Introduction

Overview of renters insurance coverage and storage units

Renters insurance is a type of insurance policy that provides coverage for your personal property, liability protection, and additional living expenses in case of covered perils, such as fire, theft, or water damage. One common question renters have is whether their insurance policy covers items stored in storage units. In this blog post, we will explore the coverage provided by renters insurance for storage units and discuss other insurance options you may consider.

Does Renters Insurance Cover Storage Units?

The answer is yes, renters insurance typically covers items stored in storage units. Renters insurance policies usually offer personal property coverage that reimburses you for financial loss if your belongings are damaged by a covered peril, even if they are stored outside of your apartment. This means that if your items are stolen or damaged by a fire or a burst pipe in a storage unit, your renters insurance policy may provide coverage for the loss.

Coverage Limits on Storage Units

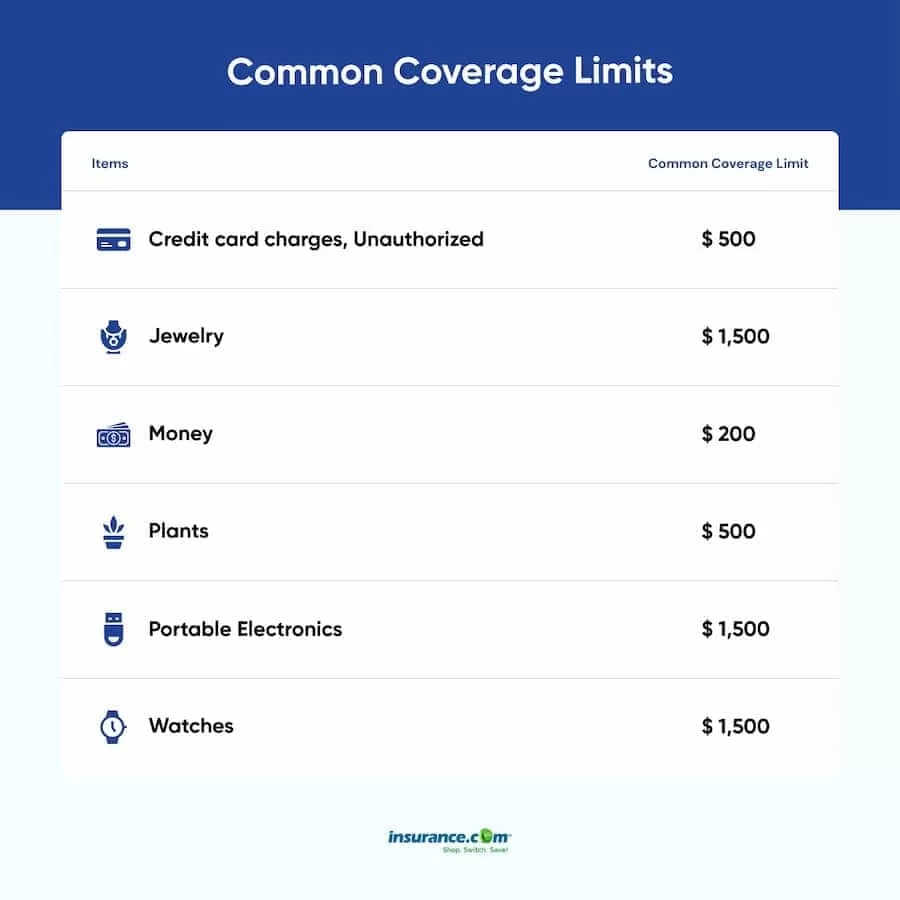

While renters insurance covers items in storage units, it is important to be aware of the coverage limits that apply. Most renters insurance policies include a certain limit on how much they will pay for off-premises coverage. This means that if your belongings in storage exceed that limit, you may need to purchase additional coverage to adequately protect your items.

When to Purchase Additional Renters Coverage for a Storage Unit

If the value of your belongings in storage exceeds the coverage limit provided by your renters insurance policy, it is a good idea to consider purchasing additional renters insurance coverage specifically for the storage unit. This additional coverage can provide higher limits for your stored items and give you peace of mind knowing that your belongings are fully protected.

Other Storage Unit Insurance Options

Aside from renters insurance, there are other insurance options specifically designed for storage units. Some storage facilities offer their own insurance policies, which you can purchase when renting a unit. These policies may offer higher coverage limits and specific protections for items in storage.

Another option is to consider standalone storage insurance policies. These policies are specifically designed to cover items stored in storage units and often provide comprehensive coverage for various perils, such as theft, fire, and water damage.

Final Thoughts: Does Renters Insurance Cover Items in Storage Units?

Therefore, renters insurance typically covers items stored in storage units. However, it is important to review your policy and understand the coverage limits that apply. If the value of your belongings in storage exceeds the provided coverage limit, consider purchasing additional coverage or exploring other insurance options specific to storage units. Protecting your personal property, whether it is inside your apartment or in a storage unit, is crucial for your peace of mind and financial well-being.

Understanding Renters Insurance Coverage

Explanation of what renters insurance typically covers

Renters insurance is an essential form of protection for tenants that covers their personal belongings in the event of theft, damage, or loss. While it is commonly known that renters insurance covers items within the rented property, many individuals wonder if this coverage extends to items stored in a separate storage unit. In this article, we will explore whether renters insurance provides coverage for storage units and what limitations may apply.

Does renters insurance cover storage units?

The answer is yes. Renters insurance typically covers personal property, and this coverage extends to storage units as well. If you have renters insurance, your policy will generally provide financial reimbursement in case of damage to your belongings, even if they are stored outside of your apartment. This means that if your belongings are damaged due to fire, theft, or other covered perils, your renters insurance should help cover the cost of repairing or replacing them.

However, it is important to note that there may be limitations on the coverage offered by your renters insurance policy when it comes to storage units. Let’s take a closer look at these limitations.

Coverage limits on storage units

While renters insurance may provide coverage for items in storage units, there are often coverage limits that apply. These limits vary depending on the insurance provider and the specific policy. It is essential to review your policy documents or speak with your insurance agent to understand the exact coverage limits that apply to storage units.

When to purchase additional renters coverage for a storage unit

If the coverage limits of your renters insurance policy are not sufficient to protect the value of your belongings in a storage unit, you may consider purchasing additional coverage. This extra coverage, often referred to as “floater” or “endorsement” coverage, can increase the coverage limits for specific items or categories of items. It is advisable to assess the value of your stored belongings and determine if additional coverage is necessary to adequately protect them.

Other storage unit insurance options

Apart from renters insurance, there are other insurance options available specifically for storage units. Storage facility insurance is offered by some storage facilities themselves. This type of insurance is designed to cover the storage unit and its contents against various risks, such as fire, theft, and natural disasters.

Additionally, some insurance companies offer standalone storage unit insurance policies. These policies provide coverage specifically for belongings stored in a storage unit and often offer more comprehensive protection than standard renters insurance. It is recommended to compare the coverage and cost of various storage unit insurance options to find the best fit for your needs.

Final thoughts: Does renters insurance cover items in storage units?

Therefore, renters insurance generally covers items stored in storage units. However, it is important to be aware of the coverage limits of your policy and consider purchasing additional coverage if necessary. Exploring other storage unit insurance options can also provide additional protection for your stored belongings. It is advisable to read your policy documents, speak with your insurance provider, and assess your storage unit insurance needs to make an informed decision. Remember, protecting your valuables with adequate insurance coverage is essential for peace of mind.

Renters Insurance and Storage Units

Explanation of whether renters insurance covers storage units

Renters insurance is an essential form of protection for tenants, providing coverage for their personal belongings in cases of theft, damage, or loss. While it is commonly known that renters insurance covers items within the rented property, many people wonder if this coverage extends to items stored in a separate storage unit. This article aims to explore whether renters insurance provides coverage for storage units and what limitations may apply.

Does renters insurance cover storage units?

Yes, renters insurance typically covers personal property, including items stored in storage units. If you have renters insurance, your policy will generally provide financial reimbursement if your belongings are damaged due to covered perils, even if they are stored outside of your apartment. This means that if your belongings are damaged by fire, theft, or other covered incidents, your renters insurance should help cover the cost of repairing or replacing them.

However, it is important to note that there may be limitations on the coverage offered by your renters insurance policy when it comes to storage units. Let’s examine these limitations more closely.

Coverage limits on storage units

While renters insurance may provide coverage for items in storage units, there are often coverage limits that apply. These limits vary depending on the insurance provider, policy, and the specific terms of your policy. It is crucial to review your policy documents or speak with your insurance agent to understand the exact coverage limits that apply to storage units.

When to purchase additional renters coverage for a storage unit

If the coverage limits of your renters insurance policy are not sufficient to protect the full value of your belongings in a storage unit, you may consider purchasing additional coverage. This additional coverage, often known as “floater” or “endorsement” coverage, can increase the coverage limits for specific items or categories of items, ensuring that they are adequately protected. It is advisable to assess the value of your stored belongings and determine if additional coverage is necessary to offer comprehensive protection.

Other storage unit insurance options

In addition to renters insurance, there are other insurance options available specifically for storage units. Some storage facilities offer storage facility insurance, which covers the storage unit and its contents against risks such as fire, theft, and natural disasters. Additionally, some insurance companies provide standalone storage unit insurance policies, which offer more comprehensive protection specifically for belongings stored in a storage unit. It is recommended to compare the coverage and cost of various storage unit insurance options to find the best fit for your needs.

Final thoughts: Does renters insurance cover items in storage units?

Therefore, renters insurance generally covers items stored in storage units, extending the financial protection provided for personal property. However, it is important to be aware of the coverage limits of your policy and consider purchasing additional coverage if necessary to adequately protect your stored belongings. Exploring other insurance options specifically designed for storage units can also provide additional peace of mind. Remember to read your policy documents, consult with your insurance provider, and assess your storage unit insurance needs to make an informed decision and ensure that your valuables are adequately protected.

Limitations of Renters Insurance for Storage Units

Discussion of the limitations and restrictions of renters insurance coverage for storage units

When it comes to storing your personal belongings in a storage unit, it is important to understand the limitations and restrictions of your renters insurance coverage. While renters insurance typically covers items within your rented property, including furniture, electronics, and clothing, there are certain limitations that apply when it comes to storage units.

One important thing to note is that renters insurance generally covers personal property, whether it is inside your apartment or stored outside in a storage unit. This means that if your stored belongings are damaged or stolen due to covered perils such as fire or theft, your renters insurance should provide financial reimbursement for the loss. However, it is crucial to review the specifics of your policy to understand the coverage limits that apply to storage units.

Coverage limits on storage units can vary depending on your insurance provider and policy. These limits may restrict the total amount of coverage available for your stored belongings. It is advisable to review your policy documents or speak with your insurance agent to determine the exact coverage limits for storage units. If the coverage offered by your policy is not sufficient to protect the value of your stored items, you may consider purchasing additional coverage.

In some cases, purchasing additional coverage specifically for your storage unit may be necessary. This extra coverage, often referred to as “floater” or “endorsement” coverage, can increase the coverage limits for specific items or categories of items. Assessing the value of your stored belongings and the potential financial loss in case of damage or theft can help determine if additional coverage is needed.

Apart from renters insurance, there are other insurance options available specifically for storage units. Some storage facilities offer storage facility insurance, which is designed to cover the storage unit and its contents against risks such as fire, theft, and natural disasters. These insurance policies are provided directly by the storage facility itself.

Additionally, some insurance companies offer standalone storage unit insurance policies. These policies provide coverage specifically for belongings stored in a storage unit and often offer more comprehensive protection than standard renters insurance. It is recommended to compare the coverage and cost of various storage unit insurance options to find the best fit for your needs.

Therefore, while renters insurance typically covers items stored in storage units, there are limitations and restrictions that apply. It is essential to review your policy documents, understand the coverage limits, and consider purchasing additional coverage if necessary. Exploring other storage unit insurance options can also provide additional protection for your stored belongings. Taking the time to assess your storage unit insurance needs and make an informed decision can help ensure that your valuable possessions are adequately protected.

Additional Coverage Options for Storage Units

Exploration of additional insurance options specifically designed for storage units

When it comes to storing your personal belongings in a storage unit, renters insurance can provide some coverage. However, it is important to understand the limitations and restrictions of this coverage. In some cases, additional insurance options may be necessary to adequately protect your stored items.

One option to consider is purchasing additional coverage specifically for your storage unit. This extra coverage, often referred to as “floater” or “endorsement” coverage, can increase the coverage limits for specific items or categories of items. Assessing the value of your stored belongings and the potential financial loss in case of damage or theft can help determine if additional coverage is needed.

Another option is to explore storage facility insurance. Some storage facilities offer insurance policies that are designed to cover the storage unit and its contents against risks such as fire, theft, and natural disasters. These policies are typically provided directly by the storage facility itself. It is recommended to compare the coverage and cost of various storage facility insurance options to find the best fit for your needs.

In addition, some insurance companies offer standalone storage unit insurance policies. These policies provide coverage specifically for belongings stored in a storage unit and often offer more comprehensive protection than standard renters insurance. It is advisable to research and compare the coverage and cost of these standalone storage unit insurance options to determine if they provide the necessary level of protection for your stored belongings.

When considering additional coverage options for your storage unit, it is important to carefully review the policy details and coverage limits. Be sure to assess the value of your stored belongings and consider the potential financial loss in case of damage or theft. Taking the time to research and compare the various options available can help ensure that your stored items are adequately protected.

Therefore, while renters insurance may cover items stored in storage units, there are limitations and restrictions that apply. To ensure sufficient protection for your stored belongings, it may be necessary to consider additional coverage options such as “floater” or “endorsement” coverage, storage facility insurance, or standalone storage unit insurance policies. By understanding the coverage limits and assessing your storage unit insurance needs, you can make an informed decision to protect your valuable possessions. Remember to carefully review and compare the details and costs of each option to find the best fit for your needs.

Factors to Consider when Using Renters Insurance for Storage Units

Considerations to keep in mind when relying on renters insurance for storage unit coverage

When it comes to utilizing renters insurance for coverage on your storage unit, there are a few factors that you should take into consideration. While renters insurance typically covers personal property, including items stored in a storage unit, it’s important to understand the limitations and restrictions that may apply to your specific policy.

Policy Coverage Limits

One of the first things to consider is the coverage limits on your renters insurance policy. These limits can vary depending on your insurance provider and policy, and may restrict the total amount of coverage available for your stored belongings. It’s recommended to review your policy documents or speak with your insurance agent to determine the exact coverage limits for storage units. If the coverage offered by your policy is not sufficient to protect the value of your stored items, you may want to consider purchasing additional coverage.

Additional Coverage Options

In some cases, purchasing additional coverage specifically for your storage unit may be necessary. This can be in the form of “floater” or “endorsement” coverage, which can increase the coverage limits for specific items or categories of items. Assessing the value of your stored belongings and the potential financial loss in case of damage or theft can help determine if additional coverage is needed.

Other Insurance Options

Apart from relying solely on renters insurance, there are other insurance options available specifically for storage units. Some storage facilities offer their own storage unit insurance, which is designed to cover the storage unit and its contents against risks such as fire, theft, and natural disasters. Additionally, certain insurance companies offer standalone storage unit insurance policies that provide more comprehensive protection than standard renters insurance. It’s recommended to compare the coverage and cost of various storage unit insurance options to find the best fit for your needs.

Evaluating Your Storage Unit Insurance Needs

To ensure that your valuable possessions are adequately protected, it’s crucial to take the time to assess your storage unit insurance needs. Review your renters insurance policy, understand the coverage limits, and consider purchasing additional coverage if necessary. Exploring other insurance options specifically designed for storage units can provide extra protection and peace of mind for your stored belongings.

By considering these factors and making an informed decision, you can ensure that your personal property in storage units is covered against potential risks. Whether it’s reviewing your policy, purchasing additional coverage, or exploring other insurance options, taking the necessary steps will help protect your valuable possessions. Remember to always seek advice from your insurance agent to fully understand the coverage provided by your renters insurance and to make the best decisions regarding storage unit insurance.

Evaluation of Renters Insurance Policies

Comparison of different renters insurance policies and their coverage for storage units

When it comes to utilizing renters insurance for coverage on your storage unit, it is essential to evaluate different renters insurance policies and understand their coverage limits. Here is a comparison of various policies and their coverage for storage units:

Policy A

– This policy provides coverage for personal property, including items stored in a storage unit.

– The coverage limits for storage units are $10,000, which may be sufficient for most individuals.

– Additional coverage options are available for specific items or categories of items.

– No standalone storage unit insurance option is provided.

Policy B

– This policy also covers personal property in storage units.

– The coverage limits for storage units are $5,000.

– Additional coverage options, such as floaters or endorsements, can be purchased for higher coverage limits.

– No standalone storage unit insurance option is offered.

Policy C

– Similar to Policy B, this policy covers personal property in storage units.

– The coverage limits for storage units are $7,500.

– Additional coverage options are available, but the exact details need to be discussed with the insurance provider.

– No standalone storage unit insurance option is included.

Policy D

– This policy provides coverage for personal property stored in storage units.

– The coverage limits for storage units are $15,000, offering higher protection for valuable items.

– Additional coverage options are available for specific items or categories of items.

– A standalone storage unit insurance option is offered, providing comprehensive coverage for the storage unit and its contents.

It is important to carefully review the coverage limits offered by each policy and assess the value of your stored belongings. If the coverage limits provided by your renters insurance policy are not sufficient to protect the value of your items, consider purchasing additional coverage or exploring standalone storage unit insurance options.

Comparing the cost and coverage of various insurance options is crucial in determining the best fit for your storage unit insurance needs. Gather quotes from different insurance providers and assess the extent of coverage they offer for storage units.

Remember to consult with your insurance agent to fully understand the coverage provided by your renters insurance policy and make informed decisions about storage unit insurance. By taking these steps, you can ensure that your personal property in storage units is adequately protected against potential risks.

How to Ensure Sufficient Coverage for Stored Items

Tips on how to ensure that your items in storage are adequately covered

When it comes to storing your personal belongings in a storage unit, it is essential to ensure that they are adequately protected and covered by insurance. Here are some tips to help you ensure sufficient coverage for your stored items:

1. Review your renters insurance policy: Start by reviewing your renters insurance policy to understand the coverage limits and any off-premises coverage provisions. Check if your policy already covers items in storage units and if there are any limitations or exclusions. This will give you a clearer idea of the protection offered by your existing policy.

2. Assess the value of your stored items: Take an inventory of the items you plan to store and assess their value. This will help you determine if the coverage provided by your renters insurance policy is sufficient to protect your belongings in case of damage, theft, or other risks. If the coverage limit is not enough, you may need to consider purchasing additional coverage.

3. Consider purchasing additional coverage: Depending on the value of your stored items, it may be prudent to purchase additional coverage specifically for your storage unit. Some insurance companies offer “floater” or “endorsement” coverage, which can increase the policy’s limits for specific items or categories of items. These additional policies can provide extra protection and peace of mind.

4. Explore standalone storage unit insurance options: Apart from relying solely on your renters insurance, consider exploring standalone storage unit insurance options. Some storage facilities offer their own insurance policies, specifically designed to cover the storage unit and its contents against risks like fire, theft, and natural disasters. Compare the coverage and cost of these options to find the best fit for your needs.

5. Consult with your insurance agent: To ensure that you make informed decisions about your storage unit insurance, it is recommended to consult with your insurance agent. They can provide guidance on the coverage provided by your renters insurance policy and help you navigate through the process of purchasing additional coverage or exploring other insurance options.

By following these tips and taking the necessary steps, you can ensure that your personal property in storage units is adequately covered against potential risks. Remember to regularly review and update your insurance coverage as needed, especially if the value of your stored items changes or you acquire new belongings.

Ensuring sufficient coverage for your stored items is crucial to protect your financial investment and provide peace of mind. Take the time to review your policy, assess your coverage needs, and consider purchasing additional insurance if necessary. With the right insurance coverage in place, you can store your belongings in a storage unit with confidence.

Conclusion

Summary of options and recommendations for using renters insurance for storage units

When it comes to storing your personal belongings in a storage unit, it is important to ensure that they are adequately protected and covered by insurance. Here is a summary of the options and recommendations for using renters insurance for storage units:

1. Review your renters insurance policy: Start by reviewing your renters insurance policy to understand the coverage limits and any off-premises coverage provisions. Determine if your policy covers items in storage units and if there are any limitations or exclusions.

2. Assess the value of your stored items: Take an inventory of the items you plan to store and assess their value. This will help you determine if the coverage provided by your renters insurance policy is sufficient. If not, consider purchasing additional coverage.

3. Consider purchasing additional coverage: Depending on the value of your stored items, it may be wise to purchase additional coverage specifically for your storage unit. Some insurance companies offer “floater” or “endorsement” coverage, which can increase the policy’s limits for specific items or categories of items.

4. Explore standalone storage unit insurance options: In addition to renters insurance, consider exploring standalone storage unit insurance options. Some storage facilities offer their own insurance policies designed to cover the unit and its contents against risks like fire, theft, and natural disasters. Compare coverage and costs to find the best fit.

5. Consult with your insurance agent: To make informed decisions about storage unit insurance, consult with your insurance agent. They can provide guidance on your renters insurance coverage and help you navigate purchasing additional coverage or exploring other insurance options.

Remember to regularly review and update your insurance coverage as needed, especially if the value of your stored items changes or you acquire new belongings. By following these recommendations and taking the necessary steps, you can ensure that your personal property in storage is adequately covered against potential risks. With the right insurance coverage in place, you can store your belongings in a storage unit with confidence.

Read more about Do i need renters insurance storage unit.

1 thought on “Can you use renters insurance for storage unit”