Renters insurance for storage units

If you’re looking for a secure storage space for your belongings, renting a storage unit is a good option. But what happens if your valuables get damaged or stolen while in storage? To protect your personal property from such risks, renters insurance is a must-have.

What is Renters Insurance for storage units

Renters insurance is a policy that covers your personal belongings against various perils, including fire, theft, vandalism, water damage and more. If you have a renters insurance policy, you may be eligible for coverage for your storage unit too. However, the coverage limit of your policy for personal property in a storage unit may vary depending on where you live.

Benefits of having renters insurance for storage units

Having renters insurance that covers your storage unit can bring you peace of mind. Here are some benefits of having renters insurance for storage units:

-

Protection against damage caused by natural disasters

-

Coverage for theft or damage to your belongings

-

Policies may cover the cost of temporary housing while you find a new place to live in case your rental unit is destroyed or uninhabitable.

-

Additional coverage can be obtained for expensive items such as jewelry or antiques.

While renting a storage unit can help clear some space in your home or apartment, it is important to remember that the storage facility does not insure your personal property. Thus, getting a renters insurance policy to cover your belongings is highly recommended.

Therefore, renters insurance is a valuable tool that can protect your personal property against unforeseen events, including those that may happen to your property while stored in a storage unit. To ensure that your belongings are adequately protected, it is essential to understand the specifics of your policy and coverage limits.

Coverage

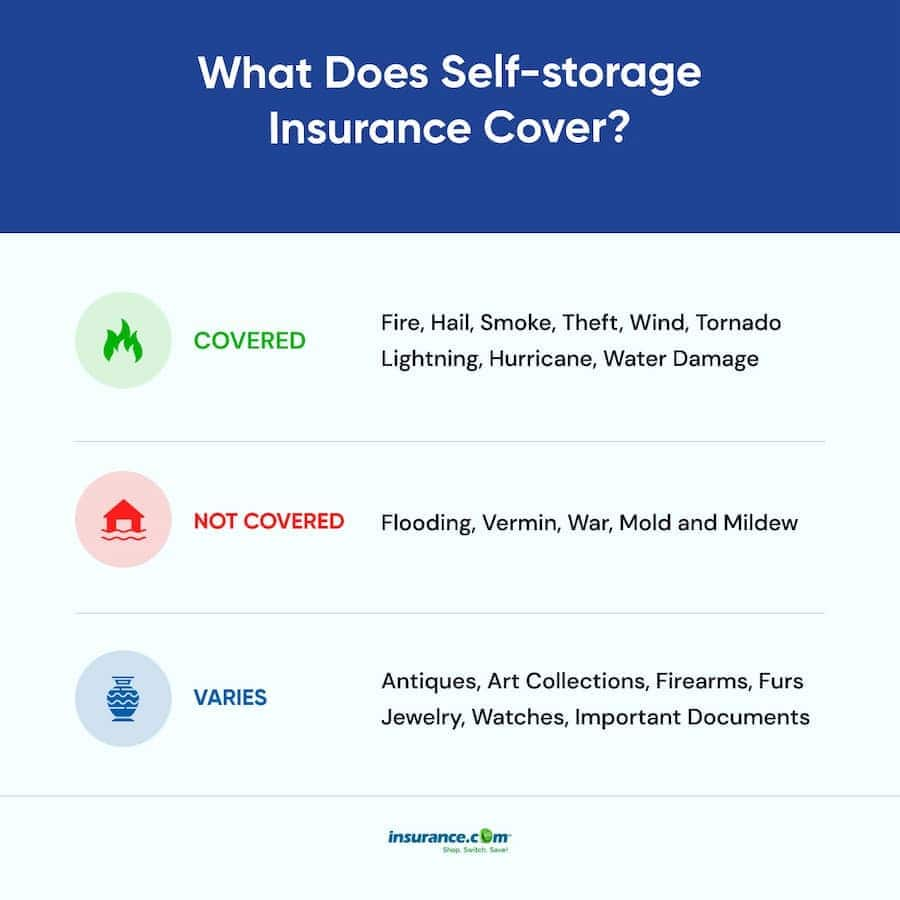

When renting a storage unit to store personal belongings, it is important to consider insurance coverage options. Renters insurance policies may offer off-premises coverage for stored possessions up to the limit stated on the policy, usually 10% of the total personal property limit. This coverage can protect against theft, vandalism, and weather-related damage up to the policy limit and minus any deductible. However, it is important to note that damage from mold, mildew, and flooding is typically not covered.

If the coverage provided by renters insurance does not sufficiently cover stored possessions, additional storage unit insurance may be worth considering. It is important to review the policy details for any exclusions, such as coverage exclusions for particularly valuable items like money, jewelry, or furs. In these cases, adding an endorsement to the renters policy may provide additional coverage.

When deciding how much additional coverage to purchase, it is important to consider the value of the stored possessions. For example, if a renter has $15,000 worth of personal belongings in a storage unit, they may want to purchase $10,000 worth of additional coverage.

Extent of Coverage offered by the renters insurance for storage units

Renters insurance policies can vary in the amount of coverage offered for off-premises storage units. It is important to review the policy details to understand the extent of coverage offered for stored possessions. Generally, renters insurance policies provide coverage for theft, vandalism, and weather-related damage up to the policy limit and minus any deductible. However, it is important to note that damage from mold, mildew, and flooding is typically not covered.

It is important to consider the value of stored possessions and whether the coverage offered by renters insurance is sufficient. If the renter has particularly valuable items, such as jewelry or watches, that are not covered by the policy, they may want to consider adding an endorsement for additional coverage.

Exclusions to the coverage in renters insurance

Renters insurance policies may have exclusions to the coverage offered for stored possessions. It is important to review the policy details to understand any exclusions that may apply, such as coverage exclusions for particularly valuable items like money, jewelry, or furs. In these cases, adding an endorsement to the renters policy may provide additional coverage.

Some insurance policies may limit off-residence coverage to theft only. It is important to review the policy details to ensure that the coverage offered is sufficient for the stored possessions. If the coverage is not sufficient, additional storage unit insurance may be worth considering. However, it is important to review the policy details for any exclusions and to ensure that the additional coverage will provide sufficient protection for the stored possessions.

Cost

When considering insurance coverage for a storage unit, cost is a significant factor to consider. Renters insurance policies typically offer off-premises coverage for stored possessions up to the limit stated on the policy, usually 10% of the total personal property limit. This coverage can protect against theft, vandalism, and weather-related damage up to the policy limit and minus any deductible. On average, renters insurance policies that include coverage for storage units cost around $29 a month or $347 annually. This coverage typically includes a limit of $40,000 for personal property and $100,000 of liability protection with a $1,000 deductible.

However, the cost of renters insurance policies for a storage unit is affected by various factors. The amount of coverage you choose, what you are storing, the value of your items, and your storage unit’s size all affect the premium. Additionally, some insurance policies may limit off-residence coverage to theft only. In this case, it may be worth considering additional storage unit insurance. This can be purchased directly through the storage company, but it can be quite pricey.

Factors affecting the cost

The amount of coverage chosen affects the monthly premium for renters insurance policies for storage units. If a renter has particularly valuable items, they may want to consider adding an endorsement for additional coverage. Typically, renters insurance policies will cover up to a certain dollar amount, with the option to add endorsements for higher coverage limits. It is important to consider the value of stored possessions and whether the coverage offered by renters insurance is sufficient.

Another factor affecting the cost is what is being stored. Some items may be more expensive to insure, such as jewelry or other valuable items. Some renters insurance policies may also have exclusions that apply to certain types of personal property, like watercraft or musical instruments. Renters should carefully review policy details and discuss any specific items to ensure they are covered sufficiently.

Storage unit size also impacts the cost of renters insurance for storage units. If renters are storing items in a larger unit, the coverage cost may increase due to a higher number of items being stored.

Comparison of different renters insurance policies for storage units

Most renters insurance policies include a special caveat for storage units, providing off-premises coverage for stored possessions. However, the extent of the coverage may vary. It is important to review the policy details to ensure the coverage meets the renter’s needs. Some policies may have limits on the value of items covered or may exclude certain types of personal property.

If the renters insurance policy does not provide sufficient coverage, additional storage unit insurance may be worth considering. Two common options for this are tenant insurance and tenant-protection plans. Tenant insurance is similar to renters insurance, but it is designed specifically for storing personal belongings in a self-storage unit. Tenant-protection plans, on the other hand, offer more limited coverage, typically protecting against fire, theft, and water damage.

When deciding between tenant insurance and tenant-protection plans, renters should carefully review the policy details and weighing the benefits of each. Tenant insurance typically offers more comprehensive coverage but may be more expensive. On the other hand, tenant-protection plans may be less expensive, but the coverage provided may be more limited. Ultimately, the choice will depend on the renter’s needs and budget.

Eligibility Criteria

Renters insurance provides coverage for personal property stored in a storage unit against theft, vandalism, and weather-related damage up to the policy limit. However, not all renters are eligible for this coverage.

Who is eligible for renters insurance for storage units?

To be eligible for renters insurance coverage for storage units, the renter must have an active renters insurance policy. Renters insurance policies may offer off-premises coverage for stored possessions up to the limit stated on the policy, usually 10% of the total personal property limit.

In addition, the renter must have a storage unit that meets the requirements set by the insurance company. The storage unit must be secure and have a locking mechanism. Storage units that are shared with others are typically not eligible for coverage under renters insurance policies.

Documentation required for renters insurance

To apply for renters insurance, the renter will need to provide basic information such as name, address, and contact information. The insurance company may also require the renter to provide documentation such as a lease agreement or proof of ownership for the stored property.

If a claim is filed for damages to stored property, the renter will need to provide documentation to support their claim. This may include a police report for stolen items, receipts or invoices for damaged items, and photos or video footage of the damage or loss.

It is important to keep all documentation related to stored personal property in a secure location. This includes receipts, photos, and other important documents that may be needed to file a claim with the insurance company.

Types of Renters Insurance providers for storage units

There are many insurance providers that offer renters insurance coverage for stored personal property. Generally, these providers fall into two categories: online and offline.

Comparison between online and offline services

Online insurance providers offer renters insurance quotes and coverage online. They often have streamlined processes for applying and filing claims. Offline providers, on the other hand, require in-person consultations and may have slower turnaround times for claims processing.

The benefits of online renters insurance providers include convenience, ease of use, and often lower premiums due to lower overhead costs. Offline providers may offer a more personalized experience, including face-to-face consultations and personalized coverage options.

Selection criteria

When selecting an insurance provider for renters insurance coverage on stored personal property, there are a few key factors to consider:

– Coverage limits: It is important to choose a provider that offers coverage limits that meet your needs. Consider the value of the property you are storing and choose a provider that offers coverage up to that value.

– Deductibles: Consider the deductible options offered by the provider. A higher deductible may result in lower premiums, but it also means paying more out of pocket in the event of a claim.

– Reputation: Look for an insurance provider with a strong reputation for customer service, claims processing, and financial stability. Check online reviews and ratings to gauge other customers’ experiences.

– Discounts: Some insurance providers offer discounts for bundling policies, such as renters and auto insurance, or for having safety features such as smoke detectors or security systems.

Therefore, renters insurance can provide coverage for personal property stored in a storage unit in the event of theft, vandalism, or weather-related damage up to the policy limit. Eligibility for this coverage depends on having an active renters insurance policy and meeting the requirements set by the insurance company. When selecting an insurance provider, consider coverage limits, deductibles, reputation, and possible discounts. Online and offline providers offer varying benefits, so it is important to weigh the options and choose the best fit for your needs.

Filing a Claim

When an incident occurs at a self-storage facility that results in property damage or loss, the renter needs to file a claim with their renters insurance company. Here is a step-by-step guide on how to file a claim for self-storage insurance:

Procedure for filing a claim

1. Report the incident: Notify the insurance company as soon as possible and provide them with all the necessary information about the incident. The renter should have their policy information ready to reference.

2. Gather documentation: The renter should gather all the facts and formal documentation required to support their claim. This may include an incident report, photos of the damaged property, and receipts or invoices for the damaged or lost items.

3. Wait for inspection: An adjuster will need to review the loss and inspect the property to determine the extent of the damage and assess how the renter’s insurance policy may apply.

4. File the claim: Once all the required documentation has been gathered and reviewed, file the claim with the insurance company.

Dos and Don’ts

To ensure the claim process goes smoothly, here are some dos and don’ts for renters filing a self-storage insurance claim:

Dos:

– Notify the insurance company as soon as possible after an incident occurs.

– Gather all necessary documentation to support the claim.

– Follow the instructions and guidance of the insurance company.

– Cooperate with the adjuster during the inspection process.

Don’ts:

– Do not wait too long to report the incident.

– Do not exaggerate or falsify the extent of the damage or loss.

– Do not dispose of any damaged items until instructed to do so by the insurance company.

– Do not attempt to repair or replace damaged items before receiving approval from the insurance company.

Filing a claim for self-storage insurance can be a stressful process, but following these steps and guidelines can help ensure a smooth and successful outcome.

Optional Add-ons

If renters are looking for additional coverage options to protect their personal property in a storage facility, there are several add-ons that can be included in their renters insurance policy. Here are some of the most common additional coverage options available for renters insurance:

– Replacement cost coverage: This add-on covers the cost of replacing lost or damaged items with new items, rather than their actual cash value.

– Scheduled property coverage: This coverage is for high-value items that are not covered under standard renters insurance policies, such as jewelry, art, or collectibles.

– Flood insurance: Most renters insurance policies do not cover damage caused by flooding, but this add-on can protect renters against flood-related damage.

– Earthquake insurance: Similar to flood insurance, this coverage is not typically included in standard renters insurance policies but can be added on to provide protection in areas prone to earthquakes.

– Identity theft coverage: This add-on provides protection against identity theft, including the cost of restoring credit, legal fees related to identity theft, and other related expenses.

– Pet liability coverage: If a renter owns a pet, this add-on can protect them against liability claims related to damages or injuries caused by their pet.

Additional coverage options available for renters insurance

When considering whether to add any of these options, renters should consider the additional cost and benefits of each. Some policies may include these coverages automatically, while others may require extra fees.

Comparison of cost and benefits

It is also important for renters to compare the rates and benefits of storage unit insurance policies offered by the facility or a third-party insurer to the add-ons available through their renters insurance policy. By doing so, they can determine which option provides the best coverage for their needs at the best price. In some cases, it may be more cost-effective to purchase a separate storage unit insurance policy, while in other cases, adding an optional coverage to a renters insurance policy may be more practical.

Overall, understanding the optional add-ons available for renters insurance policies and carefully comparing the costs and benefits of each can help renters make an informed decision about how best to protect their personal property in a storage facility.

Tips for selecting the right renters insurance for storage units

When selecting renters insurance for storage units, it’s important to take several factors into consideration. Here are some tips that can help renters choose the right insurance coverage for their stored possessions:

Factors to consider while selecting renters insurance

1. Coverage limit: The coverage limit of the policy should be high enough to cover the full value of the renter’s belongings in storage.

2. Exclusions and deductibles: Renters should review the policy exclusions and deductibles to ensure they are comfortable with them.

3. Additional coverage options: Renters should explore additional coverage options to ensure their policy covers risks relevant to their stored possessions.

4. Cost: Renters should compare policy costs to ensure they are getting a fair price for the coverage they need.

Common mistakes to avoid

1. Assuming coverage is automatic: Many renters assume that self-storage insurance is automatically included in their renters insurance policy, but this is not always the case. Make sure to check with the insurance company to see if additional coverage is needed.

2. Neglecting to review the policy: Before signing up for insurance coverage, renters should review the policy in detail to ensure they are comfortable with the coverage limits, exclusions, and deductibles.

3. Underestimating the value of stored possessions: Renters should not underestimate the value of their possessions in storage and should purchase a policy with an appropriate coverage limit to avert the risk of being under-insured.

4. Not considering additional coverage options: Renters should explore additional coverage options to ensure they have coverage for risks relevant to their stored possessions, such as natural disasters, pests, and water damage.

By taking these factors into consideration and avoiding these common mistakes, renters can select the right insurance coverage for their stored possessions and safeguard their items against potential losses.

Remember, insurance companies will request that you give all the necessary information to support your claim. You will be required to provide everything from photographs to invoices so that everything can be processed accordingly. The claim process can be overwhelming or stressful, but by following the guidelines, it can be easier. Finally, it’s essential to do your research and ensure that you get the right renters insurance coverage for your self-storage unit.

Tips for selecting the right renters insurance for storage units

When selecting renters insurance for storage units, it’s crucial to consider several factors. To start with, renters should ensure that the coverage limit of the policy is high enough to cover the full value of their stored belongings. Additionally, they should review the policy’s exclusions and deductibles to ensure that they are comfortable with them. Renters may also want to explore additional coverage options to ensure that their policy covers risks relevant to their stored possessions. Finally, it’s essential to compare policy costs to ensure that they are getting a fair price for the coverage they need.

Factors to consider while selecting renters insurance

1. Coverage limit: The coverage limit of the policy should be high enough to cover the full value of the renter’s belongings in storage.

2. Exclusions and deductibles: Renters should review the policy exclusions and deductibles to ensure they are comfortable with them.

3. Additional coverage options: Renters should explore additional coverage options to ensure their policy covers risks relevant to their stored possessions.

4. Cost: Renters should compare policy costs to ensure they are getting a fair price for the coverage they need.

Common mistakes to avoid

1. Assuming coverage is automatic: Many renters assume that self-storage insurance is automatically included in their renters insurance policy, but this is not always the case. It’s crucial to check with the insurance company to see if additional coverage is needed.

2. Neglecting to review the policy: Before signing up for insurance coverage, renters should review the policy in detail to ensure they are comfortable with the coverage limits, exclusions, and deductibles.

3. Underestimating the value of stored possessions: Renters should not underestimate the value of their possessions in storage and should purchase a policy with an appropriate coverage limit to avert the risk of being under-insured.

4. Not considering additional coverage options: Renters should explore additional coverage options to ensure they have coverage for risks relevant to their stored possessions, such as natural disasters, pests, and water damage.

Overview of renters insurance policies for storage units

Renters insurance policies offer protection for personal property, regardless of whether it’s in your home or in a storage unit. Some policies even include coverage for items stored outside of your home, such as in a storage unit. Many self-storage facilities also offer insurance options, but it’s crucial to compare the coverage and cost of these policies to other options to ensure you’re getting the best deal. Ultimately, renters should do their research and choose a policy that provides the coverage they need at a fair price.

Importance of having renters insurance for storage units

Having renters insurance for storage units is essential in protecting your valuable belongings. It covers a range of risks such as theft, fire, natural disasters, and more. Without appropriate insurance coverage, renters risk losing their stored possessions and any financial investment. Therefore, it’s necessary to select the right renters insurance policy for your storage unit and ensure that you’re adequately protected.

You’ll be interested in Storage unit contents insurance.