Introduction

Overview of GEICO renters insurance coverage for storage units

Renters insurance provides valuable coverage for your personal belongings, whether they are inside your home or in a storage unit. GEICO renters insurance offers comprehensive coverage for individuals who need to store their belongings in a self-storage unit.

Here is an overview of GEICO’s renters insurance coverage for storage units:

1. Personal property coverage

GEICO renters insurance provides coverage for personal belongings stored in a storage unit. This includes furniture, electronics, clothing, and other valuable items. The coverage extends to protect your belongings from theft, fire, water damage, and other covered perils. It’s important to note that certain high-value items may have coverage limitations, so it’s recommended to review your policy to ensure adequate coverage.

2. Liability coverage

In addition to covering your personal belongings, GEICO renters insurance also includes liability coverage. This means that if someone gets injured while visiting your storage unit, your liability coverage can help protect you from potential legal and medical expenses. This coverage extends to other locations as well, such as your home or a rented apartment.

3. Additional living expenses coverage

If you are unable to live in your home due to a covered loss, GEICO renters insurance may provide coverage for additional living expenses. While this coverage primarily applies to your primary residence, it can also extend to temporary living arrangements if you’re unable to live in your home due to a covered event, such as a fire or natural disaster.

4. Coverage limits and deductibles

It’s important to review the coverage limits and deductibles of your GEICO renters insurance policy. The coverage limit is the maximum amount that your policy will pay out for a covered loss. The deductible is the amount you will have to pay out of pocket before your insurance coverage kicks in. It’s recommended to choose coverage limits and deductibles that align with the value of your stored belongings and your budget.

5. Discounts and additional coverage options

GEICO offers various discounts and additional coverage options that you may want to consider. For example, you may qualify for a discount if you have other GEICO insurance policies or if you have certain safety features in your storage unit, such as a security system or fire alarms. Additionally, you may want to consider adding extra coverage for valuable items, such as jewelry or artwork, to ensure they are adequately protected.

Therefore, GEICO renters insurance provides comprehensive coverage for your personal belongings stored in a storage unit. It’s important to understand your policy’s coverage limits and deductibles, as well as any discounts or additional coverage options that may be available. By reviewing your policy and considering your specific needs, you can ensure that your stored belongings are adequately protected.

Proof of Insurance

Why storage unit operators require proof of insurance

Storage unit operators require proof of insurance from renters for a few important reasons. Firstly, it helps protect both the renter and the storage facility in case of any damage or loss. Insurance coverage ensures that the renter’s belongings are protected and provides financial compensation for any damages or losses incurred. This protects the storage facility from potential liability claims.

Secondly, requiring proof of insurance is a standard industry practice that helps maintain the overall security and safety of the storage facility. It ensures that all renters have taken steps to safeguard their belongings and minimizes the risk of unwanted incidents such as theft or damage. This allows storage operators to provide a secure and trustworthy environment for their renters.

Options for providing proof of insurance with GEICO renters insurance

If you have renters insurance with GEICO, there are different options to provide proof of insurance for your storage unit. GEICO offers a simple and convenient process to obtain proof of insurance.

One option is to request a certificate of insurance directly from GEICO. This document serves as proof that you have renters insurance coverage and can be provided to the storage unit operator.

Another option is to provide the storage unit operator with your GEICO policy details, such as the policy number and coverage information. This allows the operator to verify your coverage directly with GEICO.

GEICO also provides an online portal where policyholders can access and manage their insurance information. You can easily log in to your GEICO account and download a digital copy of your insurance policy or certificate of insurance. This digital proof can then be provided to the storage unit operator.

It’s important to note that different storage facilities may have specific requirements for proof of insurance, so it’s always a good idea to check with your storage facility operator to ensure you provide the required documentation.

Therefore, having renters insurance with GEICO provides you with the necessary coverage for your belongings stored in a storage unit. It’s important to be prepared and provide proof of insurance to the storage unit operator to comply with their requirements and protect your belongings. GEICO offers various options to obtain proof of insurance, making the process quick and convenient.

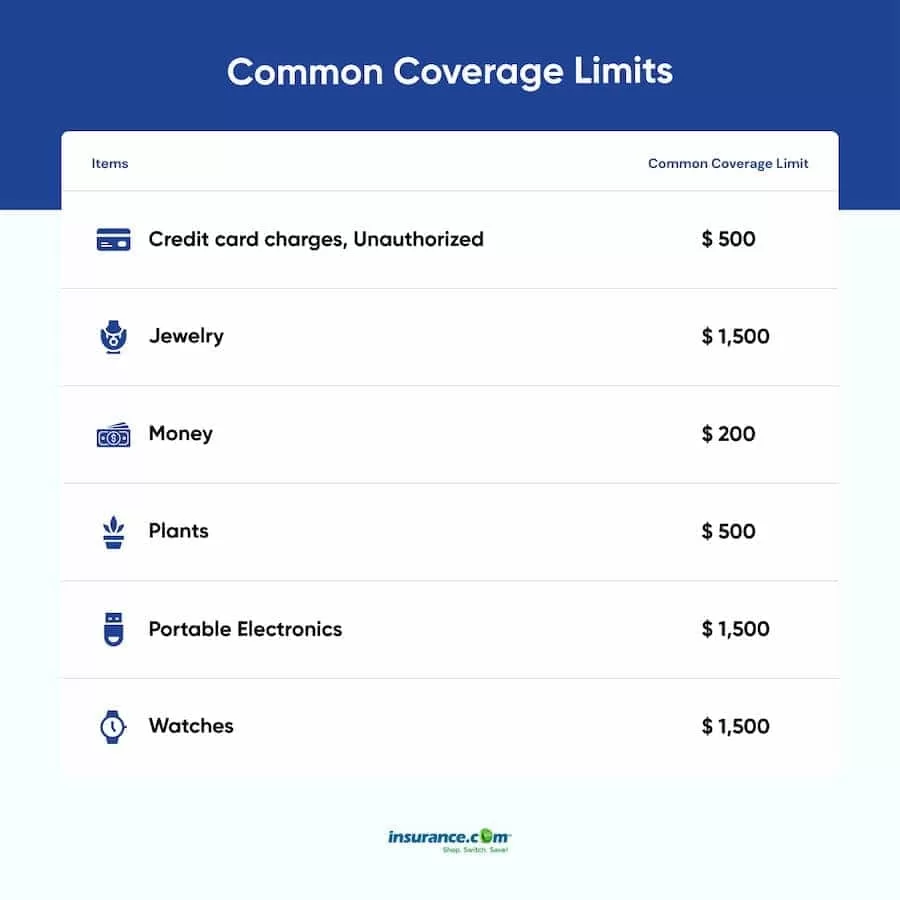

Coverage Limits

Explanation of the coverage limits for belongings stored in a storage unit

When it comes to renters insurance coverage for your belongings stored in a storage unit, it’s important to understand the policy’s coverage limits. These limits determine the maximum amount of financial protection that your insurance policy provides in the event of damage, loss, or theft of your belongings.

The coverage limits for belongings stored in a storage unit typically vary depending on your insurance policy. It’s essential to review your policy documents or consult with your insurance provider to understand the specific limits that apply to you.

The coverage limits for your stored belongings may be expressed as a percentage of your overall renters insurance coverage. For example, if your overall renters insurance coverage is $50,000, the coverage for your storage unit belongings may be limited to a certain percentage, such as 10% or $5,000.

It’s important to carefully assess the value of the items you plan to store in order to ensure that their worth falls within the coverage limits of your policy. If the total value of your stored belongings exceeds the coverage limits, you may need to consider increasing your coverage or seeking additional coverage options.

Understanding the policy’s limit and its implications

Understanding the coverage limits for your stored belongings is crucial in order to make informed decisions about your insurance coverage. Here are a few key points to consider:

1. Evaluate the value of your belongings: Take an inventory of the items you plan to store in the storage unit and assess their value. This will help you determine whether the coverage limits of your policy adequately protect your belongings.

2. Consider additional coverage options: If the coverage limits of your policy do not provide sufficient protection for your stored belongings, you may want to explore additional coverage options. This could include purchasing an endorsement or a separate policy specifically designed for storage units.

3. Keep an updated inventory: Regularly update your inventory of stored items and their values. This will help ensure that your insurance coverage accurately reflects the value of your stored belongings and that you have sufficient coverage in place.

4. Consult with your insurance provider: If you have any questions or concerns about the coverage limits and implications for your stored belongings, reach out to your insurance provider. They can provide guidance and help you understand your policy in more detail.

Remember, it’s crucial to comply with the storage facility’s requirements and provide proof of insurance. This not only protects your belongings but also ensures compliance with storage facility regulations.

Therefore, understanding the coverage limits of your renters insurance policy for storage units is essential to adequately protect your stored belongings. Assess the value of your items, consider additional coverage options if necessary, and stay in contact with your insurance provider to ensure you have the necessary coverage in place.

Inclusions and Exclusions

What is covered by GEICO renters insurance in a storage unit

GEICO renters insurance provides coverage for your personal belongings stored in a storage unit. This includes protection against a range of perils, such as fire, theft, vandalism, and water damage. If any of these events occur and your belongings are damaged or lost, your GEICO policy will provide financial compensation to replace or repair them.

Items excluded from coverage

While GEICO renters insurance offers comprehensive coverage for your belongings, there are certain items that may be excluded from coverage. It’s important to review your policy carefully to understand what is not covered. Some common items that may be excluded or have limited coverage include:

– High-value items: This includes valuable items like jewelry, art collections, and expensive electronic equipment. These items may require additional coverage, such as a floater policy or scheduled personal property endorsement, to ensure adequate protection.

– Business property: If you are storing items related to a business, such as inventory or equipment, they may not be covered under your renters insurance policy. Business property typically requires a separate business insurance policy.

– Motor vehicles: While renters insurance provides coverage for personal belongings, it usually does not cover motor vehicles, including cars, motorcycles, or boats. If you are storing a vehicle in a storage unit, you may need to obtain separate insurance coverage specifically designed for vehicles.

It’s important to note that each insurance policy is unique, and coverage may vary. It’s recommended to read your policy documents carefully and consult with your insurance agent to fully understand what is covered and any exclusions that may apply.

Conclusion

Renters insurance with GEICO offers valuable coverage for your personal belongings stored in a storage unit. It is important to have proof of insurance to comply with the requirements of the storage unit operator and protect your belongings. GEICO provides various options for obtaining proof of insurance, making the process quick and convenient. Remember to review your policy to understand what is covered and any exclusions that apply, and consider additional coverage if needed for valuable items or business property. With GEICO renters insurance, you can have peace of mind knowing that your belongings are protected.

Renters Insurance Benefits

Overview of the benefits of having renters insurance for stored possessions

Renters insurance provides valuable coverage for your personal belongings, even when they are stored in a storage unit. Here are some of the key benefits of having renters insurance for your stored possessions:

– Wide coverage: With renters insurance, your belongings are covered anywhere in the world, including in a storage unit. This means that you can have peace of mind knowing that your items are protected, even when they are not within your physical residence.

– Financial protection: In the event of perils such as theft, fire, vandalism, or water damage, your renters insurance policy will provide financial compensation to replace or repair your damaged or lost items. This can save you from significant financial loss and help you recover quickly.

– Convenience: Renters insurance with GEICO offers various options for obtaining proof of insurance, making the process quick and convenient. Having proof of insurance is important to comply with the requirements of the storage unit operator and protect your belongings.

Protection against theft, water damage, and fire

One of the main benefits of having renters insurance for stored possessions is the protection it offers against various perils. Here’s how renters insurance can help in different scenarios:

– Theft: If your personal belongings are stolen from your storage unit, your renters insurance policy will provide coverage, subject to certain conditions. Some valuable items may require additional coverage, but having renters insurance ensures that most of your possessions are protected.

– Water damage: In the unfortunate event of water damage to your stored items, either due to a leak or flooding, renters insurance can help cover the cost of repairing or replacing the damaged items. This can be especially beneficial if your stored possessions hold sentimental or monetary value.

– Fire: Fires can cause immense damage to your stored possessions. With renters insurance, you can rest assured knowing that you have coverage in case of fire-related damages. This can include the cost of replacing or repairing items that are damaged or destroyed.

It’s important to note that renters insurance policies may have specific limitations and exclusions, so it’s crucial to review your policy documents carefully and consult with your insurance agent to understand the extent of coverage provided and any exclusions that may apply.

Therefore, having renters insurance for your stored possessions offers valuable protection against various perils such as theft, water damage, and fire. It provides financial compensation to replace or repair your belongings, saving you from significant financial loss. Remember to review your policy to understand coverage and consider additional coverage if you have high-value items or business property. With renters insurance, you can have peace of mind knowing that your stored possessions are protected.

Getting Renters Insurance in California

How to obtain renters insurance from GEICO in California

To get renters insurance from GEICO in California, you can follow a simple process:

1. Visit the GEICO website: Go to GEICO’s official website and navigate to the renters insurance section.

2. Get a quote: Enter your personal information, such as your address, and provide details about your rental unit. GEICO will then generate a quote based on the coverage options you select.

3. Customize your policy: GEICO offers various coverage options and limits, allowing you to customize your policy according to your specific needs. You can choose the amount of coverage you want for your personal belongings, liability protection, and additional living expenses.

4. Review and purchase: Carefully review the details of the policy, including the coverage limits, deductible, and premiums. Once you are satisfied with the terms, you can proceed with purchasing the renters insurance policy.

Information about rates, discounts, and affordability

When it comes to rates and affordability, GEICO offers competitive pricing for renters insurance in California. The cost of your premium will depend on several factors, including the location of your rental unit, the amount of coverage you select, and your claims history.

GEICO also provides various discounts that can help lower your renters insurance premium. Some common discounts offered by GEICO include:

– Multi-Policy Discount: If you have another insurance policy with GEICO, such as auto insurance, you may be eligible for a discount on your renters insurance.

– Security System Discount: If your rental unit has security features, such as smoke detectors, burglar alarms, or deadbolt locks, you may qualify for a discount.

– Claims-Free Discount: If you have a history of being claims-free, GEICO may offer you a discount on your renters insurance premium.

It’s important to note that the availability and amount of discounts may vary depending on your location and policy details. To get an accurate assessment of rates and available discounts, it’s recommended to obtain a quote directly from GEICO.

Therefore, getting renters insurance from GEICO in California is a straightforward process. By following the steps outlined above, you can obtain a policy that provides comprehensive coverage for your personal belongings and liability protection. With competitive rates and potential discounts, GEICO offers an affordable option for renters insurance in California. Don’t forget to review the policy details and consult with a licensed insurance expert if you have any questions or need assistance.

Policy Requirements

Information on the type of coverage required for belongings in a storage unit

When renting a storage unit, it’s important to understand the type of coverage required for your belongings. Most storage facilities will have specific requirements for renters insurance to ensure that your items are adequately protected. Here are some key points to consider:

– Liability Coverage: Many storage facilities will require you to have liability coverage as part of your renters insurance policy. This protects you in case someone is injured or their property is damaged while they are on the storage unit premises.

– Personal Property Coverage: It’s important to have coverage for your personal belongings in case they are damaged or stolen while in the storage unit. Make sure your renters insurance policy includes sufficient coverage for all the items you plan to store.

– Coverage Limits: Check the coverage limits in your renters insurance policy to ensure they are adequate for the value of your stored belongings. If you have high-value items, such as expensive electronics or jewelry, you may need to consider additional coverage or a separate insurance policy.

– Deductible: The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Make sure you understand what your deductible is and choose a policy that fits your budget.

Understanding the terms and conditions

Before signing up for renters insurance for your storage unit, it’s crucial to carefully read and understand the terms and conditions of the policy. Here are some important factors to consider:

– Exclusions: Some policies may have specific exclusions that limit coverage for certain types of items or situations. Make sure you are aware of any exclusions that may affect your coverage.

– Proof of Loss: In the event of a claim, you may be required to provide proof of loss, such as receipts or appraisals. Keep a record of your belongings and their value to make the claims process smoother.

– Renewal and Cancellation Policy: Understand the renewal and cancellation policy of your renters insurance policy. Make sure you are aware of any fees or penalties associated with cancelling or making changes to your policy.

– Review Coverage Regularly: As your storage needs change or you acquire new valuable items, it’s important to regularly review and update your renters insurance coverage to ensure you are adequately protected.

Remember, renters insurance for storage units not only provides coverage for your belongings but also protects you financially in case of liability claims. It’s essential to choose a policy that meets your needs and complies with the requirements of your storage facility. Consult with a licensed insurance expert if you have any questions or need assistance in selecting the right renters insurance policy for your storage unit.

Coverage Percentage

Explanation of the 10 percent coverage provided for the value of insured property

One of the important aspects of renters insurance is understanding the coverage percentage provided for the value of insured property. Renters insurance typically provides coverage for personal belongings, and this coverage is often a percentage of the total coverage amount selected by the policyholder. In many cases, this coverage percentage is set at 10 percent.

For example, if a policyholder selects a total coverage amount of $30,000, the coverage for personal belongings would typically be up to $3,000 (10 percent of $30,000). This means that if the policyholder’s personal belongings are damaged or stolen, they can potentially receive up to $3,000 in compensation from their renters insurance policy.

It’s important to note that this 10 percent coverage percentage is a standard provision in renters insurance policies, but it may vary depending on the insurance provider and the policy terms. Some insurance companies may offer higher coverage percentages or allow policyholders to customize the coverage amount to better suit their needs.

Determining the coverage amount needed

When determining the coverage amount needed for renters insurance, it’s essential to assess the value of your personal belongings. This includes items like furniture, electronics, clothing, jewelry, and other valuable possessions.

To determine the coverage amount, you can create a home inventory by listing all your belongings and estimating their value. You can also take photos or videos of your belongings as proof of ownership and their condition. This inventory will help you calculate the total value of your possessions and determine the coverage amount needed.

It’s important to be as accurate as possible when estimating the value of your belongings. Underestimating the value may result in insufficient coverage, while overestimating may lead to higher premiums. If you have valuable items, such as expensive jewelry or artwork, you may consider adding additional coverage or obtaining separate insurance policies for those items.

When obtaining renters insurance, it’s always a good idea to review the coverage percentage and discuss your specific needs with a licensed insurance expert. They can provide guidance on selecting the appropriate coverage amount and explain any additional options or endorsements that may be available to enhance your policy.

Coverage Percentage

Understanding the Coverage Percentage for Renters Insurance

One important factor to consider when getting renters insurance is the coverage percentage provided for the value of insured property. Typically, renters insurance policies offer coverage for personal belongings, which is usually a percentage of the total coverage amount chosen by the policyholder. In many cases, this coverage percentage is set at 10 percent.

For instance, if you opt for a total coverage amount of $30,000, the coverage for personal belongings would generally be up to $3,000 (10 percent of $30,000). This means that if your personal belongings are damaged or stolen, you can potentially receive compensation up to $3,000 through your renters insurance policy.

Keep in mind that while the 10 percent coverage percentage is a standard provision in renters insurance policies, it may vary depending on the insurance company and policy terms. Some insurers might offer higher coverage percentages or allow you to customize the coverage amount according to your specific needs.

Determining the Coverage Amount You Need

Before selecting a coverage amount for renters insurance, it’s crucial to assess the value of your personal belongings. This includes items like furniture, electronics, clothing, jewelry, and other valuable possessions.

To determine the coverage amount, create a home inventory by listing all your belongings and estimating their value. You can also document your possessions through photos or videos as proof of ownership and their condition. This inventory will help you calculate the total value of your possessions and determine the coverage amount you require.

Accuracy is key when estimating the value of your belongings. Underestimating their value might result in inadequate coverage, while overestimating may lead to higher premiums. If you own valuable items such as expensive jewelry or artwork, consider adding additional coverage or obtaining separate insurance policies for those items.

When obtaining renters insurance, it’s always beneficial to review the coverage percentage and discuss your specific needs with a licensed insurance expert. They can provide guidance on selecting the appropriate coverage amount and explain any additional options or endorsements that may enhance your policy.

Conclusion

Key takeaways from the blog post and final thoughts on renters insurance for storage units.

– Renters insurance typically provides coverage for personal belongings in storage units.

– The coverage percentage for personal belongings is often set at 10 percent of the total coverage amount chosen by the policyholder.

– When determining the coverage amount needed, assess the value of your personal belongings through a home inventory.

– Be accurate in estimating the value of your belongings to avoid inadequate coverage or higher premiums.

– Discuss your specific needs with a licensed insurance expert to select the appropriate coverage amount and explore additional options or endorsements.

Renters insurance is a valuable investment to protect your belongings, whether they are in your home or a storage unit. By understanding the coverage percentage and determining the appropriate coverage amount, you can have peace of mind knowing that your personal belongings are protected. Consult with an insurance expert to customize your renters insurance policy to meet your specific needs.

Learn about Do i need storage unit insurance in tn.