Understanding Assurant Renter’s Insurance and Storage Units

Why renter’s insurance is important

Having a renter’s insurance policy is important because it provides coverage for your personal belongings in the event of unforeseen circumstances. This type of insurance can help you replace or repair damaged or stolen items, and even provides liability coverage if someone is injured in your rental home. It’s a small investment that can provide peace of mind and financial protection.

What is covered under renter’s insurance

Most renter’s insurance policies cover personal property such as clothing, furniture, electronics, and other belongings. It also covers losses caused by theft, fire, and natural disasters like hurricanes or earthquakes. Additionally, renter’s insurance can provide liability coverage in case someone is injured on your rental property.

When it comes to storage units, many renter’s insurance policies provide coverage for personal items stored off-site. However, it’s important to note that coverage is usually limited to only 10% of your normal limit, except for policies that specifically include additional coverage for storage units.

Assurant Renter’s Insurance and Storage Units

If you have Assurant renter’s insurance, you’re in luck when it comes to storage units. Your policy covers your personal property anywhere in the world, including items in storage units. This means that if your belongings are damaged or stolen while in storage, your Assurant renter’s insurance policy should cover the cost of repairs or replacement.

It’s important to keep in mind that the coverage for your storage unit will likely be limited to 10% of your normal limit unless you specifically select additional coverage for your storage unit. This means that if you have a $20,000 policy, your storage unit coverage would be limited to $2,000.

It’s also a good idea to take steps to protect your items while in storage. This can include investing in a good quality lock, insuring valuable items separately, and taking an inventory of all items stored in your unit.

Therefore, having renter’s insurance is important for protecting your personal belongings. If you have Assurant renter’s insurance, you can feel confident that your policy will cover your items in storage units, up to the predetermined limit. Be sure to take necessary precautions to protect your items and inventory them for a smooth claims process.

What is a storage unit?

A storage unit is a rented space used for storing personal items or business inventory. These units come in different sizes ranging from small lockers to large spaces that can accommodate vehicles and furniture. Storage units are usually rented out on a monthly basis and can be indoors or outdoors.

Types of storage units available

There are different types of storage units available for rent. Indoor storage units are usually housed in a building, while outdoor storage units are located outside. Climate-controlled storage units maintain a steady temperature and humidity level, preventing damage to items that are sensitive to atmospheric changes. Drive-up storage units are accessible from the outside, allowing easy loading and unloading of items.

Why do people use storage units?

People use storage units for various reasons. Some may have outgrown their current living space and need extra room for their belongings. Others may be remodeling or renovating their homes and need a temporary place to store their furniture. Business owners also use storage units to store equipment, inventory, and documents.

Does Assurant renters insurance cover a storage unit?

The straightforward answer is yes. Assurant renters insurance covers personal property anywhere in the world, including storage units. This means that any item covered by your policy will be protected, including electronics, jewelry, and furniture.

However, it’s important to note that the coverage provided by your renters insurance may vary from one policy to another. Some policies may have limitations on the amount of coverage for items stored in a storage unit, while others may exclude certain types of items altogether. It’s essential to review your policy and understand the coverage provided.

If you need additional coverage, you can increase your renters insurance coverage or purchase an additional policy from your insurer. Alternatively, you can also purchase a policy from the storage unit company. It would be best to consult your insurance agent to determine the best option for your specific needs.

Therefore, Assurant renters insurance covers a storage unit, but it’s essential to review your policy and understand the coverage provided. It’s also crucial to take precautions to prevent damage to your items in storage, such as opting for a climate-controlled unit and ensuring that items are packed and stored properly.

Does Assurant Renter’s Insurance Cover Storage Units?

Assurant Renter’s Insurance policy on storage units

Assurant Renter’s Insurance covers personal property anywhere in the world, including storage units. This means that any item covered by the policy will be protected, including electronics, jewelry, and furniture. However, the coverage provided by the renters insurance may differ from one policy to another. Some policies may have limitations on the amount of coverage for items stored in a storage unit, while others may exclude certain types of items altogether.

It’s important to review the policy and understand the coverage provided to ensure that all storage unit items are adequately covered. Also, it’s worth noting that the policy may still cover the damage to the stored items, even if they were not kept in the storage unit in Assurant’s case when the property away from the primary residence gets damaged due to covered perils.

How much coverage is offered

The stored items are covered up to the limit stated on the renter’s insurance policy. Usually, it’s up to 10% of the total personal property limit. In other words, if the policy has a coverage limit of $50,000, then the items stored in the storage unit will be covered up to $5,000.

However, it’s important to keep in mind that the policy limit may vary based on the insurer and the specific policy. As such, It’s advisable to review the policy and confirm the exact coverage amount to ensure adequate coverage for the stored items.

If additional coverage is necessary, the renter can increase the coverage on their renters’ insurance policy or purchase a separate policy from their insurer. Alternatively, they can purchase a policy from the storage unit company. It’s essential to consult with the insurance agent to determine the best coverage option for specific storage unit needs.

Therefore, Assurant Renter’s Insurance policy covers storage units, and the stored items are covered up to the limit stated on the renter’s insurance policy. However, it’s crucial to review the policy to ensure adequate coverage for the stored items. Before taking storage insurance, it’s necessary to check the policy details of renters insurance to see what perils are covered.

What Items Are Covered in a Storage Unit?

Storage units offer convenience and extra space for storing personal items, business inventory, and furniture. It’s essential to know what items are covered by your insurance policy while they’re stored in a unit. Below are the things covered by Assurant renters insurance policy in a storage unit.

Items that are covered under Assurant Renter’s Insurance

Assurant renters insurance covers personal property anywhere in the world, including a storage unit. Therefore, any item covered by your policy will be protected if stored in a storage unit. The following are examples of items covered under an Assurant renters insurance policy:

– Clothing and accessories

– Electronics

– Furniture and appliances

– Jewelry

– Musical instruments

– Sports equipment

– Tools and equipment

– Toys and games

Assurant renters insurance policy typically covers these items from common perils, including fire, theft, vandalism, and water damage, unless they’re specifically excluded.

Items that are not covered

While most personal items are covered by renters insurance in a storage unit, certain items may be excluded. Knowing what isn’t covered can help you decide whether to buy additional coverage or store those items elsewhere. The following are examples of items that may not be covered:

– Cash, coins, and precious metals

– Illegal goods and contraband

– Vehicles or motorized equipment

– Pets or animals

– Living plants

– Any item not owned by you

It’s also essential to note that renters insurance policies may have a limit on the amount of coverage for items stored in a storage unit. Therefore, it’s critical to review your policy and understand the coverage provided. You can also consult with your insurance agent to determine the best option for your specific needs.

Therefore, Assurant renters insurance covers personal property anywhere in the world, including items stored in a storage unit. However, it’s crucial to understand the coverage provided and take precautions to prevent damage to your items in storage. By knowing what items are covered, you can make informed decisions and protect your valuable possessions.

Personal Property Coverage

What is personal property coverage

Personal property coverage is included in most renters insurance policies. It covers your belongings against damage, loss, and theft. This coverage applies to personal property inside and outside your home, including items stored in a storage unit. The coverage limit for personal property coverage varies depending on your insurance policy’s terms.

How it works for items in storage units

Renters insurance policies offer off-premises coverage, which covers property stored in a storage unit that is not located in your home. The coverage limit for off-premises coverage is usually a percentage of your personal property coverage limit. For example, if you have $50,000 of coverage for personal property, your off-premises coverage limit would be $5,000. The majority of renters insurance policies offer an off-premises coverage limit of up to 10% of your personal property coverage.

If the value of the items you’re storing in a storage unit exceeds the limit provided by your renters insurance policy, you should consider purchasing additional coverage. You may also need to purchase additional storage unit insurance if your renters policy excludes particular risks, such as fire or flood.

It’s important to check your renters insurance policy’s terms to see what items are excluded. Items that are often excluded include cash, coins, valuable documents, and jewelry. If items with a high value are not covered under your policy, you should consider purchasing an additional endorsement to increase the policy limit.

So, personal property coverage applies to all your belongings, including the ones stored in a storage unit. The coverage limit for off-premises coverage is usually a percentage of your personal property coverage limit. If the value of your stored items exceeds the coverage limit, you should consider purchasing additional coverage. Knowing the items excluded by your renters insurance policy can help you make informed decisions about buying additional coverage.

The Importance of Liability Coverage for Your Stored Belongings

Liability Coverage

When renting a storage unit, liability coverage can play a significant role in protecting you from financial losses. While renters insurance typically provides coverage for your belongings, liability coverage can safeguard you against legal claims taken against you for any damage or injury caused by your stored belongings.

What is liability coverage?

Liability coverage or personal liability insurance can protect you if you unintentionally cause damage or injury to someone or their property. It covers the costs for legal defense, court costs, and settlements up to your coverage limit.

For instance, if someone gets injured in a storage unit because they stumbled upon one of your belongings, liability coverage kicks in to protect you. Without it, you could be personally responsible for the medical bills, legal fees, and damages awarded to the injured party.

How it works for storage units

Most storage companies require customers to sign a lease agreement that includes a liability waiver to protect themselves from any damage or injury caused by the stored items. However, this waiver doesn’t shield you from legal claims taken against you for damages or personal injury caused by your property.

Therefore, it’s essential to check the liability coverage provided by your renters insurance policy and supplement it if necessary. Some policies may exclude liability coverage for stored items or have a limited coverage amount. You can consider adding an endorsement or a separate policy to increase liability coverage for your stored belongings.

Suppose you’re considering storing high-value items like artwork, antiques, or expensive electronics. In that case, it’s advisable to consider additional insurance policies to protect your investment from unforeseeable damage or theft.

Therefore, liability coverage in your renters insurance policy can provide an added layer of protection for your belongings stored in a storage unit. It helps safeguard you against any legal claims due to damage or personal injury caused by your stored items. Therefore, it’s essential to review the policy’s coverage limit and consult with your agent to ensure you have adequate protection.

How to Purchase Storage Unit Coverage

When it comes to purchasing coverage for your stored belongings, there are several options available to you. Here’s what you need to know:

Options for purchasing additional coverage

1. Storage Company Insurance: Some storage companies offer insurance policies to their customers. However, their coverage may be limited and may not be sufficient to protect all your stored items. Additionally, storage company insurance typically only covers damage or loss that occurs on their property, and not while in transit.

2. Standalone Storage Insurance: You can purchase a separate policy specifically for your stored belongings. These policies usually offer higher limits and comprehensive coverage options, including protection against natural disasters, theft, and damage during transit.

3. Endorsement to Existing Policy: Most renters insurance policies offer endorsements or add-ons to supplement your coverage for stored belongings. These endorsements typically provide higher liability coverage limits and may cover various perils not included in the standard policy.

How to add coverage to an existing renters policy

If you have a renters insurance policy, you can add coverage for your storage unit in several ways:

1. Contact your agent: Your insurance agent can help you review your policy and add appropriate coverage for your storage unit.

2. Policy endorsement: You can purchase an endorsement to your existing renters insurance to increase coverage for stored belongings.

3. Policy upgrade: Another option is to upgrade your existing policy to a more comprehensive policy that includes coverage for stored belongings.

Therefore, it’s essential to ensure that your stored belongings are adequately protected against any unforeseen damage or loss. Understanding your renters insurance policy and considering additional coverage options can help provide peace of mind and protect your investment. Consult with your insurance agent to determine the best coverage options for your specific needs.

What to Do if Something Happens to Your Storage Unit

If something happens to your storage unit, such as theft or damage to your belongings, it’s important to know how to file a claim and what to expect during the claims process. Here are some steps to take:

How to file a claim for damages or theft

1. Take inventory: Before anything happens, it’s a good idea to have a list of all the items in your storage unit. This will help the insurance company determine the value of your claim.

2. Contact your insurance company: As soon as you discover the damages or theft, contact your insurance company to report the incident and start the claims process. Be prepared to provide them with an inventory of the damaged or stolen items.

3. File a police report: If your belongings were stolen, file a police report as soon as possible. The insurance company may require a copy of the report to process your claim.

4. Provide documentation: Provide the insurance company with any documentation that supports your claim, such as receipts or photos of the damaged items.

What to expect during the claims process

1. Investigation: The insurance company will investigate your claim to verify the damages or theft.

2. Settlement offer: After the investigation is complete, the insurance company will make a settlement offer. This offer is based on the value of your damaged or stolen property and the coverage limit of your policy.

3. Negotiations: If you feel that the settlement offer is insufficient, you can negotiate with the insurance company to get a higher payout. Provide them with any additional documentation or evidence that supports your claim.

4. Resolution: Once you and the insurance company have reached an agreement, they will issue a payment for the settlement amount.

Therefore, renters insurance can provide valuable coverage for your stored belongings, but it’s important to review the policy’s liability coverage and supplement it if necessary. If something happens to your storage unit, take inventory of your items, contact your insurance company, file a police report, and provide documentation to support your claim. Be prepared for the claims process, which can involve an investigation, a settlement offer, negotiations, and a final resolution.

What to Do if Something Happens to Your Storage Unit

In a world where natural disasters, theft, and accidents can happen at any time, it’s important to have a clear understanding of what steps to take if something happens to your storage unit. Here are some practical tips to ensure that you are prepared to deal with any mishaps or issues that may arise.

How to File a Claim for Damages or Theft

If your belongings are stolen or damaged while in a storage unit, it’s important to file a claim as soon as possible. Here are the necessary steps to take to file a claim:

– Take inventory: Before anything happens, make sure to have an inventory of all the items in your storage unit. This will help the insurance company determine the value of your claim.

– Contact your insurance company: As soon as you discover the damages or theft, contact your insurance company to report the incident and start the claims process. Be prepared to provide them with an inventory of the damaged or stolen items.

– File a police report: If your belongings were stolen, file a police report as soon as possible. The insurance company may require a copy of the report to process your claim.

– Provide documentation: Provide the insurance company with any documentation that supports your claim, such as receipts or photos of the damaged items.

What to Expect During the Claims Process

Once you have filed a claim, the insurance company will investigate to verify the damages or theft. After the investigation is complete, they will make a settlement offer based on the value of your damaged or stolen property and the coverage limit of your policy. If you feel that the settlement offer is insufficient, you can negotiate with the insurance company to get a higher payout. Once you and the insurance company have reached an agreement, they will issue a payment for the settlement amount.

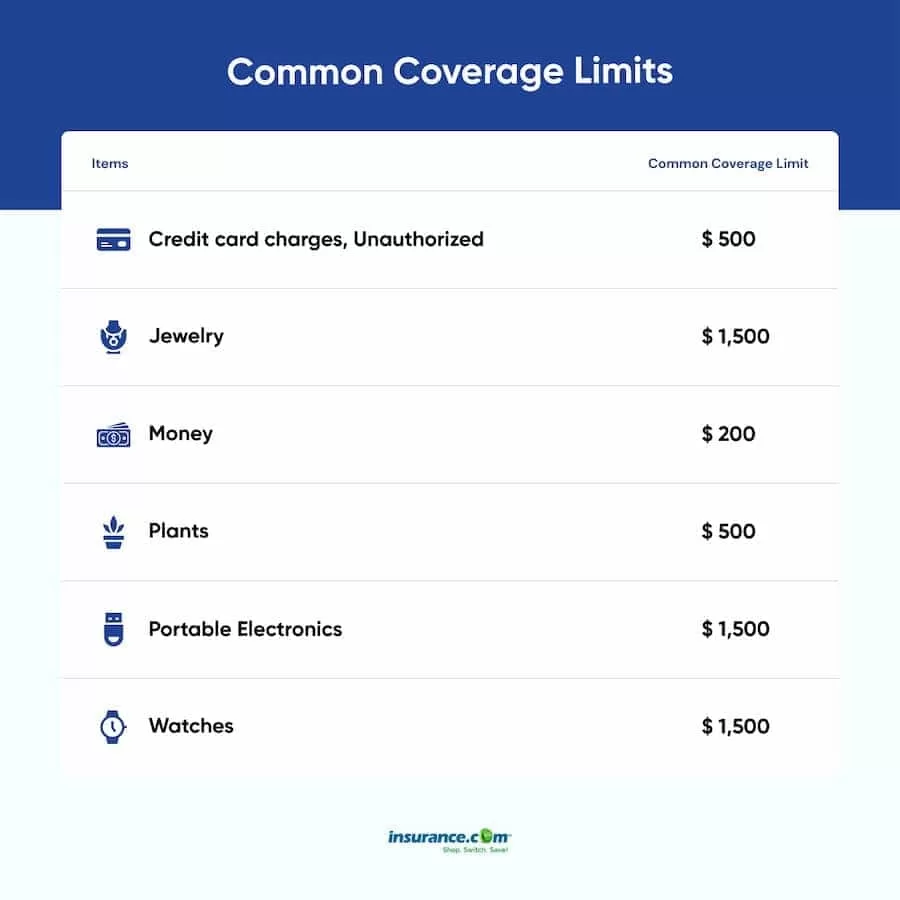

Importance of Having Renters Insurance for Storage Units

Therefore, renters insurance can provide valuable coverage for your stored belongings, but it’s important to review the policy’s liability coverage and supplement it if necessary. Renters insurance typically covers any personal property stored in a storage unit up to 10% of your total personal property limit with some exclusions. Additional storage unit insurance is usually worth it if your renters insurance doesn’t sufficiently cover your stored possessions. Make sure to check the policy details of your storage coverage, as some policies will exclude coverage of particularly valuable items such as deeds, money, jewelry, watches, furs and other valuable items.

Final Thoughts and Recommendations

It’s important to remember to take inventory of your items, contact your insurance company, file a police report, and provide documentation to support your claim should anything happen to your storage unit. Understanding the claims process and negotiating with the insurance company if needed can also help to ensure that you receive proper compensation for any damages or theft. It is recommended that you purchase additional insurance coverage for your storage unit if your renters insurance doesn’t provide sufficient coverage. Always make sure to review and understand your storage unit insurance policy to know what is and isn’t covered.

Discover Does allstate renters insurance cover storage units.

1 thought on “Does assurant renters insurance cover storage unit”