Introduction

What is renters insurance?

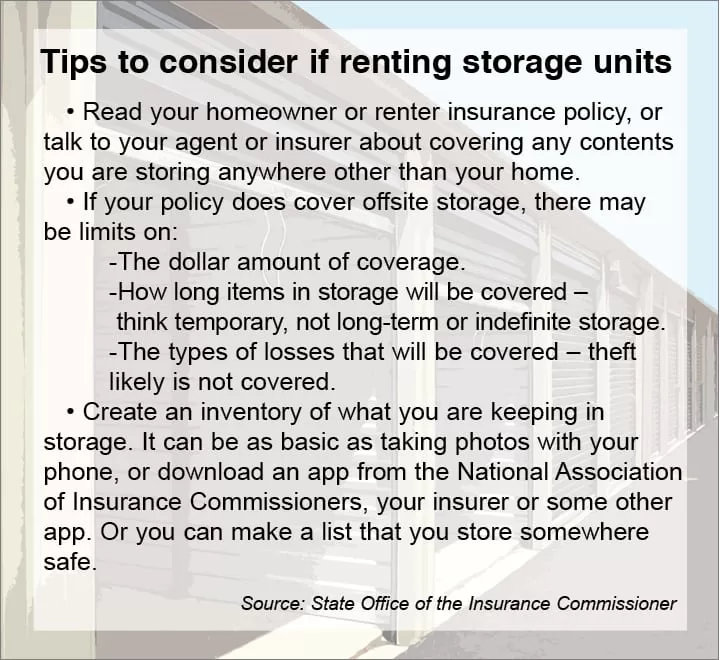

Renters insurance is a type of insurance that provides coverage for your personal belongings in the event of damage, theft, or loss. It is typically purchased by individuals who are renting a home or apartment and want to protect their possessions. Renters insurance can also extend coverage to items stored in storage units, whether they are located in a storage facility, at home, in transit, or in a commercial business location.

Importance of renters insurance for storage units

Having renters insurance for your storage unit is essential for several reasons. Here are some of the key benefits and reasons why you should consider getting coverage:

1. Comprehensive coverage for items stored in a unit: Renters insurance for storage units can provide comprehensive coverage for your stored items. This means that if your belongings are damaged by fire, water, or other covered perils, or if they are stolen, you can file a claim and receive compensation for their value. This coverage extends to items stored both inside the unit and in transit.

2. Protection during transit for your belongings: If you are moving your items to or from a storage unit, renters insurance can provide protection during transit. This means that if your belongings are damaged or stolen while in transit, you can file a claim and receive compensation for their value.

3. Low deductibles for claims: Renters insurance for storage units often has low deductibles for claims. This means that if you need to file a claim, you will only need to pay a small amount out of pocket before the insurance company covers the rest. This can provide peace of mind and financial protection in the event of a loss.

4. Prevents the risk of cancellation to your homeowner’s policy: Having renters insurance for your storage unit can help prevent the risk of cancellation to your homeowner’s policy. In the event of a claim, your homeowner’s policy may be cancelled or your premiums may increase. By having separate storage unit insurance, you can avoid these potential consequences and ensure that your homeowner’s policy remains intact.

Therefore, renters insurance for storage units is an important investment that provides comprehensive coverage for your stored items, protection during transit, low deductibles for claims, and prevents the risk of cancellation to your homeowner’s policy. It offers peace of mind knowing that your possessions are protected from potential damage, burglary, or loss, regardless of their location. If you are renting a storage unit, it is highly recommended to explore rental storage insurance options and find the right coverage for your storage needs.

Coverage Limits

Understanding coverage limits for personal property in storage units

When it comes to protecting your stored items, it is important to understand the coverage limits provided by your renters insurance policy. In many states, the coverage limit for belongings in a storage unit is set at $1,000. Unfortunately, this may not be sufficient to adequately cover the value of your stored items. That’s where additional storage unit insurance coverage becomes necessary.

Determining the sub-limit for personal possessions in storage units

Depending on the state you live in, there may be limits on the coverage available for personal property stored in a storage unit. For instance, if you reside in California, Connecticut, Virginia, or Florida, you will generally have a coverage limit of 10% of the personal property coverage for your overall renters policy. This means that if your renters policy provides $50,000 in personal property coverage, your storage unit coverage limit would be $5,000.

However, it’s important to note that not all states have this 10% sub-limit rule. Therefore, it’s essential to review your policy and consult with your insurance provider to determine the specific coverage limits for personal possessions in your storage unit.

If your renters policy does not offer adequate coverage for the value of your stored items, you have two main options:

1. Increase the coverage limits of your renters policy: Some insurance providers may allow you to increase the overall coverage limits of your renters policy, including the coverage for items stored in a storage unit. This option may require an additional premium payment, but it can provide you with the peace of mind of having sufficient coverage for your stored items.

2. Obtain separate storage unit insurance: Another option is to obtain a separate storage unit insurance policy. This type of insurance is specifically designed to cover the contents of your storage unit, regardless of their location. It can provide comprehensive coverage for potential damage, burglary, or loss of your stored items. Choosing a storage unit insurance policy allows you to customize the coverage to fit your specific needs.

Comparing the options of increasing coverage limits on your renters policy versus obtaining separate storage unit insurance can help you determine the most cost-effective and comprehensive solution for protecting your stored items. Consider factors such as the value of your stored items, the total coverage you need, and the specific terms and conditions of each option.

Therefore, it is essential to ensure that your stored items are adequately protected with the right insurance coverage. Understanding the coverage limits for personal property in storage units, as well as exploring the options of increasing coverage limits or obtaining separate storage unit insurance, can give you peace of mind, knowing that your belongings are safeguarded.

Theft Protection

How renters insurance protects against theft in storage units

Renters insurance can provide theft protection for your stored items in a storage unit. In the unfortunate event of theft, your renters insurance policy can help reimburse you for the value of the stolen items, up to your coverage limits. This coverage extends not only to theft that occurs within the storage unit but also during transit to and from the unit.

Key factors to consider for theft coverage in storage units

When considering theft coverage for your stored items, there are several key factors to take into account:

1. Coverage limits: Ensure that your renters insurance policy provides sufficient coverage limits for theft. Review your policy and consult with your insurance provider to determine the maximum amount you can claim in the event of theft.

2. Deductible: Consider the deductible amount that applies to theft claims. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choose a deductible that is affordable for you and balances the cost of the policy.

3. Item valuation: Take into consideration how your items are valued in the event of theft. Some insurance policies may reimburse you for the actual cash value of the stolen items, which takes into account depreciation. Alternatively, you may have the option to insure your items for their replacement cost, which covers the full cost of replacing the stolen items with new ones.

4. Item documentation: Keep a detailed inventory of the items you have in storage, including photographs and receipts, if possible. Proper documentation can help support your theft claim and ensure you receive adequate reimbursement for your stolen items.

5. Security measures: Consider the security measures taken by the storage facility. Opt for a storage facility that has secure access control, surveillance cameras, and other security features in place. These measures can help deter theft and provide added protection for your stored items.

By considering these key factors, you can ensure that you have the appropriate theft coverage for your stored items in a storage unit. Remember to regularly review and update your renters insurance policy as needed to ensure that it continues to meet your coverage needs.

Protection against Vandalism

Coverage for vandalism in storage units under renters insurance

When it comes to protecting your stored items, it’s crucial to understand the coverage provided for vandalism in your renters insurance policy. Vandalism can occur in storage units, leaving your belongings damaged or destroyed.

Under most renters insurance policies, vandalism is covered as part of the property damage section. This means that if your stored items are vandalized, you may be eligible for reimbursement. However, it’s important to note that there may be certain limitations and exclusions, so it’s essential to review your policy and consult with your insurance provider to fully understand what is covered.

Steps to take in case of vandalism in a storage unit

If you discover that your storage unit has been vandalized, there are several steps you should take to ensure a smooth claims process:

1. Document the damage: Take photos or videos of the vandalized items and the overall condition of your storage unit. This documentation will be essential when filing a claim with your insurance provider.

2. Notify the storage facility: Inform the storage facility management about the incident as soon as possible. They may have security measures in place, such as cameras or access logs, which can help in determining how the vandalism occurred.

3. File a police report: Contact local law enforcement and file a police report. Provide them with all the necessary details and evidence of the vandalism. A police report will be invaluable when filing your insurance claim.

4. Contact your insurance provider: Reach out to your insurance provider and report the vandalism. Provide them with all the documentation, including the photos or videos, the police report, and any other relevant information. They will guide you through the claims process and advise you on the next steps.

5. Cooperate with the claims adjuster: If an insurance claims adjuster is assigned to your case, cooperate fully with them. They may request additional information or documentation to assess the extent of the damage and determine the compensation you may be entitled to.

6. Keep records of all communication: Maintain a record of all communication with the storage facility and your insurance provider regarding the vandalism incident. This includes emails, letters, and phone calls. Having a documented trail of your interactions will help in case of any disputes or discrepancies during the claims process.

By following these steps and documenting the vandalism incident, you can help ensure a smooth and successful insurance claims process. Remember to review your policy to understand the coverage for vandalism and consult with your insurance provider for any questions or clarifications.

Conclusion:

Protecting your stored items from vandalism is crucial to prevent financial losses. Understanding the coverage provided under your renters insurance policy, documenting the vandalized items, and following the necessary steps when filing a claim are essential for a smooth claims process. Remember to review your policy, seek guidance from your insurance provider, and keep records of all communication to safeguard your stored belongings.

Weather-Related Damage

Renters insurance coverage for weather-related damage in storage units

When it comes to protecting your belongings in a storage unit, it is important to consider the coverage provided for weather-related damage in your renters insurance policy. Weather events such as storms, floods, and extreme temperatures can cause significant damage to stored items.

Under most renters insurance policies, weather-related damage is typically covered as part of the property damage section. This means that if your stored items are damaged due to weather events, you may be eligible for reimbursement. However, it is vital to review your policy carefully as there may be specific limitations and exclusions related to weather-related damage.

Common types of weather-related damage covered by renters insurance

Renters insurance typically covers a wide range of weather-related damage to your stored items. Some of the common types of weather-related damage that may be covered include:

1. Storm damage: This includes damage caused by strong winds, hail, lightning, and falling debris during a storm. Your policy may cover repairs or replacement of your belongings if they are damaged due to these weather conditions.

2. Water damage: Flooding or water leakage can occur in storage units, leading to damage to your stored items. Renters insurance may provide coverage for water damage caused by events such as burst pipes, storms, or natural disasters, depending on your policy.

3. Extreme temperature damage: Extreme heat or cold can cause damage to sensitive items stored in a unit. For example, high heat can melt or warp certain materials, while extreme cold can lead to freezing and cracking. Renters insurance may offer coverage for temperature-related damage, but it is important to review your policy to understand the specific limitations and conditions.

4. Fire damage: While fire damage is not directly related to weather, it is worth mentioning as it can occur in any location, including storage units. Renters insurance typically covers fire damage to your stored items, providing reimbursement for repairs or replacement.

It is crucial to keep in mind that each renters insurance policy may have different coverage limits and deductible amounts for weather-related damage. Additionally, certain high-value items or specialty items may require additional coverage or separate policies. Therefore, it is essential to carefully review your policy and consult with your insurance provider to fully understand the coverage and any limitations or exclusions that may apply.

Therefore, having renters insurance can provide coverage for weather-related damage to your stored items in a storage unit. Understanding the coverage provided for weather-related damage and reviewing your policy carefully will help you make informed decisions to protect your belongings. Remember to consult with your insurance provider for any questions or clarifications regarding weather-related damage coverage in your renters insurance policy.

Exclusions and Restrictions

Items excluded from coverage under renters insurance in storage units

While renters insurance provides coverage for a wide range of items, there are certain items that may be excluded from coverage when stored in a self-storage unit. It’s important to review your policy to understand any exclusions that may apply to your stored items. Common exclusions may include:

– Cash and currency: Renters insurance typically does not provide coverage for cash or currency, even when stored in a storage unit. It’s recommended to keep cash in a secure location or consider alternative options for its protection.

– Valuable jewelry and art: Some insurance policies may have limitations on coverage for valuable jewelry, art, or collectibles. If you have expensive items, it’s advisable to consider additional coverage or a separate policy specifically designed for these items.

– Motorized vehicles: Renters insurance typically does not cover motorized vehicles, such as cars, motorcycles, or boats, when stored in a storage unit. Specialized insurance policies may be required to protect these assets.

Common restrictions and limitations for personal property stored in storage units

When insuring personal property stored in a self-storage unit, there may be certain restrictions and limitations imposed by the insurance policy. These can vary depending on the insurance provider and the specific policy, but some common restrictions and limitations include:

– Limited coverage for high-value items: Insurance policies may have a limit on the coverage amount for high-value items, such as electronics or furniture. It’s important to review your policy and consider additional coverage if necessary.

– Time limitations for coverage during transit: If you’re moving your belongings to or from the storage unit, there may be restrictions on the coverage period during transit. Ensure that your insurance policy provides coverage for the entire duration of the move.

– Coverage for damage caused by natural disasters: While renters insurance typically provides coverage for damages caused by common perils like fire or theft, coverage for damages caused by natural disasters such as floods or earthquakes may require separate insurance policies.

– Deductibles and reimbursement limits: Insurance policies often include deductibles and reimbursement limits that may apply to storage unit claims. Familiarize yourself with these terms to understand your financial obligations in the event of a claim.

It’s important to thoroughly review your insurance policy and consult with your insurance provider to fully understand any exclusions, restrictions, or limitations that may apply to your storage unit insurance coverage. If necessary, consider additional insurance options or riders to ensure adequate protection for your stored items.

Exclusions and Restrictions

Items excluded from coverage under storage unit insurance

When it comes to insuring items stored in a storage unit, there are certain exclusions that may apply. It’s important to familiarize yourself with these exclusions to ensure you have adequate coverage for your stored items. Some common items that may be excluded from coverage include:

– Cash and currency: Most storage unit insurance policies do not cover cash or currency stored in the unit. It’s recommended to find alternative options for securing your cash.

– Valuable jewelry and art: Some policies may have limitations on coverage for valuable jewelry, art, or collectibles. Consider additional coverage options or a separate policy for these items.

– Motorized vehicles: Storage unit insurance typically does not cover motorized vehicles, such as cars or motorcycles. Specialized insurance policies may be necessary to protect these assets.

Common restrictions and limitations for personal property stored in storage units

In addition to exclusions, storage unit insurance policies may also have restrictions and limitations on coverage. Here are some common restrictions and limitations to be aware of:

– Limited coverage for high-value items: Insurance policies may have a maximum coverage amount for high-value items like electronics or furniture. Consider additional coverage if the value of your stored items exceeds these limits.

– Time limitations for coverage during transit: If you’re moving your belongings to or from the storage unit, there may be restrictions on the coverage period during transit. Make sure your insurance policy provides coverage throughout the entire move.

– Coverage for natural disasters: While storage unit insurance typically covers damages caused by common perils like fire or theft, coverage for natural disasters like floods or earthquakes may require separate insurance policies.

– Deductibles and reimbursement limits: Insurance policies often have deductibles and reimbursement limits that apply to storage unit claims. Understand these terms to know your financial obligations in the event of a claim.

Additional Coverage Options

Supplemental coverage for high-value items in storage units

If you have high-value items stored in your storage unit, it may be beneficial to consider supplemental coverage options. This can provide additional protection and increase the coverage limits for these valuable belongings. Contact your insurance provider to discuss these options and determine the best course of action.

Considerations for purchasing additional coverage for special belongings

For items that are not typically covered or have limited coverage under a standard storage unit insurance policy, you may want to explore additional coverage options. This can include purchasing a separate policy specifically designed for these items or obtaining riders to your existing policy. Speak to your insurance provider to evaluate the coverage needs for your special belongings and find the best solution.

Filing a Claim for Storage Unit Damage

Steps to follow when filing a claim for damage to personal property in a storage unit

When your items in a storage unit are damaged, it’s important to follow the proper steps to file a claim and ensure you receive the compensation you deserve. Here are the steps to follow when filing a claim for damage to personal property in a storage unit:

1. Notify the storage facility: As soon as you discover the damage, reach out to the storage facility and notify them about the situation. They may have specific procedures in place for handling claims and can guide you through the process.

2. Document the damage: Take detailed photographs of the damaged items and any evidence of the cause of the damage. This can include photographs of broken items, water damage, or signs of burglary. These photographs will serve as important evidence when filing your claim.

3. Review your storage insurance policy: Familiarize yourself with the terms and conditions of your storage insurance policy. This will help you understand the coverage limits, deductibles, and any specific requirements for filing a claim.

4. Contact your insurance provider: Reach out to your insurance provider and inform them about the damage to your stored items. They will guide you through the claim process and provide you with the necessary forms and information.

5. Complete the claim forms: Fill out the claim forms provided by your insurance provider. Include all relevant information about the damaged items, the cause of the damage, and any supporting documentation or photographs.

6. Submit the claim forms: Once you have completed the claim forms, submit them to your insurance provider according to their instructions. Make sure to keep copies of all documents for your records.

7. Provide additional documentation if required: In some cases, your insurance provider may require additional documentation or evidence to support your claim. This can include repair estimates, receipts for damaged items, or any other relevant information. Be prepared to provide these documents promptly.

8. Cooperate with the insurance company’s investigation: The insurance company may conduct an investigation to assess the validity of your claim. Cooperate fully and provide any requested information or assistance during this process.

Documentation and evidence required for a successful claim

When filing a claim for storage unit damage, it’s crucial to provide the necessary documentation and evidence to support your case. Here are some of the common documentation and evidence required for a successful claim:

– Photographs of the damaged items: Take detailed photographs of the damaged items, clearly showing the extent of the damage.

– Proof of ownership: Provide proof of ownership for the damaged items, such as receipts, invoices, or photographs taken before storing the items.

– Repair estimates: If you have obtained repair estimates for the damaged items, include them with your claim. These can help determine the cost of repairs or replacements.

– Police reports: If the damage is a result of burglary or vandalism, file a police report and provide a copy to your insurance provider.

– Storage facility records: Provide any documentation from the storage facility that supports your claim, such as surveillance footage or incident reports.

By following these steps and providing the necessary documentation and evidence, you can increase the likelihood of a successful claim and ensure you receive the compensation you deserve for the damage to your personal property in a storage unit. It’s important to consult with your insurance provider for specific instructions and requirements related to your policy.

Filing a Claim for Storage Unit Damage

Steps to follow when filing a claim for damage to personal property in a storage unit

When your items in a storage unit are damaged, it is important to follow the proper steps to file a claim and ensure you receive the compensation you deserve. Here are the steps to follow when filing a claim for damage to personal property in a storage unit:

1. Notify the storage facility: As soon as you discover the damage, notify the storage facility and inform them about the situation. They will guide you through the claim process.

2. Document the damage: Take detailed photographs of the damaged items and any evidence of the cause of the damage. These photographs will serve as important evidence when filing your claim.

3. Review your storage insurance policy: Familiarize yourself with the terms and conditions of your storage insurance policy. This will help you understand the coverage limits, deductibles, and any specific requirements for filing a claim.

4. Contact your insurance provider: Reach out to your insurance provider and inform them about the damage to your stored items. They will provide you with the necessary forms and guide you through the claim process.

5. Complete the claim forms: Fill out the claim forms provided by your insurance provider. Include all relevant information about the damaged items, the cause of the damage, and any supporting documentation or photographs.

6. Submit the claim forms: Once you have completed the claim forms, submit them to your insurance provider according to their instructions. Keep copies of all documents for your records.

7. Provide additional documentation if required: Your insurance provider may require additional documentation or evidence to support your claim. Be prepared to provide repair estimates, receipts for damaged items, or any other relevant information.

8. Cooperate with the insurance company’s investigation: The insurance company may conduct an investigation to assess the validity of your claim. Cooperate fully and provide any requested information or assistance during this process.

Documentation and evidence required for a successful claim

When filing a claim for storage unit damage, it is crucial to provide the necessary documentation and evidence to support your case. Here are some common documentation and evidence required for a successful claim:

– Photographs of the damaged items

– Proof of ownership for the damaged items

– Repair estimates for the damaged items

– Police reports if the damage is a result of burglary or vandalism

– Storage facility records that support your claim

By following these steps and providing the necessary documentation and evidence, you can increase the likelihood of a successful claim and ensure you receive the compensation you deserve for the damage to your personal property in a storage unit. It is important to consult with your insurance provider for specific instructions and requirements related to your policy.

Conclusion

Therefore, having storage unit insurance is essential for protecting your stored belongings from potential damage, burglary, or loss. When filing a claim for storage unit damage, it is important to follow the proper steps and provide the necessary documentation and evidence. By doing so, you can ensure a smooth claims process and increase the likelihood of receiving the compensation you deserve.

Discover Self storage unit condo insurance.