Introduction

Introduction to renters insurance and its coverage for storage units

Renters insurance is a type of insurance policy that provides coverage for individuals who are renting a home or apartment. It helps protect their personal belongings in case of theft, damage, or loss. While most people are familiar with the idea of renters insurance for their primary residence, many may not realize that it can also provide coverage for items that are stored in a storage unit.

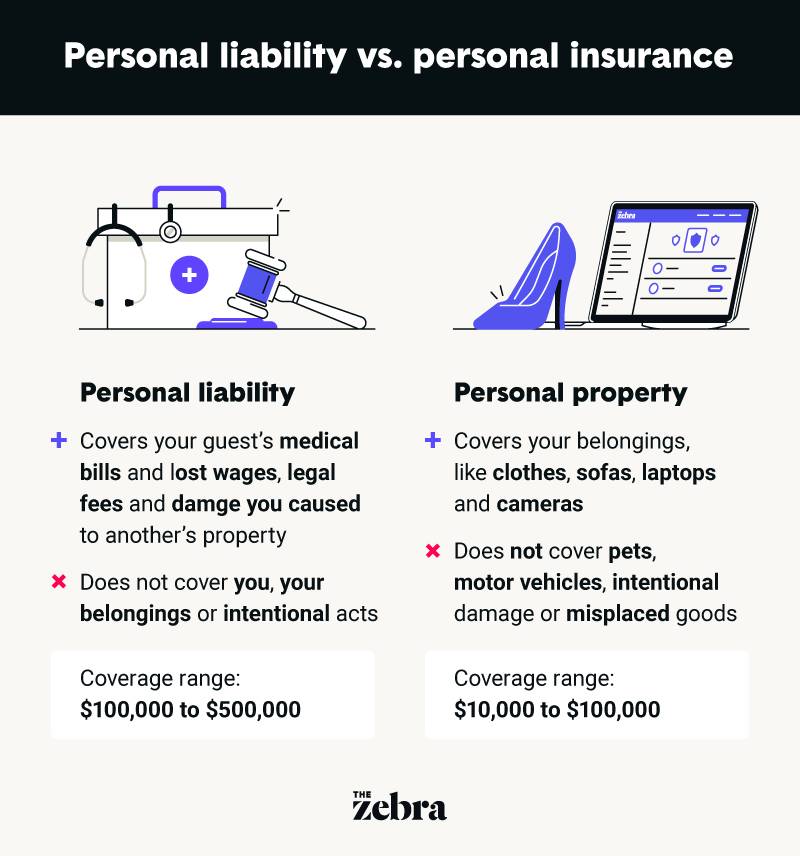

Renters insurance policies typically include coverage for personal property, liability protection, additional living expenses, and medical payments. When it comes to storage units, renters insurance can extend coverage to the belongings that are stored in them. This means that if someone’s storage unit is broken into or damaged, their renters insurance policy may provide compensation for the loss.

Importance of having renters insurance for protecting belongings

Having renters insurance is especially important for protecting belongings, both inside the home and in storage units. Here are a few reasons why it is crucial to have renters insurance for the protection of personal belongings:

1. Coverage for theft: Renters insurance can provide compensation in case of theft, whether the stolen items were inside the home or in a storage unit. This can offer peace of mind and financial protection knowing that stolen belongings can be replaced.

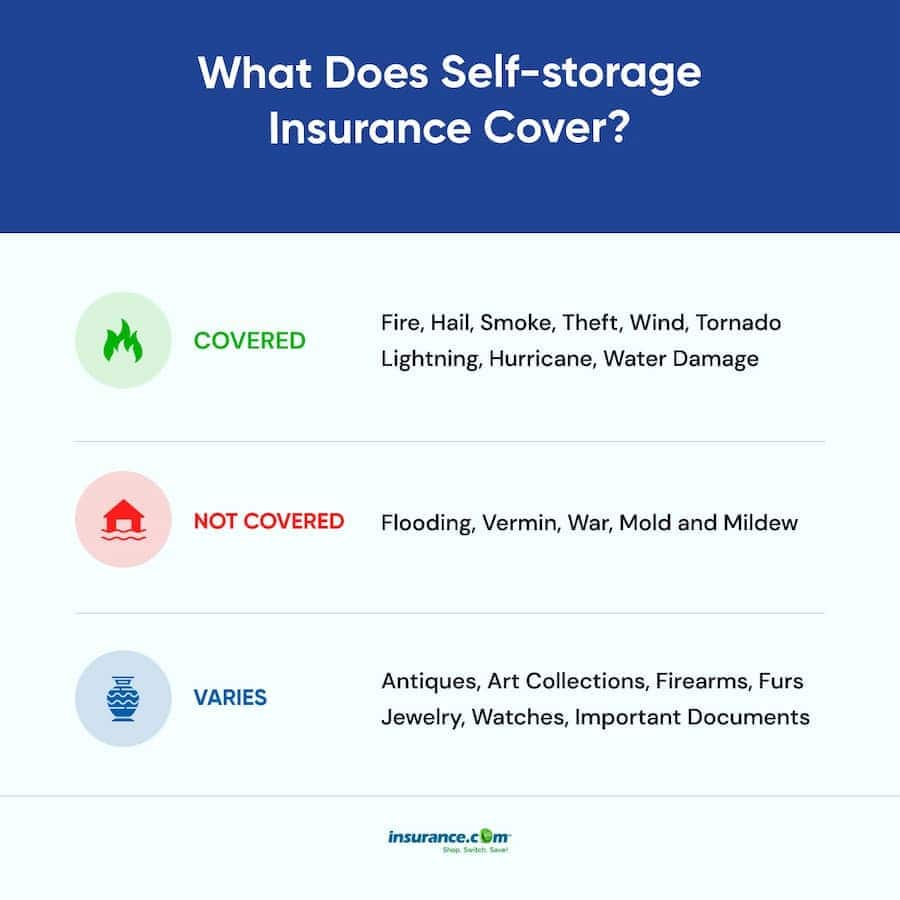

2. Coverage for damage: Renters insurance can also provide coverage for damage caused by a covered event such as a fire, water damage, or natural disasters. This includes damage to items stored in a storage unit, ensuring that individuals are not left with a financial burden if their belongings are damaged.

3. Liability protection: Renters insurance policies typically include liability protection, which can be beneficial even for items in storage. If someone’s belongings were to cause damage to another person’s property, renters insurance may provide coverage for the damages and legal expenses.

4. Additional living expenses: In the event that a covered incident renders the rented home uninhabitable, renters insurance can help cover the costs of temporary housing and other necessary expenses. This coverage can extend to situations where the stored items are also affected.

Therefore, renters insurance is a valuable investment for protecting personal belongings, both inside the home and in storage units. It provides coverage for theft, damage, liability, and additional living expenses. By having renters insurance, individuals can have peace of mind knowing that their belongings are protected no matter where they are stored.

Coverage for Storage Units

Overview of renters insurance coverage for storage units

When it comes to renters insurance, many people may not realize that their policy can also provide coverage for items stored in a storage unit. Renters insurance typically protects personal belongings against damage or loss due to covered events such as fire, theft, or vandalism. This coverage can extend to belongings stored off-premises, including items in a storage unit.

Percentage of coverage for items in a self-storage unit

The coverage for items stored in a self-storage unit is usually a percentage of the total coverage limit specified in the renters insurance policy. For example, if the policy has a coverage limit of $50,000 and the coverage for stored items is 10%, then the coverage for items in the storage unit would be $5,000. It is important to note that the coverage limit for stored items may vary depending on the insurance company and the specific policy.

When determining the coverage for stored items, it is essential to provide the insurance company with an accurate inventory of the items in the storage unit. This can include a description of each item, its value, and any supporting documentation such as receipts or photographs. This information will help ensure that the items are properly covered and that the insurance company can accurately assess the value of the items in case of a claim.

Coverage for property stored outside of residence

Renters insurance also provides coverage for property that is temporarily away from the insured residence, including items in a storage unit. This coverage can protect against risks such as theft, fire, or damage caused by natural disasters. However, it is important to review the specific policy to understand the extent of the coverage and any limitations or exclusions.

Before storing items in a storage unit, it is advisable to check with the insurance company to ensure that the coverage extends to off-premises storage. Some policies may have specific requirements or restrictions for coverage, such as the need for a lock on the storage unit or the requirement to inform the insurance company of the storage location.

Therefore, renters insurance can provide coverage for items stored in a storage unit. The coverage is usually a percentage of the total coverage limit specified in the policy and can protect against risks such as theft or damage. It is important to accurately inventory the items and provide the necessary documentation to ensure proper coverage. As always, it is essential to review the specific policy and consult with the insurance company to understand the extent of the coverage and any limitations.

Policy Limits

Explanation of policy limits and their impact on storage unit coverage

When it comes to renters insurance, policy limits play a crucial role in determining the coverage provided for items stored in a storage unit. Policy limits refer to the maximum amount the insurance company will pay for a covered claim. These limits can vary depending on the specific policy and insurance company.

When choosing a renters insurance policy, it is important to carefully consider the policy limits to ensure adequate coverage for both the belongings in your residence and those stored in a storage unit. If the coverage limit is too low, you may not be fully compensated for the loss or damage of your belongings.

Understanding the percentage of coverage provided by the policy

Coverage for items stored in a self-storage unit is usually a percentage of the total coverage limit specified in the renters insurance policy. For example, if the policy has a coverage limit of $50,000 and the coverage for stored items is 10%, then the coverage for items in the storage unit would be $5,000.

It is essential to accurately estimate the value of the items you plan to store in the unit and ensure that the policy’s coverage limit is sufficient to protect your belongings. In some cases, you may need to adjust your policy limits to ensure adequate coverage for valuable items.

To determine the coverage for stored items, it is important to provide the insurance company with a detailed inventory of the items in the storage unit. This can include a description of each item, its value, and any supporting documentation such as receipts or photographs. By providing this information, you can help ensure that your belongings are properly covered and that the insurance company can accurately assess their value in case of a claim.

It is worth noting that the coverage limit for stored items may vary depending on the insurance company and the specific policy. Therefore, it is advisable to review your policy and consult with the insurance company to understand the extent of the coverage and any limitations or exclusions for items stored in a storage unit.

Therefore, policy limits play a significant role in determining the coverage provided for items stored in a storage unit through renters insurance. Understanding the percentage of coverage provided by the policy can help you assess the adequacy of your coverage and ensure that your belongings are properly protected.

Belongings in Storage Units

Detailed information on how renters insurance protects belongings in storage units

When it comes to renters insurance, it’s important to understand that your policy can also provide coverage for items stored in a storage unit. Renters insurance typically safeguards personal belongings against damage or loss caused by covered events like fire, theft, or vandalism. This coverage can extend to belongings stored off-premises, including those in a storage unit.

Coverage for theft, damage, and loss of items in storage

The coverage for items stored in a self-storage unit is usually a percentage of the total coverage limit specified in the renters insurance policy. For example, if your policy has a coverage limit of $50,000 and the coverage for stored items is 10%, then the coverage for items in the storage unit would be $5,000. It’s worth noting that the coverage limit for stored items may vary depending on the insurance company and the specific policy.

To ensure the accurate coverage for stored items, it’s essential to provide the insurance company with an inventory of the items in the storage unit. This inventory should include a description of each item, its value, and any supporting documentation such as receipts or photographs. This information will help ensure that the items are properly covered, and the insurance company can assess their value accurately in the event of a claim.

Renters insurance also provides coverage for property that is temporarily away from the insured residence, which includes items in a storage unit. This coverage can protect against risks like theft, fire, or damage caused by natural disasters. However, it’s crucial to review the specific policy to understand the extent of the coverage and any limitations or exclusions that may apply.

Before storing items in a storage unit, it’s advisable to check with your insurance company to ensure that the coverage extends to off-premises storage. Some policies may have specific requirements or restrictions for coverage, such as the need for a lock on the storage unit or the requirement to inform the insurance company of the storage location.

Therefore, renters insurance can provide coverage for items stored in a storage unit. The coverage is usually a percentage of the total coverage limit specified in the policy and can protect against theft, damage, or loss. It’s important to accurately inventory the items and provide the necessary documentation to ensure proper coverage. Reviewing the specific policy and consulting with the insurance company is essential to understanding the extent of the coverage and any limitations that may apply.

Additional Coverage Options

Exploration of additional coverage options for storage units

In addition to the coverage provided by renters insurance for items stored in a storage unit, there may be additional coverage options available to further protect your belongings. These options can provide added peace of mind and ensure that you have adequate protection in case of unforeseen events. Below are a few additional coverage options worth considering:

1. Specialized Storage Insurance: If you have valuable items such as fine art, jewelry, or collectibles stored in a storage unit, you may want to consider specialized storage insurance. This type of coverage is designed specifically for high-value items and can provide a higher coverage limit and additional protection. It’s important to review the policy carefully to understand the specific coverage and any limitations that may apply.

2. Climate-Controlled Coverage: If you are storing items that are sensitive to temperature and humidity, like electronics or wooden furniture, it’s essential to consider climate-controlled coverage. This option can provide protection against damage caused by temperature fluctuations or excessive moisture. Not all storage units offer climate control, so it’s important to check with the facility and see if this coverage is available.

3. Business Storage Insurance: If you are using a storage unit for business purposes, such as storing inventory or equipment, you may need additional coverage beyond what is provided by renters insurance. Business storage insurance can provide coverage for business-related items and protect against loss or damage. It’s important to consult with your insurance provider to ensure that your business storage needs are adequately covered.

Insurance for high-value items or specialized storage needs

If you have high-value items or specialized storage needs, it’s important to evaluate your insurance coverage to ensure that these items are adequately protected. Some insurance policies may have limitations or exclusions for certain types of items, so it’s important to review the policy carefully and consider additional coverage options if necessary. Here are some things to consider:

1. Scheduled Personal Property Coverage: If you have valuable items that exceed the coverage limits of your renters insurance policy, you may want to consider scheduling these items separately. Scheduled personal property coverage allows you to provide specific details about each item, including its value, and obtain the appropriate coverage for those items.

2. Additional Endorsements: Depending on your storage needs, you may require additional endorsements to your existing renters insurance policy. For example, if you have a wine collection stored in a storage unit, you may need a specific endorsement to cover that collection. Consult with your insurance provider to determine if any additional endorsements are necessary for your specific storage requirements.

3. Storage-Specific Insurance: Some storage facilities offer their own insurance options specifically tailored to their units. While it may seem convenient, it’s important to carefully review the terms and conditions of such policies and compare them with your existing coverage. Make sure that the storage-specific insurance provides adequate protection and doesn’t duplicate any existing coverage you already have.

When considering additional coverage options, it’s important to carefully review each policy, taking note of coverage limits, exclusions, and any additional requirements. Consult with your insurance provider to ensure that you have the appropriate coverage in place to protect your belongings in storage. Keep in mind that the cost of additional coverage may vary depending on the value of the items being insured and the specific coverage options chosen.

By thoroughly assessing your storage needs and considering additional coverage options, you can have the peace of mind knowing that your belongings are adequately protected, no matter what may happen.

Roommate’s Belongings

Coverage for a roommate’s belongings stored in the same unit

When it comes to renters insurance, it’s important to consider how it can protect not only your own belongings but also those of your roommate. If you and your roommate share a storage unit, you may wonder if your renters insurance policy will provide coverage for their items as well.

In most cases, renters insurance policies will extend coverage to the belongings of a roommate stored in the same unit. This means that if you have renters insurance and your roommate does not, their items can still be protected under your policy.

However, it’s important to double-check the terms and conditions of your specific policy to ensure this coverage. Some insurance companies may have limitations or requirements when it comes to covering a roommate’s items. It’s advisable to contact your insurance provider and inform them of the situation to get clarification on the extent of coverage for your roommate’s belongings.

Protection for both you and your roommate’s items

Having renters insurance not only protects your own belongings but also provides coverage for your roommate’s items stored in the same unit. This can provide peace of mind for both of you, knowing that your belongings are protected against common risks like theft, damage, or loss caused by covered events.

To ensure accurate coverage for your roommate’s items, it’s essential to provide the insurance company with an inventory of their belongings. This inventory should include a description of each item, its value, and any supporting documentation such as receipts or photographs. By doing so, you can ensure that their items are properly covered, and the insurance company can assess their value accurately in the event of a claim.

It’s worth noting that the coverage for a roommate’s belongings will typically be subject to the same coverage limit as your own belongings. For example, if your policy has a coverage limit of $50,000, the coverage for both your belongings and your roommate’s belongings would be within that limit.

In the event of a claim, it’s important to note that the insurance company will likely require proof that the items belong to your roommate. This can include the lease agreement, utility bills, or any other documentation that establishes their residency in the same unit. Make sure to keep these records readily available in case of a claim.

Therefore, renters insurance can provide coverage for a roommate’s belongings stored in the same unit. It’s important to review your policy’s terms and conditions to understand the extent of coverage and any requirements or limitations that may apply. By accurately inventorying your roommate’s items and providing the necessary documentation, you can ensure that their belongings are adequately protected. Contacting your insurance provider to discuss your specific situation will help you clarify the coverage available for your roommate’s items.

International Coverage

Explanation of coverage for belongings stored in a different country

When it comes to renters insurance, it’s important to understand how international coverage works for your belongings stored in a different country. Renters insurance policies typically provide coverage for your personal property when it is stored outside of your rental unit, whether it’s in a storage unit or at a friend’s apartment in a different country.

However, it’s important to note that the coverage for belongings stored in a different country may vary depending on your specific policy and insurance provider. Some insurance policies may have limitations or exclusions when it comes to coverage outside of your home country. It’s essential to review your policy’s terms and conditions to understand the extent of international coverage and any requirements or limitations that may apply.

Ensuring protection for items stored at a friend’s apartment in Europe

If you plan to store your belongings at a friend’s apartment in Europe, it’s important to take certain steps to ensure proper protection. Here are some tips to consider:

1. Notify your insurance provider: Inform your renters insurance provider about your plan to store your belongings in a different country. They can provide guidance on the extent of international coverage and any additional steps you may need to take.

2. Verify coverage limits: Ensure that the coverage limits of your policy are sufficient to protect your belongings stored in a different country. If necessary, consider increasing your coverage limit to adequately protect valuable items.

3. Keep an inventory: Create a detailed inventory of the items you plan to store in Europe. Include descriptions, values, and any supporting documentation such as receipts or photographs. This will help ensure accurate coverage and expedite the claims process in the event of damage, theft, or loss.

4. Take necessary precautions: Before storing your belongings in a different country, take necessary precautions to protect them. This may include properly packaging fragile items, storing them securely, or using additional security measures such as locks or alarms.

5. Maintain documentation: Keep all relevant documentation, including lease agreements or any other proof of residency in the friend’s apartment in Europe. This will be useful in case you need to file a claim and provide evidence that the items were stored in a specific location.

By following these steps, you can help ensure that your belongings stored at a friend’s apartment in Europe are adequately protected. It’s essential to consult with your insurance provider to understand the specific terms and conditions of your policy, as well as any additional requirements or limitations that may apply to international coverage.

Common Damages and Claims

Coverage for common damages to storage units, such as water or heating system issues

When renting a storage unit, there is always a risk of common damages that could occur, such as water leaks or issues with the heating system. These damages can potentially affect your belongings and those of your roommate stored in the same unit. It’s important to know if your renters insurance policy provides coverage for these types of damages.

In most cases, renters insurance policies will cover damages to your belongings caused by events such as water leaks or issues with the heating system in the storage unit. This coverage will typically extend to your roommate’s items as well since they are stored in the same unit. However, it’s crucial to review your policy to ensure the specific coverage and any limitations or requirements that may apply.

When making a claim for damages to your belongings or your roommate’s belongings, it’s essential to document the extent of the damage. Take photographs and provide any evidence that demonstrates the cause of the damage, such as a water leak or a malfunctioning heating system. This documentation will help support your claim and facilitate the claims process.

Claims process for damages to belongings stored in a unit

If your belongings or your roommate’s belongings suffer damages while stored in the unit, it’s important to understand the claims process to ensure a smooth and efficient resolution.

When filing a claim for damages to stored items, contact your insurance provider as soon as possible to report the incident. They will guide you through the necessary steps and documentation required for the claims process. Be prepared to provide a detailed description of the damage, including the items affected and their estimated value.

In some cases, the insurance company may request an appraisal or inspection of the damaged items to assess their value accurately. They may also require you to provide receipts or proof of ownership for higher-value items.

Once all the necessary documentation is submitted, the insurance company will review your claim and make a determination on coverage and compensation. It’s important to be thorough and provide all requested information promptly to avoid delays in the claims process.

In the event that your claim is approved, the insurance company will typically provide compensation based on the value of the damaged items, up to the coverage limit specified in your policy. Keep in mind that deductibles may apply, so consider the deductible amount when assessing the potential compensation for your damages.

Therefore, renters insurance can provide coverage for common damages to storage units, such as water leaks or heating system issues, that affect your belongings and your roommate’s belongings stored in the same unit. By understanding your policy’s coverage, documenting the damages, and following the claims process diligently, you can seek compensation for any damages incurred. It’s always recommended to review your specific policy and consult with your insurance provider to ensure you have the appropriate coverage for your needs.

Conclusion

Summary of the key points regarding renters insurance coverage for storage units

– Renters insurance policies typically cover damages to belongings caused by water leaks or issues with the heating system in a storage unit.

– The coverage extends to both your belongings and those of your roommate, as long as they are stored in the same unit.

– It’s important to review your policy to understand the specific coverage and any limitations or requirements.

– When making a claim for damages, document the extent of the damage with photographs and evidence of the cause.

– Contact your insurance provider as soon as possible to report the damages and begin the claims process.

– Be prepared to provide a detailed description of the damage, including the items affected and their estimated value.

– The insurance company may request appraisals, inspections, receipts, or proof of ownership for higher-value items.

– Once all documentation is submitted, the insurance company will review the claim and determine coverage and compensation.

– Compensation is typically based on the value of the damaged items, up to the coverage limit specified in the policy.

– Deductibles may apply, so consider the deductible amount when assessing potential compensation.

Importance of securing proper insurance for storage needs

Securing a proper renters insurance policy that provides coverage for damages to belongings stored in a storage unit is essential. While the facility may have its own insurance, it may not cover damages to personal belongings. Having renters insurance ensures that you are protected financially in case of common damages such as water leaks or heating system issues.

Without proper insurance, you would be solely responsible for any damages and their associated costs. This could result in significant financial burden and potential loss of valuable items. Renters insurance not only provides coverage for damages but also offers peace of mind knowing that your belongings are protected.

It is important to carefully review your policy and understand the coverage it provides for storage units. Consult with your insurance provider to ensure that you have the appropriate coverage for your specific needs. By securing the right insurance, documenting damages, and following the claims process diligently, you can seek compensation for any damages incurred to your belongings or your roommate’s belongings stored in the same unit.

Discover Does flood insurance cover storage units.