’s essential to take proactive steps to safeguard your personal belongings when storing them in a storage unit. Here are some tips to help protect your items:

1. Properly pack and organize: Carefully pack your items in sturdy boxes and use appropriate padding materials to prevent damage during transportation and storage. Label your boxes clearly for easy identification and organization.

2. Choose a secure storage facility: Prioritize security when selecting a storage facility. Look for facilities with features such as gated access, surveillance cameras, and proper lighting to deter theft and vandalism.

3. Use sturdy locks: Invest in high-quality locks to secure your storage unit. Combination locks or disc locks are recommended as they are more difficult to tamper with compared to standard padlocks.

4. Limit access to your unit: Only provide access to trusted individuals who need to retrieve or store items in your unit. Avoid sharing your access code or key with unauthorized persons.

5. Consider climate-controlled units: If you are storing delicate or sensitive items, such as electronics, artwork, or wooden furniture, consider renting a climate-controlled storage unit. These units regulate temperature and humidity levels to protect your belongings from extreme conditions.

Security features, climate control, and insurance documentation

In addition to preventive measures, understanding the security features, climate control, and insurance documentation of your storage facility is crucial:

1. Security features: Ask the storage facility about their security measures, such as surveillance cameras, alarm systems, and on-site security personnel. Choose a facility that offers robust security measures to minimize the risk of theft or vandalism.

2. Climate control: If you have items sensitive to temperature and humidity fluctuations, ensure the storage facility offers climate-controlled units. These units maintain a steady environment to protect your belongings from damage caused by extreme heat, cold, or moisture.

3. Insurance documentation: Review your homeowners insurance policy to determine if it covers your stored items adequately. If not, inquire about additional storage insurance options provided by the storage facility. Maintain proper documentation of your insurance coverage and keep it easily accessible for any potential claims.

Remember that prevention is key when protecting your belongings in storage units. By following these tips and taking necessary precautions, you can minimize the risk of damage, theft, and other unforeseen events.

It’s important to regularly assess the condition of your stored items and monitor your insurance coverage to ensure ongoing protection. Regularly update your inventory, photograph valuable items, and keep records of receipts or appraisals that can be used to substantiate their value in the event of a claim.

Ensure open communication with your insurance provider and the storage facility to address any questions or concerns you may have regarding coverage and security. By being proactive and informed, you can have peace of mind knowing your belongings are well-protected in the storage unit.

Common FAQs

Answers to frequently asked questions about homeowners insurance and storage units

Here are some common questions that homeowners have about their insurance coverage for storage units:

1. Will my homeowners insurance cover my storage unit?

The answer to this question depends on your specific homeowners insurance policy. Many policies include off-premises coverage, which means that your personal property is protected even when it is not inside your home. This coverage can extend to items stored in a storage unit, but it may be limited and not cover all the valuable items you store off-premises. It’s important to review your policy or contact your insurance provider to understand the extent of your coverage.

2. What items are typically covered by homeowners insurance in a storage unit?

Homeowners insurance typically provides coverage for your personal property, including items such as furniture, clothing, electronics, and other belongings. However, coverage for high-value items such as jewelry, antiques, and collectibles may be limited. It’s important to review your policy to understand any limitations or exclusions.

3. Do I need separate insurance for my storage unit?

If your homeowners insurance does not provide adequate coverage for the items you store in a storage unit, you may need to consider purchasing separate storage insurance. Storage facilities often offer insurance options that you can purchase to supplement your existing coverage. It’s essential to carefully review the terms and conditions of any additional insurance to ensure it meets your needs.

4. How can I determine the value of my stored items for insurance purposes?

Documenting the value of your stored items is crucial for insurance purposes. Maintain a detailed inventory of your belongings, along with photographs and any relevant receipts or appraisals. This documentation can be used to substantiate the value of your items in the event of a claim. It’s also important to regularly update your inventory as needed.

5. What preventive measures can I take to protect my belongings in a storage unit?

Taking proactive steps to safeguard your personal belongings can help minimize the risk of damage or theft. Properly packing and organizing your items, choosing a secure storage facility, using sturdy locks, and limiting access to your unit are all important preventive measures. Additionally, considering a climate-controlled unit for delicate or sensitive items can help protect them from extreme conditions.

Clarifying coverage terms and policy details

When it comes to homeowners insurance coverage for storage units, it’s important to clarify certain terms and policy details:

1. Off-premises coverage: Homeowners insurance typically includes off-premises coverage, but it’s essential to understand the specific terms and conditions. Some policies may have limitations on the coverage amount or certain types of losses.

2. Deductibles: Your homeowners insurance policy will have a deductible, which is the amount you are responsible for paying before the insurance coverage kicks in. It’s important to understand your deductible and how it applies to storage unit claims.

3. Limitations and exclusions: Review your policy for any limitations or exclusions on coverage for items in storage units. High-value items or certain types of belongings may have specific coverage limitations or require additional insurance.

4. Security requirements: Some homeowners insurance policies may have security requirements for items stored off-premises. For example, you may need to have specific locks or security measures in place to ensure coverage for your stored belongings.

5. Policy updates: It’s important to regularly review and update your homeowners insurance policy, especially if you plan to use a storage unit for an extended period. Changes in your storage needs or the value of your belongings may require adjustments to your coverage.

Remember to consult with your insurance provider to get specific answers to any questions you have about your homeowners insurance and storage unit coverage. They can provide the necessary guidance and ensure that you have the appropriate coverage in place for your stored belongings.

Check out Geico home owners insurance storage unit.