Personal storage unit insurance

Overview of personal storage unit insurance and its importance

Storage unit insurance is a type of insurance coverage specifically designed to protect the belongings stored in a rented storage unit. Most storage companies require renters to have insurance coverage, as it helps safeguard both the renter and the company in case of any damage or loss to the stored items.

Having storage unit insurance is important because:

1. Protects against loss or damage: Insurance coverage provides financial protection in case of damage, theft, fire, vandalism, or other unexpected events that may occur while your belongings are stored.

2. Provides liability coverage: Storage unit insurance also typically includes liability coverage. This means that if someone is injured while on the storage unit property and you are found legally responsible, your insurance policy can help cover the costs associated with the claim.

3. Offers peace of mind: Knowing that your belongings are covered by insurance can give you peace of mind and help alleviate any worries you may have about potential loss or damage.

Things to consider before purchasing storage unit insurance

Before purchasing storage unit insurance, it’s essential to consider the following factors:

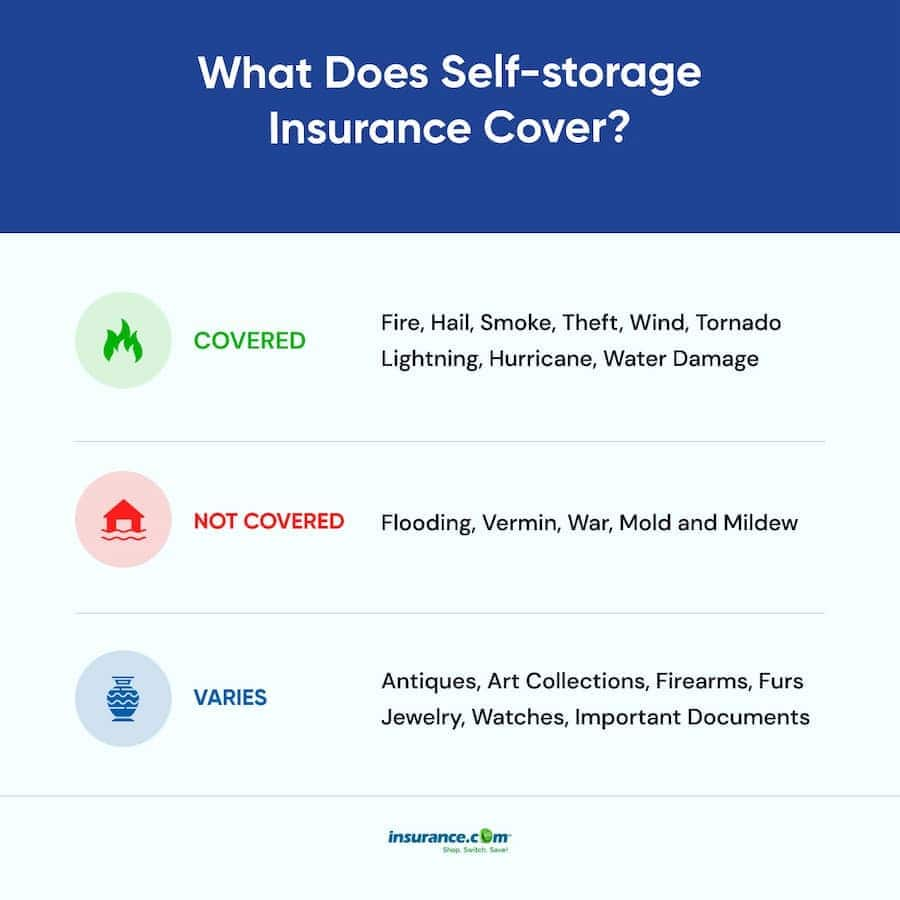

1. Coverage options: Different insurance providers may offer varying coverage options. It’s essential to understand what is specifically covered by the policy, including the types of perils covered (such as fire, theft, or water damage) and any exclusions that may apply.

2. Coverage limits: Check the coverage limits provided by the insurance policy. Ensure that the coverage amount is sufficient to protect the value of your stored belongings. You may also want to consider whether the policy has a maximum limit per item or category.

3. Deductibles: Similar to other insurance policies, storage unit insurance often includes a deductible. This is the amount you’ll have to pay out of pocket before the insurance coverage kicks in. Consider the deductible amount and choose a policy that aligns with your budget and needs.

4. Cost: Compare the cost of different insurance policies to get the best value for your money. Take into account the coverage provided, deductibles, and any additional features or benefits offered by the insurance provider.

5. Additional coverage needs: Depending on the value and nature of the items you’re storing, you may need additional coverage options such as climate control coverage or antique/collectibles coverage. Consider any specialized coverage needs before purchasing a policy.

6. Compare insurance providers: Take the time to research and compare insurance providers. Look for reputable companies with good customer reviews and a track record of reliable claims handling.

Remember, storage unit insurance is typically not included in the rental fee and is an additional expense. However, it can offer valuable protection for your stored belongings and provide peace of mind. Be sure to review all the terms and conditions of the policy before making a decision, and consider shopping around to find the best coverage and price for your needs.

Understanding Personal Storage Unit Insurance

Coverage options and what they typically include

Storage unit insurance provides financial protection for your personal belongings stored in a storage unit. It offers coverage for various risks that could damage or destroy your possessions, such as theft, vandalism, fire, water damage, and extreme weather conditions.

Here are some typical coverage options included in storage unit insurance:

– Property Damage: This covers the cost of repairing or replacing your belongings if they are damaged due to covered events like fire or water damage.

– Theft: If someone breaks into your storage unit and steals your belongings, storage unit insurance will compensate you for the value of the stolen items.

– Vandalism: If your belongings are intentionally damaged by vandals, the insurance will cover the repair or replacement costs.

– Natural Disasters: Storage unit insurance usually includes coverage for damage caused by natural disasters like hurricanes, earthquakes, or tornadoes.

– Business Inventory: If you use a storage unit to store inventory for your business, you can add coverage for that inventory to protect it from loss or damage.

Limits and exclusions to be aware of

While storage unit insurance provides valuable protection, it’s important to be aware of the limits and exclusions in your policy. Here are some common considerations:

– Coverage Limits: Each insurance policy will have a limit on the amount they will reimburse you for any loss or damage. Make sure you understand these limits and ensure they are adequate for the value of your stored belongings.

– High-Value Items: Some policies may have lower coverage limits for high-value items such as jewelry, artwork, or collectibles. If you have valuable items, you may need to purchase additional coverage or consider other options to protect them.

– Exclusions: Storage unit insurance may not cover certain events or circumstances, such as damage caused by pests, floods, or natural wear and tear. It’s important to review the policy exclusions and understand what is not covered.

– Deductibles: Like other insurance policies, storage unit insurance may have a deductible, which is the amount you need to pay out of pocket before the insurance coverage kicks in. Be sure to understand what deductible applies to your policy.

Therefore, storage unit insurance is a valuable financial safety net that provides coverage for your personal belongings stored in a storage unit. Understanding the coverage options, limits, and exclusions is crucial to ensure you have the right level of protection for your stored possessions. Whether you are storing items for personal or business reasons, storage unit insurance can offer peace of mind and protect you financially against unexpected events.

Renters Insurance for Storage Units

Explanation of how renters insurance may cover belongings in storage units

Renters insurance is a type of insurance policy that covers the belongings of individuals who rent a home or apartment. While it is primarily meant to provide coverage for personal property within the rental property itself, some renters insurance policies may also extend coverage to personal belongings stored in a storage unit.

The exact coverage for storage units under renters insurance can vary depending on the insurance company and policy. In some cases, the policy may provide coverage for belongings stored off-premises, which includes storage units. This means that if your storage unit is broken into or damaged by a covered event, such as theft or fire, your renters insurance may reimburse you for the value of the stolen or damaged items.

It’s important to note that not all renters insurance policies automatically cover belongings in storage units. Some policies may require you to add a specific endorsement or rider to your policy to extend coverage to storage units. It’s important to review your policy and speak with your insurance provider to understand the extent of coverage for storage units.

Pros and cons of relying on renters insurance for storage unit coverage

While renters insurance can provide coverage for belongings in storage units, there are some pros and cons to consider before relying solely on this type of coverage:

Pros:

– Convenience: If you already have renters insurance, adding coverage for storage units may be a convenient and cost-effective option. It eliminates the need to purchase a separate storage unit insurance policy.

– Comprehensive Coverage: Renters insurance typically provides coverage for a wide range of perils, including theft, fire, and water damage. This comprehensive coverage can give you peace of mind knowing that your belongings are protected.

– Additional Liability Coverage: In addition to covering personal belongings, renters insurance also typically includes liability coverage. This means that if someone is injured in your storage unit or if you accidentally cause damage to someone else’s property while moving your belongings, you may have liability protection.

Cons:

– Coverage Limitations: Renters insurance policies often have coverage limits for specific categories of belongings, such as high-value items like jewelry or collectibles. If you have valuable items stored in your storage unit, these coverage limits may not be sufficient to fully protect them.

– Deductibles: Like any insurance policy, renters insurance may have a deductible that you need to meet before coverage kicks in. Depending on the amount of your deductible, you may need to pay out of pocket for any losses or damages to your stored belongings.

– Policy Exclusions: Renters insurance may have exclusions that limit or exclude coverage for certain events or circumstances. It’s important to review your policy to understand what is and isn’t covered.

Overall, while renters insurance can provide coverage for belongings in storage units, it’s important to carefully review your policy and understand its limitations. If you have high-value items or have concerns about coverage limits, it may be worth considering additional storage unit insurance or exploring other coverage options. Taking the time to compare your options and understand the specifics of your insurance policies can help ensure that you have the right level of coverage for your stored belongings.

Storage Unit Insurance Providers

When it comes to choosing a storage unit insurance provider, there are several options to consider. It’s important to compare different providers to ensure you find the best coverage for your needs. Here is a comparison of some popular storage unit insurance providers:

Comparison of different storage unit insurance providers

|

Provider |

Coverage Options |

Deductible |

Policy Limit |

Price |

|---|---|---|---|---|

|

Provider A |

– Property Damage – Theft – Vandalism – Natural Disasters |

$100 |

$10,000 |

$20/month |

|

Provider B |

– Property Damage – Theft – Vandalism – Natural Disasters – Business Inventory |

$50 |

$5,000 |

$15/month |

|

Provider C |

– Property Damage – Theft – Vandalism |

$150 |

$20,000 |

$25/month |

Factors to consider when choosing a provider

When comparing storage unit insurance providers, there are several factors to consider:

– Coverage Options: Look for a provider that offers comprehensive coverage options that align with your needs. Consider what risks you are most concerned about and prioritize providers that offer coverage for those risks.

– Deductible: The deductible is the amount you will have to pay out of pocket before the insurance coverage kicks in. Choose a provider with a deductible that you are comfortable with.

– Policy Limit: The policy limit is the maximum amount the insurance provider will reimburse you for any loss or damage. Make sure the policy limit is sufficient to cover the value of your stored belongings.

– Price: Compare the prices of different providers to ensure you’re getting a competitive rate. However, don’t solely base your decision on price alone. Consider the coverage options and other factors as well.

By comparing different storage unit insurance providers and considering these factors, you can make an informed decision and find the best coverage for your personal or business storage needs. Don’t forget to review the terms and conditions of the policy and ask any questions you may have before making a final decision.

Popular Storage Unit Insurance Plans

Review of popular storage unit insurance plans and their features

When it comes to choosing a storage unit insurance provider, it’s important to compare different options to ensure you find the best coverage for your needs. Here is a review of some popular storage unit insurance plans:

|

Provider |

Coverage Options |

Deductible |

Policy Limit |

Price |

|---|---|---|---|---|

|

Provider A |

– Property Damage – Theft – Vandalism – Natural Disasters |

$100 |

$10,000 |

$20/month |

|

Provider B |

– Property Damage – Theft – Vandalism – Natural Disasters – Business Inventory |

$50 |

$5,000 |

$15/month |

|

Provider C |

– Property Damage – Theft – Vandalism |

$150 |

$20,000 |

$25/month |

Costs and benefits of each plan

When comparing storage unit insurance plans, there are several factors to consider:

– Coverage Options: Provider A and Provider B offer comprehensive coverage options that include property damage, theft, vandalism, and natural disasters. However, Provider B also covers business inventory, which may be beneficial for business storage needs. Provider C offers slightly limited coverage options.

– Deductible: Provider A has a deductible of $100, Provider B has a deductible of $50, and Provider C has a deductible of $150. Choose a plan with a deductible that you are comfortable with.

– Policy Limit: Provider A has a policy limit of $10,000, Provider B has a policy limit of $5,000, and Provider C has a policy limit of $20,000. Ensure the policy limit is sufficient to cover the value of your stored belongings.

– Price: Provider A charges $20/month, Provider B charges $15/month, and Provider C charges $25/month. Compare the prices to ensure you’re getting a competitive rate.

By considering these factors and comparing the costs and benefits of each plan, you can make an informed decision and find the best coverage for your storage needs. Don’t forget to review the terms and conditions of the policy and ask any questions you may have before making a final decision.

Tips for Buying Storage Unit Insurance

Factors to consider when determining the amount of coverage needed

* Estimate the value of your stored belongings: Take an inventory of the items you plan to store and calculate their total value. This will help you determine how much coverage you need to adequately protect your belongings in case of damage or theft.

* Consider the replacement cost: Keep in mind that the cost of replacing your belongings may be higher than their current market value. Factor in potential price increases when determining the amount of coverage you need.

* Evaluate the risks: Think about the specific risks that your storage unit may be exposed to. For example, if you live in an area prone to natural disasters, you may want to consider additional coverage for flood or earthquake damage.

Tips for getting the best deal on storage unit insurance

* Shop around: Don’t settle for the first insurance provider you come across. Compare quotes from different companies to ensure you get the best coverage at the most competitive price.

* Check with your existing insurance provider: Before purchasing storage unit insurance, check if your existing insurance policies, such as renters or homeowners insurance, provide coverage for stored belongings. You may be able to add a rider to your current policy instead of buying a separate storage unit insurance policy.

* Consider bundled coverage: Some insurance companies offer discounts if you bundle multiple policies with them. If you already have other types of insurance, such as auto or life insurance, check if the company offers storage unit insurance as well.

* Review the policy terms and conditions: Before making a final decision, thoroughly review the terms and conditions of the insurance policy. Pay close attention to coverage limits, deductibles, exclusions, and any special conditions that may apply.

* Ask for discounts: Don’t be afraid to ask the insurance provider if they offer any discounts. Some companies offer discounts for measures such as having a secure lock on your storage unit or installing an alarm system.

Taking the time to compare different storage unit insurance providers and considering these factors can help you find the best coverage for your needs. Don’t rush into a decision – take the time to research and ask questions to ensure you’re getting the right coverage at the right price. Remember, it’s always better to be prepared and protected rather than facing unexpected losses without insurance.

Making a Claim on Your Storage Unit Insurance

Step-by-step guide on how to file a claim

Filing a claim on your storage unit insurance can be a straightforward process if you follow these simple steps:

1. Review your insurance policy: Familiarize yourself with the terms and conditions of your storage unit insurance policy. Understand the coverage limits, deductibles, and any exclusions that may apply.

2. Document the damage or loss: Take photographs or videos of the damaged or stolen items as evidence. Make a detailed inventory of the items affected, including their estimated value, purchase receipts, or any other supporting documents.

3. Contact your insurance provider: Inform your insurance provider about the incident as soon as possible. Follow their specific instructions for filing a claim, which may include submitting a claim form and supporting documentation.

4. Provide necessary information: Be prepared to provide details about the incident, including the date, time, and cause of the damage or theft. Answer any questions from your insurance provider accurately and provide any additional information or documents they may require.

5. Cooperate with the investigation: Your insurance provider may need to investigate the claim to assess its validity and determine the appropriate compensation. Cooperate fully with their investigation, providing any requested information promptly.

6. Get repair or replacement estimates: If your stored items need repair or replacement, obtain quotes from reputable professionals. Keep copies of these estimates to submit to your insurance provider.

7. Review the settlement offer: Once the investigation is complete, your insurance provider will offer a settlement based on the coverage terms and the evidence provided. Review the settlement offer carefully and seek clarification if necessary.

8. Accept or negotiate the settlement: If you agree with the settlement offer, you can accept it and proceed with any necessary documentation or payments. If you believe the offer is inadequate, negotiate with your insurance provider to reach a fair resolution.

Common pitfalls to avoid when filing a claim

While filing a claim on your storage unit insurance, it’s important to be aware of common pitfalls to avoid:

1. Failure to report the incident promptly: Most insurance policies have a deadline for reporting claims. Failing to report the incident within the specified timeframe may result in denial of your claim.

2. Insufficient documentation: Inadequate documentation of the damage or loss can hinder the claims process. Take thorough photographs, keep detailed records, and collect any necessary supporting documents to strengthen your claim.

3. Misrepresentation or omission of information: Be honest and provide accurate information when filing your claim. Misrepresenting facts or omitting important details can lead to your claim being denied or delayed.

4. Lack of cooperation: Cooperate fully with your insurance provider throughout the claims process. Failure to provide requested information or delays in responding to inquiries can prolong the settlement process.

5. Accepting an unfair settlement: Don’t settle for less than what you believe is fair. If you feel the settlement offer does not adequately compensate you for the damage or loss, negotiate with your insurance provider or seek legal advice if necessary.

By following the steps outlined above and avoiding common pitfalls, you can ensure a smooth claims process for your storage unit insurance. It’s important to thoroughly understand your policy, document any damage or loss, and cooperate with your insurance provider to protect your interests and receive proper compensation.

Additional Storage Unit Insurance Considerations

Coverage for specific valuable items or collectibles

If you have valuable items or collectibles that you plan to store in your storage unit, it’s important to consider additional coverage. Standard storage unit insurance may have limitations on coverage for high-value items such as jewelry, artwork, or antiques. In such cases, you may need to purchase a separate policy or add an endorsement to your existing storage unit insurance to ensure adequate coverage for these items.

Add-ons and endorsements to enhance your storage unit insurance coverage

Some insurance providers offer add-ons or endorsements that can enhance your storage unit insurance coverage. These additional coverages may include:

* Extended coverage for specific perils: If you live in an area prone to specific risks such as hurricanes or earthquakes, you may want to consider adding extended coverage for these perils to your storage unit insurance policy.

* Business property coverage: If you plan to store business-related items in your storage unit, such as inventory or equipment, you may need to add business property coverage to your policy. This will protect your business assets in case of damage or theft.

* Climate control coverage: If you are storing items that are sensitive to temperature and humidity, such as electronics or wooden furniture, you may want to consider adding climate control coverage to your policy. This will provide coverage in case of damage caused by extreme temperatures or moisture.

* Identity theft coverage: Some insurance providers offer identity theft coverage as an add-on to storage unit insurance. This can provide coverage for expenses related to identity theft, such as legal fees and lost wages.

Before purchasing any add-ons or endorsements, carefully evaluate your storage unit insurance needs and consider if these additional coverages are necessary for your specific situation. It’s also important to review the terms and conditions of these add-ons or endorsements to ensure they provide the desired level of coverage.

By considering these additional storage unit insurance considerations, you can ensure that you have the right coverage for your stored belongings and any specific risks or valuable items you may have. Remember to compare quotes, review policy terms, and ask questions to find the best coverage for your needs. Taking these steps will give you peace of mind knowing that your belongings are protected in case of unexpected events.

Additional Storage Unit Insurance Considerations

Coverage for specific valuable items or collectibles

When considering storage unit insurance, it’s essential to think about any valuable items or collectibles you plan to store. Standard coverage may have limitations on these high-value items, such as jewelry, artwork, or antiques. Therefore, it is important to determine if you need to purchase a separate policy or add an endorsement to your existing storage unit insurance to ensure adequate coverage for these items.

Add-ons and endorsements to enhance your storage unit insurance coverage

To ensure comprehensive coverage for your stored belongings, it’s worth exploring add-ons or endorsements offered by insurance providers. These additional options can enhance your storage unit insurance coverage and may include:

– **Extended coverage for specific perils**: If you live in an area prone to risks such as hurricanes or earthquakes, consider adding extended coverage for these perils to your storage unit insurance policy.

– **Business property coverage**: If your storage unit contains business-related items, like inventory or equipment, adding business property coverage is crucial. This coverage will protect your business assets in case of damage or theft.

– **Climate control coverage**: If you are storing items sensitive to temperature and humidity, like electronics or wooden furniture, consider adding climate control coverage. This coverage provides protection against damage caused by extreme temperatures or moisture.

– **Identity theft coverage**: Some insurance providers offer add-on coverage for identity theft. This coverage can provide protection for expenses related to identity theft, such as legal fees and lost wages.

Before purchasing any add-ons or endorsements, carefully evaluate your storage unit insurance needs and determine if these additional coverages are necessary for your situation. Also, review the terms and conditions of these options to ensure they provide the desired level of coverage.

Conclusion

Summary of key points covered in the blog post:

– Storage unit insurance is essential to protect your belongings while they are in storage.

– It’s important to compare options and not feel pressured to purchase insurance from the storage rental facility.

– Additional considerations for storage unit insurance include coverage for valuable items or collectibles and available add-ons or endorsements.

– Coverage for high-value items may require separate policies or endorsements.

– Add-ons can enhance your coverage for specific risks or belongings.

Final thoughts on the importance of personal storage unit insurance:

When renting a storage unit, it’s crucial to have the right insurance coverage to protect your valuable possessions. By considering additional coverage options and evaluating your specific needs, you can ensure that you have the right level of protection. Take the time to compare quotes, review policy terms, and ask questions to find the best coverage for your needs. With personal storage unit insurance in place, you can have peace of mind knowing that your belongings are protected in case of unexpected events.

Explore Storage unit condo insurance.