Does allstate renters insurance cover storage units

When renting an apartment or a house, it is important to protect both yourself and your personal belongings. Renters insurance can help to ensure that you have the financial protection you need in case of unforeseen losses or liabilities. Allstate is a provider of renters insurance, offering coverage that can help you feel secure in your rental home. Let’s take a closer look at Allstate renters insurance coverage.

Overview of Allstate renters insurance coverage

Allstate renters insurance coverage typically includes three types of protection:

1. Personal property coverage – This type of coverage helps to pay for the repair or replacement of your personal belongings if they are stolen or damaged by a covered risk, such as fire, smoke, vandalism, or water damage. Your policy will usually cover items whether they are inside or outside your rental property.

2. Liability coverage – In case you cause damage to someone else’s property or people get hurt while they are in your rental unit, liability coverage can provide financial protection for you. Liability coverage can come in handy if, for example, you accidentally set fire to your rental unit’s kitchen or your dog bites a guest in your apartment.

3. Additional living expenses – Should your rental unit become unlivable due to events like fire or natural disasters, Allstate renters insurance can help to cover additional living expenses incurred in finding temporary accommodations while repairs are being made.

Allstate also offers additional coverage options that you can add to your policy. These options include:

– Scheduled personal property coverage – This option helps you to insure high-value items like engagement rings, expensive camera equipment, or antiques.

– Identity theft restoration coverage – If your identity is stolen while living in your rental unit, this coverage can help to cover any expenses you incur while restoring your identity.

– Flood insurance – This optional coverage can provide financial protection in case your rental unit is at risk of flooding or is located in a flood-prone area.

It is important to understand the terms and conditions of your renters insurance policy. For instance, you may only get reimbursed for the replacement value of your damaged or stolen belongings, rather than their original purchase price. To ensure you have the right coverage and limits for your needs, consider speaking with an Allstate agent. They can help you understand renters insurance coverage and customize your policy to best fit your lifestyle and budget.

Therefore, renters insurance can provide peace of mind and financial protection in case of unforeseen events. Allstate renters insurance offers personal property coverage, liability coverage, and additional living expenses coverage, with options to add more coverage for high-value items, identity theft restoration, or flood insurance. Before purchasing a policy, it is important to understand what you are buying, what it covers, and what it does not cover.

What is covered under Allstate renters insurance?

Explanation of typical coverage, known as off-premises personal property coverage

Allstate offers renters insurance policies that typically include coverage for the contents of your home. This coverage is sometimes known as contents insurance, but is usually described in most insurance policies as off-premises personal property coverage. Off-premises personal property coverage may help protect your belongings from covered risks such as theft or fire, even if the damage or loss occurs outside of your home.

Contents insurance helps pay to replace or repair your personal belongings if they’re stolen or damaged by a covered peril, such as a fire. So, if someone breaks into your home and steals your belongings or your clothing and furniture are ruined in a fire, you may find that renters insurance helps cover the loss.

With Allstate renters insurance, you may also have coverage for liability, additional living expenses, and medical payments to others. Liability coverage may help protect you financially if you are found to be responsible for accidental injury or property damage to others. Additional living expenses coverage may help cover the cost of temporary housing if you can’t stay in your home due to a covered loss. Medical payments to others coverage may help cover medical expenses if someone is injured at your home.

It’s important to understand the type of coverage you have and how much your policy may pay for a covered claim so you can be better prepared if you ever need to file a claim. Allstate allows you to customize your renters insurance policy with limits and deductibles that fit your needs and budget.

In addition, Allstate offers optional coverages like identity restoration and green improvement reimbursement. Identity restoration coverage may help you recover from identity theft, while green improvement reimbursement may help cover the cost of eco-friendly repairs or upgrades after a covered loss.

Overall, Allstate renters insurance can provide peace of mind by protecting your belongings and providing additional coverage options. It’s important to speak with an Allstate agent to determine the best coverage for your individual situation.

Does Allstate renters insurance cover storage units?

Yes, Allstate renters insurance does cover belongings kept in a storage unit

Allstate renters insurance policies typically include off-premises personal property coverage, which may help protect your belongings from covered risks like theft or fire, even if the damage or loss occurs outside your home. This means that your renters insurance policy can also cover belongings kept in a storage unit.

The coverage limit for off-premises personal property is usually a percentage of your total personal property limit, which could be up to 10%. For example, if your personal property limit is $50,000, the off-premises coverage limit could be up to $5,000. However, it’s important to review your policy or speak with an Allstate agent to understand the specific coverage and limits of your policy.

If the limit on your renters insurance policy is not sufficient to cover the value of your items in storage, you may consider purchasing additional storage unit insurance. It’s important to check the details of your storage unit insurance policy to understand what perils are covered and not covered. For certain valuables like jewelry, money, deeds, or watches, you may need to add an additional endorsement to your renters insurance policy.

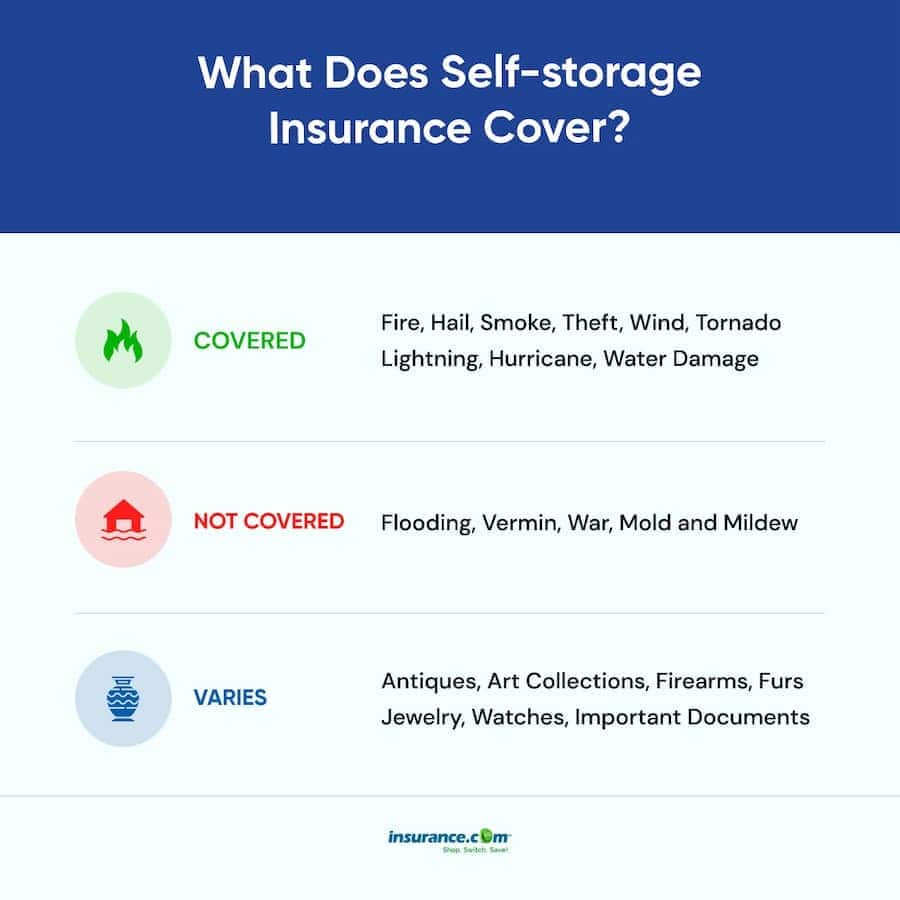

Storage unit insurance policies may exclude coverage for certain risks like flood, fire, smoke, hail, lightning, vandalism, vermin/insect infestation, and fungus/mold. It’s important to review the policy details to understand what is and is not covered by the storage facility insurance policy.

In addition, Allstate renters insurance offers optional coverages like identity restoration and green improvement reimbursement. Identity restoration coverage may help you recover from identity theft, while green improvement reimbursement may help cover the cost of eco-friendly repairs or upgrades after a covered loss.

Overall, Allstate renters insurance provides coverage for belongings kept in storage units, but it’s important to review the specific coverage and limits of your policy and consider purchasing additional storage unit insurance if necessary. Speaking with an Allstate agent can help you determine the best coverage for your individual situation.

Coverage limit

Explaining how coverage limits work for storage unit contents

When purchasing storage unit insurance, it’s important to understand how coverage limits work. Your coverage limit is the maximum amount your insurance policy will pay out for a covered loss. The coverage limit is typically determined by the type of policy you have and the amount of coverage you purchase.

Most storage unit insurance policies offer a coverage limit based on the total value of the items in your storage unit. For example, if you have $10,000 worth of items in your storage unit and your policy has a coverage limit of $10,000, your insurance will pay up to $10,000 for covered losses.

It’s important to note that you may be able to choose a higher coverage limit when purchasing your policy. However, opting for a higher coverage limit may increase your premiums. It’s important to weigh the cost of premiums against the value of your stored items when deciding on a coverage limit.

Another factor to consider when purchasing storage unit insurance is the deductible. The deductible is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. Generally, the higher your deductible, the lower your premium. However, you’ll want to ensure that your deductible is affordable in the event of a loss.

Comparing storage unit insurance to off-premises personal property coverage on your home or renters insurance policy can help you make an informed decision on which type of insurance is best for your needs. In some cases, it may be cheaper to purchase a separate storage unit insurance policy than it would be to increase your home or renters personal property coverage limit.

In addition to insurance coverage, it’s important to take steps to protect your items in storage. Even the most secure storage facility is susceptible to dangers that can damage your possessions. Consider using sturdy, lockable containers, wrapping fragile items in bubble wrap or packing paper, and placing items on pallets to avoid water damage.

Overall, understanding how coverage limits work and taking steps to protect your items can help mitigate the risk of loss when using a storage unit. Be sure to speak with an insurance agent to determine the best insurance policy and coverage limit for your individual situation.

Additional storage unit insurance

When it may be necessary to consider additional insurance for storage unit contents

Storage unit insurance can provide some peace of mind when storing valuable items off-premises. However, there may be circumstances where it is necessary to consider additional insurance for storage unit contents.

One scenario where additional insurance may be necessary is when the storage unit provider’s insurance coverage is insufficient. While many storage facilities offer insurance coverage, it may not cover all types of losses or provide adequate limits. It’s important to review the terms of the storage unit provider’s insurance policy and understand the coverage limits and exclusions.

Another scenario where additional insurance may be necessary is when storing items of particularly high value. Most storage unit insurance policies have limits on the amount of coverage they provide, and this may not be enough to fully protect items that are worth significantly more than the policy limit. In this case, it may be necessary to purchase additional coverage to supplement the storage unit policy.

In some cases, it may be necessary to consider alternative insurance options, such as off-premises personal property coverage through a home or renters insurance policy. This type of coverage may provide broader protection than storage unit insurance and may offer higher coverage limits. It’s important to review the terms of the home or renters insurance policy to determine if off-premises coverage is included and, if so, what the coverage limits and exclusions are.

When considering additional insurance for storage unit contents, it’s important to compare coverage options and costs. It may be more cost-effective to supplement a storage unit policy with additional coverage than it would be to rely solely on off-premises coverage through a home or renters insurance policy. An insurance agent can provide guidance on the best options for individual circumstances.

It’s important to note that insurance coverage is just one aspect of protecting items in storage. Taking steps to prevent losses, such as using sturdy containers and protecting items from water damage, can also help mitigate risk. It’s also important to review and update insurance coverage periodically to ensure it remains adequate for the value of the stored items.

Overall, additional insurance may be necessary in certain circumstances to fully protect items stored in a storage unit. Understanding coverage options and taking steps to prevent losses can help minimize risk and provide peace of mind when using a storage unit.

How much coverage do you need?

Determining how much coverage is necessary for storage unit contents

When it comes to purchasing storage unit insurance, it’s important to consider how much coverage you need. Determining how much coverage you require involves assessing the total value of the items you plan to store in the unit and choosing a coverage limit that adequately protects your belongings.

Most storage unit insurance policies offer coverage limits based on the value of the items in your storage unit. It’s important to remember that choosing a higher coverage limit usually means higher premiums. Therefore, it’s crucial to weigh the cost of premiums against the value of your stored items to determine a suitable coverage limit.

To determine the value of the items you plan to store, make a comprehensive list of the possessions, including furniture, electronics, clothing, and any other belongings you plan to put in storage. Assign a value to each item based on its purchase price or current market value.

It’s important to keep in mind that some items may require additional coverage. For example, if you plan to store expensive jewelry or artwork, you may need to purchase additional insurance to protect these items. Speak with an insurance agent to determine whether you need additional coverage and if it’s available through your storage unit insurance policy or if you’ll need to purchase separate insurance.

Another factor to consider when evaluating how much coverage you need is your deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Generally, choosing a higher deductible results in lower premiums. However, you need to ensure that the deductible is feasible in the event of a loss.

If you rent your home or apartment, it’s possible that your renters insurance policy may cover some of the items stored in a storage unit. Review your renters insurance policy or speak with your insurance agent to determine the extent of your coverage.

In addition to considering insurance coverage, taking steps to protect your possessions can help reduce the risk of loss. Use sturdy, lockable containers to store your belongings and place items on pallets to avoid water damage. Consider using bubble wrap or packing paper when storing fragile items.

Remember to review your insurance policy periodically to ensure that your coverage limits are adequate for your needs. If your situation or the value of your belongings changes, adjust your coverage limits accordingly to ensure that your belongings are adequately protected.

Therefore, determining how much coverage you need for your storage unit contents involves assessing the value of your possessions, considering your deductible, and taking steps to protect your belongings. Speak with an insurance agent to determine the best coverage limits for your individual situation, and be sure to review and adjust your policy periodically to ensure that your belongings are adequately protected.

Filing a claim for storage unit contents

Steps to take if storage unit contents are damaged or stolen

In the unfortunate event that your stored possessions are damaged or stolen, it’s important to know the steps to take to file a claim for storage unit insurance. Here’s what to generally expect in the claim process:

1. Promptly report the loss or damage to your insurance provider. Contact your storage unit insurance company’s claims department as soon as possible to initiate the claim process.

2. Provide documentation and evidence of your damaged or stolen items. This includes itemized lists, photographs, receipts, and appraisals that show the value of the items that were lost or damaged in storage.

3. Wait for the insurance company’s damage assessment. The insurance company will review the documentation and evidence of your damaged or stolen items to determine their value and extent of the damage.

4. Review the claim settlement details. The insurance company will provide you with details about your claim settlement, including the estimate of damages and any claim payments you are entitled to.

5. Receive your claim payment. Payment can often be made via electronic transfer, wire transfer, or check. You’ll be provided with instructions on how to receive your payment.

It’s important to know that the claim process may vary depending on the extent of the damage and the specific terms of your storage unit insurance policy. However, always try to file your claim as soon as possible to avoid any delays in the claims process.

To ensure a smooth claims process, it’s important to take steps to protect your stored possessions. Use high-quality, sturdy containers and protect fragile items with bubble wrap or packing paper. Also, consider choosing a storage unit with climate control to prevent damage from moisture, heat, or cold temperatures.

Therefore, if you incur damage or loss of your stored possessions, contact your storage unit insurance provider immediately to file a claim. Provide thorough documentation and evidence of the loss or damage to make the claims process more efficient. Taking steps to protect your possessions and reviewing your insurance policy periodically can also help ensure that your stored items are adequately protected.

.

Exclusions to coverage

Understanding what may not be covered under Allstate renters insurance

While renters insurance can provide coverage for items in a storage unit, there are exclusions to be aware of. Understanding what is not covered can help you take steps to protect your belongings and ensure that you have adequate insurance coverage.

One important exclusion to note is that renters insurance typically does not cover damage caused by pests or vermin. This means that if mice or other animals get into your storage unit and damage your belongings, you may not be covered. To protect against this, consider storing food and other items that may attract pests in airtight containers and use pest control measures to minimize the risk of damage.

Another exclusion to be aware of is that typically renters insurance does not provide coverage for items that are damaged as a result of flooding. This is important to keep in mind if you live in an area that is prone to flooding or if you are storing items that are sensitive to water damage. In this case, you may need to purchase separate flood insurance to ensure that your belongings are adequately protected.

In addition, it’s important to review your policy to determine if there are any limits or exclusions related to the type of storage unit you are using. For example, some policies may exclude coverage for items stored in outdoor storage units or units that are not equipped with proper security measures. Understanding these exclusions can help you choose a storage unit that is appropriate for your needs and ensure that you have adequate coverage.

Finally, it’s important to note that each insurance policy may have its own exclusions and limitations. Be sure to review your policy carefully and speak with your insurance agent if you have any questions or concerns about your coverage. This can help you avoid any surprises down the road and ensure that your belongings are adequately protected.

Therefore, while renters insurance can provide coverage for items stored in a storage unit, it’s important to be aware of any exclusions or limitations. Understanding what is not covered can help you take steps to protect your belongings and ensure that you have adequate insurance coverage. Be sure to review your policy carefully and speak with your insurance agent if you have any questions or concerns.

Exclusions to coverage

Understanding what may not be covered under Allstate renters insurance

Renters insurance offers coverage for personal belongings stored in self-storage units. However, there are important exclusions that renters should be aware of to ensure they have adequate insurance coverage.

One common exclusion is damage caused by pests or vermin, which is typically not covered by renters insurance policies. If pests infiltrate your storage unit and damage your items, you may not be covered. Preventative measures such as storing food and other items in airtight containers, and using pest control, can minimize this risk.

Another exclusion to consider is that renters insurance policies generally do not cover items damaged by flooding. This is a significant consideration if you live in an area prone to flooding or have stored items that are vulnerable to water damage. In such cases, separate flood insurance may need to be purchased to ensure adequate protection.

Renters should also review their policy to identify any limits or exclusions that pertain to the type of storage unit they are using. For example, coverage may be excluded for items stored in outdoor units or facilities without proper security measures. Understanding these restrictions is crucial to selecting an appropriate self-storage facility and ensuring your belongings are adequately protected.

It’s important to note that renters insurance policies can vary, with each having its own exclusions and limitations. It’s vital to review your policy carefully and consult your insurance agent if you have any questions or concerns about your coverage.

Conclusion

Summary of key points and benefits of Allstate renters insurance coverage for storage unit contents

Therefore, renters insurance coverage allows for personal items in storage units to be protected. Still, there are exclusions to coverage that should be understood. Renters should be mindful of how to protect against pests and flooding damage. It’s also essential to review an insurance policy for any possible limits or exclusions related to the type of storage unit being used.

Allstate renters insurance offers policies up to $30,000 in coverage, with the option to add coverage for jewelry, collectibles, and other valuable items. Working with an experienced insurance agent can ensure that renters have the right policy suited to their storage unit belongings.

Check out Does geico offer storage unit insurance.