Assurant storage unit insurance

The availability of a storage unit in an apartment complex can be a great convenience for renters who need extra space to store belongings. However, the possibility of damage or loss to items in storage can be a source of worry. This prompts many renters to ask whether or not their renters insurance policy covers storage units. In this blog, we will explore if Assurant renters insurance covers storage units and why storage unit insurance is important.

What is Assurant storage unit insurance?

Assurant renters insurance policies typically include coverage for personal property whether it is inside the rental unit, in transit or stored in a storage unit. As a result, if items stored in a storage unit are damaged, stolen or destroyed, the Assurant renters insurance policy should provide coverage for the loss. However, it is always best to check the specific details of the policy to ensure that it provides the necessary coverage for a particular storage unit.

Why do you need storage unit insurance?

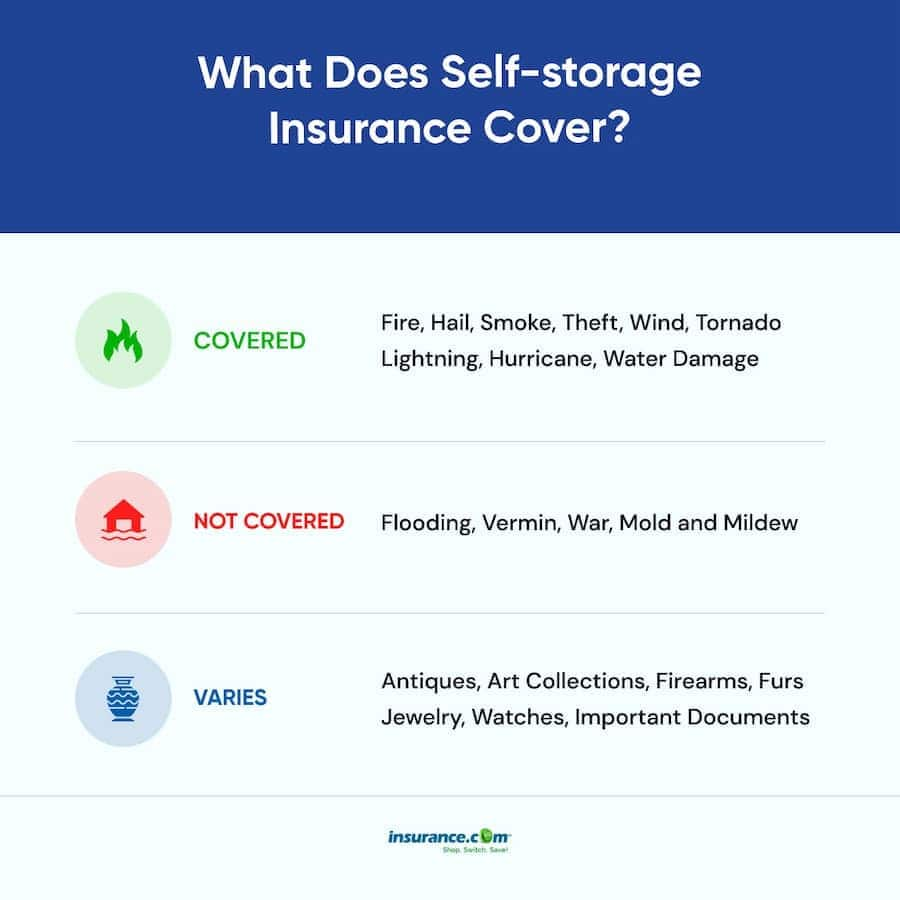

While it is tempting to think that items in storage will be safe from damage, loss or theft, the reality is that anything can happen. Storage units are not immune to floods, fires, natural disasters, theft or vandalism. Therefore, it is essential to have insurance coverage in place to protect your personal property in a storage unit.

In addition, most storage facilities require their renters to provide insurance for the contents of the storage unit. It is worth noting, however, that the insurance coverage provided by the storage facility may be minimal and insufficient to fully cover the cost of lost or damaged items. Renters should always consider taking out their own insurance policy to supplement the coverage offered by the storage facility.

Therefore, if you have Assurant renters insurance, it is highly likely that coverage includes protection for your possessions stored in a storage unit. However, it is important to check the specifics of your policy to ensure that your personal property is fully covered. Additionally, it is strongly recommended to invest in storage unit insurance to protect your belongings against unforeseen events.

Coverage Options

Types of coverage options available

Assurant renters insurance offers a variety of coverage options to their customers. Some of these options include personal property coverage, liability coverage, additional living expenses coverage, guest medical coverage, and identity theft coverage. Personal property coverage is the most common coverage that renters require. It covers the damages or theft of personal belongings such as furniture, electronics, clothing, and jewelry.

What does the coverage include?

Assurant renters insurance covers personal property anywhere in the world, including storage units outside of the rented apartment. However, the coverage for storage units is usually only 10% of the normal limit. For example, if the renters insurance limit is $50,000, the coverage for storage units would be $5,000. Renters who require additional coverage for their storage units can purchase a separate policy.

It is crucial to read through the terms and conditions of the renters insurance policy to understand the extent of coverage and limitations. Renters can also reach out to Assurant directly to discuss coverage options and clarify any doubts or questions they may have regarding their coverage.

Therefore, Assurant renters insurance covers a storage unit as personal property coverage includes belongings anywhere in the world. However, coverage for storage units is typically limited to only 10% of the normal limit, and renters may require additional coverage for their storage units. It’s essential to read through the policy document or discuss coverage options with Assurant to fully understand the extent of coverage and limitations.

Cost of Assurant Storage Unit Insurance

How much does Assurant storage unit insurance cost?

The cost of Assurant storage unit insurance varies depending on various factors such as the renter’s location, the amount of coverage required, and the value of the stored items. Generally, renters can expect to pay a monthly or annual premium ranging from $10 to $30 for storage unit insurance through Assurant. It is essential to note that the cost of the policy varies based on the level of coverage selected. Renters can choose coverage based on the value of the stored belongings. For instance, the cost of insuring a storage unit with $5,000 worth of personal belongings will be lower than the cost of coverage for a unit storing items worth $20,000.

Factors affecting the cost of insurance

Various factors influence the cost of Assurant storage unit insurance, including:

1. Location: The cost of storage unit insurance varies depending on the renter’s location. For instance, renters in major cities may pay more for coverage compared to those in rural areas.

2. Coverage limit: Renters can choose the coverage limit they require when purchasing a policy. The higher the coverage limit, the higher the premium.

3. Value of stored items: The value of the items stored in the unit will also influence the cost of insurance. Renters can opt for a higher coverage limit if they have expensive items in storage, which will increase premiums.

4. Deductibles: The deductible is the amount that the renter pays when making a claim for damages. A higher deductible may result in lower premiums, while a lower deductible attracts higher premiums.

5. Security measures: Storage units with high-security measures are considered to be less risky, hence attracting lower premiums. Features such as surveillance cameras, alarms, and onsite security personnel may reduce the cost of storage unit insurance.

Therefore, the cost of Assurant storage unit insurance depends on various factors that renters should consider when purchasing a policy. Understanding the level of coverage required, the value of stored items, location, and security measures can help renters make informed decisions on the most cost-effective policy for their storage unit. It’s crucial to read through the policy document or reach out to Assurant support for further clarification on coverage and cost.

How to Purchase Assurant Storage Unit Insurance

How to find Assurant storage unit insurance near you

Assurant offers storage unit insurance as part of its renters insurance policies. Renters who require additional coverage for their storage units can purchase a separate policy through Assurant. To find Assurant storage unit insurance near you, simply visit their website and enter your location details. The website will provide a list of agents located in your area who can assist you with purchasing storage unit insurance. Alternatively, you can also call the Assurant customer support hotline and speak directly to an agent who can guide you through the purchase process.

How to purchase Assurant storage unit insurance online

Renters who prefer the convenience of purchasing insurance online can visit the Assurant renters insurance website and explore their product offerings. To purchase storage unit insurance online, renters can select the “Add-ons” option when buying a policy and choose the amount of coverage they require for their storage unit. Renters can also customize their policy by adding additional coverage options as needed, such as liability coverage or identity theft coverage. Once the policy is selected and the payment is made, renters can print out their insurance documents for safekeeping.

It is essential to read through the policy document and understand the terms and conditions of the storage unit insurance policy before making a purchase. Renters must also ensure that the coverage they select is sufficient for the value of the items they are storing in the unit. In the event of a loss, renters can reach out to Assurant directly to file a claim and receive compensation for damages or losses covered by the policy.

Therefore, finding and purchasing Assurant storage unit insurance is a straightforward process that can be done online or in-person through their network of agents. Renters who require additional coverage for their storage units should consider purchasing a separate policy to ensure their belongings are fully protected. As with any insurance policy, it’s crucial to read through the terms and conditions and understand the extent of coverage before making a purchase. Assurant’s customer support team is always available to assist renters with any questions or concerns they may have about their coverage.

Claim Process

How to file a claim with Assurant storage unit insurance

In the unfortunate event of damage or loss to your storage unit contents, Assurant provides a simple and easy process for filing a claim. As an Assurant policyholder, you can file a claim online, by phone, or through their mobile app. The first step is to visit the “Claims & Support” section of the Assurant website and select the appropriate claim form.

To file a storage unit insurance claim, renters will need to provide details about the incident that caused the damage or loss, such as the date and time, the cause of the damage (if known), and the value of the items affected. Renters will also need to provide their policy number and contact details, so Assurant can reach out to them if they require any additional information.

What documents do you need to file a claim?

When filing a claim for storage unit insurance, renters will need to submit a few critical documents to support their claim. These typically include a copy of the storage unit lease agreement or rental contract, photos of the damaged items, a police report (if applicable), and any receipts or invoices that demonstrate the value of the lost or damaged items. The more documentation that renters can provide to support their claim, the faster and more efficiently Assurant can process the claim and provide compensation for covered losses.

What is the claim review process?

Once a storage unit insurance claim is submitted, Assurant will review all available documentation and investigate the incident to determine the extent of the coverage and the amount of compensation due. If necessary, Assurant may send a claims adjuster to assess the damage and provide an estimate for repairs or replacement costs. Once the claim has been reviewed and approved, Assurant will provide renters with compensation for their covered losses, typically through direct deposit or a check.

It’s important to note that the time it takes to process a storage unit insurance claim can vary depending on the complexity of the claim and the availability of documentation. Renters can check the status of their claim at any time through the Assurant claims portal or by contacting customer support. Assurant’s customer support team is available 24/7 to answer any questions or concerns renters may have about the claims process.

Therefore, filing a claim for Assurant storage unit insurance is a straightforward process that can be completed online, by phone, or through the mobile app. Renters will need to provide details about the incident, supporting documentation, and contact information. Assurant will review all documentation and investigate the incident, providing compensation for covered losses once the claim is approved. Renters can check the status of their claim at any time and contact customer support for assistance with the claims process.

How to Purchase Assurant Storage Unit Insurance

Renters who require additional coverage for their storage units can purchase a separate policy through Assurant, which offers storage unit insurance as an add-on to their renters insurance policies. To find Assurant storage unit insurance near them, renters can visit their website and enter their location details. Alternatively, they can call the Assurant customer support hotline and speak directly to an agent to guide them through the purchase process.

For renters who prefer the convenience of purchasing insurance online, Assurant also offers a seamless online buying experience. Renters can select the “Add-ons” option when buying a policy and choose the amount of coverage they require for their storage unit. They can customize their policy by adding additional coverage options such as liability coverage or identity theft coverage. Once the policy is selected, and the payment is made, renters can print out their insurance documents for safekeeping.

It is essential to read through the policy document and understand the terms and conditions of the storage unit insurance policy before making a purchase. Renters must also ensure that the coverage they select is sufficient for the value of the items they are storing in the unit. In the event of a loss, renters can reach out to the Assurant immediately to file a claim and receive compensation for damages or losses covered by the policy.

What is not covered in Assurant Storage Unit Insurance?

Like any insurance policy, Assurant’s storage unit insurance has some exclusions. The policy does not cover damages caused by flooding, earthquakes, hurricanes, and other natural disasters, unless these perils are added as separate coverage options. Also, the policy does not protect against damage incurred by inadequate maintenance of the storage unit.

How long does it take to process a claim?

The time it takes to process a claim varies depending on the complexity of the case. However, after filing a claim, the Assurant claims team typically contacts the policyholder within 24-48 hours to gather more information and start the claim evaluation process. Once the evaluation is complete, the claims team will communicate the decision and the amount of compensation for the loss or damages covered by the policy.

Can you cancel your storage unit insurance?

Yes, renters can cancel their storage unit insurance at any time by contacting Assurant’s customer support team. The policyholder will receive a prorated refund for any unused period. It’s essential to note that there may be cancellation fees, depending on the terms of the policy, and renters should review the policy document before cancelling their coverage.

Therefore, purchasing storage unit insurance through Assurant is a straightforward process that can be done online or in-person through their network of agents. Renters should be aware of the exclusions and coverage limits of their policy before making a purchase. In the event of a loss, they can trust Assurant’s responsive and experienced claims team to process their claims efficiently and compensate them for any damages or losses covered by their policy.

Benefits of Assurant Storage Unit Insurance

Purchasing Assurant storage unit insurance can provide several benefits for renters. Here are some of the advantages of having this coverage:

Peace of mind

Storage unit insurance from Assurant can give renters peace of mind, knowing that their belongings are protected against loss or damage. This coverage can help them avoid financial hardship caused by unexpected events such as theft, fire, or vandalism.

Protection against theft, damage, and natural disasters

Assurant’s storage unit insurance can cover renters against theft, damage caused by fire, smoke, or water, and other types of perils that can cause loss or damage to their stored items. Some policies also include coverage for natural disasters such as hurricanes, floods, and earthquakes. However, it is essential to note that this coverage may come as an optional add-on to policies and is not included by default.

Moreover, renters can customize their coverage by adding optional endorsements to protect them against specific risks such as liability claims or identity theft.

It is essential to consider the value of the items stored in the unit and the risks associated with the location before purchasing a policy from Assurant. Renters should also read through the policy document and ensure that the coverage limits and exclusions meet their needs.

Therefore, Assurant storage unit insurance provides renters with a simple and convenient way to protect their belongings against potential loss or damage. With affordable rates and customizable coverage options, renters can have peace of mind knowing that their stored items are safeguarded against unexpected events.

How to Purchase Assurant Storage Unit Insurance

Renters who require additional coverage for their storage units can purchase a separate policy through Assurant, which offers storage unit insurance as an add-on to their renters insurance policies. To find Assurant storage unit insurance near them, renters can visit their website and enter their location details. Alternatively, they can call the Assurant customer support hotline and speak directly to an agent to guide them through the purchase process.

For renters who prefer the convenience of purchasing insurance online, Assurant also offers a seamless online buying experience. Renters can select the “Add-ons” option when buying a policy and choose the amount of coverage they require for their storage unit. They can customize their policy by adding additional coverage options such as liability coverage or identity theft coverage. Once the policy is selected, and the payment is made, they can print out their insurance documents for safekeeping.

It is essential to read through the policy document and understand the terms and conditions of the storage unit insurance policy before making a purchase. Renters must also ensure that the coverage they select is sufficient for the value of the items they are storing in the unit. If they experience a loss, renters can reach out to Assurant immediately to file a claim and receive compensation for damages or losses covered by the policy.

What is not covered in Assurant Storage Unit Insurance?

Like any insurance policy, Assurant’s storage unit insurance has some exclusions. The policy does not cover damages caused by flooding, earthquakes, hurricanes, and other natural disasters, unless these perils are added as separate coverage options. Also, the policy does not protect against damage incurred by inadequate maintenance of the storage unit.

How long does it take to process a claim?

The time it takes to process a claim varies depending on the complexity of the case. However, after filing a claim, the Assurant claims team typically contacts the policyholder within 24-48 hours to gather more information and start the claim evaluation process. Once the evaluation is complete, the claims team will communicate the decision and the amount of compensation for the loss or damages covered by the policy.

Can renters Cancel their storage unit insurance?

Yes, renters can cancel their storage unit insurance at any time by contacting Assurant’s customer support team. The policyholder will receive a prorated refund for any unused period. It’s essential to note that there may be cancellation fees, depending on the terms of the policy, and renters should review the policy document before canceling their coverage.

Customer Reviews and Feedback

What do customers say about Assurant storage unit insurance?

Assurant storage unit insurance has received mixed reviews from customers. On Trustpilot, Assurant has an average rating of 3.7 out of 5 based on over 12,500 reviews. Customers appreciate the affordable cost of the insurance and the helpful customer service. However, some complaints indicate difficulties in filing claims online, while others mention issues with Assurant’s claims process.

Pros and cons of the insurance

Pros:

-

Affordable cost of insurance

-

Easy to purchase online or through an agent

-

Availability of add-on coverage options

-

Responsive customer service

Cons:

-

Exclusions in the policy might limit coverage for some renters

-

Filing claims online can be challenging

-

The complexity of claims process might lead to delays in receiving compensation

Therefore, renters can purchase storage unit insurance through Assurant either online or through their network of agents. It is vital to read through the policy document and ensure that the coverage is adequate for the value of the items stored in the unit. While the insurance has some exclusions to be aware of, renters can count on Assurant’s responsive customer service if they experience a loss.

How to Purchase Assurant Storage Unit Insurance

Renters who need coverage for their storage units can purchase a separate policy from Assurant. The insurance company offers storage unit insurance as an add-on to their renters insurance policies. They can visit the Assurant website, enter their location details and buy storage unit insurance. Additionally, they can call the customer support hotline and get help from an agent to guide them through the purchase process. For renters who prefer the convenience of purchasing insurance online, Assurant offers a seamless online buying experience. Once purchased, renters should read through the policy document and understand the terms and conditions of the storage unit insurance policy. They must also ensure that the coverage they select is sufficient for the value of the items they are storing in the unit. If they experience a loss, renters can reach out to Assurant immediately to file a claim.

What is not covered in Assurant Storage Unit Insurance?

Like any insurance policy, Assurant’s storage unit insurance has some exclusions. The policy does not cover damages caused by flooding, earthquakes, hurricanes, and other natural disasters, unless these perils are added as separate coverage options. Also, the policy does not protect against damage incurred by inadequate maintenance of the storage unit.

How long does it take to process a claim?

The time it takes to process a claim varies depending on the complexity of the case. However, after filing a claim, the Assurant claims team typically contacts the policyholder within 24-48 hours to gather more information and start the claim evaluation process. Once the evaluation is complete, the claims team will communicate the decision and the amount of compensation for the loss or damages covered by the policy.

Can renters Cancel their storage unit insurance?

Yes, renters can cancel their storage unit insurance at any time by contacting Assurant’s customer support team. The policyholder will receive a prorated refund for any unused period. Renters should review the policy document before canceling their coverage as there may be cancellation fees.

Customer Reviews and Feedback

What do customers say about Assurant storage unit insurance?

Assurant storage unit insurance has received mixed reviews from customers. On Trustpilot, Assurant has an average rating of 3.7 out of 5 based on over 12,500 reviews. Customers appreciate the affordable cost of the insurance and the helpful customer service. However, some complaints indicate difficulties in filing claims online, while others mention issues with Assurant’s claims process.

Pros and cons of the insurance

Pros:

– Affordable cost of insurance

– Easy to purchase online or through an agent

– Availability of add-on coverage options

– Responsive customer service

Cons:

– Exclusions in the policy might limit coverage for some renters

– Filing claims online can be challenging

– The complexity of claims process might lead to delays in receiving compensation

Conclusion

Renters can purchase storage unit insurance through Assurant either online or through their network of agents. Although the insurance has some exclusions to be aware of, customers appreciate the affordable cost of the insurance and responsive customer service. Renters must ensure that the coverage is sufficient for the value of the items stored in the unit. When they experience a loss, renters can count on Assurant’s customer service to file a claim and receive compensation if it is covered by the policy.

Is Assurant storage unit insurance worth it?

Assurant storage unit insurance is worth considering for renters who need to cover their storage unit contents. The cost is affordable, and the insurance company offers helpful customer service. Renters should review the policy document and ensure that the coverage is adequate for the value of the items stored in the unit.

Final thoughts and recommendations.

Therefore, Assurant storage unit insurance is a good choice for renters who require additional coverage for their storage units. Renters should read through the policy document carefully, understand the terms and conditions, and ensure that the coverage is sufficient for their needs. In case of a loss, they can count on Assurant’s customer service to guide them through the claims process and receive compensation if their loss is covered by the policy.

Discover Buy storage unit insurance.