Cheapest storage unit insurance

Storage unit insurance is a type of insurance that financially protects personal possessions kept in a storage unit from problems like theft, vandalism, and weather. It’s a small price to pay for peace of mind against unexpected loss or damage to your items.

Introduction to Storage Unit Insurance

Storage unit insurance policies can vary depending on the insurance company, but they typically cover losses due to theft, natural disasters, and other unexpected events. It’s important to read and understand the terms of any insurance policy before committing to it.

Most storage facilities require tenants to purchase some form of insurance. While some facilities may offer their own insurance policies, tenants are generally not required to purchase that particular coverage and can opt for their own policy from a different insurance provider.

Why it is essential to have storage unit insurance

While natural disasters, theft, and vandalism are rare, they can happen. Having storage unit insurance can provide a safety net and peace of mind against these unexpected events. Without insurance, the cost of replacing lost or damaged items can be significant.

It’s important to evaluate insurance options carefully and choose a policy that provides adequate coverage for your belongings. This may include considering factors like the value of your items, the location of the storage unit, and any potential risks in the area.

So, storage unit insurance is an essential form of protection for personal possessions kept in storage. It provides financial security against unexpected loss or damage from events like theft, natural disasters, and vandalism. It’s important to read and understand the policy terms before committing to coverage to ensure that you have adequate protection in place.

What is Storage Unit Insurance?

Understanding storage unit insurance, its features and benefits

Storage unit insurance is a specialized type of insurance that covers the contents of your rented storage unit. This type of insurance provides financial coverage for your belongings in the event of theft, damage or loss due to various causes like natural disasters. Typically, storage unit insurance can help replace lost items or cover the cost of repair for damaged items. Insurance policies often require a low monthly or annual premium that can secure thousands of dollars’ worth of coverage for your belongings.

While some storage facilities require renters to have insurance as part of the rental agreement, it is still important to double-check the terms of your agreement or ask a manager at the storage facility you’re interested in about insurance requirements. This is to ensure that both the renter and the facility are protected from potential liabilities.

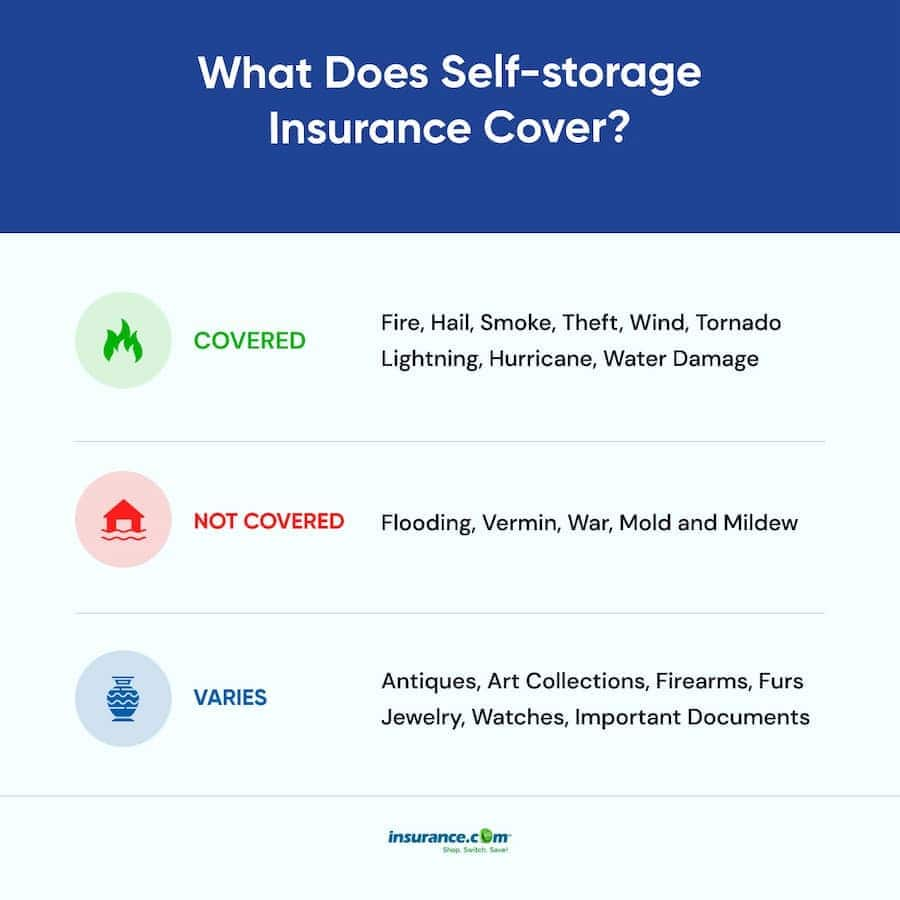

What is Covered (and Not Covered) by Storage Insurance

It’s important to remember that storage unit insurance doesn’t cover every instance of damage to your items. Common exclusions to storage unit insurance include damage caused by flooding, insects, rodents or vermin, mold, and mildew. Additionally, if you have not listed an item on your insurance policy, it will not be covered.

Do You Need Insurance for Your Storage Unit?

Storage units, though secure, aren’t immune to unpredictable events like natural disasters, and theft. Hence, it is necessary to assess your need for storage unit insurance before storing your belongings. Not all personal belongings may need coverage, and it depends on the value and importance of the items.

Though insurance policies often require a low monthly or annual premium, which can secure thousands of dollars’ worth of coverage for your belongings. It’s recommended to have insurance for peace of mind, especially if you rent a storage unit for an extended period.

The Benefits of Insuring Your Storage Unit

There are several benefits of insuring your storage unit, including:

-

Financial protection in the event of damage or loss of your belongings

-

Peace of mind knowing that your items are protected

-

Coverage for items that may not be covered under a traditional homeowners or renters insurance policy

-

Ability to choose the type of insurance that fits your needs and budget

The Different Types of Storage Unit Insurance

There are two primary types of storage unit insurance: third-party insurance and insurance provided by the storage facility.

-

Third-Party Insurance: You can purchase insurance from insurance companies that specialize in providing coverage for stored belongings. Often these policies offer more comprehensive coverage than insurance provided by storage facilities.

-

Insurance Provided by the Storage Facility: Storage facilities may offer insurance coverage for an additional fee. Coverage provided by the storage facility is typically more limited than third-party insurance.

Tips for Choosing the Right Storage Unit Insurance Policy

When choosing the right storage unit insurance policy, consider the following factors:

-

The level of coverage you need

-

The exclusions or limitations of the policy

-

The deductible you’ll be responsible for in the event of a claim

-

The reputation and financial stability of the insurance company or storage facility providing the coverage

Therefore, storage unit insurance provides financial protection for your belongings in the event of damage or loss. While it may not be necessary for everyone, it’s important to assess your need for coverage before storing your belongings. By understanding the types of coverage available and selecting the policy that best meets your needs, you can ensure your storage unit is adequately protected.

Choosing the cheapest storage unit insurance

When it comes to storage unit insurance, it’s important to find a policy that offers reliable coverage at an affordable rate. While the cost of insurance premiums may vary depending on the provider and your specific needs, there are ways to minimize the cost while still ensuring your belongings are protected. In this article, we will outline factors to consider while choosing the cheapest storage unit insurance and highlight some top affordable storage unit insurance providers.

Factors to consider while choosing the cheapest storage unit insurance

1. Coverage amount: Before choosing a storage unit insurance policy, evaluate how much coverage you need. This will depend on the value of the items you’re storing. It’s essential to choose a policy that offers adequate coverage without overestimating or underestimating the value of your property.

2. Deductible: Some insurance policies come with a deductible. This means that you will have to pay a set amount out of your pocket before the insurance policy kicks in. Look for a policy with a reasonable deductible that you can afford in the event of a claim.

3. Exclusions: Every insurance policy comes with exclusions – events or circumstances that are not covered by the policy. Exclusions can vary from one policy to another, and it’s essential to carefully read and understand the terms of the policy.

4. Reputation: Choose a reputable insurance provider with a good track record of financial stability and customer satisfaction. Research different insurance providers by reading customer reviews and checking their ratings on independent sites like the Better Business Bureau.

Top 3 affordable storage unit insurance providers

1. Neighbor: With Neighbor, you can find an affordable storage unit insurance policy by browsing through a network of trusted storage hosts and selecting the policy that best suits your needs. Neighbor boasts reliable coverage at competitive rates, with premiums starting at under $10/month.

2. Safestor: Safestor provides storage unit insurance policies catering to different coverage needs and budgets. With Safestor, you can get customized coverage plans tailored to the value of the items you’re storing. Safestor policies start at around $12/month.

3. MiniCo: MiniCo offers comprehensive and affordable storage unit insurance policies starting at around $10/month. MiniCo policies cover a range of events, including water damage, fire, and theft. MiniCo also offers customizable policies based on the coverage amount you need and your budget.

Choosing a storage unit insurance policy requires careful consideration of your needs and budget. Choose a policy that offers reliable coverage at an affordable rate. Also, ensure that you understand all the terms and conditions and have a clear understanding of what is and isn’t covered by the policy. With this information, you can make an informed decision and have peace of mind knowing your belongings are protected.

How much does Storage Unit Insurance Cost?

Average Cost of Storage Unit Insurance

The cost of storage unit insurance varies depending on several factors, such as the company you use, the amount for which you want to insure, and the type of coverage you need. On average, most insurance policies for self-storage units cost about 50 cents to $2 for every $100 value amount of storage. For instance, if you have $10,000 worth of belongings in your storage unit, you can expect to pay between $50 and $200 per year for insurance coverage.

However, costs can be higher or lower than this, depending on the provider. For example, independent self-storage insurance can cost $8 to $38 per month for $10,000 of coverage, depending on the provider you choose. On the other hand, if your homeowners or renters insurance policy already includes storage unit insurance, you may not need to pay extra for a stand-alone policy.

How to save money on storage unit insurance

If you’re looking to save money on storage unit insurance costs, here are a few tips:

-

Check if your homeowners or renters insurance policy covers storage units. If it does, you may be able to avoid paying extra for a separate policy.

-

Shop around and compare quotes from different providers to find the best deal.

-

Consider adjusting your coverage level and deductible to find a policy that fits your needs and budget.

-

Ask about discounts that may be available, such as multi-line discounts or discounts for paying annually instead of monthly.

By taking these steps, you can find an affordable storage unit insurance policy that provides the coverage you need without breaking the bank. Remember, while it’s important to have insurance for your stored belongings, it’s also important to choose a policy that fits your budget and covers only what you need.

Coverage provided by Storage Unit Insurance

When it comes to storage unit insurance, it’s essential to understand what types of coverage it provides. Here’s what you can expect from most storage unit insurance policies:

What does storage unit insurance cover?

Storage unit insurance typically provides coverage for the following types of damage or loss:

-

Theft: If someone steals your belongings from your storage unit, the policy will cover the loss.

-

Vandalism: If someone damages your belongings intentionally, storage unit insurance should cover the cost of repair or replacement.

-

Damage from weather events: Storage unit insurance can protect your belongings from damage related to flooding, severe storms, or other extreme weather events.

-

Fire: If your storage unit or its contents are damaged in a fire, most storage unit insurance policies will cover the cost of repair or replacement.

-

Water damage: If your belongings are damaged by water due to a leak or other incident, storage unit insurance can provide financial protection.

What it doesn’t cover?

While storage unit insurance provides valuable coverage, it doesn’t protect against all types of damage or loss. Here are a few things that storage unit insurance typically excludes:

-

Natural disasters: If your belongings are damaged or destroyed as a result of a natural disaster such as an earthquake or flood, you may not be covered by storage unit insurance. Consider purchasing additional insurance to cover these risks.

-

Vermin infestations: If pests such as mice, rats, or insects damage your belongings in storage, most storage unit insurance policies will not cover the cost of repair or replacement.

-

Negligence: If you are responsible for the damage or loss of your stored items through your own negligence, storage unit insurance will not cover the cost of repair or replacement.

It’s essential to read the terms and conditions of any storage unit insurance policy carefully before purchasing it to understand what is covered and what’s not. Always compare several quotes and inquire about discounts, if any, to make the best decision for your needs, budget, and peace of mind.

How to File a Claim for Storage Unit Insurance?

Step-by-step guide on how to file a storage unit insurance claim

When renting a self-storage unit, it’s important to consider getting storage unit insurance coverage to ensure your belongings are protected. In the event that an unfortunate incident occurs, such as theft, damage, or natural disaster, filing an insurance claim can help recover losses. Here’s a step-by-step guide to help you file a storage unit insurance claim:

Step 1: Document the Incident

The first step is to document the incident. Fill out an incident report that provides a summary of the cause of loss. Be specific and include all details about the incident, including the time and date it occurred, and a list of the damages or losses incurred. Taking photos and videos can further help in documenting the damages.

Step 2: Contact Your Insurance Provider

The next step is to contact your insurance provider as soon as possible after the incident occurs. Notify them of the damages or losses and provide detailed information about the incident, including the incident report and any photos or videos you have documented. Your insurance provider will assign an adjuster to handle your claim and guide you through the process.

Step 3: Work with the Adjuster

The adjuster will be responsible for investigating and assessing the damages or losses in your storage unit. Be sure to provide them with all the necessary documentation, including the incident report and any photos or videos you have taken. Work with them and answer their questions truthfully, as they will use this information to determine the coverage amount.

Step 4: Mitigate Damages

While the claims process is ongoing, it is important to mitigate any further damages. Take necessary steps to prevent further damage, such as securing the storage unit or repairing any broken locks. If necessary, move any undamaged belongings to a safe location to prevent further harm.

Step 5: Review Coverage Annually

Insurance policies are complex and don’t always cover everything you expect. It’s essential to review your coverage with your insurance agent annually. They can help you tailor a policy that fits your needs and budget, and provide advice on policy coverages and limits to ensure you’re adequately protected.

Therefore, filing an insurance claim for your storage unit can be a daunting task, but with these five steps, you can ensure a smoother process. Remember to document the incident, contact your insurance provider, work with the adjuster, mitigate any damages, and review your coverage annually. With proper coverage and planning, you can protect your belongings and have peace of mind when renting a self-storage unit.

Tips for Maximizing your Storage Unit Insurance Coverage

When renting a self-storage unit, it’s important to have adequate insurance coverage to protect your belongings. Here are some tips to help you maximize your storage unit insurance coverage:

How to make the most of your storage unit insurance coverage

1. Choose the Right Insurance Coverage: Be sure to choose the right coverage that suits your needs and budget. Insurance policies vary, so read through the policy terms and conditions to get a better understanding of what’s covered and what’s not.

2. Assess the Value of Your Stored Belongings: Take an inventory of all your stored belongings and assess their value. This can help ensure you have enough coverage and prevent any surprises in the event of a claim.

3. Declutter Your Unit Regularly: Regularly decluttering your storage unit can help reduce the risk of damage or loss. Removing unnecessary items from your unit can also help save you money on insurance premiums.

Tips for reducing your risk of damage or loss

1. Choose the Right Storage Facility: When selecting a storage facility, choose one that is equipped with security features such as surveillance cameras, gated access, and onsite security personnel.

2. Pack Your Belongings Properly: Use sturdy boxes and packing materials when storing your items. Label your boxes and pack them in a way that prevents any damage from occurring.

3. Store Items Off the Floor: Keeping your items off the floor can help prevent moisture damage. Use shelves, pallets, or other storage solutions to keep your items elevated.

So, maximizing your storage unit insurance coverage involves selecting the right coverage, assessing the value of your stored belongings, and regularly decluttering your unit. Additionally, reducing your risk of damage or loss involves choosing the right storage facility, packing your belongings properly, and storing items off the floor. By following these tips, you can help ensure that your stored items are adequately protected and easy to access.

Frequently Asked Questions about Storage Unit Insurance

Answers to commonly asked questions about storage unit insurance

If you’re renting a self-storage unit, you may be wondering if you need storage unit insurance. Here are some frequently asked questions about storage unit insurance:

What is storage unit insurance?

Storage unit insurance provides coverage for personal belongings that are stored in a self-storage unit. If your items are damaged, stolen, or lost while in storage, storage unit insurance can help cover the cost of replacement or repair.

Do I need storage unit insurance?

Most self-storage facilities require customers to have some form of insurance coverage. If you don’t already have insurance that covers offsite storage, you may need to purchase storage unit insurance.

What does storage unit insurance cover?

Storage unit insurance typically covers damage or loss caused by fire, theft, vandalism, and natural disasters such as floods or earthquakes. Coverage may vary depending on the policy, so it’s important to review the terms carefully.

How much does storage unit insurance cost?

The cost of storage unit insurance varies depending on the policy and the value of the items being stored. Some storage facilities offer their own insurance policies, while others may direct you to an affiliated third-party insurer. It’s a good idea to compare rates and coverage before choosing a policy.

Does my homeowners or renters insurance cover storage units?

Many homeowners or renters insurance policies offer some coverage for offsite storage units, but it’s important to review the policy carefully to understand what is covered. There may be limits on coverage amounts or exclusions for certain types of items.

How do I file a claim for storage unit insurance?

If you need to file a claim for storage unit insurance, the process typically involves documenting the incident, contacting your insurance provider, working with an adjuster, mitigating damages, and reviewing coverage annually. Be sure to review the details of your policy and follow the steps outlined by your insurance provider.

Overall, having storage unit insurance can provide peace of mind when renting a self-storage unit. Be sure to review your options and choose a policy that fits your needs and budget, and don’t hesitate to ask questions if you’re unsure about anything.

Conclusion

Therefore, having storage unit insurance is a vital investment for anyone renting a self-storage unit. Most self-storage facilities require insurance coverage, and even if they don’t, it’s still a wise choice to protect your valuable belongings.

While some homeowners or renters insurance policies may offer coverage for offsite storage units, it’s important to review the policy carefully to understand the limits and exclusions. Purchasing a stand-alone storage unit insurance policy can provide more comprehensive coverage at an affordable price.

When shopping for storage unit insurance, it’s important to compare rates and coverage from different providers. As shown in our factual data comparison, rates vary depending on the value of the items being stored and the policy’s coverage limit.

Filing a claim for storage unit insurance requires documentation, contacting your insurance provider, working with an adjuster, and reviewing coverage annually. It’s important to follow the steps outlined by your insurance provider promptly.

Summing up the importance of having storage unit insurance

Having storage unit insurance provides peace of mind and financial protection in case anything happens to your belongings while in storage. It’s a small price to pay for the security of knowing that your items are protected in case of theft, fire, or other unforeseen circumstances.

Which provider offers the cheapest storage unit insurance?

Based on our factual data comparison, the cheapest storage unit insurance provider for lower coverage limits is the $4000 limit for $6/month. For higher coverage limits, the cheapest option is to purchase a stand-alone storage unit insurance policy from specialized vendors. It’s important to compare rates and coverage before making a decision.

You’ll be interested in Renters insurance for storage units.