Can you get insurance on a storage unit

Many people rely on self-storage facilities to store their belongings. However, storing items in a storage unit comes with the risk of damage or loss due to unexpected events such as theft, vandalism, and natural disasters. As a result, insurance for storage units has become crucial for anyone renting a storage unit.

Explanation of self-storage and why insurance is important

Self-storage refers to rented out spaces where people can keep their belongings for a fee. Storage units come in various sizes and can store anything from documents, household items, vehicles, and even boats.

While storing items in a storage unit offers a sense of security, it does not eliminate the possibility of damages or loss. Without insurance, self-storage renters risk incurring significant losses. Insurance for storage units provides financial protection against theft, vandalism, or natural disasters.

Different types of storage insurance options

Storage facilities may offer various types of insurance options to their renters. Tenants need to carefully review these options to choose the best policy for their specific needs. Here are some types of storage insurance options:

-

Third-party insurance – renters can purchase policies from a third-party insurance company to protect their belongings

-

Self-storage insurance – storage facilities may offer their insurance policy for items stored in their units.

-

Homeowners’ or renters’ insurance – Some homeowners or renters policies can have provisions that cover belongings in a storage unit.

Regardless of the insurance option a tenant chooses, it’s essential to review the policy’s terms and conditions to ensure that it covers specific risks, deductibles, and coverage limits.

Therefore, storage unit insurance offers a safety net to protect one’s belongings in case of unexpected events like theft, vandalism, and natural disasters. Before renting a storage unit, it’s essential to understand the insurance options available and choose the best policy that fits one’s needs.

Do self-storage facilities require tenants to have insurance?

Most self-storage companies need customers to have insurance

When renting a self-storage unit, customers are usually required to provide proof of insurance for their personal belongings stored in the rented unit. Storage companies make having renters insurance policy a requirement in the application process, and without it, the lease may become invalid. Requiring insurance coverage is a way of ensuring that tenant properties kept inside the storage units are protected, and the business itself is guarded against any financial loss.

Why most self-storage companies require renters to have insurance?

Self-storage facilities require tenants to have insurance coverage because of the potential risks and uncertainties involved in storing belongings. Even with the most secure facilities, fire, water damage, pest infestations, or theft can occur. Insurance offers the peace of mind that if any of these events happen, the renter’s belongings are well covered.

Storage companies typically offer their insurance policies or policies sourced from third-party specialty insurers. Some insurance policies may exclude specific types of water and smoke damage and leaving renters vulnerable to financial loss. However, storage unit insurance can be included in the renters or homeowners’ insurance. If renters already have a policy, their belongings are likely to be protected, regardless of where they are in the world.

Therefore, it is crucial to have insurance coverage when renting a storage unit. This is because storage companies or facilities can require tenants to have proof of an insurance policy covering and protecting their belongings. To ensure the best coverage for personal belongings, renters must review their existing insurance policy carefully, or if required, purchase additional insurance coverage. It is essential to make sure an insurance policy fits a specific needs, so it is always better to ask questions regarding coverage and exclusions before deciding on the best insurance policy.

Where can you get storage insurance?

If you are renting a storage unit, it is essential to protect your belongings with insurance coverage. Several insurance companies offer self-storage insurance policies, including storage companies, independent insurance agencies, and private insurance companies.

Insurance companies providing self-storage insurance

When it comes to insurance companies, storage facilities typically offer their insurance policies or policies sourced from third-party specialty insurers. However, independent insurance agencies may provide the best rates compared to insurance policies offered by storage companies.

Independent insurance agencies can access a wide range of insurance companies, allowing them to compare policies and find the best rates and coverage for their customers. These agencies specialize in storage unit insurance and can help ensure you receive the protection you need.

Tips for choosing the right self-storage insurance

When choosing self-storage insurance, it is crucial to consider the following tips:

-

Check your existing policy: Some renters or homeowner’s insurance policies may already provide coverage for personal belongings stored in a rented storage unit. Reviewing the current policy can help you determine if additional coverage is necessary.

-

Compare policies: Independent insurance agencies can provide multiple quotes from various insurance providers. Comparing policy rates and coverage can help ensure that you receive the best protection for your personal belongings.

-

Read the policy carefully: Insurance policies can have exclusions, limitations, or requirements for coverage. It is essential to read the policy carefully to ensure that it meets your needs.

-

Consider the value of your belongings: The amount of insurance coverage you need will depend on the value of the belongings you store in the unit. Taking inventory of your items and their value can help determine how much coverage you require.

-

Understand the deductible: Insurance policies typically come with a deductible. The deductible is the amount you will pay out of pocket before the insurance policy kicks in. It is essential to understand the deductible and consider it when choosing a policy.

Therefore, most self-storage companies require tenants to have insurance coverage for their personal belongings stored in the rented unit. While storage companies offer their insurance policies or policies sourced from third-party specialty insurers, independent insurance agencies may provide the best rates and coverage. It is crucial to choose the right self-storage insurance by checking the existing policy, comparing policies, reading the policy carefully, considering the value of your belongings and understanding the deductible.

The coverage of self-storage insurance

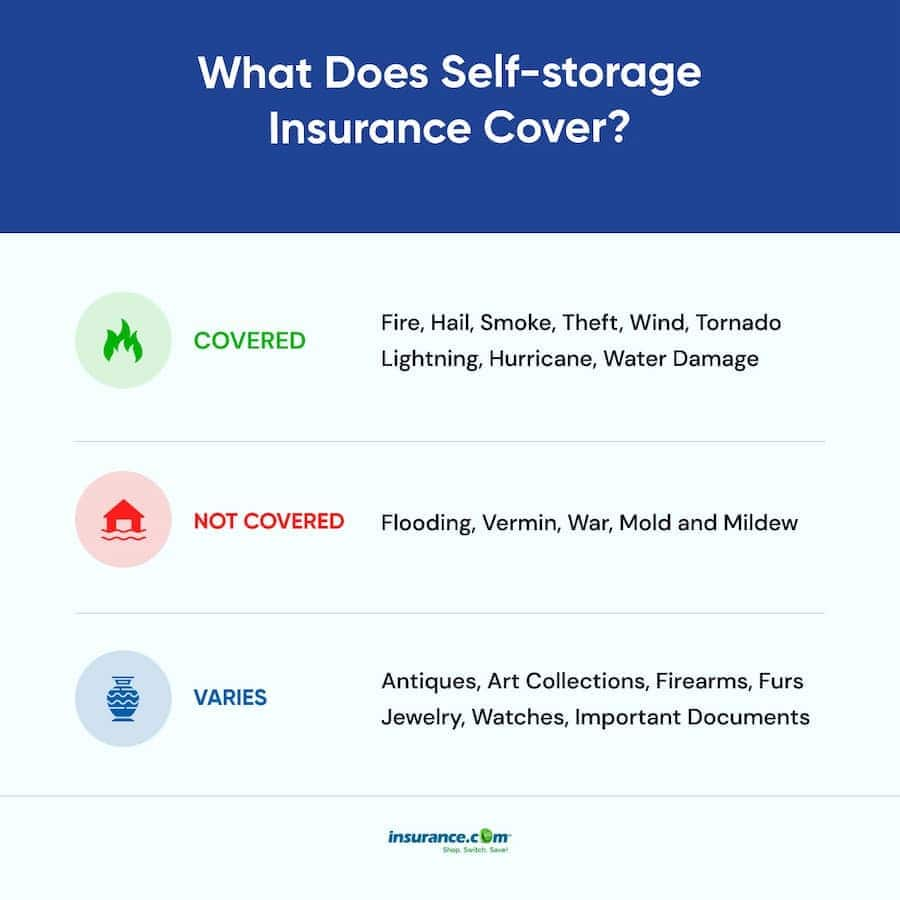

What usually is covered under a storage insurance policy?

Storage insurance policies typically cover accidental damage to the renter’s belongings stored in a self-storage unit. The coverage includes loss or damage caused by fire, theft, water damage, and certain natural disasters such as earthquakes, tornadoes, and hurricanes. Depending on the insurance policy, coverage may also include damages caused by vandalism, rodents, or pests infestations. The coverage usually operates on a replacement cost basis, meaning the insurer will pay to replace the lost or damaged items with new ones at the current market value, instead of the items’ depreciated value at the time of loss.

What is not usually covered under a storage insurance policy?

Storage insurance policies may exclude damages caused by certain events and circumstances. For instance, damage due to flooding, earthquakes, and other natural disasters may not be included unless the renter buys additional coverage. Any items that require special coverage such as fine arts or jewelry may need a separate policy or rider. Self-storage insurance policies may also exclude items that are considered hazardous materials such as gasoline, propane, or chemicals, which are prohibited from being stored in storage units.

It is essential to note that if the renter is responsible for the damage caused to their belongings, whether intentionally or through negligence, the insurance policy may not pay for the damages or losses.

Therefore, having insurance coverage for items stored in a self-storage unit is crucial. Storage companies typically require customers to provide proof of insurance, and therefore renters must review their existing homeowners or renters policy coverage or purchase additional coverage from specialized vendors. Understanding what is and what is not covered under a storage insurance policy is also crucial, as it will help renters make informed decisions about their insurance coverage. A knowledgeable renter will have peace of mind knowing that their personal belongings are protected in the event of loss or damage.

The cost of storage insurance

Storage unit insurance is an essential expense for individuals or businesses that want to protect their valuable belongings from damages or losses. The cost of storage insurance depends on several factors, including the type and amount of coverage needed, the insurance provider, and the location of the storage unit.

Factors that determine the cost of storage insurance policies

One of the significant factors that determine the cost of storage insurance policies is the coverage limit. Many self-storage facilities may require a minimum coverage limit, while others may allow you to choose your coverage limit. The higher the coverage limit, the greater the insurance premium. However, some storage facilities may offer discounts if the renter chooses to pay for a higher coverage limit.

Another factor influencing the cost of storage unit insurance is the type of coverage needed. For example, coverage for damage caused by natural disasters, such as earthquakes, floods, or hurricanes, may increase the premium cost. Similarly, coverage for specialty items such as jewelry, fine arts, or antiques, may require separate insurance policies or riders, which can add to the cost of the overall policy.

The location and security features of the self-storage facility may also affect the cost of storage insurance. Facilities located in high-risk areas or regions with a history of theft or natural disasters may have higher premiums. On the other hand, facilities with excellent security features, such as video surveillance, alarm systems, or on-site security personnel, may offer lower premiums.

The average cost of storage insurance and how to save on insurance

The cost of storage insurance varies depending on the coverage limits and the location of the storage unit. Typical storage insurance policies range from $7 to $15 per month for every $1,000 of coverage. However, the rate might be higher or lower based on the factors mentioned earlier.

To save on storage unit insurance costs, renters should shop around for insurance providers to compare rates and coverage options. Some self-storage facilities offer insurance policies through their preferred providers. Before purchasing insurance, the renter should check if their homeowner’s or renter’s insurance policy covers items stored off-site. If not, they may be able to add a storage endorsement to their policy, which may be a cost-effective option.

Therefore, storage unit insurance is an essential expense for anyone using a self-storage unit to protect their belongings against damages and losses. The cost of storage insurance can vary depending on several factors such as coverage limits, coverage type, location of the facility, and security features. Renters must review their existing insurance coverage and research insurance providers to find the best coverage at an affordable price.

Deductibles for storage insurance policies

Explanations of deductibles for self-storage insurance policies

Deductibles are the monetary amount that a renter must pay out of pocket in the event of a loss or damage to their items stored in a self-storage unit. Deductibles usually range from $0 to $500, and the renter can choose the amount that best fits their needs. However, some storage insurance policies may include a fixed deductible amount, and renters would need to pay that specific amount in the event of a claim.

It is essential to understand that the higher the deductible, the lower the monthly premium for the storage insurance policy. For instance, if a renter chooses a deductible of $100, their monthly premium may be higher than if they opted for a $500 deductible. Conversely, if the renter chooses a lower deductible, their monthly premium will be more expensive. It is up to the renter to choose the best option that fits their budget and risk tolerance.

How deductibles impact the worth of a storage insurance policy

While deductibles may appear to be an additional expense, they serve a useful purpose in reducing fraudulent claims. Deductibles help renters understand that insurance policies are not meant to cover every small loss or damage but rather significant losses. A deductible ensures that renters have skin in the game and are financially responsible for their belongings.

Renters should consider their risk tolerance and the value of the items stored in their self-storage unit before selecting a deductible amount. If the renter has high-value items stored in their storage unit, they may want to opt for a lower deductible. On the contrary, if the renter has low-value items, they may want to consider a higher deductible to reduce their monthly premium.

Therefore, self-storage insurance policies are essential in protecting renters’ belongings from damages and losses. Deductibles play a vital role in reducing fraudulent claims and ensuring that renters are financially responsible for their items stored in a self-storage unit. Renters should review their existing homeowners or renters policy coverage or purchase additional coverage from specialized vendors to ensure that their items are adequately protected.

Who is accountable for storing goods and valuables?

When it comes to storing goods and valuables in a self-storage facility, there is a shared responsibility between the tenant and the self-storage company. The self-storage company is responsible for providing a suitable and secure storage environment for the tenant’s belongings, while the tenant is responsible for properly packing and securing their items.

It is essential to remember that the self-storage facility is not an insurer of the tenant’s items, and the tenant must obtain the appropriate insurance coverage to protect their belongings. However, some self-storage companies may offer insurance policies that cover loss or damage to the tenant’s belongings while in storage, but it’s essential to understand their coverage limits and deductibles before purchasing such policies.

Responsibility of self-storage companies regarding tenants belongings

The self-storage company’s responsibilities regarding the tenant’s belongings include:

– Providing a secure and clean storage environment

– Ensuring the facility is free from hazards such as fire, water, or pest damage

– Implementing security measures such as surveillance cameras, gated access, and individual locks for each storage unit

– Providing information on insurance options and requirements

– Promptly addressing any complaints or issues raised by the tenant regarding their storage unit or belongings

If a self-storage company fails to fulfill its responsibilities, it may be liable for any damages or losses incurred by the tenant. Therefore, it’s crucial to choose a reputable self-storage company with a good track record of providing safe and secure storage units.

Tips on how to avoid problems regarding self-storage insurance

To avoid problems regarding self-storage insurance, tenants can follow these tips:

– Review their existing homeowners or renters policy coverage to see if their off-premise belongings are covered. If they’re not covered, tenants should consider purchasing additional insurance coverage from specialized vendors.

– Understand the self-storage company’s insurance options, coverage limits, and deductibles before signing a rental agreement. Tenants should also inquire about any exclusions or limitations in the policy.

– Properly pack and secure their items before storing them in a self-storage unit. Tenants should use sturdy boxes, packing material, and secure locks to protect their belongings from damage or theft.

– Regularly inspect their storage unit and report any issues to the self-storage company promptly.

– Keep an inventory of their stored items and their value. This will help tenants determine the appropriate insurance coverage and facilitate the claims process in case of loss or damage.

Therefore, self-storage insurance policies are essential in protecting tenants’ belongings from damages and losses. It’s a shared responsibility between the tenant and the self-storage company to ensure that the storage environment is secure and suitable for storing goods and valuables. Tenants should review their insurance coverage options and take appropriate steps to avoid problems regarding self-storage insurance.

Does homeowners insurance cover self-storage units?

Explanation of homeowners or renters insurance that provides coverage for storage

Homeowners insurance policies typically provide coverage for personal items not only inside the home but also off-premises, such as in a storage unit. Renters and condo policies also usually offer some protection for belongings stored in a storage facility. However, the coverage depends on the insurer and the specific policy in place.

Most standard homeowners, renters, and condo policies generally cover a percentage of the possessions stored in a storage unit. Typically, the items are covered for theft, vandalism, fire, and weather-related damage but may not cover damage caused by mold and mildew.

If a renter has high-value items in a storage unit, an endorsement can be added to the homeowners, renters or, condo insurance policy to provide additional protection. An endorsement allows for higher coverage limits, broader perils coverage, and increased sub-limits on high-value items.

Benefits and shortcomings of having homeowners insurance

One of the advantages of using the existing homeowners, renters or, condo insurance policy to provide coverage for items in a storage unit is the cost. Including a storage endorsement on an existing policy may be less expensive than purchasing separate storage insurance. Additionally, using a single insurer for all policies may offer discounts on premiums.

One of the shortcomings of relying on an existing policy is that it may not provide sufficient coverage for some items stored in a storage unit. For example, a standard policy may not cover damage to vehicles stored in a facility. Furthermore, some policies may have limitations on the amount of coverage for jewelry, art, or other high-value items.

So, homeowners, renters or, condo insurance policies usually have some coverage for belongings stored in a storage unit. However, if a renter has high-value items or needs broader coverage for potential perils, they should consider adding an endorsement or purchasing separate storage insurance. Renters should review their coverage limits, perils coverage, and sub-limits on high-value items to ensure adequate protection.

Does homeowners insurance cover self-storage units?

Explanation of homeowners or renters insurance that provides coverage for storage

When it comes to storing personal belongings, homeowners insurance policies typically provide coverage for items not just within the home, but also off-premises, such as in a storage unit. Renters and condo policies may also offer some protection for items stored in a storage facility. However, it’s important to note that the coverage depends on the insurer and the specific policy in place.

For most standard homeowners, renters, and condo policies, a percentage of the possessions stored in a storage unit are usually covered. Items are typically covered for theft, vandalism, fire, and weather-related damage, but damage caused by mold and mildew may not be covered. If a renter has high-value items in a storage unit, adding an endorsement to the homeowners, renters or condo insurance policy can provide additional protection. An endorsement allows for higher coverage limits, broader perils coverage, and increased sub-limits on high-value items.

Benefits and shortcomings of having homeowners insurance

The advantage of using an existing homeowners, renters or condo insurance policy to provide coverage for items in a storage unit is that it may be less expensive than purchasing separate storage insurance. Additionally, using a single insurer for all policies may offer discounts on premiums. However, a standard policy may not provide sufficient coverage for some items stored in a storage unit. For example, a policy may not cover damage to vehicles stored in a facility. Furthermore, some policies may have limitations on the amount of coverage for jewelry, art, or other high-value items.

It’s important for renters to review their coverage limits, perils coverage, and sub-limits on high-value items to ensure adequate protection.

Conclusion

Therefore, while homeowners, renters or condo insurance policies usually have some coverage for belongings stored in a storage unit, it’s important to consider the value of the items being stored and whether additional coverage is needed. If a renter has high-value items or needs broader coverage for potential perils, they should consider adding an endorsement or purchasing separate storage insurance.

Final thoughts on storage insurance

In the end, storage units offer a convenient solution for those needing extra space for their personal belongings. While storage facilities offer certain assurances in terms of guarding against theft and damage, adding an insurance policy provides the additional security of financial protection. Being insured provides peace of mind and prevents the risk of irreparable loss of one’s personal belongings. As such, renters are encouraged to investigate their options for storage insurance to ensure their possessions remain protected.

Learn about Can you get renters insurance on a storage unit.

1 thought on “Can you get insurance on a storage unit”