Introduction

Overview of insuring items in a storage unit

When renting a storage unit, it’s important to consider insurance coverage for your stored belongings. While some storage facilities may offer their own insurance policy or direct you to a affiliated insurer, it’s essential to understand the coverage and compare it with what your existing home or renters insurance policy offers.

Benefits of having insurance coverage for stored belongings

Having insurance coverage for your stored belongings provides several benefits:

1. Protection against damage or loss: With insurance, you can receive financial compensation if your items are damaged, stolen, or destroyed while in storage. This ensures that you are not left to bear the financial burden of replacing your belongings.

2. Peace of mind: Knowing that your stored items are covered by insurance can provide peace of mind. Whether it’s sentimental items or valuable possessions, having insurance coverage allows you to rest easy knowing that you are financially protected.

3. Flexibility in coverage options: Insurance policies for storage units can vary in terms of coverage limits and deductibles. By comparing different insurance providers, you can find a policy that suits your specific needs and budget.

4. Additional coverage for high-value items: Some storage unit insurance policies may offer additional coverage for high-value items, such as jewelry or art. This can be particularly beneficial if you have valuable possessions that require extra protection.

5. Coverage for natural disasters: Storage units are vulnerable to natural disasters such as floods, fires, and storms. Having insurance coverage ensures that your belongings are protected in the event of such unforeseen circumstances.

6. Supplementing existing insurance: While your home or renters insurance policy may offer coverage for offsite storage, it’s important to review the terms and limits. Storage unit insurance can supplement the coverage provided by your existing policy, ensuring comprehensive protection for your stored items.

It’s crucial to carefully review the terms and rates of the storage facility’s insurance policy and compare them with other insurance companies’ offerings. This allows you to make an informed decision and choose the insurance coverage that best suits your needs.

Types of Insurance Coverage

Personal Property Coverage in homeowners insurance

Homeowners insurance typically provides coverage for personal belongings, including items stored in a storage unit. However, the coverage can vary depending on the insurance policy and the specific terms and conditions. It’s important to review your homeowners insurance policy or speak with your insurance provider to understand the extent of coverage for items in storage.

Stand-alone storage unit insurance policies

For individuals who require more comprehensive coverage for their stored belongings, stand-alone storage unit insurance policies are available. These policies are specifically designed to provide coverage for items stored in a storage unit.

Comparison between homeowners insurance and stand-alone storage unit insurance

Here is a comparison between homeowners insurance and stand-alone storage unit insurance:

|

Homeowners Insurance |

Stand-alone Storage Unit Insurance |

|

|---|---|---|

|

Coverage |

Provides coverage for personal belongings, including items stored in a storage unit, but the coverage may be limited |

Offers broader coverage specifically for items stored in a storage unit |

|

Policy Terms |

Terms and conditions are predetermined in the homeowners insurance policy |

Terms and conditions can be customized based on the individual’s needs |

|

Premiums |

Storage unit coverage is typically an included part of the homeowners insurance policy, with premiums based on the overall coverage |

Separate premiums specifically for the storage unit insurance coverage |

|

Claims |

Claims may be subject to deductibles and may impact the overall homeowners insurance policy |

Claims are specific to the storage unit insurance policy and may not impact the homeowners insurance policy |

Considerations for choosing storage unit insurance

When considering storage unit insurance, it’s important to keep the following factors in mind:

1. Coverage limits: Ensure that the insurance policy provides adequate coverage for the value of your stored belongings.

2. Deductibles: Understand the deductibles that may be applicable in case of a claim and how they might impact the overall coverage and cost.

3. Exclusions: Review the policy to understand any exclusions or limitations on coverage, such as specific perils that may not be covered.

4. Policy customization: If you have unique storage needs or valuable items, consider a storage unit insurance policy that allows for customization to meet your specific requirements.

5. Premiums: Compare quotes and premiums from different insurance providers to find the best coverage at a competitive price.

6. Claims process: Familiarize yourself with the claims process and requirements, including any documentation or evidence that may be needed in case of a claim.

By considering these factors and understanding the differences between homeowners insurance and stand-alone storage unit insurance, you can make an informed decision to protect your belongings stored in a storage unit.

Coverage Limits and Terms

Understanding the coverage limits of your insurance policy

When it comes to insurance coverage for belongings stored in a storage unit, there are a few important factors to consider. The coverage provided by homeowners insurance may vary depending on the specific policy and its terms and conditions. It is crucial to review your homeowners insurance policy or speak with your insurance provider to understand the extent of coverage for items in storage. This will help you determine whether additional insurance is necessary to adequately protect your belongings.

Common terms and conditions of storage unit insurance

Stand-alone storage unit insurance policies are specifically designed to provide coverage for items stored in a storage unit. Unlike homeowners insurance, these policies offer broader and more comprehensive coverage for stored belongings. The terms and conditions of these policies can be customized based on individual needs, providing flexibility in coverage options. It is important to carefully review the terms and conditions of any storage unit insurance policy to ensure it meets your specific requirements.

|

Homeowners Insurance |

Stand-alone Storage Unit Insurance |

|

|---|---|---|

|

Coverage |

Provides coverage for personal belongings, including items stored in a storage unit, but the coverage may be limited |

Offers broader coverage specifically for items stored in a storage unit |

|

Policy Terms |

Terms and conditions are predetermined in the homeowners insurance policy |

Terms and conditions can be customized based on the individual’s needs |

|

Premiums |

Storage unit coverage is typically an included part of the homeowners insurance policy, with premiums based on the overall coverage |

Separate premiums specifically for the storage unit insurance coverage |

|

Claims |

Claims may be subject to deductibles and may impact the overall homeowners insurance policy |

Claims are specific to the storage unit insurance policy and may not impact the homeowners insurance policy |

When choosing storage unit insurance, it’s important to consider factors such as coverage limits, deductibles, exclusions, policy customization, premiums, and the claims process. Ensuring that the insurance policy provides adequate coverage for the value of your stored belongings is crucial. It’s also important to understand the deductibles that may apply and how they might impact the overall coverage and cost. Reviewing the policy for any exclusions or limitations on coverage is essential to avoid any surprises in case of a claim. If you have unique storage needs or valuable items, look for a storage unit insurance policy that allows for customization to meet your specific requirements. Comparing quotes and premiums from different insurance providers will help you find the best coverage at a competitive price. Finally, familiarize yourself with the claims process and requirements to be prepared in case you need to file a claim.

By considering these factors and understanding the differences between homeowners insurance and stand-alone storage unit insurance, you can make an informed decision to protect your belongings stored in a storage unit.

Existing Insurance Policies

Checking if your existing home, renters, or small business insurance covers storage units

If you already have a homeowners insurance, renters insurance, or small business insurance policy, it’s important to check if it provides coverage for items stored in a storage unit. Contact your insurance provider and inquire about the extent of coverage for offsite storage.

Determining the extent of coverage provided by your current policy

When reviewing your existing policy, consider the following:

1. Coverage Limits: Check if the policy provides adequate coverage for the value of your stored belongings. Some policies may have separate coverage limits specifically for storage units, so make sure you understand these limits.

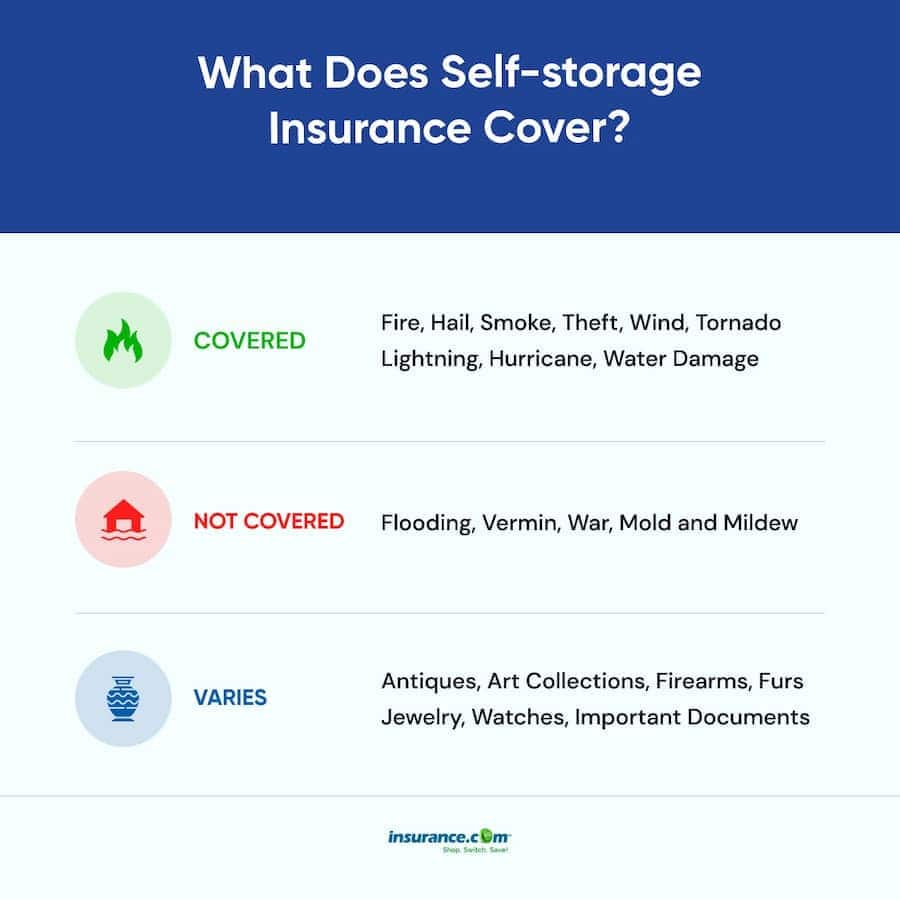

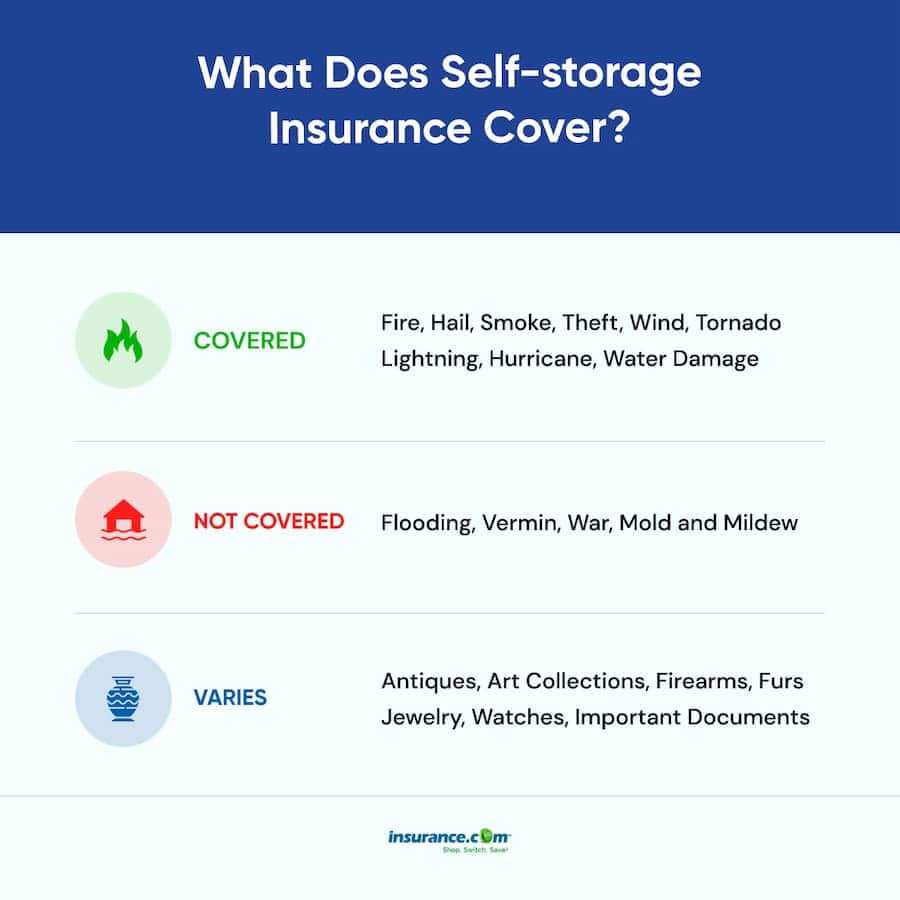

2. Perils Covered: Determine if the policy covers specific perils, such as fire, theft, or water damage, for items stored in a storage unit. Some policies may have exclusions for certain perils, so make sure you are aware of any limitations.

3. Deductibles: Understand the deductibles that may be applicable in case of a claim for items in storage. It’s important to know how these deductibles may impact the overall coverage and cost.

4. Policy Terms: Review the terms and conditions of your existing policy to ensure it aligns with your storage needs. Some policies may have restrictions on the types of items that can be covered or limitations on the storage facility location.

5. Documentation and Evidence: Familiarize yourself with the documentation and evidence requirements for filing a claim related to stored items. Knowing what is required in advance can help streamline the claims process.

It’s essential to have a clear understanding of the coverage provided by your existing insurance policy for items stored in a storage unit. If your current policy does not offer adequate coverage or if you don’t have an existing policy, you may need to consider purchasing standalone storage unit insurance.

Stand-alone Storage Unit Insurance Policies

If your existing insurance policy does not provide sufficient coverage for items stored in a storage unit, or if you don’t have an existing policy, you have the option to purchase stand-alone storage unit insurance. These policies are specifically designed to provide comprehensive coverage for items stored in a storage unit.

When considering standalone storage unit insurance, there are a few factors to consider:

1. Coverage Options: Standalone policies offer broader coverage specifically tailored for items stored in a storage unit. They typically provide protection against perils such as fire, theft, vandalism, and natural disasters.

2. Customizable Policies: Stand-alone storage unit insurance policies often allow for customization based on your specific storage needs. This can include adjusting coverage limits, adding specific perils, or including coverage for valuable or unique items.

3. Premiums: Stand-alone storage unit insurance policies have separate premiums from your existing home, renters, or small business insurance policies. It’s important to compare quotes from different insurance providers to ensure you are getting the best coverage at a competitive price.

4. Claims Process: Familiarize yourself with the claims process and requirements of the stand-alone storage unit insurance policy. Understanding the steps involved and the documentation needed will help streamline the claims process in case of damage or loss to your stored items.

By assessing the coverage provided by your existing insurance policies and considering stand-alone storage unit insurance, you can make an informed decision to protect your belongings stored in a storage unit. Remember to review the policy terms, coverage limits, deductibles, and the claims process before selecting the best insurance option for your needs.

Renters Insurance Coverage

Details of renters insurance coverage for items in a storage unit

If you have renters insurance, it’s important to understand the extent of coverage it provides for items stored in a storage unit. Renters insurance typically includes coverage for personal property, which may extend to items stored offsite. Here are some details to consider:

– Coverage Limits: Check if your renters insurance policy has specific coverage limits for offsite storage. Some policies may have lower limits for items in storage, so make sure your coverage is sufficient for the value of your stored belongings.

– Perils Covered: Renters insurance often provides coverage for perils such as fire, theft, vandalism, and weather-related damage. Confirm if these perils are included in the coverage for items stored in a storage unit.

– Deductibles: Like any insurance policy, renters insurance may have deductibles that apply to claims for stored items. Understand the deductible amount and how it may impact your coverage.

– Documentation and Evidence: Familiarize yourself with the documentation and evidence requirements for filing a claim related to stored items. Knowing what is needed in advance can help streamline the claims process.

Protection against theft, vandalism, and weather-related damage

Renters insurance can provide valuable protection for your stored belongings. Here’s how it covers common risks:

– Theft: If your stored items are stolen, renters insurance can reimburse you for their value, up to your policy’s coverage limit. This coverage can help provide peace of mind knowing that your belongings are protected against theft.

– Vandalism: In case of vandalism or malicious damage to your stored items, your renters insurance coverage can help cover the cost of repair or replacement. Make sure to report any incidents promptly and follow the claims process specified in your policy.

– Weather-related damage: Renters insurance typically covers damage caused by covered perils such as storms, hurricanes, or earthquakes. If your stored items are damaged due to weather-related events, your policy can help reimburse you for their value.

It’s important to review the terms and conditions of your renters insurance policy to understand the specific coverage provided for items in a storage unit. If you have any questions or concerns, reach out to your insurance provider for clarification.

Remember, while renters insurance can provide coverage for stored belongings, it may not cover all perils or have sufficient coverage limits. Evaluating the terms of your policy and considering standalone storage unit insurance may be necessary to ensure comprehensive protection for your stored items.

Storage Facility Requirements

Insurance requirements set by most storage unit companies

When renting a storage unit, it is common for storage facility companies to require tenants to have insurance coverage for their stored items. This is to protect both the tenant and the storage facility in case of damage or loss to the items in the unit. Here are some common insurance requirements set by storage unit companies:

– Proof of Insurance: Storage facilities may require tenants to provide proof of insurance coverage before renting a unit. This is to ensure that the tenant has taken the necessary steps to protect their belongings.

– Minimum Coverage Limits: Storage facilities may have minimum coverage limits that tenants must meet. This ensures that there is sufficient coverage in case of damage or loss to the stored items.

– Approved Insurance Providers: Some storage facilities have a list of approved insurance providers that tenants can choose from. These providers have policies specifically designed for storage units and meet the facility’s coverage requirements.

– Insurance Policy Terms: Storage facilities may have specific requirements for the policy terms, including the length of coverage, cancellation policy, and coverage for specific perils.

It is important to check with the storage facility about their insurance requirements before renting a unit. Failure to comply with their insurance requirements may result in the inability to rent a storage unit.

Exceptions and alternative options for insurance coverage

If you do not have adequate insurance coverage or prefer not to purchase insurance from the storage facility, there are alternative options available:

– Third-Party Insurance: Some storage facilities may allow tenants to use their own third-party insurance policies to meet the coverage requirements. It is important to check with the storage facility if they accept third-party insurance and what their requirements are.

– Existing Policies: As mentioned earlier, it is recommended to check if your existing home, renters, or small business insurance policies provide coverage for items stored in a storage unit. These policies may offer broader coverage and higher limits compared to the insurance offered by storage facilities.

– Stand-Alone Storage Unit Insurance: If your existing policies do not provide sufficient coverage or if you do not have existing coverage, you can consider purchasing stand-alone storage unit insurance. These policies are specifically designed for items stored in a storage unit and offer comprehensive coverage for various perils.

When considering your insurance options, it is essential to compare the coverage terms, limits, deductibles, and premiums offered by different providers. Consulting with an insurance professional can help you choose the best insurance option that suits your budget and coverage needs.

Remember, having adequate insurance coverage for your stored items is crucial to protect your belongings and provide peace of mind while they are in a storage unit.

Choosing a Storage Unit Insurance Policy

When selecting a stand-alone storage unit insurance policy, there are several factors to consider. It’s important to compare different options and choose the policy that best fits your needs. Here are some key factors to consider:

Price

The cost of the insurance policy is an important factor to consider. Compare the premiums of different insurance providers and ensure that the price is within your budget. Keep in mind that the price may vary based on factors such as the coverage limits, deductibles, and the value of the items you are storing.

Coverage Options

Review the coverage options offered by different insurance providers. It’s important to ensure that the policy covers the types of perils that you are most concerned about. Common perils covered by storage unit insurance include fire, theft, water damage, and vandalism. Additionally, some policies may offer optional coverage for specific events, such as natural disasters or pest infestations.

Reputation of Insurance Providers

Research the reputation and customer reviews of insurance providers before making a decision. Look for companies that have a good track record of promptly processing claims and providing excellent customer service. Reading reviews from other customers can give you an idea of the company’s reliability and responsiveness.

Comparison with Existing Policies

If you already have home, renters, or small business insurance, it’s important to review what coverage is already provided for items stored offsite. Compare the coverage limits and perils covered by your existing policies with what is offered by stand-alone storage unit insurance. This will help you determine if you need additional coverage or if your existing policies are sufficient.

Policy Terms and Conditions

Carefully review the terms and conditions of the insurance policies you are considering. Pay attention to factors such as the length of coverage, cancellation policy, claims process, and any exclusions or limitations. Understanding these details will help you make an informed decision and avoid any surprises in the future.

Exclusions and Deductibles

Take note of any exclusions or limitations in the insurance policy. Some policies may have certain items or situations that are not covered. Additionally, consider the deductibles associated with the policy. A higher deductible may result in lower premiums but will require you to pay more out of pocket in the event of a claim.

Price, Coverage Options, and Reputation of Insurance Providers

When comparing storage unit insurance policies, it’s important to evaluate the price, coverage options, and reputation of the insurance providers. Here is a table comparing some popular insurance providers in terms of these factors:

| Insurance Provider | Price | Coverage Options | Reputation |

|——————–|——-|—————–|————|

| Provider A | $XX | Fire, theft, water damage | Excellent customer reviews, prompt claims processing |

| Provider B | $YY | Fire, theft, vandalism | Positive customer feedback, responsive customer service |

| Provider C | $ZZ | Fire, theft, water damage, natural disasters | Highly rated customer service, fast claims settlement |

Keep in mind that the prices and coverage options may vary based on factors such as the location of the storage facility and the value of the items being stored. Reading customer reviews and researching the reputation of the insurance providers will help you make an informed decision.

Therefore, when choosing a storage unit insurance policy, consider factors such as price, coverage options, reputation of insurance providers, and the comparison with your existing policies. Taking the time to evaluate these factors will ensure that you select the best insurance policy to protect your belongings while they are in storage.

Claiming for Damages

Process of filing a claim for damages to items in a storage unit

If your stored items in a storage unit get damaged or lost, it is important to understand the process of filing a claim for reimbursement. Here are the general steps involved:

1. Contact the Storage Facility: Notify the storage facility as soon as possible about the damage or loss. They will provide you with the necessary forms and instructions to initiate the claims process.

2. Document the Damage: Take photographs or videos of the damaged items and the storage unit itself as evidence of the condition and extent of the damage. This documentation will be helpful when filing the claim.

3. Complete Claim Forms: Fill out the claim forms provided by the storage facility. Make sure to provide all the required information accurately. Include a detailed description of the damaged items, their value, and any supporting documentation such as receipts or appraisals.

4. Submit the Claim: Submit the completed claim forms and supporting documentation to the storage facility according to their specified procedures. Keep copies of all documents for your records.

5. Review and Evaluation: The storage facility or their insurance provider will review and evaluate the claim submitted. They may request additional information or evidence to support the claim.

6. Claim Settlement: Once the evaluation is complete, the storage facility or insurance provider will determine the reimbursement amount based on the policy terms and conditions. The reimbursement is usually based on the square footage of the storage unit and the value of the damaged items, rather than the replacement cost.

Documents and proofs required for claim settlement

When filing a claim for damages to items in a storage unit, you will typically need to provide the following documents and proofs:

– Proof of Storage Unit Rental: Provide a copy of the storage unit rental agreement or lease agreement as evidence that you are a tenant at the storage facility.

– Proof of Insurance Coverage: If you have insurance coverage for the stored items, provide a copy of the insurance policy or proof of coverage. This is to confirm that you have taken the necessary steps to protect your belongings.

– Inventory List: Prepare an inventory list of the damaged or lost items, including a detailed description, estimated value, and any supporting documentation such as receipts, appraisals, or photographs.

– Damage Documentation: Include photographs or videos of the damaged items and the storage unit as evidence of the damage.

– Incident Report: If the damage or loss occurred as a result of a specific incident or event, such as a break-in, fire, or water damage, provide a copy of the incident report or any other relevant documentation.

– Repair or Replacement Estimates: If repair or replacement of the damaged items is necessary, obtain estimates from reliable sources for the cost of repairs or replacement.

Having the required documents and proofs ready will help expedite the claim settlement process and ensure a smoother experience.

Remember to consult with the storage facility or their insurance provider for specific details and requirements regarding the claims process.

Conclusion

Summary of the importance of insuring items in a storage unit

Insuring your items in a storage unit is crucial to protect them from damage, loss, or theft. Storage unit insurance provides coverage for various risks, including natural disasters, fires, and burglaries. It offers financial protection and peace of mind knowing that your belongings are covered in case of any unforeseen events.

While some storage facilities offer their own insurance policies, it is important to compare their terms and rates with other insurance companies’ offerings. Additionally, review your home or renters insurance policy to see if it already covers offsite storage. Understanding your coverage options and comparing policies can help you make an informed decision and choose the most suitable insurance for your stored belongings.

Final thoughts on finding the right insurance coverage for your stored belongings

When looking for insurance coverage for your stored belongings, consider the following:

1. Evaluate your needs: Assess the value of your stored items, the risk factors involved, and the potential financial loss in case of damage or theft. This will help you determine the appropriate coverage amount.

2. Research insurance providers: Compare different insurance companies and policies to find the one that offers comprehensive coverage, competitive rates, and good customer service. Look for reputable insurers with a history of prompt claim settlements.

3. Understand the policy terms: Read and understand the policy terms, including coverage limits, deductibles, exclusions, and claim procedures. Ask questions if anything is unclear and ensure the policy meets your specific needs.

4. Consider additional coverage options: Some insurance policies offer additional coverage for specific items, such as high-value jewelry or electronic equipment. Assess whether you need any additional coverage and if it is available through your chosen insurer.

5. Maintain accurate documentation: Keep an inventory list of your stored belongings, along with supporting documentation such as receipts, appraisals, and photographs. This documentation will be essential when filing a claim for damages.

6. Review and update your coverage periodically: Periodically review your storage unit insurance coverage and update it as needed. Declutter or remove items that are no longer stored in the unit and notify your insurer of any changes in the value of your belongings.

By following these steps and taking the time to choose the right insurance coverage for your stored belongings, you can ensure that you are adequately protected and prepared in case of any unfortunate incidents. Remember to regularly review and update your coverage to maintain optimal protection.

Learn more about Insurance policies for storage unit.