Geico storage unit insurance

Putting one’s belongings into storage has become a common practice for many individuals. However, it is important to note that many storage unit operators will ask for proof of insurance. Homeowners or renters insurance may include coverage for stored possessions, but if not, insurance for the storage unit is necessary.

Overview of Geico storage unit insurance and why it’s important

The GEICO Insurance Agency offers an insurance policy specific to storage units. It is important to consider obtaining insurance for a storage unit because unforeseeable events can occur that may damage or destroy personal belongings.

When renting a storage unit, it is important to review and understand the lease agreement. The lease will outline regulations such as prohibiting items that may be considered a fire hazard. In addition to adhering to all regulations, it is recommended to pack belongings as if preparing for a move. Using packing paper on the bottom, sides, and top of boxes can help protect the contents inside during transit to the storage unit. Properly labeling boxes is also important when organizing the storage space.

Individuals who have auto insurance through GEICO can obtain a homeowners insurance quote for further coverage options. However, if storage unit insurance is needed, the insurance policy from GEICO’s Insurance Agency can provide coverage for stored belongings.

Therefore, having insurance for a storage unit is crucial as incidents can unexpectedly occur, causing damage or loss to personal belongings. Reviewing regulations presented in the lease agreement and packing belongings carefully can also prevent potential damage. The GEICO Insurance Agency offers options for storage unit insurance and can provide peace of mind for those storing their personal belongings.

Understanding Geico Storage Unit Insurance

What is Geico storage unit insurance?

When you rent a storage unit, the facility may ask you to provide proof of insurance. While your homeowners or renters insurance may cover your stored possessions, it’s important to consider options provided by major insurance companies like GEICO. They offer storage insurance that may be more robust than what most storage companies offer. GEICO’s storage unit insurance policies can provide peace of mind that your belongings are protected against various kinds of damage, such as storm or wind damage (hurricane, tornado, lightning, or hail), water damage, fire and smoke damage, and theft. By getting coverage from GEICO, you can store your possessions with confidence, knowing that you have adequate insurance protection in place.

What does Geico storage unit insurance cover?

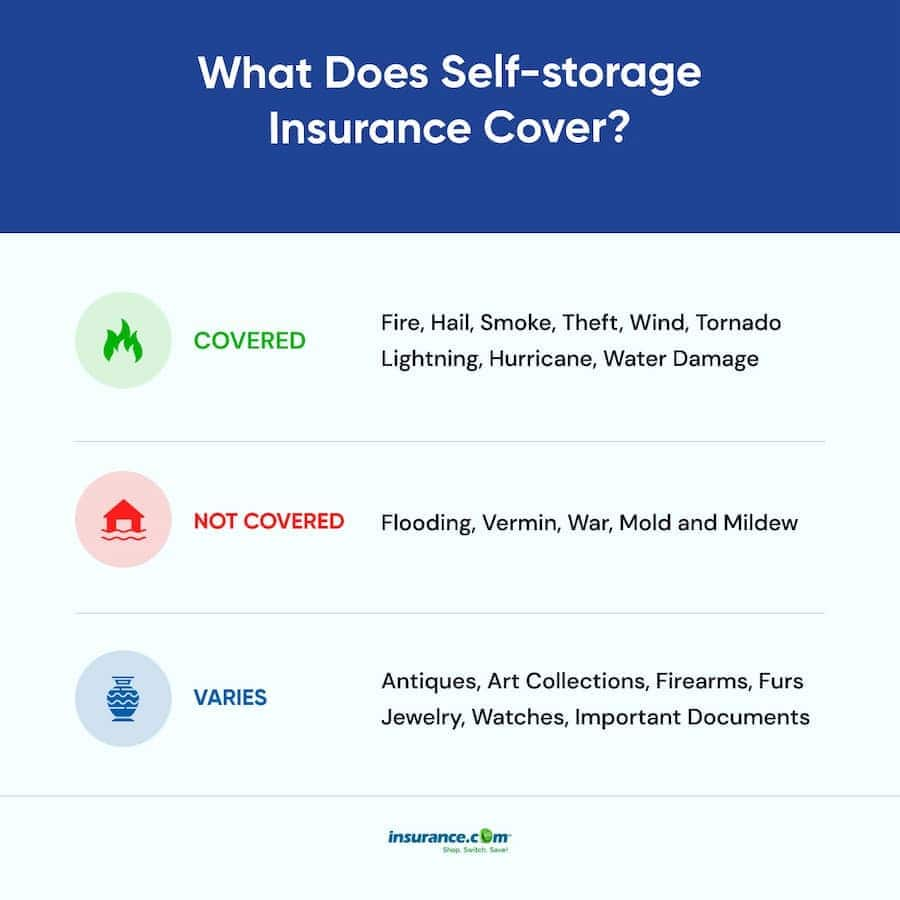

GEICO’s storage insurance policies can cover various types of damage that your belongings may be subjected to while in storage. The coverage typically includes:

– Storm or wind damage, such as damage caused by hurricanes, tornadoes, or hailstorms

– Water damage, such as damage caused by floods or leaks in the storage unit

– Fire and smoke damage, which can occur due to a variety of reasons, including electrical sparks, faulty wiring, or arson

– Theft, which can happen even in a locked storage unit.

It’s also worth noting that GEICO’s storage unit insurance policies cover not only personal possessions, but also business property. So, if you own a small business and need to store equipment, inventory, or other items, you can get the coverage you need through GEICO.

When considering storage unit insurance, it’s essential to shop around and compare coverage and rates from different providers. Keep in mind that some storage companies may offer insurance as part of their rental agreements, but those policies may not provide the same level of protection as policies offered by major insurance companies like GEICO. Additionally, some storage companies may require you to purchase their insurance, so it’s important to read through the lease agreement carefully before signing up for a storage unit.

Overall, GEICO’s storage unit insurance policies are designed to provide broad protection for your belongings while they’re in storage. By getting coverage from GEICO, you can store your items with confidence, knowing that you have adequate insurance protection in place.

Alternatives to Geico Storage Unit Insurance

Other companies that offer storage unit insurance

Aside from GEICO, there are other major insurance companies that offer storage unit insurance policies. These include:

– State Farm – State Farm is a well-known provider of homeowners and renters insurance, and the company also offers insurance for items in storage units. State Farm’s storage unit insurance coverage can protect against damage caused by fire, lightning, wind, hail, smoke, theft, and vandalism.

– Allstate – Allstate is another major insurance company that offers coverage for stored items. Like GEICO and State Farm, Allstate’s storage unit insurance coverage can protect against a variety of mishaps, including theft, fire, smoke, wind, and water damage.

– Liberty Mutual – Liberty Mutual offers a Personal Property Replacement Cost coverage that can apply to items in a storage unit. The coverage includes protection against theft, fire, lightning, and other types of damage caused by natural disasters and accidents.

It’s important to compare coverage options and rates from different insurance companies before deciding on a policy. Keep in mind that some companies may offer more comprehensive coverage for a higher premium, while others may offer barebones policies at a lower cost.

Homeowners or renters insurance options for storage unit coverage

If you have a homeowners or renters insurance policy, it’s possible that your belongings in a storage unit may already be covered. Many insurance companies include off-premises coverage, which means that your personal property is protected even when it’s not in your home. However, the coverage limits may be lower than what you need for valuable possessions, and deductibles may still apply.

Before relying on your homeowners or renters insurance for storage unit coverage, it’s important to review your policy and talk to your insurance provider to make sure you have adequate protection. You may need to purchase additional coverage or increase your coverage limits to ensure that your stored belongings are fully protected.

Therefore, when it comes to storing valuable items in a storage unit, it’s important to have insurance protection in place. While some storage companies may offer insurance, comparing policies from major insurance companies like GEICO, State Farm, Allstate, and Liberty Mutual can help you find the best coverage at the right price. Additionally, reviewing your homeowners or renters insurance policy can also help you determine if you need to purchase additional coverage for your stored possessions.

How to File a Storage Unit Insurance Claim with Geico

If your belongings sustain damage while in storage, filing a claim with GEICO is a straightforward process. Here’s what you need to know about filing a storage unit insurance claim with GEICO:

Step-by-step guide on filing a claim with Geico

1. Assess the damage: Before filing a claim, assess the extent of the damage to your belongings. Take photos of the damage as proof.

2. Gather information: To file a claim, you’ll need to have your GEICO policy number and the details of the storage facility where your belongings are stored. You should also have information about the date and time the damage occurred.

3. Contact GEICO: You can file a claim by calling GEICO’s claims center at 1-800-841-3000 or by visiting their website.

4. Provide details: During the claims process, you’ll be asked to provide details about the damage and the circumstances surrounding the incident. Be sure to provide accurate and detailed information to ensure a smooth claims process.

5. Wait for processing: After you’ve filed your claim, GEICO will review the details and process your claim. You’ll be informed of the outcome of your claim by phone, mail, or email.

Important information to include in your claim

When filing a claim with GEICO, there are a few key pieces of information to include:

– Your policy number

– The storage facility’s contact information

– A description of the damaged property

– Photos of the damage, if possible

– The date and time of the incident

– A detailed account of what happened and how the damage occurred

By providing as much information as possible, you can help ensure that your claim is processed quickly and efficiently.

Therefore, if you have GEICO storage unit insurance and your belongings are damaged while in storage, filing a claim is a straightforward process. By following the steps outlined in this guide and providing detailed information, you can help ensure a smooth claims process and get the compensation you need to replace or repair your damaged belongings.

Geico Storage Unit Insurance for Military Members

GEICO is a well-known insurance company that provides coverage for various types of vehicles, including cars, motorcycles, and boats. For military members who require storage unit insurance, GEICO offers several options that can provide coverage and savings.

Coverage options specific to deployed military members

If you are a military member who is deployed and requires storage for your vehicle, GEICO can provide a storage protection plan that will suspend or reduce your insurance coverage while your vehicle is in storage. This can help you save money on your auto insurance while deployed.

To be eligible for the discount, you must have received orders from the Department of Defense (DOD) to one of the designated areas and your vehicle must be stored under one of GEICO’s approved storage protection plans. There are some geographic limitations and exclusions for certain military operations, so it’s important to check with GEICO to determine if you are eligible for coverage.

Savings and discounts available for military personnel

In addition to the coverage options for deployed military members, GEICO also offers savings and discounts for all military personnel. This includes active duty, retired, National Guard, and Reserve Members. The following discounts are available:

– Up to 15% off for active duty and retired military members

– Up to 25% off for National Guard and Reserve members

– Emergency deployment discounts for military members who need to cancel or modify their policies due to unexpected deployment

To take advantage of these discounts, military members must provide proof of their status. This can include a military ID or a copy of their orders.

If you are a military member who requires storage unit insurance, it’s important to consider GEICO’s options for coverage and savings. By taking advantage of these benefits, you can save money on your auto insurance and have peace of mind while deployed or in storage.

Proof of Insurance for Storage Unit Operators

Why storage unit operators may ask for proof of insurance

When renting a storage unit, many operators will require proof of insurance before allowing you to store your belongings. This is because they want to protect their own liability and ensure that your items are covered in case of damage or theft. While some storage unit operators may offer their own insurance policy, many will ask you to provide proof of your own insurance coverage.

Your homeowners or renters insurance policy may include coverage for stored possessions. However, it’s important to review your policy and make sure that your insurance covers items stored outside of your home. If your policy doesn’t include storage unit coverage, you may need to purchase additional insurance.

How to provide proof of Geico storage unit insurance

If you’re a GEICO customer, you can easily provide proof of insurance for your storage unit. Simply contact GEICO by phone or visit their website to request a certificate of insurance. This document will provide proof of your coverage and can be forwarded to your storage unit operator.

In the event that your belongings are damaged while in storage, filing a claim with GEICO is a straightforward process. You’ll need to assess the damage, gather information, and contact GEICO to file your claim. Be sure to provide accurate and detailed information about the damage and the circumstances surrounding the incident to ensure a smooth claims process.

Overall, providing proof of insurance for your storage unit is an important step in protecting your belongings and ensuring that you’re prepared in case of damage or theft. By working with GEICO, you can easily obtain proof of insurance and file a claim if needed. Keep in mind that it’s important to review your policy and make sure that your coverage meets your needs before storing your belongings.

Cost and Coverage Options for Geico Storage Unit Insurance

Factors that affect the cost of Geico storage unit insurance

When it comes to obtaining insurance coverage for your storage unit, there are a variety of factors that can impact the cost of your policy. Some of the key factors that can affect the cost of your Geico storage unit insurance include:

– The amount of coverage you need: The more coverage you need to protect your stored items, the higher your insurance premiums may be.

– The location and security of your storage unit: If your storage unit is located in an area with high rates of crime or is not well-secured, your insurance premiums may be higher to account for the increased risk of theft or damage.

– Your deductible: Choosing a higher deductible will typically result in lower monthly premiums, but you’ll need to pay more out of pocket if you need to file a claim.

– Your insurance history: If you have a history of filing claims, your premiums may be higher to account for the increased risk of you needing to file another claim.

How to choose the right coverage options for your needs

When selecting a Geico storage unit insurance policy, it’s important to consider your specific needs and budget. Some factors to keep in mind include:

– The value of the items you plan to store: Make sure that your policy provides adequate coverage for all of your stored items.

– The types of items you plan to store: Some items, such as firearms or perishable goods, may not be covered by your policy.

– Your budget: Make sure that you can afford your monthly premiums and deductible, and that you’re not overpaying for coverage you don’t need.

When selecting your coverage options, it’s important to review all of the available policies and compare the benefits and costs of each. Take the time to read the fine print and ask questions if you’re unsure about any aspect of your policy.

Therefore, obtaining Geico storage unit insurance can provide peace of mind and protection for your stored belongings. By choosing the right coverage options and shopping around for the best policy, you can ensure that you’re prepared for any unexpected events that may arise. Contact Geico today to get started on a storage unit insurance policy that meets your needs.

Limitations of Geico Storage Unit Insurance

What may not be covered under Geico storage unit insurance

While Geico storage unit insurance can provide valuable coverage for your stored items, it’s important to be aware of its limitations. The policy may not cover certain events or items, and it’s important to review your policy documents and contract to ensure that you’re fully protected. Here are some things that may not be covered under Geico storage unit insurance:

– Damage caused by flooding or earthquakes: Some policies may exclude coverage for damage caused by natural disasters like earthquakes or floods. If you live in an area prone to these events, you may need to purchase additional coverage.

– Self-storage facilities without proper security measures: If the storage facility you’re using doesn’t have adequate security measures in place, such as surveillance cameras, your Geico policy may not apply.

– Items of high value: While Geico storage unit insurance can cover many of your belongings, there may be limits on coverage for items such as jewelry, art, and antiques. Be sure to review your policy to determine if you need additional coverage for these items.

How to ensure complete coverage for your stored items

To ensure that your stored items are fully protected, it’s important to review your insurance policy and contract carefully. Consider the following tips to make sure you have complete coverage:

– Review your policy documents: Look for any exclusions or limits on coverage for storage units. Make sure you understand what events and items are covered, and what may be excluded.

– Purchase additional coverage if needed: If your Geico storage unit insurance policy doesn’t provide enough coverage for items of high value or natural disasters, consider purchasing additional coverage. Speak with a Geico representative to determine what options are available.

– Choose a secure storage facility: To help ensure that your policy will apply, choose a storage facility with adequate security measures. Look for facilities with surveillance cameras, alarms, and other security features.

By taking these steps, you can help ensure that your stored items are fully protected and that you’re prepared in case of damage or theft. While Geico storage unit insurance can be a valuable resource, it’s important to review your policy carefully and make sure that it meets your needs.

Limitations of Geico Storage Unit Insurance

What may not be covered under Geico storage unit insurance

Geico storage unit insurance can provide valuable coverage for your stored items, but it’s important to be aware of its limitations. Some policyholders may not fully understand what is and is not covered under their policy, so reviewing the policy documents and contract is necessary to ensure complete coverage. Here are some potential limitations of Geico storage unit insurance:

– Damage caused by flooding or earthquakes: Some policies may exclude coverage for damage caused by natural disasters like earthquakes or floods.

– Self-storage facilities without proper security measures: Your Geico policy may not apply if the storage facility you’re using doesn’t have adequate security measures in place.

– Items of high value: While Geico storage unit insurance can cover many of your belongings, there may be limits on coverage for items such as jewelry, art, and antiques.

How to ensure complete coverage for your stored items

To ensure that your stored items are fully protected, it’s important to review your insurance policy and contract carefully. Consider the following tips to make sure you have complete coverage:

– Review your policy documents: Look for any exclusions or limits on coverage for storage units. Make sure you understand what events and items are covered, and what may be excluded.

– Purchase additional coverage if needed: If your Geico storage unit insurance policy doesn’t provide enough coverage for items of high value or natural disasters, consider purchasing additional coverage. Speak with a Geico representative to determine what options are available.

– Choose a secure storage facility: To help ensure that your policy will apply, choose a storage facility with adequate security measures. Look for facilities with surveillance cameras, alarms, and other security features.

By taking these steps, you can help ensure that your stored items are fully protected and that you’re prepared in case of damage or theft. While Geico storage unit insurance can be a valuable resource, it’s important to review your policy carefully and make sure that it meets your needs.

The benefits of Geico storage unit insurance

Geico storage unit insurance can provide valuable coverage for your stored items, including protection against theft, fire, and other events. With Geico storage unit insurance, policyholders can enjoy the following benefits:

– Coverage for a wide range of stored items: Whether you’re storing furniture, electronics, or personal items, Geico storage unit insurance can provide coverage for your belongings.

– Affordable rates: Geico’s rates for storage unit insurance are competitive, making it an affordable option for those who want to protect their stored belongings.

– Peace of mind: Knowing that your items are covered by insurance can provide peace of mind, especially if you’re storing items of high value or irreplaceable sentimental value.

Conclusion

While Geico storage unit insurance can be a valuable resource, it’s important to review the policy carefully and be aware of its limitations. Taking steps to ensure complete coverage, such as purchasing additional insurance and choosing a secure storage facility, can help ensure that your stored items are fully protected. With the benefits of Geico storage unit insurance, policyholders can enjoy affordable rates and peace of mind knowing that their stored items are covered.

Learn about Insure a storage unit.

1 thought on “Geico storage unit insurance”