Introduction to Storage Unit Insurance

What is storage unit insurance?

Storage unit insurance is a type of insurance coverage specifically designed to protect the contents of a self-storage unit in the event of theft, damage, or loss. It provides financial compensation or reimbursement for the value of the items stored in the unit, offering peace of mind to renters.

Importance of having storage unit insurance

Storage unit insurance is important for several reasons. Here are some key points to consider:

1. Protection against theft and damage: Incidents like theft, arson, and accidental fires can cause substantial damage to storage rental facilities. If your unit is affected by such incidents, you could potentially lose everything you have stored. Storage unit insurance provides coverage to replace or repair the damaged items, helping you recover financially.

2. Requirement by storage companies: Many storage companies require renters to have storage unit insurance. However, some may fail to inform renters about this requirement until the day they begin renting. This can lead to renters feeling pressured to purchase insurance coverage from the storage company without considering other options. It’s essential to be aware of this requirement and compare your insurance options before making a decision.

3. Supplemental coverage: While your current home or renters insurance may provide some coverage for items in storage units, it’s crucial to speak with your insurance provider to understand the extent of coverage. In many cases, additional or supplemental storage unit insurance may be required to adequately protect your belongings. Consider discussing with your insurance company to determine if you need supplemental coverage.

4. Peace of mind: Having storage unit insurance offers peace of mind, knowing that your valuable possessions are protected. Whether it’s furniture, electronics, antiques, or other valuable items, having insurance provides financial security and offers reassurance that you won’t suffer significant financial losses in the event of an unfortunate incident.

Comparing storage unit insurance policies can help you find the best coverage for your needs. Consider factors such as the coverage limits, deductibles, exclusions, and premiums when evaluating different options. By taking the time to research and compare insurance providers, you can make an informed decision that protects both your belongings and your financial well-being.

Factors Affecting Storage Unit Insurance Premiums

Coverage amount and limits

The amount of coverage you choose for your storage unit insurance will directly impact the premium you pay. Higher coverage limits will generally result in higher premiums. It is important to accurately assess the value of the items you have stored and determine the appropriate coverage amount. Additionally, some insurance policies may have limits on the coverage for certain types of items, such as jewelry or collectibles. Make sure you understand these limits and adjust your coverage accordingly.

Location and security of the storage facility

The location and security of the storage facility can also affect the insurance premium. Storage units located in high-crime areas may have higher premiums due to the increased risk of theft. On the other hand, storage facilities with advanced security measures, such as surveillance cameras, gated access, and onsite security personnel, may result in lower premiums. When choosing a storage facility, consider its location and the security measures in place to ensure the safety of your stored items.

Claims history and deductibles

Insurance companies take into account your claims history when determining the premium for your storage unit insurance. If you have filed multiple claims in the past, you may be considered a higher risk and could face higher premiums. Additionally, the deductible you choose will also impact the premium. Higher deductibles typically result in lower premiums, but it also means you will have to pay more out of pocket in the event of a claim.

Type of storage unit

The type of storage unit you choose can also affect the insurance premium. Climate-controlled units, for example, may be more expensive to insure due to the additional protection they provide against temperature and humidity fluctuations. If you have valuable items that are sensitive to temperature changes, such as electronics or artwork, investing in a climate-controlled unit may be worth the higher premium.

Personal factors

Lastly, personal factors such as your age, occupation, and credit history can also impact the insurance premium. Insurance companies consider these factors as indicators of risk. Younger individuals or those with poor credit history may be considered higher risks and could face higher premiums. On the other hand, individuals with stable occupations and good credit history may qualify for lower premiums.

It is important to understand these factors and compare different insurance options before purchasing storage unit insurance. By doing so, you can ensure you have adequate coverage for your stored items at a competitive premium.

Types of Storage Unit Insurance

Self-storage facility insurance

Self-storage facility insurance is typically offered by the storage rental facility itself. This type of insurance is often required by the storage company and provides coverage for damage to the facility itself, as well as liability coverage for the storage company. It may also offer limited coverage for the contents of your storage unit, but it is important to review the policy carefully to understand the extent of coverage provided.

Third-party storage unit insurance providers

In addition to self-storage facility insurance, there are also third-party insurance providers that specialize in providing coverage specifically for storage units. These providers may offer more comprehensive coverage options compared to facility insurance, including protection against theft, fire, water damage, and other unforeseen events. Third-party providers may also offer additional features such as worldwide coverage and coverage for items in transit.

Some reasons why you might consider going with a third-party provider include:

– Flexibility: Third-party providers may offer more flexible coverage options and allow you to tailor the policy to your specific needs and budget.

– Additional coverage: Third-party providers may offer higher coverage limits and broader coverage for specific items such as valuable collectibles, antiques, or high-end electronics.

– Price competitiveness: By shopping around and comparing quotes from different third-party providers, you may be able to find a more competitive premium compared to the coverage offered by the storage facility.

– Portability: If you move to a different storage facility or decide to switch providers, having insurance coverage from a third-party provider can offer more continuity and flexibility.

When considering third-party storage unit insurance providers, it is important to carefully read the policy documents and understand the terms, conditions, and exclusions. Additionally, consider the reputation and financial stability of the provider to ensure they will be able to fulfill claims in case of an event.

Comparing your options and obtaining multiple quotes is important to ensure you are getting the best coverage at the most competitive price. Take into consideration factors such as coverage limits, deductibles, policy exclusions, and any additional features that may be important to you.

By understanding the types of storage unit insurance available and comparing your options, you can make an informed decision and ensure that your items in storage are adequately protected. Remember to review your policy regularly and make any necessary updates as the value of your stored items may change over time.

How much does Storage Unit Insurance Cost?

Cost comparison of different insurance carriers

When it comes to the cost of storage unit insurance, there is no one-size-fits-all answer. The premium you pay for insurance coverage can vary depending on several factors, including the insurance carrier you choose. It is important to compare the cost of coverage from different insurance companies to ensure you are getting the best value for your money.

Here is a comparison table showcasing the average annual premiums for storage unit insurance from different insurance carriers:

| Insurance Carrier | Average Annual Premium |

|——————-|———————–|

| Carrier A | $150 |

| Carrier B | $200 |

| Carrier C | $175 |

| Carrier D | $180 |

Factors influencing the premium rates

Several factors can influence the premium rates for storage unit insurance. Understanding these factors can help you make an informed decision when purchasing coverage. Here are the key factors that can affect the cost of storage unit insurance:

1. Coverage amount and limits: The amount of coverage you choose will directly impact the premium you pay. Higher coverage limits will generally result in higher premiums. Additionally, some insurance policies may have limits on the coverage for specific types of items, so make sure you understand these limits and adjust your coverage accordingly.

2. Location and security of the storage facility: The location and security measures of the storage facility can also affect the insurance premium. Units located in high-crime areas may have higher premiums due to the increased risk of theft. On the other hand, facilities with advanced security measures may result in lower premiums.

3. Claims history and deductibles: Insurance companies consider your claims history when determining the premium. Multiple past claims may result in higher premiums. Additionally, the deductible you choose will also impact the premium. Higher deductibles typically mean lower premiums but higher out-of-pocket expenses in case of a claim.

4. Type of storage unit: The type of storage unit you choose can also affect the insurance premium. Climate-controlled units, for example, may be more expensive to insure due to the additional protection they provide against temperature and humidity fluctuations.

5. Personal factors: Your age, occupation, and credit history can also impact the insurance premium. Younger individuals or those with poor credit history may face higher premiums, while individuals with stable occupations and good credit history may qualify for lower premiums.

It is important to consider these factors and compare different insurance options before purchasing storage unit insurance. By doing so, you can ensure that you have adequate coverage for your stored items at a competitive premium.

Coverage Details and Limitations

What is covered under storage unit insurance?

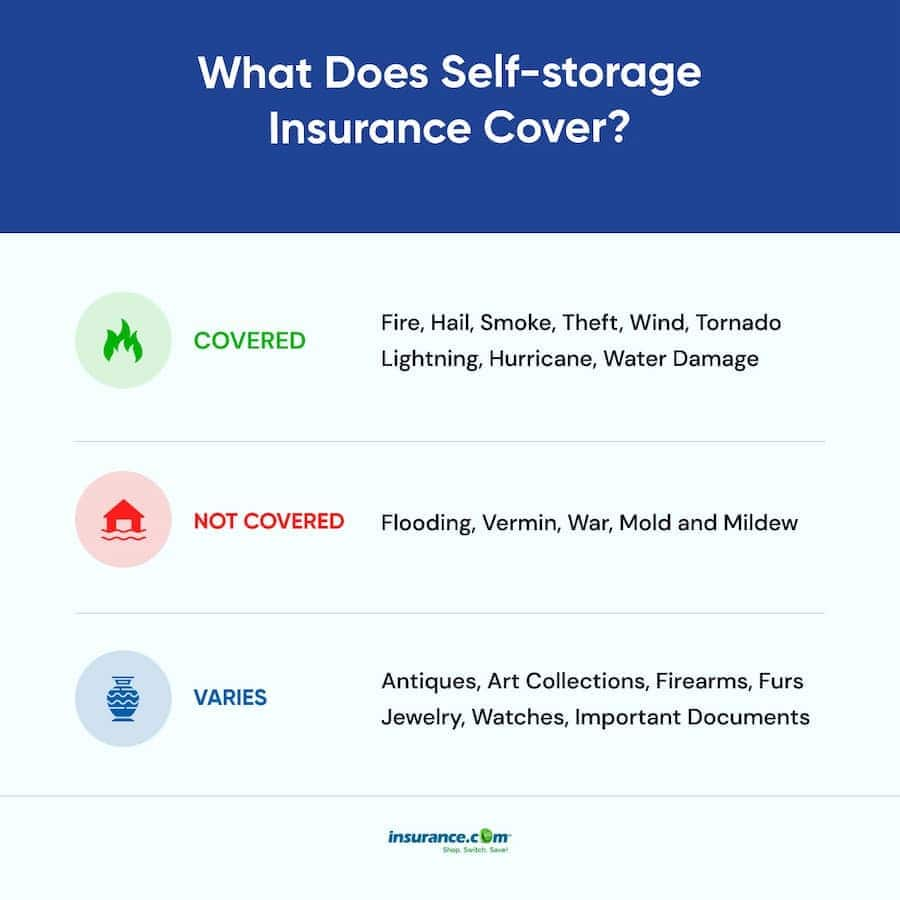

When it comes to storage unit insurance, it is important to understand what is covered and what is not. Here is a breakdown of the coverage provided by most storage unit insurance policies:

– Damage from fire, theft, and vandalism: Storage unit insurance typically covers damage caused by fire, theft, and vandalism. If your belongings are damaged or stolen due to these incidents, your insurance policy will provide compensation for the loss.

– Water damage: Storage unit insurance may also cover water damage caused by factors such as flooding or leaks. This is particularly important if your storage unit is located in an area prone to water-related issues.

– Vermin and fungus damage: Some storage unit insurance policies offer coverage for damage caused by vermin and fungus. This can include damage caused by pests like rodents and insects, as well as damage caused by mold or mildew.

– Natural disasters: Depending on the policy, storage unit insurance may also cover damage caused by natural disasters such as hurricanes, earthquakes, or tornadoes. However, it is important to review your policy carefully to understand the specific coverage in this regard.

Limitations and exclusions of storage unit insurance

While storage unit insurance provides coverage for a wide range of incidents, it is important to be aware of the limitations and exclusions that may exist. Here are some common limitations to consider:

– Valuable items: Storage unit insurance may have limits on coverage for valuable items such as jewelry, artwork, or collectibles. If you have valuable items stored in your unit, you may need to purchase additional coverage or consider a separate insurance policy specifically designed for these items.

– Negligence or intentional damage: Storage unit insurance typically does not cover damage caused by your own negligence or intentional acts. For example, if you mishandle your belongings and they get damaged, or if you intentionally damage your own property, you may not be eligible for coverage.

– War or acts of terrorism: Most storage unit insurance policies exclude coverage for damage or loss caused by war or acts of terrorism. If such incidents occur, you may need to explore other insurance options or seek compensation through alternative means.

– Wear and tear: Storage unit insurance usually does not cover damage caused by regular wear and tear or gradual deterioration of your belongings. It is important to properly maintain your items and ensure they are stored in appropriate conditions to avoid unnecessary damage.

– Uncovered perils: Some storage unit insurance policies may have specific perils or incidents that are not covered. It is important to review your policy carefully to understand what is excluded from coverage.

It is crucial to read the terms and conditions of your storage unit insurance policy thoroughly to fully understand the coverage details and limitations. If you have any questions or concerns, it is recommended to consult with your insurance provider or seek professional advice to ensure you have the right coverage for your stored items.

Understanding the Claims Process

How to file a storage unit insurance claim

If you experience a loss or damage to your stored items and need to file an insurance claim, here are the general steps you will need to follow:

1. Contact your insurance company: Notify your insurance company as soon as possible after the incident occurs. They will guide you through the claims process and provide you with any necessary forms or documentation.

2. Provide details of the incident: Be prepared to provide detailed information about the incident that caused the loss or damage. This may include the date and time of the incident, a description of what happened, and any relevant supporting evidence or witnesses.

3. Document the damage: Take photos or videos of the damage to your stored items as evidence for your claim. This visual documentation can help support your case and ensure a smoother claims process.

4. Provide proof of ownership or value: You may need to provide proof of ownership or the value of the items that were damaged or lost. This can include receipts, appraisals, or any other documentation that verifies the worth of your belongings.

5. Cooperate with the insurance company: Throughout the claims process, it is important to cooperate fully with your insurance company. Answer any questions they may have and provide any additional information or documentation they request.

6. Review the settlement offer: After assessing the damages and reviewing the details of your claim, the insurance company will provide a settlement offer. Carefully review the offer to ensure it covers the full extent of the damages and is in line with your policy coverage.

Documentation required for claims

When filing a storage unit insurance claim, you will typically need to provide the following documentation:

1. Proof of insurance: Provide a copy of your storage unit insurance policy or proof of coverage from your insurance company.

2. Incident report: If the loss or damage occurred due to theft, vandalism, or other criminal activities, you may need to file a police report. This report will serve as evidence of the incident.

3. Photos or videos: Provide visual documentation of the damage to your stored items. This can help support your claim and make the assessment process easier for the insurance company.

4. Proof of ownership or value: Provide receipts, appraisals, or any other documentation that verifies the ownership or value of the items that were damaged or lost.

5. Repair estimates: If you need to repair or replace any items, provide estimates from reputable repair companies or vendors. These estimates will help determine the compensation amount for your claim.

It is important to keep copies of all documentation related to your claim for your records. This will help ensure a smooth and efficient claims process.

Remember, the specific requirements for filing a storage unit insurance claim may vary depending on your insurance carrier and policy terms. It is always best to consult with your insurance company or review your policy documents for detailed instructions on how to file a claim.

Additional Benefits and Services

Additional coverage options like climate control and business inventory

Storage unit insurance not only covers damage or loss to your stored items, but it may also offer additional benefits and services. Some insurance policies may include options for climate-controlled storage units, which can be beneficial for storing delicate items such as artwork, electronics, or furniture that may be affected by extreme temperatures or humidity.

In addition, if you use a storage unit for your business, there may be insurance options to cover your business inventory and equipment. This can provide added peace of mind knowing that your business assets are protected in case of damage or loss.

Insurance policy add-ons and enhancements

Depending on your insurance provider, you may have the option to add supplemental coverage or enhancements to your storage unit insurance policy. These add-ons can provide additional protection and coverage for specific items or situations.

Some common insurance policy add-ons include:

– Increased coverage limits: If you have high-value items in your storage unit, such as antiques or jewelry, you may want to consider increasing your coverage limits to ensure these items are adequately protected.

– Extended coverage for specific perils: You can add coverage for specific perils that may not be included in your standard policy, such as floods or earthquakes. This can be particularly important if you live in an area prone to natural disasters.

– Additional liability coverage: If you are using your storage unit for business purposes or storing valuable items that could potentially cause harm or injury to others, you may want to consider adding liability coverage to protect yourself from potential lawsuits.

It is important to carefully review your insurance policy and consider these additional benefits and enhancements to customize your coverage based on your specific needs and circumstances.

Remember, the availability of these options may vary depending on your insurance provider and policy terms. It is recommended to speak with your insurance agent or company representative to discuss these additional benefits and services and determine if they are right for you.

By understanding the claims process and being aware of the additional benefits and services offered by storage unit insurance policies, you can make an informed decision to protect your belongings and minimize the financial impact of any potential losses or damages.

Storage Unit Insurance Requirements

Do all storage unit companies require insurance?

– Most storage unit companies require renters to have storage unit insurance.

– Some companies may neglect to inform renters about this requirement until the day they begin renting.

– Renters may feel pressured to purchase coverage from the storage facility without comparing other options.

Exceptions and alternatives for storage unit insurance

– Before purchasing storage unit insurance, renters should speak with their current home or renters insurance company to see if their policy already covers storage units.

– Home or renters insurance policies may provide coverage for stored items, either within the home or outside.

– If storage unit insurance is not included in the existing policy, renters can ask their insurance company if they offer supplemental coverage specifically for storage units.

– It’s important to compare different insurance options to ensure the best coverage and rates for storing belongings.

Conclusion

Why storage unit insurance is a worthwhile investment

When it comes to storing your belongings, having insurance coverage for your storage unit is a worthwhile investment. Incidents like theft, arson, and accidental fires can occur at storage rental facilities, causing significant damage and potential loss of your stored items. Without insurance, you could face a financial burden and lose everything you have packed away.

While most storage unit companies require insurance coverage, some may fail to inform renters about this requirement until the day they begin renting. This can lead renters to feel pressured to purchase coverage from the storage facility without exploring other options. However, it is important to compare your choices before buying storage unit insurance to ensure you get the best coverage and rates.

Tips for choosing the right storage unit insurance policy

Here are some tips to help you choose the right storage unit insurance policy:

1. Speak with your current home or renters insurance company: Before purchasing storage unit insurance, contact your current insurance provider to see if your policy already covers storage units. Home or renters insurance policies may provide coverage for stored items, either within the home or outside.

2. Inquire about supplemental coverage: If storage unit insurance is not included in your existing policy, ask your insurance company if they offer supplemental coverage specifically for storage units. This can be a more cost-effective option compared to purchasing insurance directly from the storage rental facility.

3. Compare different insurance options: It’s essential to compare different insurance providers and policies to ensure you get the best coverage and rates for storing your belongings. Consider factors such as coverage limits, deductibles, and any additional benefits offered.

4. Understand what is covered: When choosing a storage unit insurance policy, carefully review what is covered and any exclusions. Ensure that your policy adequately covers the value of your stored items and provides protection against various risks, including theft, fire, and water damage.

5. Consider additional coverage options: Depending on the value and nature of your stored items, you may want to consider additional coverage options, such as flood insurance or protection against natural disasters. Consult with your insurance provider to assess your needs and determine the appropriate level of coverage.

By following these tips, you can make an informed decision when choosing the right storage unit insurance policy. Remember, it’s crucial to have adequate coverage to protect your belongings and give you peace of mind while they are in storage.

Read more about Who sells storage unit insurance.