Does renters insurance cover storage units

When it comes to renting a storage unit, it’s important to understand what kind of protection your belongings have in case of loss or damage. Renters insurance may cover your stored items, but there are some limitations.

Why renters insurance is important

Renters insurance is designed to protect your personal property when you’re renting a home or apartment. It can also provide liability coverage for accidents that might occur within your rental property. If you have renters insurance, it can help protect your possessions against theft, fire, and other unforeseen events.

When it comes to storage units, your renters insurance may be able to provide coverage, but only up to a certain limit. This limit may depend on the location where your storage unit is located and the terms of your insurance policy.

What is covered by renters insurance

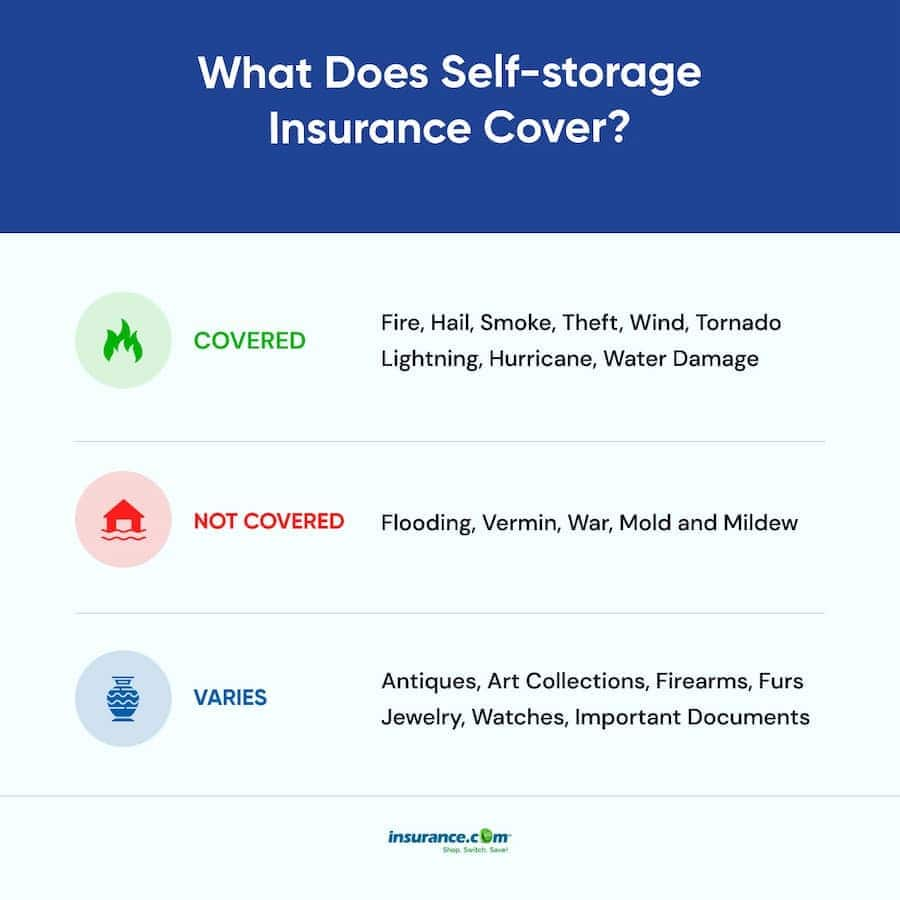

If you have renters insurance, the property you store in a storage unit is typically covered against the same “perils” it would be if it were kept at your home or apartment. This includes coverage for fire, theft, vandalism, and certain types of water damage.

However, it’s important to note that not all renters insurance policies are created equal. Some policies may offer additional coverage for stored items, while others may have limitations or exclusions.

It’s also worth mentioning that you cannot buy a renters insurance policy specifically for your storage unit. Instead, your policy would cover your stored belongings as part of the coverage for your rental property.

Therefore, renters insurance can provide valuable protection for your stored items in a storage unit. However, it’s important to review your policy and understand the limitations and sub-limits that may apply to your stored property. If you have questions about coverage or need to make a claim, be sure to reach out to your insurance provider for more information.

Personal Property Coverage in Storage Units

When it comes to storing personal property, many people opt for self-storage units. However, it is important to understand whether your renters insurance policy will cover the items stored in a storage unit. According to Lemonade, personal property in a storage unit is generally covered by renters insurance, but only up to a “sub-limit” that depends on where you live.

What is covered by renters insurance in storage units

Like home insurance, renters insurance covers personal property against perils such as fire, theft, vandalism, and some types of water damage. Therefore, if your personal property is stored in a self-storage unit, it might be covered by your renters insurance policy. However, as mentioned earlier, the coverage limit would depend on the state where you live.

If you are unsure whether your renters insurance policy covers your stored items, it would be best to speak to your insurance provider. Additionally, it is important to remember that insurance policies vary significantly, and certain exclusions may apply. Thus, it is crucial to understand the terms of your policy to determine the level of coverage for your stored items.

Sub-limits and exclusions

Although renters insurance generally covers personal property stored in self-storage units, sub-limits provisions might apply. This means that there is a maximum limit of coverage for personal property stored outside your home. Sub-limits depend on your state of residence and insurance provider, and in most cases, the sub-limit is set as a percentage of the total coverage amount of your renters insurance policy.

Additionally, certain exclusions might apply. For instance, some renters insurance policies may not cover certain types of items, such as jewelry, watches, furs, or valuable collections. Other policies might cover these items but up to a certain amount, which might not be adequate for valuable collections.

It is essential to note that if you plan to use a storage unit temporarily, such as when you are moving or renovating your home, your renters insurance policy might cover the stored items. However, if you plan to use the storage unit for an extended period, you should consider taking an additional insurance policy, such as a self-storage insurance policy.

Therefore, if you plan to store personal property in a self-storage unit, it is important to understand the level of coverage offered by your renters insurance policy. Speak to your insurance provider to know your policy’s terms and conditions, including any exclusions and sub-limits. Additionally, consider taking extra insurance coverage if necessary to secure your stored valuable items.

How Much Coverage is Provided

Renters insurance policies typically offer coverage for personal property inside a storage unit, but the amount of coverage varies based on various factors. To understand the level of coverage provided, it is necessary to know the percentage of coverage offered by the standard renters insurance policies and the maximum amount of coverage allowed.

Percentage of coverage provided by standard renters insurance policies

The majority of renters insurance policies provide off-premises coverage for personal property stored in a storage unit. However, the coverage amount allowed outside the home is usually limited to a sub-limit, which is a fraction of the overall policy limit. This sub-limit can vary depending on the state of residence and the insurance company.

On average, renters insurance policies provide up to 10% of the total personal property limit for coverage of items in a storage unit. So, if a renter has a personal property limit of $50,000, the maximum coverage for items stored in a storage unit would be $5,000. However, as mentioned earlier, these percentages may differ depending on the insurance company or the state.

Maximum amount of coverage provided

For some states, the coverage limit for items in a storage unit is capped at $1,000 and cannot be increased. However, some states allow a higher limit, such as California, New York, Connecticut, Virginia, and Florida, where the sub-limit is typically 10% of the total personal property limit of the policy. So, if the renter’s personal property limit is $50,000, then the maximum coverage for items stored in a storage unit would be $5,000.

In addition to state limitations, individual insurance policies may have their unique limits. Renters must check with their insurance company to understand the specifics of their coverage and ensure that their policy provides adequate protection for the stored items.

It’s crucial to note that while renters insurance may cover personal property stored in a storage unit, not all belongings are protected. Some belongings, such as jewelry, expensive collections, or antiques, may have a sub-limit-specific coverage cap or may not be covered at all. Renters should speak with their insurance provider to determine the items covered under the policy and their limits.

Therefore, renters insurance policies usually offer some coverage for personal property stored in self-storage units. However, the scope of coverage depends on various factors such as state of residence, insurance company, and policy limits. To ensure proper coverage for stored items, renters should carefully review their renters insurance policy and discuss with their insurance provider if additional coverage is required.

Moving and Storage Section of Renters Insurance Policy

When moving or storing personal property, it is important to understand the role of renters insurance in protecting your belongings. Renters insurance policies generally include a moving and storage section that outlines the level of coverage offered for your items during the moving process or while they are in a storage unit.

Explanation of moving and storage section in renters insurance

The moving and storage section of renters insurance typically covers personal property during a move or while it is in a storage facility. This coverage includes protection against perils such as fire, theft, vandalism, and certain types of water damage. However, it is important to keep in mind that sub-limits might apply in certain states.

Furthermore, the level of coverage offered might vary depending on the duration of storage. Some policies provide coverage only during the actual move, while others might extend coverage up to a certain period of time, such as 30 or 60 days after the move. It is essential to review your renters insurance policy to understand the duration and extent of the coverage provided by the moving and storage section.

Things not covered by this section

It is important to note that renters insurance policies might not cover certain types of personal property during a move or while in storage. Some policies might exclude valuable items such as jewelry, watches, and collections from coverage, or they might cover them only up to a certain limit.

Additionally, insurance policies might not cover damage caused by certain perils, such as earthquakes or floods. Therefore, it is crucial to review your policy to understand the exclusions and limitations of the moving and storage section.

In case your renters insurance policy does not provide adequate coverage for your items during a move or while in storage, you might consider purchasing a separate moving or storage insurance policy. These policies are designed to provide additional protection for your belongings during the moving process or when they are stored in a storage unit.

Therefore, renters insurance policies generally include a moving and storage section that offers protection for personal property during a move or while it is stored. However, certain limitations and exclusions might apply, and it is crucial to review your policy to understand these terms. Additionally, it might be necessary to purchase extra insurance coverage to adequately protect your valuables during the moving or storage process.

Other Options for Coverage

If your renters insurance policy does not provide adequate coverage for your personal property during a move or storage, there are additional options for coverage that you can consider. These options can provide additional protection for your belongings and give you peace of mind knowing that your items are fully covered in case of loss or damage.

Additional options for coverage beyond renters insurance

One option to consider is purchasing a separate moving or storage insurance policy. These policies are specifically designed to provide additional coverage for your personal property during a move or while it is stored in a storage facility. They can cover a wide range of perils, such as fire, theft, vandalism, and water damage.

Another option is to purchase a supplemental policy that can offer additional coverage for valuable items such as jewelry, watches, and art collections. Some renters insurance policies might have sub-limits for these types of items, so a supplemental policy can offer additional protection.

Benefits and drawbacks of supplemental coverage

The benefits of getting additional coverage are clear: you will have more protection for your belongings and be able to replace items that are lost or damaged during a move or while in storage. However, there are also drawbacks to consider.

One drawback is that additional coverage can be expensive, and it might not be worth it if you only have a few valuable items to protect. Additionally, some policies might have strict coverage limitations or exclusions, so it is crucial to carefully read and understand the terms of the policy before purchasing it.

Another aspect to consider is that some storage facilities might require you to purchase additional insurance coverage for your items. While this might seem like an added expense, it can be worth it to have the added protection and ensure that your belongings are covered in case of loss or damage.

So, while renters insurance policies do provide coverage for personal property during a move or while stored in a storage unit, they might not always offer sufficient protection. If this is the case, there are additional options for coverage to consider. These options can provide more comprehensive protection, but it is important to carefully review and understand the terms of the policy before purchasing it.

Theft Protection

Renters insurance protection against theft in storage units

When it comes to protecting your belongings in storage units, renters insurance can offer coverage for theft. Renters insurance policies generally include off-premises coverage that protects your personal property stored in a storage unit up to the limit stated on your policy, usually around 10% of the total personal property limit.

However, it is important to note that some insurance policies limit off-residence coverage to theft only. If your storage unit is impacted by something other than theft, such as fire, flood, or vandalism, you might be left without coverage. Therefore, it is essential to review your policy to understand the coverage provided for your items.

Coverage limitations

Although renters insurance can provide protection against theft in storage units, there might be certain limitations and exclusions on your policy. For instance, some policies might specifically exclude certain high-value items such as jewelry, watches, or collections from coverage. Additionally, sub-limits might apply in certain states.

To ensure that you have sufficient coverage for your stored possessions, it is important to review your policy and understand the terms and conditions of your coverage. If your renters insurance does not provide adequate protection for your belongings in storage, you might consider purchasing additional storage unit insurance to bridge any gaps in coverage.

Therefore, renters insurance can offer protection for personal property stored in a storage unit against theft and certain types of damage. However, coverage limitations and exclusions might apply, and it is essential to review your policy to understand the extent of the coverage provided. If necessary, consider purchasing additional insurance coverage to adequately protect your items during the moving or storage process.

Weather-Related Damage

Renters insurance protection against weather-related damage in storage units

Renters insurance can provide coverage for personal property stored in storage units against certain weather-related damages such as wind, hail, and lightning. Renters insurance policies often include off-premises coverage that protects your stored belongings up to the limit stated on your policy, minus any deductible. However, it is important to note that some policies limit off-residence coverage to theft only.

In addition to theft and weather-related damage, renters insurance might also provide coverage for other types of damage such as fire, smoke, and vandalism. However, it is essential to review your policy to understand the coverage provided for each type of damage.

Coverage limitations

Like with theft coverage, there might be certain limitations and exclusions on your policy regarding coverage for weather-related damage. Damage from mold, mildew, and flooding typically is not covered by renters insurance. Furthermore, certain high-value items might not be covered under your renters insurance policy, so it is important to review your policy’s terms and conditions.

It is also important to consider the deductible on your policy when making a claim for damage to your stored items. The deductible is the amount you are responsible for paying before your insurance coverage kicks in. If the amount of damage is less than the deductible, then your insurance company might not cover the claim.

Therefore, renters insurance can offer protection for personal property stored in a storage unit against certain types of weather-related damages, but policy limitations and exclusions might apply. Therefore, it is crucial to review your policy and understand the extent of the coverage provided. If necessary, consider purchasing additional insurance coverage to provide comprehensive protection for your belongings in storage.

Mishandling and Breakage Protection

Exclusions for mishandling and breakage under renters insurance

While renters insurance can offer coverage for theft and certain types of damage to your personal property stored in a storage unit, it might not cover mishandling and breakage. Typically, renters insurance policies do not cover the cost of replacing broken or damaged items due to mishandling or improper stacking.

Moreover, some rental insurance policies might not cover damage to fragile or high-value items such as glassware, artwork, or musical instruments. Therefore, it is necessary to review your renters insurance policy and understand the coverage limitations and exclusions.

If you plan to store delicate items, it is recommended to take appropriate precautions. Consider packing items carefully and securely, labeling boxes as fragile, and placing them on top of each other. Additionally, you might consider investing in a climate-controlled storage unit that can protect items from damage caused by temperature and humidity fluctuations.

Other options for coverage

If your renters insurance policy does not offer sufficient protection for mishandling and breakage, you might consider additional insurance coverage options. Some storage facilities offer optional insurance coverage plans that can provide additional protection for your stored items. You can consider adding this coverage to your renters insurance policy or purchasing a separate policy.

Alternatively, you might consider purchasing a separate insurance policy that is specifically designed for valuable or fragile items. These policies might offer coverage for a wide range of perils, including breakage, mishandling, and theft. However, keep in mind that these policies might have higher premiums and deductibles. Therefore, it is important to evaluate the coverage options and costs before making a decision.

Therefore, while renters insurance can offer some protection for your belongings in a storage unit, it might not cover all types of damage. It is crucial to review your policy and understand the coverage limitations and exclusions. Additionally, consider taking appropriate precautions and investing in additional coverage options, such as a separate insurance policy for valuable or fragile items or an optional insurance coverage plan offered by the storage facility.

Mishandling and Breakage Protection

Exclusions for mishandling and breakage under renters insurance

When it comes to storing your personal property in a storage unit, renters insurance can provide coverage for theft and certain types of damage such as fire or water leaks. However, mishandling and breakage may not be covered under your renters insurance policy. Typically, renters insurance does not cover the replacement cost of broken or damaged items due to improper stacking or handling. Furthermore, certain renters insurance policies may not offer coverage for fragile or high-value items such as artwork or musical instruments. Therefore, it is crucial to review your renters insurance policy and understand the extent of coverage provided.

If you plan to store delicate or fragile items in your storage unit, it is important to take appropriate measures to protect them. This can include packing items carefully and securely, labeling boxes as fragile, and placing them on top of each other. Additionally, you might consider opting for a climate-controlled storage unit that can provide protection against damage caused by temperature and humidity fluctuations.

Other options for coverage

If your renters insurance policy does not offer sufficient protection for mishandling and breakage, you might consider additional insurance coverage options. Some storage facilities offer optional insurance coverage plans that provide additional protection for your stored items. You can add this coverage to your renters insurance policy or purchase a separate policy for better protection.

Alternatively, you might consider purchasing a separate insurance policy that is specifically designed for valuable or fragile items. These policies might offer coverage for a wide range of perils, including breakage, mishandling, and theft. However, keep in mind that these policies might have higher premiums and deductibles. Therefore, it is important to evaluate the coverage options and costs before making a decision.

Summary of renters insurance coverage for storage units

Renters insurance policies typically provide coverage for personal items stored in a self-storage unit at a lower limit, usually up to 10% of your total personal property limit. However, it is important to note that renters insurance may not cover mishandling and breakage of your stored items. To ensure adequate protection, renters may consider purchasing additional coverage from their insurer or storage facility. Alternatively, they might consider purchasing a separate insurance policy for valuable or fragile items.

Considerations when choosing coverage options

When selecting a coverage option for your storage unit, it is important to consider the value and fragility of the items being stored, as well as the potential risks involved. Additionally, you should evaluate the coverage options and costs to determine the most appropriate option for your needs. By understanding the limitations and exclusions of renters insurance and exploring additional coverage options, you can ensure your stored items are adequately protected.

Conclusion

Therefore, renters insurance can provide some protection for personal items stored in a self-storage unit. However, it may not cover certain types of damage, such as mishandling or breakage. Renters should review their policy and consider additional coverage options to ensure their stored items are adequately protected. By taking appropriate precautions and selecting the right coverage option, you can have peace of mind knowing that your items are protected against potential risks.

Learn about Renters insurance for storage unit.

1 thought on “Does renters insurance cover storage units”