Storage unit insurance esurance

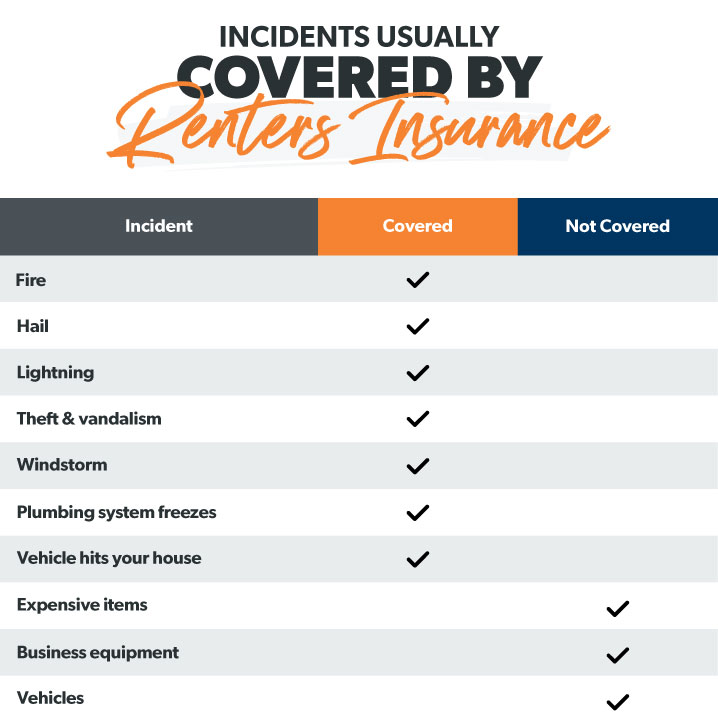

Renters insurance is a valuable investment for anyone living in a rented property. It offers protection against various unforeseen events that can lead to property damage or loss. However, it’s important to understand that renters insurance doesn’t cover everything. Before purchasing a policy, there are a few key things to know to ensure you get the right coverage for your needs.

Understanding the importance of storage unit insurance

If you have a lot of belongings and are considering renting a storage unit, it’s crucial to understand the importance of storage unit insurance. While your renters insurance may provide coverage for your personal belongings stored in a storage unit, it’s important to confirm this with your insurance provider. Some policies may offer limited coverage or require additional coverage specifically for storage units.

Storage unit insurance provides protection for your items against theft, fire, water damage, and other disasters that may occur while they are stored. It’s essential to carefully read the terms and conditions of your storage unit insurance policy to understand the extent of coverage and any exclusions that may apply.

The benefits of having storage unit insurance

Having storage unit insurance comes with several benefits, including:

1. Protection against unforeseen events: Storage unit insurance provides coverage in case of theft, fire, water damage, and other unexpected events that could damage or destroy your belongings. This can give you peace of mind knowing that even if something were to happen, you are financially protected.

2. Replacement cost coverage: Depending on your policy, storage unit insurance may offer replacement cost coverage, which means that in the event of a covered loss, your belongings will be replaced with new items of similar value. This can be especially beneficial for valuable or sentimental items.

3. Liability coverage: Some storage unit insurance policies also provide liability coverage. This can protect you in the event that someone is injured while on your rented storage unit property. It can cover medical expenses, legal fees, and other related costs.

4. Additional coverage options: Storage unit insurance policies often offer additional coverage options that can be customized based on your needs. This may include coverage for specific types of belongings, such as electronics, jewelry, or collectibles.

5. Affordable premiums: Storage unit insurance is generally affordable, especially when compared to the potential costs of replacing all of your belongings in case of a loss. The exact cost of the premiums will depend on factors such as the value of the items being stored and the level of coverage selected.

Therefore, storage unit insurance is an essential component of protecting your belongings when renting a storage unit. It provides coverage against various risks and offers peace of mind knowing that your items are financially protected. Before purchasing a policy, it’s important to understand the extent of coverage, any exclusions, and consider additional coverage options to ensure you have the right protection for your needs.

What is Storage Unit Insurance?

Explaining the concept of storage unit insurance

Storage unit insurance, also known as self-storage insurance, is a type of insurance policy that provides coverage for the contents stored within a storage unit. Whether you are storing furniture, appliances, or other valuable items in a storage facility, having this type of insurance can help protect your belongings in case of damage, theft, or loss.

Coverage and protection it provides

Storage unit insurance typically provides coverage for a variety of risks and perils. Some of the common coverage options included in storage unit insurance policies are:

1. Damage from fire, smoke, or explosions: In the event of a fire or explosion in the storage unit facility, this insurance can help cover the cost of replacing or repairing damaged items.

2. Theft or burglary: If someone breaks into the storage unit and steals your belongings, storage unit insurance can provide coverage for the stolen items.

3. Water damage: Storage unit insurance may cover water damage caused by burst pipes, leaks, or other similar incidents.

4. Natural disasters: Depending on the policy, storage unit insurance may offer coverage against damage caused by floods, earthquakes, hurricanes, or other natural disasters.

5. Vandalism: If your storage unit is vandalized, storage unit insurance can help cover the costs of repairing or replacing damaged items.

It is important to note that storage unit insurance may have certain limitations and exclusions. For example, certain high-value items like jewelry, artwork, or collectibles may require additional coverage or a separate policy. Additionally, coverage limits and deductibles may vary depending on the insurance provider and policy chosen.

Before purchasing storage unit insurance, it is advisable to carefully read and understand the terms and conditions of the policy. Compare different insurance providers to find the one that offers the coverage and protection that best suits your needs.

Therefore, storage unit insurance provides coverage for the contents stored within a storage unit, protecting against various risks such as theft, fire, water damage, and vandalism. However, it is important to review the policy details and consider any additional coverage options necessary for high-value items.

Why Do You Need Storage Unit Insurance?

Understanding the risks associated with storing belongings in a storage unit

Storing your belongings in a storage unit can offer convenience and extra space, but it also comes with certain risks. Theft, damage, and unforeseen events can jeopardize the safety of your stored items. Here are a few reasons why having storage unit insurance is crucial:

1. Peace of mind: With storage unit insurance, you can have peace of mind knowing that your belongings are protected. Whether it’s damage from a fire, theft, or natural disasters, having insurance coverage can alleviate the financial burden of replacing or repairing your items.

2. Limited coverage from the storage facility: While some storage facilities may claim to have insurance coverage, it’s important to understand that their coverage may have limitations and may not fully protect your possessions. By having your own storage unit insurance, you can ensure that your belongings are adequately protected.

3. Unforeseen events: Unexpected events such as fires, floods, or vandalism can occur at any time and put your stored items at risk. Having storage unit insurance can provide the necessary financial assistance to recover from such events and replace or repair your belongings.

The importance of protecting your personal possessions

1. Monetary value: Your personal possessions likely have significant monetary value. From furniture and electronics to sentimental items and family heirlooms, the cost of replacing these items can quickly add up. Storage unit insurance helps cover these costs, providing a safety net in case of unexpected damage or loss.

2. Emotional value: Some items stored in a storage unit may hold sentimental value, such as photo albums, family heirlooms, or treasured possessions. Losing these items can be devastating. Having storage unit insurance ensures that you can replace or repair these items, taking a step towards recovering those precious memories.

3. Liability protection: Storage unit insurance may also include liability protection. This means that if someone gets injured while accessing your storage unit, your insurance policy may help cover medical expenses or legal fees that might arise from such an incident.

Therefore, storage unit insurance is an essential precautionary measure to protect your stored belongings. Understanding the risks associated with storing items in a storage unit and the importance of protecting your personal possessions can help you make an informed decision when it comes to choosing the right insurance coverage for your needs. Always compare different insurance providers to find a policy that offers comprehensive coverage and peace of mind.

Coverage Options for Storage Unit Insurance

Types of coverage available for storage unit insurance

Storage unit insurance typically offers a variety of coverage options to protect your belongings. It’s important to understand these options before purchasing a policy. Some common coverage types include:

– Damage from fire, smoke, or explosions: This coverage helps replace or repair items damaged by fire or explosions in the storage facility.

– Theft or burglary: If someone breaks into your storage unit and steals your belongings, insurance can provide coverage for the stolen items.

– Water damage: Coverage for water damage caused by burst pipes, leaks, or other similar incidents.

– Natural disasters: Some policies may offer coverage against damage caused by floods, earthquakes, hurricanes, or other natural disasters.

– Vandalism: If your storage unit is vandalized, insurance can cover the costs of repairing or replacing damaged items.

It’s essential to note that storage unit insurance may have limitations and exclusions. High-value items like jewelry, artwork, or collectibles may require additional coverage or a separate policy. Additionally, coverage limits and deductibles may vary depending on the insurance provider and policy chosen.

Before purchasing storage unit insurance, carefully read and understand the terms and conditions of the policy. Compare different insurance providers to find the one that offers the coverage and protection that best suits your needs.

Liability coverage and its significance

In addition to coverage for your belongings, some storage unit insurance policies also include liability coverage. Liability coverage protects you if someone is injured while on your storage unit premises. It can help pay for medical expenses or legal fees if you are found responsible for an accident.

Liability coverage is important because accidents can happen at any time. If a visitor or employee gets hurt on your storage unit property, you could be held liable for their injuries. Without liability coverage, you may have to pay for medical bills or legal expenses out of pocket.

When comparing storage unit insurance options, inquire about the availability of liability coverage. It provides an extra layer of protection and peace of mind, ensuring that you are financially safeguarded in case of accidents or injuries.

Remember, it’s always best to talk to your current home or renters insurance company to see if storage unit coverage is included in your existing policy. Understanding your existing coverage can help you make an informed decision about whether you need additional storage unit insurance.

By comparing your options and considering your specific needs, you can make an informed choice when it comes to purchasing storage unit insurance. Whether you opt for a standalone policy or add coverage to your existing insurance, having protection for your stored belongings is essential in safeguarding your assets.

How Much Coverage Do You Need?

Assessing the value of your personal property

When determining how much coverage you need for your renters insurance policy, it’s essential to assess the value of your personal property. Consider the replacement cost of your belongings, including furniture, electronics, clothing, and other valuable items.

Take inventory of your possessions and estimate their value. This can be done by going room by room and listing each item along with its estimated value. Be sure to include any high-value items such as jewelry, artwork, or collectibles that may require additional coverage. This assessment will give you a better idea of the total worth of your personal property.

Determining the appropriate coverage limit

Once you have assessed the value of your personal property, it’s time to determine the appropriate coverage limit for your renters insurance policy. The coverage limit is the maximum amount the insurance company will pay in the event of a covered loss.

A common mistake is underestimating the value of your belongings and selecting a coverage limit that is too low. This can leave you financially vulnerable if you need to file a claim. On the other hand, opting for excessive coverage may result in higher premiums than necessary.

To determine the appropriate coverage limit, consider the following factors:

– Replacement cost: Calculate the cost of replacing all your personal belongings at today’s prices. This includes items that may have appreciated in value over time.

– Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Take into account how much you are willing and able to pay in the event of a claim.

– Budget: Consider your budget and how much you can comfortably afford in terms of insurance premiums. Balancing the coverage limit and the cost of the policy is crucial.

It’s also important to consider any additional coverage options you may need. For example, if you have valuable items that exceed the coverage limit, you may want to consider adding a rider or endorsement to your policy for additional protection.

Comparing quotes from different insurance providers can help you find the best coverage at a reasonable price. Take the time to review the terms and conditions of each policy to ensure it provides the necessary protection for your specific needs.

Therefore, understanding the coverage options and determining the appropriate coverage limit are crucial steps when choosing renters insurance. Assessing the value of your personal property and considering factors such as replacement cost, deductible, and budget will help you make an informed decision.

Remember, it’s always a good idea to review your renters insurance policy annually and make any necessary adjustments based on changes in your personal property or circumstances. By taking the time to accurately assess your needs and find the right coverage, you can have peace of mind knowing that you are adequately protected.

Exclusions and Limitations

Understanding what may not be covered under storage unit insurance

While storage unit insurance can provide valuable protection for your belongings, it’s important to be aware of what may not be covered. Here are some common exclusions that you should know:

– Negligence or intentional acts: If damage or loss occurs due to your own negligence or intentional acts, such as failing to secure your storage unit properly, the insurance policy may not cover the expenses.

– Wear and tear: Normal wear and tear on your belongings is typically not covered under storage unit insurance. This includes items that deteriorate naturally over time, such as fabric, leather, or electronics.

– Vermin or pest damage: Damage caused by pests or vermin, such as rodents or insects, may not be covered by storage unit insurance. It’s important to take preventive measures, such as using pest control methods, to protect your belongings.

– Unauthorized access: If someone gains unauthorized access to your storage unit using stolen keys or other means, the insurance policy may not cover any losses or damages resulting from the unauthorized access.

– Certain high-value items: While storage unit insurance may provide coverage for most of your belongings, certain high-value items like jewelry, artwork, or collectibles may require additional coverage or a separate policy. It’s important to check with your insurance provider to ensure these items are adequately protected.

Exclusions and limitations to be aware of

In addition to the specific exclusions mentioned above, it’s important to be aware of any other limitations or conditions within the storage unit insurance policy. These may include:

– Coverage limits: Each policy will have a maximum coverage amount, and it’s important to ensure that it is sufficient to protect the value of your stored belongings. Higher-value items may require additional coverage or separate policies.

– Deductibles: Like any insurance policy, storage unit insurance typically has a deductible. This is the amount you are responsible for paying before the insurance coverage kicks in. It’s important to understand the deductible and factor it into your overall cost.

– Documentation requirements: In the event of a claim, the insurance provider may require documentation to support the value of the items being claimed. It’s important to keep an inventory of your stored belongings, including receipts, appraisals, or photographs, to assist with the claims process.

– Policy cancellation or non-renewal: Insurance providers may have the right to cancel or not renew a storage unit insurance policy under certain circumstances, such as non-payment of premiums or a change in the insured property’s condition.

Before purchasing storage unit insurance, carefully review the policy’s exclusions, limitations, and conditions to ensure you have a clear understanding of what is covered and what is not. If there are any questions or concerns, it’s best to clarify them with the insurance provider before making a decision.

By being aware of the exclusions and limitations, you can make an informed decision and choose the right storage unit insurance that adequately protects your belongings and provides you with peace of mind. Remember that each insurance provider and policy may have different terms and conditions, so it’s important to compare options and choose the one that best meets your needs.

**Finding the Right Storage Unit Insurance Provider**

Factors to consider when choosing a storage unit insurance provider

When it comes to selecting a storage unit insurance provider, there are several factors to consider to ensure you make the right choice. Here are some key considerations:

1. Coverage options: Look for a provider that offers coverage options that align with your needs. Consider the types of belongings you plan to store and make sure the policy covers them adequately.

2. Coverage limits: Check the maximum coverage amount offered by different providers. Ensure that it is sufficient to protect the value of your stored items, particularly if you have high-value belongings.

3. Premiums and deductibles: Compare the premiums and deductibles charged by different insurance companies. Keep in mind that lower premiums may come with higher deductibles, so it’s important to find a balance that fits your budget.

4. Reputation and financial stability: Research the reputation and financial stability of the insurance companies you are considering. Look for providers with a track record of reliable customer service and timely claims processing.

5. Customer reviews and ratings: Read customer reviews and ratings to get insights into the experiences of other people who have used the insurance provider. This can help you gauge the quality of service and reliability.

Researching and comparing different insurance companies

To find the right storage unit insurance provider, it’s essential to do your research and compare different companies. Here are some steps to guide you in the process:

1. Seek recommendations: Ask friends, family, or colleagues if they have any recommendations for storage unit insurance providers. Personal recommendations can often be helpful in finding reliable options.

2. Use online resources: Utilize online resources to search for storage unit insurance providers in your area. Review their websites, gather information about their coverage options, and check customer reviews and ratings.

3. Request quotes: Contact different insurance companies and request quotes for their storage unit insurance policies. This will allow you to compare premiums, coverage limits, deductibles, and any additional fees.

4. Read the fine print: Carefully review the terms and conditions of the policies you are considering. Pay attention to any exclusions, limitations, or additional requirements.

5. Consult with insurance agents: If you have any questions or need clarification, don’t hesitate to reach out to insurance agents for guidance. They can provide you with more detailed information and assist you in finding the best storage unit insurance option.

By taking these steps and thoroughly comparing your options, you can make an informed decision and choose the right storage unit insurance provider for your needs. Remember to consider your specific coverage requirements, budget, and the reputation of the insurance company. With the right insurance in place, you can have peace of mind knowing that your stored belongings are protected.

How to File a Claim

Step-by-step guide on filing a storage unit insurance claim

When it comes to filing a storage unit insurance claim, it’s important to follow the proper steps to ensure a smooth process. Here’s a step-by-step guide to help you through:

1. Assess the damage: Before filing a claim, thoroughly assess the damage to your belongings. Take photos or videos of the damaged items as evidence.

2. Contact your insurance provider: Notify your insurance provider as soon as possible. They will guide you through the process and provide you with the necessary forms to fill out.

3. Fill out the claim form: Complete the claim form provided by your insurance provider. Make sure to provide accurate and detailed information about the items damaged or lost.

4. Submit supporting documents: Along with the claim form, you may be required to submit supporting documents such as receipts, appraisals, or photographs of the damaged items. Be sure to gather all necessary documentation to support your claim.

5. Cooperate with the claims adjuster: A claims adjuster may be assigned to assess the claim and determine the coverage amount. Cooperate fully with the adjuster, providing any additional information or evidence they may request.

6. Wait for the claim resolution: After submitting your claim, the insurance provider will review all the documentation and assess the validity of your claim. The length of time it takes to process a claim can vary, so be patient during this period.

7. Receive the claim settlement: If your claim is approved, you will receive a claim settlement from your insurance provider. The settlement amount will depend on your policy coverage and the assessed value of the damaged or lost items.

Tips for a smooth claims process

Here are some tips to ensure a smooth and efficient claims process:

– Report the claim promptly: Notify your insurance provider as soon as possible after the damage or loss occurs. Most insurance policies have a deadline for filing claims, so it’s important to act quickly.

– Keep detailed records: Maintain a record of all communications with your insurance provider, including phone calls, emails, and written correspondence. This will help you keep track of the progress of your claim and any instructions or requests from the insurance company.

– Be honest and accurate: Provide accurate information when filling out the claim form and communicating with the insurance company. Misrepresentation or exaggeration of the damages could lead to delays or even denial of your claim.

– Follow instructions carefully: Pay attention to any instructions provided by the insurance company and follow them precisely. This includes submitting any required documents or evidence and cooperating fully with the claims adjuster.

– Stay organized: Keep all relevant documents, such as receipts, appraisals, and photos, in a safe and easily accessible place. This will help you provide the necessary supporting documentation when filing a claim.

Remember, each insurance provider may have slightly different procedures and requirements for filing a claim. It’s important to familiarize yourself with your policy’s specific guidelines and contact your insurance provider directly if you have any questions or need clarification.

By following these steps and tips, you can navigate the claims process more effectively and increase the chances of a successful claim settlement.

Conclusion

Therefore, filing a storage unit insurance claim requires following proper steps and providing accurate information and documentation. By promptly reporting the claim, keeping detailed records, and cooperating with the insurance company, you can ensure a smooth and efficient claims process. It’s essential to familiarize yourself with your policy’s specific guidelines and contact your insurance provider directly if you have any questions or need clarification. By following these tips and guidelines, you can increase the chances of a successful claim settlement and protect your belongings in a storage unit.

The importance of protecting your belongings in a storage unit

Renting a storage unit provides a convenient and secure solution for storing your belongings. However, unexpected events like theft, fire, or water damage can occur, putting your possessions at risk. That’s why it’s crucial to have storage unit insurance to protect your valuable items. With the right insurance policy, you can have peace of mind knowing that your belongings are covered in the event of an unforeseen incident.

Final thoughts and recommendations

When it comes to storage unit insurance, it’s essential to understand the coverage and exclusions before purchasing a policy. Consider the value of your stored items and choose a policy that provides adequate coverage for their replacement or repair. Research different insurance providers, compare their policies and prices, and read customer reviews to ensure you select a reputable and reliable company. Additionally, regularly reviewing and updating your policy as needed is crucial to ensure you have the appropriate coverage for your belongings.

Remember, having insurance protection for your stored items is an investment in their safety and your peace of mind. Don’t wait until it’s too late – secure the right storage unit insurance policy today and protect your belongings from unexpected losses.

Here’s an interesting read on Self storage unit without insurance.