Introduction

Overview of the importance of storage unit insurance

Renting a storage unit can be a convenient solution for individuals who need extra space to store their belongings. However, it’s important to recognize that self-storage facilities and mobile storage container leasing companies do not automatically insure your stored property. This means that if any loss or damage occurs to your belongings while they are in a storage unit, you may not be covered by any insurance policy.

Explaining the need for insurance coverage for belongings in storage units

Given the potential risks associated with storing your belongings, it is highly advisable to consider purchasing storage contents insurance for added protection. Storage Protectors Contents Insurance Program offers economical coverages specifically tailored to provide an additional layer of protection for your stored belongings. By purchasing this insurance, you can alleviate concerns regarding potential losses associated with unanticipated incidents such as theft, fire, or natural disasters.

Here are a few key reasons why getting storage unit insurance is important:

1. Protection against unforeseen incidents: Despite the security measures taken by storage facilities, accidents can still happen. Storage unit insurance provides coverage for unexpected events such as fire, water damage, vandalism, or burglary, ensuring that you are financially protected in case of any losses.

2. Safeguarding valuable and sentimental items: Many people choose to store valuable or sentimental items in their storage units. From expensive electronics to family heirlooms, these belongings hold both monetary and emotional value. Having insurance coverage can provide peace of mind, knowing that you will be compensated if anything happens to these cherished possessions.

3. Liability coverage: In addition to protecting your belongings, storage unit insurance can also provide liability coverage. This means that if someone were to get injured or suffer property damage while on your storage unit premises, you may be protected against legal and financial consequences.

4. Additional coverage for your existing insurance policies: While it’s crucial to review your existing homeowners or renters insurance policies, they may not provide adequate coverage for items stored in a storage unit. By purchasing storage unit insurance, you can ensure that your belongings are specifically covered, avoiding any potential gaps in coverage.

5. Affordable and customizable options: Storage unit insurance programs, such as the Storage Protectors Contents Insurance Program, offer affordable and customizable coverage options. You can select the level of coverage you need based on the value of your stored items, allowing you to find a policy that fits your budget and specific needs.

Therefore, obtaining insurance coverage for your belongings in storage units is crucial to protect against potential losses. Whether it’s safeguarding valuable items or providing liability coverage, storage unit insurance provides an additional layer of financial security. By considering storage unit insurance options like the Storage Protectors Contents Insurance Program, you can have the peace of mind knowing that your belongings are protected.

Homeowners Insurance Coverage

Understanding the off-premises personal property coverage in a homeowners policy

When it comes to protecting your belongings, homeowners insurance plays a crucial role. However, it’s important to understand the extent of coverage provided by your policy, particularly for items kept in storage units or mobile storage containers. Here are a few key points to consider:

– **Off-premises personal property coverage**: Most homeowner’s policies include coverage for your personal belongings even when they are off your property. This means that items stored in a self-storage facility or mobile storage container may be covered under your existing policy. However, it’s essential to review your policy and talk to your insurance broker to understand the specific coverage limits and any deductibles that may apply.

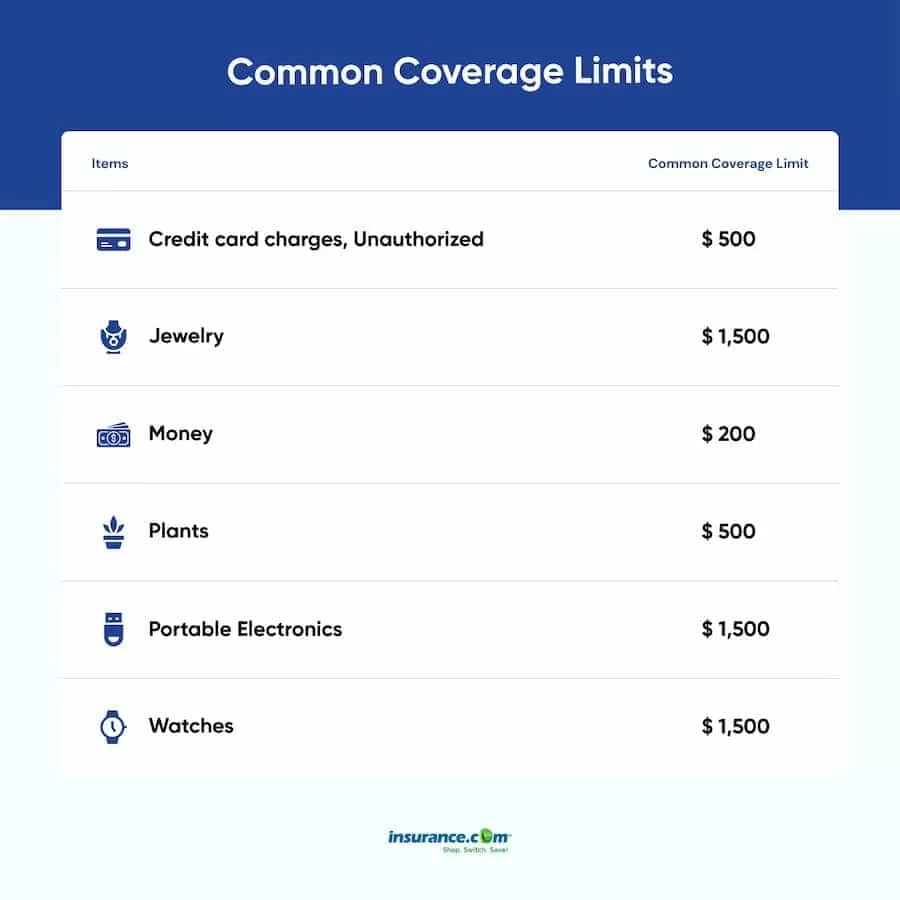

– **Limitations of coverage**: While homeowners insurance may provide some coverage for stored belongings, it’s important to note that there are usually limitations in terms of coverage amounts and types of perils covered. For example, certain high-value items like jewelry or artwork may have limited coverage, and damage caused by flooding or earthquakes may not be covered. Understanding these limitations can help you assess if additional storage insurance is necessary.

– **Deductibles and claims process**: In the event of a loss or damage to your stored belongings, the deductible and claims process for your homeowner’s insurance will apply. It’s important to be aware of the deductible amount and any potential impact on your premium. Additionally, understanding the claims process can help ensure a smooth experience if you need to make a claim.

Exploring the limitations and extent of coverage for storage units

While homeowner’s insurance may provide some coverage for stored belongings, there are often limitations that may require additional storage insurance. Here are some key factors to consider:

|

Homeowner’s Insurance |

Storage Unit Insurance |

|---|---|

|

Provides coverage for personal belongings stored off-premises |

Specialized insurance tailored for storage units |

|

Limits on coverage amounts and types of perils covered |

Customizable coverage options |

|

Deductions and claims process specific to homeowner’s insurance |

Deductions and claims process specific to storage unit insurance provider |

Storage unit insurance, like the Storage Protectors Contents Insurance Program offered by Discount Storage Insurance, provides an additional layer of protection for your stored belongings. This type of insurance allows you to customize your coverage based on your specific needs and budget. It alleviates concerns regarding potential losses associated with burglary, damage, or loss of your stored property.

So, while homeowner’s insurance may provide some coverage for items stored off-premises, it’s important to understand the limitations of this coverage and consider additional storage unit insurance if necessary. Talking to your insurance broker and reviewing the specific terms of your policy can help ensure that you have adequate protection for your belongings.

Covered Storage Protectors

Highlighting Covered Storage Protectors’ position on storage unit insurance for renters

When it comes to protecting your stored belongings, Covered Storage Protectors understands the importance of having comprehensive insurance coverage. We offer the Storage Protectors Contents Insurance Program, which provides an additional layer of protection for your stored belongings in mobile storage containers or self-storage units. Our program is designed to alleviate concerns regarding potential losses associated with unanticipated incidents of loss, such as burglary, limited water damage, vandalism, and fire or lightning.

Explaining the absence of insurance coverage offered by Covered Storage Protectors

While Covered Storage Protectors does not automatically provide insurance coverage for stored property, we highly recommend purchasing our Storage Protectors Contents Coverage. The reason for this is that homeowner’s insurance may or may not cover your stored property adequately. We understand that homeowners insurance provides some coverage for personal belongings stored off-premises, but there are limitations in terms of coverage amounts and types of perils covered. Additionally, the deductibles and claims process specific to homeowner’s insurance might not be ideal for storage units. Therefore, our specialized storage unit insurance is tailored to provide customizable coverage options and a claims process specific to storage unit insurance providers, ensuring that your stored belongings are protected adequately.

Therefore, while homeowner’s insurance may offer some coverage for items stored off-premises, it’s important to review the limitations of this coverage and consider additional storage unit insurance if necessary. Covered Storage Protectors provides the Storage Protectors Contents Insurance Program, which offers customizable coverage options specifically designed for storage units. To ensure that your stored belongings are adequately protected, it is recommended to discuss your specific needs with your insurance broker and consider adding our Storage Protectors Contents Coverage. With Covered Storage Protectors, you can have peace of mind knowing that your stored property is protected against potential losses.

Recommendations: Discount Storage Insurance

Exploring Discount Storage Insurance as a recommended provider for rental storage insurance

If you are in need of rental storage insurance to protect the contents of your storage unit or mobile storage container, Discount Storage Insurance is a recommended provider to consider. They offer specialized insurance tailored specifically for storage units, allowing you to customize your coverage to fit your individual needs and budget. With Discount Storage Insurance, you can have peace of mind knowing that your belongings are protected against burglary, damage, or loss.

Discussing the benefits and features of Discount Storage Insurance

Discount Storage Insurance offers several benefits and features that make them stand out as a recommended provider for rental storage insurance:

– **Customizable coverage options**: With Discount Storage Insurance, you have the flexibility to customize your coverage to match your specific needs. Whether you have high-value items that require additional protection or simply want basic coverage for your stored belongings, they have options to suit different budgets and requirements.

– **Affordability**: Discount Storage Insurance provides economical coverages, ensuring that you can protect your stored belongings without breaking the bank. They offer competitive rates and work with you to find a policy that fits within your budget.

– **Specialization in storage insurance**: Unlike homeowner’s insurance, which may have limitations and restrictions on coverage for stored belongings, Discount Storage Insurance focuses specifically on providing insurance for storage units. This specialization allows them to offer comprehensive coverage tailored to the unique risks and needs of storing personal belongings off-premises.

– **Ease of claims process**: In the unfortunate event of loss or damage to your stored property, Discount Storage Insurance aims to make the claims process as smooth and stress-free as possible. They have a dedicated customer support team that can guide you through the process and assist you in filing a claim.

– **Reputation and reliability**: Discount Storage Insurance has a solid reputation and is known for their reliable coverage and excellent customer service. They have been providing storage insurance for many years and have built a trusted relationship with their policyholders.

Therefore, if you are considering rental storage insurance, Discount Storage Insurance is a recommended provider to consider. Their specialization in storage insurance, customizable coverage options, affordability, and commitment to customer satisfaction make them a reliable choice for protecting your stored belongings. By choosing Discount Storage Insurance, you can have peace of mind knowing that your items are safeguarded against burglary, damage, or loss.

SafeStor: Self-Storage Insurance Provider

Introducing SafeStor as one of the largest companies specialized in self-storage insurance

SafeStor is a leading provider of self-storage insurance, offering specialized coverage for individuals and businesses who rent storage units or mobile storage containers. With their extensive experience in the industry, SafeStor understands the unique risks and challenges faced by self-storage facilities and their tenants. They have a solid reputation for providing reliable coverage and exceptional customer service.

Exploring the insurance coverage options and policies offered by SafeStor

SafeStor offers a range of insurance coverage options and policies specifically designed for self-storage tenants. Here are some key features and benefits of their offerings:

– **Comprehensive Coverage**: SafeStor’s insurance policies offer comprehensive coverage for your stored belongings. This includes protection against theft, fire, water damage, vandalism, and other unforeseen incidents. With their coverage, you can have peace of mind knowing that your items are safeguarded against potential losses.

– **Flexible Coverage Limits**: SafeStor understands that each tenant’s storage needs are different. Therefore, they provide flexible coverage limits that can be tailored to your specific requirements. Whether you have high-value items or standard belongings, they have options to suit your needs.

– **Easy Policy Management**: SafeStor makes it easy to manage your insurance policy. You can easily update your coverage limits, add or remove items, and make changes to your policy as needed. This flexibility ensures that your coverage remains up to date and aligned with your storage requirements.

– **Streamlined Claims Process**: In the unfortunate event of a loss or damage to your stored property, SafeStor aims to make the claims process as smooth and hassle-free as possible. They have a dedicated claims team that can assist you throughout the process and guide you in filing your claim. Their goal is to ensure a quick resolution and provide the support you need during a challenging time.

– **Competitive Pricing**: SafeStor offers competitive pricing for their self-storage insurance policies. They understand that affordability is an important consideration for tenants, and they strive to provide cost-effective options without compromising on coverage. By choosing SafeStor, you can get the protection you need at a price that fits your budget.

– **Expert Advice and Support**: SafeStor’s team of insurance professionals is available to provide expert advice and support. Whether you have questions about your policy, need assistance with a claim, or require guidance on understanding your coverage, their knowledgeable staff is there to help.

Therefore, SafeStor is a trusted and highly recommended provider of self-storage insurance. Their comprehensive coverage options, flexible policies, streamlined claims process, competitive pricing, and exceptional customer service set them apart in the industry. If you are renting a storage unit or mobile storage container, it is crucial to have insurance to protect your belongings. SafeStor ensures that you have the coverage you need to safeguard your stored items against potential risks and losses.

MiniCo: Self-Storage Insurance Expert

Highlighting MiniCo’s extensive experience in the self-storage industry

MiniCo, with nearly 50 years of experience in the self-storage industry, is a trusted name when it comes to insurance for self-storage units. With their expertise and knowledge, MiniCo understands the unique risks faced by self-storage businesses and tenants on a daily basis. They have tailored their Tenant Insurance programs to provide comprehensive coverage and benefits for both operators and tenants.

Discussing the unique risks faced by self-storage businesses and MiniCo’s expertise in addressing them

Self-storage businesses face various risks, including theft, damage, and loss of items stored within their facilities. MiniCo’s Tenant Insurance programs address these risks by offering convenient options for self-storage operators. They provide coverage for tenants’ belongings, ensuring that they are protected against potential losses associated with unanticipated incidents.

MiniCo’s extensive experience allows them to offer specialized insurance solutions tailored specifically for storage units. Unlike homeowner’s insurance, which may have limitations and restrictions on coverage for stored belongings, MiniCo focuses solely on providing insurance for self-storage units. This specialization enables them to offer comprehensive coverage that meets the unique needs and risks of storing personal belongings off-premises.

Additionally, MiniCo understands the importance of affordability when it comes to insurance. They offer customizable coverage options, allowing tenants to choose the level of protection that suits their needs and budget. Whether tenants have high-value items requiring additional protection or simply want basic coverage for their stored belongings, MiniCo has options to accommodate different budgets and requirements.

In the unfortunate event of a loss or damage to stored property, MiniCo aims to make the claims process as smooth and stress-free as possible. They have a dedicated customer support team that can assist tenants in filing a claim and guide them through the process.

With MiniCo, tenants can trust in their reputation for reliable coverage and excellent customer service. Over the years, MiniCo has built a trusted relationship with their policyholders, providing them with the peace of mind that their stored belongings are safeguarded against theft, damage, or loss.

Therefore, MiniCo is an experienced and trusted provider of insurance for self-storage units. Their specialization in storage insurance, customizable coverage options, affordability, and commitment to customer satisfaction make them an excellent choice for protecting stored belongings. Tenants can have peace of mind knowing that MiniCo understands the unique risks faced by self-storage businesses and has tailored their insurance programs to address them effectively.

Tenant Insurance Programs by MiniCo

Introducing MiniCo’s two Tenant Insurance programs

MiniCo offers two Tenant Insurance programs designed specifically for self-storage tenants. These programs provide convenient options for both tenants and self-storage operators, ensuring that tenants have the necessary insurance coverage for their stored belongings. Let’s explore the features and benefits of these programs:

Describing the features and benefits of MiniCo’s Tenant Insurance options

1. Pay-With-Rent Tenant Insurance:

– With Pay-With-Rent Tenant Insurance, tenants have the option to include the cost of insurance in their monthly rental fee. This convenient payment method ensures that tenants are continuously covered without the hassle of separate payments.

– This program allows tenants to easily manage their insurance coverage alongside their monthly rental fee, simplifying the administrative process and ensuring uninterrupted protection for their stored belongings.

– MiniCo’s Pay-With-Rent Tenant Insurance offers comprehensive coverage against theft, damage, and loss of stored items. This coverage provides peace of mind for tenants, knowing that their belongings are protected.

2. Insurance Application and Processing:

– MiniCo makes the insurance application process seamless for both tenants and self-storage operators. The facility provides tenants with the insurance application during the leasing process, emphasizing the tenant’s responsibility to obtain insurance for their stored goods.

– Once the tenant submits the application, MiniCo takes care of the rest. They handle the processing and underwriting of the insurance, making it a hassle-free experience for tenants.

– This simplified process saves time and effort for both tenants and self-storage operators, ensuring that tenants receive the necessary insurance coverage efficiently.

MiniCo’s Tenant Insurance programs offer a range of benefits for self-storage tenants:

– Comprehensive Coverage: MiniCo’s insurance plans cover theft, damage, and loss of stored belongings, providing tenants with the necessary protection against potential risks.

– Customizable Options: Tenants have the flexibility to choose the level of coverage that suits their needs and budget. Whether they have high-value items or require basic coverage, MiniCo’s customizable options cater to different requirements.

– Affordability: MiniCo understands the importance of affordability and offers competitive pricing for their Tenant Insurance programs. They strive to provide cost-effective insurance solutions without compromising on coverage.

– Dedicated Customer Support: In the event of a loss or damage, MiniCo has a dedicated customer support team to assist tenants with the claims process. Their knowledgeable and friendly staff ensures a smooth and stress-free experience for tenants.

Therefore, MiniCo’s Tenant Insurance programs are designed to provide comprehensive coverage and convenient options for self-storage tenants. With their extensive experience in the industry, MiniCo understands the unique risks faced by self-storage businesses and tenants. They have tailored their insurance programs to address these risks effectively. Whether tenants choose the Pay-With-Rent option or opt for the standard application process, MiniCo ensures that storing belongings in a self-storage unit is accompanied by reliable insurance coverage.

Snapnsure: Insurance for Mobile Storage

Highlighting Snapnsure as the only company offering a Real Insurance Policy for Mobile Storage

When it comes to insuring your mobile storage, Snapnsure stands out as the go-to option. Unlike other companies that only offer protection plans, Snapnsure provides a “REAL” insurance policy for mobile storage. This means that you can have peace of mind knowing that your belongings are truly protected against any unforeseen incidents.

Differentiating the insurance coverage provided by Snapnsure from other protection plans

Snapnsure offers coverage for various types of mobile storage, including PODS, PackRat, Mobile Mini, Clutter, and all types of valet storage. Whether you are using one of these mobile storage options or others, Snapnsure has you covered. Their comprehensive insurance policy ensures that your belongings are protected not only from theft and damage but also from flood and named storm incidents.

While many self-storage facilities and mobile storage container leasing companies do not automatically provide insurance for your stored property, Snapnsure fills that gap with their reliable and affordable coverage options. By purchasing Snapnsure’s insurance policy, you can add an additional layer of protection for your stored belongings, alleviating concerns about potential losses.

When it comes to providing coverage for mobile storage, Snapnsure’s expertise and commitment to customer satisfaction truly sets them apart. Their insurance policy is tailored to meet the unique risks and needs of storing personal belongings off-premises. You can customize your coverage options based on your budget and specific requirements, whether you need basic protection or additional coverage for high-value items.

In the unfortunate event of a loss or damage to your stored property, Snapnsure aims to make the claims process as simple and stress-free as possible. Their dedicated customer support team is available to assist you in filing a claim and guide you through the process, ensuring that you receive the necessary compensation for your losses.

Therefore, Snapnsure is the only company offering a “REAL” insurance policy for mobile storage. Their comprehensive coverage options, including protection against flood and named storm incidents, make them the top choice for insuring your belongings in various types of mobile storage. With their expertise, customizable options, and commitment to customer satisfaction, Snapnsure ensures that your stored possessions are well-protected. Get a free quote today and experience the peace of mind that comes with having proper insurance coverage for your mobile storage.

Conclusion

Encouraging self-storage businesses and renters to prioritize insurance coverage for storage units

It is crucial for both self-storage businesses and renters to prioritize insurance coverage for storage units. Self-storage facilities and mobile storage container leasing companies do not automatically insure your stored property, leaving you vulnerable to potential losses. By investing in storage contents insurance, such as the options provided by Storage Protectors, Discount Storage Insurance, and Snapnsure, you can add an additional layer of protection for your stored belongings.

Summarizing the options available through SafeStor, MiniCo, and Snapnsure

SafeStor, MiniCo, and Snapnsure are three reputable companies that offer specialized insurance coverage for storage units. Here’s a summary of the options they provide:

1. SafeStor: SafeStor offers comprehensive insurance coverage for self-storage facilities, protecting your belongings against theft, damage, and various other risks. They provide customizable policies tailored to your specific needs.

2. MiniCo: MiniCo specializes in self-storage insurance, offering coverage options for both commercial and personal storage units. Their policies cover risks such as fire, theft, and water damage, and they can be customized to fit your budget and coverage requirements.

3. Snapnsure: Snapnsure stands out as the only company offering a “REAL” insurance policy for mobile storage. They provide coverage for various types of mobile storage, including PODS, PackRat, Mobile Mini, Clutter, and valet storage. Their comprehensive policies protect against theft, damage, flood, and named storm incidents.

Each of these companies offers unique benefits and coverage options, allowing you to choose the insurance policy that best suits your needs. Prioritizing insurance coverage for your storage unit is a wise decision that will provide peace of mind and protect your valuable belongings.

Therefore, renters insurance for storage units is essential to protect your stored property from potential losses. While homeowner’s insurance may not always provide adequate coverage for storage units, specialized insurance policies from companies like SafeStor, MiniCo, and Snapnsure offer comprehensive protection tailored to your unique storage needs. Investing in this coverage is a small price to pay for the peace of mind and financial security it provides.

Read more about Renters insurance cover storage unit aaa.