Do i need storage unit insurance

When it comes to protecting your valuable possessions, whether they are in your home or in a storage unit, having the right insurance coverage is essential. Many people assume that their homeowners or renters insurance will cover items stored in a storage unit, but this may not always be the case. In this article, we will explore the importance of storage unit insurance and provide an overview of the options available to you.

Importance of storage unit insurance

Storing your belongings in a storage unit can come with certain risks. These units are susceptible to theft, vandalism, fire, and other unforeseen events. Without the proper insurance coverage, you could be left with extensive financial losses if something were to happen to your stored items. That’s why it is important to have insurance specifically designed to protect your belongings in a storage unit.

Overview of the article

In this article, we will discuss the following:

1. Whether renters insurance covers storage units.

2. The limitations of renters insurance coverage for storage units.

3. The importance of supplemental coverage for storage units.

4. The different options for obtaining storage unit insurance.

5. The importance of comparing your insurance options before making a decision.

We will begin by addressing whether renters insurance covers storage units and why supplemental coverage may be necessary in some cases. It is important to understand the coverage provided by your existing insurance policies and determine if additional coverage is needed for your storage unit.

Understanding Storage Unit Insurance

What is storage unit insurance?

Storage unit insurance is a type of insurance coverage specifically designed to protect your belongings while they are stored in a storage unit. It provides financial compensation in case of damage, theft, or loss of your stored items. This insurance coverage can offer you peace of mind knowing that your belongings are protected even when they are not in your home.

Different types of storage unit insurance

There are several different types of storage unit insurance options available, and it is important to understand the differences between them. Here are some common types of storage unit insurance:

1. Renters insurance: In many cases, your renters insurance policy will include off-premises coverage, which typically covers items kept in a storage unit. However, it’s important to note that your renters insurance policy may only offer a percentage of the initial coverage amount for items stored off-premises. This means that if you have a $50,000 coverage limit for your personal belongings, you may only be covered for a certain percentage of that amount for items in storage. If you require additional coverage, you may need to consider supplemental insurance.

2. Supplemental insurance: If your renters insurance policy doesn’t provide sufficient coverage for your stored items, you can consider adding supplemental insurance. This supplemental coverage can be obtained through your insurance provider or through a third-party insurance company. It can provide coverage for the full value of your items in storage, giving you added protection and peace of mind.

3. Storage facility insurance: Some storage facilities may require you to purchase storage unit insurance directly from them. This insurance coverage is specifically tailored to the storage facility’s requirements and may provide a convenient option for renters. However, it’s important to compare your options before purchasing storage facility insurance, as it may not offer the same level of coverage as other options.

4. Self-storage insurance: If you prefer more control over your insurance coverage, you can choose to purchase self-storage insurance from a separate insurance provider. This allows you to select the coverage amount and terms that suit your needs and provides greater flexibility in choosing your insurance provider.

Therefore, it is important to understand the different types of storage unit insurance available and evaluate your coverage options before making a decision. Whether you choose to rely on your renters insurance policy, add supplemental coverage, or purchase storage facility or self-storage insurance, ensuring that your stored items are adequately protected is crucial. Taking the time to compare your options and choose the right insurance coverage can give you peace of mind knowing that your belongings are safe and secure, even when they are not with you.

Insurance Requirements for Renting Storage Units

Do storage facilities require insurance?

Storage facilities generally require renters to have storage unit insurance to protect their belongings. However, some facilities may neglect to inform renters about this requirement until the day they begin renting. This can lead to renters feeling pressured to purchase insurance from the storage facility without comparing other options.

Options for obtaining storage unit insurance

There are several options for obtaining storage unit insurance, and it’s important to compare your choices before making a decision. Here are some options you may consider:

1. Renters insurance: Many renters insurance policies include off-premises coverage, which typically covers items kept in a storage unit. However, the coverage may only be a percentage of the initial coverage amount. If your renters insurance doesn’t provide sufficient coverage for your stored items, you can consider adding supplemental insurance.

2. Supplemental insurance: Supplemental insurance can be obtained through your renters insurance provider or a third-party insurance company. This additional coverage can provide protection for the full value of your items in storage, giving you added peace of mind.

3. Storage facility insurance: Some storage facilities offer their own insurance coverage that you can purchase directly from them. While this may be a convenient option, it’s important to compare it to other choices as it may not offer the same level of coverage or flexibility.

4. Self-storage insurance: If you prefer more control over your insurance coverage, you can choose to purchase self-storage insurance from a separate insurance provider. This allows you to select the coverage amount and terms that suit your needs.

When it comes to storage unit insurance, it’s essential to understand the different types of coverage available and evaluate your options. Whether you rely on your renters insurance policy, add supplemental coverage, or choose storage facility or self-storage insurance, ensuring that your stored items are adequately protected is crucial for your peace of mind.

Taking the time to compare your options and choose the right insurance coverage can give you confidence knowing that your belongings are safe and secure, even when they are not with you. Make sure to consider the coverage limits, policy terms, and any exclusions before making a decision.

Benefits of Storage Unit Insurance

Protection against theft and vandalism

Storage unit insurance provides coverage for theft and vandalism. When your belongings are stored in a storage unit, they may be vulnerable to theft or damage caused by vandalism. Having storage unit insurance ensures that you are financially protected if your items are stolen or vandalized. This can give you peace of mind knowing that even if something unfortunate happens, you will be able to recoup the value of your belongings.

Coverage for weather-related damage

Another benefit of storage unit insurance is coverage for weather-related damage. Storage units are subject to different weather conditions, including extreme temperatures, humidity, and natural disasters like floods or storms. If your stored items are damaged due to these weather conditions, having insurance can help cover the cost of repairs or replacement. This means that even if your items are not in your home, you are still protected against weather-related damage.

It’s important to note that the coverage and specific benefits of storage unit insurance may vary depending on the type of insurance you choose. Renters insurance may offer limited coverage for items stored off-premises, while supplemental insurance can provide additional coverage for the full value of your stored items. Storage facility insurance and self-storage insurance may also have their own terms and conditions.

Therefore, storage unit insurance is essential for protecting your belongings while they are stored in a storage unit. It offers benefits such as protection against theft and vandalism, as well as coverage for weather-related damage. Understanding the different types of storage unit insurance available and evaluating your coverage options can help you make an informed decision. Whether you rely on your renters insurance, choose to add supplemental coverage, or purchase storage facility or self-storage insurance, having insurance ensures that your stored items are adequately protected. Taking the time to compare your options and choose the right insurance coverage will give you peace of mind knowing that your belongings are safe and secure, even when they are not with you.

How Storage Unit Insurance Works

Policy coverage and limits

Storage unit insurance typically provides coverage for theft, vandalism, and weather-related damage to your belongings stored in a storage unit. The specific coverage and limits may vary depending on the type of insurance you choose.

For renters insurance, off-premises coverage is usually included, but it may offer only a percentage of the initial coverage amount. This means that if you have $50,000 coverage for your belongings in your rental unit, the coverage for items stored in a storage unit may be limited to a certain percentage of that amount.

Supplemental insurance can be added to your renters insurance policy or obtained through a third-party provider to cover the full value of your stored items. It is important to review the terms and conditions of your insurance policy to understand the coverage limits and any exclusions that may apply to your stored belongings.

Claim process and documentation

In the event that you need to file a claim for damage or loss of your stored items, it is important to be prepared with the necessary documentation. This may include proof of ownership, such as receipts, photographs, or appraisals of valuable items. It is recommended to keep an inventory of the items you have stored in your unit, including their estimated value.

When filing a claim, you will need to provide details about the incident, including the date and time of the damage or theft. It is also important to report the incident to the authorities, such as the police, and obtain a copy of the police report for your insurance claim.

The claim process may involve contacting your insurance provider and providing them with the necessary documentation. They will evaluate the claim and determine the amount of coverage you are eligible for based on your policy limits and the extent of the damage or loss. It is important to follow the instructions provided by your insurance company and cooperate with their investigation.

To ensure a smooth claims process, it is recommended to review your insurance policy and understand the steps involved in filing a claim before an incident occurs. This will help you be prepared and take the necessary actions promptly.

Therefore, storage unit insurance is essential for protecting your belongings while they are stored in a storage unit. It offers coverage for theft, vandalism, and weather-related damage, providing financial protection and peace of mind. By understanding the policy coverage and limits, as well as the claim process and documentation requirements, you can make informed decisions and be prepared in the event of a loss or damage to your stored items. It is important to review your options and choose the right insurance coverage to ensure that your belongings are adequately protected.

Deciding on Insurance Coverage

Factors to consider when choosing storage unit insurance

When deciding on insurance coverage for your storage unit, there are several factors to consider. These factors can help you determine the type and amount of coverage you need to adequately protect your belongings.

1. Value of your stored items: Evaluate the value of the items you plan to store in the unit. Consider the replacement cost of these items and choose insurance coverage that provides adequate protection.

2. Specific coverage needs: Understand the specific coverage needs for your stored items. Some items may require additional coverage due to their high value or unique characteristics. Make sure the insurance policy you choose covers these specific needs.

3. Deductible and premium: Compare the deductible and premium for different insurance options. A lower premium may seem attractive, but it might come with a higher deductible. Consider your budget and choose a policy that balances both factors.

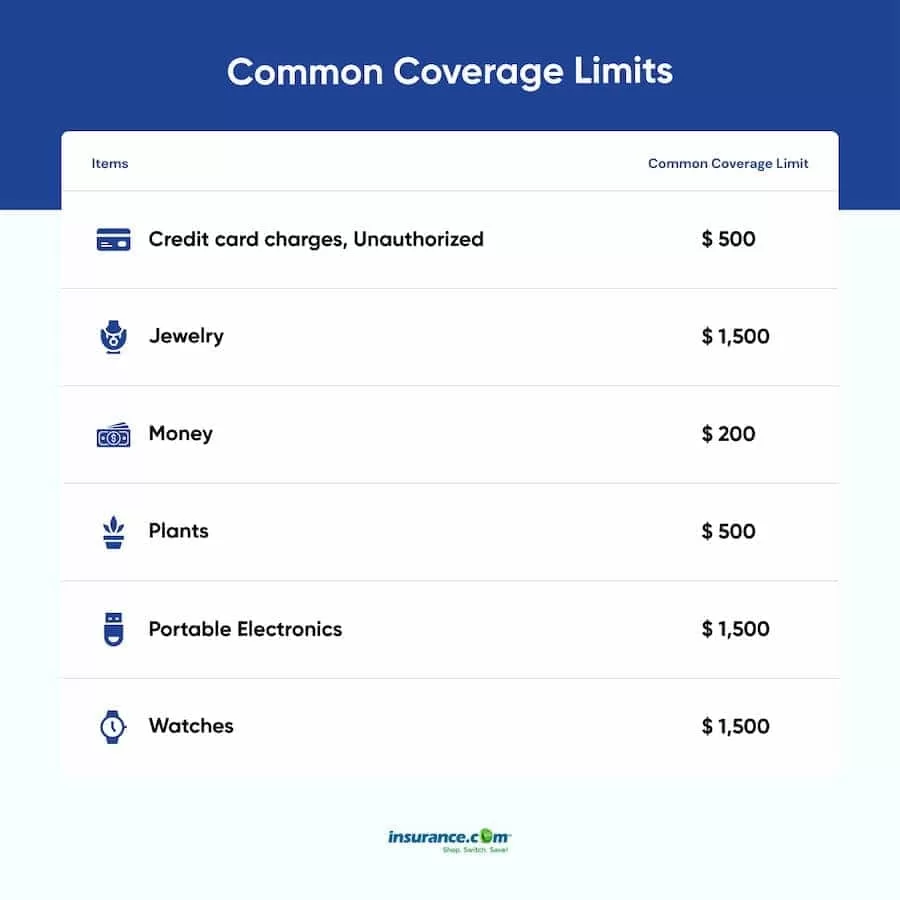

4. Coverage limits: Check the coverage limits of each insurance option. Different policies may have varying limits on the maximum amount they will pay for a claim. Ensure that the coverage limit is sufficient to cover the full value of your stored items.

5. Reputation and customer reviews: Research the reputation and customer reviews of the insurance provider. Look for feedback from other customers who have used their services to get an idea of their reliability and customer satisfaction.

Comparing different insurance options

When comparing different insurance options for your storage unit, it’s essential to review the coverage details and terms of each policy. Here is a comparison of three common insurance options:

Renters Insurance:

– Typically includes off-premises coverage, which can extend to items stored in a storage unit.

– Offers a percentage of the initial coverage amount for stored items.

– May have limitations and exclusions, so it’s important to review your policy carefully.

Supplemental Insurance:

– Can be added to your existing renters insurance policy or purchased separately.

– Provides additional coverage beyond what is included in your renters insurance policy.

– Offers flexibility in choosing the coverage amount based on your needs.

Storage facility or self-storage insurance:

– Offered by the storage facility itself for an additional fee.

– Provides coverage specifically for items stored in their facility.

– May have limitations and exclusions, so it’s important to review the policy details.

It’s important to compare the coverage, terms, and pricing of each option to ensure you choose the insurance that best fits your needs. Consider the value of your stored items, specific coverage requirements, and your budget when making your decision.

Therefore, having insurance coverage for your storage unit is crucial to protect your belongings from theft, vandalism, and weather-related damage. Evaluate your specific needs, compare different insurance options, and choose the policy that offers the best protection for your stored items. With the right insurance coverage, you can have peace of mind knowing that your belongings are safe and secure even when they are not with you.

Insurance Options from Storage Companies

Storage company-provided insurance

Storage companies often require renters to have insurance coverage for their storage units. They may offer insurance options specifically tailored for items stored in their facilities. However, it’s essential to carefully review the policy details before purchasing this coverage. Here are some key points to consider:

– Coverage limitations: The insurance provided by storage companies may have limitations and exclusions. It’s crucial to understand what is and isn’t covered by the policy to ensure it meets your needs.

– Pricing: Storage company-provided insurance is typically an additional fee added to your monthly rental cost. Compare the pricing of this insurance with other options to ensure you’re getting the best value.

– Additional coverage needs: If you have high-value items or unique belongings that require specific coverage, make sure the storage company’s insurance policy adequately protects them. Some storage companies may offer options for additional coverage beyond their standard policy.

Relying on renters insurance

Renters insurance often includes off-premises coverage, which can extend to items stored in a storage unit. However, the coverage provided by renters insurance may only be a percentage of the initial coverage amount. Here’s what to consider when relying on your renters insurance:

– Coverage amount: Review your renters insurance policy to understand the percentage of coverage it provides for stored items. Evaluate whether this coverage amount is sufficient based on the value of your belongings.

– Policy limitations: Renters insurance may have limitations and exclusions, so it’s crucial to review your policy carefully. Ensure that it covers the specific needs of your stored items, such as high-value or unique belongings.

– Supplemental coverage: If your renters insurance coverage is not sufficient to protect your stored items, you can consider adding supplemental coverage. This can be done through your renters insurance provider or by purchasing a separate policy from a third-party insurer.

In either case, comparing different insurance options is crucial to ensure you choose the right coverage for your storage unit. Consider factors such as the value of your stored items, specific coverage needs, deductible and premium amounts, coverage limits, and the reputation of the insurance provider. By evaluating these factors, you can make an informed decision and find the insurance that best fits your needs.

Having insurance coverage for your storage unit is essential to protect your belongings from theft, vandalism, and weather-related damage. Whether you opt for storage company-provided insurance or rely on your renters insurance with supplemental coverage, ensure that your policy adequately safeguards your stored items. By taking the time to compare options and choose the right coverage, you can have peace of mind knowing that your belongings are protected even when they are not with you.

Common FAQs about Storage Unit Insurance

What does storage unit insurance cover?

Storage unit insurance typically covers the contents of your storage unit against theft, vandalism, fire, and certain weather-related damage. It may also provide coverage for damage caused by pests or flooding. However, it’s important to review the specific terms and conditions of your insurance policy to understand what is and isn’t covered.

Can renters insurance cover storage units?

Yes, renters insurance usually includes off-premises coverage, which typically extends to items stored in a storage unit. However, the coverage amount for stored items may only be a percentage of the initial coverage amount for belongings kept at your rented residence. It’s important to review your renters insurance policy to understand the coverage limits for stored items. If the coverage is not sufficient, you may want to consider supplemental coverage with your insurance provider or through a third-party.

Factors to consider when choosing storage unit insurance

When deciding on insurance coverage for your storage unit, there are several factors to consider. These factors can help you determine the type and amount of coverage you need to adequately protect your belongings:

1. **Value of your stored items**: Evaluate the value of the items you plan to store in the unit. Consider the replacement cost of these items and choose insurance coverage that provides adequate protection.

2. **Specific coverage needs**: Understand the specific coverage needs for your stored items. Some items may require additional coverage due to their high value or unique characteristics. Make sure the insurance policy you choose covers these specific needs.

3. **Deductible and premium**: Compare the deductible and premium for different insurance options. A lower premium may seem attractive, but it might come with a higher deductible. Consider your budget and choose a policy that balances both factors.

4. **Coverage limits**: Check the coverage limits of each insurance option. Different policies may have varying limits on the maximum amount they will pay for a claim. Ensure that the coverage limit is sufficient to cover the full value of your stored items.

5. **Reputation and customer reviews**: Research the reputation and customer reviews of the insurance provider. Look for feedback from other customers who have used their services to get an idea of their reliability and customer satisfaction.

Comparing different insurance options

When comparing different insurance options for your storage unit, it’s essential to review the coverage details and terms of each policy. Here is a comparison of three common insurance options:

**Renters Insurance:**

– Typically includes off-premises coverage, which can extend to items stored in a storage unit.

– Offers a percentage of the initial coverage amount for stored items.

– May have limitations and exclusions, so it’s important to review your policy carefully.

**Supplemental Insurance:**

– Can be added to your existing renters insurance policy or purchased separately.

– Provides additional coverage beyond what is included in your renters insurance policy.

– Offers flexibility in choosing the coverage amount based on your needs.

**Storage facility or self-storage insurance:**

– Offered by the storage facility itself for an additional fee.

– Provides coverage specifically for items stored in their facility.

– May have limitations and exclusions, so it’s important to review the policy details.

It’s important to compare the coverage, terms, and pricing of each option to ensure you choose the insurance that best fits your needs. Consider the value of your stored items, specific coverage requirements, and your budget when making your decision.

Having insurance coverage for your storage unit is crucial to protect your belongings from theft, vandalism, and weather-related damage. Evaluate your specific needs, compare different insurance options, and choose the policy that offers the best protection for your stored items. With the right insurance coverage, you can have peace of mind knowing that your belongings are safe and secure even when they are not with you.

Conclusion

Summary of the importance of storage unit insurance

Storage unit insurance is essential for protecting your belongings stored outside of your home. Whether you are a homeowner or a renter, it’s important to understand what your existing insurance policies cover and consider supplemental coverage if needed. Renters insurance usually includes off-premises coverage for stored items, but the coverage amount may be limited. Homeowners insurance typically covers storage units, but with lower coverage limits for stored belongings.

Final thoughts and recommendations

When choosing storage unit insurance, carefully review the coverage details, limitations, and exclusions of each policy. Consider the value of your stored items, specific coverage needs, and your budget. Compare different insurance options such as renters insurance, supplemental insurance, and storage facility insurance to determine the best fit for your needs.

It’s important to regularly reassess and update your insurance coverage as the value of your stored items may change over time. Additionally, take steps to protect your belongings by properly securing them within the storage unit and ensuring the unit itself has appropriate security measures.

Overall, having insurance coverage for your storage unit provides peace of mind knowing that your belongings are protected against theft, vandalism, and damage. Consider your individual circumstances, consult with your insurance agent, and choose the insurance option that offers the best protection for your stored items.

Read more about Can a storage unit force you to buy their insurance.