Introduction

Explanation of the importance of insurance on storage units

When it comes to storing your valuable belongings, whether in a storage facility, your home, during transit, or in a commercial business location, it is crucial to have insurance coverage to protect them from potential damage, theft, or loss. This is where Discount Storage Insurance comes in, offering comprehensive storage unit insurance to give you peace of mind.

Having insurance for your storage unit means that even if something unfortunate happens to your stored items, you are financially protected. Whether it’s a natural disaster, burglary, or any unforeseen event, you can rest easy knowing that your possessions are covered.

Different types of insurance available for storage units

Discount Storage Insurance provides different types of insurance specifically tailored for storage units, ensuring that your storage needs are met. Here are the options available:

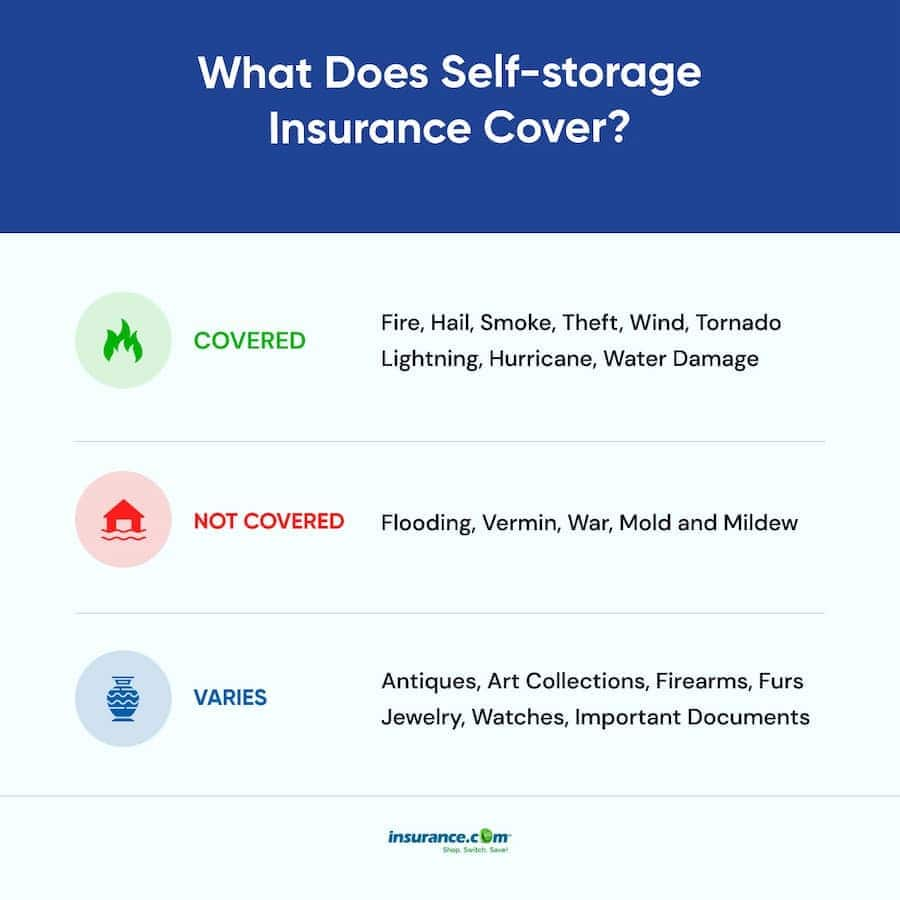

1. Self Storage Insurance: This type of insurance offers comprehensive coverage for items stored in a unit. It includes protection against damage caused by fire, water, natural disasters, and theft. Self storage insurance is specifically designed for storage units and offers additional benefits that may not be covered by homeowners or renters insurance.

2. Mobile Storage Insurance: If you are using mobile storage containers to store your belongings, having mobile storage insurance is essential. This coverage will protect your items from damage or loss during transit. Whether you are moving or need temporary storage, mobile storage insurance ensures that your belongings are safeguarded throughout the entire process.

3. Rental Storage Insurance: If you are renting a storage unit, rental storage insurance is an important consideration. This type of insurance protects your stored items from theft, damage, and loss while they are stored in the rental unit. By getting rental storage insurance, you can prevent the risk of cancellation to your homeowner’s policy should a claim occur. This way, your personal property is protected, and your homeowner’s insurance remains intact.

In addition to comprehensive coverage, Discount Storage Insurance offers low deductibles for claims, making it easier for you to file a claim and recover the value of your lost or damaged belongings.

Therefore, having insurance coverage for your storage unit is crucial to protect your valuable possessions from potential damage, theft, or loss. Discount Storage Insurance provides comprehensive insurance options specifically designed for storage units, ensuring that your storage needs are met and giving you the peace of mind you deserve. So, don’t wait any longer, fill out the online form and explore the insurance options available to safeguard your stored items today.

Homeowners Insurance for Storage Units

Coverage provided by off-premises personal property coverage in homeowners insurance

When it comes to storing your belongings in a storage unit, many people assume that their homeowners insurance will automatically cover any loss, damage, or theft that may occur. However, this is often not the case. Most homeowners insurance policies include coverage for off-premises personal property, which means your belongings are protected even when they are not physically located at your home.

This coverage typically extends to storage units, but there are limitations and exclusions that you need to be aware of. It’s important to review your policy and speak with your homeowner insurance brokerage to clarify the specifics of their coverage and deductibles.

Limitations and exclusions of homeowners insurance for storage units

While homeowners insurance may provide some coverage for items stored in a storage unit, there are often limitations and exclusions that can leave you at a financial risk if something were to happen to your stored belongings. These limitations may include:

– Limited coverage amount: Homeowners insurance may only provide a certain amount of coverage for off-premises personal property, which may not be sufficient to cover the value of your stored belongings.

– Deductibles: Your homeowners insurance may have a deductible that you need to pay before coverage kicks in. This deductible can be a significant amount and may make it impractical to make a claim for smaller losses.

– Exclusions: Homeowners insurance policies often have exclusions for certain types of losses, such as damage caused by flooding, earthquakes, or acts of terrorism. If your stored belongings are damaged or lost due to one of these excluded events, your homeowners insurance will not provide coverage.

Due to these limitations and exclusions, it is advisable to consider obtaining separate storage unit rental insurance to ensure that your stored belongings are adequately protected.

Benefits of separate storage unit rental insurance

Having a separate storage unit rental insurance policy offers several benefits over relying solely on your homeowners insurance:

– Eliminates the need for extra coverage or an insurance rider: With a storage unit rental insurance policy, you do not have to add extra coverage to your homeowners insurance policy or purchase an insurance rider. This can simplify your insurance coverage and potentially save you money.

– Specialized coverage for storage units: Companies like Discount Storage Insurance offer specialized rental storage insurance that is designed to protect the contents of storage units and mobile storage containers against burglary, damage, or loss. These insurance policies can provide coverage for a wide range of scenarios, ensuring that your stored belongings are adequately protected.

– Customizable coverage: Storage unit rental insurance policies are often customizable, allowing you to tailor your coverage to fit your specific needs and budget. You can choose the coverage limits and deductibles that work best for you.

By opting for a separate storage unit rental insurance policy, you can have peace of mind knowing that your stored belongings are backed by a licensed, certified program specialized in covering more diverse scenarios with your contents in storage. It eliminates the risk of cancellation of your homeowner’s policy and provides comprehensive coverage that is specifically designed for storage units.

Rental Storage Insurance

The benefits of getting rental storage insurance

When it comes to storing your belongings in a storage unit, it’s important to have the right insurance coverage. While some people assume that their homeowners insurance will automatically cover any loss, damage, or theft that may occur, this is often not the case. Rental storage insurance offers a specialized and customizable solution for protecting your stored belongings. Here are some benefits of getting rental storage insurance:

– **Eliminates the need for extra coverage or an insurance rider:** One of the main advantages of rental storage insurance is that it eliminates the need to add extra coverage or an insurance rider to your homeowner’s policy. This simplifies your insurance coverage and potentially saves you money.

– **Specialized coverage for storage units:** Companies like Discount Storage Insurance offer specialized rental storage insurance that is specifically designed to protect the contents of storage units and mobile storage containers against burglary, damage, or loss. With this type of insurance, you can have peace of mind knowing that your stored belongings are adequately protected.

– **Customizable coverage:** Rental storage insurance policies are often customizable, allowing you to tailor your coverage to fit your specific needs and budget. You can choose the coverage limits and deductibles that work best for you. This flexibility ensures that you are not paying for coverage that you don’t need and that you have the right level of protection for your stored belongings.

Discount Storage Insurance as a recommended option for storage unit insurance

When it comes to choosing a rental storage insurance provider, Discount Storage Insurance is a highly recommended option. They offer a range of flexible and customizable storage unit insurance policies to fit your needs and budget. Here’s why Discount Storage Insurance is a great choice:

– **Online process with support:** Discount Storage Insurance offers a fully online process, making it easy and convenient to get the coverage you need. They also provide phone support, online chat, and 24/7 claims service, ensuring that assistance is always just a phone call or email away.

– **Tailored coverage:** Discount Storage Insurance allows renters to tailor their coverage to fit their specific needs and budgets. This means that you can choose the coverage limits and deductibles that work best for you, ensuring that you have the right level of protection.

– **Specialized expertise:** Discount Storage Insurance specializes in rental storage insurance, which means they have the knowledge and expertise to provide you with the best coverage options for your stored belongings. They understand the unique risks associated with storage units and mobile storage containers, and tailor their policies accordingly.

– **Peace of mind:** With Discount Storage Insurance, you can have peace of mind knowing that your stored belongings are protected by a licensed and certified program specialized in covering more diverse scenarios with your contents in storage. This eliminates the risk of cancellation of your homeowner’s policy and provides comprehensive coverage that is specifically designed for storage units.

Therefore, rental storage insurance offers numerous benefits over relying solely on your homeowners insurance. It eliminates the need for extra coverage, provides specialized coverage for storage units, and allows for customizable coverage. Discount Storage Insurance is a recommended option for rental storage insurance, offering a convenient online process, tailored coverage options, specialized expertise, and peace of mind knowing that your stored belongings are adequately protected.

SafeStor and MiniCo: Self-Storage Insurance Companies

Overview of SafeStor and MiniCo as the two largest self-storage insurance companies

SafeStor and MiniCo are two of the largest self-storage insurance companies in the industry. With decades of experience and a focus on providing comprehensive coverage for both self-storage businesses and tenants, these companies have established themselves as leaders in the market.

SafeStor offers a range of insurance products specifically tailored for the self-storage industry. Their policies cover risks such as property damage, theft, and liability, providing peace of mind for both self-storage operators and tenants. SafeStor prides itself on its customer service and claims handling processes, ensuring a smooth and efficient experience for policyholders.

MiniCo, with nearly 50 years of self-storage experience, understands the unique risks faced by self-storage businesses and tenants. They offer two tenant insurance programs that provide the same coverage and benefits for tenants. The Pay-With-Rent Tenant Insurance program allows self-storage businesses to bundle the insurance costs into the tenants’ monthly rental fee, providing a convenient and hassle-free option. The TenantOne Direct program is a popular mail-in tenant insurance program widely used across America. The self-storage facility simply provides tenants with the insurance application, and MiniCo takes care of the rest.

How self-storage insurance works through these companies

When it comes to self-storage insurance, both SafeStor and MiniCo offer convenient options for self-storage operators and tenants. Here’s how their insurance programs work:

– SafeStor: Self-storage operators can choose to purchase coverage through SafeStor to protect their property, contents, and liability. Tenants may also have the option to purchase coverage for their stored belongings. The coverage can be tailored to meet the specific needs of each facility, ensuring comprehensive protection. SafeStor handles the underwriting and claims processes, making it easy for self-storage businesses and tenants to navigate insurance matters.

– MiniCo: MiniCo’s tenant insurance programs provide coverage for tenants’ stored belongings. With the Pay-With-Rent Tenant Insurance program, tenants can pay for insurance alongside their monthly rental fee, simplifying the process and providing an additional revenue stream for self-storage businesses. The TenantOne Direct program allows tenants to mail in their insurance applications, with MiniCo handling the rest of the process.

Both SafeStor and MiniCo aim to provide comprehensive coverage options and excellent customer service for self-storage businesses and tenants. Their expertise in the industry ensures that policyholders receive the protection they need, giving them peace of mind while using self-storage facilities.

Therefore, with their extensive experience and focus on the unique risks faced by the self-storage industry, SafeStor and MiniCo are two of the leading self-storage insurance companies. Their comprehensive coverage options, convenient insurance programs, and excellent customer service make them the go-to choice for self-storage businesses and tenants alike. Whether you are a self-storage operator or a tenant looking to protect your stored belongings, it is important to consider these reputable insurance companies for your insurance needs.

Snapnsure: Insurance for Mobile Storage

Snapnsure offering a Real Insurance Policy for Mobile Storage

Snapnsure is a leading provider of insurance specifically designed for mobile storage. Unlike traditional protection plans offered by mobile storage companies, Snapnsure provides a “REAL” insurance policy that offers comprehensive coverage for items stored in mobile storage units. With decades of experience and the backing of an A-rated insurance company, Snapnsure offers peace of mind to customers by ensuring their belongings are protected.

Comparison of Snapnsure’s insurance to traditional Protection Plans

When it comes to insurance for mobile storage, Snapnsure stands out from traditional protection plans offered by mobile storage companies. Here’s how Snapnsure’s insurance compares:

|

Insurance Coverage |

Snapnsure |

Traditional Protection Plans |

|---|---|---|

|

Comprehensive Coverage |

✓ |

✗ |

|

Property Damage |

✓ |

✗ |

|

Theft |

✓ |

✗ |

|

Liability |

✓ |

✗ |

|

Underwritten by A-rated Insurance Company |

✓ |

✗ |

Snapnsure offers comprehensive coverage for property damage, theft, and liability, ensuring that customer’s stored belongings are fully protected. In contrast, traditional protection plans provided by mobile storage companies often have limited coverage and may not offer protection against property damage, theft, or liability.

Furthermore, Snapnsure’s insurance policies are underwritten by an A-rated insurance company, providing customers with the security and peace of mind that their claims will be handled by a reputable and reliable insurer. On the other hand, traditional protection plans offered by mobile storage companies may not have the same level of backing, leading to potential difficulties in handling claims.

In terms of cost, Snapnsure offers savings of 50% or more compared to traditional protection plans offered by mobile storage companies. With rates starting at just $7.99 per month, customers can obtain comprehensive insurance coverage for their stored belongings at an affordable price.

Switching to Snapnsure is also easy and hassle-free. Snapnsure handles the cancellation of an existing policy at no extra cost, making the transition seamless for customers.

Therefore, Snapnsure is a top choice for mobile storage insurance due to its real insurance policies offering comprehensive coverage for property damage, theft, and liability. With the backing of an A-rated insurance company and savings of 50% or more compared to traditional protection plans, Snapnsure provides customers with peace of mind while ensuring their belongings are fully protected.

TenantOne Direct Tenant Insurance

Easy implementation of the TenantOne Direct Tenant Insurance program for self-storage facilities

Implementing MiniCo’s TenantOne Direct Tenant Insurance program in self-storage facilities is a straightforward process. The facility provides tenants with the insurance application during the leasing process and explains that obtaining insurance for their stored goods is the tenant’s responsibility. Once the tenant submits the application, MiniCo takes care of the rest, handling the underwriting and claims processes.

This program offers self-storage operators a convenient way to ensure that their tenants have insurance coverage. By offering the application and emphasizing the importance of insurance, self-storage facilities can protect themselves and their tenants from financial losses related to property damage or theft.

Convenience for tenants to purchase insurance directly

TenantOne Direct Tenant Insurance offers tenants the convenience of purchasing insurance directly. The program allows tenants to mail in their insurance applications, making it easy and hassle-free. This eliminates the need for tenants to search for insurance providers themselves or meet with agents to get coverage.

By offering this option, MiniCo is ensuring that tenants have access to the insurance they need to protect their stored belongings. The simplicity of the program allows tenants to focus on the move-in process and have peace of mind knowing that their belongings are covered.

Comparison: SafeStor vs. MiniCo

Coverage and Benefits

| | SafeStor | MiniCo |

|———————|——————————————-|—————————————————–|

| Property Coverage | ✔️ | ✔️ |

| Contents Coverage | ✔️ | ✔️ |

| Liability Coverage | ✔️ | ✔️ |

| Claims Handling | Efficient and customer-centric | Efficient and customer-centric |

| Tenant Options | Tenants can purchase individual coverage | Tenants can choose Pay-With-Rent or TenantOne Direct |

Customer Service

Both SafeStor and MiniCo are known for their excellent customer service. They prioritize assisting policyholders with any questions or concerns, making the insurance experience as smooth as possible. With years of experience in the self-storage industry, both companies understand the unique needs and challenges faced by self-storage businesses and tenants.

Convenience for Self-Storage Businesses

| | SafeStor | MiniCo |

|————————-|—————–|———————————————-|

| Bundling Coverage Costs | ✔️ | ✔️ |

| Administrative Effort | Minimal | Minimal |

| New Revenue Stream | ✔️ | ✔️ |

SafeStor and MiniCo offer convenient options for self-storage businesses to bundle coverage costs into tenants’ monthly rental fees. This provides a new revenue stream for the business and minimizes administrative effort. Both companies understand the importance of making insurance implementation as effortless as possible for self-storage operators.

So, SafeStor and MiniCo are two of the leading self-storage insurance companies in the industry. Their comprehensive coverage options, convenient insurance programs, and excellent customer service make them the go-to choice for self-storage businesses and tenants alike. Whether you are a self-storage operator or a tenant looking to protect your stored belongings, considering these reputable insurance companies for your insurance needs is essential.

Storage Protectors: Insurance Exclusions for Renters

Explanation of Storage Protectors’ lack of storage unit insurance for renters

Storage Protectors is a reputable insurance company that offers a comprehensive Contents Insurance Program for stored belongings. However, it does not provide storage unit insurance specifically for renters. This means that if you are a renter and you solely rely on Storage Protectors for your insurance coverage, your stored property in a storage unit might not be protected.

While Storage Protectors does offer economical coverages for stored belongings, these coverages are meant to add an additional layer of protection on top of any existing insurance policies you may have. Therefore, it is important for renters to understand that it is their responsibility to secure insurance coverage for their stored goods.

Alternative options for renters seeking insurance coverage

Although Storage Protectors does not offer storage unit insurance for renters, there are alternative insurance options available that can provide the necessary coverage for your stored belongings. One highly recommended option is TenantOne Direct Tenant Insurance.

TenantOne Direct Tenant Insurance is an insurance program offered by MiniCo that is specifically designed for tenants who need insurance coverage for their stored goods. This program is affordable, flexible, and can be easily purchased online, with the insurance certificate being available within minutes.

By choosing TenantOne Direct Tenant Insurance, you can rest assured knowing that your stored belongings are covered, whether they are located in a storage facility, home, in transit, or a commercial business location where you pay rent. This convenient insurance option eliminates the need to search for insurance providers or meet with agents, making the process hassle-free.

Therefore, if you are a renter and are in need of storage unit insurance, it is highly recommended to explore TenantOne Direct Tenant Insurance as a reliable and convenient solution to protect your stored property.

Therefore, while Storage Protectors does not offer storage unit insurance for renters directly, there are alternative insurance options available such as TenantOne Direct Tenant Insurance. It is important for renters to proactively secure insurance coverage for their stored goods to protect themselves from potential losses.

Benefits of Covered Storage Unit Insurance

Financial protection against theft, vandalism, and weather-related damage

Storage unit insurance provides comprehensive coverage for items stored in a unit, protecting them from theft, vandalism, and weather-related damage. This includes coverage for damage caused by natural disasters such as hurricanes, floods, and fires. With this insurance, tenants can have peace of mind knowing that their belongings are protected in case of unforeseen events.

Peace of mind for storage unit renters

Having insurance for a storage unit gives renters peace of mind, knowing that their belongings are covered in case of any damage or loss. It eliminates the risk of cancellation to their homeowner’s policy in the event of a claim, ensuring that they have insurance specifically tailored for their stored items. Whether moving belongings to a self-storage facility or using a portable or mobile storage unit, having storage unit insurance provides peace of mind throughout the entire process.

TenantOne Direct Tenant Insurance

Easy implementation of the TenantOne Direct Tenant Insurance program for self-storage facilities

Implementing MiniCo’s TenantOne Direct Tenant Insurance program in self-storage facilities is a straightforward process. During the leasing process, the facility provides tenants with the insurance application and explains their responsibility to obtain insurance for their stored goods. Once the tenant submits the application, MiniCo handles the underwriting and claims processes, ensuring that both the facility and tenants are protected from financial losses related to property damage or theft.

Convenience for tenants to purchase insurance directly

TenantOne Direct Tenant Insurance offers tenants the convenience of purchasing insurance directly. Tenants can simply mail in their insurance applications, eliminating the need to search for insurance providers or meet with agents. This streamlined process allows tenants to focus on the move-in process and have peace of mind knowing that their belongings are covered.

Comparison: SafeStor vs. MiniCo

Coverage and Benefits

| | SafeStor | MiniCo |

|———————|——————————————-|—————————————————–|

| Property Coverage | ✔️ | ✔️ |

| Contents Coverage | ✔️ | ✔️ |

| Liability Coverage | ✔️ | ✔️ |

| Claims Handling | Efficient and customer-centric | Efficient and customer-centric |

| Tenant Options | Tenants can purchase individual coverage | Tenants can choose Pay-With-Rent or TenantOne Direct |

Customer Service

Both SafeStor and MiniCo are known for their excellent customer service. They prioritize assisting policyholders with any questions or concerns, making the insurance experience as smooth as possible. With years of experience in the self-storage industry, both companies understand the unique needs and challenges faced by self-storage businesses and tenants.

Convenience for Self-Storage Businesses

| | SafeStor | MiniCo |

|————————-|—————–|———————————————-|

| Bundling Coverage Costs | ✔️ | ✔️ |

| Administrative Effort | Minimal | Minimal |

| New Revenue Stream | ✔️ | ✔️ |

SafeStor and MiniCo offer convenient options for self-storage businesses to bundle coverage costs into tenants’ monthly rental fees, providing a new revenue stream for the business and minimizing administrative effort. Both companies understand the importance of making insurance implementation as effortless as possible for self-storage operators.

Therefore, having covered storage unit insurance offers financial protection and peace of mind for renters. MiniCo’s TenantOne Direct Tenant Insurance program provides an easy and convenient way for tenants to obtain insurance specifically tailored for their stored items. Comparing SafeStor and MiniCo, both companies offer comprehensive coverage and exceptional customer service. They also prioritize convenience for self-storage businesses, making insurance implementation effortless. Whether you are a self-storage operator or a tenant, considering these reputable insurance companies is essential for your insurance needs.

Conclusion

Summary of different insurance options for storage units

When it comes to insuring your stored items, there are several options to consider. SafeStor and MiniCo are two reputable companies that offer comprehensive coverage for storage units. Both companies provide property coverage, contents coverage, and liability coverage, ensuring that your belongings are protected from theft, vandalism, and weather-related damage. They also have efficient claims handling processes and prioritize customer service.

TenantOne Direct Tenant Insurance, offered by MiniCo, provides an easy and convenient way for tenants to obtain insurance specifically tailored for their stored items. Tenants can choose between the Pay-With-Rent option or the TenantOne Direct option. The program is implemented seamlessly in self-storage facilities, with MiniCo handling the underwriting and claims processes. This eliminates the need for tenants to search for insurance providers or meet with agents, offering them convenience during the move-in process.

Recommendation for Discount Storage Insurance as the preferred choice

While both SafeStor and MiniCo offer comprehensive coverage and exceptional customer service, Discount Storage Insurance stands out as the preferred choice. They provide comprehensive storage unit insurance coverage for items stored in various locations, including storage facilities, homes, during transit, or in commercial business locations. Their policies offer low deductibles for claims, ensuring that you are adequately covered without breaking the bank. Furthermore, having storage unit insurance prevents the risk of cancellation to your homeowner’s policy should a claim occur.

By filling out their online form, you can easily explore rental storage insurance options and find the right coverage for your storage needs. The checkout process is quick and simple, and you will receive your insurance certificate instantly. With Discount Storage Insurance, you can have peace of mind knowing that your stored belongings are protected from potential damage, burglary, or loss, regardless of their location.

Therefore, having covered storage unit insurance is essential for both tenants and self-storage operators. It provides financial protection and peace of mind, ensuring that your belongings are covered in case of any damage or loss. Discount Storage Insurance offers comprehensive coverage, low deductibles, and a convenient online application process, making them the preferred choice for storage unit insurance. Whether you are a tenant or a self-storage operator, considering Discount Storage Insurance for your insurance needs is highly recommended.

Discover Does state farm renters insurance extend to a storage unit.

1 thought on “Best insurance on storage units”