Do you need insurance to rent a storage unit

Overview of the importance of storage unit insurance

When it comes to storing your belongings in a rented storage unit, it’s important to understand the insurance coverage available to you. While your homeowners insurance or renters insurance policy may provide some coverage for items stored off-premises, it’s essential to check the details of your policy to ensure that you have adequate protection.

Benefits of having insurance for rental storage units

There are several benefits to having insurance specifically for rental storage units. Here are some of the advantages:

1. Protection for stored belongings: Rental storage unit insurance provides coverage for your belongings stored in the unit. This coverage can help protect against damage or loss caused by events such as fire, theft, or natural disasters.

2. Off-premises coverage: Many renters insurance policies include off-premises coverage, which typically covers items stored in a storage unit. However, the coverage may be limited to a certain percentage of the initial coverage amount. Having additional insurance specifically for storage units can help fill in any gaps and provide full coverage for your stored items.

3. Supplemental coverage options: If your homeowners or renters insurance policy doesn’t offer sufficient coverage for storage units, you may have the option to add supplemental coverage through your insurance provider or a third-party insurer. This supplemental coverage can provide additional protection and peace of mind.

4. Cost-effective solution: Rental storage unit insurance is often an affordable option compared to replacing your belongings in the event of theft, damage, or loss. The cost of the insurance premium is typically a small fraction of the value of the stored items.

5. Flexibility and customization: With rental storage unit insurance, you have the flexibility to customize your coverage based on the value of your stored belongings. This allows you to ensure that you have adequate coverage for your specific needs.

6. Ease of claims process: Having dedicated insurance for rental storage units can make the claims process smoother and more efficient. With a separate insurance policy specifically for your storage unit, you can streamline the claims process and get reimbursed quickly in the event of an incident.

Overall, having insurance for rental storage units is crucial to protect your belongings and provide financial security in case of unexpected events. Whether it’s through your homeowners insurance policy or supplemental coverage, it’s important to review your options and ensure that you have the appropriate coverage for your stored items.

Understanding Storage Unit Insurance

What is storage unit insurance and how does it work?

Storage unit insurance is a type of insurance policy that provides coverage for the items you keep in a storage unit. It helps protect your belongings from damages or losses caused by various risks, including theft, fire, vandalism, or natural disasters.

When you rent a storage unit, the storage facility may offer insurance options for your belongings. This insurance coverage is typically optional but highly recommended, as the storage facility’s insurance policy usually covers only their own property and not your personal belongings.

If you decide to purchase storage unit insurance, you will pay a monthly or annual premium to the insurance provider. In the event of a covered loss, such as theft or damage, you can file a claim with the insurance company to receive compensation for the value of the lost or damaged items, up to the coverage limits specified in your policy.

It’s important to carefully review the terms and conditions of the storage unit insurance policy to understand what is covered, any exclusions or limitations, deductibles, and the process for filing a claim.

Different types of coverage options available

There are different types of coverage options available for storage unit insurance, depending on your needs and budget. Here are some common options:

1. Basic coverage: This provides coverage for specific risks, such as fire, theft, or water damage. It may have limitations on the specific types of items covered or their value.

2. Comprehensive coverage: This offers broader protection for a wider range of risks, including natural disasters, vandalism, and accidental damage. It typically has higher coverage limits and may include additional benefits like reimbursement for temporary housing if your stored belongings are damaged.

3. Valuables coverage: If you store high-value items like jewelry, artwork, or collectibles, you may need additional insurance specifically for these items. Valuables coverage provides higher coverage limits and may include provisions for appraisals or special protection.

4. Replacement cost coverage: Standard storage unit insurance policies typically provide coverage based on the depreciated value of your belongings. Replacement cost coverage, on the other hand, reimburses you for the cost of replacing your items with new ones of similar kind and quality, without deducting for depreciation.

When choosing a storage unit insurance policy, consider the value and importance of the items you’re storing, as well as your budget and any existing insurance coverage you may have. It may also be beneficial to compare quotes from different insurance providers to ensure you’re getting the best coverage at a competitive price.

Remember, storage unit insurance is separate from any homeowners or renters insurance you may have, so it’s essential to understand the coverage provided by each policy and consider supplemental coverage if needed. If you have any questions or concerns, it’s always a good idea to consult with your insurance agent or a professional insurance advisor to ensure you have the appropriate level of insurance protection for your stored belongings.

Why Insurance is Required

Explaining the reasons behind the requirement of insurance for renting storage units

Storage unit companies often require customers to have insurance when renting a unit for several reasons:

1. Liability Protection: Insurance helps protect the storage facility from liability in case of damage or loss to a customer’s belongings. Without insurance, the storage facility could be held responsible for compensating the customer for any damages.

2. Risk Mitigation: By requiring insurance, storage facilities minimize the risk of financial loss. In the event of theft, fire, or other covered risks, insurance provides compensation to customers for the value of their belongings, reducing the financial burden on the storage facility.

3. Peace of Mind: Insurance gives both the storage facility and the customer peace of mind. Knowing that belongings are insured provides reassurance for customers, ensuring they are adequately compensated in case of unexpected events.

Insurance regulations and legalities for storage facilities

Storage unit companies often have legal and regulatory requirements that dictate the need for insurance. These regulations may vary by location, and compliance is crucial for storage facilities to operate within the applicable laws.

Some storage facilities have their own insurance coverage, but it typically only covers the property owned by the facility, not the personal belongings of customers. Therefore, customers are required to have their own insurance to protect their stored items.

Insurance requirements may also be driven by the terms of the rental agreement between the customer and the storage facility. These agreements often outline the responsibilities and obligations of both parties and include provisions related to insurance coverage.

To ensure compliance and provide transparency, storage facilities clearly communicate their insurance requirements to customers. This allows customers to make informed decisions and choose the insurance coverage that best suits their needs.

It’s worth noting that while some storage facilities may not explicitly require insurance, it is still highly recommended. Choosing to forego insurance puts the customer at risk of financial loss in the event of any covered risks.

Therefore, insurance is required by most storage unit companies for several reasons, including liability protection, risk mitigation, and to ensure peace of mind for both the storage facility and customer. Compliance with insurance regulations and legal requirements gives storage facilities the assurance that their operations are within the applicable laws. While some facilities may not explicitly require insurance, it is still advisable for customers to have appropriate coverage to protect their belongings from unexpected events.

What Insurance Covers

Understanding the specific risks and incidents covered by storage unit insurance

Storage unit insurance provides coverage for your belongings against various risks and incidents. Here are some examples of what storage unit insurance typically covers:

– Theft: If your stored items are stolen, storage unit insurance can help compensate you for the value of the stolen items.

– Fire: In the event of a fire, storage unit insurance can provide coverage for damage caused to your belongings.

– Vandalism: If your storage unit is subjected to vandalism, storage unit insurance can help cover the costs of repairs or replacement.

– Natural disasters: Storage unit insurance can protect your belongings from damage caused by natural disasters such as floods, earthquakes, or hurricanes.

– Water damage: If your storage unit experiences water damage from a leak or flooding, storage unit insurance can help cover the costs of repairs or replacement.

It’s important to note that storage unit insurance policies may have limitations or exclusions for certain incidents or types of items. For example, some policies may not cover damages caused by mold or pests, or may have specific coverage limits for high-value items such as jewelry or artwork. It’s crucial to review the terms and conditions of your policy carefully to understand what is covered and any limitations that may apply.

Examples of common situations where insurance comes into play

While we hope that nothing unfortunate happens to your stored items, it’s essential to be prepared for unexpected incidents. Here are some common situations where storage unit insurance can provide valuable coverage:

– Break-in or theft: If your storage unit is targeted by thieves and your belongings are stolen, storage unit insurance can help reimburse you for the value of the stolen items.

– Fire or smoke damage: In the unfortunate event of a fire or smoke damage in the storage facility, storage unit insurance can cover the costs of repairing or replacing your damaged belongings.

– Water damage: If a pipe bursts or there is a flood in the storage facility, resulting in water damage to your stored items, storage unit insurance can help cover the restoration or replacement costs.

– Natural disasters: Storage unit insurance is especially crucial in areas prone to natural disasters like hurricanes, floods, or earthquakes. It can help compensate you for any damages caused by these events.

– Accidental damage: Storage unit insurance can also provide coverage if your belongings are accidentally damaged while in storage, such as during transport or due to mishandling by the storage facility staff.

Remember, storage unit insurance is a separate policy from homeowners or renters insurance. It’s important to ensure you have the appropriate level of insurance protection for your stored belongings and to understand the coverage provided by each policy. If you have any questions or concerns, it’s advisable to consult with your insurance agent or a professional insurance advisor to make informed decisions about your insurance needs.

Finding the Right Insurance Policy

Factors to consider when choosing a storage unit insurance policy

When selecting a storage unit insurance policy, there are several factors to consider to ensure you find the right coverage for your needs. Here are some key considerations:

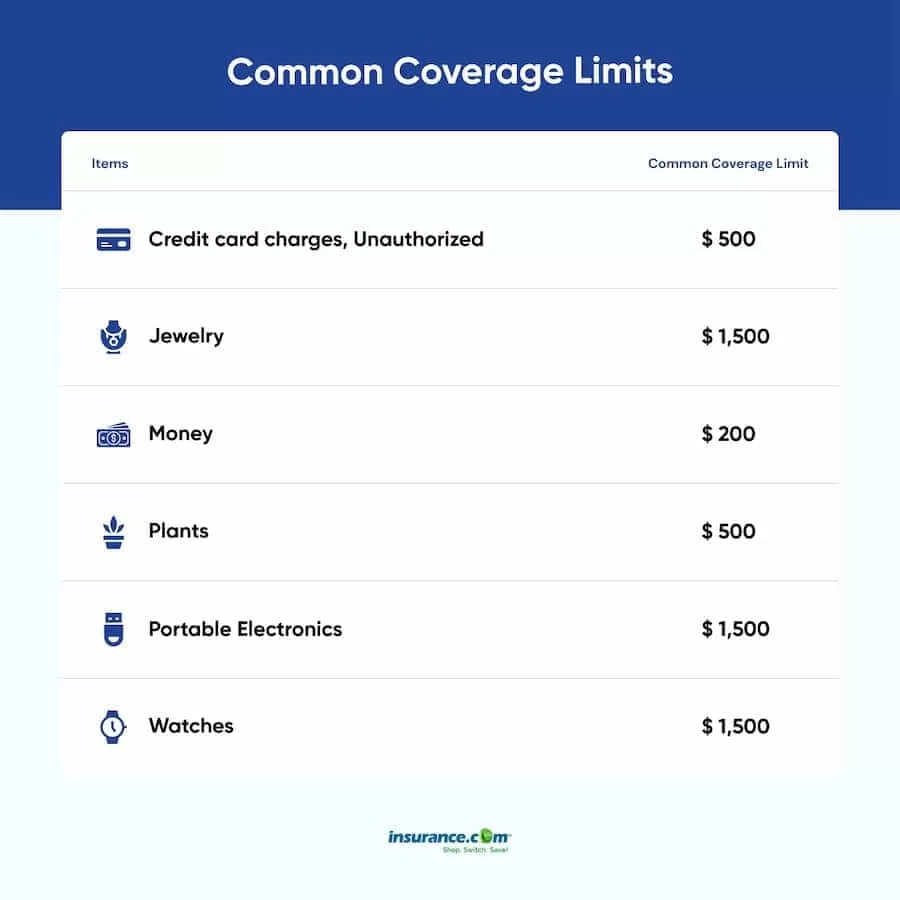

– Coverage limits: Review the policy to understand the maximum amount the insurance company will pay out in case of a claim. Consider the total value of your stored belongings and choose a policy with sufficient coverage limits.

– Deductible: Check the deductible amount, which is the portion of the claim you will have to pay out of pocket. A higher deductible may result in lower premiums but could also mean more out-of-pocket expenses in the event of a claim.

– Premiums: Compare the premiums from different insurance providers to find the most competitive rates. Keep in mind that lower premiums may come with higher deductibles or limited coverage.

– Additional coverage options: Determine if you need additional coverage for specific items such as high-value jewelry, collectibles, or electronics. Some insurance policies may offer optional coverage for these items at an additional cost.

– Policy exclusions: Read the policy carefully to understand any exclusions or limitations. Certain items or incidents may not be covered by the policy, so it’s essential to be aware of any restrictions.

Comparing different insurance providers and their offerings

To find the right storage unit insurance policy, it’s beneficial to compare offerings from different insurance providers. Here are some factors to consider when comparing providers:

– Reputation and customer reviews: Research the reputation of insurance providers and read customer reviews to gauge their reliability and customer satisfaction.

– Financial stability: Look for insurance companies with a strong financial stability rating. This ensures they have the capability to pay out claims promptly.

– Claims process: Understand the claims process of each insurance provider. Look for a company that has a straightforward and efficient claims process to minimize any potential hassle in case of a claim.

– Customer service: Consider the level of customer service provided by the insurance company. Are they easily accessible for inquiries or assistance? Do they have a dedicated claims department to handle your concerns promptly?

– Additional benefits: Some insurance providers may offer additional benefits or discounts, such as bundling storage unit insurance with other policies or providing coverage for moving and transportation of belongings.

Comparing different insurance providers and their offerings can help you find the best storage unit insurance policy that meets your specific needs and budget. Take the time to research and obtain quotes from multiple providers to make an informed decision.

Remember, it’s important to review and update your storage unit insurance policy regularly. As the value of your stored belongings may change over time, ensure that your coverage remains adequate to protect your investment.

The Cost of Insurance

Determining the cost of storage unit insurance and how it is determined

The cost of storage unit insurance can vary depending on several factors. Insurance providers take into account these factors to determine the premium you will pay for coverage. Some of the key factors influencing the cost of storage unit insurance include:

– Location: The location of the storage facility can affect insurance rates. Areas with higher crime rates or a history of natural disasters may command higher premiums.

– Coverage amount: The value of the items you have stored in the unit will impact the cost of insurance. Higher coverage limits will typically result in higher premiums.

– Deductible: The deductible is the amount you pay out-of-pocket before the insurance coverage kicks in. Choosing a higher deductible can lower your premium but increases your financial responsibility in case of a claim.

– Insurance provider: Different insurance companies may offer different rates for storage unit insurance. It’s always a good idea to compare quotes from multiple providers to find the best coverage at the most affordable price.

Factors that can affect insurance premiums

Insurance premiums for storage unit insurance are calculated based on various factors. Understanding these factors can help you better assess the cost of coverage and make informed decisions. Some common factors that can affect insurance premiums include:

– Security measures: Storage facilities with robust security measures such as surveillance cameras, gated access, or on-site security personnel may result in lower premiums as they reduce the risk of theft or vandalism.

– Type of items stored: Certain types of items, such as high-value jewelry or collectibles, may require additional coverage or result in higher premiums. It’s important to disclose accurately the types and value of the items you have stored to ensure adequate coverage.

– Storage unit condition: The condition of the storage unit itself can impact insurance premiums. Units with proper climate control or fire-resistant features may result in lower premiums as they mitigate the risk of damage.

– Claims history: Your claims history can also play a role in determining insurance premiums. If you have a history of frequent claims, insurance providers may perceive you as a higher risk and charge higher premiums.

It’s important to keep in mind that insurance premiums for storage units are typically affordable compared to the potential financial loss or damage that can occur. Investing in the right coverage can give you peace of mind knowing that your stored belongings are protected.

Therefore, storage unit insurance is an essential consideration when renting a storage unit. It provides coverage for various risks and incidents, including theft, fire, vandalism, and natural disasters. The cost of insurance can vary based on factors like location, coverage amount, deductible, and security measures. Understanding these factors and comparing quotes from different insurance providers can help you find the best coverage at an affordable price. Remember to review the terms and conditions of your policy carefully and consult with your insurance agent or advisor for any questions or concerns.

Insurance Provided by Storage Facilities

Exploring the option of insurance offered by storage facilities

When renting a storage unit, you may have the option to purchase insurance directly from the storage facility. This can seem convenient, but it’s important to understand the pros and cons of this type of insurance coverage.

Pros and cons of purchasing insurance directly from the facility

Pros:

– Simplicity: Purchasing insurance directly from the storage facility may be convenient since it can be included in your rental agreement. This means you don’t have to go through the process of shopping for insurance separately.

– Immediate coverage: When you purchase insurance from the storage facility, you typically get coverage right away. This can provide peace of mind knowing that your belongings are protected from day one.

– Coverage tailored to the facility: Insurance provided by storage facilities is specifically designed to cover the risks associated with storing items at their location. This can include protection against theft, fire, and damage caused by extreme weather conditions.

Cons:

– Limited coverage: Keep in mind that insurance offered by storage facilities usually comes with coverage limits. This means that the amount you can claim may be capped, and certain high-value items may not be fully covered.

– Lack of customization: Insurance provided by storage facilities may not offer the same level of customization as a policy from a separate insurance provider. You may not have the flexibility to choose coverage amounts or add additional coverage options that suit your specific needs.

– Higher premiums: Insurance offered by storage facilities may come at a higher cost compared to insurance obtained through other means. This is because storage facilities may mark up the price to cover administrative costs and potential liabilities.

It’s important to carefully consider whether insurance provided by storage facilities is the right choice for you. While it may offer convenience and immediate coverage, it’s essential to weigh the limitations and potential higher costs associated with this type of insurance.

When deciding on insurance for your storage unit, it’s always a good idea to compare quotes from multiple providers and review their coverage options. Third-party insurance providers can offer more comprehensive coverage and tailor it to your specific needs. A separate policy may also provide higher coverage limits and options to add endorsements or supplements for valuable items.

Remember that the cost of insurance for your storage unit should be seen as an investment in protecting your belongings from potential risks and damage. By choosing the right coverage and provider, you can have peace of mind knowing that your stored items are safeguarded. Consult with an insurance agent or advisor to help you navigate through different options and make an informed decision.

Therefore, while insurance provided by storage facilities may be convenient, it’s essential to explore alternative options in order to find the most suitable coverage for your specific needs. Understanding the pros and cons and comparing quotes from different insurance providers will help you make an informed decision. Protecting your stored belongings with the right insurance coverage is a crucial step in ensuring peace of mind throughout your storage unit rental.

Tips for Ensuring Proper Coverage

Steps to take to ensure you have adequate insurance coverage for your stored belongings

When considering storage unit insurance, it’s important to take certain steps to ensure you have proper coverage for your stored belongings. Here are a few tips to help you make sure you’re adequately protected:

1. Assess the value of your stored items: Before purchasing storage unit insurance, take inventory of the items you have stored and estimate their value. This will help you determine the appropriate coverage amount and ensure you’re adequately protected.

2. Review your existing insurance policies: Check your homeowners or renters insurance policy to see if it covers items stored in a storage unit. If it does, review the coverage limits to determine if additional insurance is needed. If your existing policy does not cover storage units, consider adding a rider or purchasing supplemental insurance.

3. Understand the coverage limits: It’s important to read and understand the coverage limits of your insurance policy. Some policies may only offer a percentage of the initial coverage amount for off-premises coverage. If this is the case, consider supplementing your policy with additional coverage to protect your stored belongings.

4. Consider the specific risks: Depending on the location and condition of the storage facility, there may be specific risks to consider. For example, if the facility is in an area prone to flooding, you may want to ensure your policy covers water damage. Assess the potential risks and choose coverage accordingly.

5. Review and compare quotes: To ensure you’re getting the best coverage at an affordable price, it’s important to compare quotes from different insurance providers. Consider not only the cost but also the coverage and any additional benefits or discounts offered. Take the time to research and select a reputable insurance provider.

Reading and understanding the insurance policy terms and conditions

Before purchasing storage unit insurance, it’s crucial to thoroughly read and understand the terms and conditions of the policy. Here are some key points to consider:

1. Coverage details: Review the policy to understand what is covered and what is excluded. Make sure the policy adequately covers the specific risks and types of belongings you have stored.

2. Deductibles: Determine the amount of the deductible and how it will affect your out-of-pocket expenses in case of a claim. Consider whether a higher deductible will result in a lower premium and assess your ability to cover the deductible amount if needed.

3. Claims process: Familiarize yourself with the claims process outlined in the policy. Understand the steps you need to take and the documentation required in the event of a claim. This will help ensure a smoother claims experience if the need arises.

4. Policy renewal: Pay attention to the renewal process and any changes in coverage or terms that may occur. Stay proactive in reviewing your policy annually or when significant life events occur to ensure your coverage remains adequate.

By taking these steps and reading the policy terms and conditions carefully, you can ensure you have the proper insurance coverage for your stored belongings. This will give you peace of mind knowing that you’re protected against potential risks and losses. Always consult with your insurance agent or advisor if you have any questions or concerns about your coverage.

Conclusion

Summarizing the importance of having insurance for rental storage units

It is essential to have the proper insurance coverage for your belongings stored in rental storage units. Whether you have homeowners insurance or renters insurance, it’s crucial to review your policy and understand the coverage limitations for off-premises items. In some cases, your existing policy may offer only a percentage of the initial coverage amount, which may not provide adequate protection. Adding supplemental coverage through your insurance provider or a third-party can be a viable option to ensure you have the necessary coverage.

Final thoughts on protecting your belongings in storage

To protect your belongings in storage, it’s important to assess the value of your stored items, review your existing insurance policies, and understand the coverage limits. Additionally, considering the specific risks associated with the storage facility’s location and condition is crucial. Reading and understanding the terms and conditions of your insurance policy is also essential to ensure you have the appropriate coverage. By following these tips, comparing quotes from different insurance providers, and consulting with your insurance agent, you can ensure your stored belongings are adequately protected.

It is always better to be safe than sorry when it comes to protecting your belongings in storage units. Taking the time to assess your insurance coverage and consider supplemental options can provide peace of mind knowing that you are protected against potential risks and losses. Remember to regularly review your policy and update it as needed to ensure your coverage remains adequate.

Check out Storage unit insurance australia.