Introduction

Overview of renters insurance and its coverage for storage units

Renters insurance is a type of insurance designed to protect tenants against financial losses that may occur due to damage to their personal belongings or their liability for accidents that happen within their rented property. Typically, renters insurance includes two main components: personal liability coverage and personal property coverage.

Personal property coverage is the part of renters insurance that reimburses tenants for the cost of replacing their belongings if they are lost, damaged, or stolen. This coverage extends beyond the rental property, meaning that your belongings are covered even if they are not physically located within your rented space. However, there may be exceptions to this coverage, and it is important to understand the specific terms and conditions of your policy.

When it comes to storage units, renters insurance can provide coverage for your belongings stored in these facilities. However, there may be certain limitations and requirements that need to be met in order for the coverage to apply. It is crucial to review your policy and consult with your insurance provider to determine if your renters insurance covers property in self-storage units.

Importance of protecting belongings in a storage unit

Renters insurance coverage for property stored in self-storage units can be invaluable. Here are some reasons why it is important to protect your belongings in a storage unit:

1. Theft and burglary: Storage units are not immune to theft and burglary. Your valuable possessions stored in a storage unit can be targeted by criminals. Having renters insurance can provide financial protection in such situations.

2. Natural disasters: Storage units are susceptible to natural disasters such as floods, fires, and storms. These events can cause severe damage to your belongings. Renters insurance can help cover the cost of replacing or repairing your damaged items.

3. Accidental damage: Accidents can happen even in storage units. For example, water leakage from another unit can damage your belongings. Having renters insurance can provide coverage for such accidental damage.

4. Peace of mind: Knowing that your belongings are protected by renters insurance can give you peace of mind. You can focus on other aspects of your life without worrying about the financial implications of potential losses or damages to your stored items.

Therefore, renters insurance can provide coverage for belongings stored in self-storage units. However, it is important to review your policy and understand the specific terms and conditions regarding coverage for storage units. Protecting your belongings in a storage unit with renters insurance is crucial to mitigate financial risks associated with theft, natural disasters, and accidental damages.

Understanding Renters Insurance Coverage

Explanation of off-premises personal property coverage in homeowners policy

Renters insurance is a type of insurance that provides coverage for your personal belongings and personal liability in the event of a loss or damage. It is important to understand the coverage included in your renters insurance policy, especially when it comes to off-premises personal property coverage.

Off-premises personal property coverage refers to the protection provided for your belongings when they are not in your rental property. This means that even if your belongings are lost, damaged, or stolen while outside of your rental, they may still be covered by your renters insurance policy.

In some cases, off-premises personal property coverage may also extend to items stored in a storage unit. This is good news if you are worried about the safety and security of your belongings while they are in storage. With renters insurance, you can have peace of mind knowing that your belongings are protected even when they are not inside your home.

Details of Allstate® renters insurance and its coverage for belongings in rented apartments or homes

If you have Allstate® renters insurance, you are in luck. Allstate® renters insurance covers your belongings while they are in a storage unit, as long as they are not excluded from coverage. This means that you can store your belongings with confidence, knowing that they are protected against losses such as theft, fire, or water damage.

It is important to note that the coverage for belongings in a storage unit may be limited. In most cases, the coverage for personal property away from your residence is up to ten percent of your personal property coverage amount. Therefore, it is essential to review your policy and understand the specific coverage limits for your belongings in a storage unit.

Overall, renters insurance provides valuable protection for your personal belongings, whether they are inside your rental property or in a storage unit. It is always a good idea to consult with your insurance provider and review your policy to ensure you have the right coverage to meet your needs.

Remember, renters insurance is not only about protecting your belongings, but also about providing personal liability coverage. This coverage can protect you financially if someone is injured in your rental property or if you accidentally damage someone else’s property.

Therefore, having renters insurance gives you peace of mind knowing that your belongings are protected, even when they are not inside your rental property. If you have a storage unit, make sure to review your policy and understand the coverage limits for your belongings. By taking the time to understand your renters insurance coverage, you can be prepared for any unexpected events and protect your valuable belongings.

Coverage Limitations for Storage Units

Information on the percentage of coverage for items in self-storage units

When it comes to storing your belongings in a self-storage unit, it’s important to understand the coverage limitations of your renters insurance policy. In most cases, renters insurance policies provide coverage for personal property away from your residence, including items stored in a storage unit. However, the coverage for belongings in a storage unit is typically limited to a percentage of your personal property coverage amount.

Explanation of how coverage limits are determined

The coverage limit for belongings in a storage unit is usually up to ten percent of your personal property coverage amount. This means that if your renters insurance policy provides $50,000 in personal property coverage, you would have coverage for up to $5,000 worth of belongings in a storage unit. It’s important to note that this coverage limit may vary depending on your specific policy, so it’s always a good idea to review your policy documents or speak with your insurance provider to understand your exact coverage limits.

It’s also worth mentioning that not all items may be covered under your renters insurance policy while in a storage unit. Certain high-value items, such as jewelry or fine art, may have separate coverage limits or require additional coverage. Again, it’s important to review your policy or consult with your insurance provider to understand any limitations or exclusions for specific items.

Therefore, your Allstate renters insurance will cover your belongings while they are in a storage unit, up to the coverage limit specified in your policy. It’s important to review your policy documents and understand the coverage limits for belongings in a storage unit to ensure that your valuable items are adequately protected. If you have any questions or concerns about your coverage, don’t hesitate to reach out to your insurance provider for clarification.

Benefits of Renters Insurance for Storage Units

Protection against loss or damage from various situations

Having renters insurance provides you with protection and peace of mind, not only for your belongings inside your rental property but also for items stored in a storage unit. With renters insurance coverage, you can be confident that your belongings are protected against various situations, such as theft, fire, or water damage.

Examples of covered incidents, such as water damage and theft

Renters insurance generally covers a wide range of incidents, including water damage and theft. If a water leak occurs in the storage unit and damages your belongings, your renters insurance policy can help cover the cost of repairs or replacement. Similarly, if someone breaks into the storage unit and steals your belongings, your insurance can provide financial assistance to recover the value of the stolen items.

It is important to note that the coverage for belongings in a storage unit may have certain limitations. In most cases, the coverage for personal property away from your residence is up to ten percent of your personal property coverage amount. Therefore, it is crucial to review your renters insurance policy and understand the specific coverage limits for your belongings in a storage unit.

Comparing renters insurance policies from different providers can help you find the one that best suits your needs. Consider factors such as coverage limits, deductibles, and additional features offered by each insurance provider. It’s also a good idea to consult with a licensed insurance agent who can guide you through the process and help you make an informed decision.

By having renters insurance coverage for your storage unit, you can have peace of mind knowing that your belongings are protected against unforeseen events. Whether it’s damage caused by a natural disaster or theft, your insurance can provide the financial support you need to replace or repair your belongings.

In addition to coverage for your belongings, renters insurance also provides personal liability coverage. This means that if someone is injured while in your storage unit, your insurance can help cover the medical expenses or legal costs that may arise from the incident.

To ensure you have the right renters insurance coverage for your storage unit, it is essential to evaluate your policy regularly and make any necessary updates. By understanding the specifics of your coverage, you can be well-prepared and protected in case of any unexpected incidents.

Therefore, renters insurance can provide coverage for your belongings even when they are stored in a storage unit. With the right policy in place, you can have peace of mind knowing that your items are protected against loss or damage from various situations. Take the time to review your renters insurance coverage, understand the limits and exclusions, and consult with an insurance agent to ensure you have the coverage that fits your needs.

How to Determine Insurance Needs for Storage Units

Guidance on assessing the value of stored belongings

When determining the insurance needs for your storage unit, it is important to assess the value of the belongings you plan to store. Follow these steps to accurately determine the value:

1. Take inventory: Make a detailed list of all the items you plan to store in the unit. Include their estimated value and any relevant descriptions.

2. Calculate the total value: Add up the estimated value of each item on your list to determine the total value of your stored belongings. This will help you ensure that you have adequate coverage.

3. Consider replacement costs: Keep in mind that the value of your belongings may have changed since you initially purchased them. Research current market prices to determine the cost of replacing your items in case of loss or damage.

4. Assess sentimental value: Some items may have sentimental value that cannot be replaced. While insurance cannot replace sentimental value, it is important to consider the emotional significance of certain items when determining coverage needs.

5. Consult with an expert: If you are unsure about the value of certain items or need assistance in assessing your insurance needs, consider consulting with a professional appraiser or an insurance agent. They can provide valuable insights and help ensure that you have the right level of coverage.

Tips for determining appropriate coverage limits

Once you have assessed the value of your stored belongings, it is essential to determine the appropriate coverage limits for your renters insurance policy. Consider the following tips:

1. Review your current coverage: If you already have renters insurance, review your policy to understand the coverage limits for personal property away from your residence. This will give you a baseline for determining the additional coverage needed for your stored belongings.

2. Consider the value of high-ticket items: If you plan to store valuable items, such as jewelry, electronics, or collectibles, make sure your coverage limits are sufficient to protect these items. It may be necessary to add additional coverage or schedule these items separately on your policy.

3. Evaluate the risk factors: Assess the location and security measures of the storage facility. If the unit is in an area prone to natural disasters or has inadequate security measures, you may want to consider higher coverage limits to protect against potential risks.

4. Consider your budget: While adequate coverage is important, it is also essential to consider your budget. Determine an insurance premium that you can comfortably afford while still providing sufficient coverage for your stored belongings.

Remember, the specific coverage limits for your renters insurance policy may vary depending on your insurance provider and policy details. It is crucial to review your policy carefully and consult with an insurance agent to ensure you have the appropriate coverage.

By accurately assessing the value of your stored belongings and considering the appropriate coverage limits, you can have confidence that your renters insurance policy will adequately protect your items in storage. Regularly review your policy and make any necessary updates to ensure continued coverage in case of any unforeseen events.

Requesting a Renters Insurance Quote

Process of obtaining a free renters insurance quote

To obtain a renters insurance quote, you can follow a simple and straightforward process:

1. Research insurance providers: Start by researching different insurance providers that offer renters insurance coverage. Look for reputable companies that have good customer reviews and a track record of providing excellent service.

2. Contact insurance providers: Once you have a list of potential insurance providers, contact them either by phone or through their website. Provide them with the necessary information, such as your name, address, and details about your rental property.

3. Provide details about your belongings: During the quote process, you will be asked to provide information about your personal belongings, including their estimated value. Make sure to be as accurate as possible to ensure you receive an accurate quote.

4. Review and compare quotes: After providing all the necessary information, you will receive quotes from the insurance providers. Take the time to review and compare the quotes, considering factors such as coverage limits, deductibles, and additional features.

5. Make an informed decision: Once you have reviewed and compared the quotes, you can make an informed decision about which renters insurance policy suits your needs and budget. Consider the coverage options and prices offered by each insurance provider.

Benefits of choosing dependable coverage for as little as $4 per month

Choosing dependable renters insurance coverage offers several benefits, even at a low cost of around $4 per month:

– Protection for your belongings: Renters insurance provides coverage for your personal belongings, including those stored in a storage unit. In case of theft, fire, or water damage, your insurance can help cover the cost of repairs or replacement.

– Peace of mind: Having renters insurance can give you peace of mind knowing that your belongings are protected against unexpected events. Whether it’s damage caused by a natural disaster or theft, your insurance can provide the financial support you need to recover.

– Personal liability coverage: Renters insurance also includes personal liability coverage. If someone is injured while in your storage unit, your insurance can assist in covering medical expenses or legal costs that may arise from the incident.

– Affordable premiums: Renters insurance is generally affordable, with premiums starting as low as $4 per month. By choosing a dependable insurance provider, you can secure coverage for your belongings without breaking the bank.

– Flexibility to customize coverage: Many insurance providers offer the option to customize your renters insurance policy to fit your specific needs. This allows you to add additional coverage for valuable items or specific risks that are important to you.

Therefore, requesting a renters insurance quote is a simple process that can provide you with valuable coverage for your belongings, including those stored in a storage unit. By choosing dependable coverage for as little as $4 per month, you can have peace of mind knowing that your belongings are protected against loss or damage. Remember to review and compare quotes from different insurance providers to ensure you select the policy that best suits your needs.

Tips for Safeguarding Belongings in Storage Units

Recommendations for securing items in the storage unit

When using a storage unit to store your belongings, it’s important to take measures to ensure their safety and security. Here are some recommendations to help safeguard your items:

1. Choose a reputable storage facility: Before renting a storage unit, research different facilities in your area and choose one that has a good reputation for security. Look for facilities with features such as gated access, surveillance cameras, and on-site security personnel.

2. Use a sturdy lock: Invest in a high-quality lock to secure your storage unit. Avoid using padlocks that can be easily picked or cut. Instead, opt for disc locks or cylinder locks that are more difficult to tamper with.

3. Opt for climate-controlled units: If you have sensitive or valuable items, consider renting a climate-controlled unit. These units maintain a constant temperature and humidity level, protecting your belongings from damage caused by extreme weather conditions.

4. Properly stack and secure items: When storing your items, use sturdy boxes and containers to prevent them from shifting or falling. Stack heavier items on the bottom and lighter ones on top. Use straps or bungee cords to secure larger objects and prevent them from tipping over.

5. Consider using shelves or pallets: To further protect your items, consider using shelves or pallets to keep them off the ground. This can help prevent moisture from seeping into the storage unit and damaging your belongings.

Importance of maintaining an inventory and updating coverage as needed

Keeping an inventory of your stored items is crucial for several reasons. It allows you to:

– Keep track of your belongings: By maintaining an inventory, you can easily keep track of what items you have stored in the unit. This can be especially useful if you need to retrieve specific items in the future.

– Prove ownership and value: In the event of a loss or damage, having an inventory can help you prove ownership and the value of your belongings. This can expedite the claims process and ensure that you receive the appropriate compensation.

– Determine coverage needs: Regularly updating your inventory allows you to assess whether your current renters insurance coverage is sufficient. If you acquire new valuable items, such as electronics or jewelry, you may need to adjust your coverage limits to adequately protect these items.

– Provide documentation for insurance purposes: Insurance companies may require documentation of your stored items when filing a claim. Having an updated inventory can provide the necessary documentation to support your claim and ensure a smooth claims process.

Therefore, taking steps to secure your items in a storage unit and maintaining an inventory are essential for protecting your belongings. Following the recommendations provided and regularly updating your insurance coverage can help ensure that your items are safeguarded against theft, damage, or loss. Remember to consult with your insurance provider to understand the specific coverage options available to you.

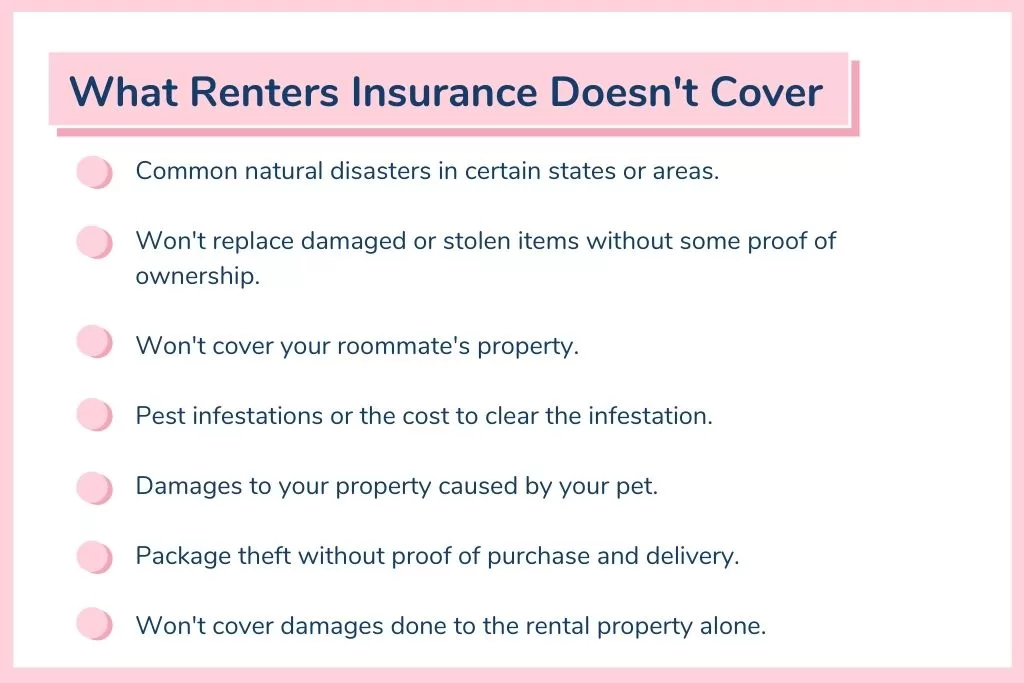

Understanding Policy Exclusions

Explanation of items or situations that may not be covered by renters insurance

While renters insurance provides valuable coverage for your belongings, there are certain items or situations that may not be covered. It’s important to understand these policy exclusions to ensure you have the appropriate coverage for your needs. Some common exclusions include:

1. High-value items: Most renters insurance policies have a coverage limit for high-value items such as jewelry, artwork, or electronics. If the value of these items exceeds the coverage limit, you may need to purchase additional coverage or a separate policy to protect them adequately.

2. Natural disasters: While renters insurance typically covers damages caused by fire, water damage, or theft, it may not cover damages caused by certain natural disasters like earthquakes or floods. If you live in an area prone to these events, you may need to purchase additional coverage specific to these risks.

3. Intentional damages: Renters insurance does not cover intentional damages caused by the policyholder. If you purposefully damage your own belongings, they will not be covered by your insurance.

4. Wear and tear: Renters insurance is designed to cover sudden and unexpected incidents, not normal wear and tear. If your belongings deteriorate over time or require repairs due to regular use, they may not be covered by your insurance policy.

5. Business-related items: If you operate a business from your rental property or store business items in a storage unit, these items may not be covered by your renters insurance policy. You may need to purchase separate business insurance to protect these assets.

Clarification on specific exclusions and limitations

It’s important to review your policy carefully to understand the specific exclusions and limitations that apply to your renters insurance. Some policies may have additional exclusions or limitations that are unique to the insurance provider. Here are a few specific scenarios that may have limitations:

1. Water damage and mold: While renters insurance typically covers water damage, it may not cover damages caused by long-term leakage or mold. Mold damage may require separate coverage, or the insurance company may have specific limitations related to mold claims.

2. Pets: Some renters insurance policies may exclude or limit coverage for damages caused by pets. For example, if your pet causes damage to your rental property, it may not be covered by your insurance.

3. Roommates: If you have roommates, it’s important to clarify how your renters insurance policy addresses their belongings. Some policies may only cover the belongings of the policyholder and not extend coverage to roommates.

To ensure you have a comprehensive understanding of your renters insurance policy, it’s essential to carefully read through the terms and conditions and ask your insurance provider any questions you may have. By being aware of the policy exclusions and limitations, you can make informed decisions about additional coverage or adjustments needed to protect your belongings adequately.

Conclusion

Recap of the importance of renters insurance for storage units

Renters insurance is an essential coverage for individuals who rent their living spaces, including those who use self-storage units. It provides personal liability and personal property coverage, protecting both your belongings and your financial interests. While renters insurance generally covers items in self-storage units, there may be limitations and exclusions that you need to be aware of.

Final thoughts and encouragement to protect belongings with adequate coverage

To ensure that your belongings are thoroughly protected, it is crucial to review your renters insurance policy and understand the specific exclusions and limitations. Consider purchasing additional coverage or separate policies if necessary, especially for high-value items, natural disasters, intentional damages, wear and tear, and business-related items.

It is also important to clarify how your policy addresses specific scenarios such as water damage and mold, damages caused by pets, and coverage for roommates. By thoroughly understanding your policy and asking your insurance provider any questions you may have, you can make informed decisions about your coverage needs.

Remember, renters insurance provides peace of mind and financial protection in the event of unforeseen circumstances. Take the necessary steps to ensure that your belongings are adequately covered, and don’t hesitate to reach out to your insurance provider for assistance.

Learn about Insurance claim for storage unit renter's policy.